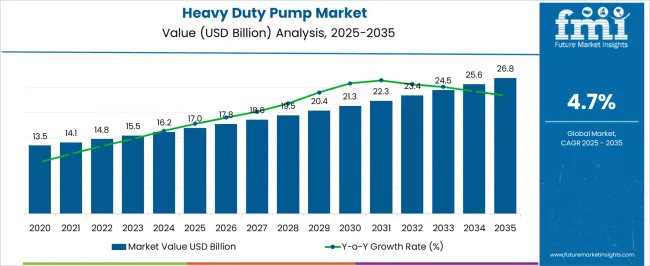

The Heavy Duty Pump Market is estimated to be valued at USD 17.0 billion in 2025 and is projected to reach USD 26.8 billion by 2035, registering a compound annual growth rate (CAGR) of 4.7% over the forecast period.

The heavy duty pump market is growing steadily, supported by increasing investments in infrastructure, energy, and water management sectors. These pumps are critical in handling large volumes of fluids under high pressure, making them indispensable in industries such as oil and gas, mining, power generation, and wastewater treatment.

The market is benefiting from industrial expansion and the rising need for efficient fluid transport systems that minimize energy losses and operational downtime. Manufacturers are emphasizing the development of durable, corrosion-resistant materials and advanced control systems to improve reliability and efficiency.

Global efforts toward sustainability are also driving innovation in energy-efficient pump designs. Future market prospects remain favorable, with ongoing industrialization and infrastructure renewal projects creating sustained demand for robust pumping solutions.

| Metric | Value |

|---|---|

| Heavy Duty Pump Market Estimated Value in (2025 E) | USD 17.0 billion |

| Heavy Duty Pump Market Forecast Value in (2035 F) | USD 26.8 billion |

| Forecast CAGR (2025 to 2035) | 4.7% |

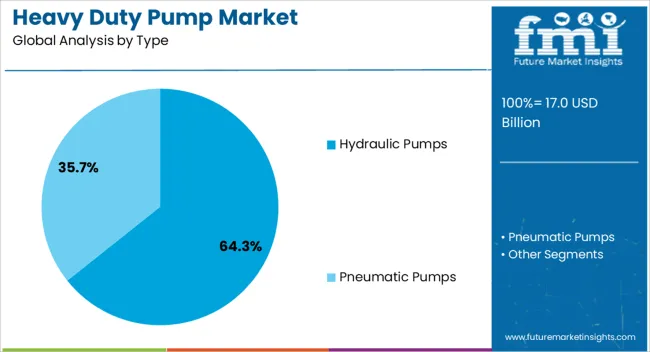

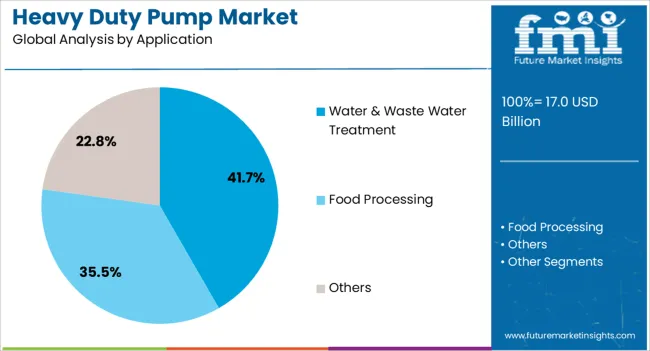

The market is segmented by Type and Application and region. By Type, the market is divided into Hydraulic Pumps and Pneumatic Pumps. In terms of Application, the market is classified into Water & Waste Water Treatment, Food Processing, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hydraulic pumps segment holds approximately 64.30% share in the type category, reflecting its dominance in heavy-duty applications that require consistent pressure and power transmission. These pumps are widely used in construction, mining, and industrial machinery for lifting, pressing, and fluid transfer operations.

The segment’s leadership is driven by its proven performance, durability, and compatibility with modern hydraulic systems. Technological improvements in sealing, flow control, and energy optimization have enhanced operational efficiency and reduced maintenance needs.

With industries prioritizing productivity and reliability, hydraulic pumps continue to be the preferred choice in high-demand environments. Their scalability and adaptability to various industrial applications ensure continued market prominence.

The water and wastewater treatment segment dominates the application category, accounting for approximately 41.70% share. This segment’s growth is driven by rising global concerns over water scarcity and pollution, necessitating efficient fluid handling solutions.

Heavy duty pumps are essential for processes such as sludge management, desalination, and filtration, ensuring reliable operation under challenging conditions. Government initiatives for water infrastructure development and stricter environmental regulations are reinforcing market demand.

Technological advancements, including smart monitoring and energy recovery systems, are improving pump performance in treatment facilities. As urbanization and industrialization continue to strain water resources, the segment is expected to maintain strong momentum throughout the forecast period.

From 2020 to 2025, the heavy duty pump industry experienced a CAGR of 6.4%. Government initiatives promoting the reduction of carbon footprints and energy consumption have become significant drivers for encouraging consumers to adopt heavy duty pumps.

The market is experiencing growth fueled by increasing technological advancements that lead to the development of more efficient system designs with enhanced control features. These advancements play a pivotal role in propelling the overall market forward.

The increasing demand for heavy duty pumps in different industries around the globe is creating high growth virtues for the growth in demand for heavy duty pumps over the forecast period.

Global market value is estimated to reach USD 26.8 billion by 2035. Projections indicate that the global heavy duty pump market is expected to experience a CAGR of 4.7% from 2025 to 2035.

| Historical CAGR from 2020 to 2025 | 6.4% |

|---|---|

| Forecasted CAGR from 2025 to 2035 | 4.7% |

The following table shows the top five countries by revenue, led by United Kingdom and South Korea. Stringent environmental regulations in the United Kingdom are expected to drive the adoption of heavy duty pumps that meet high standards of efficiency and environmental sustainability.

Advances in pump technologies, including improvements in efficiency and digitalization, influence the demand for modern heavy duty pumps in South Korea.

| Countries | Forecast CAGRs from 2025 to 2035 |

|---|---|

| United States | 5.1% |

| United Kingdom | 6.2% |

| China | 5.2% |

| Japan | 5.5% |

| South Korea | 7.5% |

The heavy duty pump market in the United States is expected to grow with a CAGR of 5.1% from 2025 to 2035. The United States is considered to be the target market for heavy duty pumps market due to the continuously growing manufacturing industry in the region.

With growing emphasis on sustainability and reducing carbon emissions in the United States, there has been an increasing demand for renewable energy solutions, including heavy duty pumps. The presence of leading heavy duty pump manufacturers in the region boosts the market growth.

The heavy duty pump market in the United Kingdom is expected to grow with a CAGR of 6.2% from 2025 to 2035. The construction sector in the United Kingdom contributes to the demand for heavy duty pumps. These pumps are used in construction projects for tasks such as dewatering, concrete pumping, and handling various fluids associated with building and infrastructure development.

Increasing demand in water and wastewater treatment for processes such as sewage handling, water circulation, and treatment, drives the heavy duty pump in the United Kingdom.

China's rapid industrialization and ongoing industrial growth contribute significantly to the demand for heavy duty pumps. The heavy duty pump market in China is expected to grow with a CAGR of 5.2% from 2025 to 2035.

China has been undergoing extensive infrastructure development, including the construction of buildings, bridges, and transportation networks. Heavy duty pumps are essential for tasks such as dewatering construction sites, concrete pumping, and other construction-related processes.

Government initiatives and policies promoting energy efficiency, environmental protection, and sustainable development influence the demand for heavy duty pumps in China.

The heavy duty pump market in Japan is expected to grow with a CAGR of 5.5% from 2025 to 2035. Industries in Japan such as manufacturing, construction, and mining rely on heavy duty pumps for various applications, including fluid transfer, processing, and water management.

The chemical processing industry in Japan relies on heavy duty pumps for the transfer and processing of chemicals. These pumps are crucial for maintaining the efficiency and safety of chemical manufacturing processes.

South Korea remains one of the most lucrative markets throughout the forecast period. The market is anticipated to expand at a CAGR of 7.5% over the forecast period. The increasing application in industries such as manufacturing, and construction, drives the market growth in South Korea.

South Korea, with its developed industrial base, uses heavy duty pumps in the energy sector for applications such as power generation, including tasks like boiler feedwater, cooling water circulation, and fuel transfer.

The below section shows the leading segment. The hydraulic pump segment is expected to register a CAGR of 4.5% from 2025 to 2035. Based on application, the food processing segment is anticipated to hold a dominant share through 2035. It is set to exhibit a CAGR of 4.1% from 2025 to 2035.

| Category | CAGR by 2035 |

|---|---|

| Hydraulic Pumps | 4.5% |

| Food Processing | 4.1% |

Based on type, the hydraulic pumps segment is anticipated to thrive at a CAGR of 4.5% from 2025 to 2035. Hydraulic pumps offer high power density, meaning they can provide substantial power output in a relatively compact and lightweight design. This makes them well-suited for heavy duty applications where space and weight considerations are crucial.

Hydraulic pumps are highly versatile and can be employed in a wide range of heavy duty applications, including construction equipment, mining machinery, industrial processes, and material handling. Their adaptability contributes to their widespread use in diverse sectors.

Hydraulic pumps excel in applications that require high force or torque, such as lifting heavy loads, crushing materials, or bending metal. They can efficiently generate the force needed for these demanding tasks.

Hydraulic systems offer precise control over speed, direction, and force. This level of control is crucial in heavy duty applications where accurate and responsive operation is required, such as in construction equipment or manufacturing machinery.

Based on the application, the food processing segment is projected to rise at a 4.1% CAGR through 2035. Heavy duty pumps can handle high flow rates, making them suitable for bulk processing in the food industry. This capability is particularly beneficial in applications like beverage production, where large quantities need to be transported and processed rapidly.

Some food products contain solid particles or abrasive materials that require specialized pumps. Heavy duty pumps are designed to handle these challenging conditions, ensuring the reliable and efficient transfer of food materials without damage to the pump components.

The food processing industry places a strong emphasis on hygiene and sanitary standards. Heavy duty pumps are often designed with materials and finishes that comply with industry regulations and can be easily cleaned to meet strict hygiene standards.

The growing demand for processed and packaged food products globally has led to increased production requirements. Heavy duty pumps, with their capacity for high flow rates and robust performance, help food processing facilities meet these escalating production demands.

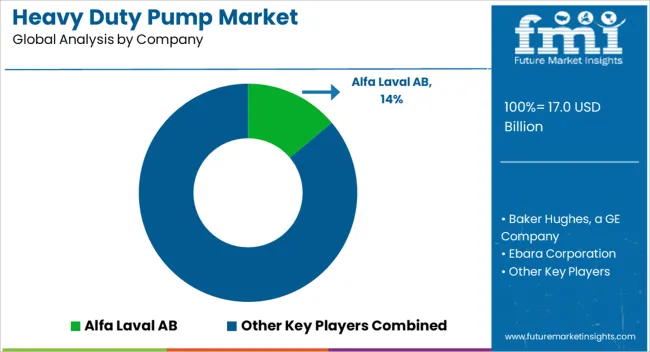

The global heavy duty pump market is characterized by intense competition among key players who play a pivotal role in driving innovation within the industry. Employing diverse marketing strategies, including collaborations, mergers, acquisitions, product launches, and agreements, these key players actively contribute to elevating the overall global market.

| Attributes | Details |

|---|---|

| Estimated Market Size in 2025 | USD 16.2 billion |

| Projected Market Valuation in 2035 | USD 25.7 billion |

| Value-based CAGR 2025 to 2035 | 4.7% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD billion |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East and Africa |

| Key Market Segments Covered | Type, Application, Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Russia, Poland, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC countries, South Africa, Israel |

| Key Companies Profiled | Alfa Laval AB; Baker Hughes, a GE company; Ebara Corporation; Flowserve Corporation; Gardner Denver Inc.; General Electric Company; Grundfos Holding A/S; Ingersoll-Rand PLC; ITT Corporation; KSB AG; Metso Corporation; Sulzer Ltd.; Weir Group PLC |

The global heavy duty pump market is estimated to be valued at USD 17.0 billion in 2025.

The market size for the heavy duty pump market is projected to reach USD 26.8 billion by 2035.

The heavy duty pump market is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in heavy duty pump market are hydraulic pumps and pneumatic pumps.

In terms of application, water & waste water treatment segment to command 41.7% share in the heavy duty pump market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Heavy Duty Heat Pump Market Growth - Trends & Forecast 2025 to 2035

Heavy-Truck Composite Component Market Size and Share Forecast Outlook 2025 to 2035

Heavy Cordless Tools Market Analysis Size and Share Forecast Outlook 2025 to 2035

Heavy Haul Truck Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Heavy Lifting Equipment Market Size and Share Forecast Outlook 2025 to 2035

Heavy Commercial Vehicle Eps Market Size and Share Forecast Outlook 2025 to 2035

Heavyweight Motorcycles Market Size and Share Forecast Outlook 2025 to 2035

Heavy Oil Cracking Catalyst Market Size and Share Forecast Outlook 2025 to 2035

Heavy Wall Bottles Market Size, Share & Forecast 2025 to 2035

Heavy Duty Corrugated Packaging Market Size and Share Forecast Outlook 2025 to 2035

Heavy-duty Truck AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Heavy-duty Truck AMT Synchronizer Market Size and Share Forecast Outlook 2025 to 2035

Heavy-Duty Hydrogen Compressors Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Bins Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Pick Up Trucks Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Gas Turbine Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Vehicle Rental Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Engine Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Trucks Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Paper Tags Market Insights – Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA