The On-Pack Recycling Labelling Solutions Market is estimated to be valued at USD 42.8 billion in 2025 and is projected to reach USD 84.2 billion by 2035, registering a compound annual growth rate (CAGR) of 7.0% over the forecast period.

The on pack recycling labelling solutions market is witnessing significant momentum, driven by intensifying global regulatory frameworks, growing consumer demand for environmental transparency, and corporate sustainability commitments. As environmental awareness increases, brands are under greater pressure to clearly communicate recyclability and waste disposal instructions on product packaging.

This has led to widespread adoption of standardized, easy-to-read recycling labels that help consumers make informed disposal decisions. Governments across Europe, North America, and parts of Asia are mandating clearer recycling instructions on packaging, which is further encouraging manufacturers to incorporate these solutions.

The market outlook remains positive, supported by technological advances in smart labels, increasing penetration across food, beverage, and personal care sectors, and the strategic value of recycling labels in brand reputation and compliance. As circular economy goals gain traction, the relevance of on pack recycling labelling will continue to rise, particularly among brands aiming to reduce contamination in recycling streams and improve end-of-life packaging outcomes.

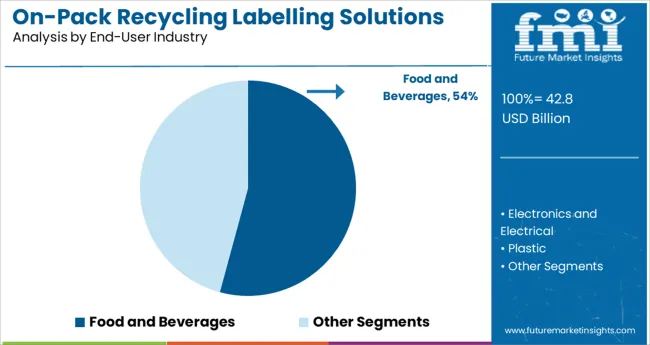

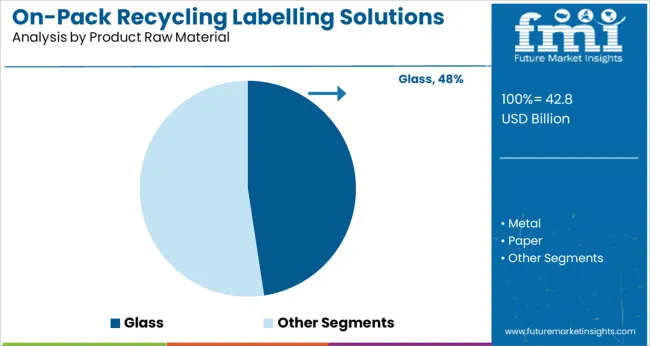

The market is segmented by End-User Industry and Product Raw Material and region. By End-User Industry, the market is divided into Food and Beverages, Electronics and Electrical, Plastic, and Others. In terms of Product Raw Material, the market is classified into Glass, Metal, Paper, Plastic, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The food and beverages sector is projected to account for 54.20% of the total market revenue by 2025, establishing it as the dominant end user segment. This growth is attributed to increasing pressure from both regulatory bodies and environmentally conscious consumers to provide transparent waste management information directly on packaging.

Food and beverage packaging contributes significantly to global packaging waste, making clear recycling instructions a crucial factor in reducing landfill overflow and boosting material recovery rates. Major global brands in this sector are aligning with national and regional labeling programs to avoid penalties and enhance consumer trust.

The widespread variety of packaging formats in this sector ranging from cartons and cans to plastic and flexible films further necessitates consistent recycling guidance. As food and beverage companies continue to emphasize sustainability and packaging lifecycle communication, this segment remains the key driver of growth in the on pack recycling labelling solutions market.

The glass raw material category holds a 47.60% share of the market, making it the leading material segment within this space. Glass packaging is widely used in the food and beverage industry and is recognized for its high recyclability and inert nature. However, challenges associated with proper sorting and contamination during recycling have intensified the demand for clear, informative labeling.

Recycling labels applied on glass packaging serve as an essential communication tool to educate consumers on rinsing, separating, and disposing practices that ensure recyclability. Furthermore, governments and municipal recycling authorities are emphasizing proper labeling on glass containers to avoid cross-contamination, particularly in single-stream recycling systems.

The combination of policy enforcement, growing adoption in beverage and condiment packaging, and the inherently recyclable nature of glass has positioned this material segment at the forefront of the market. As closed-loop glass recycling systems expand, labeling clarity will remain a critical component in driving consumer compliance and recovery efficiency.

On-pack recycling labelling solutions use less energy and have a less negative impact on the environment. High carbon emissions in the environment are caused by the expanding usage of plastic packaging materials that are neither recyclable nor biodegradable. Therefore, large firms like Amazon, Google, and Tetrapak are attempting to attain net zero, which is likely to be capital-demanding, to decrease their carbon imprint on the environment.

On-pack recycling labelling solutions alternatives to items like plastic and Styrofoam use recyclable and biodegradable components. As a result, manufacturers are turning towards the extensive use of on-pack recycling labelling solutions, propelling the market growth.

On-pack recycling labelling solutions use eco-friendly materials such as bioplastics, recyclable paper and plastics, plant-based biomaterials, organic textiles, and repurposed goods. These products can readily replace conventional plastics and have less impact on the environment as they are simple to use and naturally biodegradable. These substances don't react with food, preventing contamination and other negative environmental impacts. These are the primary factors driving up the demand for on-pack recycling labelling solutions.

The on-pack recycling labelling solutions make it simple to deliver comfort food. They have been an enabling element that has motivated customers to switch to convenience meals. The market expansion of convenience foods has also been significantly supported by other forms of technology, such as transportation and communication. As a result, this is anticipated to benefit the growth of the on-pack recycling labelling solutions market during the projected period. Product safety and sustainability are the primary concerns of the majority of package makers.

By using less packing material overall, several manufacturers of personal care goods are moving toward environmentally friendly options like on-pack recycling labelling solutions. Consumer awareness of a product's packaging's sustainability has contributed to the transformation. The excessive packaging of personal care products done for aesthetic rather than functional reasons has come under fire from many consumers. Thus, major companies in the on-pack recycling labelling solutions market have substituted paperboard packaging with thin plastic packaging when needed.

To lessen the influence on the environment and the ecological footprint of packaging, it is necessary to employ life cycle assessment and life cycle inventory more frequently. The interest in on-pack recycling labelling solutions has increased dramatically in recent years, especially among consumers. On-pack recycling labelling solutions have received a lot of attention since the Circular Economy idea has acquired major traction. Governments have also responded to public concerns over packaging waste, particularly single-use packaging waste, on every continent. To reduce environmental waste and enhance waste management procedures, rules are being implemented.

Globally, the governments are concernedabout environmental issues and taking serious steps to create an eco-friendly community. Recycling is one of the initiatives that governments across the world are focusing on to reuse the waste of materials, to cut the consumption offresh raw materials and to cut the pollution such as air and water.

Materials such as paper, glass, textiles, electronics and plastics are recyclable, and products that are madeout of such materials can berecycled according to the guidance provided by the manufacturer. Generally, companies across the world follow ISO standards for recycling their products. According to the materials used in the products, companies put recycling labels to give recycling directions to the consumers.

On-pack recycling labeling solutions are designed according to the government guidelines to help consumers to recycle the products.

Stringent government rules about usage of on-pack recycling labels on products are fueling the demand for on-pack recycling labelling solutions globally. The manufacturers these days are concernedabout their social-responsibility and to adhere to it, the manufacturers implementon-pack recycling labelling solutions, to promote the recycling of their products.

The expected growth in end-use industries such as Food Beverage, Electrical and Electronics, etc. is expectedto propel the demand for on-pack recycling labelling solutions during the forecast period.

Lack of awareness about on-pack recycling labelling solutions in the emerging economies such as India and few ASEAN countries is inhibiting the growth for on-pack recycling labelling solutions.

The global on-pack recycling labelling market by volume is expected to expand at a CAGR of around 5-7% during the forecast period (2020 to 2025), due to increasing demand from various industries such as Food Beverage, Electronics, Plastic, Glass, etc. and stringent government regulations.

The global on-pack recycling labelling market is expected to register a single-digit CAGR during the forecast period. Depending on geographic regions, global on-pack recycling market is segmented into seven key regions: North America, South America, Eastern Europe, Western Europe, Asia-Pacific, Japan, and Middle East & Africa.

In terms of market revenue, Asia-Pacific on-pack recycling labelling market is projected to register a significant CAGR during the forecast period.Growth in end-use industries and increasing consumer base, are some of the factors which are fueling the growth of on-pack recycling labelling market in Asia-Pacific.

India and China are forecast to register a significant growth in the Asia-Pacific on-pack recycling labelling market, as consumer base in these countries is expected to continue its dominance during the forecast period.

Developed economies such as United Kingdom and United States of America are having high awareness about on-pack recycling labelling.

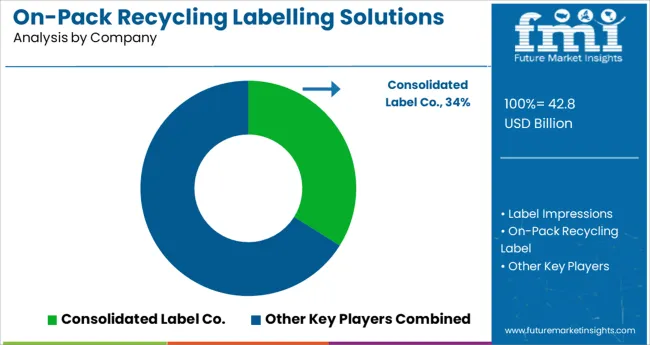

Some of the key market participants in global on-pack recycling labelling market are Consolidated Label Co., Label Impressions, On-Pack Recycling Label, Woolworths, etc.

The research report presents a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, and statistically supported and industry-validated market data. It also contains projections using a suitable set of assumptions and methodologies. The research report provides analysis and information according to categories such as market segments by geographies, by end-use industries process and by product raw materials.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The global on-pack recycling labelling solutions market is estimated to be valued at USD 42.8 billion in 2025.

It is projected to reach USD 84.2 billion by 2035.

The market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types are food and beverages, electronics and electrical, plastic and others.

glass segment is expected to dominate with a 47.6% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Recycling Trucks Market Size and Share Forecast Outlook 2025 to 2035

Recycling Equipment And Machinery Market Size and Share Forecast Outlook 2025 to 2035

Wood Recycling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Metal Recycling Market Size and Share Forecast Outlook 2025 to 2035

Paper Recycling Market Size and Share Forecast Outlook 2025 to 2035

Metal Recycling Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Waste Recycling Services Market by Application, Product Type, and Region - Growth, Trends, and Forecast 2025 to 2035

Solvent Recycling & Recovery Equipment Market Size and Share Forecast Outlook 2025 to 2035

Textile Recycling Market Analysis by Material, Source, Process, and Region: Forecast for 2025 and 2035

Plastic Recycling Market

Chemical Recycling Service Market Forecast Outlook 2025 to 2035

Solar PV Recycling Market Size and Share Forecast Outlook 2025 to 2035

Clothing Recycling Market Analysis – Growth & Trends 2025 to 2035

Waste Wood Recycling Market Size and Share Forecast Outlook 2025 to 2035

EV Battery Recycling and Black Mass Processing Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Commercial Recycling Bins Market Size and Share Forecast Outlook 2025 to 2035

Solar Panel Recycling Management Market Size and Share Forecast Outlook 2025 to 2035

Solar Module Recycling Service Market Size and Share Forecast Outlook 2025 to 2035

Textile Waste Recycling Machine Market Size and Share Forecast Outlook 2025 to 2035

Release Liner Recycling Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA