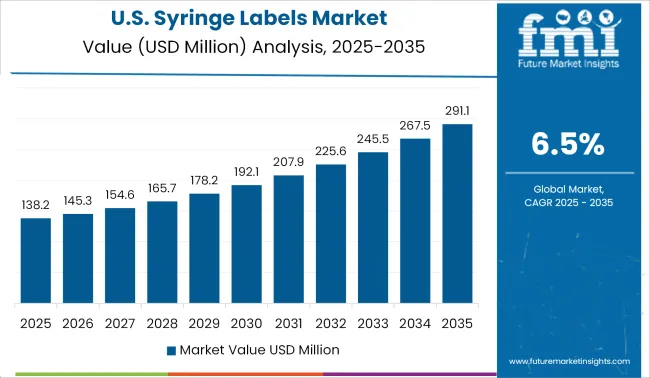

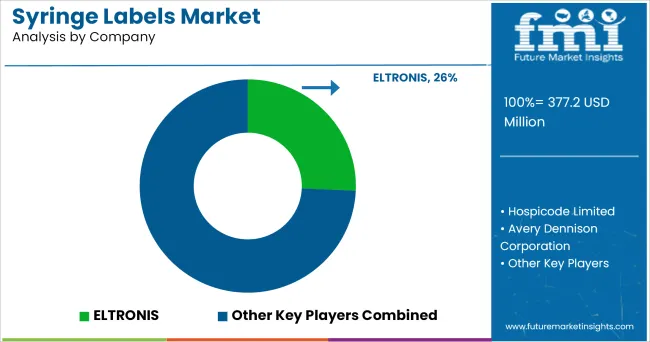

The Syringe Labels Market is estimated to be valued at USD 377.2 million in 2025 and is projected to reach USD 708.0 million by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period.

The syringe labels market is expanding steadily, driven by the increasing need for precise identification, traceability, and compliance in pharmaceutical packaging. Industry publications and manufacturer announcements have underscored a growing demand for durable and chemical-resistant labeling materials that can withstand sterilization processes and frequent handling.

Pharmaceutical companies have prioritized the integration of clear and legible syringe labels to enhance medication safety and support regulatory compliance across global markets. Innovations in printing technologies and adhesive formulations have further improved label performance under challenging storage and transportation conditions.

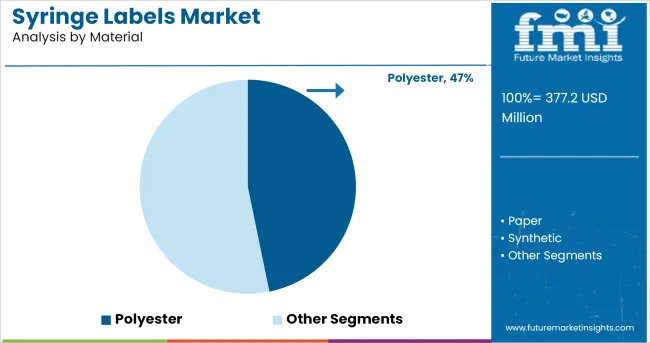

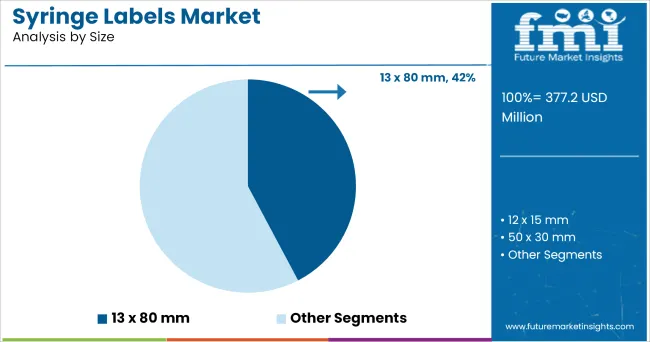

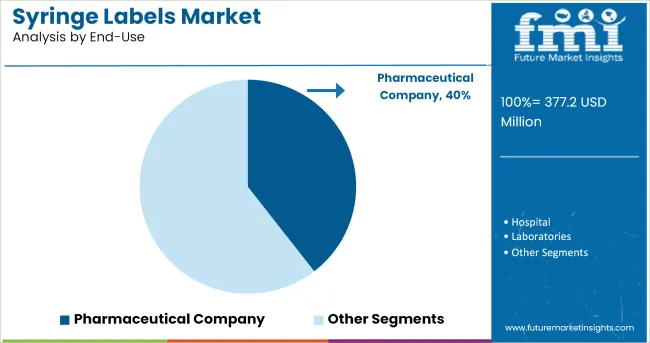

The growth of injectable drug formulations, including biologics and vaccines, has contributed to the rising volume of prefilled syringes requiring specialized labels. Future market expansion is expected to be supported by advancements in tamper-evident and smart labeling solutions. Segmental growth is being led by Polyester in the material category, 13 x 80 mm in size due to its compatibility with standard syringe formats, and Pharmaceutical Companies as the primary end-use segment, reflecting their extensive use of labeled syringes in drug manufacturing and distribution.

The market is segmented by Material, Size, and End-Use and region. By Material, the market is divided into Polyester, Paper, and Synthetic. In terms of Size, the market is classified into 13 x 80 mm, 12 x 15 mm, 50 x 30 mm, and 100 x 40 mm. Based on End-Use, the market is segmented into Pharmaceutical Company, Hospital, Laboratories, Clinics, Research Organization, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Polyester segment is projected to contribute 46.8% of the syringe labels market revenue in 2025, maintaining its position as the preferred material type. Growth in this segment has been driven by polyester’s proven durability, moisture resistance, and ability to maintain label integrity during autoclaving and cold storage.

Pharmaceutical companies have favored polyester labels for their compatibility with high resolution printing, ensuring clear readability of critical drug information such as dosage instructions, batch numbers, and expiration dates. Additionally, polyester’s chemical resistance has supported its adoption in environments where syringes may be exposed to disinfectants and solvents.

Label manufacturers have expanded product offerings with low-migration adhesives and compliant materials suitable for direct contact with sensitive drug formulations. As regulatory frameworks continue to emphasize labeling durability and safety, the Polyester segment is expected to remain the material of choice in syringe labeling applications.

The 13 x 80 mm size segment is projected to hold 42.3% of the syringe labels market revenue in 2025, securing its position as the leading size specification. Growth in this segment has been influenced by its compatibility with a wide range of syringe formats commonly used for injectable drugs.

Pharmaceutical manufacturers and packaging suppliers have standardized this size due to its ability to accommodate essential information while maintaining a secure fit on curved syringe surfaces. The size’s versatility has also supported efficient production workflows, enabling automated label application without compromising accuracy.

Additionally, the 13 x 80 mm format has been optimized for barcode placement, serialization, and branding requirements, further enhancing traceability in the pharmaceutical supply chain. With the continued growth of prefilled syringes and personalized medicine applications, the 13 x 80 mm size segment is expected to maintain its prominence in the market.

The Pharmaceutical Company segment is projected to account for 39.5% of the syringe labels market revenue in 2025, maintaining its leadership in end-use adoption. Growth of this segment has been driven by the rising volume of injectable therapeutics produced by pharmaceutical manufacturers, requiring compliant and durable labeling solutions.

Pharmaceutical companies have integrated syringe labels as part of their broader track and trace initiatives, ensuring product authenticity and regulatory compliance across global markets. Industry announcements have highlighted increased production of biologics, vaccines, and specialty injectables, all of which require precise syringe labeling to ensure safe administration.

Additionally, the complexity of pharmaceutical supply chains has elevated the importance of robust labeling for inventory management and anti-counterfeiting measures. As injectable drug formulations continue to expand across therapeutic areas, the Pharmaceutical Company segment is expected to remain the primary end user of syringe labels, driving consistent market demand.

The innovation-driven pharmaceutical industry has come up with various lifesaving drugs and vaccines, resulting in increased life expectancy rates across the globe. For efficient delivery of drugs, the proper packaging and labelling products allow proper identification and dosage instructions about the usage.

The packaging industry has developed a variety of syringe labels for overcoming the disadvantages of using the syringes without any labels or proper identification tags on them. Syringe labels are made up of paper, polyester or synthetic materials and used as a tag on the syringe making it easy for a medical practitioner to identify the syringe or its contents for proper utilization of drugs and vaccines through it.

Growing worldwide awareness regarding proper labelling and packaging of medicinal supplies has resulted in increased worldwide popularity of syringe labels as a best-suited label for syringes used across all types of healthcare facilities. Over the years the demand for syringe labels is expected to rise and indicates an expansion of the global syringe label market.

The exponential rise in demand for pharmaceutical supplies across the globe, as a result of the increased geriatric population and rising number of healthcare facilities across the globe, fuels the demand for syringes and eventually increases the need for syringe labels as a perfect drug identification label.

Strict regulatory laws regarding the labelling of syringes containing drug dosages are made, to prevent the loss of lives that occurred due to improper administration of syringes filled with dosages and to prevent the patients from further injuries due to mistakes made by medical practitioners.

Alarming situations such as hundreds of people losing their lives due to improper administration of drugs and millions suffering from injuries boosts the global demand for syringe labels.

The rising geriatric population and patients suffering from chronic diseases such as diabetes, heart diseases and various autoimmune diseases, resulting in increased consumption of self-medication and high consumption of prefilled syringes across the regions, propel the demand for syringe labels to avoid any chances of improper dosage of any type of medicinal drugs.

Non-uniformity of the units of drugs stored in the syringe leads to improper labelling in the handwritten syringe labels causes thousands of lives each year, as the person who was filled the syringe might have labelled it in milligram or microgram, but some drugs are labelled in ratios which causes ambiguity and confusion in the mind of the medical practitioner delivering the drug to the final patient.

Thus, the drawbacks of handwritten plain labels are expected to hamper the potential growth of the global syringe labels market.

The expensive production process of these syringe labels increases the overall cost of production of the prefilled syringes, syringes and acts as an extra overhead cost to the medical facilities. Though these limitations have a very little negative impact on overall sales of syringe labels but have a long term impact on the global syringe labels market.

The presence of key global manufacturers of syringe labels, as the USA is home to pharmaceutical giants of the world, making it the most important market for the syringe labels.

The advanced healthcare system in the country and strict laws regarding the labelling of all types of pharmaceutical supplies making it mandatory for all healthcare facilities to use syringe labels for eliminating any possibility of an accident during the administration of the drug.

The syringe label market in the USA is divided between a global leader and several medium and small-sized label makers, trying to increase their market share by offering high-grade labels, labels offering printability on both sides and a variety of customized options in syringe labels.

Moreover, the high growth of advanced medicinal drugs and increased population preferring self-medication makes the USA an important market for syringe labels.

The manufacturers of syringe eletronis labels are targeting developing regions of the world, where the healthcare infrastructure is witnessing a tremendous growth rate and penetrating these regions to expand their client base and monetize on the lucrative growth opportunities offered by these regions.

Attractive looking packaging and labels are gaining traction across all end-user industries, in pharmaceutical sectors the labels with different colours are often used to differentiate among the drug types stored in the syringes, which offer easy identification of drugs and eliminates chances of improper dosages to the patients.

Digitally printed labelling products are adapted by international healthcare chains having medicinal facilities across the globe, to avoid any confusion during the drug administration and proper storage and transportation of drugs as and when required.

The digitally pre-printed syringe labels of different sizes are available for all types of syringes from small to large and facilitate proper identification of drugs. The increased worldwide popularity of digitally printed labels indicates growth opportunities for key manufacturers of syringe labels across the globe.

Fast-paced development witnessed by the healthcare sector in the country, along with an increased number of people choosing advanced medicinal drugs for the cure of the diseases and growing number of clinics, healthcare centres and government healthcare facilities makes India the second-largest market for syringe labels.

Availability of cheaper raw materials and adoption of advanced production technologies makes China a leading market for syringe labels, global manufacturers are planning to expand their production capabilities in China to cater for the fast-growing demand for syringe labels across the globe.

The presence of several small and medium-sized manufacturers of syringe label producers in the country indicates towards future expansion of the syringe label market in the country.

The global syringe labels market is estimated to be valued at USD 377.2 million in 2025.

The market size for the syringe labels market is projected to reach USD 708.0 million by 2035.

The syringe labels market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in syringe labels market are polyester, paper and synthetic.

In terms of size, 13 x 80 mm segment to command 42.3% share in the syringe labels market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Labels Market Forecast and Outlook 2025 to 2035

Syringes and Injectable Drugs Packaging Market Size and Share Forecast Outlook 2025 to 2035

Syringe Scale Magnifiers Market Size and Share Forecast Outlook 2025 to 2035

Labels, Tapes And Films Market Size and Share Forecast Outlook 2025 to 2035

Syringes Market Analysis - Growth & Demand 2025 to 2035

Competitive Overview of Labels Companies

Syringeless Injector Market Analysis – Size, Share & Forecast 2025-2035

Syringe Filling Machine Market from 2024 to 2034

Syringe Trays Market

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

BFS Syringes Market Analysis - Size & Growth Forecast 2025 to 2035

Market Share Distribution Among USA Labels Providers

MENA Syringes & Cannula Market Size and Share Forecast Outlook 2025 to 2035

Foam Labels Market Trends and Growth 2035

Market Share Breakdown of Foil Labels Manufacturers

Foil Labels Market Analysis by Metal Foils & Polymer-Based Foils Through 2035

Oral Syringe Market

Kraft Labels Market Size and Share Forecast Outlook 2025 to 2035

Safety Syringe Market Size and Share Forecast Outlook 2025 to 2035

HAZMAT Labels Market Growth and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA