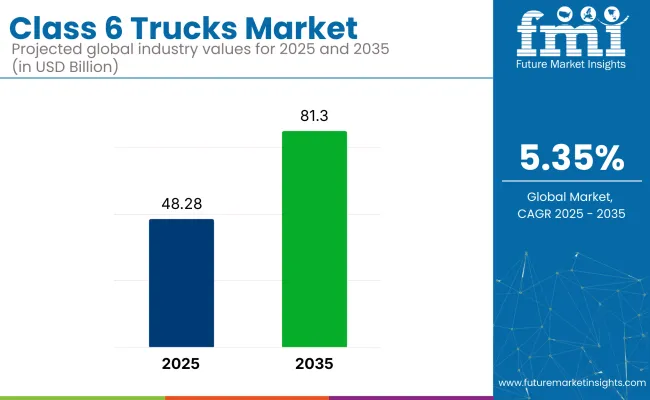

The global Class 6 trucks market is projected to grow from USD 48.28 billion in 2025 to USD 81.3 billion by 2035, registering a CAGR of 5.3% during the forecast period. This growth is being driven by the increasing demand for medium-duty trucks across sectors such as logistics, construction, and distribution. Class 6 trucks are preferred for their ability to carry heavier payloads, making them ideal for urban deliveries and construction applications that require durability, efficiency, and cost-effectiveness.

“We see ’24, ’25, ’26 as strong industries in the commercial Class 8 and Class 6-7. We'll see what happens after we hit the '27 emissions. But for right now, when customers are buying and planning, they’ve got to plan on that three-year cycle,” said Jonathan Randall, President of Mack Trucks. This outlook highlights the multi-year purchase cycle for medium-duty trucks and the potential impact of emissions regulations on future purchasing decisions.

The industry is benefiting from the growing demand for commercial vehicles equipped with advanced features such as fuel efficiency and emissions control systems. This demand is being fueled by the rising need for urban mobility solutions and the shift toward greener technologies that meet stricter environmental regulations.

Additionally, the focus on cost-efficient transportation solutions for last-mile deliveries is further pushing the adoption of medium-duty trucks, especially in emerging industries. As the industry evolves, there will be a growing focus on sustainability, fuel efficiency, and smart technologies. These advancements will drive sustained growth, particularly in Asia and India.

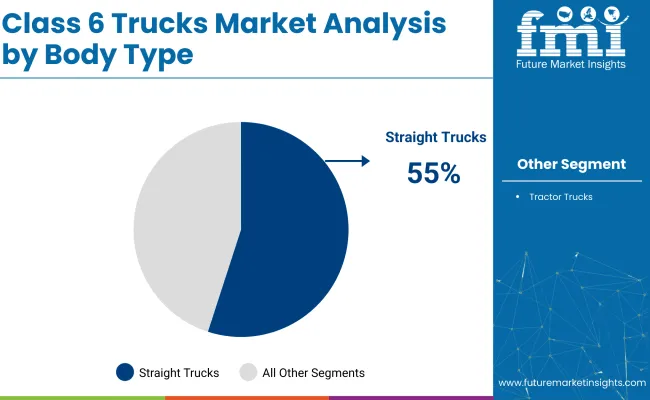

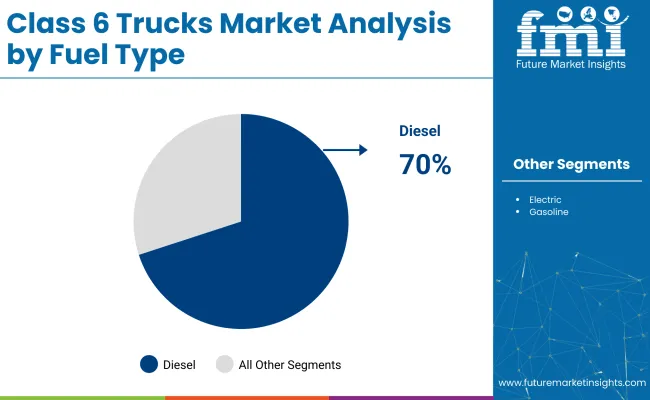

The Class 6 trucks market is segmented into key investment areas. By body type, the market includes straight trucks and tractor trucks. It is further categorized by fuel type, which includes diesel, electric, and gasoline. The payload capacity segment is divided into up to 10 tonnes, 10-15 tonnes, and 15-20 tonnes.

In terms of application, the industry covers construction, transportation, distribution, and utilities sectors. Geographically, the market spans across North America, Latin America, Western Europe, Eastern Europe, Asia Pacific, the Middle East and Africa, each contributing to the market’s growth and diversification.

Straight trucks are expected to dominate the industry by body type, holding 55% of the share in 2025.

Diesel is projected to capture 70% of the industry share in the Class 6 truck segment by fuel type in 2025.

The 10-15 tonnes payload capacity segment is expected to capture 40% of the industry share by 2025.

The construction application segment is expected to hold a 40% industry share in 2025.

The industry is being driven by rising demand in freight delivery, construction, and utility services. Technological advancements and e-commerce growth support expansion, while high production costs and regulations limit growth.

Increasing demand across various sectors is driving industry growth

The demand for Class 6 trucks is being significantly boosted by their versatility across a wide range of industries. In the freight delivery sector, they are being preferred for their ability to navigate urban environments and efficiently handle last-mile deliveries.

The construction industry is adopting Class 6 trucks to transport materials and equipment to job sites, benefiting from their maneuverability and payload capacity. Utility services are increasingly using these trucks for maintenance and service operations due to their adaptability and reliability. The diverse adoption of Class 6 trucks in these sectors is driving substantial industry growth.

High production costs and regulatory complexities are limiting industry growth.

Despite strong growth prospects, the industry is facing challenges related to high production costs and regulatory complexities. The integration of advanced technologies and the use of specialized materials in truck manufacturing are raising production expenses, which could deter smaller companies from investing in these vehicles.

Additionally, stringent environmental regulations and safety standards are imposing compliance costs, further increasing operational expenses. These factors are limiting the accessibility of Class 6 trucks, especially in emerging industries, and may slow down the pace of industry expansion. Overcoming these challenges is essential for continued growth.

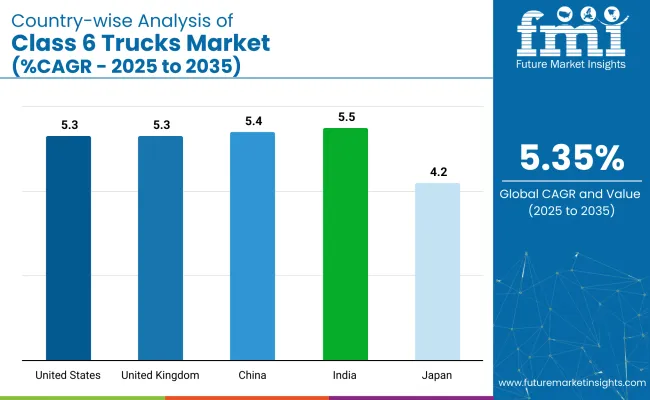

The industry will grow steadily through 2035, driven by rising logistics demand, industrial expansion in China and India, and innovation and sustainability focus in the United States and the United Kingdom.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 5.3% |

| United Kingdom | 5.3% |

| China | 5.4% |

| India | 5.5% |

| Japan | 4.2% |

The United States industry is projected to grow at a CAGR of 5.3% through 2035.

The United Kingdom industry is projected to grow at a CAGR of 5.3% through 2035.

The industry in China is projected to grow at a CAGR of 5.4% through 2035.

The industry in India is expected to grow at a CAGR of 5.5% through 2035.

The industry in Japan is expected to grow at a CAGR of 4.2% through 2035.

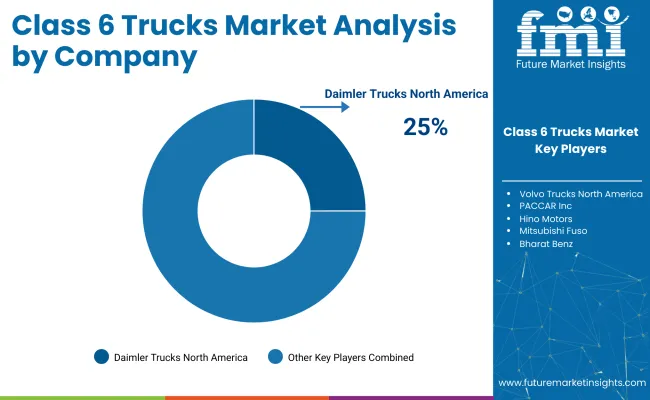

Prominent players like Daimler Trucks North America, Volvo Trucks North America, PACCAR Inc., and International Inc. (Traton SE) dominate the industry due to their extensive product portfolios, technological advancements, and strong global presence in the heavy-duty truck sector.

Key suppliers such as Isuzu Motors Limited, Hino Motors, and Mitsubishi Fuso focus on specialized industries, offering innovative and sustainable packaging solutions tailored to the unique requirements of Class 6 trucks. Emerging companies like Bharat Benz, Tata Motors, and Ashok Leyland target regional industries with cost-effective and niche product offerings, catering to specific consumer needs and preferences.

Recent Class 6 Truck Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 48.28 billion |

| Projected Market Size (2035) | USD 81.3 billion |

| CAGR (2025 to 2035) | 5.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value, million units for volume |

| Body Types Analyzed (Segment 1) | Straight Trucks; Tractor Trucks |

| Fuel Types Analyzed (Segment 2) | Diesel; Electric; Gasoline |

| Payload Capacities Analyzed (Segment 3) | Up to 10 tonnes; 10-15 tonnes; 15-20 tonnes |

| Applications Covered (Segment 4) | Construction; Transportation; Distribution; Utilities |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, Asia Pacific, the Middle East and Africa |

| Countries Covered | United States, Canada, Brazil, Mexico, Argentina, United Kingdom, Germany, France, Italy, Spain, Russia, Poland, Romania, China, India, Japan, South Korea, Australia, Saudi Arabia, UAE, South Africa, Egypt, Turkey |

| Key Players Influencing the Industry | Daimler Trucks North America; Volvo Trucks North America; PACCAR Inc.; International Inc. (Traton SE); Isuzu Motors Limited; Hino Motors; Mitsubishi Fuso; Bharat Benz; Tata Motors; Ashok Leyland |

| Additional Attributes | Dollar sales by body type (straight trucks vs tractor trucks); Growth in electric truck adoption; Regional demand for diesel vs electric trucks; Technological advancements in fuel efficiency; Trends in truck applications for construction, transportation, and distribution |

The industry is segmented into straight trucks and tractor trucks.

The industry includes diesel, electric, and gasoline fuel types.

The industry is categorized into up to 10 tonnes, 10-15 tonnes, and 15-20 tonnes payload capacities.

The industry covers construction, transportation, distribution, and utilities applications.

The industry spans North America, Latin America, Western Europe, Eastern Europe, Asia Pacific, and the Middle East and Africa.

The industry is expected to reach USD 81.3 billion by 2035.

The industry size is projected to be USD 48.28 billion in 2025.

The industry is expected to grow at a CAGR of 5.3%.

In the fuel type segment, diesel-powered trucks capture 70% market share.

India is projected to hold the highest CAGR with 5.5%.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Class 7 Truck Market Size and Share Forecast Outlook 2025 to 2035

Class 8 Truck Market Size and Share Forecast Outlook 2025 to 2035

Class 3 Truck Market Size and Share Forecast Outlook 2025 to 2035

Class 1 Truck Market Size and Share Forecast Outlook 2025 to 2035

Classic Organic Pigments Market Size and Share Forecast Outlook 2025 to 2035

Class 4 Truck Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Class D Audio Amplifiers Market is Segmented by Type, End Use and Region through 2025 to 2035

Classified Platform Market Analysis by Type, Application, and Region Through 2035

Class 5 Trucks Market Size and Share Forecast Outlook 2025 to 2035

Class 2 Trucks Market Size and Share Forecast Outlook 2025 to 2035

Air Classifying Mill Market Size and Share Forecast Outlook 2025 to 2035

Smart Classroom Market Size and Share Forecast Outlook 2025 to 2035

V-type Classifiers Market Size and Share Forecast Outlook 2025 to 2035

Virtual Classroom Market Trends – Size, Demand & Forecast 2024-2034

Enterprise-Class Hybrid Storage Market Size and Share Forecast Outlook 2025 to 2035

Unpowered Powder Classifiers Market Size and Share Forecast Outlook 2025 to 2035

Fault Detection and Classification Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Defense C Class Parts Market Size and Share Forecast Outlook 2025 to 2035

6-KT Mother Liquor Market Size and Share Forecast Outlook 2025 to 2035

60GHz Radar Evaluation Kit Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA