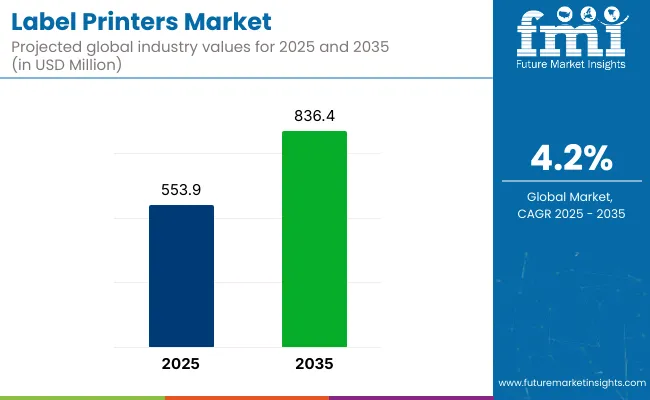

The label printers market is valued at USD 553.9 million in 2025 and is slated to reach USD 836.4 million by 2035, reflecting a CAGR of 4.2% during the forecast period. Growth is driven by increased demand for efficient labelling solutions across retail, logistics, healthcare, and manufacturing sectors. Automation in warehouses, rising e-commerce shipments, and regulatory requirements for traceable labelling are key factors supporting market expansion globally.

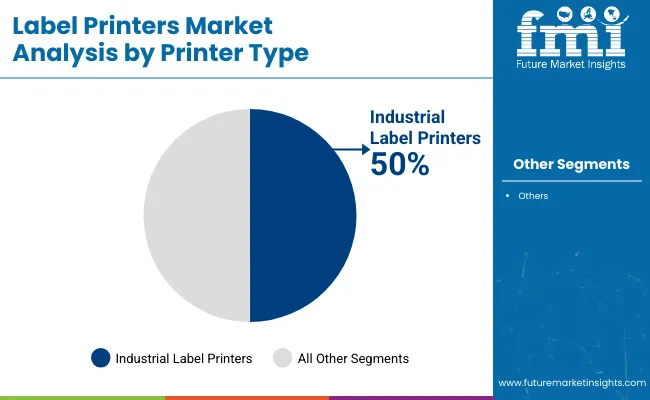

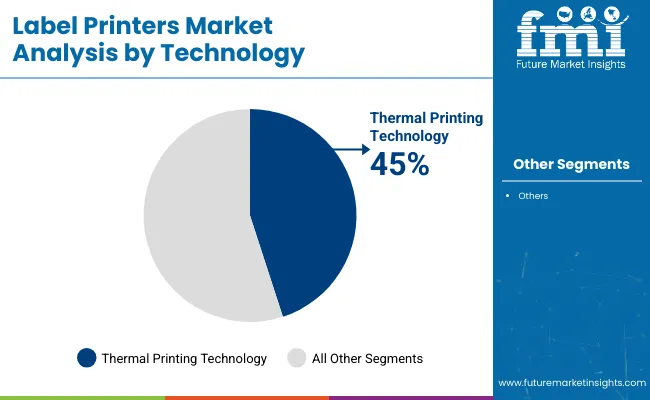

In 2025, industrial label printers are expected to dominate with approximately 50% market share due to their use in mass manufacturing, logistics, and pharmaceutical labelling operations. Thermal printing technology is projected to lead with over 45% market share, driven by its cost-effectiveness and high-resolution capabilities for shipping, barcode, and retail labelling applications. USA is forecast to register the fastest growth with a CAGR of 4.2%, supported by e-commerce expansion and Industry 4.0 integration.

| Metric | Value |

|---|---|

| Estimated Market Size (2025) | USD 553.9 Million |

| Projected Market Size (2035) | USD 836.4 Million |

| CAGR (2025 to 2035) | 4.2% |

Technological innovations in the label printers market are focusing on AI integration to enhance operational accuracy and efficiency. AI-enabled label printers are being developed for automatic error detection, layout optimization, and seamless integration with enterprise software.

IoT-enabled label printers are gaining traction as companies invest in real-time inventory tracking and connected printing solutions to improve warehouse and supply chain productivity. Furthermore, liner less label technologies are witnessing increasing investment, as they eliminate the need for backing paper, reducing material waste and enhancing sustainability goals.

Label printers hold approximately 30% to 35% share in the barcode and RFID solutions market, driven by widespread use in inventory and asset tracking. In the product identification and tracking market, their share is around 25%, supporting regulatory compliance and traceability. Within the industrial printing market, label printers account for 15% to 18%, primarily for packaging and logistics applications.

They hold a 12% to 15% share in the broader printing equipment market and about 10% in the packaging machinery market. In the office equipment and retail automation markets, label printers contribute 8% to 10%, supporting point-of-sale and back-office functions.

The market is segmented into printer type, technology, end use, and region. By printer type, the market is divided into industrial, desktop, and mobile/portable. Based on technology, it is categorized into direct, thermal, inkjet, and laser. In terms of end use, the market is segmented into manufacturing, warehousing, retail, transportation & logistics. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and Middle East and Africa.

Industrial label printers are projected to lead the printer type segment, accounting for approximately 50% of the global market share by 2025. These printers are widely used for large-scale labelling needs in manufacturing, automotive, logistics, and pharmaceutical industries due to their high-speed, high-volume capabilities. Their integration with ERP and warehouse management systems supports efficient operations and real-time inventory tracking.

Thermal printing technology is expected to dominate the technology segment, capturing over 45% market share in 2025. Thermal printers are favored across logistics, retail, and healthcare sectors because of their fast printing speeds, cost-effectiveness, and high-resolution outputs. Direct thermal printers are commonly used for shipping labels, barcodes, and receipts where short-term use is required, while thermal transfer printers are preferred for durable, long-lasting labels in industrial and pharmaceutical settings.

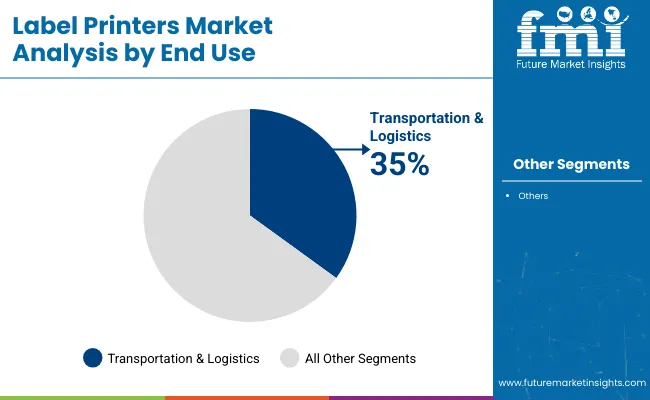

The transportation & logistics sector is projected to lead the end use segment, accounting for approximately 35% of the global market share by 2025. Demand is driven by expanding e-commerce, international trade, and the adoption of automated warehousing systems. Label printers in this sector are essential for generating accurate shipping labels, asset tracking tags, and inventory management barcodes to ensure efficient supply chain operations.

The label printers market has been witnessing consistent growth, driven by increasing demand for efficient packaging solutions, product traceability, and regulatory compliance across food & beverage, healthcare, and logistics industries.

Recent Trends in the Label Printers Market

Challenges in the Label Printers Market

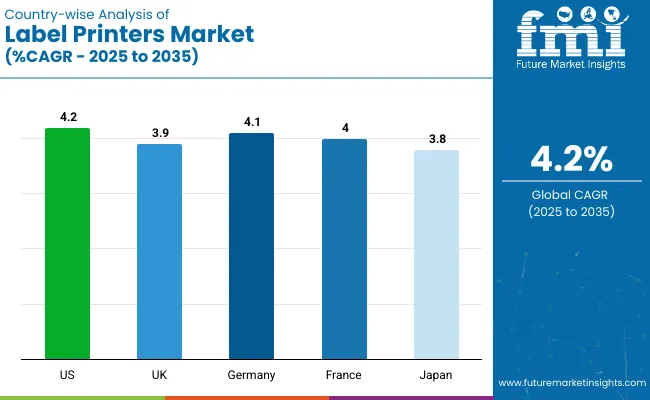

The USA label printers market is set to grow at a CAGR of 4.2% (2025 to 2035), fueled by e-commerce, RFID adoption, and sustainable labeling. The UK follows with a 3.9% CAGR, driven by retail digitalization, REACH compliance, and smart labels. Germany (4.1%) benefits from strong automotive and logistics sectors, with a focus on green printing.

France (4.0%) sees rising demand in food, pharma, and F&B industries, emphasizing environmental compliance. Japan, growing at 3.8%, leverages electronics, automotive, and healthcare sectors, adopting compact, sustainable printing solutions. Across all countries, regulatory compliance and smart labeling technologies are central to market expansion.

The report covers in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The label printers demand in the USA is projected to grow at a CAGR of 4.2% from 2025 to 2035. Growth has been supported by rising e-commerce activities, automated warehouse management, and increased retail labelling applications.

The UK label printers market is forecast to expand at a CAGR of 3.9% over the forecast period. Demand has been driven by the retail, pharmaceutical, and logistics sectors with an emphasis on sustainability and digitalization.

Label printers demand in Germany is projected to grow at a CAGR of 4.1% between 2025 and 2035. The nation’s strong automotive, manufacturing, and logistics sectors are driving market growth.

France’s label printers market is expected to grow at a CAGR of 4.0% from 2025 to 2035. Growth has been supported by increased adoption in retail, food & beverage, and pharmaceutical sectors for advanced labelling applications.

Label printers sales in Japan are forecast to grow at a CAGR of 3.8% through 2035. Growth has been driven by electronics manufacturing, automotive production, and healthcare applications.

The label printers market is moderately consolidated, with global leaders holding significant shares while regional players innovate in mobile, sustainable, and smart printing solutions. Competitive strategies include technological advancements, product portfolio expansion, and strategic collaborations to strengthen market presence.

Tier-one firms such as Brother Industries, Ltd., Rollo, Pitney Bowes, Epson, Bixolon, Phomemo, Nelko, NIIMBOT, FreeX, and MUNBYN are investing in RFID-enabled printing technologies, linerless and eco-friendly printing solutions, and compact mobile printers to enhance their market positioning. Partnerships with logistics providers, retail chains, and manufacturing companies have been formed to secure long-term demand.

These companies are focusing on integrating IoT and AI capabilities into their printers to improve operational efficiency, error detection, and print accuracy. Additionally, they are expanding their service and distribution networks globally to provide faster technical support and delivery. The strategic focus on sustainability, automation, and real-time data solutions continues to define their competitive edge in the label printers market.

Recent Label Printers Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 553.9 million |

| Projected Market Size (2035) | USD 836.4 million |

| CAGR (2025 to 2035) | 4.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD million / Volume in units |

| By Printer Type | Industrial, Desktop, Mobile/Portable |

| By Technology | Thermal, Inkjet, Laser, Direct |

| By End Use | Manufacturing, Warehousing, Retail, Transportation & Logistics |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East and Africa |

| Countries Covered | United States, United Kingdom, Germany, France, Japan, South Korea, China, Brazil, India, Italy |

| Key Players | Brother Industries, Ltd., Rollo, Pitney Bowes, Epson, Bixolon , Phomemo , Nelko , NIIMBOT, FreeX , MUNBYN |

| Additional Attributes | Market share analysis by printer type and technology, country-wise CAGR analysis, and brand positioning insights |

The market is expected to reach USD 836.4 million by 2035.

The global market is projected to grow at a CAGR of 4.2% during this period.

Industrial label printers are expected to lead with approximately 50% market share in 2025.

Thermal printing technology is expected to hold over 45% of the market share in 2025.

The USA is anticipated to grow fastest with a 4.2% CAGR through 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Labels Market Size and Share Forecast Outlook 2025 to 2035

Label Applicators Market Size and Share Forecast Outlook 2025 to 2035

Labeling and Coding Equipment Market Size and Share Forecast Outlook 2025 to 2035

Labels, Tapes And Films Market Size and Share Forecast Outlook 2025 to 2035

Labeling Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Labelling Machine Market Growth & Industry Trends through 2035

Competitive Overview of Labels Companies

Key Players & Market Share in the Label Applicators Industry

Competitive Breakdown of Labeling Equipment Providers

Labeling Software Market Growth - Trends & Forecast through 2034

Label Printing Software Market – Smart Labeling & Automation

GHS Label Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

GMO Labelling Market Size and Share Forecast Outlook 2025 to 2035

Top Labelling Equipment Market Trends - Growth & Forecast 2025 to 2035

Market Share Distribution Among USA Labels Providers

Leading Providers & Market Share in GHS Label Industry

Foam Labels Market Trends and Growth 2035

Market Share Breakdown of Foil Labels Manufacturers

Foil Labels Market Analysis by Metal Foils & Polymer-Based Foils Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA