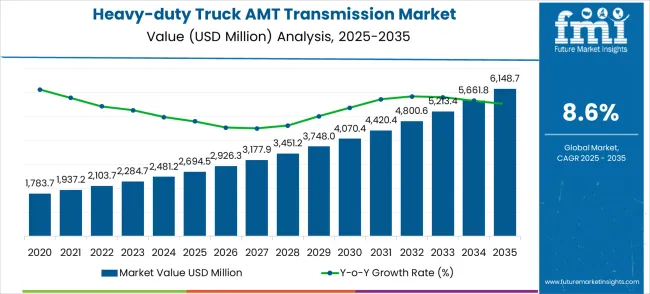

The heavy-duty truck AMT transmission market is valued at USD 2,694.5 million in 2025 and is projected to reach USD 6,148.7 million by 2035, with a CAGR of 8.6%. From 2021 to 2025, the market grows from USD 1,783.7 million to USD 2,694.5 million, with intermediate values of USD 1,937.2 million, USD 2,103.7 million, USD 2,284.7 million, and USD 2,481.2 million. This early phase is characterized by gradual yet steady growth, driven by the increasing adoption of automated manual transmission (AMT) systems in heavy-duty trucks. These systems offer improved fuel efficiency, reduced driver fatigue, and enhanced driving comfort, which are crucial benefits for fleet operators and the transportation industry.

Between 2026 and 2030, the market is projected to accelerate from USD 2,694.5 million to USD 4,070.4 million, with intermediate values of USD 2,926.3 million, USD 3,177.9 million, and USD 3,451.2 million. This period highlights the transition from early-stage adoption to broader market penetration. The growth momentum during these years reflects the increasing preference for AMT transmissions in commercial trucks, particularly due to the ongoing shift towards automation in the automotive industry. By 2030, the market will reach USD 4,420.4 million, and from 2031 to 2035, the market will reach its peak at USD 6,148.7 million, with values progressing through USD 4,800.6 million, USD 5,213.4 million, and USD 5,661.8 million, driven by technological advancements and growing demand for high-performance, fuel-efficient vehicles.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 2,694.5 million |

| Forecast Value in (2035F) | USD 6,149 million |

| Forecast CAGR (2025 to 2035) | 9% |

The automotive transmission market contributes about 35-40%, driven by the growing adoption of automated transmission systems in heavy-duty trucks to improve fuel efficiency, reduce driver fatigue, and enhance overall performance. The commercial vehicle market adds roughly 25-30%, as AMT systems are increasingly integrated into trucks and fleets for long-haul and construction applications, where reliability and fuel efficiency are essential for operators. The manufacturing and industrial equipment market contributes around 15-18%, as AMT transmissions are used in vehicles and machinery designed for heavy-duty work in sectors such as logistics, mining, and construction, where high torque handling and durability are crucial. The electrification and hybrid vehicle market accounts for approximately 10-12%, as the rise of hybrid and electric heavy-duty trucks calls for AMT transmissions that can seamlessly integrate with hybrid powertrains and optimize energy usage. The automotive parts and components market contributes about 8-10%, with a focus on the production of AMT components, including actuators, sensors, and control units, to meet the growing demand for high-performance transmission systems.

Market expansion is being supported by the increasing demand for operational efficiency and fuel economy in commercial transportation, creating corresponding need for automated transmission technologies that can optimize gear shifting, reduce fuel consumption, and minimize driver workload while maintaining superior performance characteristics. Modern heavy-duty trucking operations require sophisticated transmission systems that can provide optimal torque delivery, efficient power transfer, and consistent performance across diverse operating conditions while supporting comprehensive fleet management and operational cost optimization. AMT transmissions provide the necessary automation, efficiency, and reliability to ensure optimal vehicle performance while reducing operating costs and improving driver comfort.

The growing complexity of commercial vehicle operations and increasing emphasis on driver retention are driving demand for automated transmission technologies that can reduce driving difficulty, minimize fatigue, and enhance overall vehicle operation experience while maintaining superior performance and reliability characteristics. Commercial fleet operators are implementing comprehensive technology upgrades that focus on improving operational efficiency, reducing maintenance costs, and enhancing driver satisfaction through advanced transmission technologies. Regulatory requirements and industry standards are establishing comprehensive emission and efficiency protocols that require specialized transmission technologies with validated performance characteristics and comprehensive fuel economy documentation.

The heavy-duty truck AMT transmission market (USD 2,694.5M → 6,148.7M by 2035, CAGR ~9%) is being fueled by rising logistics demand, electrification of heavy trucks, and the push for fuel efficiency and driver comfort in engineering transport vehicles. Together, targeted gear-class innovation and application-driven adoption unlock USD 3.2–3.5 billion in incremental revenue opportunities by 2035 (aligned with the ~USD 3.45B market expansion).

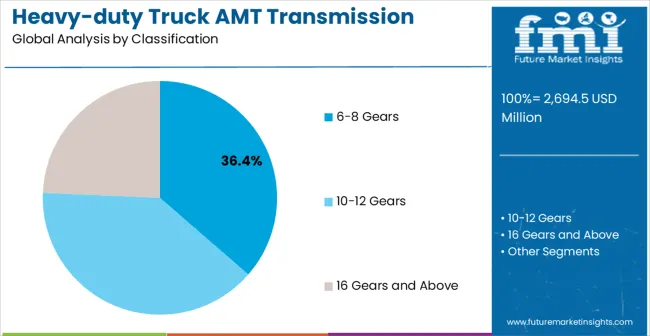

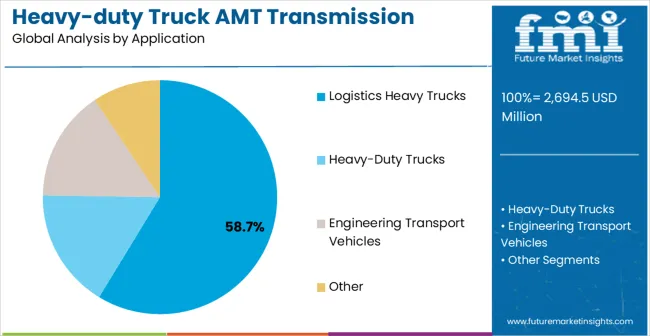

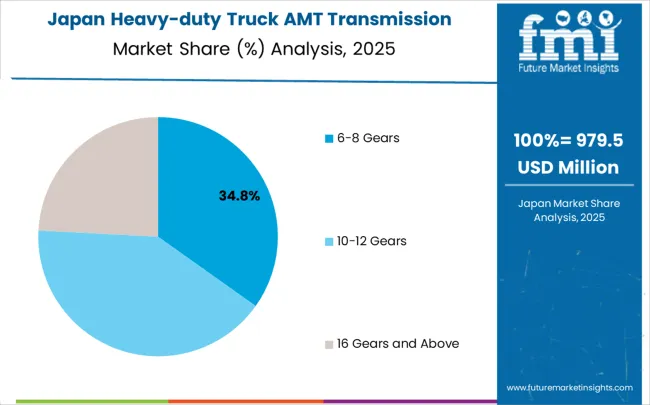

The market is segmented by classification, application, and region. By classification, the market is divided into 6-8 gears, 10-12 gears, and 16 gears and above. Based on application, the market is categorized into logistics heavy trucks, heavy-duty trucks, engineering transport vehicles, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

6-8 gears AMT transmissions are projected to account for 36.4% of the heavy-duty truck AMT transmission market in 2025. This leading share is supported by the optimal balance of performance, efficiency, and cost-effectiveness that 6-8 gear configurations provide for diverse heavy-duty trucking applications. 6-8 gear AMT transmissions offer sufficient gear ratios for most commercial vehicle operations while maintaining manageable complexity and competitive pricing that make them preferred choices for logistics companies, regional haulers, and medium to heavy-duty applications. The segment benefits from established manufacturing capabilities, comprehensive validation databases, and extensive service support infrastructure that facilitate adoption across diverse commercial vehicle applications.

6-8 gear AMT transmission technology continues advancing through integration of sophisticated control algorithms, enhanced shift quality optimization, and improved durability features that support modern heavy-duty vehicle requirements and operational demands. The segment growth reflects increasing adoption of 6-8 gear systems in expanding commercial vehicle fleets and growing logistics applications that require reliable automated transmission performance without excessive complexity or cost. Manufacturers are developing next-generation 6-8 gear AMT systems with advanced electronic controls, predictive shifting algorithms, and comprehensive diagnostic capabilities that address evolving commercial vehicle requirements while maintaining optimal cost-performance characteristics for diverse applications.

Logistics heavy trucks applications are expected to represent 58.7% of heavy-duty truck AMT transmission demand in 2025. This dominant share reflects the extensive use of automated transmissions in logistics and freight transportation operations that require consistent performance, operational efficiency, and driver comfort for long-haul and distribution applications. Modern logistics operations depend on reliable AMT transmissions for optimal fuel economy, reduced driver fatigue, and consistent performance across diverse route conditions and loading scenarios that support comprehensive fleet efficiency and operational cost management. The segment benefits from ongoing e-commerce growth, expanding freight transportation requirements, and increasing emphasis on operational efficiency that drive demand for advanced automated transmission technologies.

Logistics industry transformation toward automated operations and enhanced efficiency is driving significant AMT transmission demand as fleet operators implement comprehensive technology upgrades for improved fuel economy, reduced maintenance costs, and enhanced driver retention through improved vehicle operation characteristics. The segment expansion reflects increasing emphasis on operational optimization, cost management, and service reliability that depend on superior transmission performance and comprehensive fleet management integration. Advanced logistics applications are incorporating telematics systems, route optimization technologies, and comprehensive performance monitoring that require sophisticated AMT transmission technologies with enhanced connectivity and diagnostic capabilities for optimal fleet management and operational efficiency.

The heavy-duty truck AMT transmission market is advancing rapidly due to increasing commercial vehicle automation and growing emphasis on operational efficiency optimization. The market faces challenges including high initial costs compared to manual transmissions, complex maintenance requirements, and driver training needs for optimal system utilization. Technological advancement efforts and cost reduction initiatives continue to influence product development and market expansion patterns.

The growing implementation of advanced electronic control systems and comprehensive connectivity features in AMT transmissions is enabling predictive shifting, fleet management integration, and real-time performance optimization that enhance operational efficiency and maintenance planning capabilities. Smart transmission technologies provide comprehensive data analytics, remote monitoring capabilities, and integrated telematics that support efficient fleet operations and proactive maintenance scheduling. These technological advances enable fleet operators to achieve higher levels of operational efficiency and cost optimization while reducing maintenance requirements and improving overall fleet performance through intelligent transmission management approaches.

AMT transmission manufacturers are developing specialized systems and compatibility solutions for hybrid and electric heavy-duty vehicles that enable optimal power delivery, energy recovery, and comprehensive drivetrain integration while maintaining superior performance characteristics. Next-generation AMT systems provide seamless integration with electric motors, regenerative braking optimization, and comprehensive energy management that support efficient hybrid and electric vehicle operation. These innovations support broader market adoption by providing enhanced capabilities for emerging vehicle technologies while maintaining traditional AMT benefits for evolving commercial vehicle applications and alternative powertrains.

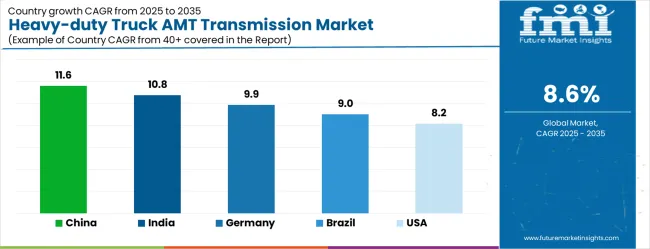

| Country | CAGR (2025-2035) |

|---|---|

| China | 11.6% |

| India | 10.8% |

| Germany | 9.9% |

| Brazil | 9.0% |

| United States | 8.2% |

| United Kingdom | 7.3% |

| Japan | 6.5% |

The heavy-duty truck AMT transmission market demonstrates varied growth patterns across key countries, with China leading at an 11.6% CAGR through 2035, driven by massive commercial vehicle production expansion, growing logistics industry development, and increasing adoption of automated transmission technologies. India follows at 10.8%, supported by expanding commercial vehicle manufacturing, growing freight transportation requirements, and increasing infrastructure development. Germany records 9.9% growth, emphasizing advanced transmission technology development, commercial vehicle innovation, and comprehensive automotive industry capabilities. Brazil shows strong growth at 9.0%, expanding commercial vehicle operations and logistics infrastructure development. The United States maintains 8.2% growth, focusing on fleet modernization and commercial vehicle technology advancement. The United Kingdom demonstrates 7.3% expansion, supported by logistics industry development and commercial vehicle modernization. Japan records 6.5% growth, leveraging technological excellence and precision manufacturing capabilities.

The report covers an in-depth analysis of 40+ countries with top-performing countries highlighted below.

Revenue from heavy-duty truck AMT transmissions in China is projected to expand at the highest growth rate with a CAGR of 11.6% through 2035, driven by unprecedented commercial vehicle production capacity, comprehensive logistics industry development, and government support for transportation modernization initiatives. The country's massive infrastructure development and urbanization programs are creating substantial demand for commercial vehicles equipped with advanced AMT transmission systems for construction, logistics, and freight transportation applications. Major commercial vehicle manufacturers are implementing comprehensive production capabilities that support domestic demand growth and export market expansion while incorporating advanced transmission technologies.

The heavy-duty truck AMT transmission market in India is growing at a CAGR of 10.8%, supported by expanding commercial vehicle manufacturing capabilities, growing freight transportation requirements, and comprehensive infrastructure development programs across diverse regional markets. The country's emphasis on industrial development and transportation modernization is driving demand for AMT transmission systems that support efficient commercial vehicle operations, improved fuel economy, and enhanced operational performance. Government programs promoting commercial vehicle modernization are creating favorable conditions for automated transmission adoption and technology development. Major international companies are establishing manufacturing facilities that require comprehensive commercial vehicle supply chains and technical support services.

Demand for heavy-duty truck AMT transmissions in Germany is expanding at a CAGR of 9.9%, supported by the country's leadership in advanced transmission technology development, commercial vehicle innovation, and comprehensive automotive industry capabilities. German manufacturers are implementing sophisticated AMT transmission solutions that meet stringent performance standards while supporting complex commercial vehicle applications and demanding operational requirements. The country's extensive commercial vehicle industry is driving significant AMT transmission demand for advanced logistics applications, construction vehicles, and specialized transportation systems. Research institutions are collaborating with industry partners to develop next-generation transmission technologies that maintain German competitiveness in global commercial vehicle markets. ad

Revenue from heavy-duty truck AMT transmissions in Brazil is projected to grow at a CAGR of 9.0%, driven by expanding commercial vehicle operations, growing logistics infrastructure development, and increasing emphasis on transportation efficiency across diverse regional markets. Brazilian commercial vehicle operators and logistics companies are investing in AMT transmission systems to enhance operational efficiency and support cost optimization while improving driver comfort and vehicle performance. Government programs supporting transportation infrastructure development are facilitating access to advanced commercial vehicle technologies and comprehensive technical expertise. Regional logistics centers are developing specialized capabilities that support AMT transmission applications across freight transportation, construction, and industrial vehicle sectors.

Demand for heavy-duty truck AMT transmissions in the United States is projected to grow at a CAGR of 8.2%, driven by comprehensive fleet modernization programs, commercial vehicle technology advancement, and ongoing efficiency improvement initiatives across transportation and logistics sectors. American fleet operators and commercial vehicle companies are implementing advanced AMT transmission solutions to maintain competitive advantages while supporting operational efficiency and regulatory compliance requirements. The logistics industry is driving significant AMT transmission demand for long-haul operations, regional distribution, and specialized transportation applications requiring superior performance and reliability. Government initiatives supporting transportation efficiency and emission reduction are creating opportunities for advanced transmission technology adoption and development programs.

The heavy-duty truck AMT transmission market in the United Kingdom is expected to expand at a CAGR of 7.3%, supported by logistics industry development, commercial vehicle modernization programs, and increasing emphasis on operational efficiency improvement across transportation sectors. British logistics companies and fleet operators are investing in AMT transmission systems to support operational optimization, driver comfort enhancement, and comprehensive fleet efficiency while maintaining competitive positioning in evolving markets. The country's established transportation infrastructure is facilitating AMT transmission adoption through comprehensive fleet modernization programs and technology development initiatives. Government initiatives supporting transportation efficiency are creating favorable conditions for advanced transmission technology adoption and comprehensive operational improvement.

Revenue from heavy-duty truck AMT transmissions in Japan is projected to expand at a CAGR of 6.5%, supported by technological excellence capabilities, precision manufacturing expertise, and comprehensive emphasis on operational optimization across commercial vehicle applications. Japanese manufacturers are implementing sophisticated AMT transmission solutions that demonstrate superior performance characteristics while supporting various commercial vehicle applications requiring exceptional reliability and operational efficiency. The country's commercial vehicle and logistics industries are driving demand for high-performance AMT transmissions that support precision operations and comprehensive quality requirements. Collaborative research programs between industry and academic institutions are developing innovative transmission technologies that maintain Japan's competitive advantage in global commercial vehicle markets. Advanced manufacturing methodologies are enabling the development of next-generation transmission technologies that provide enhanced performance characteristics and comprehensive operational optimization.

The heavy-duty truck AMT transmission market in Europe is projected to expand from USD 729.0 million in 2025 to USD 1,663.1 million by 2035, registering a CAGR of 9% over the forecast period. Germany is expected to maintain its leadership with 32.8% market share in 2025, projected to grow to 33.3% by 2035, supported by its extensive commercial vehicle manufacturing infrastructure and advanced transmission technology capabilities. France follows with 19.4% market share in 2025, expected to reach 19.7% by 2035, driven by logistics industry development and commercial vehicle modernization programs.

The Rest of Europe region is projected to maintain stable share at 19% throughout the forecast period, attributed to expanding commercial vehicle operations in Eastern European countries and growing logistics industry development. United Kingdom contributes 15.7% in 2025, projected to reach 15.2% by 2035, supported by commercial vehicle industry modernization and logistics sector development. Italy maintains 13.5% share in 2025, expected to grow to 14.8% by 2035, while other European countries demonstrate steady growth patterns reflecting regional commercial vehicle development and transportation industry advancement.

The heavy-duty truck AMT transmission market is characterized by competition among established transmission manufacturers, automotive suppliers, and specialized drivetrain companies. Companies are investing in advanced control technologies, electronic systems integration, comprehensive testing capabilities, and global service networks to deliver reliable, efficient, and cost-effective AMT transmission solutions. Strategic partnerships, technological innovation, and market expansion initiatives are central to strengthening product portfolios and commercial vehicle industry relationships.

ZF Friedrichshafen, Germany-based, offers comprehensive heavy-duty truck AMT transmission solutions with focus on commercial vehicle applications, advanced electronic controls, and global technical support capabilities across diverse heavy-duty vehicle segments. Eaton Corporation, USA, provides specialized AMT transmission systems emphasizing reliability, fuel efficiency optimization, and comprehensive fleet support for demanding commercial applications. Borgwarner delivers advanced transmission technologies with focus on performance optimization, durability, and comprehensive application support.

Allison Transmission specializes in automatic and AMT transmission systems with emphasis on commercial vehicle applications and comprehensive service support. HYUNDAI TRANSYS provides advanced transmission solutions with focus on Asian markets and comprehensive vehicle integration. SAIC offers specialized transmission systems for Chinese commercial vehicle markets with emphasis on cost-effective solutions. Other key players including Chongqing Tsingshan, Zhejiang Wanliyang Co., Ltd., and Shaanxi Fast Gear contribute specialized expertise and regional manufacturing capabilities across global and local commercial vehicle markets.

| Item | Value |

|---|---|

| Quantitative Units (2025) | USD 2,694.5 million |

| Classification | 6-8 Gears, 10-12 Gears, 16 Gears and Above |

| Application | Logistics Heavy Trucks, Heavy-Duty Trucks, Engineering Transport Vehicles, and Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | ZF Friedrichshafen, Eaton Corporation, Borgwarner, Allison Transmission, HYUNDAI TRANSYS, SAIC, Chongqing Tsingshan, Zhejiang Wanliyang Co., Ltd., Shaanxi Fast Gear |

| Additional Attributes | Dollar sales by classification and application segments, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established transmission manufacturers and specialized drivetrain companies, buyer preferences for different gear configurations and performance characteristics, integration with commercial vehicle platforms and fleet management systems, innovations in electronic control systems and connectivity features, and adoption of hybrid and electric vehicle compatible transmission technologies for enhanced operational efficiency and comprehensive performance optimization. |

The global heavy-duty truck AMT transmission market is estimated to be valued at USD 2,694.5 million in 2025.

The market size for the heavy-duty truck AMT transmission market is projected to reach USD 6,148.7 million by 2035.

The heavy-duty truck AMT transmission market is expected to grow at a 8.6% CAGR between 2025 and 2035.

The key product types in heavy-duty truck AMT transmission market are 6-8 gears, 10-12 gears and 16 gears and above.

In terms of application, logistics heavy trucks segment to command 58.7% share in the heavy-duty truck AMT transmission market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Heavy-duty Truck AMT Synchronizer Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Truck with Mast Market Size and Share Forecast Outlook 2025 to 2035

Truck Mounted Cranes Market Size and Share Forecast Outlook 2025 to 2035

Transmission Overload Protectors Market Size and Share Forecast Outlook 2025 to 2035

Trucks Market Size and Share Forecast Outlook 2025 to 2035

Transmission Substation Market Size and Share Forecast Outlook 2025 to 2035

Truck Loader Crane Market Size and Share Forecast Outlook 2025 to 2035

Transmission Oil Filters Market Size and Share Forecast Outlook 2025 to 2035

Truck Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Truck Racks Market Size and Share Forecast Outlook 2025 to 2035

Transmission Components Market Size and Share Forecast Outlook 2025 to 2035

Transmission Towers Market Size and Share Forecast Outlook 2025 to 2035

Transmission & Distribution Electric Capacitor Market Size and Share Forecast Outlook 2025 to 2035

Transmission Fluids Market Trends & Demand 2025 to 2035

Truck Bedliners Market Outlook- Trends & Forecast 2025 to 2035

Truck Mounted Knuckle Boom Cranes Market – Growth & Demand 2025 to 2035

Transmission Sales Market Analysis & Forecast by Type, End Use Through 2035

Transmission Mounting Bracket Market

Truck Platooning Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA