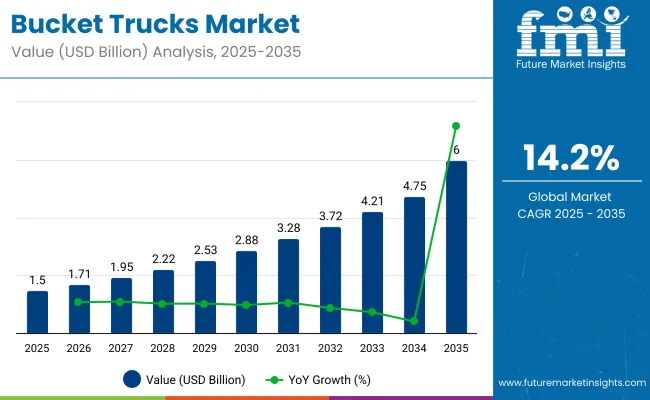

The bucket trucks market is forecast to reach USD 1.5 billion by 2025, with a CAGR of 14.2%. This growth results in a substantial absolute dollar opportunity as the market expands from approximately USD 0.7 billion in 2020. By 2035, the market value is expected to surpass USD 6 billion, supported by rising demand across utilities, telecommunications, and construction sectors.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.5 billion |

| Industry Value (2035F) | USD 6 billion |

| CAGR (2025 to 2035) | 14.2% |

The replacement of older equipment and ongoing infrastructure development drive consistent market expansion. Investments in power grid upgrades, fiber-optic network installations, and industrial maintenance increase the need for bucket trucks worldwide. North America and Europe account for significant shares due to strict safety regulations and infrastructure enhancements.

Asia Pacific is set for notable growth as urban areas and industrial activity increase. Advancements such as electric and hybrid bucket trucks improve efficiency and reduce emissions, making these vehicles more attractive to fleet operators. The absolute dollar opportunity reflects the revenue growth potential over the coming decade, offering promising prospects for manufacturers and service providers. The market’s steady rise corresponds with the critical role bucket trucks play in supporting infrastructure maintenance and development globally.

The bucket truck market holds distinct shares across its parent markets, reflecting its specialized role. Within the heavy duty trucks market, bucket trucks represent approximately 5-7%. In the broader commercial vehicles market, the share is around 3-5%. Their presence is more significant in the aerial work platforms market, accounting for about 20-25%.

Within the utility vehicles market, bucket trucks comprise roughly 10-12%, while in the construction equipment market, they hold a 4-6% share. These percentages highlight the market’s focused application in sectors requiring elevated access and maintenance.

The industry is experiencing significant advancements, with key players focusing on enhancing safety features, fuel efficiency, and operational capabilities. Manufacturers are integrating advanced telematics systems for real-time monitoring and diagnostics, improving fleet management. There is a growing trend towards the adoption of electric and hybrid powertrains to meet environmental regulations and reduce operating costs.

Additionally, innovations in boom design and insulation materials are enhancing the versatility and safety of bucket trucks, particularly in utility and telecommunications applications. These developments are shaping the future of the bucket truck market, aligning with broader industry trends towards sustainability and technological integration.

Utilities spend approximately 10 to 15% of their budgets on aerial maintenance activities. Advanced insulated booms with load capacities up to 500 kilograms improve job safety and efficiency. Acquisition costs typically range from USD 150,000 to USD 200,000 per vehicle, with maintenance expenses limiting wider fleet adoption. Electric bucket trucks reduce fuel consumption by up to 40%. Telematics technology is implemented in nearly 30% of new trucks, enhancing operational control.

Utilities worldwide plan to invest over USD 100 billion in grid modernization and upkeep through 2028, driving bucket truck requirements. Telecom 5G coverage targets over 60% of the population by 2025, necessitating elevated equipment access for installation and repair. Bucket trucks enable safe work at heights from 10 to 40 meters on power poles, streetlights, and telecom towers. Improved electrical insulation reduces exposure to hazards by nearly 80%, enhancing workplace safety and compliance.

Bucket trucks cost between USD 120,000 and USD 250,000 depending on features, creating barriers for smaller operators. Annual maintenance consumes 10 to 15% of total ownership costs, including hydraulic system upkeep and part replacements. Mandatory operator training imposes additional expenses estimated at USD 1,000 to USD 3,000 annually per driver. Diesel fuel price volatility, sometimes shifting by 20% yearly, affects operational budgets. Equipment downtime averages 5 to 7% of operational hours, impacting fleet productivity.

Electric bucket trucks cut fuel consumption by as much as 40% and lower maintenance needs by roughly 25%, thanks to fewer mechanical components. Hybrid trucks extend operational hours and reduce emissions by approximately 30% compared to diesel models. Government incentives provide tax credits up to 30% of purchase price, boosting adoption rates. Battery technology improvements enable over 8 hours of continuous operation per charge. Adoption by municipal and utility fleets is growing, with electric models expected to reach 15% of new sales by 2030.

Approximately 30% of bucket trucks in developed markets utilize telematics for live location tracking, equipment monitoring, and maintenance forecasting, decreasing fuel usage by 12% and downtime by 15%. Modular designs allow operators to adjust aerial lift heights from 10 to 40 meters and support load capacities up to 1,000 kilograms.

Cloud-based management platforms enable remote diagnostics and efficient fleet coordination. Use of lightweight materials such as aluminum alloys lowers vehicle weight by 15%, improving fuel economy. Hybrid powertrain adoption increases at about 8% annually, reflecting demand for greener solutions.

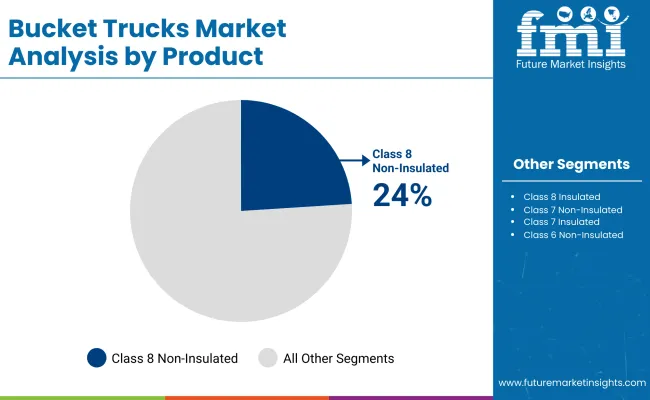

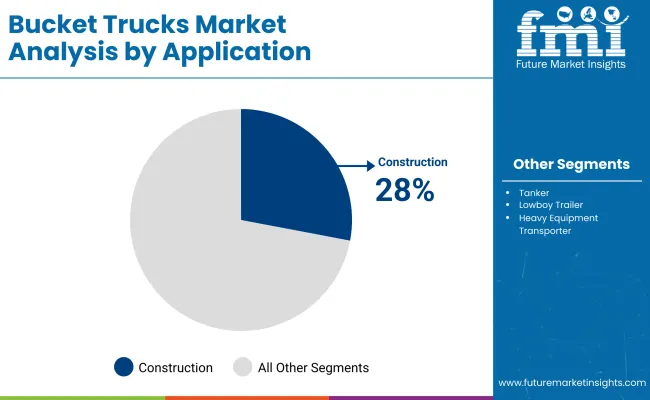

The bucket trucks market in 2025 is primarily led by class 8 non-insulated trucks, which capture 24% market share by product. Non-insulated trucks dominate the type category at 55%, reflecting their widespread use across applications. Construction is the largest application segment with 28%, driven by infrastructure projects and equipment installation. The utility sector follows with 22% share, relying on bucket trucks for maintenance and repair activities. Insulated variants account for 45% of the type segment, addressing safety needs in electrical and telecommunication work.

Class 8 non-insulated trucks hold 24% share of the product category, positioning them as the largest sub segment by value. These trucks are widely used in heavy-duty applications requiring extended reach and load capacity, including large-scale construction and utility maintenance. Manufacturers like Altec, Versalift, and Terex focus on optimizing chassis strength and boom reach for demanding environments.

The non-insulated design suits applications where electrical isolation is not required, providing cost-effective solutions with robust performance. Class 8 trucks’ high GVWR enables them to carry heavier equipment and withstand rugged terrain, which is critical for heavy infrastructure projects and emergency repair operations.

Non-insulated trucks account for 55% of the bucket trucks market by type, reflecting their extensive use across construction, forestry, and water management applications. These trucks offer versatility in non-electrical environments where safety insulation is not required, reducing manufacturing costs and maintenance complexity.

Companies such as Altec and Terex emphasize modular designs and ease of serviceability to enhance uptime for operators. Non-insulated variants are preferred for their ruggedness and adaptability, serving as workhorses for industries that require frequent, reliable aerial access without electrical hazard concerns. The segment’s dominance aligns with increasing infrastructure projects and utility maintenance needs globally.

Construction is the leading application segment with 28% share, driven by demand for aerial access in building, maintenance, and infrastructure development projects. Bucket trucks facilitate installation of electrical lines, signage, and lighting, enabling safe, elevated work. Companies like Terex, Altec, and Versalift supply models tailored for construction environments, focusing on boom reach, maneuverability, and operator safety.

The sector’s growth is linked to expanding urban development, highway projects, and commercial construction activity. Demand is particularly strong for non-insulated trucks in construction, where electrical hazard is limited, but precise reach and durability are critical.

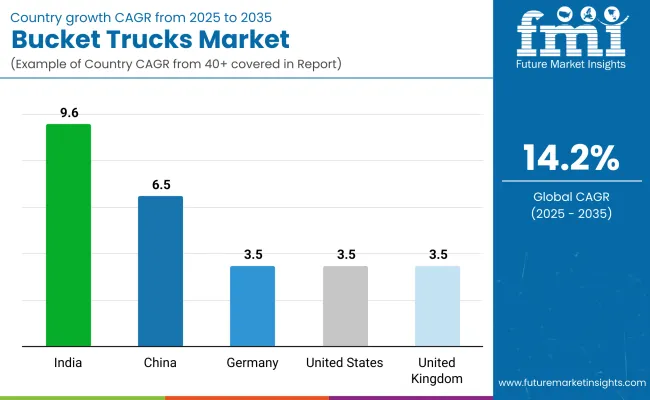

The market is projected to grow at a CAGR of 14.2% from 2025 to 2035. India leads with a CAGR of 9.6%, followed by China at 6.5%. Germany, the United States, and the United Kingdom each record growth of 3.5%. India’s growth is -32% below the global average, while China trails by -54%.

Germany, the United States, and the United Kingdom show a similar difference of -75%. Market expansion is shaped by rapid infrastructure development and utility sector investments in BRICS countries, while OECD nations focus on fleet modernization and technological upgrades. ASEAN economies, although not listed here, are expected to contribute through increasing demand for maintenance and service vehicles. The contrast between emerging and mature markets highlights varied drivers influencing the bucket trucks segment globally.

The demand of bucket trucks in India is projected to grow at a CAGR of 9.6%, propelled by infrastructure development and expanding utility networks. Operators prefer versatile models with robust hydraulic lifts suitable for varied terrain and climatic conditions. Domestic manufacturers focus on cost effective solutions with extended service intervals to reduce downtime. Financing linked to project schedules has enabled smaller operators to acquire new equipment. Safety training programs are increasingly adopted to meet regulatory requirements and reduce on-site incidents.

The bucket trucks market in China is expected to expand at a CAGR of 6.5%, driven by rapid industrial growth and urban infrastructure upgrades. Large OEMs provide a range of electric and diesel-powered bucket trucks tailored for heavy duty applications. Dealer networks have improved spare parts availability, reducing repair lead times. Integration of smart control systems enhances operational precision and safety during maintenance work. Municipal fleet renewals and renewable energy projects contribute to sustained demand for bucket trucks with advanced features.

The bucket trucks industry in Germany is forecast to grow at a CAGR of 3.5%, supported by stringent safety standards and emphasis on energy efficient vehicles. Operators select models with advanced stabilization systems and low emission engines to comply with regulatory norms.

Modular aerial platforms improve adaptability for diverse applications including maintenance of renewable energy installations. Digital fleet management tools enhance scheduling efficiency and reduce idle times, improving overall productivity in heavy maintenance operations.

The United States bucket trucks market is anticipated to grow at a CAGR of 3.5%, driven by infrastructure upgrades and utility grid modernization projects. Demand focuses on models with higher reach and load capacities to support telecom and power distribution maintenance. Lease and rental options are widely used to optimize capital deployment. Increasing use of telematics supports real-time monitoring and predictive maintenance, helping reduce downtime and repair costs in fleet operations.

The United Kingdom bucket trucks market is forecast to grow at a CAGR of 3.5%, supported by rising demand for aerial work platforms in urban infrastructure and telecom sectors. Operators prefer compact, maneuverable models capable of navigating narrow streets and congested sites. Investment in electric bucket trucks is increasing due to emission regulations. Close collaboration between fleet operators and local authority’s streamlines permitting for oversize vehicles, reducing project delays.

Leading bucket truck manufacturers employ a variety of strategies to strengthen their market positions and meet diverse industry demands. Aichi Corporation has expanded its product lineup with models offering greater reach and enhanced safety features. Altec Inc. focuses on research and development, recently launching lightweight, durable aerial devices tailored for utility and telecommunications sectors. Axion Lift emphasizes modular designs for customization, helping it grow in regional markets.

BrontoSkylift and CTE Group SPA broaden their ranges to address different height and terrain needs, with BrontoSkylift introducing trucks designed for challenging urban environments and CTE Group SPA expanding its international dealer network. Dur-A-Lift Inc. and Elliott Equipment Company invest in hydraulic system improvements aimed at boosting performance and reducing maintenance costs. Equipment Technology LLC gains traction with engineering focused on stability and maneuverability in specialized applications.

Manitex International Inc. pursues growth through acquisitions and diversified product offerings, serving construction and maintenance industries with versatile boom trucks. Palfinger AG and Tadano Ltd. have launched models featuring improved controls and safety technology to enhance operator efficiency. Terex Corporation integrates user feedback into product development, expanding its range with versatile, cost-effective bucket trucks.

Versalift focuses on customer retention through training and aftersales support while targeting global expansion. Emerging companies compete with competitive pricing and tailored designs for specific regions, using localized manufacturing and flexible product configurations to capture market share. These strategies collectively reflect the industry’s response to evolving operational challenges and customer needs.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 1.5 billion |

| Projected Market Size (2035) | Exceeding USD 6 billion |

| CAGR (2025 to 2035) | 14.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and relevant units for volume |

| Product Types Analyzed (Segment 1) | Class 4 (Insulated, Non-Insulated), Class 5 (Insulated, Non-Insulated), Class 6 (Insulated, Non-Insulated), Class 7 (Insulated, Non-Insulated), Class 8 (Insulated, Non-Insulated) |

| Type Analyzed (Segment 2) | Insulated, Non-Insulated |

| Applications Analyzed (Segment 3) | Construction, Utility, Electric, Water, Telecommunication, Forestry |

| Regions Covered | North America; Europe; Asia Pacific; Latin America; Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, Brazil, India, South Africa, UAE |

| Key Players Influencing the Market | Aichi Corporation, Altec Inc., Axion Lift, Bronto Skylift, CTE Group SPA, Dur -A-Lift Inc., Elliott Equipment Company, Equipment Technology LLC, Manitex International Inc., Palfinger AG, Tadano Ltd., Terex Corporation, Versalift |

| Additional Attributes | Dollar sales by truck type and lifting capacity, demand dynamics across utility services, construction, and telecommunications, regional trends in deployment across North America, Europe, and Asia-Pacific, innovation in safety systems, electric powertrains, and telematics, environmental impact of fuel use and emissions, and emerging use cases in renewable energy maintenance, smart city infrastructure, and disaster response operations |

The market is expected to exceed USD 6 billion by 2035.

The market is growing at a CAGR of 14.2% during this period.

Non-insulated trucks hold 55% of the market share in 2025.

Approximately 30% of new bucket trucks are equipped with telematics.

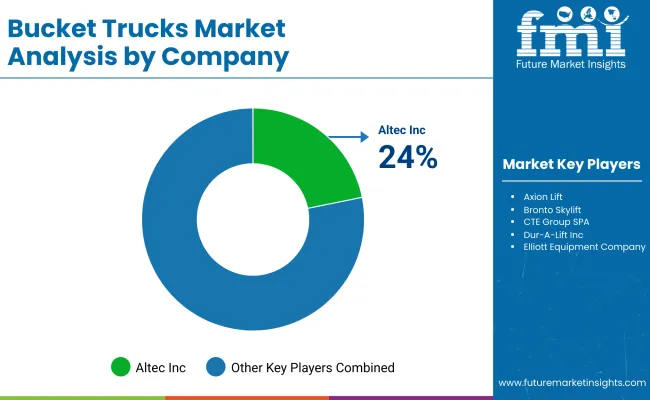

Altec Inc. holds the leading market share at 24%.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bucket 4 in 1 Market Size and Share Forecast Outlook 2025 to 2035

Bucket Market Forecast Outlook 2025 to 2035

Bucket Water Heater Market Analysis - Trends, Growth & Forecast 2025 to 2035

Food Bucket Elevators Market

Paint Buckets Market Size, Share & Forecast 2025 to 2035

Loader Bucket Market Size and Share Forecast Outlook 2025 to 2035

Loader Bucket Attachments Market Size and Share Forecast Outlook 2025 to 2035

Backhoe Bucket Market Size and Share Forecast Outlook 2025 to 2035

Chicken Buckets Market

Agricultural Bucket Market Size and Share Forecast Outlook 2025 to 2035

Ice Transport Buckets Market

Agricultural Multifunction Grab Bucket Market Size and Share Forecast Outlook 2025 to 2035

Trucks Market Size and Share Forecast Outlook 2025 to 2035

Hand Trucks And Dollies Market Size and Share Forecast Outlook 2025 to 2035

Dump Trucks Market Size and Share Forecast Outlook 2025 to 2035

Crane Trucks Market Size and Share Forecast Outlook 2025 to 2035

Mining Trucks Market Size and Share Forecast Outlook 2025 to 2035

Flatbed Trucks Market Size and Share Forecast Outlook 2025 to 2035

Class 5 Trucks Market Size and Share Forecast Outlook 2025 to 2035

Class 2 Trucks Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA