The repositionable labels market is continuously rising because of growing demand across retail, logistics, pharmaceuticals, and consumer goods. Key participants are focusing on innovation within adhesive technologies, sustainability and printing technologies. Improvement in the cost-efficiency and quality through automation in the production process also further drives market expansion.

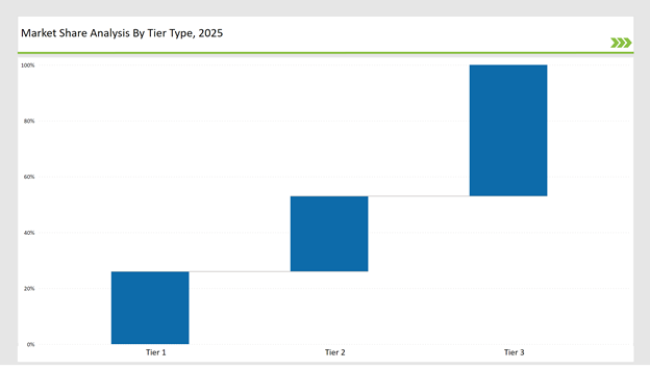

Tier 1: Leading companies such as Avery Dennison, CCL Industries, and UPM Raflatac dominate 26% of the market, leveraging advanced adhesive formulations, extensive distribution networks, and continuous innovation in eco-friendly labels.

Tier 2: Companies like 3M, Multi-Color Corporation, and LINTEC control 27% of the market. These firms cater to mid-sized consumers by offering high-performance labeling solutions, benefiting from cost-effective production and strong regulatory compliance.

Tier 3: Regional and niche manufacturers specializing in customized, specialty, and removable labels account for the remaining 47% of the market. These players focus on tailored solutions with localized distribution strategies.

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Avery Dennison, CCL Industries, UPM Raflatac) | 12% |

| Rest of Top 5 (3M, Multi-Color Corporation) | 9% |

| Next 5 of Top 10 (LINTEC, Fuji Seal, MCC Verstraete, SATO Holdings, Inland Label) | 5% |

The repositionable labels market serves multiple industries, driven by the need for product identification, regulatory compliance, and sustainability.

To satisfy industry expectations, businesses are concentrating on eco-friendly materials, high-performance printing processes, and adhesive durability.

The utilization of sustainability-focused materials, automated label application, and AI-driven quality monitoring has raised competition. In order to improve utilization and reduce their environmental impact, manufacturers are investing in research and development to create intelligent and compostable labels.

Year-on-Year Leaders

Technology suppliers should focus on integrating smart labeling solutions, sustainability, and advanced printing technologies. Collaborations with raw material providers will further enhance innovation.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Avery Dennison, CCL Industries, UPM Raflatac |

| Tier 2 | 3M, Multi-Color Corporation, LINTEC |

| Tier 3 | Fuji Seal, MCC Verstraete, SATO Holdings, Inland Label |

Leading manufacturers are extending their production capabilities, integrating sustainable materials, and developing printing technology in order to meet shifting industry demands.

| Manufacturer | Latest Developments |

|---|---|

| Avery Dennison | Launched a new line of 100% recyclable repositionable labels (March 2024) |

| CCL Industries | Developed advanced adhesive technology for repositionable logistics labels (August 2023) |

| UPM Raflatac | Introduced biodegradable labeling materials (May 2024) |

| 3M | Expanded its smart label solutions for inventory tracking (November 2023) |

| Multi-Color Corporation | Launched water-resistant repositionable labels for food and beverage packaging (February 2024) |

In order to preserve a solid market position, major players in the repositionable labels industry are concentrating on innovation, sustainability, and automation as the competitive landscape changes quickly.

Automation, eco-friendly materials, and intelligent labeling technologies will propel the market for repositionable labels. To satisfy industry demands, businesses will create ultra-thin, high-performance label films, invest in biodegradable adhesives, and incorporate RFID and NFC capabilities. The future of the sector will continue to be shaped by the growing regulatory demand on sustainability.

Leading players include Avery Dennison, CCL Industries, UPM Raflatac, 3M, and Multi-Color Corporation.

The top 3 players collectively control 12% of the global market.

The market exhibits medium concentration, with top players holding 26%.

Key drivers include sustainability, automation, material innovation, and regulatory compliance.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Repositionable Labels Market Size and Share Forecast Outlook 2025 to 2035

Labels Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Labels, Tapes And Films Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Labels Companies

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among USA Labels Providers

Foam Labels Market Trends and Growth 2035

Foil Labels Market Analysis by Metal Foils & Polymer-Based Foils Through 2035

Market Share Breakdown of Foil Labels Manufacturers

Kraft Labels Market Size and Share Forecast Outlook 2025 to 2035

HAZMAT Labels Market Growth and Forecast 2025 to 2035

In-mold Labels Market Size and Share Forecast Outlook 2025 to 2035

Printed Labels Market Size and Share Forecast Outlook 2025 to 2035

Sheeted Labels Market Size and Share Forecast Outlook 2025 to 2035

QR Code Labels Market Size and Share Forecast Outlook 2025 to 2035

Braille Labels Market Size and Share Forecast Outlook 2025 to 2035

Syringe Labels Market Size and Share Forecast Outlook 2025 to 2035

Thermal Labels Market Analysis - Size, Growth & Outlook 2025 to 2035

Canning Labels Market

Die Cut Labels Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA