The Class 2 Trucks Market is estimated to be valued at USD 771.1 million in 2025 and is projected to reach USD 1825.4 million by 2035, registering a compound annual growth rate (CAGR) of 9.0% over the forecast period. This steady growth will be driven by rising demand for medium-duty trucks in various sectors, including e-commerce, retail, and construction, where last-mile deliveries and urban operations are increasingly essential. Between 2025 and 2029, the market will expand from USD 771.1 million to USD 1,186.4 million, as companies look for versatile, cost-effective transportation solutions.

The growing demand for efficient delivery vehicles capable of handling moderate payloads while navigating congested urban environments will boost the adoption of class 2 trucks, making them ideal for last-mile delivery tasks. From 2030 to 2034, the market will continue to show steady growth, reaching USD 1,674.7 million. This phase will be characterized by a continued push for supply chain optimization and the integration of advanced fuel-efficient technologies that enhance the performance of these trucks. The market’s final phase, from 2035 onwards, will see it peak at USD 1,825.4 million. Key factors driving this growth will include the increased adoption of eco-friendly technologies and advancements in fleet management solutions, which will help reduce operational costs while improving efficiency.

| Metric | Value |

|---|---|

| Class 2 Trucks Market Estimated Value in (2025 E) | USD 771.1 million |

| Class 2 Trucks Market Forecast Value in (2035 F) | USD 1825.4 million |

| Forecast CAGR (2025 to 2035) | 9.0% |

The class 2 trucks market is experiencing notable growth due to rising demand for light commercial vehicles that balance payload efficiency with fuel economy. Expanding urban infrastructure, the boom in e commerce, and the need for last mile delivery solutions are encouraging the deployment of compact trucks across densely populated regions.

These vehicles offer versatility in navigating narrow streets while maintaining commercial utility, making them ideal for retail distribution, courier services, and service industries. Government initiatives supporting the replacement of older fleet vehicles with fuel efficient alternatives and favorable credit availability for small businesses are also accelerating fleet expansion.

Manufacturers are responding with improved engine performance, ergonomic designs, and compliance with stricter emission standards. As urban logistics intensify and fleet operators prioritize operational efficiency, class 2 trucks are expected to witness consistent demand in both emerging and developed economies.

The class 2 trucks market is segmented by product, fuel, application, drive configuration, and geographic regions. By product, the class 2 trucks market is divided into Minivan, Cargo Van, Full-size Pickup, and Step Van. In terms of fuel, the class 2 trucks market is classified into Gasoline, Diesel, Hybrid, Electric, and Others. Based on the application, the class 2 trucks market is segmented into Urban delivery, Service & maintenance, Recreation & leisure, and Commercial.

By drive configuration, the class 2 trucks market is segmented into Rear-wheel drive, All-wheel drive, and Front-wheel drive. Regionally, the class 2 trucks industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The minivan segment is anticipated to represent 36.70% of the total market revenue by 2025 within the product category, making it the dominant product type. This is largely driven by its multifunctional use, ease of customization, and superior handling in urban and suburban environments.

Minivans offer optimal cargo capacity while maintaining compact dimensions, which is ideal for delivery and utility-based applications. Their relatively lower maintenance costs and higher fuel efficiency compared to larger commercial trucks further enhance their appeal.

Increased adoption by small and mid-sized enterprises for logistics, trades, and services has reinforced the market share of this product segment.

The gasoline segment is expected to capture 42.90% of the overall fuel type revenue by 2025. This is attributed to its cost-effectiveness, widespread availability, and strong performance in light-duty applications.

Gasoline powered trucks are easier to maintain, more affordable at the point of purchase, and well suited for short distance urban driving. With continued improvements in engine efficiency and emissions compliance, gasoline continues to be the preferred choice for fleet operators that prioritize initial investment over long term fuel economy.

The segment’s dominance reflects its ability to meet the practical and operational needs of urban transport networks.

The urban delivery segment is forecasted to contribute 48.30% of the total application based market revenue by 2025, making it the leading end use. This growth is primarily driven by the explosive rise in e-commerce and the necessity for fast and frequent last-mile deliveries.

Compact trucks such as those in class 2 are well-suited for navigating traffic congestion, parking limitations, and short route cycles typical in city centers. Retail chains, logistics providers, and courier services are increasingly relying on urban-capable fleets to fulfill same-day and next-day delivery expectations.

The practicality, maneuverability, and operational cost benefits of these vehicles continue to support their dominant position in the urban delivery application space.

The class 2 trucks market is expanding as demand for light-duty trucks with increased payload capacity rises across industries such as retail, logistics, and construction. With a gross vehicle weight rating (GVWR) of 6,001 to 10,000 pounds, class 2 trucks are versatile and widely used for local deliveries, transportation, and service-based applications. These vehicles are ideal for navigating both urban and suburban environments while carrying moderate loads. Technological advancements, including the integration of electric and hybrid vehicles, as well as enhanced fuel efficiency, are also driving the market forward, meeting the growing demand for sustainable and cost-effective transportation solutions.

The class 2 truck market is primarily driven by the increasing demand for efficient and versatile delivery solutions, especially as e-commerce and retail industries continue to grow. The need for reliable last-mile delivery and urban transportation has become crucial as businesses strive to meet customer expectations for fast and accurate deliveries. Class 2 trucks, offering a balance between payload capacity and maneuverability, are ideal for navigating congested urban areas while carrying moderate loads. These vehicles provide flexibility and efficiency in urban settings where larger trucks may not be practical. The growing demand for local transportation services in construction, service, and logistics sectors further supports market growth, as class 2 trucks remain an optimal choice due to their adaptability and fuel efficiency.

Despite the growing demand, the class 2 truck market faces challenges, particularly in terms of emission regulations and operational costs. Stricter environmental standards across cities and regions are pushing truck manufacturers to ensure compliance, often leading to higher production costs for manufacturers. Meeting these regulations requires technological innovations and the use of cleaner fuels or alternative technologies. Rising fuel prices also affect the cost-effectiveness of class 2 trucks, which can significantly increase operational expenses, especially for businesses with large fleets. Although these trucks offer better fuel efficiency than larger vehicles, their fuel consumption still impacts the overall cost for companies seeking to minimize operational expenses. Overcoming these challenges is essential for maintaining competitiveness in the market.

The class 2 truck market presents significant growth opportunities, particularly with the increasing adoption of electric and hybrid vehicles. As governments and businesses focus on reducing carbon emissions and improving energy efficiency, electric and hybrid class 2 trucks are gaining traction. These trucks offer lower operational costs due to reduced fuel consumption and less frequent maintenance needs compared to traditional vehicles with internal combustion engines. Government incentives and subsidies are helping accelerate the adoption of electric vehicles, further driving market growth. The expansion of charging infrastructure and advancements in battery technology also contribute to the market’s development, making electric class 2 trucks more viable and attractive for businesses, particularly those in urban settings looking for eco-friendly alternatives.

A significant trend in the class 2 truck market is the integration of advanced telematics and fleet management solutions. These technologies enable fleet operators to optimize vehicle performance by providing real-time data on vehicle locations, driving behavior, fuel efficiency, and overall operational efficiency. By using telematics systems, businesses can reduce downtime, improve fleet utilization, and manage maintenance schedules more effectively. Telematics allow for better route optimization, reducing fuel consumption and improving delivery efficiency. As the market for connected vehicles continues to grow, class 2 trucks are increasingly being equipped with these advanced systems. This trend is enhancing operational capabilities, lowering costs, and improving safety, contributing to the market's growth and increasing the demand for technologically advanced fleet management solutions.

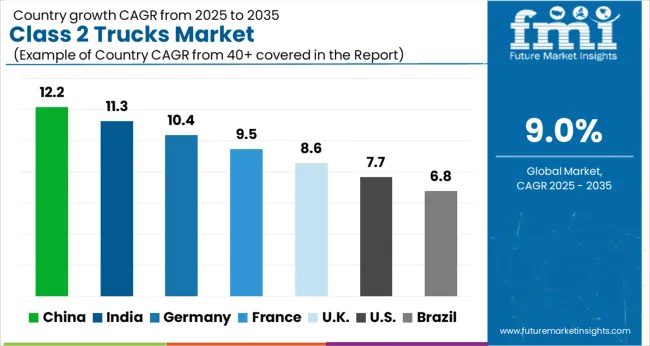

| Country | CAGR |

|---|---|

| China | 12.2% |

| India | 11.3% |

| Germany | 10.4% |

| France | 9.5% |

| UK | 8.6% |

| USA | 7.7% |

| Brazil | 6.8% |

Global Class 2 trucks market demand is projected to rise at a 9.0% CAGR from 2025 to 2035. Of the five profiled markets out of 40 covered, China leads at 12.2%, followed by India at 11.3%, and France at 9.5%, while the United Kingdom records 8.6% and the United States posts 7.7%. These rates translate to a growth premium of +35% for China, +25% for India, and +5% for France versus the baseline, while the United States and the United Kingdom show slower growth. Divergence reflects local catalysts: rising demand for logistics solutions and urbanization in China and India, while more mature markets like the United States and the United Kingdom experience moderate growth due to established truck fleets and infrastructure. The analysis includes over 40+ countries, with the leading markets detailed below.

The class 2 trucks market in China is expanding rapidly at a CAGR of 12.2%, driven by the country’s significant investments in infrastructure, logistics, and urbanization. The rapid growth of e-commerce and consumer goods industries in China has created a surge in demand for light-duty trucks used for last-mile deliveries. The increasing focus on urbanization, along with the government’s push to enhance transportation networks in both urban and rural areas, is boosting demand for Class 2 trucks. China’s growing industrial and retail sectors, along with its vast road infrastructure, further enhance the need for efficient transportation solutions.

The class 2 trucks market in India is projected to grow at a CAGR of 11.3%, supported by the country’s expanding logistics, e-commerce, and manufacturing sectors. The government’s focus on improving infrastructure, particularly in rural and semi-urban areas, is driving the need for light-duty trucks. As India continues to experience rapid urbanization, the demand for transportation solutions, including Class 2 trucks, is rising. The country’s growing middle class and their increasing purchasing power further fuel demand for goods and services, contributing to the growth of the light-duty truck market. Additionally, the rise of e-commerce and online retail platforms is creating demand for efficient delivery vehicles.

Demand for class 2 trucks is expected to expand at a CAGR of 9.5%, driven by a strong demand from the logistics, food, and retail sectors. France’s well-established road network and industrial base support the need for efficient transportation solutions. The rise in urbanization and the push for sustainable transport options are influencing the market for light-duty trucks. Additionally, government incentives and policies to reduce emissions and promote green transportation solutions are contributing to the adoption of more energy-efficient Class 2 trucks. As the French economy continues to shift towards digitalization and e-commerce, demand for Class 2 trucks for last-mile deliveries is also increasing.

Sale of class 2 trucks in the United Kingdom is growing at a moderate CAGR of 8.6%, driven by steady demand from the logistics and distribution industries. The UK’s mature infrastructure and high demand for transportation solutions in urban and suburban areas support the market. The country’s push for cleaner, more efficient vehicles and government policies to reduce emissions are influencing the adoption of greener Class 2 trucks. With the increase in e-commerce and home deliveries, the demand for light-duty trucks continues to rise. Although the market growth is slower compared to emerging markets, the UK remains a key player due to its well-developed logistics sector.

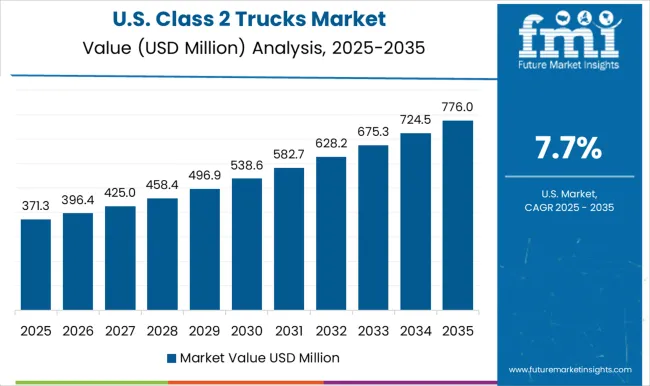

The USA Class 2 trucks market is expanding at a CAGR of 7.7%, with demand driven by the expansion of the logistics, delivery, and e-commerce sectors. While the market is mature, the growth of online retail and increasing demand for fast, reliable deliveries are driving the adoption of Class 2 trucks for last-mile transportation. The need for fuel-efficient and environmentally-friendly trucks is also contributing to market growth, as the USA government focuses on improving fuel standards and reducing emissions. The USA market benefits from its established road networks, growing distribution centers, and ongoing urbanization, which support the demand for light-duty trucks.

Chevrolet is a significant player, providing robust Class 2 trucks like the Chevrolet Silverado 2500HD, which is known for its power, towing capabilities, and advanced technology. Ford offers popular Class 2 trucks such as the Ford F-250, known for its durability, performance, and a wide range of customization options for both work and leisure use.

Freightliner is a major competitor, offering Class 2 trucks that focus on high-performance commercial applications, especially in the delivery and logistics sectors, with an emphasis on fuel efficiency and technology. Hino is another key player, providing a range of Class 2 trucks that cater to the commercial transportation industry, known for their reliability, low maintenance, and strong performance in heavy-duty tasks. Isuzu specializes in Class 2 trucks, offering models known for their dependability, fuel efficiency, and suitability for light commercial applications. Mercedes-Benz is recognized for offering premium Class 2 trucks, including the Mercedes-Benz Sprinter, which is favored for its combination of comfort, safety, and advanced features, making it ideal for both cargo and passenger transport. Mitsubishi Fuso provides versatile Class 2 trucks known for their efficiency, advanced technology, and strong performance in commercial operations, particularly in the light-duty and delivery segments. Nissan offers the Nissan Titan, a well-regarded Class 2 truck that combines performance with modern tech features, catering to both personal and light commercial use. Ram, with its popular Ram 2500, provides high-performance Class 2 trucks that are widely used for both personal and business applications, with a focus on towing, comfort, and durability. Utilimaster specializes in Class 2 trucks designed for commercial and fleet applications, offering cargo vans and work vehicles with an emphasis on efficiency and customizable features.

| Item | Value |

|---|---|

| Quantitative Units | USD 771.1 Million |

| Product | Minivan, Cargo Van, Full-size Pickup, and Step Van |

| Fuel | Gasoline, Diesel, Hybrid, Electric, and Others |

| Application | Urban delivery, Service & maintenance, Recreation & leisure, and Commercial |

| Drive Configuration | Rear-wheel drive, All-wheel drive, and Front-wheel drive |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Chevrolet, Ford, Freightliner, Hino, Isuzu, Mercedes-Benz, Mitsubishi Fuso, Nissan, Ram, and Utilimaster |

| Additional Attributes | Dollar sales by product type (pickup trucks, cargo vans, light-duty trucks) and end-use segments (commercial use, fleet management, personal use). Demand dynamics are driven by the increasing adoption of light-duty trucks in industries like logistics, construction, and services, with a growing emphasis on fuel efficiency, durability, and advanced technology. Regional trends indicate strong growth in North America, Europe, and Asia-Pacific, with a focus on vehicle electrification, fuel efficiency, and custom configurations to meet specific business needs driving market expansion. |

The global class 2 trucks market is estimated to be valued at USD 771.1 million in 2025.

The market size for the class 2 trucks market is projected to reach USD 1,825.4 million by 2035.

The class 2 trucks market is expected to grow at a 9.0% CAGR between 2025 and 2035.

The key product types in class 2 trucks market are minivan, cargo van, full-size pickup and step van.

In terms of fuel, gasoline segment to command 42.9% share in the class 2 trucks market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Class 7 Truck Market Size and Share Forecast Outlook 2025 to 2035

Class 8 Truck Market Size and Share Forecast Outlook 2025 to 2035

Class 3 Truck Market Size and Share Forecast Outlook 2025 to 2035

Class 1 Truck Market Size and Share Forecast Outlook 2025 to 2035

Classic Organic Pigments Market Size and Share Forecast Outlook 2025 to 2035

Class 4 Truck Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Class D Audio Amplifiers Market is Segmented by Type, End Use and Region through 2025 to 2035

Classified Platform Market Analysis by Type, Application, and Region Through 2035

Class 5 Trucks Market Size and Share Forecast Outlook 2025 to 2035

Class 6 Trucks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Air Classifying Mill Market Size and Share Forecast Outlook 2025 to 2035

Smart Classroom Market Size and Share Forecast Outlook 2025 to 2035

Virtual Classroom Market Trends – Size, Demand & Forecast 2024-2034

Enterprise-Class Hybrid Storage Market Size and Share Forecast Outlook 2025 to 2035

Fault Detection and Classification Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Defense C Class Parts Market Size and Share Forecast Outlook 2025 to 2035

20MnCr5 Steel Market Size and Share Forecast Outlook 2025 to 2035

2-Ethoxy Propene Market Size and Share Forecast Outlook 2025 to 2035

2-in-1 Material Rack Correction Machine Market Size and Share Forecast Outlook 2025 to 2035

2-Ethyl-3,4-ethylenedioxythiophene Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA