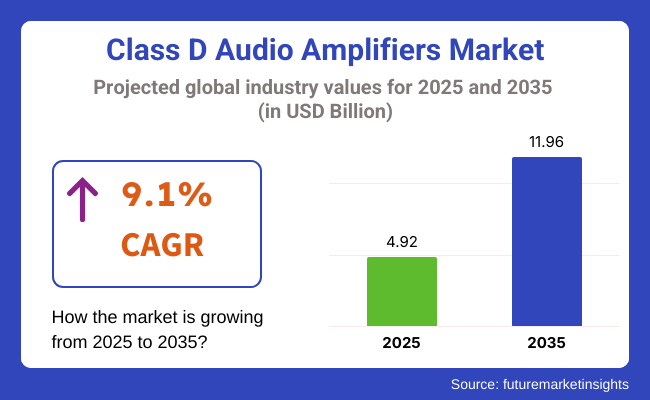

The class D audio amplifiers market was USD 4.9 billion in 2025 and is expected to grow at a 9.1% CAGR from 2025 to 2035. The class D audio amplifier market is expected to grow to USD 11.9 billion by 2035. One of the key drivers of growth is the increasing demand for power-efficient and miniaturized sound systems for consumer electronics and automotive applications.

With the growing application of smart devices, electric vehicles, and mobile entertainment systems, the need for low-power consumption, heat-efficient, and high-performance audio amplifiers is increasing tremendously. Class D amplifiers, with their switch-mode-based technology, enable high output with minimum heat generation, making them ideal for compact designs in smartphones, TVs, and IoT devices.

In the automotive sector, advances in infotainment systems and the growing need for high-quality in-car audio are propelling the use of Class D amplifiers in economy vehicles as well as luxury vehicles. Electric and hybrid cars, where power efficiency is the prime concern, are also turning into prime adopters of the technology due to their minimal battery drain and compact size.

The industry is also experiencing substantial momentum in commercial and industrial uses, where professional audio devices and public address systems require cost-effective and scalable amplifier solutions. Convergence with digital signal processing (DSP) and advancements in semiconductor technology are also fueling innovation and the fidelity and features of these amplifiers.

Asia Pacific leads the world with its strong manufacturing base for consumer electronics and automotive systems, followed by North America and Europe. Increasing R&D investments, collaborations, and product miniaturization are fueling competitive pressures and positioning Class D amplifiers as the preferred architecture for future audio amplification across multiple verticals.

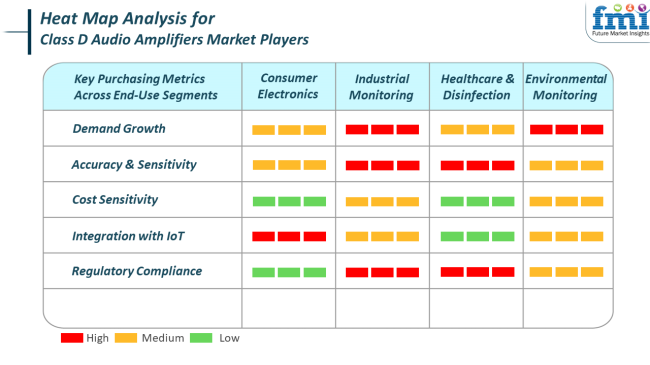

Class D audio amplifiers are used more and more in consumer applications for their efficiency in delivering high performance with controlled battery life. Low-heat and small-size audio solutions are what the consumer is looking for, and they have become easily embedded in portable devices like smartphones, smart speakers, and wearables. Embedding of IoT capability, as well as AI-aided sound optimization, has become a strong value driver for this category.

In industrial measurement, amplifier modules find application in real-time alert and notification systems that demand high reliability, no loss of power, and precise amplification of the signal. Their regulatory support and durability are the point of concern for these amplifiers as they are used for mission-critical applications such as factory plants and infrastructure.

Healthcare equipment requires high-fidelity audio with strict compliance with regulatory demands, particularly for hearing aids and diagnostic gear. Safety and reliability are the paramount considerations, and cost is a secondary concern. Environmental monitoring in outdoor and off-site installations has advantages, such as the ability of Class D amplifiers to operate under varied conditions and limited power availability and is thus sought-after equipment.

The Class D audio amplifier industry, while possibly subject to strong growth, is exposed to a variety of intrinsic technological threats and competition forces. The most serious threat is the increasing commoditization of amplifier devices, which could lead to cost pressures and profit squeezes for experienced players. With increasing numbers of players entering the industry, differentiation due to quality, integration features, and proprietary architecture assumes importance in maintaining industry share.

Yet another peril arises from potential compatibility and integration issues with building electronic ecosystems. More networked devices mean amplifiers must be engineered to very precise specifications, and deviation from new chipsets, communication protocols, or safety guidelines can hinder product adoption. Delays in semiconductor platform upgrades might affect industry leaders' time-to-market.

Additionally, logistical and financial weaknesses exist in the supply chain for such semiconductors and crucial electronic components. Such a supply chain's vulnerabilities are sensitive to component shortages and manufacturing planning schedules affected by global disruptions, trade practices, or geopolitical differences. Manufacturers must cover such risks through the diversification of supply sources, vertical integration, and refined inventory control mechanisms to stabilize and maintain sustainable business growth.

Between 2020 and 2024, the industry experienced a steep growth rate driven by the growing demand for power-efficient and compact-sized audio solutions in consumer electronics. The rise of tablets, smartphones, and wireless speakers necessitated amplifiers that were highly power-efficient and produced minimal heat emissions.

This era also experienced rising adoption in automotive infotainment systems, where both space and efficiency of heat become major concerns. Firms emphasized deploying Class D amplifiers in other products, too, according to their relative merits over traditional amplifier classes. On the horizon up through 2025 to 2035, the industry will continue to grow with momentum fostered by innovation in semiconductor technology and escalating usage of smart home and wearable products.

The adoption of class D amplifiers in Internet of Things (IoT) devices will grow, solidifying the push for connected and energy-efficient devices. Additionally, the push for sustainability and energy efficiency will continue to solidify the position of Class D amplifiers as a leading option in most electronic applications. In addition, the need for sustainability and energy efficiency will continue to support the role of Class D amplifiers as a preferred option in most electronic applications.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Consumer electronics demand for energy-efficient audio solutions. | Integration in IoT devices and focus on sustainability. |

| Use in smartphones, tablets, and car infotainment systems. | Growth in smart home and wearable devices. |

| High power efficiency and small form factor focus. | Integration focus with leading-edge semiconductor technologies. |

| Asia-Pacific growth with consumer electronics production. | Further growth in emerging economies with rising electronic adoption. |

| Portable and energy-efficient audio products preference. | Increased demand for networked, smart, and green audio solutions. |

The industry segment by type has a clear preference for multi-channel from a 2-channel amplifier, which is expected to dominate the industry in 2025 with 35% of the share, followed by mono-channel units with 28%. This segmentation reflects the change in demand for audio systems in the consumer and professional domains, which increases the demand for portable, energy-efficient, and high-fidelity sound solutions.

Massive usage of the 2-channel Class D amplifier in consumer electronic devices has made them the star as far as normal stereo audio in home systems, portable Bluetooth speakers, and car audio applications are concerned. This has allowed consumers to use them in most instances as they connect two distinct speakers, but do it efficiently, offering clarity rather than distortion.

For example, Texas Instruments, which has a whole range of very high-efficiency 2-channel Class D amplifiers, such as TAS5766M, which are being used in TVs and soundbars, contributes to the reduction of heat dissipation and delivers more powerful stereo sound in line with the energy-saving methodology adopted by manufacturers of electronics.

Monochannel amplifiers account for 28% of the industry and are mostly used for subwoofers and professional audio equipment, where only one high-power channel is needed. They are most common in automotive audio systems and professional public address (PA) setups.

STM icroelectronics and Infineon Technologies are both known for their powerful mono Class D amplifier solutions, such as the ST TAS5414C-Q1, specifically built for automotive subwoofer applications. Like most amplifiers of such kind, these also prefer something like their high output with little power loss and, therefore, last much longer without damage, even in challenging situations.

New and smart, intelligent home devices, electric vehicles, and miniaturized systems for personal entertainment continue to push the growth of the world audio electronics industry.

Thus, the industry for amplifier types such as these is expected to flourish well into the future. Current examples of companies in this field include Qualcomm, NXP Semiconductors, and Cirrus Logic, all of whom offer compact, power-efficient solutions to what the modern digital audio system desires.

The end-user segmentation of the industry has two dominant sectors: the consumer electronics sector, which dominates the industry with 45% of the industry share by the year 2025, followed by the automotive industry, which holds 30%. These shares are indicative of the widespread adoption of compact and energy-efficient amplifier technology into connected and audio-driven environments.

Consumer electronics represent the leading sector due to the phenomenal growth of smart speakers, soundbars, wireless headphones, portable Bluetooth speakers, and home theater systems. Due to their excellent efficiency and lower heat generation, Class D amplifiers are preferred in these applications, where very slim and compact designs are required with minimum or no heat sinks.

Companies like Cirrus Logic and Qualcomm provide Class D amplifier chipsets designed for mobile and wireless applications. Advanced digital signal processing features of Qualcomm's DDFA (Direct Digital Feedback Amplifier) platform for high-resolution audio products provide not only enhancement of audio quality but also efficiency in power consumption, which is much appreciated in battery-operated electronics.

Increased demand for infotainment systems in vehicles, electric vehicles (EVs), and luxury car audio installations has acted as an enabler for Class D amplifiers in the automotive sector. The Class D amplifiers also reduce the load on the car's power systems while delivering high-output sound to several speaker zones in compact spaces.

Manufacturers such as STMicroelectronics and NXP Semiconductors manufacture automotive-grade Class D amplifier ICs that satisfy stringent AEC-Q100 standards. NXP's TDF8546A, for example, is widely used to provide high-efficiency audio amplification in premium car infotainment systems, along with diagnostics and fault protection features.

Such trends demonstrate how Class D amplifiers enable many extremely demanding audio applications in both the consumer and automotive aspects, thus driving technology and expansion in the industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 8.5% |

| UK | 7.3% |

| France | 6.9% |

| Germany | 7.2% |

| Italy | 6.6% |

| South Korea | 8.1% |

| Japan | 7% |

| China | 9% |

| Australia-NZ | 6.8% |

The USA industry will have an 8.5% CAGR through the forecast period. The industry demand in the USA is dominated by the fast-growing consumer electronics and automotive industries. The adoption of high-efficiency, low-heat amplifiers in portable audio products, smart speakers, and car infotainment systems increases.

Rapid technology evolution, along with a well-developed semiconductor sector, supports consistent product development and uptake. Class D amps are favored due to their efficiency, compactness, and compatibility with wireless systems essential elements in USA home and car audio trends. Expansion is also supported through the expanding usage of IoT-enabled devices where Class D amplifiers are the main audio components.

The USA consumer economy requires high-performance, power-efficient electronics, and the environment is therefore well-placed for high-end audio integration. Additionally, regional industry players that belong to the region contribute to high R&D spending, improving regional ability.

The movement towards electrically powered vehicles and autonomous driving systems also works in favor of increased demand, bearing in mind that energy-saving audio systems have become vital. Regulator preference towards sustainable and power-efficient technology is yet another factor working in favor of the growth until 2035.

The UK industry is anticipated to develop at 7.3% CAGR during the periods under consideration. UK demand for Class D audio amplifiers is closely tied to increased usage of smart devices and home automation entertainment systems.

Consumers very much appreciate thin and low-power audio equipment that can be incorporated into small-sized living spaces, especially in city center areas. With the increased penetration of smart homes, there is an increasing focus on wireless audio solutions using Class D technology. Automotive applications are also a major driver, fueled by increased installations of high-end infotainment systems in cars.

The UK automotive sector continues to shift towards EV manufacturing, which is dependent on low-power, small-size components such as Class D amplifiers. Further, more mid-market audio and electronics companies in the UK are using these amplifiers as part of mass-market products to enhance cost-efficiency and design flexibility.

Regulators interest in power efficiency is also a benefit related to Class D architecture. Greater consumer and commercial audio industry digitization will be called for to provide long-term growth to the industries.

The French industry will expand at a 6.9% CAGR during the study period. France's class D audio amplifier industry growth relies most strongly on evolving audio consumption patterns among urban dwellers and young consumers. Wireless headphones, portable audio products, and mini speaker systems dominate product demand as a leading majority. French consumers are increasingly looking towards audio products fulfilling performance, aesthetic, and sustainability requirements, and therefore, Class D technology is a sought-after option.

The French industrial ecosystem, especially the electric mobility and consumer electronics sector, lends support to the increasing installation of energy-efficient audio systems. Class D amplifiers are perfectly suited to the low-heat as well as thin-line design specifications of new French residential and automotive electronics.

The government's attention to green technologies and the standards of energy efficiency for electronics also supplement the advantages provided by Class D architecture. Additionally, the existence of a good design-centric electronics industry and firm investment in 5G and digital infrastructure will increase demand, at least by device manufacturers and integrators.

The German industry is likely to grow at a CAGR of 7.2% throughout the period under study. The German industry consists of a very strong automotive and industrial electronics industry, wherein class D audio amplifiers are quickly becoming a design standard.

The hybrid and electric car trend promise a steady demand for lightweight and high-thermal efficiency audio products. German automobile producers are the leaders in the adoption of next-generation infotainment technology, thus raising the importance of high-efficiency audio components.

There is also high consumer electronics industry adoption in Germany, with a high penetration of home automation and high-end audio devices. The soundbar, multi-room audio system, and wireless speaker trend promotes ongoing innovation among domestic producers. Class D amplifiers are the answer to high-performance requirements in home and commercial AV systems.

The nation's strict environmental regulations and power-limited design favor extensive applications of energy-saving technologies, which favor Class D amplifiers. O.N.'s ongoing R&D and robust domestic manufacturing strength. Will continue to keep Germany strategically positioned in the industry during the forecast period.

Italy's industry is anticipated to expand at 6.6% CAGR throughout the study. Italy's class D audio amplifier industry is driven by steady growth in consumer electronics and lifestyle-driven product segments. The domestic industry prefers stylish, compact audio systems for home use, such as mini-Bluetooth speakers, entertainment systems, and wireless headsets. Class D technology is appropriate for the power and design limitations characteristic of such applications, hence being popular with local producers.

Although the Italian automotive sector is comparatively small in relation to European rivals, energy-efficient in-car entertainment systems use is continually on the rise. The pressure to electrify and make transport more modern ensures a steady but modest industry for high-quality audio components.

Audio solutions also designed for tourism, shopping, and public spaces add to the steady adoption of amplifiers. Italy's creative sector also drives specialized audio device innovation, where miniaturization and high-fidelity audio are critical. These combined drivers drive a steady if slightly more conservative, growth trajectory for Class D amplifier adoption.

South Korea industry is likely to record 8.1% CAGR over the study period. South Korea boasts a highly developed consumer electronics industry dominated by world-renowned brands heavily investing in high-performance audio technology.

The industry is marked by intense product innovation, with consumers having a strong affinity for thin, high-performance audio products. Class D amplifiers address both technical and design requirements and, therefore, are a designer's favorite when it comes to new product design.

Smartphones, TVs, and wearables are some of the key applications driving demand. Class D amplifiers deliver the performance needed in thin-profile products with low power consumption. The nation is also marked by high investment in automotive electronics, where Class D solutions are employed in automotive entertainment systems.

The transition to EVs and connected car platforms is extremely well-suited to the capabilities of Class D technology. In addition, government-driven initiatives to boost digital infrastructure and energy efficiency create a favorable regulatory environment for industry growth up to 2035.

The Japanese industry will experience a growth rate of 7.0% CAGR over the forecast period. Japan is still in the vanguard of high-fidelity sound and precision electronics, and its industries offer rich soil to adopt Class D amplifiers.

Miniaturization of audio systems, integration with smart homes, and the use of eco-efficient technology are some driving forces behind such expansion. Japanese consumers, in particular, are sensitive to audio fidelity, device efficiency, and design simplicity all of which are easily addressed by Class D topology.

Japan's dominance in high-end consumer electronics, as well as healthy demand for wireless and portable audio solutions, also spur amplifier adoption. In the automotive industry, incumbent players are using Class D amplifiers in automotive infotainment and telematics platforms to enhance the quality of the sound without taking a hit on power efficiency.

The aging population in the country is also boosting the demand for assistive listening devices and home audio systems with easy-to-use controls. These uses are best positioned for Class D integration, with consistent industry growth across various sectors.

The China industry will account for a growth of 9.0% CAGR during the forecast period. China is the fastest-growing class D audio amplifier industry, spurred by a huge and fast-expanding consumer electronics industry. Mass production of multimedia devices, smart speakers, wearables, and smartphones is greatly dependent on Class D architecture as it's very efficient, power-saving, and space-efficient.

Domestic demand is massive, and companies are preparing to fulfill domestic as well as global demand. Early adoption of smart home systems in China and rising EV penetration also fuels the robust performance of the industry.

Most Chinese automotive manufacturers are implementing advanced infotainment and driver-assist technologies, all of which demand audio components with high-energy efficiency. Moreover, local clusters of high-technology enterprises in the regions have turned into local R&D centers for hardware products, further enhancing regional sophistication in audio system design. Facilitated by policy support towards supporting local innovation, energy savings, and digitalization, China will dominate the international industry throughout the decade.

Australia-New Zealand's industry will grow at 6.8% CAGR during the forecast period. The increasing adoption of home entertainment systems, wireless audio solutions, and automotive audio upgrades propels the expansion in this region.

Consumer demand for clean, minimalist technology solutions favors the application of Class D amplifiers, which are best appropriate for small, energy-efficient devices. Smart home penetration and growing disposable incomes in urban areas are boosting demand for multi-room audio, soundbars, and Bluetooth systems.

In the automotive industry, EV adoption has been increasing gradually, which is also in support of the adoption of power-conscious audio solutions such as Class D schemes. Domestic consumers' attitudes toward energy efficiency and saving the environment are well compatible with the Class D amplifier system's major benefit. Even though this industry is smaller than Asian or North American industries, the growth trend here is consistent with the strength of residential and car audio upgrades.

The industry is led primarily on the technological innovation in the low-power, high-efficiency amplification field, with industry leaders such as Texas Instruments, Infineon Technologies, and Analog Devices advancing IC development as well as audio fidelity optimization.

Texas Instruments, for example, broadened its portfolio early in 2025 with next-generation digital input Class D amplifiers for ultra-compact, battery-powered audio devices. Analog Devices continues to gain ground through its integration in SigmaDSP, allowing real-time processing of audio signals in high-end consumer and professional audio products.

Infineon Technologies AG pioneered its further differentiation as it unveiled multi-channel Class D modules made for automotive infotainment systems. Meanwhile, STMicroelectronics released new low-EMI Class D amplifiers optimized for smart speakers and IoT-based audio ecosystems. The year 2024 has witnessed the unveiling by NXP Semiconductors of their line of Class D amplifiers with built-in protection features targeting harsh industrial and automotive environments.

Startups and niche companies like Icepower A/S plan to make forays into the audiophile industry by underscoring sound purity and ultra-compact module design. Rohm Semiconductors as well as Monolithic Power Systems are further building their mid-power portfolio for home audio and portable applications by utilizing cost-efficient power stages in conjunction with an energy-efficient approach.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Texas Instruments, Inc. | 18-22% |

| Infineon Technologies AG | 14-18% |

| Analog Devices, Inc. | 12-16% |

| STMicroelectronics NV | 9-13% |

| NXP Semiconductors NV | 7-10% |

| Other Players | 25-30% |

| Company Name | Offerings & Activities |

|---|---|

| Texas Instruments | Released digital input Class D amplifiers with integrated DSP for portable and automotive use. |

| Infineon Technologies | Focused on multi-channel, automotive-grade Class D modules with high power density. |

| Analog Devices | Integrated SigmaDSP technology in audio amplifiers for pro and consumer industries. |

| STMicroelectronics | Launched compact, EMI-optimized Class D amplifiers for IoT audio. |

| NXP Semiconductors | Developed ruggedized Class D amplifiers with thermal protection for industrial audio. |

Key Company Insights

Texas Instruments, Inc. (18-22%)

The industry leader is known for power-efficient, compact Class D solutions with a strong footprint in automotive and portable devices.

Infineon Technologies AG (14-18%)

Aggressively expanding in automotive audio and industrial markets with highly reliable, multi-channel Class D systems.

Analog Devices, Inc. (12-16%)

Maintains a premium audio industry presence through DSP-enhanced amplifiers and professional-grade sound fidelity.

STMicroelectronics NV (9-13%)

Capturing IoT and smart home demand with Class D designs focused on EMI reduction and integration.

NXP Semiconductors NV (7-10%)

Leverages automotive electronics experience to develop rugged Class D amplifiers for robust and high-temperature environments.

Other Key Players

By type, the industry is segmented into mono channel, 2-channel, 4-channel, 6-channel, and others.

By end use, the industry is segmented into consumer electronics, automotive, healthcare, telecommunications, industrial & retail, and others.

By region, the industry is segmented into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East and Africa.

The industry is estimated to reach USD 4.9 billion by 2025.

By 2035, the industry is expected to expand to USD 11.9 billion.

China is forecasted to grow at a 9% CAGR.

Multi-channel Class D amplifiers dominate the segment due to their widespread use in home theaters, automotive infotainment systems, and professional audio applications.

Leading companies include Analog Devices, Inc., Texas Instruments, Inc., Infineon Technologies AG, Monolithic Power Systems, Inc., NXP Semiconductors NV, ON Semiconductor Corporation, Rohm Semiconductors, Silicon Laboratories, Inc., STMicroelectronics NV, and Icepower A/S.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 16: Latin America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 22: Western Europe Market Volume (Units) Forecast by Type, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 24: Western Europe Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 28: Eastern Europe Market Volume (Units) Forecast by Type, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 30: Eastern Europe Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Type, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 40: East Asia Market Volume (Units) Forecast by Type, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 42: East Asia Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Units) Forecast by Type, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Units) Forecast by End-Use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 9: Global Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 13: Global Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 16: Global Market Attractiveness by Type, 2023 to 2033

Figure 17: Global Market Attractiveness by End-Use, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 27: North America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 31: North America Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 34: North America Market Attractiveness by Type, 2023 to 2033

Figure 35: North America Market Attractiveness by End-Use, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 45: Latin America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 49: Latin America Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by End-Use, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 63: Western Europe Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 67: Western Europe Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Type, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by End-Use, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Type, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by End-Use, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Type, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by End-Use, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 117: East Asia Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 121: East Asia Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 125: East Asia Market Attractiveness by End-Use, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Type, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Type, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by End-Use, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Class 7 Truck Market Size and Share Forecast Outlook 2025 to 2035

Class 8 Truck Market Size and Share Forecast Outlook 2025 to 2035

Class 3 Truck Market Size and Share Forecast Outlook 2025 to 2035

Class 5 Trucks Market Size and Share Forecast Outlook 2025 to 2035

Class 1 Truck Market Size and Share Forecast Outlook 2025 to 2035

Class 2 Trucks Market Size and Share Forecast Outlook 2025 to 2035

Classic Organic Pigments Market Size and Share Forecast Outlook 2025 to 2035

Class 4 Truck Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Class 6 Trucks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Classified Platform Market Analysis by Type, Application, and Region Through 2035

Air Classifying Mill Market Size and Share Forecast Outlook 2025 to 2035

Smart Classroom Market Size and Share Forecast Outlook 2025 to 2035

Virtual Classroom Market Trends – Size, Demand & Forecast 2024-2034

Enterprise-Class Hybrid Storage Market Size and Share Forecast Outlook 2025 to 2035

Fault Detection and Classification Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Defense C Class Parts Market Size and Share Forecast Outlook 2025 to 2035

DOAS Industry Analysis in the United States Forecast and Outlook 2025 to 2035

Digital Marketing Analytics Industry Analysis in Latin America Forecast Outlook 2025 to 2035

Delinting Machine Market Size and Share Forecast Outlook 2025 to 2035

Doypack Market Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA