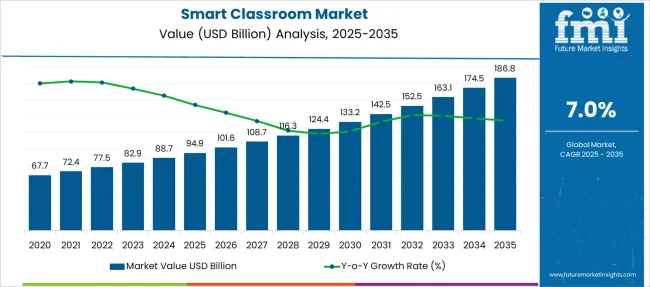

The Smart Classroom Market is estimated to be valued at USD 94.9 billion in 2025 and is projected to reach USD 186.8 billion by 2035, registering a compound annual growth rate (CAGR) of 7.0% over the forecast period.

| Metric | Value |

|---|---|

| Smart Classroom Market Estimated Value in (2025 E) | USD 94.9 billion |

| Smart Classroom Market Forecast Value in (2035 F) | USD 186.8 billion |

| Forecast CAGR (2025 to 2035) | 7.0% |

The smart classroom market is expanding rapidly as educational institutions seek to enhance learning experiences through technology integration. Increasing adoption of digital tools and interactive platforms has transformed traditional classrooms into dynamic learning environments.

The growing emphasis on personalized education and remote learning capabilities has accelerated demand for smart classroom solutions globally. Governments and education boards have been investing in modernizing school infrastructure to support technology-driven teaching methods.

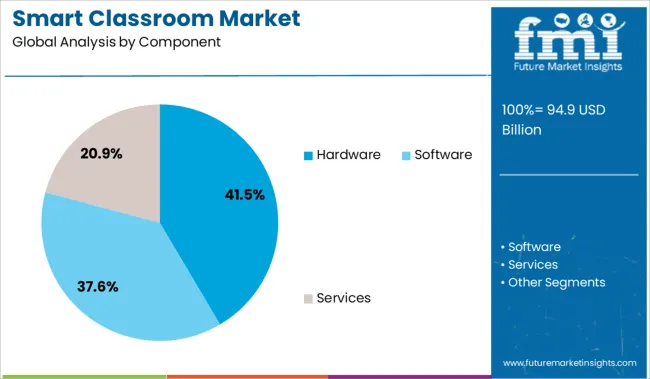

Additionally, the rising penetration of internet connectivity and mobile devices in schools has facilitated the implementation of smart classrooms, particularly in K-12 education. Ongoing developments in augmented reality, artificial intelligence, and cloud computing are expected to further enrich classroom interactivity and collaboration. Market growth is expected to be driven by the hardware segment, which provides the physical foundation for smart classrooms, and the K-12 education segment, reflecting the focus on early education technology adoption.

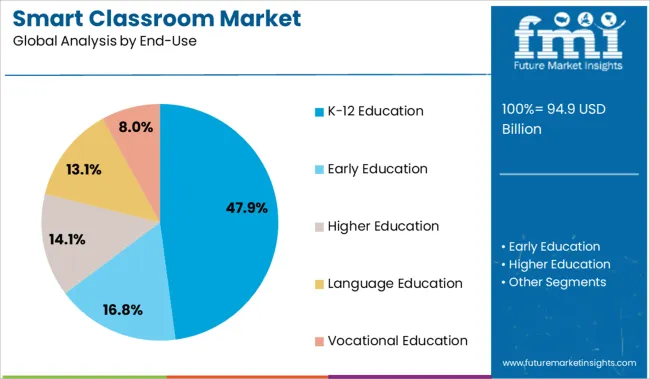

The market is segmented by Component and End-Use and region. By Component, the market is divided into Hardware, Software, and Services. In terms of End-Use, the market is classified into K-12 Education, Early Education, Higher Education, Language Education, and Vocational Education. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Hardware segment is projected to contribute 41.5% of the smart classroom market revenue in 2025, establishing it as the leading component category. This segment includes interactive displays, projectors, sensors, and communication devices essential for creating an immersive educational environment.

Schools and educational institutions have prioritized hardware investments to support seamless integration of software applications and content delivery systems. The advancement of affordable and versatile hardware options has enabled wider adoption across diverse educational settings.

Additionally, the durability and ease of maintenance of hardware solutions have made them preferred choices for long-term educational investments. As demand for reliable and user-friendly devices grows, the Hardware segment is expected to maintain its significant market share.

The K-12 Education segment is expected to hold 47.9% of the smart classroom market revenue in 2025, maintaining its dominance among end-use sectors. Growth in this segment is driven by the increasing integration of technology in primary and secondary schools to improve student engagement and learning outcomes.

Educational policymakers have emphasized digital literacy from early grades, boosting funding for smart classroom initiatives. Schools are adopting interactive learning tools to accommodate diverse learning styles and foster collaboration among students.

The rising availability of government grants and public-private partnerships has facilitated technology adoption in K-12 institutions. Furthermore, the shift towards hybrid and remote learning models has reinforced the need for smart classroom infrastructure in this segment. Continued investments and curriculum reforms are expected to sustain the growth momentum in K-12 education.

As per the Smart Classroom Market research by Future Market Insights - a market research and competitive intelligence provider, historically, from 2020 to 2024, the market value of the Smart Classroom Market increased at around 7.8% CAGR.

Based on End-use, the Smart Classroom industry is being affected by the K 12 Education component. This segment is expected to expand at a CAGR of 7.3% through 2035.

The expansion of the smart classroom market is being fuelled by increased demand and use of digital learning technologies, as well as an increase in the number of mobile learning apps.

The rising education spending has been the key factor in the growth of the smart classroom market. With USD 88.67.7 Billion in investments in VC-backed education in 2024, the growing expenditure on smart education is expected to further propel the smart classroom market. This investment has more than doubled from that of USD 67.7 Billion in 2020.

BYJU for instance, raised USD 88.67.7 Million for K-12 personalized learning programs, extending the momentum beyond 2024. Articulate raised USD 1.5 Billion for corporate training technologies, while BYJU raised USD 1.5 Billion for the same.

Similarly, education technology businesses focusing on skill development have been hit hard. In February 2024, Roblox, an online gaming portal that teaches programming, received USD 150 Million in investment. Such significant investments and budgets are predicted to fuel market expansion over the forecast period.

Increased mobile adoption and the lowering prices of e-learning resources are considered key game-changer in the expansion of the education business. Europe, the United States, and developing markets lead the way with respect to internet and mobile penetration.

Meanwhile, emerging markets are likely to grow significantly, with mobile becoming a key instrument for gaining knowledge. As a result, the market is expected to rise rapidly in the coming years.

The smart classroom industry is also largely influenced by government approaches toward providing learners with digital education. Several nations' governments are becoming involved in delivering digital learning in various educational institutions. Governments are pushing different institutions to offer online learning programs in addition to offering internet access.

For example, FutureSchools@Singapore, a government program in Singapore, delivers high-end technological and digital material to Singapore schools. Furthermore, in January 2025, the Delhi government in India took a creative step to build and provide 20,000+ smart classroom facilities in different schools by making 16 smart classrooms in Shaheed Amir Chand Sarvodaya Vidyalaya.

The idea is to provide a smart classroom that can improve the teaching-learning process by providing the learners with access to all online learning materials. Modern cameras would be put in the classrooms to record live classes, which students and teachers would be able to access later.

As a result, the growth in government initiatives promoting digital education is one of the key drivers driving the global smart classroom market.

Furthermore, the increased usage of the internet of things (IoT) and other novel techniques in the educational sector is likely to propel the smart classroom market ahead.

During the projected period, the United States is expected to hold the largest share of the global Smart Classroom Market with a projected market size of over USD 186.8 Billion by 2035.

The large smart classroom market size can be ascribed to a large number of investment firms and private equity investors investing in the smart classroom industry in the United States. For example, Class Technologies Inc., an educational platform located in the United States that provides both higher education classrooms and K-12 classes, earned around USD 88.7 Million in Series B investment in July 2024.

This support has led them to extend their worldwide footprint outside of the United States and remain resourced to assist colleges in teaching affected students during the epidemic.

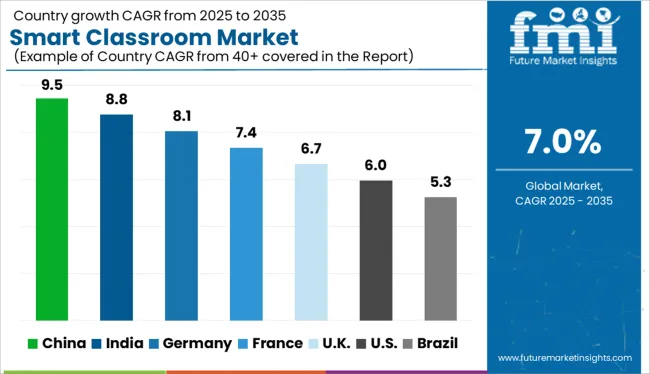

Along with the United States, the Asia Pacific smart classroom industry will also develop rapidly due to positive government initiatives in Japan, China, India, and Australia. Leading firms are anticipated to profit from the expansion of smart learning platforms. Smart classrooms will be helpful to generate traction as large corporations prioritize interactive learning.

Europe is also expected to account for a significant percentage of global smart classroom revenues due to the usage of e-learning solutions. Furthermore, with the increasing popularity of AI-enabled gadgets, education management systems will be in great demand in the coming future.

The United States is expected to account for the highest market size of USD 186.8 Billion by the end of 2035 with an expected CAGR of 6.1% between 2025 and 2035. Technological advancements, rising usage of the internet of things (IoT) and other novel techniques, strong government support, increased mobile adoption, and the low price of e-learning resources and foreign investments are the key drivers of growth.

The K-12 Education segment is forecasted to grow at the highest CAGR of over 7.3% from 2025 to 2035. It is due to the rising pattern of game-based education in the K-12 domain. The majority of K-12 instructors support gamification projects in schools to improve students' arithmetic learning skills through the incorporation of practical, project-based work.

Incorporating technology in this area also allows for immersive material and experiences, like virtual field excursions and intricate lab-based investigations, leading to an engaging educational experience. For example, Matific, an e-Learning platform that provides Mathematics instructions for K-6 kids, will create a gamified setting for their students to study Mathematics in September 2024.

This advanced edition is AI-powered and customized for students to help them improve their arithmetic abilities.

The Hardware segment is forecasted to grow at the highest CAGR of around 7.1% from 2025 to 2035. It is due to the rising importance of smart classrooms in the education business. For example, Creative Labs., a provider of virtual reality for the smart classroom sector, delivered virtual reality headphones to Smt. Godavari Devi Saraf Senior Secondary School in Andhra Pradesh, India, in February 2025, to allow learners to feel what they are studying.

The school provides 20 minutes every day for students to use virtual reality headsets. Additionally, this enables learners to have real-time exposure to what they are studying in disciplines such as science, where they might study the structure of the heart of a human being via headphones.

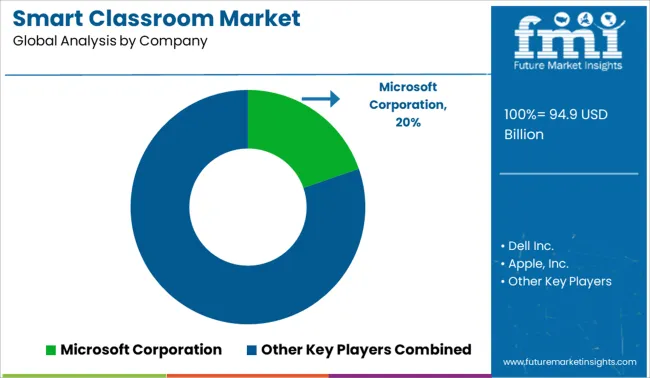

Market participants are pursuing a variety of strategic initiatives, including partnerships, mergers and acquisitions, collaborations, and the creation of new products and technologies. Some of the key market participants in the Smart Classroom market include Microsoft Corporation, Dell Inc., Apple, Inc., Fujitsu Ltd., Cisco Systems, Inc., Discovery Communication, Dynavox Mayer-Johnson, Huawei Technologies Co., Blackboard Inc., and SAP SE.

Some of the recent developments in the smart classroom market include:

In January 2025, Teachmint Technologies Pvt. Ltd, an e-learning company for teachers and students, purchased MyClassCampus (Teachmint Technologies Pvt. Ltd), an ERP platform for educational enterprises, in January 2025. By merging its learning management system (LMS) with ERP software, Teachmint will be able to increase its offerings in schools and other educational institutions.

In March 2024, Huawei Technologies Co., Ltd. announced the debut of a smart classroom solution that depends on the HUAWEI IdeaHub Board as well as the educational cloud platform. This approach is utilized for online education, live broadcasting, and remote teaching. Moreover, the group discussion scenario allows instructors and students to exchange material and engage with one another, enhancing student interest and encouraging them to take charge, thereby improving the learning environment and efficiency.

In May 2024, SAP SE introduced SAP Learning Hub, a free learning resource for students and teachers. This new free program for the next generations of talent will provide the information and opportunities needed to attain in-demand digital skills.

In February 2024, Blackboard Inc. revealed the acceptance of its edtech software and services for Navajo Technical University (NTU). Through the cooperation, the firm provides its cloud-based installation of a Learning Management System (LMS), online educational solution, course material accessibility service, blackboard collaborations, blackboard studies, blackboard ally, and IT help desk services.

Similarly, recent developments related to Smart Classroom Solution Providers have been tracked by the team at Future Market Insights, which are available in the full report.

The global smart classroom market is estimated to be valued at USD 94.9 billion in 2025.

The market size for the smart classroom market is projected to reach USD 186.8 billion by 2035.

The smart classroom market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in smart classroom market are hardware, _interactive whiteboards, _digital displays, _smart projectors, _others, software, _learning management software, _student response software, _classroom management and assessment software, _distance learning solutions, _security, _others, services, _managed/outsourced and _professional.

In terms of end-use, k-12 education segment to command 47.9% share in the smart classroom market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smart Electrogastrogram Recorder Market Size and Share Forecast Outlook 2025 to 2035

Smart Aerial Work Robots Market Size and Share Forecast Outlook 2025 to 2035

Smart Bladder Scanner Market Size and Share Forecast Outlook 2025 to 2035

Smart School Bus Platform Market Size and Share Forecast Outlook 2025 to 2035

Smart Home Wireless Smoke Detector Market Size and Share Forecast Outlook 2025 to 2035

Smart Bus Platform Market Size and Share Forecast Outlook 2025 to 2035

Smart Vision Processing Chips Market Size and Share Forecast Outlook 2025 to 2035

Smart Touch Screen Scale Market Size and Share Forecast Outlook 2025 to 2035

Smart Magnetic Drive Conveyor System Market Size and Share Forecast Outlook 2025 to 2035

Smart Wheelchair market Size and Share Forecast Outlook 2025 to 2035

Smart Mining Technologies Market Size and Share Forecast Outlook 2025 to 2035

Smart Parking Market Size and Share Forecast Outlook 2025 to 2035

Smart Digital Valve Positioner Market Forecast and Outlook 2025 to 2035

Smart Card IC Market Size and Share Forecast Outlook 2025 to 2035

Smart-Tag Inlay Inserters Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Smart TV Market Forecast and Outlook 2025 to 2035

Smart/AI Toy Market Size and Share Forecast Outlook 2025 to 2035

Smart Locks Market Size and Share Forecast Outlook 2025 to 2035

Smart Sprinkler Controller Market Size and Share Forecast Outlook 2025 to 2035

Smart Indoor Gardening System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA