The Class 5 Trucks Market is estimated to be valued at USD 23.9 billion in 2025 and is projected to reach USD 41.6 billion by 2035, registering a compound annual growth rate (CAGR) of 5.7% over the forecast period. A year-on-year (YoY) growth analysis reveals consistent growth throughout the forecast period, driven by the increasing demand for trucks in logistics, construction, and transportation sectors. Between 2025 and 2030, the market grows from USD 23.9 billion to USD 33.3 billion, contributing USD 9.4 billion in growth, with a CAGR of 6.8%. This early-phase acceleration is fueled by the growing need for efficient freight transport solutions, particularly in last-mile delivery services, e-commerce, and urban mobility solutions.

Additionally, the market benefits from infrastructure development, demand for medium-duty trucks, and regulations promoting fuel efficiency and emissions reductions. From 2030 to 2035, the market continues its upward trend, expanding from USD 33.3 billion to USD 41.6 billion, contributing USD 8.3 billion in growth, with a slightly lower CAGR of 4.5%. This deceleration reflects a maturing market as demand stabilizes in more developed regions. However, the continued adoption of electric and hybrid trucks, along with emerging markets expanding their logistics infrastructure, sustains growth. The YoY analysis highlights strong early-phase growth driven by innovation and demand for advanced truck technologies, followed by stable growth as the market reaches maturity.

| Metric | Value |

|---|---|

| Class 5 Trucks Market Estimated Value in (2025 E) | USD 23.9 billion |

| Class 5 Trucks Market Forecast Value in (2035 F) | USD 41.6 billion |

| Forecast CAGR (2025 to 2035) | 5.7% |

The Class 5 trucks market is expanding steadily due to increased demand for mid duty vehicles that offer a balance between payload capacity and operational efficiency. These trucks are favored across various industries for their versatility in urban and regional applications, particularly where maneuverability and regulatory compliance are crucial.

Enhanced engine technologies, emissions standards, and the adoption of telematics are improving vehicle performance, fleet management, and fuel economy. Government investments in infrastructure development and last mile logistics are also contributing to the rising demand.

As the commercial transport landscape evolves to meet sustainability and efficiency goals, Class 5 trucks are positioned to play a critical role in bridging operational gaps between light and heavy duty vehicles.

The class 5 trucks market is segmented by product, fuel, applicationownership, and geographic regions. By product, the class 5 trucks market is divided into Bucket trucks, Large walk-in truck, and City delivery. In terms of fuel, the class 5 trucks market is classified into Diesel, Natural gas, Hybrid electric, and Others. Based on application, the class 5 trucks market is segmented into Freight delivery, Utility Services, Construction & mining, and Others.

By ownership, the class 5 trucks market is segmented into Fleet operators and Independent operators. Regionally, the class 5 trucks industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The bucket trucks segment is anticipated to contribute 48.60% of the total revenue by 2025 under the product category, making it the most prominent segment. This growth is driven by increasing demand for elevated work platforms across utility maintenance, telecom installation, and electrical grid servicing.

The capability of bucket trucks to support vertical reach and operational safety in overhead tasks has made them indispensable in public service and infrastructure sectors. Their structural reliability and adaptability across diverse terrains and climates have further encouraged widespread adoption.

As utility expansion and smart grid upgrades continue globally, the use of bucket trucks remains critical, ensuring their sustained dominance within the product segment.

Diesel-powered trucks are expected to represent 54.20% of the overall market by 2025 in the fuel category, emerging as the leading segment. This is due to the high torque output, fuel efficiency, and durability offered by diesel engines, particularly in demanding operational environments.

Diesel vehicles are widely used in freight, construction, and utility sectors where consistent power delivery and longer range capabilities are essential. Additionally, the existing infrastructure for diesel fueling and maintenance supports continued preference in fleet operations.

While alternative fuel adoption is growing, the reliability and cost-effectiveness of diesel technologies ensure their ongoing leadership in this segment.

The freight delivery application segment is projected to hold 46.30% of market revenue by 2025, making it the leading segment by application. The surge in e-commerce, regional logistics, and retail distribution is propelling the use of Class 5 trucks for freight delivery operations.

These trucks offer the right blend of payload capacity and maneuverability for urban and suburban delivery routes. Companies are increasingly deploying them for time-sensitive and high-frequency delivery tasks that require vehicle agility without sacrificing cargo volume.

As same-day and regional delivery services become more prevalent, Class 5 trucks are positioned as key assets in last-mile and mid-mile freight operations, supporting their growth within the application landscape.

The class 5 trucks market is growing due to the increasing demand for medium-duty trucks in industries such as logistics, construction, and transportation. Class 5 trucks, which typically have a gross vehicle weight rating (GVWR) between 16,001 and 19,500 pounds, offer a balance of power and payload capacity, making them ideal for urban deliveries, construction sites, and service-based applications. With the rise in e-commerce and last-mile delivery needs, class 5 trucks are increasingly favored for their ability to transport goods efficiently in urban environments. Technological advancements and growing commercial transportation needs are driving market expansion.

The growth of the class 5 trucks market is primarily driven by the increasing demand for last-mile delivery solutions and urban transport. With the boom in e-commerce, the need for reliable, efficient vehicles capable of navigating congested city streets and making quick deliveries is rising. Class 5 trucks, which offer a manageable size and sufficient load capacity, are well-suited for these tasks. The expansion of the logistics and distribution sectors, coupled with urbanization trends, is pushing the demand for medium-duty trucks. Their ability to handle lighter payloads efficiently while offering lower fuel consumption and better maneuverability in cities drives their growing adoption in last-mile delivery services.

The class 5 truck market faces challenges, particularly in terms of regulatory compliance and maintenance costs. Stricter emissions standards in many regions are pushing manufacturers to innovate and produce trucks that comply with environmental regulations, which can increase the cost of production. Moreover, as these trucks are used for demanding commercial purposes, their maintenance can be costly, especially in terms of engine wear and tear, brake systems, and other critical components. The complexity of ensuring these vehicles remain compliant with local and international standards, while managing repair and maintenance costs, may limit market growth, particularly for smaller operators and fleets with limited budgets.

The class 5 truck market presents significant opportunities through advancements in truck technology and the integration of electric vehicles (EVs). Technological innovations, such as improved fuel efficiency, autonomous driving capabilities, and connected vehicle systems, are enhancing the performance and efficiency of class 5 trucks. Additionally, the rising interest in reducing carbon emissions is driving the development and adoption of electric class 5 trucks. As the charging infrastructure for electric vehicles continues to expand, the market for electric class 5 trucks is set to grow, providing businesses with eco-friendly options for urban deliveries and fleet operations. These technological developments are creating new growth avenues for the market.

A key trend in the Class 5 truck market is the growing adoption of fleet management systems. As businesses seek to enhance operational efficiency, fleet management technologies are gaining popularity for tracking vehicle performance, monitoring fuel consumption, and optimizing routes. These systems help businesses manage their fleets more effectively, reducing operational costs and improving delivery times.

The integration of telematics and real-time tracking solutions is allowing businesses to gain deeper insights into fleet performance, enhance vehicle maintenance schedules, and reduce downtime. This trend is expected to continue as more commercial fleet operators embrace digital solutions to enhance productivity and reduce costs, driving the demand for class 5 trucks equipped with these technologies.

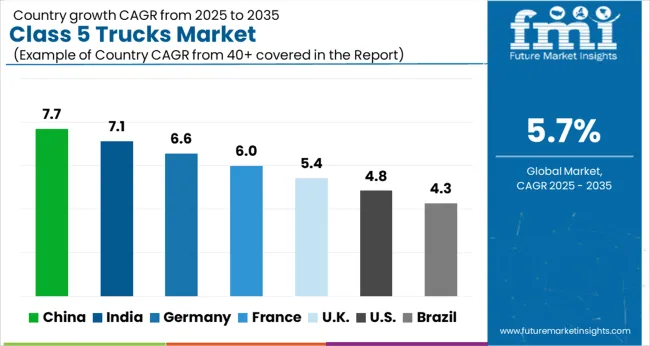

| Country | CAGR |

|---|---|

| China | 7.7% |

| India | 7.1% |

| Germany | 6.6% |

| France | 6.0% |

| UK | 5.4% |

| USA | 4.8% |

| Brazil | 4.3% |

Global class 5 trucks market demand is projected to rise at a 5.7% CAGR from 2025 to 2035. Of the five profiled markets out of 40 covered, China leads at 7.7%, followed by India at 7.1%, and Germany at 6.6%, while the United Kingdom records 5.4% and the United States posts 4.8%. These rates translate to a growth premium of +35% for China, +25% for India, and +10% for Germany versus the baseline, while the United States and the United Kingdom show slower growth. Divergence reflects local catalysts: growing logistics and infrastructure needs in China and India, while more mature markets like the United States and the United Kingdom experience moderate growth due to market saturation and infrastructure maturity. The analysis includes over 40+ countries, with the leading markets detailed below.

The class 5 trucks market in China is expanding at a CAGR of 7.7%, driven by rapid infrastructure development, particularly in the logistics and transportation sectors. As one of the largest manufacturing hubs globally, China is seeing increasing demand for transportation solutions. The country’s booming e-commerce sector, coupled with the growing need for efficient last-mile delivery, is further boosting the market. In addition, government initiatives aimed at modernizing infrastructure and increasing urbanization are contributing to the adoption of Class 5 trucks. China’s ambitious plans to expand its road networks, especially in tier-2 and tier-3 cities, are fueling the need for new, durable, and high-performance trucks. Furthermore, advancements in fuel efficiency and the government’s push for environmentally-friendly vehicles are driving the shift towards advanced Class 5 trucks.

The class 5 trucks market in India is projected to grow at a CAGR of 7.1%, supported by significant investments in road infrastructure and increasing demand for logistics solutions. The government’s focus on developing national highways, expanding city connectivity, and modernizing ports is driving the adoption of advanced transportation solutions, including Class 5 trucks. With India’s growing industrial base and an expanding middle class, there is a rising demand for more efficient freight and goods transportation. The increase in urbanization, especially in tier-2 and tier-3 cities, is further pushing the need for Class 5 trucks in India. In addition, the government’s initiatives such as the Pradhan Mantri Kisan Sampada Yojana are promoting food and agricultural products’ cold storage and transportation, further driving the demand for these trucks.

Demand for class 5 trucks in Germany is expanding at a CAGR of 6.6%, supported by the central role in European logistics and transportation. As one of the largest manufacturing economies, Germany’s need for heavy-duty trucks is substantial, particularly in the automotive, food, and industrial sectors. Class 5 trucks play a crucial role in freight transportation, especially for longer hauls and high-capacity loads. The government’s focus on advancing its infrastructure to accommodate growing urbanization and transportation needs is boosting market demand. Germany’s commitment to green logistics solutions, including low-emission vehicles, is influencing the adoption of energy-efficient Class 5 trucks. The ongoing transition to electric and hybrid-powered trucks further fuels this market. Furthermore, Germany’s strong industrial production, especially in automotive and heavy machinery, continues to require heavy-duty trucks for material handling and distribution, contributing to the market’s continued growth.

The United Kingdom’s Class 5 trucks market is growing at a CAGR of 5.4%, driven by demand in the logistics and freight transportation sectors. The UK’s well-established manufacturing industry continues to require efficient transportation solutions, including heavy-duty Class 5 trucks, to move goods across the country and to international markets. The rise of e-commerce and the need for last-mile delivery solutions are driving the demand for efficient trucks in urban areas. Government policies supporting infrastructure development, such as the Road Investment Strategy, further boost the adoption of Class 5 trucks. The UK’s emphasis on transitioning towards greener transportation options, including electric trucks, also contributes to market growth.

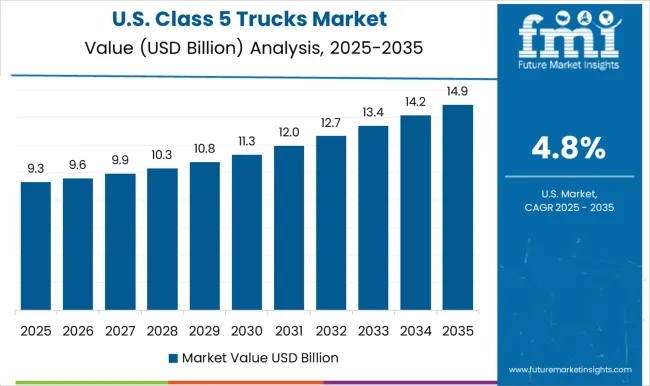

The USA Class 5 trucks market is growing at a CAGR of 4.8%, with demand driven by the logistics, freight, and e-commerce sectors. The market is somewhat mature, but the continued need for heavy-duty vehicles, particularly in last-mile delivery, is contributing to the market’s steady growth. The USA has a well-established infrastructure for logistics and transportation, but there is a rising focus on upgrading fleets with more efficient, environmentally-friendly trucks. The government’s emphasis on improving fuel efficiency and reducing emissions is driving the adoption of electric and hybrid Class 5 trucks. With growing consumer demand for fast deliveries, especially in e-commerce, there is an increasing reliance on these trucks for timely transportation.

Daimler AG is a prominent player, offering a wide range of Class 5 trucks known for their durability, fuel efficiency, and advanced technology. Doosan is recognized for its high-quality trucks that cater to various industries, including construction, logistics, and material handling, focusing on performance and cost-effectiveness. Fiat Chrysler Automobiles (FCA) offers a range of Class 5 trucks that stand out for their design, fuel efficiency, and robustness, catering to both urban and long-haul commercial needs.

Ford, known for its reliable and versatile trucks, provides Class 5 models that are widely used in logistics, construction, and delivery services, offering excellent towing capacity and advanced safety features. Hino is a leading manufacturer of Class 5 trucks, particularly known for their fuel-efficient models and low total cost of ownership, ideal for commercial transportation and delivery services. Kenworth is renowned for its premium Class 5 trucks, designed for long-haul, construction, and heavy-duty applications, emphasizing performance and driver comfort. Navistar, Inc. offers a variety of heavy-duty trucks, including Class 5 models, focusing on innovation, fuel efficiency, and advanced safety systems. PACCAR is recognized for its high-quality trucks, offering Class 5 models that are known for their durability, low maintenance costs, and superior performance. Stellantis is another key player, offering Class 5 trucks that focus on affordability and performance, with a wide array of models catering to various commercial applications. Toyota manufactures Class 5 trucks with a focus on innovation, fuel efficiency, and driver safety. Volvo Group provides Class 5 trucks that combine advanced technology, fuel efficiency, and safety, ideal for both urban and long-haul transport needs.

| Item | Value |

|---|---|

| Quantitative Units | USD 23.9 Billion |

| Product | Bucket trucks, Large walk-in truck, and City delivery |

| Fuel | Diesel, Natural gas, Hybrid electric, and Others |

| Application | Freight delivery, Utility Services, Construction & mining, and Others |

| Ownership | Fleet operator and Independent operator |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Daimler AG, Doosan, Fiat Chrysler Automobiles, Ford, Hino, Kenworth, Navistar, Inc., PACCAR, Stellantis, Toyota, and Volvo Group |

| Additional Attributes | Dollar sales by product type (delivery trucks, dump trucks, box trucks) and end-use segments (logistics, construction, urban delivery, utilities). Demand dynamics are driven by increasing urbanization, demand for last-mile delivery, and growing construction activities. Regional trends indicate strong growth in North America, Europe, and Asia-Pacific, with technological innovations, fuel-efficient solutions, and eco-friendly designs leading to expansion. |

The global class 5 trucks market is estimated to be valued at USD 23.9 billion in 2025.

The market size for the class 5 trucks market is projected to reach USD 41.6 billion by 2035.

The class 5 trucks market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in class 5 trucks market are bucket trucks, large walk-in truck and city delivery.

In terms of fuel, diesel segment to command 54.2% share in the class 5 trucks market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.