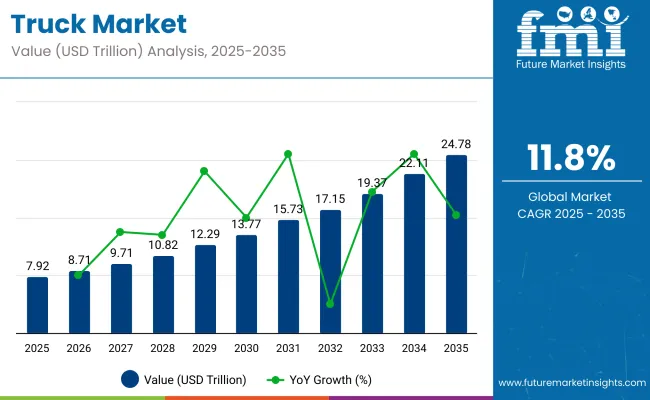

In 2025, the global truck market was valued at USD 7.92 trillion and is likely to reach USD 24.78 trillion by 2035, registering a CAGR of 11.8%. The peak-to-trough assessment indicates a steady upward cycle supported by freight expansion, infrastructure development, and advanced fleet technologies. Between 2025 and 2028, peak intervals are influenced by fleet modernization in OECD economies and increased cargo movement across industrial corridors. Trough phases in this period remain limited as consistent freight requirements sustain baseline activity.

From 2028 to 2031, peaks strengthen with higher cross-border trade in ASEAN countries and wider use of telematics for fleet efficiency. Trough intervals shorten as the transition to low-emission vehicles becomes commercially viable, supported by charging and refueling networks. Between 2031 and 2035, peak cycles are reinforced by integration of electric and hydrogen-powered trucks into long-haul logistics and automation in freight handling.

Trough points are further reduced as trade volumes and infrastructure projects broaden global trucking demand. This peak-to-trough pattern shows reduced volatility over the decade, offering stable ground for long-term operational planning. The data suggests that structural demand drivers and technological integration will define the market’s expansion cycle through 2035.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 7.92 trillion |

| Industry Value (2035F) | USD 24.78 trillion |

| CAGR (2025 to 2035) | 11.8% |

Trucks have formed 35% of global automotive output, serving as the backbone for goods movement and industrial activity. Around 60% of medium and heavy-duty vehicle registrations have been attributed to trucks supporting logistics, mining, and infrastructure development.

Nearly 50% of commercial vehicle investment in OECD and ASEAN countries has been allocated to truck fleets for regional and cross-border transport. Within total automotive fuel demand, trucks have accounted for about 45% due to extended travel distances and payload capacity. Telematics and fleet tracking systems have been integrated into 55% of trucks, enabling route optimization and operational efficiency.

Electric trucks have reached nearly 12% of current manufacturing volumes, primarily focused on short-haul and urban delivery networks. Hybrid truck platforms have been introduced in around 18% of new models, aimed at lowering operational fuel costs.

Autonomous driving trials have covered 8% of active fleets, targeting improved road safety and driver assistance. Manufacturers have adopted modular chassis formats in about 25% of truck lines to cater to diverse application requirements. Predictive maintenance and real-time monitoring have been implemented in 30% of operational fleets, reducing downtime and supporting extended service intervals.

High demand for freight capacity has been recorded in China, India, and the United States, supported by e-commerce growth, mining activity, and infrastructure projects. Light and medium-duty trucks have been deployed in last-mile logistics, while heavy-duty vehicles have dominated long-haul freight routes. Fuel diversification into LNG, electric, and hybrid formats has been incorporated into new platforms to meet evolving regulations. Production capacity has been expanded in manufacturing clusters across Mexico, Thailand, and Poland to serve regional and export needs.

Freight volumes in Asia Pacific rose by more than 6% in 2024, driving procurement of medium and heavy trucks for industrial and agricultural transport. North America maintained strong demand for Class 8 trucks, supported by highway freight movement exceeding 13 billion tons annually. Government investment in road networks and port upgrades has influenced vehicle orders in ASEAN and African markets. In Europe, light commercial trucks have been favored in urban logistics where emission restrictions apply.

Fleet operators have replaced older diesel units with lower-emission models to comply with regulatory timelines. Seasonal demand peaks have been recorded in construction, retail distribution, and agricultural export cycles. Digital freight platforms have been used to match capacity with shippers, improving asset productivity. Regional component sourcing has been increased to reduce delivery lead times and currency exposure.

Fluctuating steel and aluminum prices have raised chassis and body manufacturing costs by over 12% in the past year. Diesel price volatility has affected operating margins for long-haul fleets, especially in markets without fuel subsidies. Semiconductor shortages have slowed production of telematics-equipped trucks, creating order backlogs in North America and Europe. A shortage of trained drivers has been reported in multiple OECD markets, reducing available freight capacity.

Emission compliance upgrades have added costs to vehicle acquisition, particularly in Euro VI and equivalent standard markets. Shipping container rate volatility has disrupted delivery schedules for CKD and SKD truck kits. Smaller fleet operators have deferred vehicle replacement cycles due to high borrowing costs. Inventory levels at dealerships have remained below pre-2020 norms, affecting spot purchase availability in both domestic and export channels.

Electric truck sales in China surpassed 100,000 units in 2024, supported by urban freight mandates and battery-swapping infrastructure. India has initiated state-backed procurement of electric medium-duty trucks for municipal logistics, targeting over 1,000 units by 2026. Fleet replacement opportunities have emerged as the average age of commercial trucks in several markets now exceeds nine years. OEMs have expanded production of LNG and hybrid trucks to serve intercity and regional freight segments.

Telematics integration has been positioned as a value driver for predictive maintenance and fuel optimization. Entry of new manufacturing facilities in Indonesia and Brazil has been used to serve domestic markets and reduce reliance on imports. Modular truck platforms have been adopted to enable flexible body configurations, catering to diverse freight categories including temperature-controlled, bulk, and containerized cargo.

Autonomous truck pilots have been conducted on high-volume freight corridors in the United States and China, operating under controlled regulatory frameworks. Fleet operators have adopted truck-as-a-service models to access vehicles without long-term capital commitment. Digital freight brokerage platforms have increased their market share by matching real-time supply with demand, reducing empty backhauls. Predictive analytics has been applied to optimize routing and improve load planning.

In Europe, zero-emission zones have accelerated adoption of electric light trucks in last-mile delivery. Platooning trials have been conducted to lower fuel consumption and improve safety on expressways. Over-the-air software updates have been deployed to manage performance and compliance remotely. Partnerships between OEMs and battery manufacturers have been expanded to secure cell supply and support long-term electrification strategies for both regional and long-haul segments.

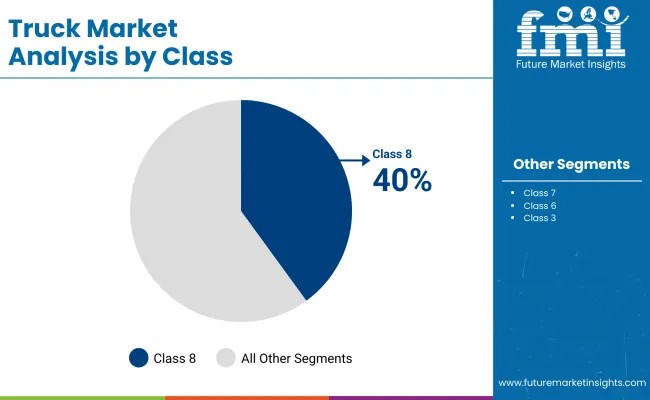

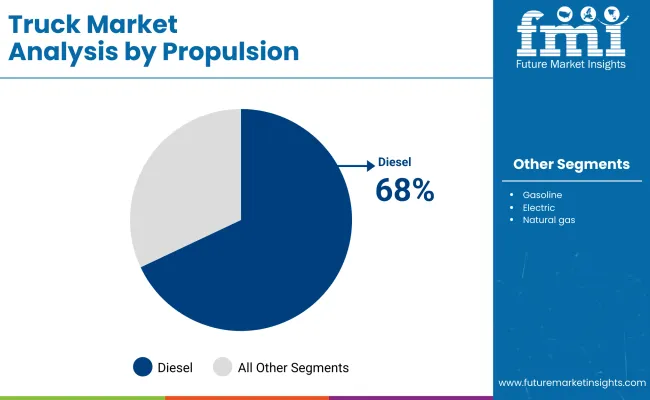

The global truck market in 2025 is driven by high-performing segments including Class 8 trucks, diesel propulsion, and heavy-duty configurations. Logistics and transportation remains the primary application, supported by cross-border trade and expanding distribution networks. The dominance of these segments is reinforced by infrastructure development, fleet replacement cycles, and the operational need for high payload capacity.

While electric and alternative propulsion types are gaining gradual traction, traditional diesel-powered models still dominate due to fueling convenience, established servicing networks, and competitive total cost of ownership in both developed and emerging markets.

Class 8 trucks will hold a commanding 40% share of the truck market by class in 2025, primarily due to their payload capacity and suitability for long-haul freight. Manufacturers such as Daimler Truck, Volvo Trucks, and PACCAR’s Kenworth are strengthening Class 8 portfolios with advanced safety systems, fuel-efficient engines, and connected telematics.

These trucks are essential for heavy cargo transport across North America, Europe, and Asia, particularly in industries such as logistics, mining, and construction. The expansion of e-commerce distribution centers and international freight routes further boosts demand, as fleet operators prioritize capacity and operational efficiency in procurement decisions.

Diesel propulsion will maintain a strong 68% share in 2025, driven by its superior torque, long-range capability, and fueling network accessibility. OEMs including Scania, MAN, and Tata Motors continue to improve diesel truck efficiency through turbocharging, advanced fuel injection, and emission control technologies. In heavy-duty and long-haul operations, diesel remains the preferred choice due to payload requirements and refueling speed compared to electric alternatives.

Many emerging economies lack EV charging infrastructure for heavy vehicles, which reinforces diesel’s position. Even in regions pursuing stricter emission targets, retrofitted diesel trucks remain in active service due to cost considerations and operator familiarity.

Heavy-duty trucks are forecasted to command a 44% share of the truck market in 2025, driven by their role in construction, mining, and bulk logistics. Key manufacturers such as Hino Motors, Mack Trucks, and Isuzu are focusing on durability, axle load capacity, and telematics integration to meet fleet efficiency goals.

These trucks are preferred in regions with long freight corridors, high cargo weight limits, and demanding terrain. The growing scale of infrastructure projects in Asia-Pacific, Middle East, and Africa has also stimulated procurement. Heavy-duty models typically offer better lifecycle value for fleet operators, balancing fuel cost with revenue per ton transported.

Logistics and transportation will remain the leading truck market application in 2025 with a 42% share, supported by growth in e-commerce, FMCG distribution, and cross-border freight movement. OEMs including Freightliner, Ashok Leyland, and UD Trucks are offering application-specific models with enhanced cargo handling features and connected fleet management solutions.

The segment benefits from trade route expansions, port capacity upgrades, and supply chain digitalization. Regional and long-haul logistics operators are increasingly using real-time tracking and route optimization software to reduce operating costs. Demand is especially strong in North America, China, and Southeast Asia where freight volumes are rising consistently.

Electric trucks will account for 7% of the truck market by propulsion in 2025, driven by zero-emission mandates, urban delivery requirements, and OEM investment. Companies like BYD, Volvo, and Tesla are focusing on medium-duty electric trucks for city logistics where charging access is easier. While adoption remains modest compared to diesel, operational cost savings from lower fuel and maintenance expenses are influencing fleet trials.

Municipal procurement of electric refuse and service trucks has also contributed to growth. Long-range electric models are still in limited rollout due to battery cost and weight constraints, but technology improvements are steadily narrowing the gap.

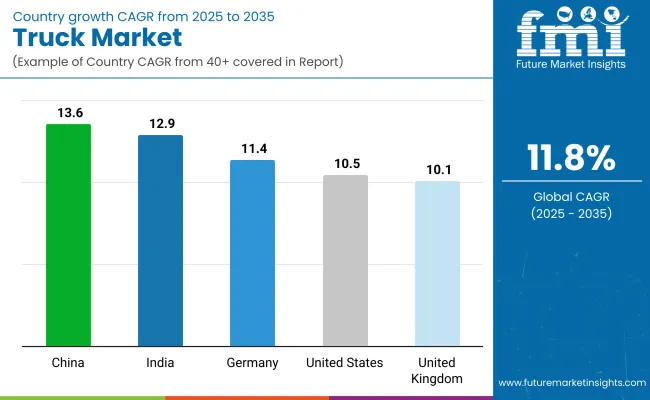

The global truck market is projected to grow at a CAGR of 11.8% between 2025 and 2035. China is estimated to lead growth with a CAGR of 13.6%, followed by India at 12.9% and Germany at 11.4%. The United States is projected at 10.5%, while the United Kingdom will see an estimated 10.1%. China’s growth outpaces the global average by +15%, with India maintaining a +9% premium.

Germany aligns closely with the baseline, while the United States and United Kingdom record -11% and -14% differences. Growth patterns are being shaped by infrastructure expansion in emerging markets, technological integration in freight operations, and strategic fleet modernization in established economies, creating differentiated opportunities across OECD and ASEAN trade corridors.

China is forecast at a 13.6% CAGR, underpinned by the rapid integration of autonomous freight trials in industrial corridors and increased investment in cross province logistics hubs. OEMs including FAW, Dongfeng, and Sinotruk are expanding assembly lines for high capacity heavy duty units tailored for mineral transport and industrial goods. Battery swapping infrastructure is being piloted in logistics clusters to reduce charging downtime for electric trucks. Long haul hydrogen powered vehicles are entering limited commercial use, supported by national energy policies.

Digital freight matching platforms are consolidating fragmented carrier networks. Export oriented manufacturers are targeting Belt and Road partner nations with competitively priced models. Strategic partnerships between component suppliers and truck assemblers are strengthening domestic supply chains to reduce dependency on imports.

The truck market in India is projected at a 12.9% CAGR, shaped by rural freight penetration and state-led agricultural produce transport programs. OEMs like Tata Motors, Ashok Leyland, and Eicher are optimising load body designs to improve payload efficiency on varied road conditions. The push for LNG powered long distance trucks is being backed by corridor specific refuelling infrastructure. Seasonal demand fluctuations from agriculture are prompting fleet operators to invest in flexible fleet composition.

Government-backed vehicle scrappage policies are accelerating fleet modernisation, benefiting mid-tier carriers. Cooperative logistics models are being piloted to pool capacity for small and medium transporters. Enhanced driver training programs are being implemented to address safety compliance and fuel efficiency in multi-shift operations. Financing models tailored for owner-operators are expanding in rural markets.

The truck market in Germany, with an 11.4% CAGR forecast, is being shaped by cross-border freight harmonization and just-in-time manufacturing supply needs. OEMs including Daimler Truck, MAN, and Scania are advancing modular chassis adaptable to both right and left-hand configurations for export markets. High-speed rail freight integration is influencing demand for medium range delivery trucks as feeder vehicles.

Urban low-noise delivery regulations are accelerating uptake of electric light and medium trucks in city cores. Fleet management systems are leveraging AI-based route prediction to coordinate deliveries across national borders. Hydrogen refueling corridors spanning industrial clusters are being deployed to support heavy duty applications. Logistics companies are investing in driverless yard tractors to improve terminal efficiency and turnaround times in freight depots.

The United States truck market, projected at a 10.5% CAGR, is being driven by intermodal freight growth and high-volume regional distribution contracts. OEMs such as Freightliner, PACCAR, and Volvo are investing in natural gas and hybrid heavy trucks for interstate operations. The expansion of dedicated freight corridors between major port cities and inland hubs is influencing fleet specification demand.

Large retail chains are adopting hub-and-spoke delivery models, creating demand for short-haul Class 6 and 7 trucks. Fleet telematics integration is enabling dynamic load allocation based on real-time capacity data. Tax incentives for alternative fuel adoption are accelerating purchases among regional carriers. Autonomous safety technologies including collision mitigation and adaptive cruise control are becoming standard in premium fleet orders.

The truck market in UK is forecast at a 10.1% CAGR, supported by regional distribution restructuring due to evolving import-export trade flows. OEMs such as Leyland Trucks, Volvo, and DAF are adjusting product lines to meet weight restrictions in bridge-limited rural networks. Fleet electrification pilots are being concentrated in postal and municipal services. Cold-chain transport demand is rising due to growth in temperature-controlled pharmaceuticals and fresh produce imports.

Road toll policy adjustments are impacting route planning for long-haul carriers. Retrofitting of existing diesel trucks with hybrid drivetrains is being trialled by private logistics firms to extend asset life. Micro-hub distribution centres are being established to serve low-emission city zones, requiring customized vehicle dimensions and turning radii for narrow streets.

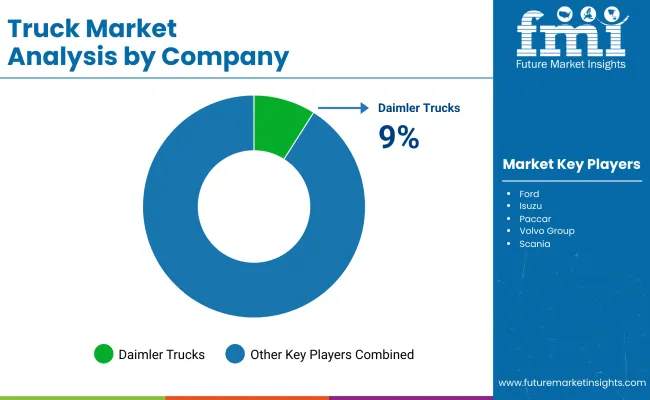

The market is led by manufacturers such as Daimler Trucks, Volvo Group, and Paccar, each maintaining strong regional dominance through targeted product launches and platform optimization. Daimler Trucks has upgraded its Freightliner and Mercedes-Benz heavy-duty series for North American and European freight operations. Volvo Group has expanded modular platforms to serve multiple weight categories, improving manufacturing efficiency. Paccar has reinforced its Kenworth and DAF brands in Latin America through localized assembly.

Dongfeng Motor has expanded its medium-duty range in ASEAN to address rising logistics needs. Ford has refreshed its commercial truck lineup in North America with fleet-oriented upgrades. Isuzu continues to lead in light and medium-duty trucks in Japan and Australia through reliable chassis designs. Tata Motors has developed high-load capacity trucks for construction and mining in India and Africa, while Ashok Leyland has expanded exports with market-specific configurations in Africa and the Middle East.

Premium segment players like Scania remain competitive by offering service-based fleet contracts, securing long-term customer retention. Toyota’s role in the truck market is regional, with commercial vehicle partnerships in select Asian markets. Across the industry, R&D is concentrated on drivetrain efficiency, chassis adaptability, and platform scalability, enabling manufacturers to respond effectively to varying freight and construction sector demands.

Recent Industry Quote In June 2025, Girish Wagh, the executive director at Tata Motors, announced that the all-new Tata Ace Pro was developed to build on the legacy of the Tata Ace with a renewed focus on meeting the aspirations of the next generation of entrepreneurs. The model has been engineered to enhance stability, safety, and profitability, aiming to increase earning potential for users and support the ambitions of individuals seeking to establish and expand their businesses.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 7.92 trillion |

| Projected Market Size (2035) | USD 24.78 trillion |

| CAGR (2025 to 2035) | 11.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD trillion for value and volume units as applicable |

| Class Segments (Segment 1) | Class 3, Class 4, Class 5, Class 6, Class 7, Class 8 |

| Propulsion Types (Segment 2) | Gasoline, Diesel, Electric, Natural Gas, FCEV |

| Truck Categories (Segment 3) | Light Duty, Medium Duty, Heavy Duty |

| Application Segments (Segment 4) | Logistics & Transportation, Construction & Infrastructure, Mining, Retail & E-Commerce, Others |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; Asia Pacific; Middle East and Africa |

| Countries Covered | United States, Canada, Brazil, Mexico, Germany, United Kingdom, France, Italy, China, Japan, India, UAE, South Africa |

| Key Players Influencing the Market | Ashok Leyland, Daimler Trucks, Dongfeng Motor, Ford, Isuzu, Paccar, Volvo Group, Scania, Tata Motors, Toyota |

| Additional Attributes | Heavy-duty trucks dominate revenue share globally, with strong demand in freight-intensive economies; electric and FCEV adoption is increasing due to fuel cost and emissions policies |

The market is expected to reach USD 24.78 trillion by 2035.

It is forecast to grow at a CAGR of 11.8% during the period.

Class 8 trucks hold a 40% share in 2025.

Diesel propulsion accounts for 68% of the market in 2025.

Daimler Trucks leads with a 9% market share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Truck with Mast Market Size and Share Forecast Outlook 2025 to 2035

Truck Mounted Cranes Market Size and Share Forecast Outlook 2025 to 2035

Trucks Market Size and Share Forecast Outlook 2025 to 2035

Truck Loader Crane Market Size and Share Forecast Outlook 2025 to 2035

Truck Racks Market Size and Share Forecast Outlook 2025 to 2035

Truck Bedliners Market Outlook- Trends & Forecast 2025 to 2035

Truck Mounted Knuckle Boom Cranes Market – Growth & Demand 2025 to 2035

Truck Platooning Market

Truck Mounted Concrete Mixer Market

Semi-Truck Market Size and Share Forecast Outlook 2025 to 2035

Hand Trucks And Dollies Market Size and Share Forecast Outlook 2025 to 2035

Food Truck Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dump Trucks Market Size and Share Forecast Outlook 2025 to 2035

Fire Truck Market Growth - Trends & Forecast 2025 to 2035

Heavy-Truck Composite Component Market Size and Share Forecast Outlook 2025 to 2035

Crane Trucks Market Size and Share Forecast Outlook 2025 to 2035

Mining Trucks Market Size and Share Forecast Outlook 2025 to 2035

Tanker Truck Market Size and Share Forecast Outlook 2025 to 2035

Bucket Trucks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vacuum Truck Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA