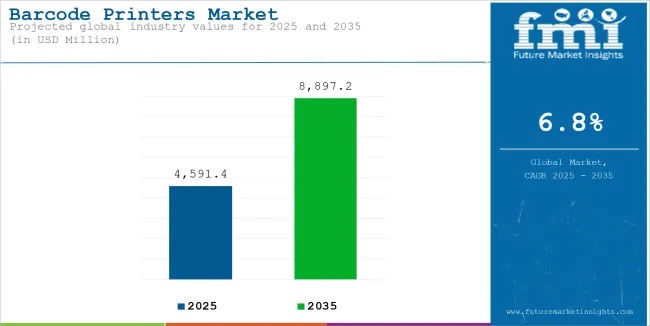

The global barcode printers market reached USD 3,456.8 million in 2020. Worldwide demand for barcode printers saw a 6.1% year-on-year growth in 2025, suggesting an expansion of the market to USD 4,591.4 million in 2025. Projections for the period between 2025 and 2035 indicate a 6.8% compound annual growth rate (CAGR) for global barcode printer sales, resulting in a market size of USD 8,897.2 million by the end of 2035.

Thermal printing accounted for highest market share in the global barcode printers market. Thermal printers have come a long way as a result of technological advancements in the printing industry.

These printers are commonly used for printing labels and barcodes in a variety of industries, including logistics, manufacturing, healthcare, and retail. Thermal printing is a type of printing process that involves the application of heat to a paper or label stock that contains a special coating. This coating reacts to the heat by producing an image or text, thus creating the final print output.

Advantages of barcode thermal printers include

Cost effectiveness

Thermal printing is a cost-effective method of printing since it eliminates the need for ink cartridges, toners, and other consumables. Direct thermal printing, in particular, is more cost-effective since it eliminates the need for ribbons.

Efficiency

Thermal printers are fast and efficient, producing high-quality prints in a matter of seconds. They are ideal for high-volume printing tasks, such as label and barcode printing.

Durability

Thermal prints are more durable than traditional prints since they are resistant to smudging, fading, and other forms of wear and tear. They are ideal for use in harsh environments where regular prints may not hold up.

Versatility

Thermal printers are versatile and can be used to print on a variety of label or paper stocks. They can also print barcodes, graphics, images, and text, making them ideal for use in different applications.

| Attributes | Key Insights |

|---|---|

| Estimated Value (2025) | USD 4,591.4 million |

| Projected Size (2035) | USD 8,897.2 million |

| Value-based CAGR (2025 to 2035) | 6.8% |

The growth trajectory of laser printing is anticipated to grow at fastest CAGR in the forecast period and is expected to account for CAGR of 7.5% in 2025 to 2035. Laser barcode printers are popular choice among low printing volume application.

This type of barcode printers offer high printing speed and impeccable quality. A laser printer for barcode labels is a specialized printing device designed to produce high-quality and precise barcode labels for various applications. It utilizes laser technology to create detailed and sharp images, making it ideal for barcode printing due to its ability to produce accurate and easily scannable codes.

These printers are commonly used in retail, logistics, manufacturing, and other industries where barcodes play a crucial role in inventory tracking, product identification, and data management. Some of the key features of a laser printer for barcode include:

Resolution

Laser printers offer high resolution, typically measured in dots per inch (DPI), which ensures that the barcodes are printed with clarity and precision. A higher DPI value results in more detailed and readable barcodes.

Speed

Barcode label printing often requires high volumes of labels in a short time. Laser printers are known for their fast printing capabilities, enabling efficient production of labels without compromising quality.

Barcode Compatibility

These printers support various barcode symbolizes, such as Code 39, Code 128, QR codes, and more. This versatility allows businesses to create labels compatible with their specific needs and industry standards.

Media Handling

Barcode labels may need to be printed on different types of media, including adhesive labels, synthetic materials, and even pre-printed forms. Laser printers for barcode labels are equipped to handle various media types and sizes, providing flexibility in printing options.

Connectivity Options

Modern laser printers come with multiple connectivity options, such as USB, Ethernet, and Wi-Fi, allowing seamless integration with existing networks and systems. This enables easy printing from multiple devices and locations.

Barcode Software Support

To design and generate barcodes, specialized barcode software is often used. A good laser printer for barcode labels should be compatible with commonly used barcode software, streamlining the label creation process.

The annual growth rates of the barcode printers market from 2025 to 2035 are illustrated below in the table. Starting with the base year 2024 and going up to the present year 2025, the report examined how the industry growth trajectory changes from the first half of the year, i.e. January through June (H1) to the second half consisting of July through December (H2).

This gives stakeholders a comprehensive picture of the sector’s performance over time and insights into potential future developments.

The table provided shows the growth of the sector for each half-year between 2024 and 2025. The market was projected to grow at a CAGR of 5.8% in the first half (H1) of 2024. However, in the second half (H2), there is a noticeable increase in the growth rate.

| Particular | Value CAGR |

|---|---|

| H1(2024 to 2034) | 5.8% |

| H2(2024 to 2034) | 6.0% |

| H1(2025 to 2035) | 6.0% |

| H2(2025 to 2035) | 6.2% |

Moving into the subsequent period, from H1 2024 to H2 2024, the CAGR is projected as 6.0% in the first half and grow to 6.2% in the second half. In the first half (H1) and second half (H2), the market witnessed an increase of 20 BPS each.

The section explains the market share analysis of the leading segments in the industry. In terms of printing type, the thermal printing type will likely dominate and generate a share of around 65.6% in 2025.

Based on the end use, the retail end use is projected to hold a major share of 30.2% in 2025. The analysis would enable potential clients to make effective business decisions for investment purposes.

| Segment | Value Share (2025) |

|---|---|

| Thermal Printing (Printing Type) | 65.6% |

Thermal printing technology, which includes both direct thermal and thermal transfer methods, offers exceptional print quality with high-resolution outputs. The sharp, clear, and durable labels produced by thermal printers are particularly suited for barcode scanning, ensuring high accuracy in data capture. These printers also have fewer moving parts compared to other types, such as dot matrix or inkjet, making them highly reliable and less prone to mechanical failure. This durability and consistency are essential for industries requiring error-free operations, such as logistics, healthcare, and retail.

The ability of thermal printers to print on various media types, including paper, polyester, and synthetic materials, makes them suitable for a wide range of applications. From shipping labels and price tags in retail to patient wristbands in healthcare and durable labels in industrial settings, thermal printing technology is adaptable to diverse industry needs.

| Segment | Value Share (2025) |

|---|---|

| Retail (End Use) | 30.2% |

Retail environments, especially large-scale stores and e-commerce platforms, handle a high volume of transactions daily. Barcode printers are essential for labeling products, managing stock, and streamlining checkout processes. Efficient barcode systems help retailers ensure accuracy in pricing, promotions, and inventory control, reducing errors and enhancing operational efficiency. As retail businesses continue to expand, the need for accurate labeling and tracking of goods drives significant demand for barcode printers.

Barcode printers are seamlessly integrated into retail Point-of-Sale (POS) systems, which are used in stores to scan product barcodes at checkout. This integration ensures fast and accurate processing of purchases, improving the customer experience. Retailers use barcode labels not only for product identification but also for inventory replenishment, stock taking, and product tracking across multiple store locations. The ability to quickly adapt barcode printing systems to ever-changing retail needs, such as price changes, discounts, and promotions, further fuels their demand in the retail sector.

Between 2020 and 2024, the target market registered growth rate of 5.8% by reaching a value of USD 4,327.9 million in 2024 from USD 3,456.8 million in 2020.

The landscape of barcode technology is brimming with innovation, promising to redefine not just how businesses operate, but how they interact with customers, manage inventory, and even approach the broader market. Some of the trends in barcode technology include eco-friendly barcodes, block-chain integration, smart barcode with IoT, AR integration, and others.

Enhanced data encryption and security measures are becoming a top priority as barcodes carry increasingly sensitive information. Protecting this data is crucial in maintaining consumer trust and compliance with regulations.

Thus, the demand for printing advanced barcodes is predominantly achieved with thermal barcode printers. Barcode printers have become crucial across industries as these tend to manage inventory, enables effective product tracking, and optimizes & tracks entire value chain (sales process). These barcode printers support several industries including retail, healthcare, logistics & transportation, and others.

Retail organizations are attracting the customers by providing the quality products at lesser cost. To achieve the economies of scale, these retailers are utilizing the technology benefits. In India most of the customers are price conscious and that is the reason the retailers are facing challenges to offer superior products at lesser cost.

To reduce the cost of overall business operations, the retailers depend on technology. Lots of tools are available to run the business smoothly at lower cost. Electronic Data Interchange (EDI), Bar-coding and Radio Frequency Identification (RFID) are some technological inventions to reduce operating cost and ultimately cost reduction in product cost.

All these factors have played pivotal role in expanding the demand for barcode printers industry in 2020 to 2024.

Looking ahead to 2025 to 2035, the market is anticipated to grow faster. Barcodes were primarily used to manage retail inventories in the logistics industry. Technological advancement further widened the application of barcode are used to track shipments.

The adoption of Universal Product Codes (UPC) and the International Article Number (EAN) allowed for a standardized system of identification that streamlined global trade processes.

QR codes emerged as a sophisticated evolution of barcodes, capable of storing more information and being scanned from any direction, which increased their utility in logistics. The introduction of smartphones and tablets equipped with cameras has made scanning these codes more accessible and flexible.

Logistics companies have adapted by using these mobile devices to manage inventory and execute shipping and receiving operations, eliminating the need for bulky, specialized barcode scanners. This factor has enabled barcode printer manufacturers to advance their printers in order to meet the evolving demand of the advanced barcodes in the logistical industry.

Barcode technology has also gained immense popularity in the healthcare industry as this technology enables better, efficient and safe patient care. Barcodes are widely used across the medical sector, particularly in warehouses and central pharmacies. Barcodes are also a common feature in clinical environments – on patients’ wristbands, bio-samples, test tubes, order sheets and many other objects.

While the technology can dramatically improve processes and patient safety, systems are often conceived and implemented without an overall strategy. This leads to different types of code being used across the clinical environment and even on the same product which can lead to problems for clinicians.

Increasingly, legislators and key organizations in the healthcare sector – from pharmaceutical manufacturers to distributors and clinics themselves – recognize the benefit of using GS1 compliant 2D barcodes. Using one type of barcode label will make it much easier, and more affordable, to implement scanning systems that can capture data on any device, medicine or product.

And with more medicines and medical devices carrying detailed information on barcodes, the healthcare industry can more easily embrace better workflows and care practices. All these factors are foreseen to propel the barcode printers market in the near future.

The evolution of barcode label solutions: from analog to digital

In the ever-evolving landscape of technology, few innovations have had the profound impact and longevity of the barcode. Predominantly barcodes were used as simple means of tracking products in grocery stores.

However, the barcode development has witnessed rapid development and is considered as omnipresent tool across industries, revolutionizing inventory management, supply chain logistics, and retail operations. This evolution, from analog to digital, has been driven by advancements in barcode label solutions, printers, labels, and scanners, each playing a pivotal role in enhancing efficiency, accuracy, and productivity.

Analog Era: The Birth of Barcode Labels

In the analog era, barcode labels were primarily linear, consisting of parallel lines of varying thickness. These lines represented encoded data, typically numerical digits, which could be scanned and interpreted by barcode readers. The Universal Product Code (UPC) system, introduced in the 1970s, standardized barcode symbolizes for retail products, facilitating automated checkout and inventory management. Early barcode labels faced challenges such as limited data storage capacity and susceptibility to damage or degradation. However, they marked a significant leap forward in efficiency compared to manual data entry methods, reducing errors and speeding up transactions.

Digital Evolution: The Rise of Barcode Printers

Advancements in barcode scanners: enhancing productivity and mobility

Barcode scanners evolved to meet the growing demand for efficiency, accuracy, and mobility in data capture applications. Traditional laser scanners gave way to imaging scanners equipped with advanced image processing algorithms, capable of decoding complex 1D and 2D symbolizes with unparalleled speed and accuracy.

Wireless and mobile scanning solutions revolutionized workflows by enabling real-time data capture and transmission, eliminating the need for tethered connections and stationary scanning stations.

Bluetooth-enabled scanners, handheld devices, and mobile applications empowered workers to perform inventory tasks, asset tracking, and point-of-sale transactions on the go, improving operational efficiency and customer satisfaction.

Integration with enterprise systems and cloud-based platforms facilitated seamless data synchronization and analytics, enabling organizations to gain actionable insights from barcode data and optimize their operations.

The evolution of barcode technology from analog to digital represents a remarkable journey of innovation and adaptation. Barcode label solutions, printers, and scanners have evolved in tandem, driven by the need for efficiency, accuracy, and versatility in a rapidly changing business landscape. As we look to the future, the potential for further advancements in barcode technology is boundless.

Emerging trends such as Internet of Things (IoT) integration, artificial intelligence (AI)-powered image recognition, and blockchain-based traceability solutions promise to revolutionize supply chain management, consumer engagement, and beyond.

The evolution of barcode technology underscores the transformative power of innovation in shaping the way we do business and interact with the world. By embracing digital solutions and leveraging the full potential of barcode technology, organizations can streamline their operations, drive efficiency, and unlock new opportunities for growth and success in the digital age.

PostScript/PDF (Portable Document Format) has rapidly gained acceptance in the global marketplace as the standard file format for document printing. The integration of PostScript/PDF printing into thermal barcode printers provides greater flexibility, eliminating the need for customized middleware.

Some competitive barcode printers offer no direct way to print PostScript/PDF nor can your PostScript/PDF files be converted to their native printer language.

This is due to the fundamental difference in the way the printers are designed to process the printer language emulations. However, Printronix System Architecture (PSA) enabled thermal barcode printers were the first in the thermal printer industry to offer PostScript/PDF support that easily integrates into existing operating systems with support for up to 35 different scalable fonts.

This printers support both 203 and 300 dpi printing applications and offer plug-and-play compatibility with the latest ERP and native SAP drivers. In today’s competitive economic environment, eliminating the complexity and simplifying the barcode printing process is critical for the survival of any business.

Benefits of Printing PostScript/PDF with Thermal Barcode Printers

Every industry relies on efficiency and accuracy. These two factors are pivotal to run business effectively. From healthcare to retail, barcodes and scanners have become tools for identification or tracking.

Trends in barcode technology

2D Barcodes

2D barcodes have the capability of storing more data as compared to 1D barcodes. They can hold information like URLs, images, or entire documents.

Mobile Barcode Scanners

Smartphones can now act as barcode scanners through apps that use phone cameras, making scanning more convenient and accessible for consumers.

Integrating It with IoT and AI

Barcode registration is mandatory for every business. Then the registered barcode needs to be integrated with the Internet of Things (IoT) and Artificial Intelligence (AI). These two could be immensely efficient and help in the automation of several industries.

IoT-enabled barcode scanners can communicate with connected devices. A primary example of this is an inventory management system.

These advancements in barcode technology has further propelled the demand for adoption of advanced and hi-tech barcode printers.

Barcode printers, especially thermal printers, often struggle to maintain print quality under extreme environmental conditions. Labels printed using direct thermal technology are prone to fading when exposed to heat, sunlight, or moisture, making them unsuitable for long-term applications or outdoor use. This limitation can result in frequent reprinting, increased costs, and inefficiencies in industries requiring durable labels, such as logistics or heavy manufacturing.

Industrial barcode printers, though essential for high-volume operations, can incur significant maintenance and operational expenses. Components like printheads and rollers are subject to wear and tear, requiring regular replacement. Additionally, thermal transfer printers need specialized ribbons, which add to consumable costs. Users also face compatibility issues when upgrading printer models, as proprietary software or hardware often restricts interoperability with existing systems.

Barcode printers are optimized for specific tasks like printing linear barcodes or QR codes but may lack the versatility to handle unique or complex label requirements.

For example, printing on non-standard materials such as fabric, metal, or textured surfaces may require additional customization or specialized printers, increasing costs and limiting their appeal. Furthermore, advancements like RFID or near-field communication (NFC) tags are gradually reducing reliance on traditional barcodes, posing a long-term challenge to the relevance of barcode printers.

Tier 1 companies comprise players with a revenue of above USD 1,000 million capturing a significant share of 40-45% in the global market. These players are characterized by high production capacity and a wide product portfolio.

These leaders are distinguished by their extensive expertise in manufacturing and reconditioning across multiple barcode printers application and a broad geographical reach, underpinned by a robust consumer base. Prominent companies within Tier 1 include Toshiba Tec Corporation, Honeywell International Inc., Canon Finetech Nisca Inc., AVERY DENNISON CORPORATION and other players.

Tier 2 companies include mid-size players with revenue of below USD 1,000 million having a presence in specific regions and highly influencing the local industry.

These are characterized by a strong presence overseas and strong industry knowledge. These players have good technology and ensure regulatory compliance but may not have advanced technology and wide global reach. Prominent companies in tier 2 include TVS ELECTRONICS, Linx Printing Technologies, DASCOM, OKI Data Australia and other player.

The section below covers the industry analysis for barcode printers demand in different countries. The demand analysis on key countries in several regions of the globe, including North America, Latin America, East Asia, South Asia Pacific, Western Europe, Eastern Europe, Middle East, and Africa is provided.

China will hold 63.1% in East Asia due to robust manufacturing & logistical sector and rising E-commerce industry. The USA will capture 75.6% in North America owing to advanced logistics and supply chain management. Germany will lead Western Europe with 34.8% due to robust manufacturing sector specializing in automotive, machinery, chemicals, and electronics.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| Spain | 8.1% |

| India | 7.3% |

| Brazil | 7.7% |

| Germany | 6.1% |

| China | 5.3% |

The sales of barcode printers in China is projected to reach USD 1,403.5 million and is estimated to grow at an 5.3% CAGR by 2035.

As one of the largest exporters globally, efficient inventory management and supply chain operations are critical. Barcode printers are integral to labeling, tracking, and streamlining these operations, making them indispensable tools in China’s industrial landscape. The proliferation of large-scale warehouses and the adoption of smart logistics further amplify the demand.

China is home to the world’s largest e-commerce market, with platforms like Alibaba, JD.com, and Pinduoduo serving millions of customers daily. These platforms rely heavily on barcode printing for packaging, tracking, and delivery, ensuring efficiency and accuracy in their vast logistics networks.

The sales of barcode printer in the USA are projected to reach USD 2,017.9 million by 2035.

The USA boasts a highly developed retail and e-commerce market, led by giants such as Amazon, Walmart, and Target. These businesses rely heavily on barcode printers for inventory management, order tracking, and efficient checkout processes. The scale of operations and emphasis on automation to meet consumer demand make barcode printing technology indispensable in this sector, driving its adoption across the country.

The USA healthcare industry has stringent regulations for tracking medical devices, pharmaceuticals, and patient records. Barcode printers are critical in ensuring compliance with standards such as the USA FDA’s Unique Device Identification (UDI) system. Hospitals, pharmacies, and labs extensively use barcode labels for medication safety, equipment identification, and patient management, driving significant market demand.

The sale of barcode printers in Germany is projected to reach USD 464.4 million and grow at a CAGR of 6.1% by 2035.

Germany is known for its engineering excellence and focus on technological innovation. This extends to barcode printing solutions, where businesses demand high-quality, durable, and efficient printing technologies. Advanced barcode printers capable of handling high-resolution printing, specialized materials, and integration with automated systems are widely adopted across industries. This demand for cutting-edge solutions drives Germany's leadership in the Western European market.

Key companies producing barcode printers are slightly consolidate the market with about 50-55% share that are prioritizing technological advancements, integrating sustainable practices, and expanding their footprints in the region. Customer satisfaction remains paramount, with a keen focus on producing barcode printers to meet diverse applications. These industry leaders actively foster collaborations to stay at the forefront of innovation, ensuring their barcode printers align with the evolving demands and maintain the highest standards of quality and adaptability.

Recent Industry Developments

The Printing Speed segment is further categorized into Upto 4 inch/second, 5-8 inch/second, >8 inch/second.

The Product Type segment is classified into Desktop Barcode Printers, Industrial Barcode Printers, and Mobile Barcode Printer.

The Printing Type segment is classified into Dot Matrix, Inkjet, Laser, and Thermal.

The End Use segment is classified into Retail, Manufacturing & Industrial, Transportation & Logistics, Healthcare & Hospitality, Government, and Others.

Regions considered in the study include North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and the Middle East and Africa.

The global barcode printers market for residential end use was valued at USD 1,386.6 million in 2025.

The demand for barcode printers industry is set to reach USD 8,897.2 million in 2035.

Industries like retail, manufacturing, logistics, and healthcare focus on enhancing operational efficiency, there is a growing need for automation. Barcode printers play a critical role in automating inventory management, shipping processes, and point-of-sale systems. The adoption of barcode technology helps streamline workflows, reduce errors, and improve productivity, driving demand for barcode printers across various sectors.

The barcode printers demand was valued at USD 3,456.8 million in 2020 and is projected to reach USD 8,897.2 million by 2035 growing at CAGR of 6.8% in the forecast period.

Thermal printing type is expected to lead during the forecast period.

Table 1: Global Barcode Printers Market Value (US$ million) Forecast by Region, 2017 to 2032

Table 2: Global Barcode Printers Market Volume (Unit) Forecast by Region, 2017 to 2032

Table 3: Global Barcode Printers Market Value (US$ million) Forecast by Printer Type, 2017 to 2032

Table 4: Global Barcode Printers Market Volume (Unit) Forecast by Printer Type, 2017 to 2032

Table 5: Global Barcode Printers Market Value (US$ million) Forecast by Printing Technology, 2017 to 2032

Table 6: Global Barcode Printers Market Volume (Unit) Forecast by Printing Technology, 2017 to 2032

Table 7: Global Barcode Printers Market Value (US$ million) Forecast by Consumables, 2017 to 2032

Table 8: Global Barcode Printers Market Volume (Unit) Forecast by Consumables, 2017 to 2032

Table 9: Global Barcode Printers Market Value (US$ million) Forecast by Application, 2017 to 2032

Table 10: Global Barcode Printers Market Volume (Unit) Forecast by Application, 2017 to 2032

Table 11: Global Barcode Printers Market Value (US$ million) Forecast by Distribution Channel, 2017 to 2032

Table 12: Global Barcode Printers Market Volume (Unit) Forecast by Distribution Channel, 2017 to 2032

Table 13: North America Barcode Printers Market Value (US$ million) Forecast by Country, 2017 to 2032

Table 14: North America Barcode Printers Market Volume (Unit) Forecast by Country, 2017 to 2032

Table 15: North America Barcode Printers Market Value (US$ million) Forecast by Printer Type, 2017 to 2032

Table 16: North America Barcode Printers Market Volume (Unit) Forecast by Printer Type, 2017 to 2032

Table 17: North America Barcode Printers Market Value (US$ million) Forecast by Printing Technology, 2017 to 2032

Table 18: North America Barcode Printers Market Volume (Unit) Forecast by Printing Technology, 2017 to 2032

Table 19: North America Barcode Printers Market Value (US$ million) Forecast by Consumables, 2017 to 2032

Table 20: North America Barcode Printers Market Volume (Unit) Forecast by Consumables, 2017 to 2032

Table 21: North America Barcode Printers Market Value (US$ million) Forecast by Application, 2017 to 2032

Table 22: North America Barcode Printers Market Volume (Unit) Forecast by Application, 2017 to 2032

Table 23: North America Barcode Printers Market Value (US$ million) Forecast by Distribution Channel, 2017 to 2032

Table 24: North America Barcode Printers Market Volume (Unit) Forecast by Distribution Channel, 2017 to 2032

Table 25: Latin America Barcode Printers Market Value (US$ million) Forecast by Country, 2017 to 2032

Table 26: Latin America Barcode Printers Market Volume (Unit) Forecast by Country, 2017 to 2032

Table 27: Latin America Barcode Printers Market Value (US$ million) Forecast by Printer Type, 2017 to 2032

Table 28: Latin America Barcode Printers Market Volume (Unit) Forecast by Printer Type, 2017 to 2032

Table 29: Latin America Barcode Printers Market Value (US$ million) Forecast by Printing Technology, 2017 to 2032

Table 30: Latin America Barcode Printers Market Volume (Unit) Forecast by Printing Technology, 2017 to 2032

Table 31: Latin America Barcode Printers Market Value (US$ million) Forecast by Consumables, 2017 to 2032

Table 32: Latin America Barcode Printers Market Volume (Unit) Forecast by Consumables, 2017 to 2032

Table 33: Latin America Barcode Printers Market Value (US$ million) Forecast by Application, 2017 to 2032

Table 34: Latin America Barcode Printers Market Volume (Unit) Forecast by Application, 2017 to 2032

Table 35: Latin America Barcode Printers Market Value (US$ million) Forecast by Distribution Channel, 2017 to 2032

Table 36: Latin America Barcode Printers Market Volume (Unit) Forecast by Distribution Channel, 2017 to 2032

Table 37: Europe Barcode Printers Market Value (US$ million) Forecast by Country, 2017 to 2032

Table 38: Europe Barcode Printers Market Volume (Unit) Forecast by Country, 2017 to 2032

Table 39: Europe Barcode Printers Market Value (US$ million) Forecast by Printer Type, 2017 to 2032

Table 40: Europe Barcode Printers Market Volume (Unit) Forecast by Printer Type, 2017 to 2032

Table 41: Europe Barcode Printers Market Value (US$ million) Forecast by Printing Technology, 2017 to 2032

Table 42: Europe Barcode Printers Market Volume (Unit) Forecast by Printing Technology, 2017 to 2032

Table 43: Europe Barcode Printers Market Value (US$ million) Forecast by Consumables, 2017 to 2032

Table 44: Europe Barcode Printers Market Volume (Unit) Forecast by Consumables, 2017 to 2032

Table 45: Europe Barcode Printers Market Value (US$ million) Forecast by Application, 2017 to 2032

Table 46: Europe Barcode Printers Market Volume (Unit) Forecast by Application, 2017 to 2032

Table 47: Europe Barcode Printers Market Value (US$ million) Forecast by Distribution Channel, 2017 to 2032

Table 48: Europe Barcode Printers Market Volume (Unit) Forecast by Distribution Channel, 2017 to 2032

Table 49: Asia Pacific Barcode Printers Market Value (US$ million) Forecast by Country, 2017 to 2032

Table 50: Asia Pacific Barcode Printers Market Volume (Unit) Forecast by Country, 2017 to 2032

Table 51: Asia Pacific Barcode Printers Market Value (US$ million) Forecast by Printer Type, 2017 to 2032

Table 52: Asia Pacific Barcode Printers Market Volume (Unit) Forecast by Printer Type, 2017 to 2032

Table 53: Asia Pacific Barcode Printers Market Value (US$ million) Forecast by Printing Technology, 2017 to 2032

Table 54: Asia Pacific Barcode Printers Market Volume (Unit) Forecast by Printing Technology, 2017 to 2032

Table 55: Asia Pacific Barcode Printers Market Value (US$ million) Forecast by Consumables, 2017 to 2032

Table 56: Asia Pacific Barcode Printers Market Volume (Unit) Forecast by Consumables, 2017 to 2032

Table 57: Asia Pacific Barcode Printers Market Value (US$ million) Forecast by Application, 2017 to 2032

Table 58: Asia Pacific Barcode Printers Market Volume (Unit) Forecast by Application, 2017 to 2032

Table 59: Asia Pacific Barcode Printers Market Value (US$ million) Forecast by Distribution Channel, 2017 to 2032

Table 60: Asia Pacific Barcode Printers Market Volume (Unit) Forecast by Distribution Channel, 2017 to 2032

Table 61: MEA Barcode Printers Market Value (US$ million) Forecast by Country, 2017 to 2032

Table 62: MEA Barcode Printers Market Volume (Unit) Forecast by Country, 2017 to 2032

Table 63: MEA Barcode Printers Market Value (US$ million) Forecast by Printer Type, 2017 to 2032

Table 64: MEA Barcode Printers Market Volume (Unit) Forecast by Printer Type, 2017 to 2032

Table 65: MEA Barcode Printers Market Value (US$ million) Forecast by Printing Technology, 2017 to 2032

Table 66: MEA Barcode Printers Market Volume (Unit) Forecast by Printing Technology, 2017 to 2032

Table 67: MEA Barcode Printers Market Value (US$ million) Forecast by Consumables, 2017 to 2032

Table 68: MEA Barcode Printers Market Volume (Unit) Forecast by Consumables, 2017 to 2032

Table 69: MEA Barcode Printers Market Value (US$ million) Forecast by Application, 2017 to 2032

Table 70: MEA Barcode Printers Market Volume (Unit) Forecast by Application, 2017 to 2032

Table 71: MEA Barcode Printers Market Value (US$ million) Forecast by Distribution Channel, 2017 to 2032

Table 72: MEA Barcode Printers Market Volume (Unit) Forecast by Distribution Channel, 2017 to 2032

Figure 1: Global Barcode Printers Market Value (US$ million) by Printer Type, 2022 to 2032

Figure 2: Global Barcode Printers Market Value (US$ million) by Printing Technology, 2022 to 2032

Figure 3: Global Barcode Printers Market Value (US$ million) by Consumables, 2022 to 2032

Figure 4: Global Barcode Printers Market Value (US$ million) by Application, 2022 to 2032

Figure 5: Global Barcode Printers Market Value (US$ million) by Distribution Channel, 2022 to 2032

Figure 6: Global Barcode Printers Market Value (US$ million) by Region, 2022 to 2032

Figure 7: Global Barcode Printers Market Value (US$ million) Analysis by Region, 2017 to 2032

Figure 8: Global Barcode Printers Market Volume (Unit) Analysis by Region, 2017 to 2032

Figure 9: Global Barcode Printers Market Value Share (%) and BPS Analysis by Region, 2022 to 2032

Figure 10: Global Barcode Printers Market Y-o-Y Growth (%) Projections by Region, 2022 to 2032

Figure 11: Global Barcode Printers Market Value (US$ million) Analysis by Printer Type, 2017 to 2032

Figure 12: Global Barcode Printers Market Volume (Unit) Analysis by Printer Type, 2017 to 2032

Figure 13: Global Barcode Printers Market Value Share (%) and BPS Analysis by Printer Type, 2022 to 2032

Figure 14: Global Barcode Printers Market Y-o-Y Growth (%) Projections by Printer Type, 2022 to 2032

Figure 15: Global Barcode Printers Market Value (US$ million) Analysis by Printing Technology, 2017 to 2032

Figure 16: Global Barcode Printers Market Volume (Unit) Analysis by Printing Technology, 2017 to 2032

Figure 17: Global Barcode Printers Market Value Share (%) and BPS Analysis by Printing Technology, 2022 to 2032

Figure 18: Global Barcode Printers Market Y-o-Y Growth (%) Projections by Printing Technology, 2022 to 2032

Figure 19: Global Barcode Printers Market Value (US$ million) Analysis by Consumables, 2017 to 2032

Figure 20: Global Barcode Printers Market Volume (Unit) Analysis by Consumables, 2017 to 2032

Figure 21: Global Barcode Printers Market Value Share (%) and BPS Analysis by Consumables, 2022 to 2032

Figure 22: Global Barcode Printers Market Y-o-Y Growth (%) Projections by Consumables, 2022 to 2032

Figure 23: Global Barcode Printers Market Value (US$ million) Analysis by Application, 2017 to 2032

Figure 24: Global Barcode Printers Market Volume (Unit) Analysis by Application, 2017 to 2032

Figure 25: Global Barcode Printers Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 26: Global Barcode Printers Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 27: Global Barcode Printers Market Value (US$ million) Analysis by Distribution Channel, 2017 to 2032

Figure 28: Global Barcode Printers Market Volume (Unit) Analysis by Distribution Channel, 2017 to 2032

Figure 29: Global Barcode Printers Market Value Share (%) and BPS Analysis by Distribution Channel, 2022 to 2032

Figure 30: Global Barcode Printers Market Y-o-Y Growth (%) Projections by Distribution Channel, 2022 to 2032

Figure 31: Global Barcode Printers Market Attractiveness by Printer Type, 2022 to 2032

Figure 32: Global Barcode Printers Market Attractiveness by Printing Technology, 2022 to 2032

Figure 33: Global Barcode Printers Market Attractiveness by Consumables, 2022 to 2032

Figure 34: Global Barcode Printers Market Attractiveness by Application, 2022 to 2032

Figure 35: Global Barcode Printers Market Attractiveness by Distribution Channel, 2022 to 2032

Figure 36: Global Barcode Printers Market Attractiveness by Region, 2022 to 2032

Figure 37: North America Barcode Printers Market Value (US$ million) by Printer Type, 2022 to 2032

Figure 38: North America Barcode Printers Market Value (US$ million) by Printing Technology, 2022 to 2032

Figure 39: North America Barcode Printers Market Value (US$ million) by Consumables, 2022 to 2032

Figure 40: North America Barcode Printers Market Value (US$ million) by Application, 2022 to 2032

Figure 41: North America Barcode Printers Market Value (US$ million) by Distribution Channel, 2022 to 2032

Figure 42: North America Barcode Printers Market Value (US$ million) by Country, 2022 to 2032

Figure 43: North America Barcode Printers Market Value (US$ million) Analysis by Country, 2017 to 2032

Figure 44: North America Barcode Printers Market Volume (Unit) Analysis by Country, 2017 to 2032

Figure 45: North America Barcode Printers Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 46: North America Barcode Printers Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 47: North America Barcode Printers Market Value (US$ million) Analysis by Printer Type, 2017 to 2032

Figure 48: North America Barcode Printers Market Volume (Unit) Analysis by Printer Type, 2017 to 2032

Figure 49: North America Barcode Printers Market Value Share (%) and BPS Analysis by Printer Type, 2022 to 2032

Figure 50: North America Barcode Printers Market Y-o-Y Growth (%) Projections by Printer Type, 2022 to 2032

Figure 51: North America Barcode Printers Market Value (US$ million) Analysis by Printing Technology, 2017 to 2032

Figure 52: North America Barcode Printers Market Volume (Unit) Analysis by Printing Technology, 2017 to 2032

Figure 53: North America Barcode Printers Market Value Share (%) and BPS Analysis by Printing Technology, 2022 to 2032

Figure 54: North America Barcode Printers Market Y-o-Y Growth (%) Projections by Printing Technology, 2022 to 2032

Figure 55: North America Barcode Printers Market Value (US$ million) Analysis by Consumables, 2017 to 2032

Figure 56: North America Barcode Printers Market Volume (Unit) Analysis by Consumables, 2017 to 2032

Figure 57: North America Barcode Printers Market Value Share (%) and BPS Analysis by Consumables, 2022 to 2032

Figure 58: North America Barcode Printers Market Y-o-Y Growth (%) Projections by Consumables, 2022 to 2032

Figure 59: North America Barcode Printers Market Value (US$ million) Analysis by Application, 2017 to 2032

Figure 60: North America Barcode Printers Market Volume (Unit) Analysis by Application, 2017 to 2032

Figure 61: North America Barcode Printers Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 62: North America Barcode Printers Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 63: North America Barcode Printers Market Value (US$ million) Analysis by Distribution Channel, 2017 to 2032

Figure 64: North America Barcode Printers Market Volume (Unit) Analysis by Distribution Channel, 2017 to 2032

Figure 65: North America Barcode Printers Market Value Share (%) and BPS Analysis by Distribution Channel, 2022 to 2032

Figure 66: North America Barcode Printers Market Y-o-Y Growth (%) Projections by Distribution Channel, 2022 to 2032

Figure 67: North America Barcode Printers Market Attractiveness by Printer Type, 2022 to 2032

Figure 68: North America Barcode Printers Market Attractiveness by Printing Technology, 2022 to 2032

Figure 69: North America Barcode Printers Market Attractiveness by Consumables, 2022 to 2032

Figure 70: North America Barcode Printers Market Attractiveness by Application, 2022 to 2032

Figure 71: North America Barcode Printers Market Attractiveness by Distribution Channel, 2022 to 2032

Figure 72: North America Barcode Printers Market Attractiveness by Country, 2022 to 2032

Figure 73: Latin America Barcode Printers Market Value (US$ million) by Printer Type, 2022 to 2032

Figure 74: Latin America Barcode Printers Market Value (US$ million) by Printing Technology, 2022 to 2032

Figure 75: Latin America Barcode Printers Market Value (US$ million) by Consumables, 2022 to 2032

Figure 76: Latin America Barcode Printers Market Value (US$ million) by Application, 2022 to 2032

Figure 77: Latin America Barcode Printers Market Value (US$ million) by Distribution Channel, 2022 to 2032

Figure 78: Latin America Barcode Printers Market Value (US$ million) by Country, 2022 to 2032

Figure 79: Latin America Barcode Printers Market Value (US$ million) Analysis by Country, 2017 to 2032

Figure 80: Latin America Barcode Printers Market Volume (Unit) Analysis by Country, 2017 to 2032

Figure 81: Latin America Barcode Printers Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 82: Latin America Barcode Printers Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 83: Latin America Barcode Printers Market Value (US$ million) Analysis by Printer Type, 2017 to 2032

Figure 84: Latin America Barcode Printers Market Volume (Unit) Analysis by Printer Type, 2017 to 2032

Figure 85: Latin America Barcode Printers Market Value Share (%) and BPS Analysis by Printer Type, 2022 to 2032

Figure 86: Latin America Barcode Printers Market Y-o-Y Growth (%) Projections by Printer Type, 2022 to 2032

Figure 87: Latin America Barcode Printers Market Value (US$ million) Analysis by Printing Technology, 2017 to 2032

Figure 88: Latin America Barcode Printers Market Volume (Unit) Analysis by Printing Technology, 2017 to 2032

Figure 89: Latin America Barcode Printers Market Value Share (%) and BPS Analysis by Printing Technology, 2022 to 2032

Figure 90: Latin America Barcode Printers Market Y-o-Y Growth (%) Projections by Printing Technology, 2022 to 2032

Figure 91: Latin America Barcode Printers Market Value (US$ million) Analysis by Consumables, 2017 to 2032

Figure 92: Latin America Barcode Printers Market Volume (Unit) Analysis by Consumables, 2017 to 2032

Figure 93: Latin America Barcode Printers Market Value Share (%) and BPS Analysis by Consumables, 2022 to 2032

Figure 94: Latin America Barcode Printers Market Y-o-Y Growth (%) Projections by Consumables, 2022 to 2032

Figure 95: Latin America Barcode Printers Market Value (US$ million) Analysis by Application, 2017 to 2032

Figure 96: Latin America Barcode Printers Market Volume (Unit) Analysis by Application, 2017 to 2032

Figure 97: Latin America Barcode Printers Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 98: Latin America Barcode Printers Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 99: Latin America Barcode Printers Market Value (US$ million) Analysis by Distribution Channel, 2017 to 2032

Figure 100: Latin America Barcode Printers Market Volume (Unit) Analysis by Distribution Channel, 2017 to 2032

Figure 101: Latin America Barcode Printers Market Value Share (%) and BPS Analysis by Distribution Channel, 2022 to 2032

Figure 102: Latin America Barcode Printers Market Y-o-Y Growth (%) Projections by Distribution Channel, 2022 to 2032

Figure 103: Latin America Barcode Printers Market Attractiveness by Printer Type, 2022 to 2032

Figure 104: Latin America Barcode Printers Market Attractiveness by Printing Technology, 2022 to 2032

Figure 105: Latin America Barcode Printers Market Attractiveness by Consumables, 2022 to 2032

Figure 106: Latin America Barcode Printers Market Attractiveness by Application, 2022 to 2032

Figure 107: Latin America Barcode Printers Market Attractiveness by Distribution Channel, 2022 to 2032

Figure 108: Latin America Barcode Printers Market Attractiveness by Country, 2022 to 2032

Figure 109: Europe Barcode Printers Market Value (US$ million) by Printer Type, 2022 to 2032

Figure 110: Europe Barcode Printers Market Value (US$ million) by Printing Technology, 2022 to 2032

Figure 111: Europe Barcode Printers Market Value (US$ million) by Consumables, 2022 to 2032

Figure 112: Europe Barcode Printers Market Value (US$ million) by Application, 2022 to 2032

Figure 113: Europe Barcode Printers Market Value (US$ million) by Distribution Channel, 2022 to 2032

Figure 114: Europe Barcode Printers Market Value (US$ million) by Country, 2022 to 2032

Figure 115: Europe Barcode Printers Market Value (US$ million) Analysis by Country, 2017 to 2032

Figure 116: Europe Barcode Printers Market Volume (Unit) Analysis by Country, 2017 to 2032

Figure 117: Europe Barcode Printers Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 118: Europe Barcode Printers Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 119: Europe Barcode Printers Market Value (US$ million) Analysis by Printer Type, 2017 to 2032

Figure 120: Europe Barcode Printers Market Volume (Unit) Analysis by Printer Type, 2017 to 2032

Figure 121: Europe Barcode Printers Market Value Share (%) and BPS Analysis by Printer Type, 2022 to 2032

Figure 122: Europe Barcode Printers Market Y-o-Y Growth (%) Projections by Printer Type, 2022 to 2032

Figure 123: Europe Barcode Printers Market Value (US$ million) Analysis by Printing Technology, 2017 to 2032

Figure 124: Europe Barcode Printers Market Volume (Unit) Analysis by Printing Technology, 2017 to 2032

Figure 125: Europe Barcode Printers Market Value Share (%) and BPS Analysis by Printing Technology, 2022 to 2032

Figure 126: Europe Barcode Printers Market Y-o-Y Growth (%) Projections by Printing Technology, 2022 to 2032

Figure 127: Europe Barcode Printers Market Value (US$ million) Analysis by Consumables, 2017 to 2032

Figure 128: Europe Barcode Printers Market Volume (Unit) Analysis by Consumables, 2017 to 2032

Figure 129: Europe Barcode Printers Market Value Share (%) and BPS Analysis by Consumables, 2022 to 2032

Figure 130: Europe Barcode Printers Market Y-o-Y Growth (%) Projections by Consumables, 2022 to 2032

Figure 131: Europe Barcode Printers Market Value (US$ million) Analysis by Application, 2017 to 2032

Figure 132: Europe Barcode Printers Market Volume (Unit) Analysis by Application, 2017 to 2032

Figure 133: Europe Barcode Printers Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 134: Europe Barcode Printers Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 135: Europe Barcode Printers Market Value (US$ million) Analysis by Distribution Channel, 2017 to 2032

Figure 136: Europe Barcode Printers Market Volume (Unit) Analysis by Distribution Channel, 2017 to 2032

Figure 137: Europe Barcode Printers Market Value Share (%) and BPS Analysis by Distribution Channel, 2022 to 2032

Figure 138: Europe Barcode Printers Market Y-o-Y Growth (%) Projections by Distribution Channel, 2022 to 2032

Figure 139: Europe Barcode Printers Market Attractiveness by Printer Type, 2022 to 2032

Figure 140: Europe Barcode Printers Market Attractiveness by Printing Technology, 2022 to 2032

Figure 141: Europe Barcode Printers Market Attractiveness by Consumables, 2022 to 2032

Figure 142: Europe Barcode Printers Market Attractiveness by Application, 2022 to 2032

Figure 143: Europe Barcode Printers Market Attractiveness by Distribution Channel, 2022 to 2032

Figure 144: Europe Barcode Printers Market Attractiveness by Country, 2022 to 2032

Figure 145: Asia Pacific Barcode Printers Market Value (US$ million) by Printer Type, 2022 to 2032

Figure 146: Asia Pacific Barcode Printers Market Value (US$ million) by Printing Technology, 2022 to 2032

Figure 147: Asia Pacific Barcode Printers Market Value (US$ million) by Consumables, 2022 to 2032

Figure 148: Asia Pacific Barcode Printers Market Value (US$ million) by Application, 2022 to 2032

Figure 149: Asia Pacific Barcode Printers Market Value (US$ million) by Distribution Channel, 2022 to 2032

Figure 150: Asia Pacific Barcode Printers Market Value (US$ million) by Country, 2022 to 2032

Figure 151: Asia Pacific Barcode Printers Market Value (US$ million) Analysis by Country, 2017 to 2032

Figure 152: Asia Pacific Barcode Printers Market Volume (Unit) Analysis by Country, 2017 to 2032

Figure 153: Asia Pacific Barcode Printers Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 154: Asia Pacific Barcode Printers Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 155: Asia Pacific Barcode Printers Market Value (US$ million) Analysis by Printer Type, 2017 to 2032

Figure 156: Asia Pacific Barcode Printers Market Volume (Unit) Analysis by Printer Type, 2017 to 2032

Figure 157: Asia Pacific Barcode Printers Market Value Share (%) and BPS Analysis by Printer Type, 2022 to 2032

Figure 158: Asia Pacific Barcode Printers Market Y-o-Y Growth (%) Projections by Printer Type, 2022 to 2032

Figure 159: Asia Pacific Barcode Printers Market Value (US$ million) Analysis by Printing Technology, 2017 to 2032

Figure 160: Asia Pacific Barcode Printers Market Volume (Unit) Analysis by Printing Technology, 2017 to 2032

Figure 161: Asia Pacific Barcode Printers Market Value Share (%) and BPS Analysis by Printing Technology, 2022 to 2032

Figure 162: Asia Pacific Barcode Printers Market Y-o-Y Growth (%) Projections by Printing Technology, 2022 to 2032

Figure 163: Asia Pacific Barcode Printers Market Value (US$ million) Analysis by Consumables, 2017 to 2032

Figure 164: Asia Pacific Barcode Printers Market Volume (Unit) Analysis by Consumables, 2017 to 2032

Figure 165: Asia Pacific Barcode Printers Market Value Share (%) and BPS Analysis by Consumables, 2022 to 2032

Figure 166: Asia Pacific Barcode Printers Market Y-o-Y Growth (%) Projections by Consumables, 2022 to 2032

Figure 167: Asia Pacific Barcode Printers Market Value (US$ million) Analysis by Application, 2017 to 2032

Figure 168: Asia Pacific Barcode Printers Market Volume (Unit) Analysis by Application, 2017 to 2032

Figure 169: Asia Pacific Barcode Printers Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 170: Asia Pacific Barcode Printers Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 171: Asia Pacific Barcode Printers Market Value (US$ million) Analysis by Distribution Channel, 2017 to 2032

Figure 172: Asia Pacific Barcode Printers Market Volume (Unit) Analysis by Distribution Channel, 2017 to 2032

Figure 173: Asia Pacific Barcode Printers Market Value Share (%) and BPS Analysis by Distribution Channel, 2022 to 2032

Figure 174: Asia Pacific Barcode Printers Market Y-o-Y Growth (%) Projections by Distribution Channel, 2022 to 2032

Figure 175: Asia Pacific Barcode Printers Market Attractiveness by Printer Type, 2022 to 2032

Figure 176: Asia Pacific Barcode Printers Market Attractiveness by Printing Technology, 2022 to 2032

Figure 177: Asia Pacific Barcode Printers Market Attractiveness by Consumables, 2022 to 2032

Figure 178: Asia Pacific Barcode Printers Market Attractiveness by Application, 2022 to 2032

Figure 179: Asia Pacific Barcode Printers Market Attractiveness by Distribution Channel, 2022 to 2032

Figure 180: Asia Pacific Barcode Printers Market Attractiveness by Country, 2022 to 2032

Figure 181: MEA Barcode Printers Market Value (US$ million) by Printer Type, 2022 to 2032

Figure 182: MEA Barcode Printers Market Value (US$ million) by Printing Technology, 2022 to 2032

Figure 183: MEA Barcode Printers Market Value (US$ million) by Consumables, 2022 to 2032

Figure 184: MEA Barcode Printers Market Value (US$ million) by Application, 2022 to 2032

Figure 185: MEA Barcode Printers Market Value (US$ million) by Distribution Channel, 2022 to 2032

Figure 186: MEA Barcode Printers Market Value (US$ million) by Country, 2022 to 2032

Figure 187: MEA Barcode Printers Market Value (US$ million) Analysis by Country, 2017 to 2032

Figure 188: MEA Barcode Printers Market Volume (Unit) Analysis by Country, 2017 to 2032

Figure 189: MEA Barcode Printers Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 190: MEA Barcode Printers Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 191: MEA Barcode Printers Market Value (US$ million) Analysis by Printer Type, 2017 to 2032

Figure 192: MEA Barcode Printers Market Volume (Unit) Analysis by Printer Type, 2017 to 2032

Figure 193: MEA Barcode Printers Market Value Share (%) and BPS Analysis by Printer Type, 2022 to 2032

Figure 194: MEA Barcode Printers Market Y-o-Y Growth (%) Projections by Printer Type, 2022 to 2032

Figure 195: MEA Barcode Printers Market Value (US$ million) Analysis by Printing Technology, 2017 to 2032

Figure 196: MEA Barcode Printers Market Volume (Unit) Analysis by Printing Technology, 2017 to 2032

Figure 197: MEA Barcode Printers Market Value Share (%) and BPS Analysis by Printing Technology, 2022 to 2032

Figure 198: MEA Barcode Printers Market Y-o-Y Growth (%) Projections by Printing Technology, 2022 to 2032

Figure 199: MEA Barcode Printers Market Value (US$ million) Analysis by Consumables, 2017 to 2032

Figure 200: MEA Barcode Printers Market Volume (Unit) Analysis by Consumables, 2017 to 2032

Figure 201: MEA Barcode Printers Market Value Share (%) and BPS Analysis by Consumables, 2022 to 2032

Figure 202: MEA Barcode Printers Market Y-o-Y Growth (%) Projections by Consumables, 2022 to 2032

Figure 203: MEA Barcode Printers Market Value (US$ million) Analysis by Application, 2017 to 2032

Figure 204: MEA Barcode Printers Market Volume (Unit) Analysis by Application, 2017 to 2032

Figure 205: MEA Barcode Printers Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 206: MEA Barcode Printers Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 207: MEA Barcode Printers Market Value (US$ million) Analysis by Distribution Channel, 2017 to 2032

Figure 208: MEA Barcode Printers Market Volume (Unit) Analysis by Distribution Channel, 2017 to 2032

Figure 209: MEA Barcode Printers Market Value Share (%) and BPS Analysis by Distribution Channel, 2022 to 2032

Figure 210: MEA Barcode Printers Market Y-o-Y Growth (%) Projections by Distribution Channel, 2022 to 2032

Figure 211: MEA Barcode Printers Market Attractiveness by Printer Type, 2022 to 2032

Figure 212: MEA Barcode Printers Market Attractiveness by Printing Technology, 2022 to 2032

Figure 213: MEA Barcode Printers Market Attractiveness by Consumables, 2022 to 2032

Figure 214: MEA Barcode Printers Market Attractiveness by Application, 2022 to 2032

Figure 215: MEA Barcode Printers Market Attractiveness by Distribution Channel, 2022 to 2032

Figure 216: MEA Barcode Printers Market Attractiveness by Country, 2022 to 2032

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Barcode Printers & Consumables Market Growth - Trends & Forecast 2025 to 2035

Barcode Scanner Market Size and Share Forecast Outlook 2025 to 2035

Barcode Labeller Machine Market

Barcode Label Market

2D Barcode Reader Market Size and Share Forecast Outlook 2025 to 2035

UK Barcode Printer Market Analysis – Demand, Growth & Forecast 2025-2035

USA Barcode Printer Market Trends – Size, Share & Industry Growth 2025-2035

ASEAN Barcode Printer Market Insights – Size, Share & Industry Growth 2025-2035

Japan Barcode Printer Market Growth – Innovations, Trends & Forecast 2025-2035

Germany Barcode Printer Market Analysis – Growth, Applications & Outlook 2025-2035

Warehouse Barcode Systems Market

In-Counter Barcode Scanners Market Size and Share Forecast Outlook 2025 to 2035

Industrial Barcode Scanners Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Image Based Barcode Reader Market Growth – Trends & Forecast 2020-2030

Fixed 2D Industrial Barcode Scanner Market Size and Share Forecast Outlook 2025 to 2035

NCR Printers Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of NCR Printers Companies

RFID Printers Market by Product Type, Printing Type, Industry, and Region – Growth, Trends, and Forecast through 2025 to 2035

Card Printers Market

Photo Printers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA