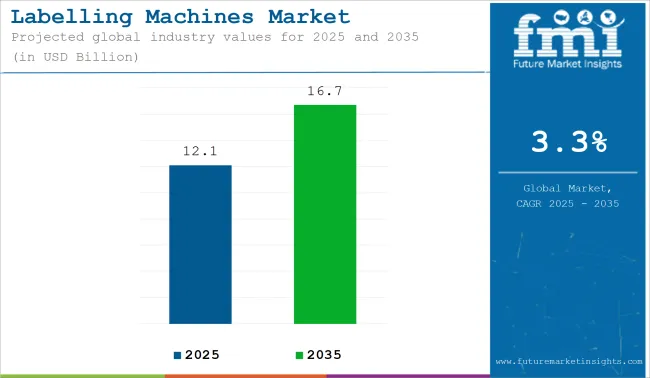

The labelling machine market is projected to grow from USD 12.1 billion in 2025 to USD 16.7 billion by 2035, registering a CAGR of 3.3% during the forecast period.

| Attributes | Key Insights |

|---|---|

| Historical Size, 2024 | USD 11.9 billion |

| Estimated Size, 2025 | USD 12.1 billion |

| Projected Size, 2035 | USD 16.7 billion |

| Value-based CAGR (2025 to 2035) | 3.3% |

Sales in 2024 reached USD 11.7 billion, reflecting consistent demand across food & beverage, pharmaceutical, and personal care industries. Market growth has been driven by the need for high-speed, accurate, and automated labelling solutions to meet regulatory and branding requirements.

Expansion of e-commerce and retail logistics has supported the integration of flexible labelling systems. Technological improvements in label placement precision, touchless operation, and machine learning-assisted controls have been adopted to enhance production reliability.

In May 2024, Herma demonstrated new ways of label-based marking of chemical and pharmaceutical products at ACHEMA. "Our customers benefit from the fact that we are probably a unique system provider in the industry," emphasizes HERMA Key Account Manager Sven Pleier. "HERMA not only produces the labels, but also develops and produces the self-adhesive material itself.

This enables HERMA to respond to individual challenges in a targeted manner. And as a leading specialist for label applicators and labelling machines, HERMA also knows how labels need to be made so that they can be reliably dispensed, even in high-speed systems." The latest example of this is the new HERMA PE White UV Laser film labels, which can be printed using UV lasers with a simple color change in the label material.

A growing emphasis has been placed on reducing the environmental impact of labelling operations. Manufacturers are investing in all-electric labelling systems, recyclable liner materials, and energy-efficient servo motors to reduce carbon footprint during operation. Digital labelling solutions and on-demand variable data printing have been introduced to minimize label wastage.

Integration of cloud-based control systems is enabling real-time performance monitoring and preventive maintenance scheduling. New systems are being designed for compatibility with biodegradable or compostable label substrates. These innovations align with sustainability mandates while improving operational uptime, especially in fast-moving consumer goods (FMCG) and pharma production environments. The market is being steered toward greener compliance with evolving waste-reduction frameworks.

A projected increase in the adoption of inline labelling for e-commerce, cold-chain, and cleanroom environments is expected to unlock incremental market opportunities. Manufacturers are anticipated to integrate AI-enabled vision systems and IoT connectivity to support end-user demands for intelligent maintenance and downtime prediction. Strong competition among mid-sized OEMs is likely to drive price competitiveness, feature bundling, and localization strategies, particularly in emerging Asian and Eastern European markets.

In the technology segment, labelling machine solutions with a pressure-sensitive technology are likely to account for over 43% of the market share over the forecast period. This technology is dominating the labelling market because it is flexible, economical, and can be easily applied.

Most often, it is used on products such as bottles and jars because it doesn't need much pressure to adhere. Because of this, pressure-sensitive films are highly used for high-speed production lines in food, beverage, and consumer goods, holding a large portion of the market share.

The labelling machine market will grow with profitable prospects in the forecast period, as it is expected to offer an incremental opportunity of USD 2.8 billion and will increase 1.5 times the existing value by 2035.

The below table presents the expected CAGR for the global labelling machine market over several semi-annual periods spanning from 2025 to 2035.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 3.4% |

| H2 (2024 to 2034) | 3.8% |

| H1 (2025 to 2035) | 2.7% |

| H2 (2025 to 2035) | 4.5% |

In the first half (H1) of the decade from 2024 to 2033, the business is predicted to surge at a CAGR of 3.4%, followed by a slightly higher growth rate of 3.8% in the second half (H2) of the same decade. Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 2.7% in the first half and remain relatively moderate at 4.5% in the second half. In the first half (H1) the market witnessed a decrease of 70 BPS while in the second half (H2), the market witnessed an increase of 70 BPS.

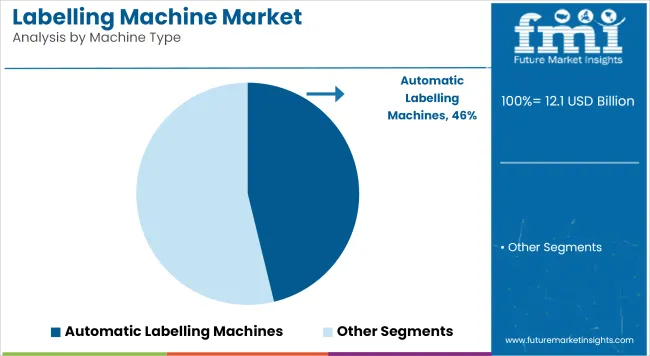

The market is segmented based on technology, machine type, end use, and region. By technology, the market includes pressure sensitive technology, glue-based technology, heat-shrink technology, laser marking technology, and others. In terms of machine type, the market is categorized into automatic labelling machines, semi-automatic labelling machines, and manual labelling machines.

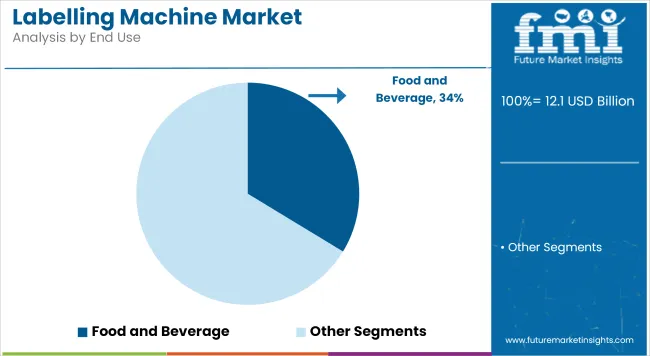

By end use, the market comprises food & beverages, pharmaceuticals & healthcare, cosmetics & personal care, industrial & chemicals, logistics & warehousing, and retail & consumer goods. Regionally, the market is analyzed across North America, Latin America, East Asia, South Asia & Pacific, Eastern Europe, Western Europe, Oceania, and the Middle East & Africa.

Automatic labelling machines have been projected to account for 46.2% of the global labelling machine market by 2025, owing to their ability to deliver consistent, high-speed application with minimal human intervention. Integration into high-volume production lines has been prioritized to reduce bottlenecks and maintain throughput in packaging environments.

Barcode, batch code, and multi-panel label applications have been streamlined using these machines, particularly in sectors requiring traceability and compliance. Increased adoption of smart sensors and servo-driven systems has enabled improved accuracy and flexibility across diverse container types.

Operational downtime has been minimized through auto-adjustment, label roll change detection, and advanced user interfaces, which have been deployed to facilitate seamless line changeovers. Automatic machines have also been chosen for their ability to support serialization in pharmaceutical and food manufacturing.

The demand for end-to-end automated packaging workflows has driven investments in labeling automation across emerging markets. Industry 4.0 compatibility and real-time production data integration have positioned automatic machines as critical infrastructure in smart factories.

The food and beverage sector has been estimated to contribute 33.7% of the global demand for labelling machines in 2025, attributed to the sector’s need for high-volume, visually impactful, and regulation-compliant labelling. Nutrition facts, barcodes, tamper-evidence, and branding have all been consistently applied at scale in automated packaging environments.

Self-adhesive, wrap-around, and sleeve labels have been frequently applied across bottle, jar, and pouch formats in this sector. Consistency in label placement and print clarity has been maintained through advanced inspection and control systems integrated into labelling machines.

Frequent SKU changes and seasonal product launches have necessitated flexible machines that accommodate label type and size variation. Hygienic design standards and wash-down-compatible labelers have been widely adopted in dairy, meat, and beverage processing lines.

With increasing consumer demand for transparency and brand storytelling, labelling has emerged as a key point of differentiation in food and beverage packaging. Investments in high-speed, multi-line labelling systems are expected to continue as the sector expands into Omni channel retail and export markets.

Automation and Efficiency Accelerate the Growth of Labelling Machines

The trend of automation and efficiency of labelling machines is speeding the labelling process, making it more accurate and less labor-intensive. Automated labelling machines can apply labels on products at high speeds and consistently without requiring human workers to handle each item. This speeds up production and reduces error rates because labels will be correctly applied every time.

These machines can work continuously without breaks, which increases productivity in general. Labor costs are also reduced because fewer workers are required to run the machines. It has become one of the basic needs of companies nowadays as they work towards increasing their efficiency and thus becoming competitive in the market.

Technological Advancement Boosts the Market Growth

Labelling systems which are smart include track-and-trace, QR codes, and RFID tags make labelling much more accurate, and companies better manage their inventories. Improved correctness of labels due to advanced sensors and better data analytics support high-quality prints.

Eco-friendly technologies, from sustainable inks to energy-efficiency machines, help companies reduce their environmental hazards and meet the guidelines set by related authorities. Such sectors include food, beverages, pharmaceutical industries, and home products with a surge due to high demand, for which labeling techniques are quicker and more inexpensive while entirely flexible.

Competition from Manual Labor May Reduce the Market Growth

Many businesses will outsource labelling labor; it only costs a bit in the starting amount for a low-budget start-up or a business. Certain companies with automatic labelling, high speed, and accuracy, but even so some tend to have an individual do this little batch order while others also depend on when flexibilities come their way. Workers can easily switch between different product types and label designs, which can be harder for machines to adjust to without reconfiguration.

It delays the full-fledged integration of automated labelling machines since they mostly rely on hand labor in a market. Here, despite their potential advantages in automaticity, business people would hardly consider change, taking into consideration their initial and additional charges of training compared to those manually done.

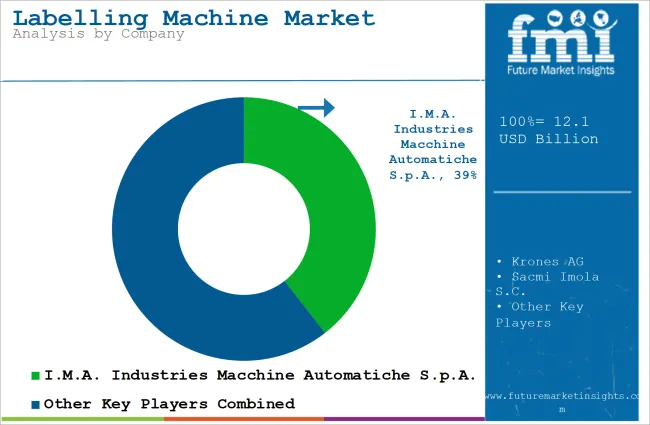

Tier 1 companies comprise market leaders with significant market share in global market. These market leaders are characterized by high production capacity and a wide product portfolio. These market leaders are distinguished by their extensive expertise in manufacturing across multiple packaging formats and a broad geographical reach, underpinned by a robust consumer base. They provide a wide range of series including recycling and manufacturing utilizing the latest technology and meeting the regulatory standards providing the highest quality. Prominent companies within tier 1 include I.M.A. Industries Macchine Automatiche S.p.A., Krones AG, Sacmi Imola S.C., Sato

Tier 2 companies include mid-size players having presence in specific regions and highly influencing the local market. These are characterized by a strong presence overseas and strong market knowledge. These market players have good technology and ensure regulatory compliance but may not have advanced technology and wide global reach. Prominent companies in tier 2 include ProMach Inc., Quadrel Labelling System, Domino Printech India LLP

Barry-Wehmiller Group Inc Tier 3 includes the majority of small-scale companies operating at the local presence and serving niche markets. These companies are notably oriented towards fulfilling local market demands and are consequently classified within the tier 3 share segment. They are small-scale players and have limited geographical reach. Tier 3, within this context, is recognized as an unorganized market, denoting a sector characterized by a lack of extensive structure and formalization when compared to organized competitors.

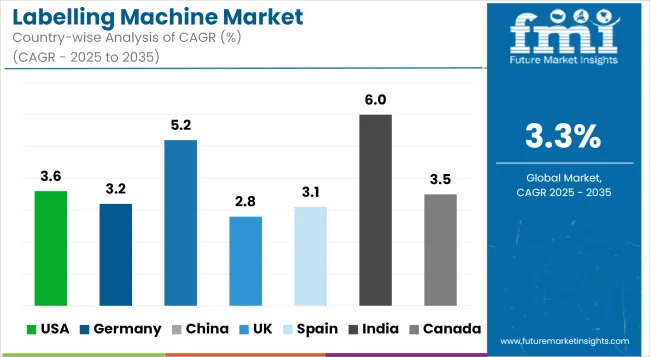

The section below covers the future forecast for the labelling machine market in terms of countries. Information on key countries in several parts of the globe, including North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe and MEA is provided. US is anticipated to remain at the forefront in North America, with a CAGR of 3.6% through 2035. In Europe, Spain is projected to witness a CAGR 3.1% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 3.6% |

| Germany | 3.2% |

| China | 5.2% |

| UK | 2.8% |

| Spain | 3.1% |

| India | 6.0% |

| Canada | 3.5% |

Smart technology improves the efficiency and accuracy of the product in its production. Smart technology integration has therefore boosted the labelling machine market in Germany. Industries, such as manufacturing and packaging, have seen the uptake of advanced technologies, including sensors, RFID, and IoT, for the bettering of labelling processes. With sensors, labelling machines can identify an incorrectly applied label and automatically correct it, reducing error and waste.

RFID technology helps to track the product and to improve inventory management. It also ensures that the right product gets to the right place. Integration of IoT helps companies monitor and control machines remotely. This allows companies to avoid having people at the site and thus saves on downtime.

Growing environmental awareness in the UK along with stringent regulations imposed by the government is giving a strong push to sustainable labelling solutions in terms of fast pace demand. With single-use plastic targets, as well as an ambitious recycling rate, set by the UK government, companies are focusing on adopting environmentally friendly packaging materials such as recyclable labels, and these businesses need efficient labelling machines to accommodate the same.

Also, with awareness related to sustainability of consumers in the UK, more are choosing those brands that support the cause of sustainability. This, therefore, means the behavior of the consumer is now raising the stakes for brands in investing in sustainable labelling, thus propelling further demand for machines that can support such eco-friendly practices.

Key players of labelling machine industry are developing and launching new products in the market. They are integrating with different firms and extending their geographical presence. Few of them are also collaborating and partnering with local brands and start-up companies for new product development.

Key Developments in Labelling Machine Market

The labelling machine industry is projected to witness CAGR of 3.6% between 2025 and 2035.

The global labelling machine industry stood at USD 5.9 billion in 2024.

Global labelling machine industry is anticipated to reach USD 8.7 billion by 2035 end.

South Asia & Pacific is set to record a CAGR of 6.0% in assessment period.

The key players operating in the labelling machine industry are I.M.A. Industries Macchine Automatiche S.p.A., Krones AG, Sacmi Imola S.C.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

C Wrap Labelling Machine Market

Wet Glue Labelling Machines Market

Clamshell Labelling Machines Market Growth - Trends & Forecast 2022 to 2032

Wrap Around Labelling Machine Market

Semi Automatic Labelling Machines Market Size and Share Forecast Outlook 2025 to 2035

Bottle Sticker Labelling Machine Market Size and Share Forecast Outlook 2025 to 2035

GMO Labelling Market Size and Share Forecast Outlook 2025 to 2035

Top Labelling Equipment Market Trends - Growth & Forecast 2025 to 2035

Smart Labelling in Logistics Market Size and Share Forecast Outlook 2025 to 2035

Pallet Labelling System Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Pallet Labelling System Providers

Protein Labelling Market Size and Share Forecast Outlook 2025 to 2035

Nutritional Labelling Market Trends and Forecast 2025 to 2035

On-Pack Recycling Labelling Solutions Market Size and Share Forecast Outlook 2025 to 2035

Print & Apply Corner Wrap Labelling System Market

Machine Glazed Paper Industry Analysis in Asia Pacific Forecast Outlook 2025 to 2035

Machine Glazed Paper Market Size and Share Forecast Outlook 2025 to 2035

Machine Vision Camera Market Size and Share Forecast Outlook 2025 to 2035

Machine Tool Oils Market Size and Share Forecast Outlook 2025 to 2035

Machine Vision System And Services Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA