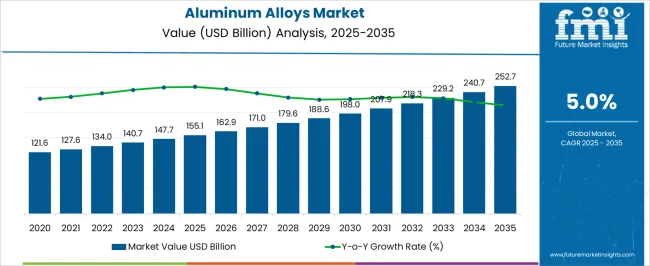

The aluminum alloys market is estimated to be valued at USD 155.1 billion in 2025 and is projected to reach USD 252.7 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period.

Market estimates indicate a steady increase from USD 121.6 billion in 2025, gradually expanding to USD 127.6 billion, USD 134.0 billion, and USD 140.7 billion in the early years, driven by rising demand across aerospace, automotive, and construction industries. By 2030, the market is expected to surpass USD 179.6 billion, supported by lightweighting trends in transportation, fuel efficiency mandates, and the adoption of high-strength alloys for structural and performance applications. The period from 2031 to 2035 is projected to witness accelerated growth, with the market anticipated to climb from USD 207.9 billion in 2031 to USD 252.7 billion in 2035, fueled by increasing industrialization, infrastructure development, and urban expansion in emerging economies.

Key growth contributors include high corrosion resistance, recyclability, and versatility of aluminum alloys in automotive bodies, aerospace components, and energy-efficient building materials. Moreover, investments in R&D for advanced alloys, enhanced fabrication techniques, and strategic collaborations between manufacturers and end-use industries are expected to drive innovation and adoption. Overall, the market’s forecasted growth highlights the significant absolute dollar opportunity available for stakeholders across multiple sectors, underpinned by both functional performance and regulatory compliance imperatives.

The aluminum alloys market is strongly influenced by five interconnected parent markets, each contributing to overall demand and adoption. The automotive and transportation sector holds the largest share at 35%, as aluminum alloys are widely used for lightweight vehicle bodies, chassis components, and structural parts to improve fuel efficiency, reduce emissions, and enhance performance.

The aerospace and defense market follows with a 25% share, driven by the need for high-strength, corrosion-resistant alloys for aircraft frames, engine components, and military vehicles, supporting reliability, safety, and long-term durability. The construction and infrastructure market accounts for 20%, where aluminum alloys are extensively applied in building facades, roofing, curtain walls, and structural frameworks to provide strength while reducing overall structural weight.

The packaging and consumer goods market holds a 12% share, with applications ranging from beverage cans, foil, and household products to electronics casings, leveraging aluminum’s recyclability and lightweight nature. The electrical and power distribution sector represents 8%, as aluminum alloys are increasingly adopted for conductors, cables, and heat exchangers, balancing performance with cost-effectiveness.

The automotive, aerospace, and construction sectors account for 80% of total aluminum alloy demand, highlighting that transportation efficiency, industrial innovation, and structural performance remain the primary growth drivers, while packaging and electrical applications provide consistent complementary demand across global regions.

| Metric | Value |

|---|---|

| Aluminum Alloys Market Estimated Value in (2025 E) | USD 155.1 billion |

| Aluminum Alloys Market Forecast Value in (2035 F) | USD 252.7 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The aluminum alloys market is witnessing robust growth, underpinned by its expanding role across high-performance applications and the consistent push for lightweight, durable, and corrosion-resistant materials. Current market conditions reflect steady demand from manufacturing and infrastructure sectors, while technological advancements in alloy composition and processing have enabled enhanced strength-to-weight ratios and improved performance in demanding environments.

The global shift toward energy efficiency, coupled with stricter environmental regulations, is encouraging the substitution of heavier metals with aluminum alloys across multiple industries. Trade flows remain influenced by raw material pricing and regional capacity utilization, prompting manufacturers to optimize supply chains and invest in recycling capabilities to meet sustainability targets.

Future growth prospects are supported by ongoing innovation in alloy formulations, expansion of capacity in emerging economies, and strategic partnerships between producers and end users These factors, combined with the increasing penetration of aluminum alloys into transportation, aerospace, and industrial applications, are expected to sustain steady market expansion in the coming years.

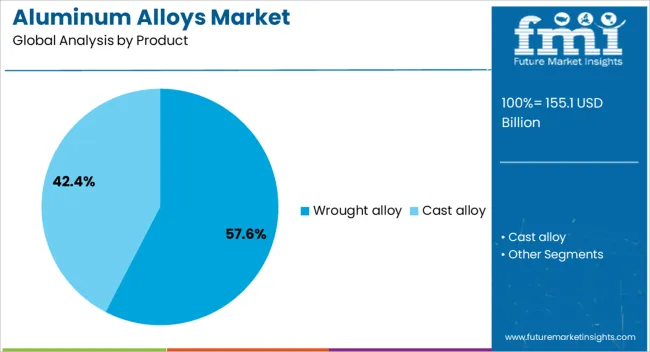

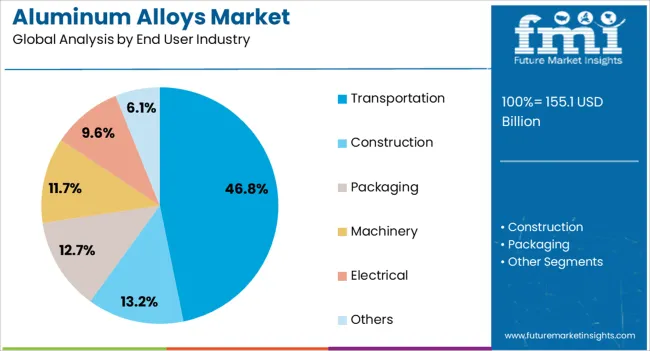

The aluminum alloys market is segmented by product, end user industry, and geographic regions. By product, aluminum alloys market is divided into wrought alloy and cast alloy. In terms of end user industry, aluminum alloys market is classified into transportation, construction, packaging, machinery, electrical, and others. Regionally, the aluminum alloys industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The wrought alloy segment, holding 57.60% of the product category, has maintained dominance due to its superior mechanical properties, high corrosion resistance, and versatility in manufacturing processes. Its extensive use in rolled, extruded, and forged products has made it a preferred choice across a wide range of structural and functional applications.

The segment’s strong position is supported by efficient production techniques that ensure consistent quality and performance, enabling it to meet the stringent standards of industries such as transportation, aerospace, and construction. Continued investment in advanced forming technologies has improved production yield and reduced waste, strengthening cost competitiveness.

The segment benefits from the ability to be customized for specific strength, formability, and fatigue resistance requirements, aligning with evolving end-user demands With expanding adoption in emerging markets and sustained demand in developed economies, the wrought alloy category is expected to retain its market leadership through both volume growth and value-added innovation.

The transportation segment, accounting for 46.80% of the end user industry category, has remained the largest consumer due to the critical need for lightweight materials that enhance fuel efficiency and performance. Aluminum alloys are widely integrated into automotive, aerospace, rail, and marine applications, where weight reduction directly contributes to operational cost savings and compliance with emission regulations.

The segment’s dominance has been reinforced by rising global vehicle production, increased adoption of electric mobility, and the push for extended range and payload capacity in transportation assets. Advances in alloy processing have enabled higher strength grades suitable for safety-critical components, supporting broader usage across structural and exterior parts.

Additionally, the recyclability of aluminum aligns with sustainability objectives in the transportation industry, further boosting its adoption Long-term growth in this segment is expected to be supported by the convergence of regulatory mandates, consumer demand for efficient transportation solutions, and ongoing technological enhancements in alloy manufacturing.

The aluminum alloys market growth is primarily driven by automotive, aerospace, and construction demand, with packaging and electrical applications providing steady complementary growth. Lightweighting, performance, and versatility remain key factors shaping market dynamics worldwide.

The aluminum alloys market is witnessing strong growth due to rising demand in the automotive and transportation sectors. Lightweighting requirements are driving manufacturers to replace steel with aluminum alloys in vehicle bodies, chassis, engine components, and structural parts, improving fuel efficiency, performance, and emissions compliance. Passenger vehicles, commercial trucks, and electric vehicles are increasingly adopting high-strength aluminum alloys for weight reduction without compromising safety or durability. The growth is further supported by rising vehicle production in emerging markets and stringent global fuel efficiency regulations. Aluminum alloys’ combination of strength, formability, and corrosion resistance enables cost-effective solutions, making them essential for automotive manufacturers aiming to balance performance, efficiency, and compliance in highly competitive markets.

Aerospace and defense remain major drivers of aluminum alloys consumption due to their lightweight and high-strength characteristics. Aircraft frames, fuselages, wings, engine components, and landing gear systems increasingly rely on aluminum alloys to reduce overall aircraft weight, improve fuel efficiency, and enhance structural integrity. Military aircraft, helicopters, and unmanned aerial vehicles also leverage aluminum alloys for durability, corrosion resistance, and operational performance. Rising defense budgets, fleet expansion, and replacement of aging aircraft support sustained demand. Additionally, collaborations between aerospace manufacturers and alloy suppliers facilitate the development of specialized grades tailored to stringent operational and environmental standards. The sector continues to prioritize materials that ensure reliability, long service life, and cost-efficiency in high-performance aviation and defense applications.

The construction and infrastructure sector contributes significantly to aluminum alloys demand due to their strength-to-weight ratio and corrosion resistance. Applications include building facades, roofing, curtain walls, window frames, and structural frameworks in residential, commercial, and industrial projects. The adoption of aluminum alloys reduces structural weight, improves ease of installation, and lowers maintenance costs over the building lifecycle. Rising construction activities in developing economies, along with modernization projects in mature markets, are driving consistent growth. The versatility of aluminum alloys enables architects and engineers to design lightweight, durable, and aesthetically appealing structures. Additionally, demand is supported by infrastructural projects requiring long-span bridges, transit systems, and energy-efficient buildings where aluminum alloys provide a balance of performance and functionality.

Aluminum alloys are increasingly used in packaging, consumer goods, and electrical applications due to their lightweight, malleable, and conductive properties. Beverage cans, foil, and packaging materials benefit from aluminum’s recyclability and corrosion resistance. In consumer electronics, appliances, and casings, aluminum alloys offer aesthetic appeal and durability. The electrical and power distribution segment relies on aluminum alloys for cables, conductors, and heat exchangers, balancing cost-efficiency with performance. Market growth is further driven by rising consumer demand for packaged products, increased electrification, and modernization of electrical infrastructure. Suppliers are focusing on high-performance alloys that meet industry-specific requirements, enabling manufacturers to achieve operational efficiency, consistent quality, and competitive differentiation in end-use markets globally.

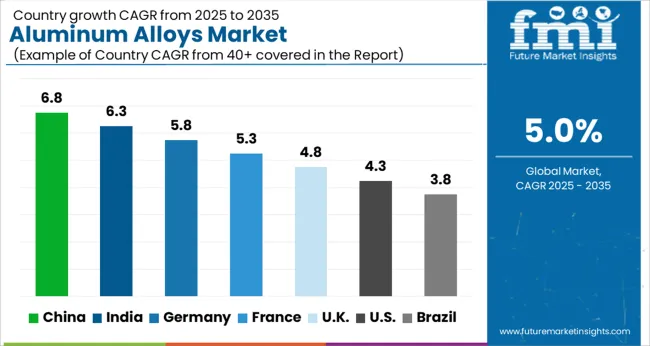

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

| USA. | 4.3% |

| Brazil | 3.8% |

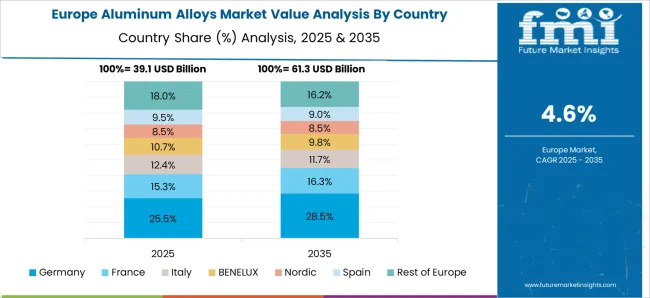

The global aluminum alloys market is projected to grow at a CAGR of 5.0% from 2025 to 2035. China leads expansion at 6.8%, followed by India at 6.3%, Germany at 5.8%, the UK at 4.8%, and the USA. at 4.3%. BRICS nations, particularly China and India, are driving demand through automotive, aerospace, and industrial manufacturing growth.

OECD countries, including Germany, the UK, and the USA., focus on high-performance alloys, structural applications, and advanced fabrication techniques. Growth is fueled by lightweighting requirements, efficiency improvements, and adoption of aluminum alloys in infrastructure, transportation, packaging, and electrical sectors, creating substantial market opportunities across end-use industries. The analysis covers over 30 countries, with the leading markets highlighted below.

The aluminum alloys market in China is projected to grow at a CAGR of 6.8% from 2025 to 2035, driven by strong industrial, automotive, and aerospace manufacturing growth. Increasing vehicle production, including electric and commercial vehicles, is fueling demand for lightweight, high-strength aluminum alloys to improve fuel efficiency, reduce emissions, and enhance structural performance.

The aerospace sector is adopting advanced alloys for aircraft fuselages, wings, and engine components to reduce weight while maintaining safety and durability. Construction and infrastructure projects further support market expansion, with aluminum alloys used in facades, roofing, and structural frameworks. Collaborations between domestic alloy manufacturers and global suppliers accelerate technology transfer, product innovation, and adoption of high-performance alloys.

The aluminum alloys market in India is expected to grow at a CAGR of 6.3% from 2025 to 2035, supported by expanding automotive, railways, and infrastructure projects. Vehicle lightweighting initiatives, especially in passenger and commercial vehicles, are increasing the use of high-strength alloys for chassis, body panels, and structural components.

The aerospace industry is investing in aluminum alloy-based components for regional aircraft and defense applications. Urban and industrial construction projects also contribute to demand, with alloys used in roofing, cladding, and structural frameworks. Government policies promoting Make in India and industrial growth further drive adoption, while partnerships with international alloy producers ensure access to advanced grades, process expertise, and customized solutions.

The aluminum alloys market in Germany is projected to grow at a CAGR of 5.8% from 2025 to 2035, driven by high-quality automotive, aerospace, and industrial manufacturing. Germany’s focus on premium vehicles, electric mobility, and energy-efficient transportation supports demand for high-performance aluminum alloys. Aerospace manufacturers adopt lightweight, corrosion-resistant alloys for aircraft components, while industrial machinery producers use alloys for structural and mechanical applications. Construction projects for modern buildings and infrastructure increasingly incorporate aluminum frameworks, curtain walls, and facades.

German companies emphasize eco-friendly alloy production, recycling, and advanced fabrication techniques. Collaborations with research institutions facilitate innovation in high-strength, lightweight alloys tailored to stringent European standards, enabling consistent product quality, durability, and operational performance.

The aluminum alloys market in the UK is expected to grow at a CAGR of 4.8% from 2025 to 2035, fueled by automotive lightweighting, aerospace modernization, and industrial applications. High-strength, lightweight alloys are increasingly used in vehicle bodies, structural components, and aerospace frames to enhance fuel efficiency, performance, and safety.

Construction applications, including commercial building frameworks and architectural components, further contribute to demand. Domestic manufacturers are partnering with international suppliers to access advanced alloy grades, improve fabrication techniques, and customize products for niche industrial requirements. Investments in advanced manufacturing facilities and retrofit projects in transportation, defense, and energy sectors support consistent market expansion.

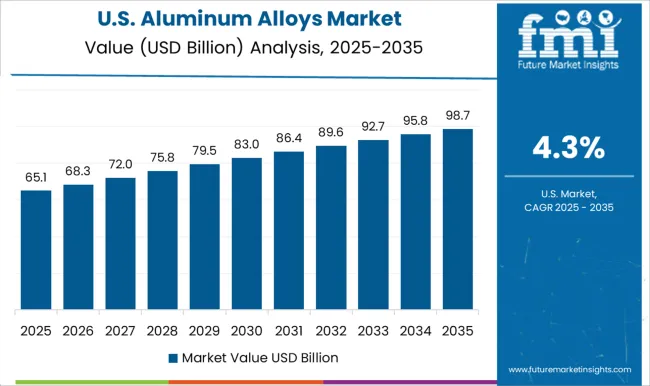

The aluminum alloys market in the USA. is projected to grow at a CAGR of 4.3% from 2025 to 2035, supported by automotive, aerospace, and construction sectors. Demand for high-performance alloys in electric vehicles, commercial trucks, and lightweight vehicle structures is growing to meet fuel efficiency and emissions standards.

Aerospace applications, including military and commercial aircraft, drive adoption of corrosion-resistant and high-strength aluminum alloys. Construction, packaging, and industrial machinery sectors further contribute to market growth. Manufacturers emphasize advanced alloy formulations, recycling practices, and sustainable production to meet regulatory standards. Partnerships with global alloy producers and R&D investment support innovation, improved performance, and customized solutions across multiple industrial applications.

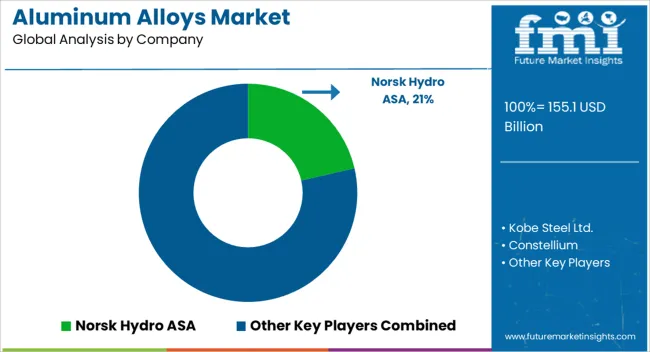

Competition in the aluminum alloys market is defined by product performance, alloy strength, and versatility across automotive, aerospace, construction, and industrial applications. Norsk Hydro ASA and Kobe Steel Ltd. lead with high-strength, corrosion-resistant, and lightweight alloys tailored for transportation, aerospace, and industrial manufacturing, emphasizing advanced extrusion and rolling technologies. Constellium and Aleris International Inc. compete through specialized aluminum sheets, plates, and profiles for automotive lightweighting, aerospace components, and architectural applications. Aluminium Bahrain B.S.C. and Dubai Aluminium Company Ltd. focus on large-scale primary aluminum production and integrated alloy solutions to meet global industrial demand, providing both standard and custom formulations. Kaiser Aluminum Corporation differentiates through premium aerospace-grade alloys, precision-engineered components, and heat-treated products for specialized applications.

Mid-tier and regional competitors, including UACJ Corporation, Novelis Inc., and Hindalco Industries, provide niche products for packaging, construction, and transportation, often emphasizing recyclability, energy efficiency, and tailored alloy compositions. Strategies across the industry focus on product diversification, high-performance alloy development, and compliance with international quality and environmental standards.

Lifecycle support, technical advisory, and customized fabrication services are increasingly highlighted. Product brochures and marketing materials detail mechanical properties, alloy composition, extrusion and rolling specifications, corrosion resistance, thermal treatment options, and application guidelines, reflecting a market focused on strength, durability, and end-use adaptability.

| Item | Value |

|---|---|

| Quantitative Units | USD 155.1 billion |

| Product | Wrought alloy and Cast alloy |

| End User Industry | Transportation, Construction, Packaging, Machinery, Electrical, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Norsk Hydro ASA, Kobe Steel Ltd., Constellium, Aleris International Inc., Aluminium Bahrain B.S.C., Dubai Aluminium Company Ltd., and Kaiser Aluminum Corporation |

| Additional Attributes | Dollar sales, market share, CAGR, top-growing regions, end-use sector demand (automotive, aerospace, construction, packaging), competitive landscape, leading players’ product offerings, pricing trends, alloy grades, and export-import dynamics. |

The global aluminum alloys market is estimated to be valued at USD 155.1 billion in 2025.

The market size for the aluminum alloys market is projected to reach USD 252.7 billion by 2035.

The aluminum alloys market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in aluminum alloys market are wrought alloy and cast alloy.

In terms of end user industry, transportation segment to command 46.8% share in the aluminum alloys market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aluminum Foam Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Cap & Closure Market Forecast and Outlook 2025 to 2035

Aluminum Casing of the Blade Battery Market Size and Share Forecast Outlook 2025 to 2035

Aluminum ROPP Closure Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Cans Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Packaging Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Pouches Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Peel-Off Ends Maker Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Tape Market Size and Share Forecast Outlook 2025 to 2035

Aluminum-Free Food Pouch Market Size and Share Forecast Outlook 2025 to 2035

Aluminum-Nickel Catalyst Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Frame Monitors Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Composite Materials Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Coated Thermal Protective Clothing Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Flat Products Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Sheets and Coils Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Containers Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Aerosol Cans Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Extrusion Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Hydroxide Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA