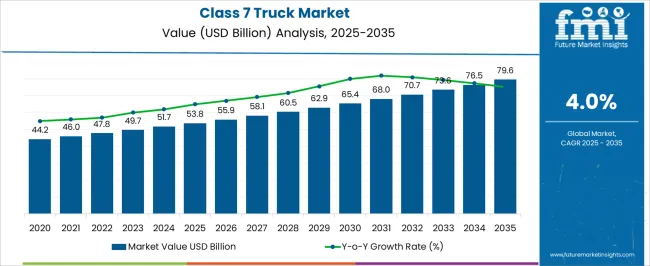

The Class 7 Truck Market is estimated to be valued at USD 53.8 billion in 2025 and is projected to reach USD 79.6 billion by 2035, registering a compound annual growth rate (CAGR) of 4.0% over the forecast period. An acceleration and deceleration pattern analysis reveals gradual growth, with a strong early phase followed by a stabilization period as the market matures. Between 2025 and 2030, the market grows from USD 53.8 billion to USD 65.4 billion, contributing USD 11.6 billion in growth, with a CAGR of 4.2%. This early-stage growth is driven by increasing demand for class 7 trucks in freight and logistics, particularly due to expanding e-commerce, global supply chains, and demand for higher payload capacity vehicles.

The continued development of infrastructure and logistics networks, along with the adoption of energy-efficient solutions in transportation, also drives growth in the early years. From 2030 to 2035, the market continues to expand from USD 65.4 billion to USD 79.6 billion, adding USD 14.2 billion in growth, with a slightly lower CAGR of 3.9%. This deceleration in growth rate reflects the market approaching maturity, as demand for class 7 trucks becomes more stable and saturated in developed regions. Despite this, demand remains strong in emerging markets and driven by upgrades in fleets and technology adoption, including electric and autonomous truck innovations. The overall pattern highlights robust early-phase acceleration, followed by steady, sustained growth.

| Metric | Value |

|---|---|

| Class 7 Truck Market Estimated Value in (2025 E) | USD 53.8 billion |

| Class 7 Truck Market Forecast Value in (2035 F) | USD 79.6 billion |

| Forecast CAGR (2025 to 2035) | 4.0% |

The Class 7 truck market is expanding steadily, driven by increasing freight volumes, regional logistics demand, and infrastructure development initiatives across key global economies. These trucks, positioned as medium heavy-duty vehicles, are essential for regional distribution and specialized commercial tasks that require high payload capacity without the added regulatory burden of Class 8.

Technological improvements in engine efficiency, telematics integration, and vehicle automation are further enhancing fleet performance and operational cost savings. Environmental regulations continue to shape product development, particularly influencing the choice of fuel systems and emissions technologies.

Growing investments in commercial transport fleets and rising demand for durable vehicles in urban and intercity routes are reinforcing market growth. The outlook remains positive as both private and public logistics operators modernize fleets to meet evolving efficiency, compliance, and sustainability expectations.

The class 7 truck market is segmented by fuel, application, axle, horsepower, ownership, and geographic regions. By fuel, the class 7 truck market is divided into Diesel, Freight delivery, Utility services, Construction & mining, Others, Natural gas, Freight delivery, Utility services, Construction & mining, Others, Hybrid electric, Freight delivery, Utility services, Construction & mining, Others, Others, Freight delivery, Utility services, Construction & mining, and Others.

In terms of application, the class 7 truck market is classified into Freight delivery, Utility services, Construction & mining, and Others. Based on axle, the class 7 truck market is segmented into 4x2, 6x4, and 6x2. By horsepower, the class 7 truck market is segmented into Below 300HP, 300HP - 400HP, 400HP - 500HP, and 500HP & Above. By ownership, the class 7 truck market is segmented into Fleet operators and Independent operators. Regionally, the class 7 truck industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

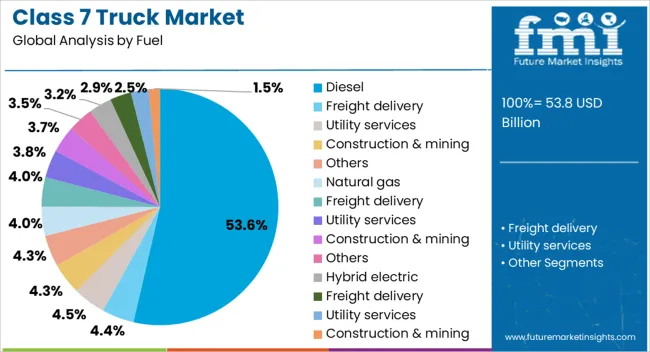

The diesel segment is expected to account for 53.60% of market revenue by 2025, making it the most prominent fuel category. This dominance is attributed to the established infrastructure supporting diesel refueling, along with the high torque output and fuel efficiency of diesel engines, which are crucial for heavy load transportation.

Fleet operators continue to prefer diesel due to its lower cost per mile and reliability over long distances and varied terrains. While alternative fuels are gaining attention, the cost advantages and mechanical familiarity of diesel systems remain significant factors for adoption.

As emissions control technologies advance, diesel-powered Class 7 trucks are expected to retain a major share in medium heavy-duty logistics.

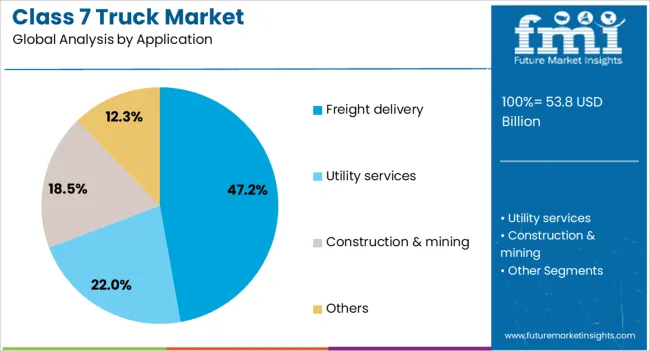

The freight delivery segment is projected to represent 47.20% of the total market share by 2025 within the application category, emerging as the leading use case. Growing e-commerce activities, regional distribution demand, and supply chain expansion across both urban and suburban areas are driving this trend.

Class 7 trucks offer the ideal capacity and range for these operations, balancing maneuverability with load handling efficiency. Their use in last mile and middle mile logistics has increased as retailers and distribution networks seek flexible transport solutions that can adapt to various payload demands.

The consistency and cost effectiveness offered by Class 7 trucks make them indispensable for freight delivery operations across multiple industries.

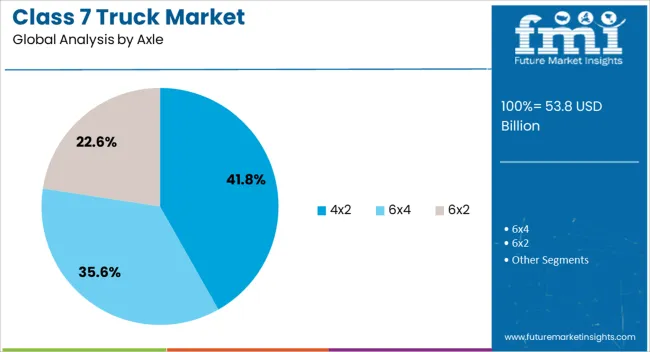

The 4x2 axle configuration segment is expected to hold 41.80% of market revenue by 2025, making it the preferred configuration in the axle category. This configuration is valued for its reduced weight, improved fuel economy, and suitability for regional and urban delivery applications.

Operators favor 4x2 trucks for their lower acquisition and maintenance costs, especially when the intended load requirements do not necessitate multi-axle systems. Additionally, this axle type is well-suited to infrastructure and road conditions in developed markets, where paved roads dominate delivery routes.

The operational simplicity and economic benefits associated with 4x2 configurations continue to support their widespread adoption in the Class 7 truck market.

Increasing consumer demand for efficient freight solutions, along with the rise in e-commerce and last-mile deliveries, is driving market growth. Technological advancements in fuel efficiency, safety features, and electric truck solutions are further contributing to the market’s development, making these vehicles a crucial component of modern supply chains.

The primary driver of growth in the class 7 truck market is the increasing demand for efficient and reliable transportation solutions across various industries. The rise in e-commerce and online retail has boosted the need for timely and cost-effective delivery options, driving the demand for medium-duty trucks that can handle last-mile deliveries in urban environments. The growing construction and infrastructure sectors require robust vehicles for transporting materials and equipment. As businesses continue to prioritize operational efficiency and reduced costs, the demand for fuel-efficient, durable, and versatile Class 7 trucks is expected to grow, further expanding the market.

Rising fuel costs can significantly impact the operational expenses of fleet operators, reducing the profitability of Class 7 trucks for long-distance or frequent-use applications. Tightening emissions standards and environmental regulations, particularly in urban areas, require manufacturers to develop trucks that meet higher sustainability benchmarks. Compliance with these regulations can increase production costs, leading to higher prices for end consumers. These factors, combined with the need to invest in new technologies to meet regulatory requirements, can slow down the market's growth, especially in regions with stringent environmental standards.

The class 7 truck market presents significant opportunities driven by advancements in electric and hybrid truck technologies. With increasing concerns about fuel efficiency and environmental impact, the development of electric trucks is becoming a key area of focus. Electric and hybrid Class 7 trucks offer lower operational costs, reduced emissions, and the ability to meet stringent environmental regulations, making them attractive for urban deliveries and long-haul operations. Government incentives and subsidies for electric vehicle adoption further encourage the growth of this segment. Advancements in battery technology, along with growing charging infrastructure, are enhancing the feasibility of electric trucks, opening new avenues for the market’s expansion in the coming years.

A key trend shaping the class 7 truck market is the integration of advanced technologies and safety features. Fleet operators are increasingly adopting telematics, fleet management systems, and advanced driver-assistance systems (ADAS) to improve vehicle performance, safety, and driver productivity. These technologies allow real-time monitoring of truck performance, enhancing fuel efficiency and reducing downtime. Furthermore, the growing focus on driver safety and regulatory compliance is leading to the incorporation of features such as automatic emergency braking, lane-keeping assistance, and collision avoidance systems in Class 7 trucks. As these technologies continue to evolve, their integration into trucks will help improve overall operational efficiency, contributing to the market’s continued growth.

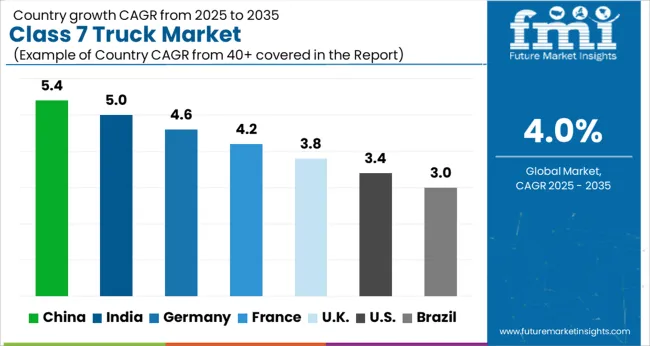

The Class 7 truck market is projected to grow at a global CAGR of 4.0% from 2025 to 2035, driven by rising demand for heavy-duty vehicles in logistics, construction, and transportation sectors. China leads with 5.4% growth, supported by rapid industrialization and infrastructure development. India follows at 5.0%, fueled by the expansion of the logistics sector and increased urbanization. Germany, the UK, and the USA show steady growth, driven by technological advancements in truck efficiency, regulatory standards, and demand for durable trucks in both commercial and industrial sectors. The analysis includes over 40+ countries, with the leading markets detailed below.

The Class 7 truck market in China is projected to grow at a CAGR of 5.4% through 2035. Rapid industrialization and significant investments in infrastructure development are major drivers for this growth. The logistics and transportation sectors are seeing increasing demand for heavy-duty trucks as businesses expand across the country. China’s growing e-commerce industry also contributes to the rise in demand for Class 7 trucks, as supply chains require efficient and reliable transportation solutions. The government’s focus on improving road networks and increasing freight capacity to support the booming trade and manufacturing sectors further supports the market's expansion. Technological innovations in fuel efficiency, emission control, and vehicle safety standards continue to enhance the appeal of Class 7 trucks in the country.

Demand for class 7 truck is growing at a CAGR of 5.0% through 2035. The rapid growth in the country’s logistics and transportation sectors, driven by increasing urbanization and expanding infrastructure, is a key factor contributing to the demand for heavy-duty trucks. As e-commerce continues to expand in India, there is a greater need for efficient transportation solutions, further fueling the market. The government’s focus on improving national highways and industrial corridors is providing better connectivity, driving up the need for durable and high-capacity trucks. With rising demand for better road safety standards, the Class 7 truck market is evolving, driven by the need for technologically advanced trucks that can handle both urban and rural conditions efficiently.

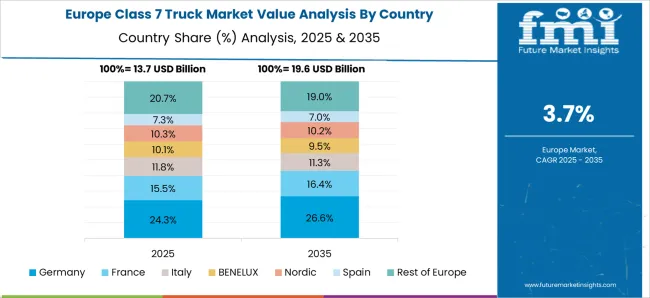

Germany’s Class 7 truck market is projected to grow at a CAGR of 4.6% through 2035. As one of Europe’s largest transportation hubs, Germany’s demand for heavy-duty trucks is driven by the country’s well-established logistics and manufacturing sectors. The rise in cross-border trade within Europe further fuels demand for reliable and efficient trucks. Stricter emission regulations and the focus on fuel efficiency are pushing the adoption of advanced truck technologies. Germany’s emphasis on sustainability in transportation, alongside the growing need for high-performance trucks in industrial sectors like construction and infrastructure, is contributing to market growth. With a strong emphasis on safety, reliability, and innovation, Germany’s truck market is expected to continue evolving with new technological advancements.

The class 7 truck market in the United Kingdom is expected to grow at a CAGR of 3.8% through 2035. As a major transportation hub in Europe, the UK is experiencing steady demand for heavy-duty trucks, particularly driven by the growing logistics, construction, and delivery industries. The need for more fuel-efficient and sustainable trucks is increasing due to government regulations aimed at reducing carbon emissions. Additionally, with the rise of online retail, the logistics sector in the UK continues to expand, fueling the demand for Class 7 trucks. The UK market is also witnessing a shift toward more technologically advanced trucks with better safety features, contributing to steady growth.

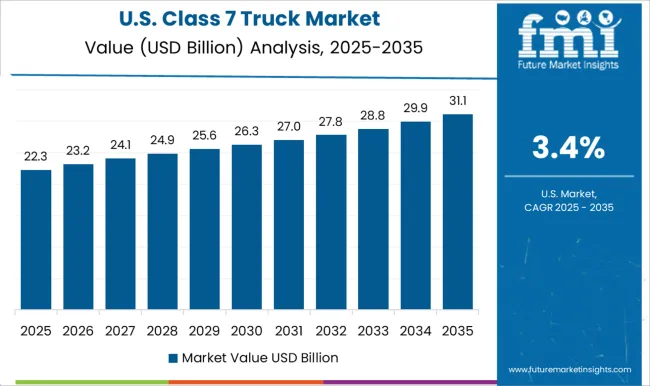

The USA Class 7 truck market is projected to grow at a CAGR of 3.4% through 2035. The USA remains a significant player in the heavy-duty truck market, driven by strong demand from the logistics, freight, and construction sectors. The growing need for more sustainable and fuel-efficient transportation solutions is influencing the market, as stricter emission regulations and consumer demand for greener technologies increase. Advancements in autonomous driving technology and smart truck systems are shaping the future of the Class 7 truck market in the USA Established infrastructure and well-developed road networks further bolster the demand for heavy-duty trucks to support growing industrial activities.

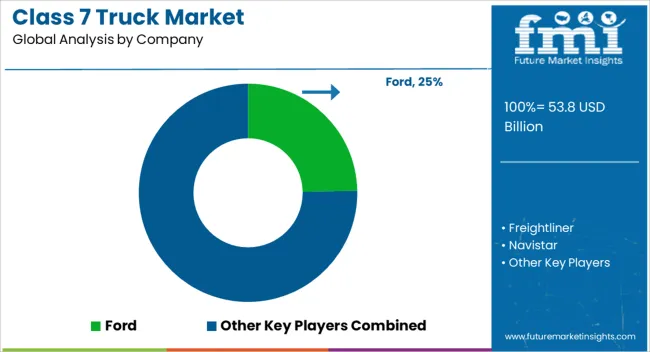

Ford provides durable, fuel efficient models that emphasize payload, uptime, and safety features. Freightliner offers well-equipped Class 7 chassis for distribution and vocational use with proven efficiency and driver-focused cabins. Navistar, through the International brand, fields versatile class 7 models with efficient powertrains for varied commercial applications. Isuzu Motors supplies compact, maneuverable class 7 trucks favored by urban and small fleet operators. Kenworth and Peterbilt, within PACCAR, provide premium medium-duty offerings that prioritize driver comfort, efficiency, and body upfit flexibility. Mack Trucks, within Volvo Group, delivers robust class 7 models suited to construction, municipal, and regional tasks. MAN and Scania operate mainly in Europe with medium-duty ranges in the 12 to 26 tonne bands that address class 7 equivalent use cases in their home markets. Volvo Group coverage of class 7 in North America is centered on Mack, while Volvo-branded medium-duty platforms serve comparable roles in select regions.

| Item | Value |

|---|---|

| Quantitative Units | USD 53.8 Billion |

| Fuel | Diesel, Freight delivery, Utility services, Construction & mining, Others, Natural gas, Freight delivery, Utility services, Construction & mining, Others, Hybrid electric, Freight delivery, Utility services, Construction & mining, Others, Others, Freight delivery, Utility services, Construction & mining, and Others |

| Application | Freight delivery, Utility services, Construction & mining, and Others |

| Axle | 4x2, 6x4, and 6x2 |

| Horsepower | Below 300HP, 300HP - 400HP, 400HP - 500HP, and 500HP & Above |

| Ownership | Fleet operator and Independent operator |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Ford, Freightliner, Navistar, Isuzu Motors, Kenworth, Mack Trucks, MAN, Peterbilt, Scania AB, and Volvo Trucks |

| Additional Attributes | Dollar sales by product type (diesel-powered trucks, electric trucks, hybrid trucks) and end-use segments (long-haul transportation, urban deliveries, construction, distribution). Demand dynamics are influenced by the growing need for fuel-efficient and environmentally friendly commercial vehicles, increasing demand for last-mile delivery services, and rising transportation requirements across industries. Regional trends show strong growth in North America, Europe, and Asia-Pacific, driven by the need for commercial vehicles to support logistics, infrastructure development, and urban transportation. Innovation trends focus on the development of electric and hybrid trucks, telematics for fleet management, and advanced driver-assistance systems. |

The global class 7 truck market is estimated to be valued at USD 53.8 billion in 2025.

The market size for the class 7 truck market is projected to reach USD 79.6 billion by 2035.

The class 7 truck market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in class 7 truck market are diesel, freight delivery, utility services, construction & mining, others, natural gas, freight delivery, utility services, construction & mining, others, hybrid electric, freight delivery, utility services, construction & mining, others, others, freight delivery, utility services, construction & mining and others.

In terms of application, freight delivery segment to command 47.2% share in the class 7 truck market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Classic Organic Pigments Market Size and Share Forecast Outlook 2025 to 2035

Class D Audio Amplifiers Market is Segmented by Type, End Use and Region through 2025 to 2035

Classified Platform Market Analysis by Type, Application, and Region Through 2035

Class 8 Truck Market Size and Share Forecast Outlook 2025 to 2035

Class 3 Truck Market Size and Share Forecast Outlook 2025 to 2035

Class 5 Trucks Market Size and Share Forecast Outlook 2025 to 2035

Class 1 Truck Market Size and Share Forecast Outlook 2025 to 2035

Class 2 Trucks Market Size and Share Forecast Outlook 2025 to 2035

Class 4 Truck Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Class 6 Trucks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Air Classifying Mill Market Size and Share Forecast Outlook 2025 to 2035

Smart Classroom Market Size and Share Forecast Outlook 2025 to 2035

Virtual Classroom Market Trends – Size, Demand & Forecast 2024-2034

Enterprise-Class Hybrid Storage Market Size and Share Forecast Outlook 2025 to 2035

Fault Detection and Classification Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Defense C Class Parts Market Size and Share Forecast Outlook 2025 to 2035

7075 T6 Aluminum Market Size and Share Forecast Outlook 2025 to 2035

Th17 Driven Disease Treatment Market

Truck Mounted Cranes Market Size and Share Forecast Outlook 2025 to 2035

Trucks Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA