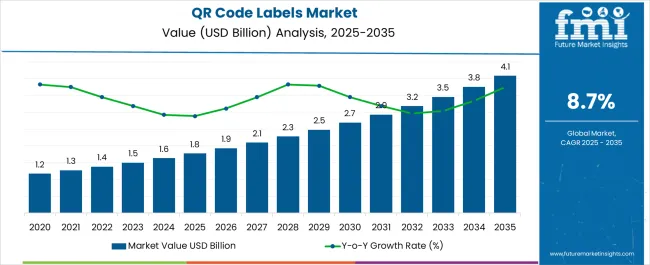

The QR Code Labels Market is estimated to be valued at USD 1.8 billion in 2025 and is projected to reach USD 4.1 billion by 2035, registering a compound annual growth rate (CAGR) of 8.7% over the forecast period.

Packaging engineers evaluate QR code label specifications based on data storage density, scanning reliability characteristics, and substrate adhesion performance when implementing track-and-trace systems for prescription medications, consumer electronics, and luxury goods requiring comprehensive product lifecycle visibility. Label selection involves analyzing print resolution requirements, contrast optimization, and environmental durability while considering scanning distance parameters, smartphone camera compatibility, and database integration complexity factors necessary for successful deployment across retail environments. Investment decisions balance labeling costs against supply chain transparency benefits, incorporating counterfeit prevention value, consumer engagement enhancement, and regulatory compliance assurance that justify advanced coding technology adoption through measurable operational improvements.

Manufacturing processes require precision digital printing, substrate preparation, and quality verification systems that achieve pharmaceutical serialization standards while maintaining production efficiency throughout high-volume labeling operations serving diverse market applications. Production coordination involves managing adhesive formulation, printing ink optimization, and finishing operations while addressing environmental resistance requirements, scanning accuracy validation, and regulatory documentation protocols specific to identification label manufacturing. Quality assurance encompasses readability testing, adhesion strength verification, and durability assessment that ensure specification compliance while supporting customer application requirements and regulatory inspection readiness throughout varying environmental exposures.

Implementation coordination involves labeling specialists, IT integration teams, and compliance officers collaborating to optimize QR code deployment that balances data management with operational efficiency while addressing specific industry requirements and regulatory mandates. System integration encompasses database connectivity, scanning application development, and workflow automation while coordinating with enterprise resource planning systems, customer relationship management platforms, and regulatory reporting requirements. Performance validation includes scanning accuracy verification, data integrity confirmation, and user experience testing that ensure system effectiveness while supporting customer engagement and compliance objectives throughout complex supply chain operations.

Market segmentation encompasses pharmaceutical manufacturers requiring serialization compliance, food companies seeking traceability enhancement, and luxury brands needing authentication solutions that support diverse operational requirements across QR code label applications. Product differentiation involves durability optimization, security feature enhancement, and integration capability advancement that improve identification system value while addressing specific customer challenges and competitive positioning requirements throughout product labeling implementations.

Digital transformation evolution reflects increasing emphasis on supply chain transparency, consumer engagement optimization, and product authentication advancement that drives demand for intelligent labeling systems supporting business digitization and customer interaction enhancement throughout applications requiring comprehensive product identification and information delivery across industries seeking competitive advantages through advanced labeling technology and consumer connectivity solutions.

| Metric | Value |

|---|---|

| QR Code Labels Market Estimated Value in (2025 E) | USD 1.8 billion |

| QR Code Labels Market Forecast Value in (2035 F) | USD 4.1 billion |

| Forecast CAGR (2025 to 2035) | 8.7% |

The QR code labels market is experiencing strong momentum as businesses and regulators emphasize traceability, transparency, and consumer engagement. Rising adoption of smart packaging and the growing importance of digital connectivity in retail, healthcare, and logistics are driving widespread integration of QR codes on labels.

Advancements in printing technologies have improved the durability, scan quality, and cost efficiency of these labels, enhancing their usability across diverse substrates and packaging formats. Regulatory bodies in food and pharmaceutical industries are increasingly mandating traceability features, further boosting demand.

Additionally, QR code labels are being leveraged as marketing tools, enabling brands to deliver product authentication, promotions, and sustainability information directly to consumers. The outlook remains promising as digital transformation and compliance requirements converge, positioning QR code labels as an essential enabler of intelligent packaging solutions.

The sleeve labels segment is projected to account for 41.70% of market revenue by 2025 within the label type category, making it the leading segment. Its growth is being driven by high visual appeal, 360 degree branding opportunities, and the ability to accommodate variable product sizes without compromising design integrity.

Sleeve labels provide durability, tamper evidence, and compatibility with QR code integration, making them highly effective for industries focused on authenticity and consumer engagement.

The combination of aesthetic flexibility and functional performance has solidified their dominance in the label type category.

The flexographic printing technology segment is expected to contribute 46.20% of overall revenue by 2025 within the printing technology category, positioning it as the top contributor. Its dominance is supported by cost efficiency in high volume production, adaptability across a variety of substrates, and consistent high quality output.

Flexographic technology enables rapid production of QR code labels with enhanced precision, ensuring easy readability and reliable consumer interaction.

Its suitability for large scale applications across consumer goods and industrial packaging has reinforced its leadership in the printing technology category.

The food and beverage segment is projected to represent 52.90% of the market by 2025 under the end use category, making it the most dominant application. Growth is being fueled by regulatory mandates for product traceability, rising consumer demand for transparency, and the sector’s focus on building trust through interactive packaging.

QR code labels allow brands to share nutritional details, supply chain history, and promotional campaigns directly with consumers. Their application has also been strengthened by the rapid growth of e commerce food sales, where authenticity and safety remain critical.

These factors have positioned food and beverage as the leading end use sector within the QR code labels market.

According to FMI, the QR code market is booming at an impressive 8.9% CAGR between 2025 and 2035, which is higher than the CAGR of 7.5% recorded between 2020 and 2025. This is due to the increased demand for QR code labels in the food & beverage, and pharmaceuticals industries.

By scanning the code on smartphones, custom QR code labels show product information. When space is at a premium, choosing QR code labels to display product information is a great option. And a terrific way to engage with brands is QR codes. A sign-up form or a link to the page with all the product details can be found using the QR codes on the labels.

Adoption of QR code labels on consumer goods, the consumer can locate the information the maker wishes to share with them without having to recall the product's website.

Product makers and packers are developing competitions, reward points, cash-back incentives, and other consumer-facing activities to promote their brands. The industrial QR code labels are printed on the product to put these on the packaging, making it simple for the consumer to scan and raising social media interaction.

Due to the rising acceptance of customized QR code labels as a solution to space limitations, the market may expand at a quicker CAGR during the anticipated period than it did earlier.

| Attributes | Details |

|---|---|

| QR Code Labels Market CAGR (From 2025 to 2035) | 8.7% |

| QR Code Labels Market Size (2025) | USD 1.5 billion |

| QR Code Labels Market Size (2035) | USD 3.5 billion |

| Global Market Absolute Dollar Growth (USD million/billion) | USD 2 billion |

The market for counterfeit goods is expanding, which is problematic for firms everywhere. This is causing a significant economic loss and might even harm customers.

Counterfeiting affects various industries, including food and beverage, pharmaceutical, personal care, cosmetics, and electronics. Manufacturers are now incorporating industrial QR code labels to protect their brands.

One industry that is implementing anti-counterfeiting solutions at a significant rate is the food and beverage sector. The rise in products on the market that are fake imitations of well-known brands is driving the expansion of the food and beverage category.

There are a lot of different QR code labels like QR code clothing labels, QR code asset labels, industrial QR code labels, and QR code white labels.

Due to developing economies and rising consumer awareness of fake goods, the Asia-Pacific region may hold the lion’s amount of the anti-counterfeit packaging market. The QR code labels market may expand if fake goods hurt customers and brand reputations.

In low- and middle-income nations where sophisticated smartphones are not available to the general public, QR codes cannot be used since smartphones that can scan them are more expensive than basic mobile phones.

The adoption of QR codes may be in constrain by many variables, including a low understanding of the technology and QR code readers, the annoyance of scanning QR codes, and concerns about the security of payments and QR code scanning.

Longer scanning intervals can be time- and labor-intensive. Moreover, QR codes aren't always adopted and used due to the need for physical manipulation and an unobstructed view of the label, which may limit the expansion of the market's revenue.

The developing commercial feasibility of replacement technologies like near field communications (NFC) and visual recognition (VR), which do not face the same challenges as QR codes, may further limit its use and impede the market growth.

| Attributes | Details |

|---|---|

| Top Label Type | Pressure Sensitive Labels |

| CAGR % 2020 to 2025 | 8.2% |

| CAGR % 2025 to End of Forecast(2035) | 8.7% |

According to the FMI study by label type, the pressure-sensitive labels segment witnessed increased demand in the QR codes market due to the pressure-sensitive labels' expanding demand from various end-use sectors.

Between 2025 and 2035, the global QR code labels market witnessed pressure-sensitive labels gain value at a CAGR of 8.8%.

Another segment of the market is QR code white label. You can use a QR code white label to use a different URL instead of the standard one. QR code white label helps advance your branding because QR codes are effective instruments for branding. You can remove all external domains and substitute your branded URLs in their place.

| Attributes | Details |

|---|---|

| Top Printing Technology | Flexographic Printing |

| CAGR % 2020 to 2025 | 8.1% |

| CAGR % 2025 to End of Forecast(2035) | 8.5% |

In this market, QR code labels are printed using a variety of printing technologies, including flexography, digital printing, offset lithography, and gravure print. Flexographic printing may witness significant growth during the projection period and hold a sizeable proportion between 2025 and 2035.

The analysts project that during the forecast period, the digital printing technology segment of the QR codes market may present profitable chances.

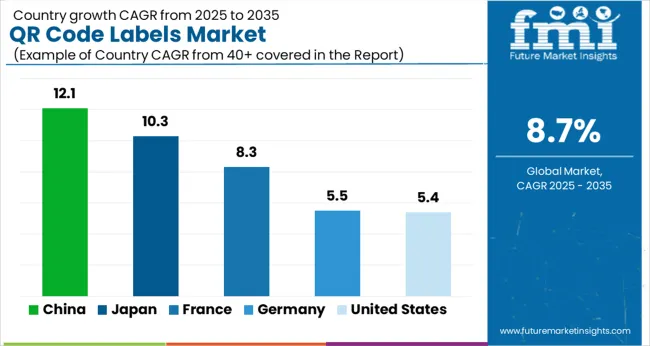

| Country | United States |

|---|---|

| HCAGR (From 2020 to 2025) | 6.4% |

| CAGR (From 2025 to 2035) | 5.4% |

| Country | Germany |

|---|---|

| HCAGR (From 2020 to 2025) | 6.5% |

| CAGR (From 2025 to 2035) | 5.5% |

| Country | France |

|---|---|

| HCAGR (From 2020 to 2025) | 7.7% |

| CAGR (From 2025 to 2035) | 8.3% |

| Country | China |

|---|---|

| HCAGR (From 2020 to 2025) | 11.1% |

| CAGR (From 2025 to 2035) | 12.1% |

| Country | Japan |

|---|---|

| HCAGR (From 2020 to 2025) | 9.5% |

| CAGR (From 2025 to 2035) | 10.3% |

| Attributes | Details |

|---|---|

| United States Market Size (USD million/ billion) by End of Forecast Period (2035) | USD 568.8 Million |

| United States Market Absolute Dollar Growth (USD million/billion) | USD 1.8.0 Million |

The United States QR codes market may offer a remarkable opportunity at USD 1.8 million between 2025 and 2035. Due to the massive manufacturing and adoption of QR code labels, North America is predicted to have a profitable development throughout the projection period.

By 2035, the United States market to have grown at a CAGR of 5.4%, totaling USD 568.8 million. Besides, the booming food and beverage industries in the United States are poised to hasten the market expansion in the United States.

| Attributes | Details |

|---|---|

| Germany Market Size (USD million/ billion) by End of Forecast Period (2035) | USD 124.0 Million |

| Germany Market Absolute Dollar Growth (USD million/billion) | USD 51.4 Million |

Over the forecast period from 2025 to 2035, the QR code labels market in Germany presents an exceptional incremental opportunity of USD 51.4 million. Germany was the fourth-place pharmaceutical market in the world in 2025, per Germany Trade and Invested.

By 2035, the German market to have grown at a CAGR of 5.5%, totaling USD 124 million. FMI projects that the expanding pharmaceutical industry in the nation may increase demand for QR code labels for medicinal products.

| Attributes | Details |

|---|---|

| France Market Size (USD million/ billion) by End of Forecast Period (2035) | USD 4.1 Million |

| France Market Absolute Dollar Growth (USD million/billion) | USD 75.8 Million |

The France QR codes market is to develop at an 8.3% CAGR and reach USD4.1 million by 2035. The increasing adoption of QR code labels as a straightforward physical tool for quick access to websites for advertising and social interaction, in addition to a growing demand for QR code labels on various packaged goods like seafood and liquor bottles, are additional factors anticipated to propel market revenue growth.

| Attributes | Details |

|---|---|

| China Market Size (USD million/ billion) by End of Forecast Period (2035) | USD 645.2 Million |

| China Market Absolute Dollar Growth (USD million/billion | USD 437.2 Million |

Due to the rising usage of connected packaging and on-pack QR codes, the Chinese QR code market revenue soared at a quick CAGR of 12.1%. The increasing use of QR code labels on e-commerce and food and beverage containers. The increasing usage of QR code labels transforms traditional packaging into interactive packaging that provides crucial information on ingredients, manufacturing processes, and finished goods transportation.

| Attributes | Details |

|---|---|

| Japan Market Size (USD million/ billion) by End of Forecast Period (2035) | USD 277.1 Million |

| Japan Market Absolute Dollar Growth (USD million/billion) | USD 173.1 Million |

The Japanese QR codes market is to expand at a CAGR of 10.3% to USD 277.1 million by 2035. Customers are embracing QR codes to gain access to more product information, digital wallets, maps, restaurant menus, and digital entertainment content, which is driving up demand for QR code labels in the region.

The growing trend of customers preferring connected packaging experiences such as augmented reality, near-field communication, Radio Frequency Identification (RFID), and smart barcodes to access product information is likely to contribute to market revenue growth in the future.

The QR Code Labels Market is experiencing steady growth, driven by increasing adoption of digital tracking, authentication, and marketing integration across industries. Leading players such as Packtica Sdn. Bhd., Label Logic Inc., and Hibiscus plc are developing high-resolution, tamper-proof QR code labels that enable product traceability and consumer engagement. Lintec Corporation and CCL Industries Inc. are at the forefront of integrating advanced printing technologies and security inks to improve label durability and data accuracy.

Companies like Advanced Labels NW, Coast Label Company, and Data Label Co. (United Kingdom) are focusing on customizable QR solutions that meet compliance requirements in logistics, pharmaceuticals, and food packaging. Label Impressions Inc., PPG Industries Inc., and Consolidated Label Co. are investing in UV-resistant and water-proof substrates for outdoor and industrial applications.

Regional manufacturers such as Fastroll Labels Sdn. Bhd., Multi-Color Corporation, and Brady Corporation are expanding production capacity to serve growing e-commerce and retail labeling demand. HERMA GmbH and Bizerba Group are advancing smart labeling systems integrated with real-time data analytics.

| Item | Value |

|---|---|

| Quantitative Units (2025) | USD 1.8 billion |

| Label Type | Sleeve Labels, Glue Applied Labels, Pressure Sensitive Labels, Other Labels |

| Printing Technology | Flexographic Printing, Digital Printing, Offset Lithography, Gravure Printing, Other Printing Technologies |

| End Use | Food & Beverage, Pharmaceuticals, Personal Care & Cosmetics, Automotive, Homecare & Toiletries, Chemicals, Industrial, Others |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, Asia Pacific, Middle East & Africa |

| Countries Covered | United States, Germany, France, China, Japan, and 40+ countries |

| Key Companies Profiled | Packtica Sdn. Bhd., Label Logic Inc., Hibiscus plc, Lintec Corporation, CCL Industries Inc., Advanced Labels NW, Coast Label Company, Data Label Co. (United Kingdom), Label Impressions Inc., PPG Industries Inc., Consolidated Label Co., Fastroll Labels Sdn. Bhd., Multi-Color Corporation, Brady Corporation, HERMA GmbH, Bizerba Group, Scanindo Interprinting, Exel Print, MPI Label Systems Inc., Holo Security Technologies |

| Additional Attributes | Dollar sales by label type, printing technology, and end-use sector; regional adoption patterns across North America, Asia Pacific, and Europe; country-level QR label compliance and traceability mandates; technological developments in flexographic and digital printing for intelligent packaging; integration of QR labels in anti-counterfeiting and brand authentication systems. |

The global qr code labels market is estimated to be valued at USD 1.8 billion in 2025.

The market size for the qr code labels market is projected to reach USD 4.1 billion by 2035.

The qr code labels market is expected to grow at a 8.7% CAGR between 2025 and 2035.

The key product types in qr code labels market are sleeve labels, glue applied labels, pressure sensitive labels and other labels.

In terms of printing technology, flexographic printing segment to command 46.2% share in the qr code labels market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

The global QR code payment market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Codeless Testing Market Size and Share Forecast Outlook 2025 to 2035

Encoder Market Analysis - Size, Share, and Forecast 2025 to 2035

Barcode Scanner Market Size and Share Forecast Outlook 2025 to 2035

No-code AI Platform Market Size and Share Forecast Outlook 2025 to 2035

Barcode Printers & Consumables Market Growth - Trends & Forecast 2025 to 2035

Barcode Printers Market Growth - Trends & Forecast 2025 to 2035

Barcode Labeller Machine Market

Barcode Label Market

Low Code Development Platform Market Size and Share Forecast Outlook 2025 to 2035

Low-Code Embedded Analytics Market Growth - Trends & Forecast 2025 to 2035

Case Coders Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Case Coders Industry

2D Barcode Reader Market Size and Share Forecast Outlook 2025 to 2035

UK Barcode Printer Market Analysis – Demand, Growth & Forecast 2025-2035

Audio Codec Market

Inkjet Coders Market Growth - Trends & Outlook 2025 to 2035

2D Bar Code Marketing Market Analysis by Technology, Code Types, Applications, and Region Through 2035

USA Barcode Printer Market Trends – Size, Share & Industry Growth 2025-2035

Video Encoders Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA