The 2-Ethyl-3,4-ethylenedioxythiophene (EDOT) market is expected to grow from USD 22.0 billion in 2025 to USD 32.0 billion by 2035, registering a 3.8% CAGR and generating an absolute dollar opportunity of USD 10.0 billion. Growth is driven by increasing demand for conductive polymers in electronics, energy storage, organic photovoltaics, and sensor applications.

EDOT is valued for its high conductivity, stability, and ease of polymerization, which support adoption across various industrial and commercial sectors. Advancements in polymer synthesis and the expansion of flexible electronics further support market development globally. Analyzing the contribution of volume versus price growth provides insight into the primary drivers of revenue.

From 2025 to 2028, growth is largely volume-driven, supported by increased production and adoption in North America, Europe, and the Asia Pacific, particularly for printed electronics and energy storage applications. Between 2029 and 2032, both volume and price contribute, as manufacturers introduce higher-purity grades, specialized derivatives, and premium EDOT-based polymers to meet technical requirements, allowing price growth to complement rising demand.

From 2033 to 2035, price growth increasingly drives revenue, particularly in mature markets with stabilized volume, where higher-value applications and specialty polymers command premium pricing. The USD 10.0 billion opportunity reflects a balanced combination of rising production volumes and value-based pricing, highlighting consistent and sustainable growth in the EDOT market between 2025 and 2035.

| Metric | Value |

|---|---|

| 2-Ethyl-3,4-ethylenedioxythiophene Market Estimated Value in (2025 E) | USD 22.0 billion |

| 2-Ethyl-3,4-ethylenedioxythiophene Market Forecast Value in (2035 F) | USD 32.0 billion |

| Forecast CAGR (2025 to 2035) | 3.8% |

The 2-ethyl-3,4-ethylenedioxythiophene (EDOT) market is driven by five primary parent markets with specific shares. Conductive polymers lead with 40%, as EDOT is a key monomer for synthesizing PEDOT used in electronic and optoelectronic applications. Electronics and semiconductors contribute 25%, employing EDOT-based polymers in OLEDs, solar cells, and sensors. Coatings and films represent 15%, where EDOT enhances conductivity and corrosion resistance. Biomedical and healthcare applications account for 10%, using EDOT polymers in bioelectronics, tissue engineering, and biosensors. Energy storage systems hold 10%, leveraging EDOT in supercapacitors and batteries. These sectors collectively define demand and guide technological adoption.

Recent developments in the 2-ethyl-3,4-ethylenedioxythiophene market focus on performance optimization, sustainability, and application expansion. Manufacturers are advancing polymerization techniques to improve conductivity, processability, and stability of PEDOT. Research is exploring EDOT derivatives for enhanced electrochemical properties in sensors, energy storage, and optoelectronic devices. Eco-friendly synthesis methods and solvent-free processes are gaining traction to reduce environmental impact. Integration into flexible electronics, wearable devices, and advanced coatings is expanding market opportunities.

The 2-Ethyl-3,4-ethylenedioxythiophene market is experiencing focused growth as demand rises for advanced conductive polymers in emerging electronics and optoelectronic applications. This compound serves as a critical monomer in the synthesis of PEDOT, prized for its high conductivity, transparency, and stability.

The market is being driven by growing requirements for lightweight, flexible, and durable conductive materials in displays, sensors, and energy devices. As product development shifts toward miniaturized and high-performance components, 2-ethyl-3,4-ethylenedioxythiophene is gaining preference due to its processing advantages and consistent electrical properties.

The market outlook remains optimistic with increased R&D investments aimed at enhancing purity levels and reducing production costs. Additionally, strong demand from the electronics sector and the development of novel applications in bioelectronics and wearable technology are expected to sustain long-term growth.

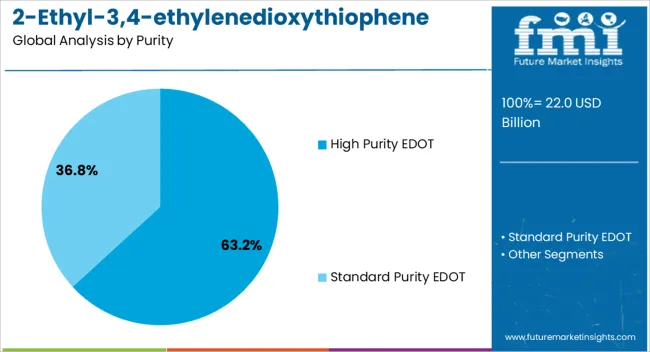

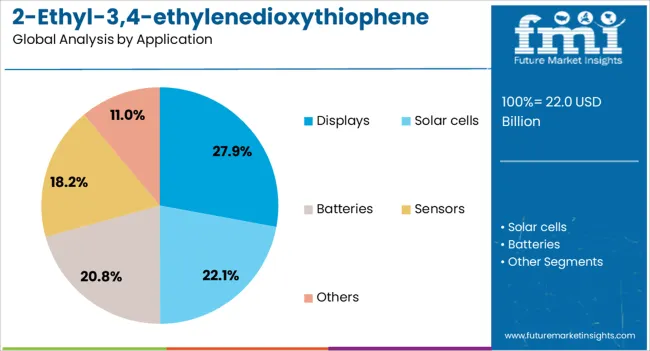

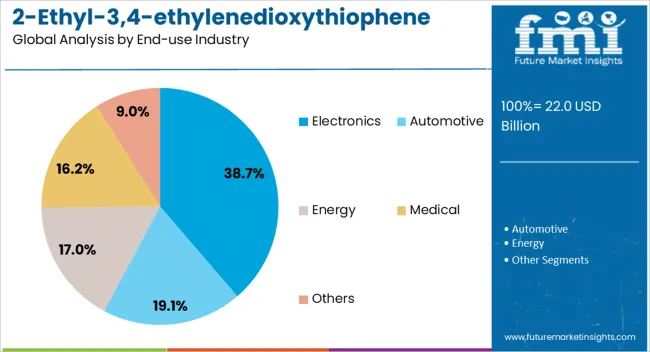

The 2-ethyl-3,4-ethylenedioxythiophene market is segmented by purity, application, end-use industry, and geographic regions. By purity, 2-ethyl-3,4-ethylenedioxythiophene market is divided into High Purity EDOT and Standard Purity EDOT. In terms of application, 2-ethyl-3,4-ethylenedioxythiophene market is classified into Displays, Solar cells, Batteries, Sensors, and Others. Based on end-use industry, 2-ethyl-3,4-ethylenedioxythiophene market is segmented into Electronics, Automotive, Energy, Medical, and Others. Regionally, the 2-ethyl-3,4-ethylenedioxythiophene industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The high purity EDOT segment leads the market with a commanding 63% share, reflecting the compound’s critical role in advanced material synthesis where electrical consistency and minimal impurities are essential. High purity formulations are particularly sought after in optoelectronic and medical device applications, where performance stability and reproducibility are non-negotiable.

This segment benefits from ongoing advancements in purification technology and process optimization, which enable the production of material that meets stringent industrial and research standards. The rise in demand for high-quality PEDOT, especially in thin-film electronics and organic photovoltaics, continues to elevate the importance of this segment.

Growth is further supported by expanding regulatory emphasis on material quality and the increasing prevalence of precision-based manufacturing across the electronics industry.

The displays segment captures 28% of the market, driven by the integration of EDOT-derived conductive polymers in a wide range of flat-panel and flexible display technologies. These materials are favored for their ability to maintain high optical transparency while offering low electrical resistance, which is essential for touchscreens, OLED panels, and other next-generation display formats.

As demand for lightweight, energy-efficient, and durable display systems accelerates, especially in consumer electronics and automotive sectors, the use of 2-ethyl-3,4-ethylenedioxythiophene-based solutions is expected to rise accordingly. The segment’s growth is also supported by increasing R&D efforts to develop transparent and stretchable electronics, where polymer-based conductors are considered vital.

Continuous innovation in display performance and form factor will likely sustain demand within this application category.

The electronics industry dominates end-use demand with a 39% market share, driven by its wide adoption of EDOT-based polymers for enhancing conductivity, flexibility, and miniaturization in components. The material’s adaptability to various deposition methods, including inkjet printing and roll-to-roll processing, makes it highly suitable for next-generation electronic devices.

Applications range from printed circuits and sensors to electrochromic windows and smart textiles, with the electronics sector leveraging EDOT’s performance benefits to improve device reliability and efficiency. The shift toward wearable, flexible, and low-power electronics further reinforces the prominence of this segment.

As manufacturers increasingly focus on sustainable and scalable material solutions, the adoption of EDOT in electronic systems is expected to grow, positioning the segment for continued dominance within the market.

The global 2-Ethyl-3,4-ethylenedioxythiophene (EDOT) market is expanding due to increasing demand in organic electronics, conductive polymers, and advanced material applications. Asia Pacific accounts for over 40% of production, driven by electronics manufacturing, photovoltaics, and energy storage sectors. North America and Europe focus on high-purity EDOT for research and industrial applications. Technological innovations in polymerization, coating, and conductive film processing enhance performance and conductivity. Rising adoption in flexible electronics, smart devices, and energy storage systems is creating measurable opportunities for global market growth.

The EDOT market is primarily driven by the increasing use of conductive polymers in electronics, photovoltaics, and energy storage systems. Poly(3,4-ethylenedioxythiophene) (PEDOT), synthesized from EDOT, is widely used in organic solar cells, supercapacitors, and flexible electronics due to high conductivity and stability. Demand in Asia Pacific is increasing at 6–8% annually because of electronics manufacturing and renewable energy adoption. High-purity EDOT with ≥99% purity is essential for consistent polymer performance. Research and development in PEDOT-based coatings for antistatic applications, OLEDs, and sensors further fuels market growth. Industrial adoption in coatings, printed electronics, and transparent conductive films also supports sustained demand globally.

Opportunities in the EDOT market arise from adoption in flexible electronics, organic photovoltaics, and energy storage devices. PEDOT films derived from EDOT improve conductivity, transparency, and chemical stability in flexible displays, touchscreens, and wearable electronics. Asia Pacific is witnessing strong growth due to increasing smart device production and solar panel manufacturing. Integration of EDOT-based polymers in supercapacitors and organic batteries enhances energy efficiency by 10–15%. Expansion in research applications for antistatic coatings, electrochromic devices, and sensors provides additional avenues. Manufacturers investing in scalable polymerization processes and high-purity EDOT production can capture market share across electronics, energy, and advanced material sectors globally.

Key trends in the EDOT market include advancements in polymerization techniques, coating processes, and conductive polymer integration. Solution-processable PEDOT enables high-throughput manufacturing for organic electronics and solar cells. Asia Pacific leads adoption due to electronics and renewable energy infrastructure, while Europe and North America emphasize high-performance EDOT derivatives for R&D and specialty applications. Increasing use of PEDOT in flexible displays, OLEDs, and printed sensors highlights demand for thin, uniform conductive films. Companies are adopting continuous flow polymerization, automated deposition, and high-purity synthesis to enhance yield and consistency. Trends toward miniaturization, wearable electronics, and energy-efficient devices are driving industrial adoption globally.

The EDOT market faces challenges from high production costs, complex synthesis, and purity requirements. High-purity EDOT (>99%) is essential for consistent polymer conductivity, but production involves costly precursors and multi-step synthesis. Scaling production while maintaining purity can increase operational costs by 20–30%. Limited availability of specialized chemical intermediates restricts production in emerging markets. Handling and storage require strict safety measures due to EDOT’s sensitivity to moisture and oxygen. Manufacturers must focus on optimizing synthesis, reducing energy consumption, and ensuring consistent purity to overcome these barriers. Regulatory compliance in chemical handling and environmental standards further influences global adoption and cost structures.

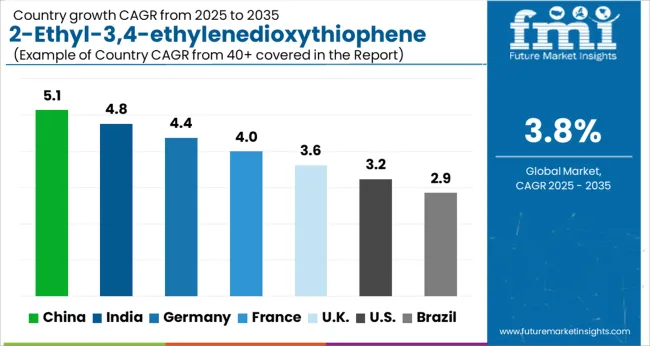

| Country | CAGR |

|---|---|

| China | 5.1% |

| India | 4.8% |

| Germany | 4.4% |

| France | 4.0% |

| U.K. | 3.6% |

| U.S. | 3.2% |

| Brazil | 2.9% |

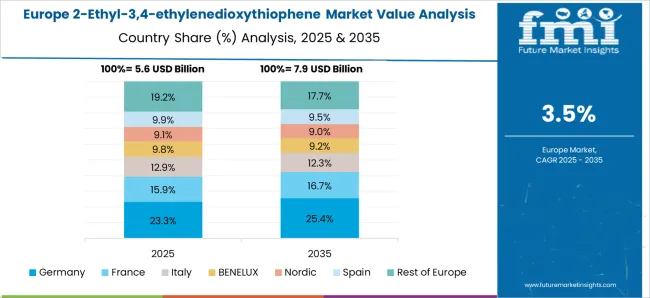

The 2-Ethyl-3,4-ethylenedioxythiophene market is projected to grow at a global CAGR of 3.8% through 2035, supported by rising demand in electronics, conductive polymers, and advanced materials applications. China leads at 5.1%, a 1.34× multiple over the global benchmark, driven by BRICS-focused chemical production, industrial adoption, and electronics manufacturing. India follows at 4.8%, a 1.26× multiple, reflecting growth in conductive polymer production, electronic devices, and industrial applications. Germany records 4.4%, a 1.16× multiple, shaped by OECD-backed innovation, high-quality manufacturing, and specialty chemical use. The United Kingdom posts 3.6%, 0.95× the global CAGR, with adoption centered on advanced materials and electronics applications. The United States stands at 3.2%, 0.84× the benchmark, with steady uptake in polymer applications, electronics, and specialty chemicals. BRICS nations contribute the majority of market volume, OECD countries emphasize quality and technological development, while ASEAN markets support growth through expanding industrial and electronics manufacturing. This report includes insights on 40+ countries; the top markets are shown here for reference.

The 2-ethyl-3,4-ethylenedioxythiophene (EDOT) market in China is projected to grow at a CAGR of 5.1%, driven by demand from conductive polymers, flexible electronics, and energy storage applications. Leading manufacturers such as Heraeus, Sigma-Aldrich, and local chemical producers provide high-purity EDOT for polymerization and electronic devices. Adoption is concentrated in organic electronics, sensors, and supercapacitors. Technological trends focus on improved polymerization efficiency, high conductivity, and compatibility with large-scale manufacturing. Government initiatives supporting advanced materials, electronics manufacturing, and chemical research reinforce market growth. Rising demand for flexible and conductive polymer solutions accelerates adoption in China.

The EDOT market in India is expected to expand at a CAGR of 4.8%, supported by growth in electronics, polymer composites, and energy storage sectors. Key suppliers such as Sigma-Aldrich, Merck, and local chemical companies provide high-purity EDOT for polymerization and flexible electronics applications. Adoption is concentrated in organic electronics, sensors, and capacitors. Technological developments focus on enhanced polymerization processes, improved conductivity, and scalability for industrial use. Government policies promoting advanced materials, electronics manufacturing, and research infrastructure reinforce market growth. Increasing demand for high-performance conductive polymers accelerates adoption across India.

The EDOT market in Germany is projected to grow at a CAGR of 4.4%, driven by adoption in conductive polymers, sensors, and energy storage devices. Leading companies such as Heraeus, Sigma-Aldrich, and Merck supply high-purity EDOT for electronic, polymer, and research applications. Adoption is concentrated in flexible electronics, sensors, and supercapacitors. Technological trends focus on polymerization efficiency, high conductivity, and integration with industrial-scale processes. Government initiatives supporting advanced materials, electronics research, and chemical production reinforce market growth. Rising demand for high-quality conductive polymers accelerates adoption in Germany.

The EDOT market in the United Kingdom is projected to grow at a CAGR of 3.6%, supported by demand in conductive polymers, energy storage devices, and flexible electronics. Key suppliers such as Merck, Sigma-Aldrich, and Heraeus provide high-purity EDOT suitable for polymerization, research, and electronic applications. Adoption is concentrated in sensors, supercapacitors, and polymer-based devices. Technological trends emphasize high conductivity, polymerization efficiency, and process scalability. Government programs promoting research in advanced materials, electronics, and chemical production reinforce market growth. Increasing demand for flexible, high-performance polymer solutions supports adoption in the United Kingdom.

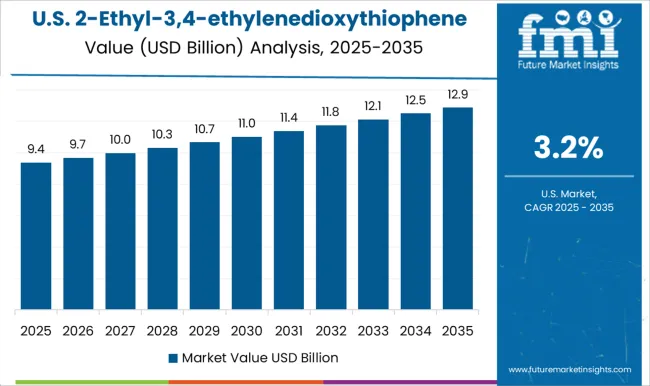

The EDOT market in the United States is expected to grow at a CAGR of 3.2%, supported by adoption in conductive polymers, flexible electronics, and energy storage applications. Leading manufacturers such as Heraeus, Merck, and Sigma-Aldrich supply high-purity EDOT for polymerization and electronic devices. Adoption is concentrated in supercapacitors, sensors, and flexible electronics. Technological trends include enhanced polymerization efficiency, high conductivity, and industrial-scale process integration. Government initiatives promoting advanced materials, electronics research, and energy storage development reinforce market adoption. Rising demand for high-quality conductive polymers and flexible devices supports steady growth in the United States.

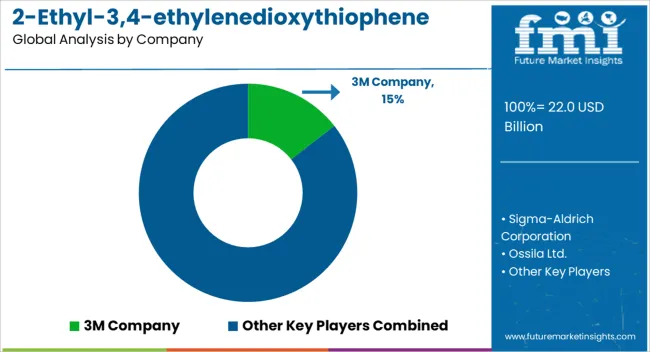

Competition in the 2-Ethyl-3,4-ethylenedioxythiophene sector is being driven by demand for high-purity monomers used in conductive polymers, with companies focusing on product quality, consistency, and advanced synthesis capabilities. 3M Company and Sigma-Aldrich Corporation are being advanced with laboratory-grade and bulk supply options that cater to research institutions and industrial applications, emphasizing purity, reproducibility, and handling safety. Ossila Ltd. and TCI Chemicals are being positioned with monomers suitable for organic electronics, including photovoltaics and polymer-based semiconductors. Xi'an Polymer Light Technology Corp. and Tokyo Chemical Industry Co., Ltd. are being showcased with scalable production capabilities and custom formulations to meet specialized electronic material requirements. Lianyungang Ruiqiang Chemical Co., Ltd. and BeiJing Hwrk Chemicals Limited are being applied with high-yield, cost-effective synthesis options, while Kanto Chemical Co., Inc. and Hangzhou J&H Chemical Co., Ltd. are being highlighted for their strict quality control and adherence to international standards. Energy Chemical, Rieke Metals, LLC, Fluorochem Limited, and Changzhou Hongke Chemical Co., Ltd. are being positioned with tailored supply volumes, packaging options, and technical support. Product brochures are being structured with chemical specifications, molecular purity, handling instructions, and potential applications in electronic devices. Strategies focus on strengthening production reliability, expanding distribution networks, and innovating for specialized high-performance polymer applications. Collectively, these companies are being advanced to reinforce the global supply chain of 2-Ethyl-3,4-ethylenedioxythiophene by delivering high-quality, reliable monomers that meet evolving industrial and research needs.

| Item | Value |

|---|---|

| Quantitative Units | USD 22.0 Billion |

| Purity | High Purity EDOT and Standard Purity EDOT |

| Application | Displays, Solar cells, Batteries, Sensors, and Others |

| End-use Industry | Electronics, Automotive, Energy, Medical, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | 3M Company, Sigma-Aldrich Corporation, Ossila Ltd., TCI Chemicals, Xi'an Polymer Light Technology Corp., Tokyo Chemical Industry Co., Ltd., Lianyungang Ruiqiang Chemical Co., Ltd., BeiJing Hwrk Chemicals Limited, Kanto Chemical Co., Inc., Hangzhou J&H Chemical Co., Ltd., Energy Chemical, Rieke Metals, LLC, Fluorochem Limited, and Changzhou Hongke Chemical Co., Ltd. |

| Additional Attributes | Dollar sales by product type and end use, demand dynamics across electronics, conductive polymers, and specialty chemicals, regional trends in Asia, Europe, and North America, innovation in conductivity, stability, and process efficiency, environmental impact of chemical production and disposal, and emerging use cases in flexible electronics and organic semiconductors. |

The global 2-ethyl-3,4-ethylenedioxythiophene market is estimated to be valued at USD 22.0 billion in 2025.

The market size for the 2-ethyl-3,4-ethylenedioxythiophene market is projected to reach USD 32.0 billion by 2035.

The 2-ethyl-3,4-ethylenedioxythiophene market is expected to grow at a 3.8% CAGR between 2025 and 2035.

The key product types in 2-ethyl-3,4-ethylenedioxythiophene market are high purity edot and standard purity edot.

In terms of application, displays segment to command 27.9% share in the 2-ethyl-3,4-ethylenedioxythiophene market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA