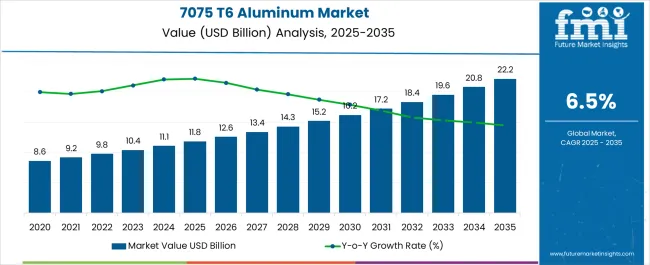

The 7075 T6 aluminum market is projected to grow from USD 11.8 billion in 2025 to USD 22.2 billion by 2035, expanding at a CAGR of 6.5% over the assessment period. A rolling CAGR analysis of this market highlights a steady acceleration in growth, underpinned by expanding applications across aerospace, defense, automotive, and high-performance engineering industries. From 2025 to 2028, the market is expected to experience moderate expansion as demand for lightweight yet high-strength alloys gains traction in aircraft manufacturing and performance-driven automotive parts.

By 2029, the growth curve strengthens as rolling CAGR edges higher, supported by technological advancements in alloy processing, new joining techniques, and broader adoption in electric vehicle structures that demand fuel efficiency and durability.

Entering the early 2030s, the pace of growth further accelerates, with CAGR values in rolling five-year windows trending upward as global supply chains adapt to the rising need for high-strength aluminum alloys in sustainable mobility and defense modernization programs. Toward the latter half of the forecast period, particularly from 2031 to 2035, the market momentum peaks as cumulative technological innovation, regulatory shifts toward lightweighting, and higher penetration in marine and industrial equipment create compounding demand. By 2035, the rolling CAGR analysis demonstrates not only consistent growth but also an amplified trajectory, signaling that the 7075 T6 aluminum market will remain highly lucrative across multiple end-use sectors.

| Metric | Value |

|---|---|

| 7075 T6 Aluminum Market Estimated Value in (2025 E) | USD 11.8 billion |

| 7075 T6 Aluminum Market Forecast Value in (2035 F) | USD 22.2 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

The 7075 T6 aluminum market holds a significant position within the broader high-strength aluminum alloys sector due to its excellent strength-to-weight ratio, corrosion resistance, and fatigue performance. Within the overall aerospace and defense aluminum market, 7075 T6 accounts for approximately 18–20% share, reflecting its critical role in structural applications and load-bearing components. In aerospace applications, the alloy contributes about 22–24% share, driven by its use in aircraft fuselage frames, wing spars, and landing gear assemblies, where lightweight strength is crucial. In automotive engineering, 7075 T6 represents around 10–12% share, applied in high-performance vehicles, chassis components, and structural reinforcements.

Marine and offshore platforms use the alloy at roughly 6–8% share for corrosion-resistant components exposed to harsh environments. The electronics and precision machinery sectors account for approximately 5–7% share, leveraging the alloy for high-strength frames and housings. Growth is propelled by increasing adoption of lightweight, high-strength alloys in aerospace modernization, defense upgrades, and performance automotive segments. Manufacturers are focused on optimizing heat-treatment processes, enhancing machinability, and expanding their supply chains to meet the growing demand in strategic industrial applications.

The 7075 T6 Aluminum market is experiencing strong growth due to its exceptional combination of strength, light weight, and corrosion resistance, making it highly suitable for critical engineering applications. Increasing demand from industries that require high-performance materials, such as aerospace, defense, marine, and transportation, is driving adoption. Advancements in metallurgical processes have enhanced the fatigue strength and machinability of 7075 T6 Aluminum, further expanding its suitability for precision components.

Its use in high-stress environments has been reinforced by the growing emphasis on lightweighting to improve fuel efficiency and operational performance. Rising investments in defense modernization programs, along with growth in commercial and private aviation, are contributing to sustained demand.

The market is also supported by innovation in manufacturing technologies, including CNC machining and additive manufacturing compatibility, which improve cost-effectiveness With expanding applications across multiple sectors and increasing global trade of engineered aluminum products, 7075 T6 aluminum is positioned for continued long-term growth.

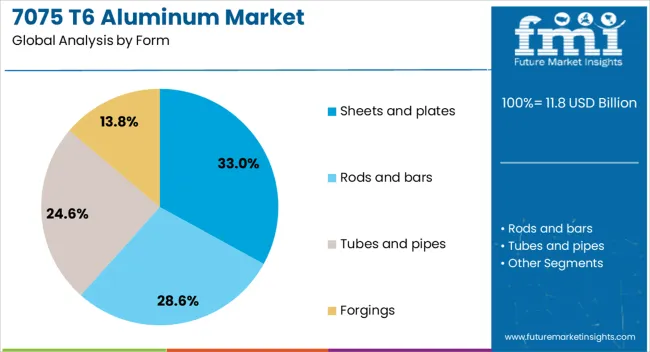

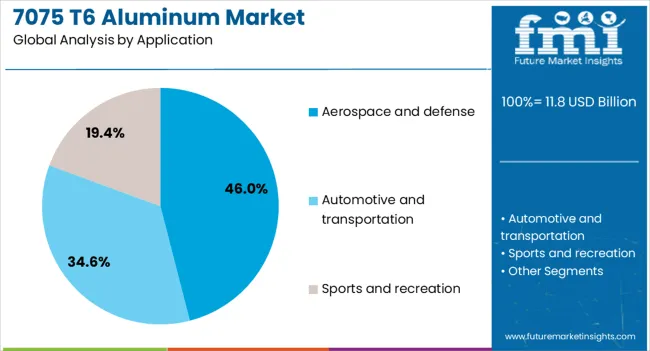

The 7075 T6 aluminum market is segmented by form, application, and geographic regions. By form, 7075 T6 aluminum market is divided into Sheets and plates, Rods and bars, Tubes and pipes, Forgings, Extrusions, and Other forms. In terms of application, 7075 T6 aluminum market is classified into Aerospace and defense, Automotive and transportation, Sports and recreation, Industrial equipment, Marine applications, Electronics and telecommunications, and Other applications. Regionally, the 7075 T6 aluminum industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The sheets and plates segment is projected to hold 33% of the 7075 T6 Aluminum market revenue share in 2025, making it the leading form segment. This dominance is attributed to the extensive use of sheets and plates in structural and load-bearing components that require high tensile strength and durability.

The form’s adaptability to complex machining and fabrication processes has supported its widespread acceptance in manufacturing critical aerospace structures, defense armor panels, and marine parts. Sheets and plates have been preferred for their dimensional stability, uniform mechanical properties, and ability to be produced in a wide range of thicknesses.

Their compatibility with advanced coating and surface treatments enhances resistance to wear and environmental degradation, which is vital for long-term performance The capacity to deliver consistent quality and performance in demanding operational environments has solidified the position of sheets and plates as a primary choice for manufacturers, sustaining their market leadership.

The aerospace and defense segment is anticipated to account for 46% of the 7075 T6 Aluminum market revenue share in 2025, emerging as the leading application area. Growth in this segment has been driven by the need for materials that combine high strength-to-weight ratios with excellent fatigue resistance, critical for aircraft structures, missile components, and defense vehicles. The material’s proven track record in enduring high stress and extreme environmental conditions has reinforced its use in mission-critical applications.

Increasing investments in aircraft production, military fleet upgrades, and defense infrastructure modernization programs are accelerating demand. Furthermore, the growing emphasis on lightweighting to improve fuel efficiency and operational range in both military and commercial aviation has expanded the scope of 7075-T6 aluminum usage.

The segment benefits from stringent industry standards that favor high-performance alloys, ensuring its continued dominance. Enhanced supply chain capabilities and precision manufacturing technologies are also supporting the segment’s strong market position.

7075 T6 aluminum continues to grow across aerospace, defense, automotive, and industrial sectors, driven by its high strength, corrosion resistance, and fatigue performance. Rising structural and performance requirements in these sectors are expanding dollar sales and market share worldwide.

The aerospace sector remains the largest driver for 7075 T6 aluminum, as manufacturers prioritize high-strength, lightweight materials for structural components. Increasing production of commercial and military aircraft has fueled demand for fuselage frames, wing spars, and landing gear assemblies. Enhanced fatigue resistance and corrosion protection make this alloy critical for maintaining aircraft safety and performance standards. Expansion of regional aircraft programs and defense modernization initiatives in Asia, Europe, and North America is directly supporting the adoption of 7075 T6 aluminum. Growth is also influenced by rising procurement of unmanned aerial systems, which require strong yet lightweight structural materials. Supply chains are being optimized to meet aerospace demand, while heat-treatment and extrusion processes are being refined to maintain alloy integrity under rigorous operational conditions.

High-performance automotive and motorsports industries are increasingly relying on 7075 T6 aluminum to reduce vehicle weight while maintaining structural integrity. Components such as chassis reinforcements, suspension arms, and transmission housings leverage the alloy for its exceptional strength-to-weight ratio. The push for fuel efficiency, high-speed performance, and crash safety standards further encourages integration of 7075 T6 aluminum into premium vehicles. Electric vehicle adoption also fuels demand as manufacturers seek lightweight materials to maximize battery efficiency and driving range. OEMs and tier-1 suppliers are investing in machining and forming capabilities to handle high-strength aluminum, supporting growing dollar sales and market share. The automotive sector’s adoption of alloy-intensive designs is expected to continue, driven by performance and durability requirements.

Military modernization initiatives and defense procurement programs are significant growth engines for 7075 T6 aluminum. Armored vehicles, missile casings, artillery components, and naval structures utilize the alloy for its high tensile strength and resistance to fatigue under harsh conditions. Geopolitical tensions in regions such as the Middle East, Europe, and Asia-Pacific have accelerated investments in defense infrastructure, which in turn drives alloy consumption. Governments are focusing on upgrading fleets, improving UAV and fighter aircraft structures, and expanding naval shipbuilding programs. Strategic partnerships between defense contractors and aluminum suppliers ensure stable supply chains, enabling manufacturers to meet performance specifications and maintain operational readiness. Ongoing R&D into alloy processing techniques further supports consistent quality and increased share in defense applications.

7075 T6 aluminum has found increasing use in marine platforms, offshore structures, and industrial machinery due to its corrosion resistance and high mechanical strength. Components such as ship hulls, deck structures, and offshore support equipment benefit from the alloy’s durability in harsh environments. Industrial applications include precision machinery frames, high-load structural components, and equipment in energy and manufacturing sectors. Demand growth is reinforced by ongoing offshore oil and gas exploration, regional shipbuilding projects, and replacement of steel components with lightweight aluminum to reduce operational costs. The alloy’s performance under stress and exposure to environmental factors makes it a preferred choice, expanding dollar sales, increasing share in structural applications, and reinforcing its industrial significance.

| Country | CAGR |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| France | 6.8% |

| U.K. | 6.2% |

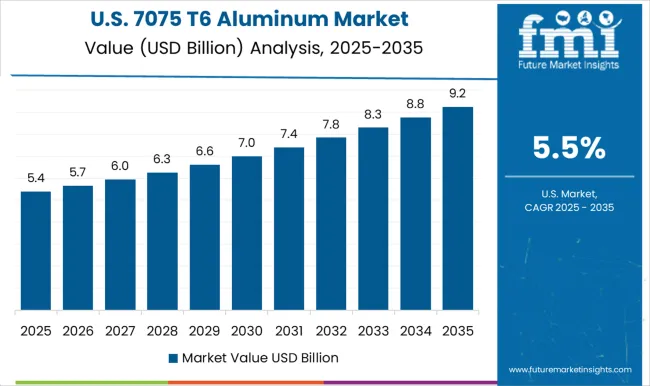

| U.S. | 5.5% |

| Brazil | 4.9% |

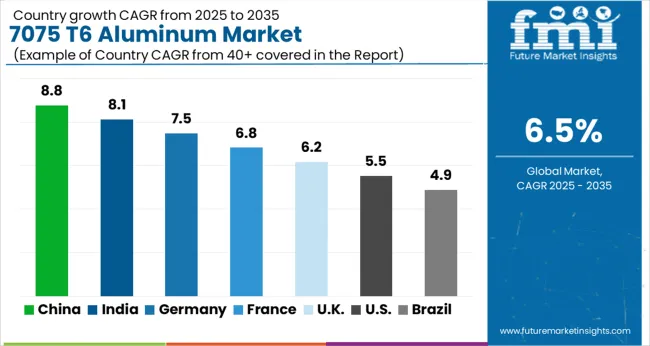

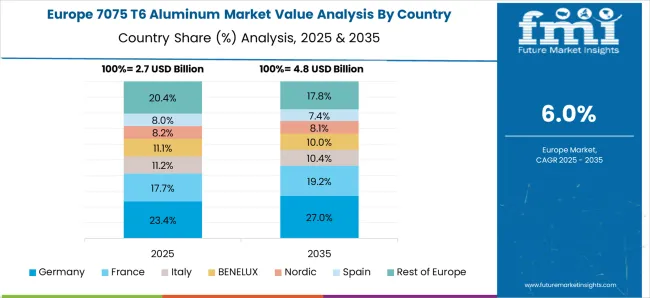

The 7075 T6 aluminum market is projected to expand at a global CAGR of 6.5% from 2025 to 2035, driven by rising demand across aerospace, defense, automotive, and industrial applications. China leads with a CAGR of 8.8%, supported by large-scale aircraft production, defense modernization programs, and growing industrial and automotive use. India follows at 8.1%, fueled by expanding aerospace manufacturing, military vehicle upgrades, and high-performance automotive adoption. France grows at 6.8%, driven by demand in aerospace components, defense projects, and precision machinery. The United Kingdom records 6.2%, supported by structural applications in defense, automotive, and offshore industries. The United States posts 5.5%, influenced by replacement demand in mature aerospace and defense sectors, as well as adoption in high-strength automotive components. This study covers over 40 countries, with these five serving as benchmarks for production capacity, technological adoption, and strategic investments in high-strength aluminum alloys.

China recorded a CAGR of approximately 6.2% between 2020–2024, which rose to 8.8% during 2025–2035, reflecting a notable acceleration in high-strength aluminum adoption. Early growth was supported by moderate utilization in aerospace structural components and industrial machinery requiring lightweight yet durable materials. Post-2025, the surge was driven by large-scale aircraft production, expanding defense modernization projects, and rising automotive applications in high-performance vehicles. Strategic collaborations between domestic manufacturers and international suppliers enhanced production capabilities and alloy development. Government incentives for advanced materials in defense and commercial aerospace further strengthened market momentum, enabling China to emerge as a global leader in 7075 T6 aluminum production.

India achieved a CAGR of approximately 5.6% during 2020–2024, which increased to 8.1% in the 2025–2035 period, reflecting rising momentum in aerospace, defense, and automotive segments. Initial growth was moderate due to selective adoption in aircraft components, military hardware, and industrial tools where high-strength aluminum was preferred for weight reduction. After 2025, accelerated government spending on defense upgrades, expansion of indigenous aircraft production, and increased demand for lightweight automotive alloys significantly contributed to market growth. Policies promoting domestic alloy production, coupled with higher exports of aerospace-grade components, further enhanced market competitiveness. The use of 7075 T6 aluminum in critical defense and transport applications underscored its strategic importance.

France recorded a CAGR of approximately 5.9% between 2020–2024, which rose to 6.8% during 2025–2035, indicating gradual acceleration in aerospace and industrial sectors. Early growth was driven by established aerospace manufacturing, automotive engineering, and precision machinery where 7075 T6 aluminum improved strength-to-weight ratios. Growth after 2025 was influenced by increased defense procurement, modernization of commercial aircraft fleets, and expansion in high-performance automotive applications. Domestic suppliers’ focus on alloy refinement, combined with partnerships with European aerospace leaders, ensured steady supply and quality standards. Adoption in offshore and industrial machinery applications further supported sustained demand in France, making it a key European hub for high-strength aluminum alloys.

The United Kingdom recorded a CAGR of approximately 5.7% between 2020–2024, which is expected to rise to 6.2% for 2025–2035, showing moderate acceleration in demand. Early adoption was driven by aerospace structural components, defense equipment, and high-performance automotive manufacturing. Post-2025, demand increased due to expanding aerospace production, naval and defense modernization programs, and industrial machinery requiring lightweight, high-strength alloys. The rise in CAGR reflects strategic investments in domestic alloy production, collaboration with global aerospace and automotive suppliers, and government support for high-performance material applications. The UK’s focus on improving efficiency in structural components and maintaining competitive manufacturing capabilities underpins steady growth.

The United States recorded a CAGR of approximately 5.0% between 2020–2024, which is projected to increase to 5.5% during 2025–2035, reflecting gradual market expansion. Early growth was supported by replacement demand in mature aerospace fleets, defense procurement, and industrial machinery requiring durable high-strength aluminum. After 2025, adoption accelerated due to modernization of military aircraft, naval platforms, and high-performance automotive components. Investments in advanced production technologies and partnerships with domestic and international aerospace firms ensured reliable supply and quality. Focus on lightweight structural applications and expansion of precision industrial machinery maintained steady growth in 7075 T6 aluminum demand.

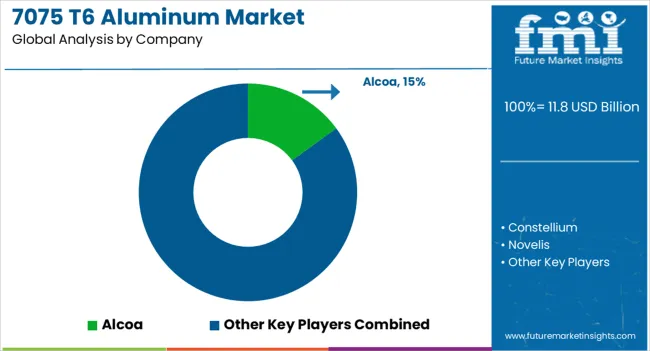

The 7075 T6 aluminum market is defined by competition among leading global and regional producers supplying high-strength, lightweight alloys for aerospace, defense, automotive, and industrial applications. Alcoa maintains a dominant position with extensive upstream bauxite refining, integrated aluminum production, and specialty alloy manufacturing, enabling consistent quality and large-scale supply for aerospace and military components. Constellium focuses on rolled, extruded, and precision-engineered aluminum products, targeting high-performance sectors such as automotive structural parts and defense hardware with tailored alloy grades. Novelis leverages its global rolling and recycling capabilities to provide high-quality 7075 T6 sheets and plates, emphasizing sustainability of feedstock and alloy integrity. Kaiser Aluminum has established a strong niche in extrusions, plates, and forgings for aerospace, defense, and industrial machinery, with specialized finishing and heat-treatment capabilities enhancing mechanical performance.

Aleris / Arconic (fabricators) supply precision-rolled and machined aluminum alloys to OEMs and tier-one manufacturers, supporting aerospace, automotive, and defense programs. Zhongwang / Shandong Union (plate suppliers) focus on large-scale plate production for industrial, automotive, and defense applications, ensuring regional supply reliability. Competitive strategies across the sector include expansion of production facilities, vertical integration for alloy quality control, and collaborations with aerospace and automotive OEMs. The market is shaped by increasing demand for lightweight, high-strength components, and ongoing innovation in alloy processing, heat treatment, and fabrication techniques positions these companies as leaders in 7075 T6 aluminum supply.

| Item | Value |

|---|---|

| Quantitative Units | USD 11.8 Billion |

| Form | Sheets and plates, Rods and bars, Tubes and pipes, Forgings, Extrusions, and Other forms |

| Application | Aerospace and defense, Automotive and transportation, Sports and recreation, Industrial equipment, Marine applications, Electronics and telecommunications, and Other applications |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Alcoa, Constellium, Novelis, Kaiser Aluminum, Aleris / Arconic (fabricators), and Zhongwang / Shandong Union (plate suppliers) |

| Additional Attributes | Dollar sales, market share by aerospace, defense, automotive, industrial segments, CAGR projections, capacity expansions, pricing trends, alloy demand, competitive landscape, raw material supply, and end-use adoption. |

The global 7075 T6 aluminum market is estimated to be valued at USD 11.8 billion in 2025.

The market size for the 7075 T6 aluminum market is projected to reach USD 22.2 billion by 2035.

The 7075 T6 aluminum market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in 7075 T6 aluminum market are sheets and plates, _standard dimensions, _thickness ranges, _surface finishes, rods and bars, _round bars, _rectangular bars, _hexagonal bars, _other profiles, tubes and pipes, _seamless tubes, _extruded tubes, _standard dimensions, forgings, _open die forgings, _closed die forgings, _custom forgings, extrusions, _standard profiles, _custom profiles and other forms.

In terms of application, aerospace and defense segment to command 46.0% share in the 7075 T6 aluminum market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA