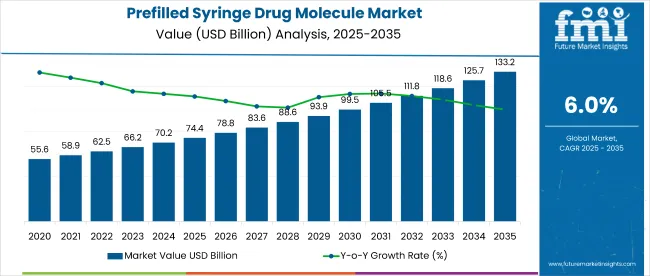

The global prefilled syringe drug molecule market is projected to expand from USD 74.38 billion in 2025 to approximately USD 133.24 billion by 2035, reflecting a CAGR of 6.% % over the forecast period. In 2024, the market was valued at USD 70.17 billion, with demand supported by the growing prevalence of chronic diseases and increasing adoption of biologics.

Prefilled syringes are being widely used to enhance convenience, dosing accuracy, and patient compliance. These benefits are especially valued in the management of diabetes, rheumatoid arthritis, and multiple sclerosis, where frequent self-administration is required.

| Attributes | Details |

|---|---|

| Industry Size, 2025 | USD 74.38 billion |

| Industry Size, 2035 | USD 133.24 billion |

| Value CAGR (2025 to 2035) | 6% |

By 2025, growth is being driven by the shift from conventional drug delivery systems to more patient-centric models. Prefilled syringes are being preferred in both home care and clinical settings due to their ready-to-use format, which minimizes preparation time and reduces contamination risk.

Pharmaceutical manufacturers are investing in proprietary syringe technologies to support drug stability and precision delivery. In the biologics segment, which encompasses monoclonal antibodies and other large-molecule therapies, the demand for high-viscosity drug compatibility and auto-injector compatibility is on the rise, thereby driving innovation in syringe design and materials.

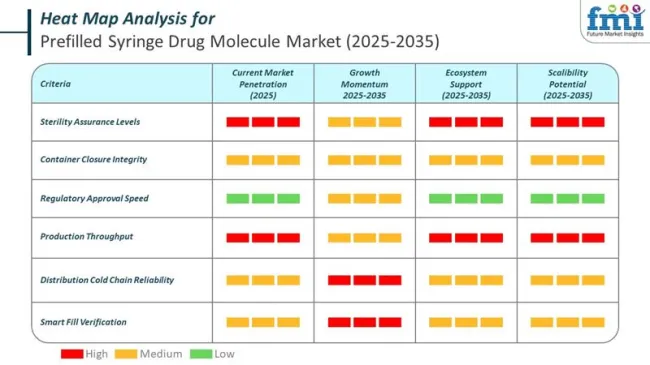

Regulatory and safety factors are also contributing to market expansion. Stringent guidelines from global health authorities are promoting the use of single-dose formats to reduce dosing errors and needle reuse. Prefilled syringes are being equipped with passive safety mechanisms, needle-shield systems, and tamper-evident closures to enhance patient safety and ease of use.

In 2025, smart syringes featuring RFID and connectivity modules are also being introduced in pilot programs to support remote monitoring and adherence tracking. These innovations are being tested in therapeutic areas like oncology and immunotherapy.

Key pharmaceutical and device manufacturers are driving growth through strategic partnerships and product launches. Companies such as Becton, Dickinson and Company, Gerresheimer AG, SCHOTT AG, West Pharmaceutical Services, and Nipro Corporation are expanding production capabilities and developing integrated delivery systems.

Major drugmakers are increasingly collaborating with device firms to co-develop drug-device combination products tailored for prefilled formats. As biologics pipelines continue to grow, and patient-centered care models expand globally, the prefilled syringe drug molecule market is expected to remain on a strong upward trajectory through 2035, driven by innovation, clinical demand, and regulatory alignment.

The prefilled syringe drug molecule market is governed by robust regulatory systems across major regions to ensure the safety, quality, and performance of drug-device combination products. These regulations define classification, manufacturing protocols, and submission requirements, and they also reflect increasing attention to global safety and technical standards.

Becton Dickinson (BD) has been at the forefront of regulatory compliance in the prefilled syringe drug molecule market. The company designs its syringe platforms with strict adherence to global standards, focusing on sterility, compatibility, and integrity. BD’s technologies help biologic drug manufacturers meet rigorous FDA, EMA, and USP requirements.

Gerresheimer ensures regulatory alignment by manufacturing prefillable syringes under ISO 11040 standards and offering detailed technical support to pharmaceutical partners. The company emphasizes material safety, extractables control, and device performance, which are critical for regulatory filings in the US and Europe. Their solutions are tailored to injectable biologics and biosimilars.

West Pharmaceutical Services focuses on combining drug delivery and containment compliance through integrated prefilled syringe components. Their systems are engineered to comply with FDA and EMA regulations for combination products, ensuring dose accuracy, sterility, and ease of use. West also assists clients with regulatory documentation for global market submissions.

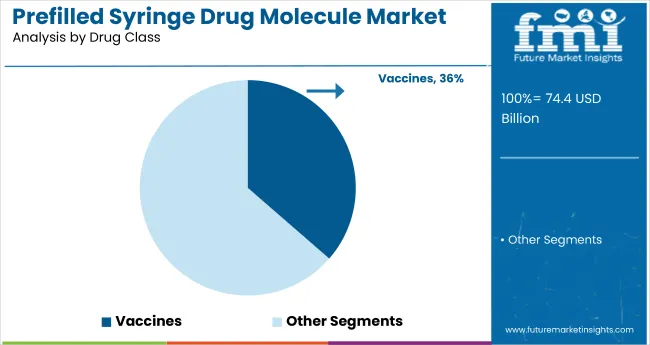

Vaccines are projected to dominate the drug class segment in the prefilled syringe market by 2025, holding a 36.4% share. Their extensive use in large-scale immunization campaigns for diseases like polio, measles, rubella, and influenza has driven consistent demand. Prefilled syringes offer critical advantages such as ease of administration, reduced dosing errors, and enhanced safety-making them highly suitable for mass vaccination efforts. Major pharmaceutical firms, including GlaxoSmithKline, Pfizer, and Sanofi, continue to expand their vaccine portfolios using prefilled delivery systems to improve logistics and compliance.

These syringes are increasingly being adopted in both pediatric and adult immunization schedules due to their minimal preparation time and suitability for single-use formats. As health authorities and global organizations scale up preventive care initiatives, particularly in emerging markets, the vaccine segment is expected to remain a strategic focus for manufacturers investing in sterile, ready-to-use delivery solutions.

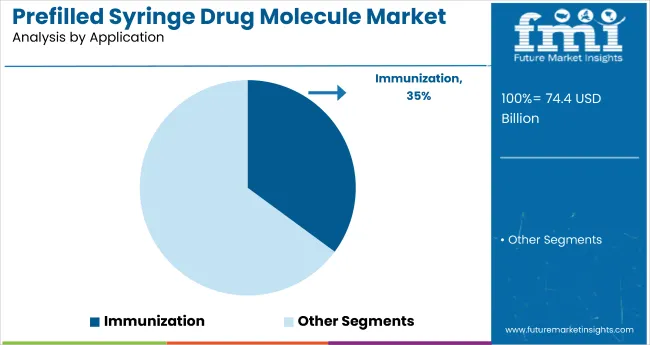

Immunization is forecast to command 35.1% of the prefilled syringe market by application in 2025, solidifying its role as a leading segment. The rising emphasis on preventive care and global vaccine accessibility has made immunization one of the most vital applications for prefilled syringes. These devices offer reliable dosing, simplified administration, and improved patient adherence-key factors in expanding national and international vaccination programs.

Organizations such as WHO and UNICEF, along with regional health departments, have increasingly turned to prefilled syringes for their operational efficiency in field-based immunization campaigns. They are especially valuable in pediatric vaccination, seasonal influenza drives, and emerging infectious disease control.

Manufacturers are innovating with tamper-evident, temperature-stable syringe formats to meet the demands of mass deployment. As booster campaigns and multi-dose regimens gain traction globally, the immunization application remains a high-priority investment area for pharmaceutical companies and public health systems alike.

The increasing need for biologics is presumed to drive the demand for prefilled syringe drug molecules in the current period. By providing a more precise and controlled drug delivery system for biologics, prefilled syringe drug molecules are primarily accepted among patients. Moreover, the surge in the prevalence of chronic diseases has driven up demand for the industry in recent years.

As a requirement for frequent injections among patients who suffer from chronic illness, medical professionals are increasingly using prefilled syringes drug molecules owing to their benefits. These syringe drug molecules provide a painless and more convenient option for patients.

Self-administered drugs have gained popularity over the years, contributing to the sector's demand nowadays. As people seek out self-controlling healthcare therapies, prefilled syringe drug molecules are increasingly providing easy-to-use options for these individuals to achieve maximum industry potential.

The ever-changing regulatory environment is likely to hinder industry growth during the forecast horizon. Also, these regulatory changes create significant industry barriers for manufacturers as they must be up to date with the latest regulations and ensure their product's quality standards according to them.

Prefilled syringes have high manufacturing costs, which can limit sector growth in the coming years. Additionally, these high-cost obstacles can impact product pricing and competitiveness in the industry. Sterilization is another challenging factor for the sector's growth. Manufacturers need to pay attention to quality standards and ensure that the syringe is strong enough.

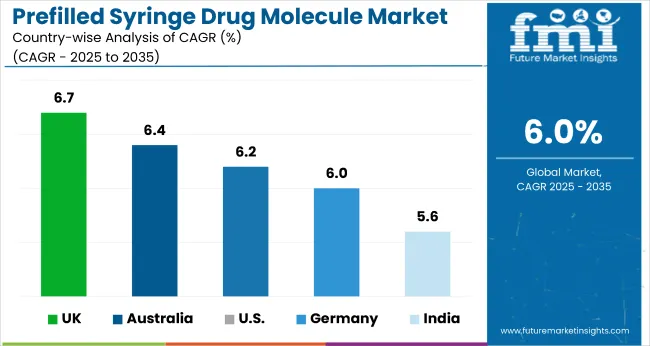

| Countries | CAGR from 2025 to 2035 |

|---|---|

| United states | 6.2% |

| Germany | 6% |

| United Kingdom | 6.7% |

| India | 5.6% |

| Australia | 6.4% |

Europe leads in the prefilled syringe drug molecule industry, with the United Kingdom at the forefront, followed by Germany. The United States also sees rising demand, making North America an opportune time for investors. On the other hand, key countries in the Asia Pacific, like India, are also set to join the race.

The United States prefilled syringe drug molecule market is expected to grow significantly, with a projected 6.2% CAGR. The industry in the United States has grown owing to rising lifestyle-related diseases and the increased need for easy-to-administer injectables among chronic disease patients.

In the retail sector, there is a high concentration of vendors that offer both end products and original elements. The availability of approved vendors assures widespread use of prefilled syringes in the United States. Furthermore, increased pharmaceutical research, an aging population, healthcare advancements, and a growing number of diabetes patients are all raising the demand for prefilled syringe drug molecules in the United States.

Germany’s prefilled syringe drug molecule market is on track for strong growth, projected at a 6% CAGR by 2035. The highly developed medical infrastructure, coupled with focused research and innovation, is anticipated to contribute to the prefilled syringe drug molecule industry in Germany.

With these advances, individuals are increasingly demanding a modern drug delivery system in the country. Moreover, the German government has played a major role in the industry's growth by setting up several rules and regulations for ensuring product quality in recent years.

It is fascinating to note that the United Kingdom prefilled syringe drug molecule market is poised to exhibit a truly promising CAGR of 6.7%. Manufacturers in the United Kingdom are primarily focusing on expanding their product lines.

For instance, Gerresheimer AG is one of the leading manufacturers in the United Kingdom. They offer a wide range of product lines, including various material options such as glass and plastic, and also deliver customized solutions for their consumers.

India’s prefilled syringe drug molecule market is set to witness a moderate CAGR of 5.6%. Pharmaceutical companies are leading the industry growth in India in recent years. The prevalence of chronic disease in the country has risen rapidly over the years.

As chronic diseases become a major global health concern, several governments have implemented awareness campaigns in their counties in recent years. Similar awareness campaigns are also seen in India. Moreover, doctors and healthcare professionals are increasingly using prefilled syringes due to their ease of convenience in the country.

Australia’s prefilled syringe drug molecule market is poised for robust growth, with an anticipated CAGR of 6.4% through 2035. This creates an enticing opportunity for investors and stakeholders to explore the industry’s potential.

The surging incidences related to infectious diseases are driving up the demand for prefilled syringe drug molecules in Australia. The aging population is further contributing to the product demand in the country nowadays. As individuals seek out the easy-to-use drug delivery system in the region, prefilled syringes are increasingly popularity among them.

The prefilled syringe drug molecule market is also highly competitive. Leading firms are continuously investing in research and development activities to capture substantial industry share in the coming years. Several smaller players are entering the industry and making excellent contributions to this industry.

Recent Development

Amgen Inc.

Amgen Inc. is a global biotechnology company committed to developing innovative and transformative medicines for patients with serious illnesses. One of Amgen's key areas of focus is the production of prefilled syringe drug molecules, which are used to treat a wide range of conditions including cancer, inflammation, and autoimmune diseases.

Amgen's expertise in this area has enabled it to create some of the most effective and advanced prefilled syringe drug molecules available today.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 74.38 billion |

| Projected Market Size (2035) | USD 133.24 billion |

| CAGR (2025 to 2035) | 6% |

| Base Year for Estimation | 2025 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million doses for volume |

| Drug Classes Analyzed (Segment 1) | Vaccines, Insulin, Adrenaline, Opioids, Others |

| Applications Analyzed (Segment 2) | Cardiovascular Diseases, Diabetes, Immunization, Pain Management |

| End Users Analyzed (Segment 3) | Hospital Pharmacies, Retail Pharmacies, Online Pharmacies, Drug Stores |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Japan, China, India, South Korea, Brazil |

| Key Players Influencing the Market | Amgen Inc., Teva Pharmaceutical Industries Ltd., AstraZeneca plc, Mylan N.V., Pfizer Inc., Fresenius Kabi AG, Johnson & Johnson, Sanofi, Merck & Co. Inc., Novartis AG, McKesson Corporation |

| Additional Attributes | Increasing demand for self-administration, Growth in biologics and vaccine-based therapies, Shift from vials to prefilled formats in chronic care |

| Customization and Pricing | Customization and Pricing Available on Request |

Depending on the drug class, the industry is categorized into vaccines, insulin, adrenaline, opioids, and others.

Prefilled syringe drug molecules are effective in cardiovascular diseases, diabetes, immunization, and pain management.

Key end-user industries are hospital pharmacies, retail pharmacies, online pharmacies, and drug stores.

Regional analysis of the industry is conducted in North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East and Africa.

The CAGR of the industry from 2025 to 2035 in the United States is estimated to be 6.2%.

The industry is expected to develop at a CAGR of 6% from 2025 to 2035.

The industry size is expected to be worth USD 74.38 billion in 2025.

The CAGR of the industry from 2025 to 2035 in Germany is estimated to be 6%

The industry is estimated to get as big as USD 133.24 billion by 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Small Molecule-Drug Conjugates Market Size and Share Forecast Outlook 2025 to 2035

Syringes and Injectable Drugs Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe Glass Prefilled Syringes and Glass Vials Packaging Equipment Market Analysis – Outlook & Forecast 2025–2035

Polymer-based Prefilled Syringe Market Size and Share Forecast Outlook 2025 to 2035

Drug Taste Masking Technologies Market Forecast and Outlook 2025 to 2035

Drug-Gene Interaction Panels Market Size and Share Forecast Outlook 2025 to 2035

Drug Testing Systems Market Size and Share Forecast Outlook 2025 to 2035

Drug Tester Market Size and Share Forecast Outlook 2025 to 2035

Drug Device Combination Products Market Size and Share Forecast Outlook 2025 to 2035

Drug Discovery Enzymes Market Size and Share Forecast Outlook 2025 to 2035

Drug Integrated Polymer Fibers Market Size and Share Forecast Outlook 2025 to 2035

Drug Discovery Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Syringe Scale Magnifiers Market Size and Share Forecast Outlook 2025 to 2035

Global Prefilled Formalin Vials Market Trends – Size, Share & Growth 2025 to 2035

Drug Formulation Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Drug-Induced Dyskinesia Market Size and Share Forecast Outlook 2025 to 2035

Drug Free Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Syringe Labels Market Size and Share Forecast Outlook 2025 to 2035

Drug Delivery Technology Market is segmented by route of administration, and end user from 2025 to 2035

Syringes Market Analysis - Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA