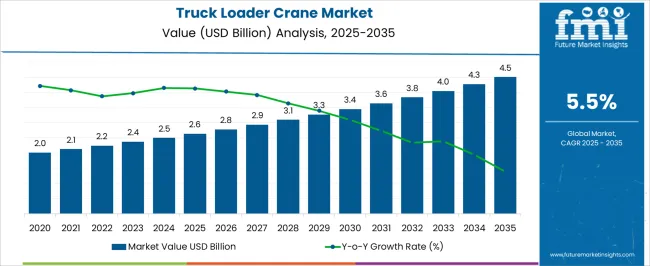

The truck loader crane market is positioned to grow from USD 2.6 billion in 2025 to USD 4.5 billion by 2035, reflecting a CAGR of 5.5%. Inflection point mapping identifies critical phases where market growth accelerates or decelerates due to technological innovations, regulatory shifts, and evolving end-user demand. Understanding these turning points helps stakeholders optimize investment and production strategies. From 2025 to 2027, the market rises from USD 2.6 billion to USD 2.9 billion, representing early adoption of advanced telescopic and knuckle-boom cranes.

Inflection points in this phase are influenced by fleet modernization in construction, logistics, and infrastructure sectors, with gains concentrated among OEMs offering high-efficiency, lightweight crane solutions. Between 2028 and 2031, revenues accelerate from USD 3.1 billion to USD 3.6 billion. Growth inflection occurs as regulatory standards for safety and emissions drive upgrades, and new technological features such as remote-control operation, automated load sensing, and IoT-enabled maintenance gain adoption. This period marks a significant shift in market dynamics, with adoption rates climbing faster than in the earlier phase. From 2032 to 2035, the market further strengthens, reaching USD 4.5 billion. Inflection points here are shaped by broader global infrastructure projects, increased demand for multi-purpose cranes, and expansion into emerging markets.

| Metric | Value |

|---|---|

| Truck Loader Crane Market Estimated Value in (2025 E) | USD 2.6 billion |

| Truck Loader Crane Market Forecast Value in (2035 F) | USD 4.5 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The truck loader crane market is strongly influenced by five interconnected parent markets, each contributing differently to overall demand and growth. The construction and infrastructure market holds the largest share at 35%, driven by the need for material handling, lifting, and transport operations in building projects, roads, bridges, and large-scale civil engineering projects. The mining and quarrying market contributes 25%, with truck loader cranes used for transporting heavy minerals, raw materials, and mining equipment efficiently and safely.

The logistics and transportation market accounts for 20%, as cranes are critical for loading and unloading goods, containers, and heavy cargo at ports, warehouses, and freight terminals. The oil, gas, and energy market holds a 12% share, driven by the handling of pipelines, machinery, and equipment for both onshore and offshore energy projects. Finally, the industrial manufacturing market represents 8%, supporting factories and heavy industries in moving raw materials, components, and finished products.

The truck loader crane market is witnessing sustained expansion due to growing demand for efficient material handling solutions in construction, logistics, and utility applications. Increasing investments in infrastructure and urban development across emerging economies are driving the need for versatile, truck-mounted lifting equipment.

Advancements in hydraulic systems and vehicle chassis integration have enhanced crane payload, maneuverability, and operational safety. Furthermore, OEMs are prioritizing modular design and automated control technologies to improve usability and reduce operator fatigue.

As governments and private contractors adopt stricter safety and efficiency standards, the adoption of modern loader cranes is expected to accelerate across sectors.

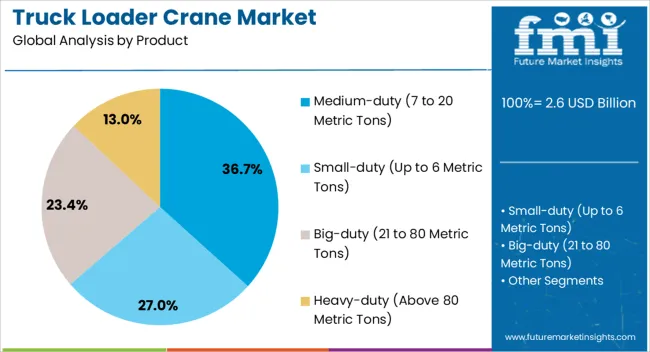

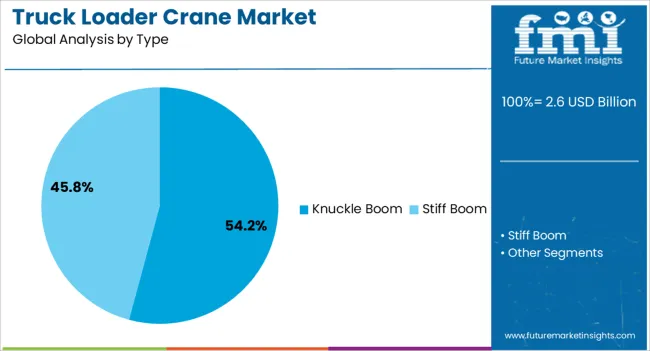

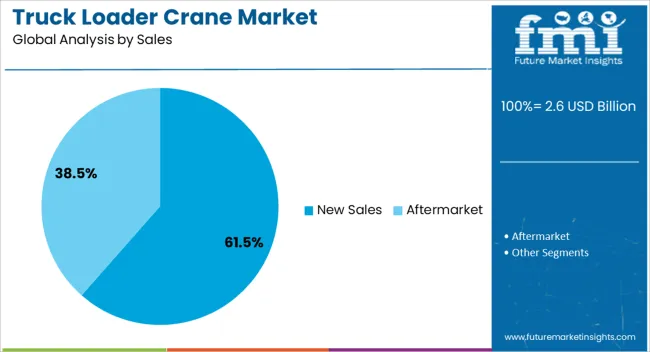

The truck loader crane market is segmented by product, type, sales, end-use, and geographic regions. By product, truck loader crane market is divided into Medium-duty (7 to 20 Metric Tons), Small-duty (Up to 6 Metric Tons), Big-duty (21 to 80 Metric Tons), and Heavy-duty (Above 80 Metric Tons). In terms of type, truck loader crane market is classified into Knuckle Boom and Stiff Boom. Based on sales, truck loader crane market is segmented into New Sales and Aftermarket.

By end-use, truck loader crane market is segmented into Construction, Rental, Mining, Oil & Gas, Energy, Forestry, and Logistics. Regionally, the truck loader crane industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Medium-duty cranes are forecast to account for 36.7% of the total truck loader crane market by 2025, positioning this product range at the forefront. Their widespread use in construction, utilities, and delivery logistics is attributed to their optimal balance between lifting capacity and vehicle compatibility.

These cranes offer versatility for daily operations requiring mid-range payloads without compromising mobility or fuel efficiency. Increased preference for multi-tasking vehicles in fleet operations has also reinforced demand for this segment.

The ability to operate in urban and semi-urban environments while performing both lifting and transport functions gives medium-duty cranes a distinct commercial advantage.

Knuckle boom cranes are projected to dominate the market with 54.2% share by 2025, emerging as the leading type. Their articulated design allows compact storage and greater flexibility during operation, especially in tight or confined spaces.

Popular in Europe and gaining adoption globally, knuckle boom cranes offer enhanced lifting angles and reach, supporting complex placement tasks with reduced setup time. As urban construction and retrofitting projects increase, their adaptability and safety benefits are making them the preferred option.

Their integration with advanced sensors and telematics is further enhancing productivity and compliance in regulated environments.

New sales are expected to represent 61.5% of the market by 2025, securing their position as the dominant sales channel. This trend is being driven by fleet modernization initiatives, emission regulation compliance, and the replacement of aging crane units.

OEMs are launching new models equipped with automation, diagnostics, and eco-friendly hydraulic systems, attracting both public and private buyers. Leasing firms and large construction companies are increasing investments in new units to minimize downtime and meet contract requirements.

The resale value and warranty coverage associated with new equipment purchases are also supporting the continued growth of this segment.

The truck loader crane market is growing as construction, logistics, and industrial operators prioritize material handling efficiency, safety, and operational versatility. Demand is driven by the need for compact, high-capacity cranes mounted on trucks for loading, unloading, and lifting operations across urban and off-road environments.

Challenges include high capital costs, maintenance requirements, and adherence to safety and vehicle regulations. Opportunities exist in telescopic and articulating crane designs, remote operation systems, and hybrid or electric-powered models. Trends highlight modular designs, enhanced load monitoring, and digital fleet integration.

Construction, logistics, and industrial operators increasingly require versatile lifting solutions that can handle heavy loads in urban, rural, and off-road settings. Truck loader cranes provide flexibility for rapid loading and unloading while reducing dependency on separate lifting equipment.

The growth of urban construction projects, e-commerce logistics, and infrastructure development has intensified the need for cranes that combine compactness with high lifting capacity. Enhanced safety features, operator-friendly controls, and adaptability to different truck platforms are critical. Rising awareness of workplace safety, operational efficiency, and productivity improvement is driving the adoption of advanced truck loader crane solutions across commercial, industrial, and municipal applications.

The truck loader crane market faces constraints from high manufacturing and maintenance costs, complex integration with truck platforms, and variability in lifting capacity requirements. Compliance with regional safety, vehicle, and load-handling regulations is critical. Supply chain limitations for hydraulic systems, steel alloys, and electronic control components can impact production timelines. Technical challenges include stability under heavy loads, precise load control, and durability under harsh operating conditions. Buyers increasingly prefer suppliers offering certified equipment, predictable delivery schedules, comprehensive after-sales support, and operator training to minimize operational risk and ensure compliance with safety and transport regulations.

Opportunities are strongest in hybrid-electric cranes, remote-controlled systems, and modular crane designs that allow easy adaptation to different truck platforms. Digital load monitoring, telematics, and automation enhance operational safety, efficiency, and maintenance scheduling. Growth in urban construction, infrastructure projects, logistics operations, and mining activities presents significant adoption potential. Lightweight materials and compact design improve fuel efficiency and maneuverability. Suppliers providing innovative, durable, and adaptable truck loader cranes, combined with technical support and service packages, are well positioned to capture growth across commercial, industrial, and municipal applications worldwide.

The market is trending toward digitally integrated cranes with telematics, load sensors, and remote monitoring for enhanced safety and performance tracking. Lightweight, high-strength materials improve load-to-weight ratios while reducing operational costs. Safety systems, including anti-overload and stabilization features, are becoming standard to meet regulatory requirements and minimize workplace accidents. Modular and telescopic designs allow easy customization and deployment across different truck types. Collaboration between crane manufacturers, truck OEMs, and fleet operators is enhancing innovation, operational reliability, and lifecycle management. Suppliers offering certified, technologically advanced, and operator-friendly truck loader cranes are best positioned to meet evolving market demand globally.

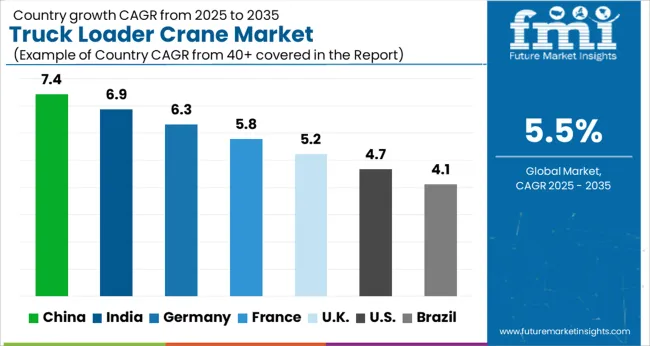

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| France | 5.8% |

| UK | 5.2% |

| USA | 4.7% |

| Brazil | 4.1% |

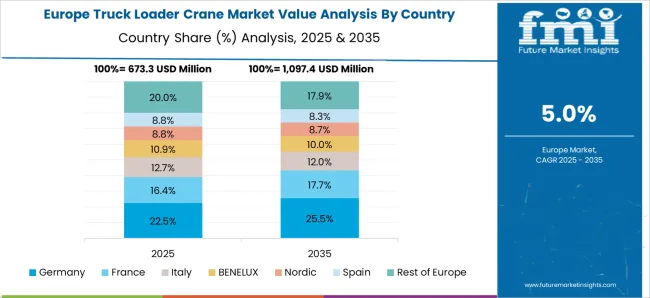

The global truck loader crane market is projected to grow at a CAGR of 5.5% from 2025 to 2035. China leads at 7.4%, followed by India at 6.9%, France at 5.8%, the UK at 5.2%, and the USA at 4.7%. Growth is driven by urban development, industrial infrastructure, logistics hubs, and e-commerce warehousing. Demand is increasing for telescopic, hydraulic, and modular cranes with advanced safety and digital monitoring features. Leasing and rental models are supporting adoption among small and medium enterprises. Asia shows rapid expansion due to infrastructure and logistics growth, while Europe and North America focus on safety, precision, and retrofit projects. The analysis includes over 40+ countries, with the leading markets detailed below.

The truck loader crane market inn China is projected to grow at a CAGR of 7.4% from 2025 to 2035, driven by rapid infrastructure expansion, urban construction projects, and logistics sector modernization. Manufacturers are focusing on high-capacity, mobile, and telescopic cranes to meet industrial and commercial demand. The adoption of hydraulic and electric crane systems is increasing due to their operational efficiency and safety features. E-commerce and warehouse development further enhance demand for compact, versatile cranes capable of quick deployment. Domestic players are investing in R&D for automation, remote control, and load-sensing technologies, while partnerships with global suppliers provide access to advanced components.

The truck loader crane market in India is expected to grow at a CAGR of 6.9% from 2025 to 2035, supported by urban development, highway construction, and industrial infrastructure projects. Cranes with advanced hydraulic systems, telescopic booms, and modular attachments are preferred for flexibility and performance. Rising demand in ports, logistics hubs, and construction sites is accelerating adoption. Domestic manufacturers are expanding production capacities and collaborating with international technology partners for improved safety, efficiency, and durability. E-commerce and cold-chain logistics sectors are driving demand for cranes capable of fast, precise handling. Leasing and rental models are gaining traction among small and medium enterprises seeking cost-effective solutions.

The truck loader crane market in France is projected to grow at a CAGR of 5.8% from 2025 to 2035, driven by urban construction, industrial modernization, and transport infrastructure projects. Manufacturers focus on versatile cranes with advanced safety features, load sensors, and energy-efficient hydraulic systems. Leasing solutions are popular among small construction and logistics firms for cost-effective operations. Smart construction projects, including high-rise buildings and automated warehouses, increase demand for compact and precise cranes. Partnerships between domestic and European equipment suppliers enhance product offerings and after-sales service. Renovation of aging industrial and commercial infrastructure further contributes to market growth. Environmental regulations also promote adoption of low-emission, quieter cranes suitable for urban areas.

The UK truck loader crane market is expected to grow at a CAGR of 5.2% from 2025 to 2035, driven by commercial and residential infrastructure projects, logistics expansion, and port modernization. Cranes with telescopic booms, high lifting capacity, and hydraulic stability are increasingly adopted. Leasing and rental models remain popular among small and medium-sized enterprises, providing flexible access to modern equipment. Industrial, construction, and municipal applications benefit from precision, efficiency, and safety upgrades in crane technology. Domestic manufacturers collaborate with European and global suppliers to integrate digital monitoring, load-sensing, and remote operation systems. Infrastructure projects such as highway upgrades, rail expansion, and urban redevelopment support continuous market growth, while retrofitting older cranes ensures compliance with safety and operational standards.

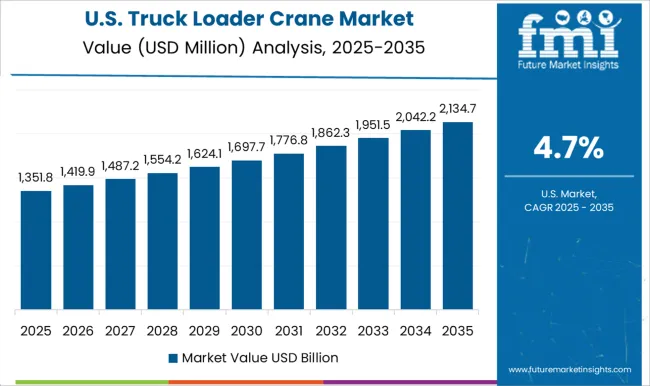

The USA truck loader crane market is projected to grow at a CAGR of 4.7% from 2025 to 2035, driven by industrial construction, urban redevelopment, and transportation infrastructure projects. Cranes with telescopic, hydraulic, and modular designs are widely deployed for their versatility, lifting capacity, and safety features. Ports, logistics hubs, and warehouse facilities are key end users requiring precision handling and fast operational deployment. Domestic manufacturers emphasize product reliability, long service life, and compliance with OSHA and ANSI safety standards. Leasing and rental solutions are growing in popularity among small and medium contractors. Continuous investment in R&D, coupled with the adoption of digital load monitoring and advanced control systems, ensures steady growth.

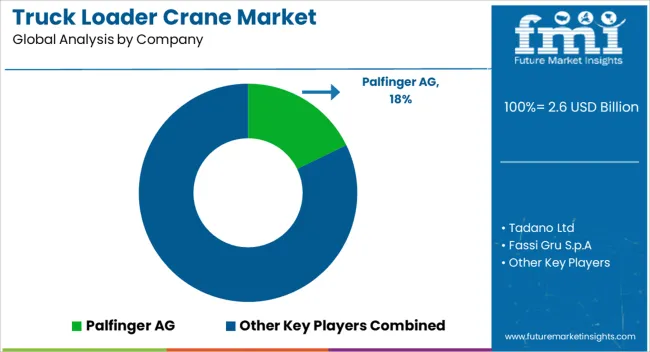

Competition in the truck loader crane market is shaped by lifting capacity, deployment speed, and operational reliability. Palfinger AG leads with high-performance articulated cranes, integrated control systems, and a global service network supporting commercial and industrial operators. Tadano Ltd competes with compact, mobile cranes engineered for maneuverability, telescopic reach, and hydraulic efficiency, while Fassi Gru S.p.A. differentiates through modular crane designs, remote-control operation, and high-precision load handling suited for construction and logistics tasks. Hiab AB emphasizes reliability, automation, and retrofit solutions for fleet operators seeking seamless integration with existing vehicles.

Specialized and regional players, including Texer Corporation, Manitex International, Inc., Amco Veba, Sany Group Co. Ltd, Hyva Crane, PM OIL & STEEL S.P.A., EFFER S.R.L., and F.lli Ferrari, compete with cost-efficient solutions, heavy-duty lifting modules, and application-specific customizations. Strategies focus on modular platforms, hydraulic efficiency, and adherence to ISO and CE safety standards. Predictive maintenance, remote diagnostics, and aftermarket support are marketed to minimize downtime for contractors and fleet operators.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.6 Billion |

| Product | Medium-duty (7 to 20 Metric Tons), Small-duty (Up to 6 Metric Tons), Big-duty (21 to 80 Metric Tons), and Heavy-duty (Above 80 Metric Tons) |

| Type | Knuckle Boom and Stiff Boom |

| Sales | New Sales and Aftermarket |

| End-use | Construction, Rental, Mining, Oil & Gas, Energy, Forestry, and Logistics |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Palfinger AG, Tadano Ltd, Fassi Gru S.p.A, Texer Corporation, Hiab AB, Manitex International,Inc, Amco Veba, Sany Group Co. Ltd, Hyva Crane, PM OIL & STEEL S.P.A., EFFER S.R.L., and F.lli Ferrari |

| Additional Attributes | Dollar sales by crane type (knuckle boom, telescopic, loader cranes), lifting capacity (light, medium, heavy-duty), and application (construction, logistics, industrial, municipal services). Demand dynamics are driven by infrastructure development, logistics sector growth, and the need for versatile, mobile lifting solutions. Regional trends indicate strong growth in North America, Europe, and Asia-Pacific, supported by expanding construction activities, rising demand for on-site material handling, and government investment in public works and industrial projects. |

The global truck loader crane market is estimated to be valued at USD 2.6 billion in 2025.

The market size for the truck loader crane market is projected to reach USD 4.5 billion by 2035.

The truck loader crane market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in truck loader crane market are medium-duty (7 to 20 metric tons), small-duty (up to 6 metric tons), big-duty (21 to 80 metric tons) and heavy-duty (above 80 metric tons).

In terms of type, knuckle boom segment to command 54.2% share in the truck loader crane market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Trucks Market Size and Share Forecast Outlook 2025 to 2035

Truck Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Truck Racks Market Size and Share Forecast Outlook 2025 to 2035

Truck Bedliners Market Outlook- Trends & Forecast 2025 to 2035

Truck Platooning Market

Truck Mounted Concrete Mixer Market

Truck Mounted Cranes Market Size and Share Forecast Outlook 2025 to 2035

Truck Mounted Knuckle Boom Cranes Market – Growth & Demand 2025 to 2035

Semi-Truck Market Size and Share Forecast Outlook 2025 to 2035

Hand Trucks And Dollies Market Size and Share Forecast Outlook 2025 to 2035

Food Truck Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dump Trucks Market Size and Share Forecast Outlook 2025 to 2035

Fire Truck Market Growth - Trends & Forecast 2025 to 2035

Heavy-Truck Composite Component Market Size and Share Forecast Outlook 2025 to 2035

Crane Trucks Market Size and Share Forecast Outlook 2025 to 2035

Mining Trucks Market Size and Share Forecast Outlook 2025 to 2035

Tanker Truck Market Size and Share Forecast Outlook 2025 to 2035

Bucket Trucks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vacuum Truck Market Size and Share Forecast Outlook 2025 to 2035

Pallet Truck Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA