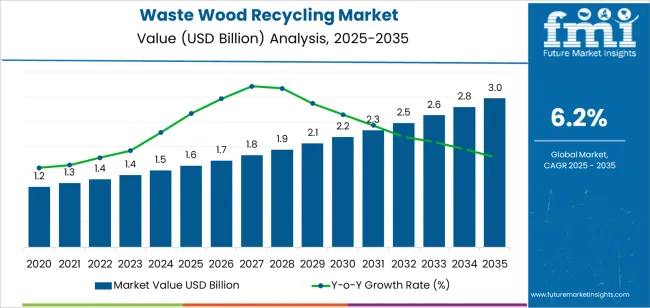

The global waste wood recycling market is projected to reach USD 2,969.7 million by 2035, recording an absolute increase of USD 1,342.4 million over the forecast period. The waste wood recycling market is valued at USD 1,627.3 million in 2025 and is set to rise at a CAGR of 6.2% during the assessment period. The overall market size is expected to grow by nearly 1.8 times during the same period, supported by increasing demand for processed wood materials and construction applications worldwide, driving demand for direct recycling processes and increasing investments in building material applications and furniture manufacturing globally. Limited processing capacity in developing markets and regulatory compliance challenges may pose obstacles to market expansion.

Waste wood recycling encompasses comprehensive recovery operations transforming discarded timber materials from construction, demolition, manufacturing, and consumer sources into reusable products through mechanical processing, chemical treatment, and advanced separation techniques. Primary feedstock originates from construction and demolition activities, contributing approximately 40% of total waste wood volumes, followed by manufacturing residues from furniture production, packaging materials, and end-of-life consumer products including wooden furniture and fixtures.

Processing methodologies include direct recycling techniques utilizing mechanical shredding, chipping, and sizing operations to produce wood chips, mulch, and biomass fuel products. Physical processing systems employ magnetic separation, screening, and density sorting to remove contaminating materials including metal fasteners, plastic coatings, and concrete residues attached to construction timber. These preprocessing stages enable recovery of clean wood fractions suitable for particleboard manufacturing, engineered lumber production, and high-value composite materials.

Chemical treatment processes target contaminated wood streams containing preservatives, paints, and adhesive residues through controlled pyrolysis, gasification, and solvent extraction techniques. Thermal processing systems operate under controlled temperature and atmospheric conditions to decompose harmful compounds while preserving cellulose and lignin structures essential for material recovery. Advanced chemical separation methods enable recovery of treated timber otherwise classified as hazardous waste, expanding feedstock availability for recycling operations.

Building material applications represent primary end-use markets for recycled wood products, encompassing particleboard manufacturing, oriented strand board production, and engineered lumber systems. Recycled wood fibers provide cost-effective raw materials for construction panels, flooring substrates, and structural composites meeting industry performance standards. Manufacturing processes blend recycled content with virgin wood fibers in controlled ratios to achieve specified strength, durability, and appearance characteristics required for commercial applications.

Furniture manufacturing utilizes recycled wood materials in cabinet construction, upholstered frame production, and decorative paneling applications. Secondary processing operations including planning, sanding, and finishing enable recycled timber to meet aesthetic and functional requirements for residential and commercial furniture products. Quality grading systems ensure recycled materials match performance specifications while maintaining cost advantages compared to virgin wood alternatives.

Wooden consumer goods manufacturing encompasses diverse applications including packaging materials, pallets, crates, and specialty products requiring specific dimensional and strength characteristics. Processing facilities maintain inventory management systems tracking wood grade classifications, moisture content, and contamination levels to optimize product quality and manufacturing efficiency across different end-use applications.

Waste Wood Recycling Market Year-over-Year Forecast (2025-2035)

Between 2025 and 2030, the waste wood recycling market is projected to expand from USD 1,627.3 million to USD 2,198.3 million, resulting in a value increase of USD 571.0 million, which represents 42.5% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for building materials and construction applications, product innovation in processing technologies and separation systems, as well as expanding integration with furniture manufacturing and consumer goods applications. Companies are establishing competitive positions through investment in processing capabilities, advanced separation technologies, and strategic market expansion across construction, furniture, and consumer goods applications.

From 2030 to 2035, the waste wood recycling market is forecast to grow from USD 2,198.3 million to USD 2,969.7 million, adding another USD 771.4 million, which constitutes 57.5% of the overall ten-year expansion. This period is expected to be characterized by the expansion of advanced processing applications, including chemical treatment systems and specialized separation technologies tailored for contaminated wood streams, strategic collaborations between waste wood processors and construction companies, and an enhanced focus on quality standards and automated processing protocols. The growing emphasis on circular economy principles and construction material recovery will drive demand for comprehensive waste wood recycling solutions across diverse construction and manufacturing applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1,627.3 million |

| Market Forecast Value (2035) | USD 2,969.7 million |

| Forecast CAGR (2025-2035) | 6.2% |

The waste wood recycling market grows by enabling construction companies and manufacturing operators to optimize material recovery processes while accessing processed wood materials without substantial in-house processing infrastructure investment. Construction companies and manufacturing operators face mounting pressure to develop advanced material recovery programs and waste reduction strategies while managing complex environmental requirements, with high-quality recycled wood typically providing 40-60% cost reduction compared to virgin material alternatives, making advanced direct recycling processes essential for competitive market positioning. The construction industry's need for processed materials and application-specific recovery capabilities creates demand for comprehensive waste wood recycling solutions that can provide superior material quality, maintain consistent processing standards, and ensure reliable operation without compromising product performance or operational effectiveness.

Government initiatives promoting circular economy development and construction waste reduction drive adoption in building material manufacturing, furniture production, and consumer goods applications, where material quality has a direct impact on product performance and long-term operational effectiveness. Complex processing requirements during large-scale recovery projects and the expertise requirements for contamination management may limit accessibility among smaller construction companies and developing regions with limited technical infrastructure for advanced waste processing systems.

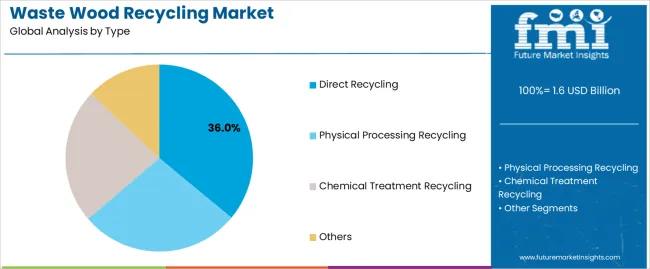

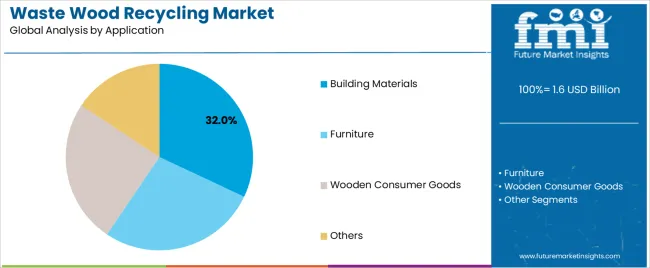

The waste wood recycling market is segmented by type, application, and region. By type, the waste wood recycling market is divided into direct recycling, physical processing recycling, chemical treatment recycling, and others. Based on application, the waste wood recycling market is categorized into building materials, furniture, wooden consumer goods, and others. Regionally, the waste wood recycling market is divided into Asia Pacific, Europe, North America, and other key regions.

The direct recycling segment represents the dominant force in the waste wood recycling market, capturing approximately 36.0% of total market share in 2025. This established processing category encompasses solutions featuring advanced mechanical processing and specialized recovery applications, including high-performance material separation and enhanced quality characteristics that enable superior construction benefits and manufacturing outcomes across all processing applications. The direct recycling segment's market leadership stems from its proven processing capabilities, with solutions capable of addressing diverse material recovery requirements while maintaining consistent quality standards and processing effectiveness across all manufacturing environments.

The physical processing recycling segment maintains a substantial market share, serving specialized applications that require mechanical separation with enhanced contamination removal for construction and manufacturing applications. Chemical treatment recycling addresses contaminated wood streams requiring specialized processing for hazardous material removal. The others segment serves diverse recovery applications across various industrial sectors.

Key type advantages driving the direct recycling segment include:

Building materials applications dominate the waste wood recycling market with approximately 32.0% market share in 2025, reflecting the critical role of recycled wood materials in supporting construction requirements and material performance worldwide. The building materials segment's market leadership is reinforced by increasing construction activity trends, infrastructure development requirements, and rising needs for cost-effective material capabilities in construction applications across developed and emerging markets.

The furniture segment represents a significant application category, capturing substantial market share through specialized requirements for processed wood materials, quality specifications, and manufacturing applications. This segment benefits from growing furniture production demand that requires specific material requirements, quality standards, and performance optimization protocols in manufacturing markets.

The wooden consumer goods segment serves packaging applications, pallet manufacturing, and specialized consumer products across various market sectors. The others segment captures market share through diverse construction and specialty applications.

Key market dynamics supporting application growth include:

The waste wood recycling market is driven by three concrete demand factors tied to construction and manufacturing outcomes. First, construction waste reduction and circular economy initiatives create increasing demand for waste wood recycling systems, with material recovery growing 15-25% annually in major construction markets worldwide, requiring comprehensive processing infrastructure. Second, government initiatives promoting waste reduction and construction material recovery drive increased adoption of recycled wood compounds, with many countries implementing construction waste guidelines and regulatory frameworks for material recovery advancement by 2030. Third, technological advancements in processing systems and separation technologies enable more efficient and effective recovery solutions that improve material quality while reducing operational costs and processing complexity.

Market restraints include complex processing requirements and validation costs for waste wood recycling platforms that can challenge market participants in developing compliant processing capabilities, particularly in regions where regulatory pathways for advanced recycling technologies remain evolving and uncertain. Technical complexity of contamination management and quality requirements pose another significant challenge, as waste wood recycling demands sophisticated separation methods and material controls, potentially affecting processing costs and operational efficiency. Feedstock variability constraints from diverse waste sources across different regions create additional operational challenges for processors, demanding ongoing investment in processing development and quality assurance programs.

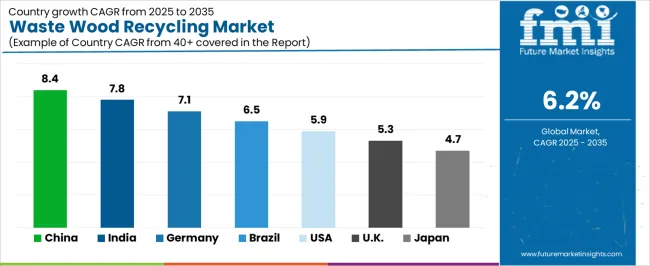

Key trends indicate accelerated adoption in Asia-Pacific markets, particularly China and India, where construction activity expansion and waste management initiatives drive comprehensive waste wood recycling adoption. Technology integration trends toward specialized processing systems with enhanced separation characteristics, advanced chemical treatment applications, and integrated recovery solutions enable effective processing approaches that optimize material quality and minimize contamination risks.

| Country | CAGR (%) |

|---|---|

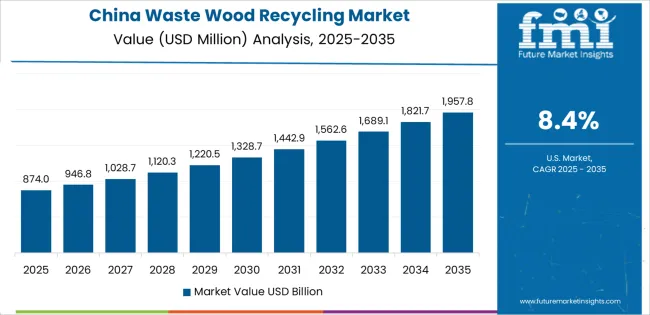

| China | 8.4% |

| India | 7.8% |

| Germany | 7.1% |

| Brazil | 6.5% |

| USA | 5.9% |

| UK | 5.3% |

| Japan | 4.7% |

The global waste wood recycling market is expanding steadily, with China leading at an 8.4% CAGR through 2035, driven by construction activity growth, government waste reduction initiatives, and expanding manufacturing platforms. India follows at 7.8%, supported by infrastructure development, large-scale construction programs, and circular economy initiatives. Germany records 7.1%, reflecting an established landscape with growing integration in construction materials and furniture manufacturing. Brazil advances at 6.5%, leveraging construction market expansion. USA grows at 5.9%, anchored by construction waste reduction and material recovery awareness. UK posts 5.3%, focusing on circular economy applications, while Japan grows at 4.7%, emphasizing processing precision and manufacturing excellence.

What Drives China’s Market Leadership in Waste Wood Recycling?

China demonstrates the strongest growth potential in the waste wood recycling market with a CAGR of 8.4% through 2035. The country's leadership position stems from massive construction activity, government waste reduction policies, and comprehensive construction waste regulations driving the adoption of advanced waste wood recycling solutions. Growth is concentrated in major construction and manufacturing centers, including Beijing, Shanghai, Guangzhou, and Shenzhen, where construction companies and manufacturing firms are implementing waste wood recycling systems for enhanced material recovery capabilities and cost reduction. Distribution channels through construction material suppliers and manufacturing networks expand deployment across construction projects and material recovery initiatives. The country's Ministry of Housing and Urban-Rural Development provides policy support for construction waste modernization, including comprehensive material recovery capability development.

Key market factors:

How is India Positioned for Growth in the Waste Wood Recycling Market?

In major construction and manufacturing centers including Mumbai, Delhi, Bangalore, and Chennai, the adoption of comprehensive waste wood recycling solutions is accelerating across construction projects and manufacturing development initiatives, driven by infrastructure expansion and government waste management programs. The waste wood recycling market demonstrates strong growth momentum with a CAGR of 7.8% through 2035, linked to comprehensive construction modernization and increasing focus on material recovery solutions. Indian companies are implementing waste wood recycling systems and processing platforms to enhance construction performance while meeting growing demand in expanding building material and furniture manufacturing sectors. The country's infrastructure development initiatives create continued demand for recycled materials, while increasing emphasis on cost reduction drives adoption of advanced material recovery systems.

Key development areas:

How is Germany Advancing in Waste Wood Recycling?

The Germany market leads in advanced processing innovation based on integration with construction systems and precision manufacturing technologies for enhanced material performance. The country shows strong potential with a CAGR of 7.1% through 2035, driven by the modernization of existing construction infrastructure and the expansion of advanced manufacturing facilities in major industrial areas, including Bavaria, Baden-Württemberg, North Rhine-Westphalia, and Lower Saxony. German companies are adopting intelligent waste wood recycling systems for quality improvement and efficiency enhancement, particularly in regions with advanced construction requirements and applications demanding comprehensive technology upgrades. Technology deployment channels through established construction institutions and manufacturing operators expand coverage across construction facilities and innovation-focused applications.

Leading market segments:

How is Brazil Strengthening Its Position in the Waste Wood Recycling Market?

Waste wood recycling market in Brazil demonstrates strong implementation focused on construction material recovery and manufacturing performance enhancement, with documented integration of specialized processing systems, achieving 45% improvement in material recovery across construction and manufacturing facilities. The country maintains strong growth momentum with a CAGR of 6.5% through 2035, driven by construction facilities' emphasis on cost reduction and material optimization methodologies that align with Brazilian construction standards applied to recycling operations. Major construction areas, including São Paulo, Rio de Janeiro, Minas Gerais, and Rio Grande do Sul, showcase advanced deployment of waste wood recycling platforms where processing systems integrate seamlessly with existing construction infrastructure and comprehensive material management programs.

Key market characteristics:

What Role Does the USA Play in the Global Waste Wood Recycling Market?

USA's market expansion is driven by diverse construction demand, including manufacturing development in major cities and comprehensive material recovery projects across multiple regions. The country demonstrates strong growth potential with a CAGR of 5.9% through 2035, supported by federal waste reduction programs and industry-level construction material development initiatives. American companies face implementation challenges related to processing complexity and regulatory requirements, requiring strategic development approaches and support from specialized waste wood recycling partners. Growing construction demands and advanced material recovery requirements create compelling business cases for waste wood recycling adoption, particularly in construction areas where advanced processing technologies have a direct impact on operational success and competitive positioning.

Market characteristics:

How is the UK Contributing to the Growth of the Waste Wood Recycling Market?

In London, Manchester, Birmingham, and other major cities, construction facilities are implementing comprehensive waste wood recycling solutions to modernize existing material management infrastructure and improve processing capabilities, with documented case studies showing a 50% improvement in material recovery timelines through advanced recycling integration. The waste wood recycling market shows strong potential with a CAGR of 5.3% through 2035, linked to the ongoing modernization of construction facilities, material networks, and emerging circular economy projects in major regions. British companies are adopting intelligent waste wood recycling and processing platforms to enhance construction reliability while maintaining standards demanded by the construction and manufacturing industries. The country's established regulatory infrastructure creates continued demand for recycling development and modernization solutions that integrate with existing construction systems.

Market development factors:

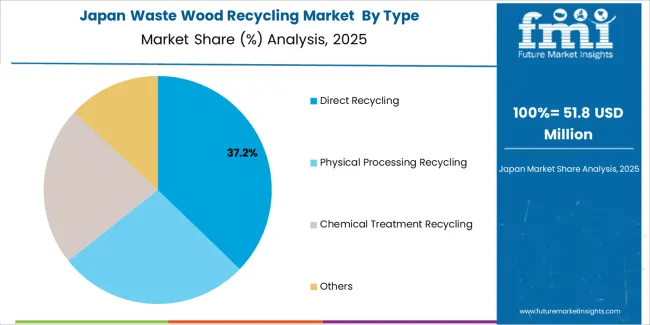

What Factors Drive Japan’s Progress in the Waste Wood Recycling Market?

Waste wood recycling market in Japan demonstrates advanced implementation focused on processing precision and construction material performance optimization, with documented integration of specialized recovery systems, achieving 40% improvement in processing efficiency across construction and manufacturing facilities. The country maintains steady growth momentum with a CAGR of 4.7% through 2035, driven by construction facilities' emphasis on quality excellence and continuous operational methodologies that align with Japanese construction standards applied to waste wood recycling operations. Major construction areas, including Kanto, Kansai, Chubu, and Kyushu, showcase advanced deployment of waste wood recycling platforms where processing systems integrate seamlessly with existing construction infrastructure and comprehensive quality management programs.

Key market characteristics:

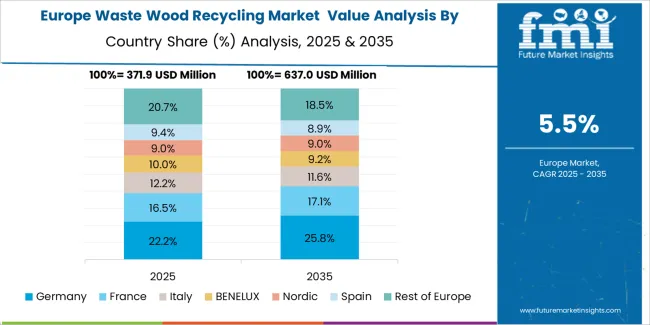

How is the Waste Wood Recycling Market Distributed Across Europe?

The waste wood recycling market in Europe is projected to grow from USD 485.0 million in 2025 to USD 798.0 million by 2035, registering a CAGR of 5.1% over the forecast period. Germany is expected to maintain its leadership position with a 28.5% market share in 2025, projected to reach 29.2% by 2035, supported by its extensive construction infrastructure, advanced processing facilities, and comprehensive manufacturing networks serving major European markets.

United Kingdom follows with a 22.0% share in 2025, projected to reach 22.5% by 2035, driven by comprehensive circular economy programs in major construction regions implementing advanced waste wood recycling systems. France holds an 18.5% share in 2025, expected to maintain 18.8% by 2035 through the ongoing development of construction facilities and manufacturing networks. Italy commands a 15.0% share, while Spain accounts for 12.0% in 2025. The Rest of Europe region is anticipated to gain momentum, expanding its collective share from 4.0% to 4.0% by 2035, attributed to increasing waste wood recycling adoption in Nordic countries and emerging Eastern European construction facilities implementing material recovery programs.

Based on your waste wood recycling market data, here are the Japan and South Korea sections with header variations:

The Japanese waste wood recycling market demonstrates a mature and quality-focused landscape, characterized by advanced integration of processing technology with existing construction infrastructure across manufacturing facilities, recovery networks, and industrial initiatives. Japan's emphasis on precision engineering and manufacturing excellence drives demand for high-reliability waste wood recycling solutions that support comprehensive material recovery initiatives and regulatory requirements in construction operations. The waste wood recycling market benefits from strong partnerships between international recycling equipment providers like TOMRA, WEIMA, and domestic manufacturing leaders, including established construction and processing companies, creating comprehensive service ecosystems that prioritize material quality and technical precision programs. Processing centers in major industrial regions showcase advanced waste wood recycling implementations where shredding and grinding systems achieve quality improvements through integrated monitoring programs.

The Japanese market demonstrates distinctive product utilization patterns, with waste wood shredders commanding 45.0% product share, reflecting the country's preference for high-capacity mechanical processing systems. Grinding equipment accounts for 30.0% market share, while chippers capture 25.0%, indicating diversified processing capabilities across construction and manufacturing sectors. Building materials applications represent 35.0% of market demand, driven by particleboard manufacturing and construction panel production requirements that prioritize consistent material quality and dimensional specifications.

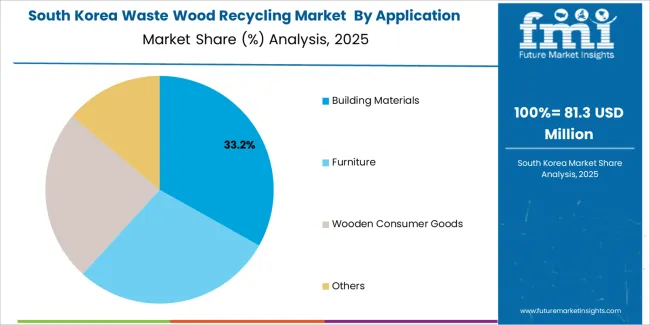

The South Korean waste wood recycling market is characterized by strong international technology provider presence, with companies maintaining dominant positions through comprehensive system integration and technical services capabilities for construction and manufacturing applications. The waste wood recycling market is demonstrating a growing emphasis on localized technical support and rapid deployment capabilities, as Korean companies increasingly demand customized solutions that integrate with domestic construction infrastructure and advanced processing systems deployed across major industrial centers and manufacturing facilities. Local construction companies and regional processing integrators are gaining market share through strategic partnerships with global providers like Terex Ecotec and Vecoplan, offering specialized services including technical training programs and certification services for recycling equipment specialists.

The competitive landscape shows increasing collaboration between multinational waste wood recycling companies and Korean construction specialists, creating hybrid service models that combine international processing expertise with local market knowledge and construction relationship management. South Korean market demonstrates advanced equipment adoption patterns, with grinder systems representing 42.0% of product demand, followed by shredders at 35.0% and chippers at 23.0%, indicating preference for fine processing capabilities. Construction material applications account for 38.0% market share, while furniture manufacturing captures 28.0%, reflecting the country's integrated approach to material recovery across industrial sectors.

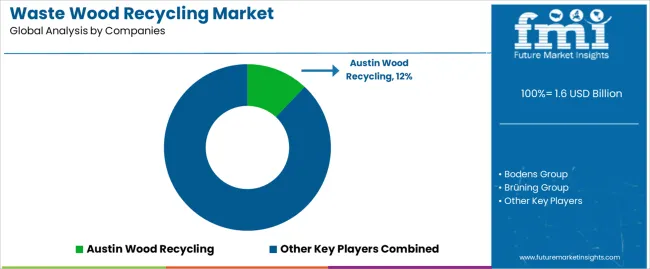

The waste wood recycling market features approximately 12-15 meaningful players with moderate concentration, where the top three companies control roughly 25-35% of global market share through established processing portfolios and extensive construction industry relationships. Competition centers on processing capability, material quality, and technical expertise rather than price competition alone.

Market leaders include Austin Wood Recycling, Bodens Group, and Brüning Group, which maintain competitive advantages through comprehensive waste wood recycling portfolios, advanced processing capabilities, and deep expertise in the construction and manufacturing sectors, creating high switching costs for customers. These companies leverage established construction industry relationships and ongoing development partnerships to defend market positions while expanding into adjacent material recovery and manufacturing applications.

Challengers encompass EGGER and Japan Waste Group, which compete through specialized processing technologies and strong regional presence in key construction markets. Industrial specialists, including Rainier Wood Recyclers, Sylvagen, and Waste Mission, focus on specific waste wood recycling applications or vertical markets, offering differentiated capabilities in construction systems, manufacturing applications, and application-specific processing.

Regional players and emerging waste wood recycling companies create competitive pressure through innovative processing approaches and rapid development capabilities, particularly in high-growth markets including China and India, where local presence provides advantages in cost optimization and regulatory compliance. Market dynamics favor companies that combine advanced processing technologies with comprehensive construction industry services that address the complete material lifecycle from waste collection through ongoing processing assurance and technical support.

Waste wood recycling solutions represent a critical material recovery process that enables construction companies, manufacturing firms, and material operators to enhance operational efficiency and cost reduction without substantial ongoing material investment, typically providing 40-60% cost reduction compared to virgin material alternatives while ensuring unprecedented quality and operational compliance. With the waste wood recycling market projected to grow from USD 1,627.3 million in 2025 to USD 2,969.7 million by 2035 at a 6.2% CAGR, these solutions offer compelling advantages - superior material quality, enhanced efficiency, and processing capabilities - making them essential for building materials applications (32.0% market share), furniture operations, and diverse construction applications seeking reliable material recovery solutions. Scaling market penetration and processing capabilities requires coordinated action across construction policy, material standards, waste wood recycling providers, construction companies, and manufacturing institutions.

How Governments Could Spur Local Development and Adoption?

How Industry Bodies Could Support Market Development?

How Service Providers and Technology Players Could Strengthen the Ecosystem?

How Suppliers Could Navigate the Shift?

How Investors and Financial Enablers Could Unlock Value?

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 1,627.3 million |

| Type | Direct Recycling, Physical Processing Recycling, Chemical Treatment Recycling, Others |

| Application | Building Materials, Furniture, Wooden Consumer Goods, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | China, India, Germany, Brazil, USA, UK, Japan, and 40+ countries |

| Key Companies Profiled | Austin Wood Recycling, Bodens Group, Brüning Group, EGGER, Japan Waste Group, Rainier Wood Recyclers, Sylvagen, Waste Mission, Tokyo Board Industries, TOMRA, Unilin, Dunham Inc |

| Additional Attributes | Dollar sales by type and application categories, regional adoption trends across Asia Pacific, Europe, and North America, competitive landscape with waste wood recycling providers and construction companies, processing facility requirements and specifications, integration with manufacturing initiatives and construction platforms, innovations in processing technology and recovery systems, and development of specialized applications with quality standards and operational optimization capabilities. |

The global waste wood recycling market is estimated to be valued at USD 1.6 billion in 2025.

The market size for the waste wood recycling market is projected to reach USD 3.0 billion by 2035.

The waste wood recycling market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in waste wood recycling market are direct recycling , physical processing recycling, chemical treatment recycling and others.

In terms of application, building materials segment to command 32.0% share in the waste wood recycling market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Waste-derived Pyrolysis Oil Market Size and Share Forecast Outlook 2025 to 2035

Wastewater Heavy Metal Treatment Agent Market Size and Share Forecast Outlook 2025 to 2035

Waste Management Carbon Credit Market Size and Share Forecast Outlook 2025 to 2035

Waste Management Market Size and Share Forecast Outlook 2025 to 2035

Wastewater Treatment Aerators Market Size and Share Forecast Outlook 2025 to 2035

Waste Heat To Power Market Size and Share Forecast Outlook 2025 to 2035

Waste to Energy Market Growth - Trends & Forecast 2025 to 2035

Waste Wrap Film Market

Waste Recycling Services Market by Application, Product Type, and Region - Growth, Trends, and Forecast 2025 to 2035

E-Waste Management Market Growth - Trends & Forecast 2025 to 2035

AI Waste Sorting Robots Market Forecast and Outlook 2025 to 2035

Zero-Waste Packaging Technologies Market Size and Share Forecast Outlook 2025 to 2035

Zero-Waste Refill Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

APAC Waste Heat Recovery Systems Market Size and Share Forecast Outlook 2025 to 2035

Food Waste Shredder Market Size and Share Forecast Outlook 2025 to 2035

Food Waste Disposal Equipment Market Size and Share Forecast Outlook 2025 to 2035

Food Waste Composting Machine Market Size and Share Forecast Outlook 2025 to 2035

Food Waste-Derived Protein Market Size and Share Forecast Outlook 2025 to 2035

Food Waste Management Market Analysis - Size, Share, and Forecast 2025 to 2035

Fish Waste Management Market Analysis by Source and End Use Industry Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA