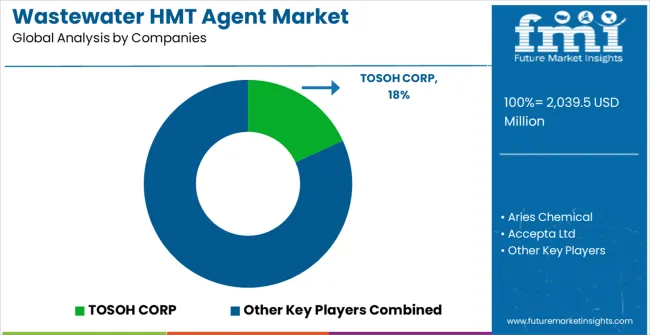

The global wastewater heavy metal treatment agent market is projected to grow from USD 2,039.5 million in 2025 to approximately USD 3,757.1 million by 2035, recording an absolute increase of USD 1,717.6 million over the forecast period. This translates into a total growth of 84.2%, with the market forecast to expand at a compound annual growth rate (CAGR) of 6.3% between 2025 and 2035. The overall market size is expected to grow by nearly 1.84X during the same period, supported by the rising industrial activities and stringent environmental regulations mandating effective heavy metal removal from wastewater streams.

Between 2025 and 2030, the wastewater heavy metal treatment agent market is projected to expand from USD 2,039.5 million to USD 2,768.2 million, resulting in a value increase of USD 728.7 million, which represents 42.4% of the total forecast growth for the decade. This phase of growth will be shaped by rising industrial production activities requiring effective wastewater treatment, increasing adoption of advanced treatment technologies, and growing awareness among industries about environmental compliance. Manufacturing facilities across emerging economies are expanding their treatment capabilities to address increasingly complex heavy metal contamination challenges.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 2,039.5 million |

| Forecast Value in (2035F) | USD 3,757.1 million |

| Forecast CAGR (2025 to 2035) | 6.3% |

The wastewater heavy metal treatment agent market has been recognized as a specialized segment within broader water and environmental treatment domains. It accounts for nearly 6.5% of the water treatment chemicals market, as these agents are employed to selectively remove heavy metals from contaminated streams, ensuring regulatory compliance and process efficiency. Within the industrial wastewater treatment market, its share is 5.8%, reflecting the critical role in treating effluents from manufacturing, mining, and chemical industries. In the environmental protection chemicals market, it contributes 4.9%, demonstrating adoption to mitigate ecological impact and safeguard aquatic ecosystems. The effluent treatment solutions market sees a 5.2% share, as these agents are integrated into modular and centralized treatment systems for consistent heavy metal removal. Finally, within the industrial water management market, a 4.6% contribution is observed, with heavy metal treatment agents supporting the broader water reuse and process safety objectives. Combined, these parent markets represent a total share of 27%, indicating that wastewater heavy metal treatment agents are essential in enhancing water quality, reducing contamination risks, and supporting industrial and environmental operational standards across sectors.

/The Wastewater Heavy Metal Treatment Agent market is entering a growth phase, fueled by industrial expansion, stricter environmental regulations, and advanced treatment technologies. By 2035, these pathways together unlock USD 1.7–1.9 billion in incremental revenue opportunities, expanding the market from USD 2.04 billion (2025) to USD 3.76 billion (2035) at a 6.3% CAGR.

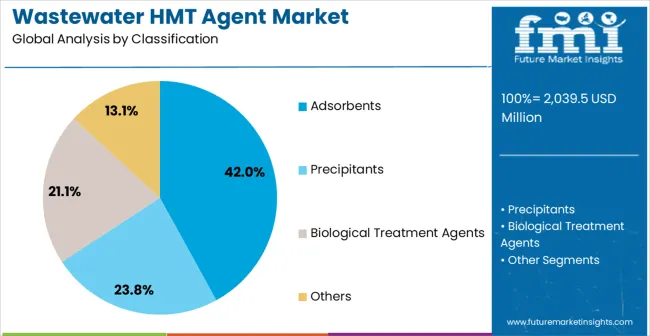

Pathway A – Advanced Adsorbent Solutions. Adsorbents lead with a 42% share in 2025, benefiting from innovations in activated carbon, ion exchange resins, and nanomaterials. Improved regeneration and selectivity can unlock USD 0.5–0.7 billion in additional revenues by 2035.

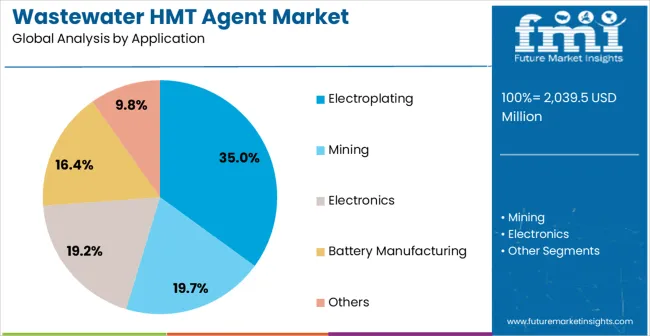

Pathway B – Specialized Electroplating Applications. Electroplating, accounting for 35% of demand in 2025, remains the largest end-use. Expansion in automotive, electronics, and precision manufacturing will create USD 0.4–0.6 billion incremental opportunity, especially in Asia-Pacific.

Pathway C – Mining & Metals Sector Integration. Mining generates large volumes of heavy metal-laden wastewater. With modernization and stricter discharge mandates, treatment agent demand here could add USD 0.3–0.5 billion, particularly in Brazil, India, and Africa.

Pathway D – Electronics & Battery Manufacturing Growth. High-tech industries (electronics, EV batteries) are scaling up in China, India, and Europe, generating complex wastewater streams. Tailored treatment formulations represent USD 0.25–0.4 billion in new opportunities by 2035.

Pathway E – Circular Economy & Metal Recovery Systems. Zero liquid discharge (ZLD) and resource recovery programs are expanding. Selective treatment agents that enable metal recovery and reuse can unlock USD 0.15–0.3 billion while aligning with sustainability mandates.

Pathway F – Smart Monitoring & Automated Dosing. Integration of IoT sensors, predictive dosing, and AI-driven optimization enhances efficiency and compliance. Smart-enabled treatment systems could create USD 0.1–0.2 billion in incremental value, especially for large-scale industrial parks.

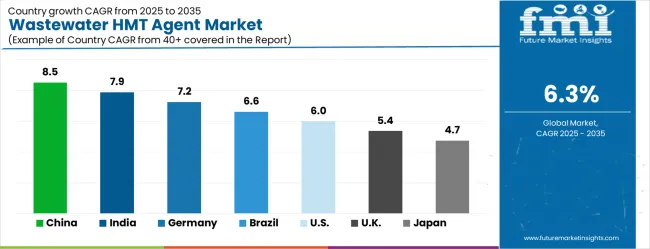

Pathway G – Regional High-Growth Hotspots. China (8.5% CAGR) and India (7.9% CAGR) together account for the largest pool, worth USD 0.3–0.4 billion by 2035. Germany, Brazil, and the USA add steady growth through industrial modernization and regulatory enforcement.

Pathway H – Sustainable & Certified Solutions. Treatment agents with eco-friendly formulations, biodegradable chemistry, and certified compliance standards can capture premium pricing in Europe and North America, representing USD 0.1–0.15 billion in additional revenue.

Why the Wastewater Heavy Metal Treatment Agent Market is Growing?

Market expansion is being supported by the rapid increase in industrial activities worldwide and the corresponding need for specialized treatment agents to remove heavy metals from wastewater streams. Modern manufacturing processes in electroplating, mining, electronics, and battery production generate significant volumes of wastewater contaminated with toxic heavy metals including chromium, lead, nickel, copper, and zinc. Even trace concentrations of these metals can cause severe environmental damage and pose serious health risks if not properly treated before discharge.

The growing complexity of industrial wastewater compositions and increasing regulatory enforcement are driving demand for advanced treatment agents from certified suppliers with proven removal efficiency and reliable performance. Environmental agencies worldwide are implementing stricter discharge limits and mandatory monitoring requirements that necessitate comprehensive heavy metal removal systems. Industries are increasingly recognizing that proper wastewater treatment is essential for operational continuity, regulatory compliance, and corporate sustainability objectives.

The market is segmented by type, end-use, and region. By type, the market is divided into adsorbents, precipitants, biological treatment agents, and others. Based on end-use, the market is categorized into electroplating, mining, electronics, battery manufacturing, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

Adsorbents are projected to account for 42% of the wastewater heavy metal treatment agent market in 2025. This leading share is supported by the widespread adoption of activated carbon, ion exchange resins, and specialized adsorption materials for removing heavy metals from industrial wastewater. Adsorbent technologies provide excellent removal efficiency across a wide range of heavy metal concentrations and can be tailored for specific industrial applications. The segment benefits from continuous technological improvements in adsorption capacity, selectivity, and regeneration capabilities that enhance overall treatment economics.

Electroplating applications are expected to represent 35% of wastewater heavy metal treatment agent demand in 2025. This dominant share reflects the high volume of heavy metal-contaminated wastewater generated by electroplating operations and the stringent discharge requirements for chromium, nickel, copper, and zinc removal. Modern electroplating facilities require comprehensive treatment systems that can handle varying metal concentrations and complex wastewater compositions. The segment benefits from growing automotive and electronics manufacturing activities that utilize extensive electroplating processes for component finishing and protection.

The wastewater heavy metal treatment agent market is advancing steadily due to increasing industrial production and growing recognition of environmental protection importance. However, the market faces challenges including high treatment costs, need for specialized technical expertise, and varying treatment requirements across different industrial applications. Technological advancement and regulatory standardization continue to influence treatment efficiency and market development patterns.

The growing deployment of advanced treatment technologies is enabling more efficient heavy metal removal through combination treatment approaches, enhanced adsorption materials, and automated process control systems. Modern treatment facilities are incorporating membrane technologies, electrochemical processes, and advanced oxidation methods that provide superior removal performance and reduced operational costs. These technologies are particularly valuable for industries requiring ultra-low discharge concentrations and comprehensive metal recovery capabilities.

Modern treatment facilities are incorporating automated monitoring systems and real-time process control technologies that optimize treatment agent dosing and improve removal efficiency. Integration of online analyzers and predictive maintenance systems enables precise treatment agent utilization and comprehensive discharge compliance monitoring. Advanced control systems also support treatment optimization for varying influent characteristics and regulatory requirements across different industrial applications.

| Country | CAGR (2025-2035) |

|---|---|

| China | 8.5% |

| India | 7.9% |

| Germany | 7.2% |

| Brazil | 6.6% |

| United States | 6% |

| United Kingdom | 5.4% |

| Japan | 4.7% |

The wastewater heavy metal treatment agent market is experiencing robust growth globally, with China leading at an 8.5% CAGR through 2035, driven by massive industrial expansion, government environmental mandates, and increasing adoption of advanced treatment technologies. India follows at 7.9%, supported by rapid industrialization and growing regulatory enforcement for wastewater discharge standards. Germany records 7.2% growth, emphasizing technological innovation and environmental compliance in manufacturing sectors. Brazil maintains 6.6% growth, expanding treatment capabilities across mining and electroplating industries. The United States shows 6% growth, focusing on regulatory compliance and treatment efficiency improvements. The United Kingdom demonstrates 5.4% growth, driven by industrial modernization and environmental protection initiatives. Japan exhibits the most mature market with 4.7% growth, emphasizing advanced treatment technologies and justifiable manufacturing practices.

The report covers an in-depth analysis of 40+ countries, the top-performing countries are highlighted below.

The wastewater heavy metal treatment agent market in China is growing at a CAGR of 8.5%, driven by the rapid expansion of the industrial and manufacturing sectors. Rising environmental awareness and strict government regulations regarding effluent discharge are increasing the adoption of heavy metal treatment agents. China’s growing investments in wastewater treatment infrastructure and technological upgrades in water purification systems further enhance market growth. The need to reduce environmental pollution and comply with international standards for water quality continues to drive demand.

The wastewater heavy metal treatment agent market in India is projected to grow at a CAGR of 7.9%, fueled by the country’s rapid industrialization and expanding municipal wastewater treatment initiatives. Increasing regulatory enforcement on heavy metal discharge and rising awareness of environmental pollution are driving the adoption of advanced treatment agents. India’s growth in chemical, textile, and metal industries further contributes to the demand for efficient wastewater management solutions.

The wastewater heavy metal treatment agent market in Germany is expanding at a CAGR of 7.2%, supported by the country’s strong industrial base and focus on environmental protection. Stringent European Union regulations on wastewater discharge encourage industries to adopt advanced heavy metal treatment solutions. Germany’s investments in eco-friendly water treatment technologies and modernization of industrial effluent management systems further strengthen the market.

The wastewater heavy metal treatment agent market in Brazil is projected to grow at a CAGR of 6.6%, driven by increasing industrial activities, especially in mining, metallurgy, and chemical sectors. Growing focus on environmental protection and compliance with wastewater discharge standards is accelerating the adoption of heavy metal treatment agents. Infrastructure upgrades and modernization of municipal water treatment facilities are also contributing to market growth.

The wastewater heavy metal treatment agent market in the United States is expected to grow at a CAGR of 6%, supported by regulatory compliance requirements and industrial demand. USA industries, including chemical, metal processing, and power generation, are increasingly adopting heavy metal treatment agents to meet environmental standards. Municipal wastewater treatment projects and government initiatives for cleaner water supply further strengthen market growth.

The wastewater heavy metal treatment agent market in the United Kingdom is growing at a CAGR of 5.4%, driven by industrial and municipal wastewater treatment needs. Adoption is encouraged by regulatory frameworks enforcing strict limits on heavy metal discharge. The country’s focus on modernizing water treatment infrastructure and investing in efficient purification technologies supports steady growth.

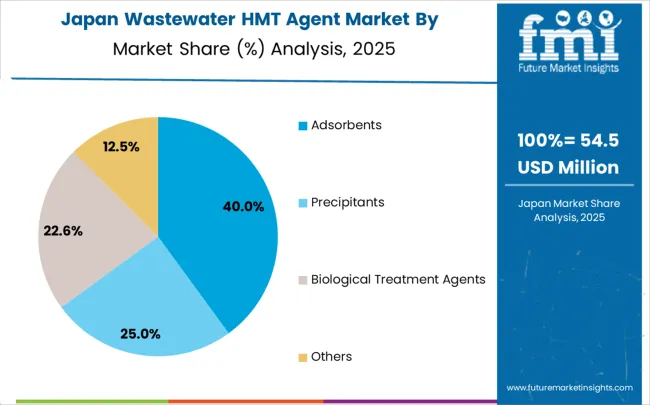

The wastewater heavy metal treatment agent market in Japan is projected to grow at a CAGR of 4.7%, fueled by stringent environmental regulations and growing industrial water treatment requirements. Japan’s chemical, manufacturing, and electronics sectors increasingly rely on advanced heavy metal treatment solutions to comply with effluent standards. Adoption is further supported by investments in advanced purification technologies and modernization of wastewater management systems.

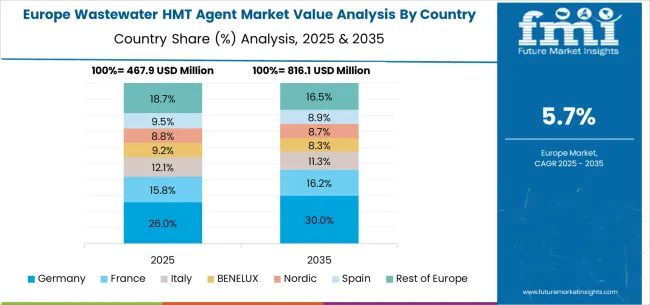

The wastewater heavy metal treatment agent market in Europe is projected to grow from USD 448.7 million in 2025 to USD 826.6 million by 2035, registering a CAGR of 6.2% over the forecast period. By type, adsorbents are expected to maintain their leadership with a 40% share in 2025, supported by widespread adoption of activated carbon and ion exchange technologies across European industrial facilities. Precipitants are projected to account for 32% of the market, driven by chemical precipitation methods commonly used in automotive and metalworking industries.

By end-use, electroplating applications are anticipated to represent 38% of the European market in 2025, reflecting the significant automotive manufacturing base and electronics production facilities throughout Germany, France, and Italy. Mining applications are expected to contribute 25% of market demand, primarily from copper and zinc processing operations in Nordic and Eastern European regions. Electronics manufacturing is projected to account for 20% of the market, concentrated in high-tech manufacturing clusters across Germany, Netherlands, and Ireland.

The wastewater heavy metal treatment agent market is defined by competition among specialty chemical manufacturers, environmental technology companies, and water treatment solution providers. Companies are investing in advanced formulation technologies, specialized application expertise, comprehensive technical support, and global distribution capabilities to deliver effective, reliable, and cost-efficient heavy metal removal solutions. Strategic partnerships, technological innovation, and geographic expansion are central to strengthening product portfolios and market presence.

TOSOH CORP, Japan-based, offers advanced ion exchange resins and specialized adsorption materials with focus on high removal efficiency and process optimization. Aries Chemical, USA-based, provides comprehensive heavy metal treatment solutions with emphasis on application-specific formulations and technical support. Accepta Ltd, UK-based, delivers specialized treatment chemicals and process optimization services for diverse industrial applications. Ecologix, USA-based, focuses on environmentally conscious treatment agents and comprehensive technical expertise.

Lanyao Water treatment Co.,Ltd., China-based, offers cost-effective treatment solutions with emphasis on large-scale industrial applications. NEP CO., Ltd., Japan-based, provides advanced treatment technologies with focus on precision and reliability. Aikoh-japan specializes in specialized treatment formulations for electronics and precision manufacturing applications. Nihon Filter Co,Ltd. delivers comprehensive filtration and treatment systems with integrated chemical solutions. Kemira, Finland-based, offers global expertise in water treatment chemicals with emphasis on process optimization. Guangdong Shanmei Environmental Technology Co.,Ltd. and Swing Corporation provide regional expertise and specialized treatment solutions for diverse industrial applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.8 Billion |

| Type | Adsorbents, precipitants, biological treatment agents, and others |

| End-use | Electroplating, mining, electronics, battery manufacturing, and others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Germany, India, China, United Kingdom, Japan, Brazil |

| Key Companies Profiled | TOSOH CORP, Aries Chemical, Accepta Ltd, Ecologix, Lanyao Water treatment Co.,Ltd., NEP CO., Ltd., Aikoh-japan, Nihon Filter Co,Ltd., Kemira, Guangdong Shanmei Environmental Technology Co.,Ltd., Swing Corporation |

| Additional Attributes | Dollar sales by type and end-use sectors, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established chemical manufacturers and environmental technology providers, treatment efficiency comparisons across different agent types, integration with advanced monitoring and control systems, innovations in selective removal technologies and metal recovery capabilities, and adoption of ecological treatment solutions with reduced environmental impact and enhanced resource recovery potential. |

The global wastewater heavy metal treatment agent market is estimated to be valued at USD 2,039.5 million in 2025.

The market size for the wastewater heavy metal treatment agent market is projected to reach USD 3,757.1 million by 2035.

The wastewater heavy metal treatment agent market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in wastewater heavy metal treatment agent market are adsorbents, precipitants, biological treatment agents and others.

In terms of application, electroplating segment to command 35.0% share in the wastewater heavy metal treatment agent market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wastewater Treatment Aerators Market Size and Share Forecast Outlook 2025 to 2035

Water and Wastewater Treatment Equipment Market Size and Share Forecast Outlook 2025 to 2035

Industrial Wastewater Treatment Chemical Market Insights - Growth & Demand 2025 to 2035

Precious Metal Beneficiation Reagents Market Size and Share Forecast Outlook 2025 to 2035

Eco-friendly Precious Metal Beneficiation Reagents Market Forecast and Outlook 2025 to 2035

Bioelectrochemical Systems For Wastewater Treatment Market Size and Share Forecast Outlook 2025 to 2035

Non-eco-friendly Precious Metal Beneficiation Reagents Market Forecast and Outlook 2025 to 2035

Metallurgical Lighting Market Size and Share Forecast Outlook 2025 to 2035

Metal Evaporation Boat Market Size and Share Forecast Outlook 2025 to 2035

Metal Miniature Bone Plates Market Size and Share Forecast Outlook 2025 to 2035

Heavy-Duty Pallet Warehouse Racking Market Size and Share Forecast Outlook 2025 to 2035

Metal Locking Plate and Screw System Market Size and Share Forecast Outlook 2025 to 2035

Metal Pallet Market Size and Share Forecast Outlook 2025 to 2035

Metal Oxide Varistor (MOV) Surge Arresters Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Pallet Rack Market Size and Share Forecast Outlook 2025 to 2035

Metal Straw Market Size and Share Forecast Outlook 2025 to 2035

Metal Can Market Size and Share Forecast Outlook 2025 to 2035

Metal IBC Market Forecast and Outlook 2025 to 2035

Heavy Duty Pump Market Size and Share Forecast Outlook 2025 to 2035

Metalized Barrier Film Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA