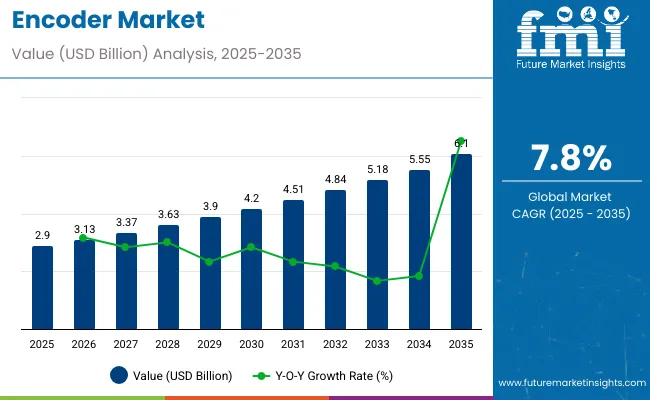

The global encoder market is projected to grow from an estimated USD 2.90 billion in 2025 to USD 6.10 billion by 2035, representing a CAGR of 7.8%. In 2023, the encoder market generated revenue of approximately USD 23.81 billion, with a strong year-on-year (Y-o-Y) growth of 15.8% expected in 2025. This growth is driven by rising demand for precision motion control and automation across industries such as manufacturing, robotics, automotive, and aerospace.

Encoders are critical components used to measure position, speed, and direction in mechanical systems. Their application is integral to automation, enabling precise control in industrial machinery, robotics, elevators, and renewable energy systems like wind turbines. The rapid growth of Industry 4.0 and smart factories is further propelling demand for advanced encoder technologies that enhance efficiency, accuracy, and safety.

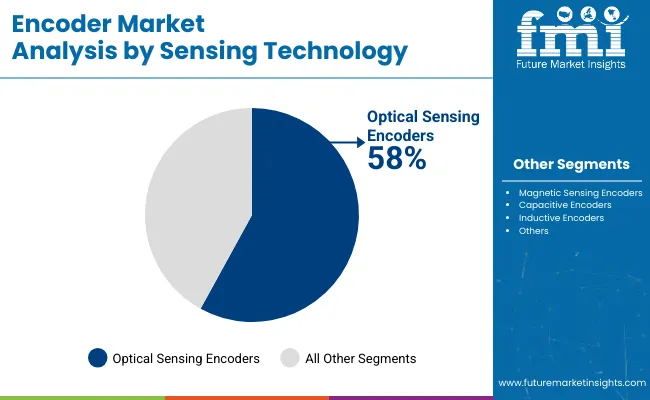

Recent technological advancements have focused on developing high-resolution, robust, and compact encoders suitable for harsh industrial environments. Innovations include optical, magnetic, and capacitive encoder technologies that offer improved durability and performance. In 2024, major players like Renishaw and HEIDENHAIN introduced new encoder models featuring enhanced signal processing and wireless connectivity, enabling easier integration with IoT-enabled industrial systems.

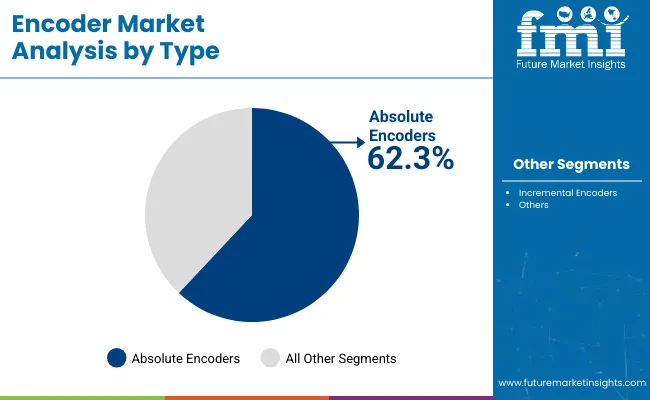

The market is also witnessing growth in absolute encoders that provide precise positional data without the need for a reference point, increasing accuracy in applications such as CNC machines and robotics. Incremental encoders continue to be widely used due to their cost-effectiveness and versatility.

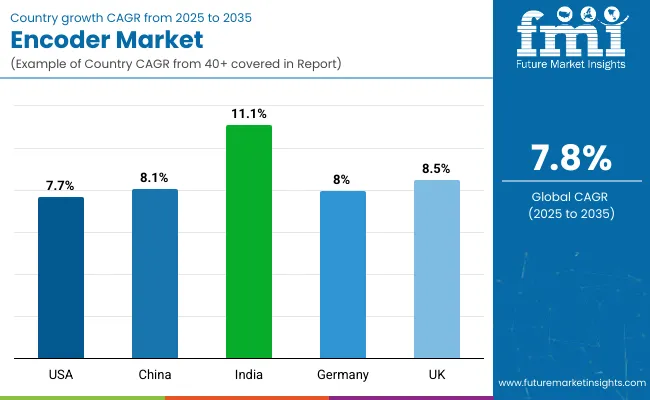

Regionally, Asia Pacific is expected to witness the highest growth due to rapid industrialization, increasing adoption of automation technologies, and expanding manufacturing hubs in countries like China, India, and Japan. North America and Europe remain significant markets, driven by advanced manufacturing infrastructure and continuous innovation.

With increasing emphasis on automation, precision control, and smart manufacturing, the encoder market is poised for strong growth through 2035, supported by technological innovation and expanding industrial applications.

| Attributes | Key Insights |

|---|---|

| Estimated Size, 2025 | USD 2.90 billion |

| Projected Size, 2035 | USD 6.10 billion |

| Value-based CAGR (2025 to 2035) | 7.8% |

Leading companies in the encoder market are leveraging smart technologies such as edge computing, real-time diagnostics, predictive maintenance, and integrated IoT features to enhance precision, efficiency, and reliability in automation systems. These advancements are widely applied in industries such as robotics, automotive, aerospace, and industrial machinery, where intelligent motion control is critical.

Encoders, being critical components in automation, robotics, and motion control systems, must adhere to various international certifications that ensure product safety, reliability, environmental compliance, and electromagnetic compatibility. These certifications are essential for usage in industrial, automotive, aerospace, and medical sectors.

The absolute encoders segment is poised to dominate the encoder market, expected to hold around 62.3% market share by 2025. Absolute encoders are highly valued for their ability to provide precise position feedback even after power loss or system shutdown, unlike incremental encoders that require a reference point to recalibrate. This inherent reliability makes them essential in applications demanding continuous and accurate position tracking.

Industries such as aerospace, robotics, and automotive heavily rely on absolute encoders to ensure precision and uninterrupted production processes. The growing complexity of automation systems and increasing demand for safety and downtime reduction drive the adoption of absolute encoders. Their capability to enhance control system accuracy and maintain operational efficiency underpins their dominant market position. As high-tech industries continue evolving, absolute encoders are expected to remain a key technology supporting advanced automation and precision control through 2025.

The optical sensing encoders segment is projected to expand at a robust CAGR of 18.0% between 2025 and 2035, playing a vital role in overall encoder market growth. Optical encoders provide high-resolution and highly accurate position detection, crucial for precision control in various industries including factory automation, medical equipment, and consumer electronics.

Their non-contact detection mechanism reduces wear and tear, extending equipment lifespan and lowering maintenance costs. Increasing adoption in cutting-edge technologies such as self-driving cars, robotics, and 3D printing further fuels demand. Optical sensing encoders perform reliably in harsh environments, and ongoing advances in optical technology continue to enhance their capabilities. As precision engineering requirements escalate across sectors, optical sensing encoders are emerging as critical drivers of innovation and market expansion through 2035.

The below table presents the expected CAGR for the global Encoder market over several semi-annual periods spanning from 2025 to 2035. In the first half H1 of the year from 2024 to 2034, the business is predicted to surge at a CAGR of 7.8%, followed by a slightly higher growth rate of 8.1% in the second half H2 of the same year.

| Particular | Value CAGR |

|---|---|

| H1, 2024 | 6.3% (2024 to 2034) |

| H2, 2024 | 6.9% (2024 to 2034) |

| H1, 2025 | 7.8% (2025 to 2035) |

| H2, 2025 | 8.1% (2025 to 2035) |

Moving into the subsequent period, from H1 2024 to H2 2034, the CAGR is projected to increase slightly to 7.8% in the first half and remain relatively moderate at 8.1% in the second half. In the first half H1 the market witnessed a decrease of 60 BPS while in the second half H2, the market witnessed an increase of 30 BPS.

Demand for High-Resolution Position Feedback

As automation and robotics have improved, the demand for accurate position feedback in industrial applications has increased. Encoders are useful to provide actual information about how fast, and the direction rotations of machines and parts.

This is very important in many fields, where the precision matters a ton like in manufacturing, automotive, aerospace, and health care where both close control and accurate calibration are critical. High detail encoders provide extremely precise positional data, sometimes down to small fractions of a meter allowing machines to operate better, and without difficulties.

Well, new tech like 3D printing benefits from this sort of fine resolution, too. They ensure the printed objects maintain their proper size and shape in each layer, which you need to print complex shapes and components in working order.

Encoders are critical components in autonomous vehicles that provide accurate feedback to assist with navigation, obstacle detection, and vehicle control. With more and more areas requiring sophisticated systems to regulate things, for precise position feedback, encoder tech will continue to improve, seeking more detail, faster responses, and more trust in its operations.

Rising Demand for Precision in Robotics and Automation

The growing need for precision in robotics and automation is impactfully driving the need for efficient and accurate industrial processes across the global industrial landscape. This scene involves encoders that play a vital role by providing accurate feedback on position, speed, and orientation of robotic arms allowing them to perform tasks precisely.

For example, encoders enable robots to perform complicated assembly tasks with minimal errors which enhance product quality and operational efficiency. This precision is important in industries such as electronics assembly, in which small components of electronic devices need to be carefully manipulated to ensure that products operate correctly.

High Initial Costs of Advanced Encoder Technologies

Premium encoders tend to offer state-of-the-art sensors, carefully reworked engineering, and robust materials. These features come at a premium over conventional encoders. Their cost heavily impacts sectors such as auto manufacturing, aviation, and robotics that require super-high precision measurement and control.

Consider, for example, the car business. Encoders here help control motors and provide position feedback in automated assembly lines. Investing in these higher-end encoders at the beginning can drive profit margins and make an overall project cost seem double.

Integrating Challenges with Diverse Industrial Automation Platforms

ndustrial Automation situations usually have various systems from multiple suppliers with its own communication methods, interfaces and software requirements. They provide accurate feedback for motion control and position sensing. They need to interact with these different platforms to make sure that they are compatible and that they can work together.

The encoders help to communicate with legacy automation systems that may have an obsolete communication face or proprietary protocol. Squeezing new encoders into existing systems may require custom hardware adapters, gap-closing software, or reprogramming. This has made the setup more complicated and expensive. That kind of complex integration can delay adoption in environments where companies can’t afford much downtime or interruptions to their business.

The Encoder market exhibits high growth potential and is projected to grow at a dynamic CAGR of 7.8% during the historical period (2020 to 2024). Encoder Market Report Growth was Positive: Encoder market value did increase, with which the market was USD 2.12 billion in 2020 and USD 23.81 billion in 2024, with an annual average growth of 35.30% from 2020 to 2024.

Global encoder sales expanded from 2020 to 2024, as more sectors adopted automation and Industry 4.0 technology. During this period, the demand for accurate and reliable motion control solutions drove the market.

Between 2025 to 2035 it is estimated a big demand for encoders. This is from advances in robotics more smart manufacturing which is leading to more encoders being adopted in new applications such as electric vehicles and green energy. The years before were fairly constant but the next decade will grow even more since their industries are evolving and being digitalized more.

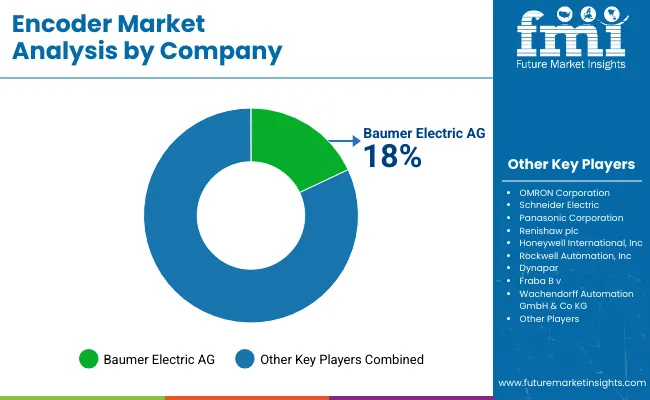

Tier 1 players only include OMRON Corporation, Schneider Electric, Panasonic Corporation, Honeywell International, Inc, Rockwell Automation, Inc. These industries are the players who are the world with a broader market share and a variety of the encoder market range of production.

They have popular brands and plenty of cash to invest in research, which means they are able to keep innovating and raising the bar for the industry. Their encoders are widely used in various industries, including automotive, medical, and factory, due to their reliability, accuracy, and advanced features.

Tier 2 companies are Baumer Electric AG, Renishaw plc, Heidenhain Corporation, TE Connectivity, Mitutoyo Corporation. These are major players that dominate some areas or segments of the encoder market. They produce only the highest quality specialized products and often operate as niche market suppliers. They may not be Tier 1 on a global scale but they are respected in the industry. They remain competitive through their technology expertise and customer loyalty.

Tier 3 are Dynapar, Fraba B v, Wachendorff Automation GmbH & Co KG, Fenac Engineering, and BEI Sensors. These companies focus on niche segments of the encoder market for a specific use or application. They may not be able to compete with the larger industries in terms of bigger budgets or a global reach, yet they excel in delivering tailored solutions with an emphasis on innovation, as well as customer service. These firms tend to serve niche areas where precision and tailoring are key, and they’re well positioned to grow as they expand the range of their products and tap new market.

The section below covers the industry analysis for the Encoder market for different countries. The market demand analysis on key countries in several countries of the globe, including USA, Germany, UK, China and India are provided.

The united states are expected to remains at the forefront in North America, with a value share of 72.3% in 2025. In South Asia & pacific, India is projected to witness a CAGR of 11.1% during the forecasted period.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 7.7% |

| China | 8.1% |

| India | 11.1% |

| Germany | 8.0% |

| UK | 8.5% |

As more American industries opted for automation, the encoder demand was steadily rising. Factories, car makers, and robot builders are among them. To increase productivity and precision, encoders are essential for motion control systems and industrial machines. Finally, the demand for smart factories and Industry 4.0 affects the necessity for advanced encoder solutions. improve precision and reliability of industry requirements on these new encoders.

The USA encoder market is expected to grow significantly, with a projected CAGR of around 7.7% over the next few years, underscoring the increasing demand in the USA

In China, encoders are important for sales and for the vast manufacturing sector in the country, which is aiming to be the global leader in automation and robotics. The “Made in China 2025” program, which seeks to lift up high-tech industries, is driving investments in high-end manufacturing technologies that include encoders.

With the country's industries expanding and progressing towards automation and robotics, encoder sales could see a major increase. Analysts say the year-on-year growth in the near term, could be a strong double digit number.

The rapid embrace of industry and advanced manufacturing in India makes it opportune to adopt encoders in the country. Indian companies demand of precise engineering and automated systems that require high-quality encoders.

Things are improving for encoder use due to the Government of India's "Make in India" platform and continuous work in this area spanning towards infrastructure. Over the 2023 to 2028 period, the encoder market in India is expected to grow at a CAGR of 11.1%, according to experts. Manufacturers and suppliers in India can use this opportunity to grow their business.

The encoder market is characterized by the presence of some of the prominent players such as Heidenhain Corporation, Renishaw plc, Honeywell International Inc., Rockwell Automation, Inc. You train on data until the end of October 2023. To improve their standing, firms frequently join forces, acquire other companies or expand into new areas.

The increasing competition from new entrants especially in the Asia-Pacific region along with the fast-growing factories and automation in this region is providing renewed opportunities in the market. Trends such as precision, reliability, and integration in IoT and smart manufacturing systems are further governing the competitive terrain of encoder industry.

Recent Industry Developments in Encoder Market

| Report Attributes | Details |

|---|---|

| Market Size (2023) | USD 23.81 billion |

| Current Total Market Size (2025) | USD 2.90 billion |

| Projected Market Size (2035) | USD 6.10 billion |

| CAGR (2025 to 2035) | 7.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million units for volume |

| Types Analyzed (Segment 1) | Absolute Encoders, Incremental Encoders |

| Sensing Technologies Analyzed (Segment 2) | Optical Sensing Encoders, Magnetic Sensing Encoders, Capacitive Encoders, Inductive Encoders |

| End Use Industries Analyzed (Segment 3) | Automotive, Consumer Electronics, Aerospace and Defense, Healthcare and Medical Devices, Industrial, Others |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players influencing the Encoder Market | OMRON Corporation, Baumer Electric AG, Schneider Electric, Panasonic Corporation, Renishaw plc, Honeywell International, Inc, Rockwell Automation, Inc, Dynapar, Fraba B V, Wachendorff Automation GmbH & Co KG |

| Additional Attributes | Dollar sales by encoder type (absolute vs incremental), Optical sensing adoption in high-precision environments, Growth in encoder demand from automation and robotics, Trends in miniaturization for consumer electronics, Encoders supporting advanced medical devices and aerospace navigation |

| Customization and Pricing | Customization and Pricing Available on Request |

In terms of Type, the Absolute Encoders and Incremental Encoders.

The Application is classified by industries as Optical Sensing Encoders, Magnetic Sensing Encoders, Capacitive Encoders and Inductive Encoders.

In terms of End User, the End User is Automotive, Consumer Electronics, Aerospace and Defense, Healthcare and Medical Devices, Industrial and Others.

Key countries of North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & pacific, Middle East and Africa (MEA) have been covered in the report.

The global Encoder industry is projected to witness CAGR of 7.8% between 2025 and 2035.

The global Encoder industry stood at USD 2.90 billion in 2025.

The global Encoder industry is anticipated to reach USD 6.10 billion by 2035 end.

East Asia is set to record the highest CAGR of 8.3% in the assessment period.

The key players operating in the global Encoder industry include OMRON Corporation, Baumer Electric AG, Schneider Electric, Panasonic Corporation., Renishaw plc., Honeywell International, Inc., Rockwell Automation, Inc. and others.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Video Encoders Market Size and Share Forecast Outlook 2025 to 2035

Video Encoder and Decoder Market

Rotary Encoder Market

Optical Encoder Market Analysis 2025 to 2035 by Configuration, Output Signal Format, Application, and Region

Ex Proof Absolute Encoders Market Size and Share Forecast Outlook 2025 to 2035

Ex Proof Incremental Encoders Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA