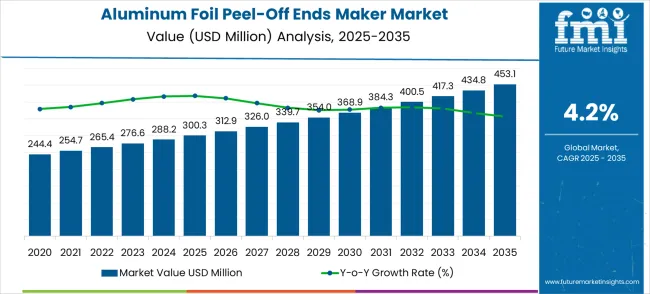

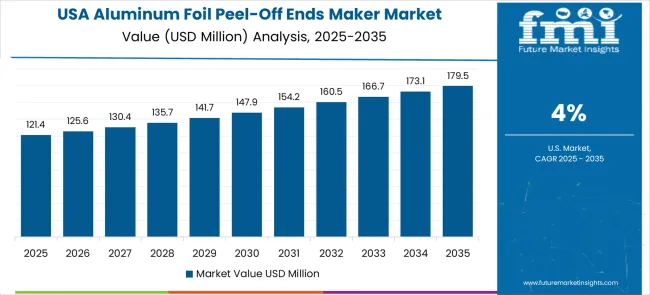

The aluminum foil peel-off ends maker market is valued at USD 300.3 million in 2025 and is forecasted to reach USD 453.1 million by 2035, reflecting a CAGR of 4.2%. This growth trajectory indicates a steady expansion of USD 152.8 million over the decade, with incremental increases each year. The demand is primarily influenced by the rising adoption of lightweight and recyclable packaging solutions in the food, beverage, and pharmaceutical industries. The CAGR value indicates moderate yet consistent growth, highlighting a market driven by stable industrial consumption patterns rather than volatile demand cycles.

The long-term growth trend suggests a consistent upward trajectory across the entire 10-year forecast period. The market is projected to progress from USD 300.3 million in 2025 to USD 312.9 million in 2026 and subsequently to USD 339.7 million by 2028, indicating steady demand without stagnation. By 2030, the market is expected to reach USD 368.9 million and continue its expansion to USD 434.8 million by 2034. This gradual growth pattern confirms that the market is not experiencing sharp spikes or sudden declines. Instead, it reflects ongoing reliance on aluminum-based peel-off ends, particularly in sectors where hygiene, preservation, and convenience drive packaging innovations.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 300.3 million |

| Forecast Value in (2035F) | USD 453.1 million |

| Forecast CAGR (2025 to 2035) | 4.2% |

The CAGR of 4.2% across the 2025–2035 period captures the average annual growth rate of the market. Year-on-year changes remain balanced, with an approximate 4% to 4.4% range that ensures predictability in market performance. This consistency suggests that the industry is neither overexposed to volatility nor driven by short-term consumption shifts. Instead, it reflects incremental increases in packaging demand across food products, canned beverages, and pharmaceutical packaging. The advancements in manufacturing efficiency and growing demand for eco-friendly packaging are expected to reinforce this CAGR, creating a stable environment for producers of peel-off ends machinery.

Trendline visualization indicates that the market follows a smooth linear trajectory, aligning closely with its CAGR-driven pattern. A linear trendline best represents this market because the year-over-year increments remain consistent across the ten-year period, with growth adding between USD 12 million and USD 20 million every two years. While an exponential or polynomial trendline could capture future innovation-driven surges, the available data supports a predominantly linear progression. This reflects a market poised for reliable growth, fueled by gradual adoption of modern packaging technology, increasing focus on steady consumer demand in end-use industries.

Market expansion is being supported by the increasing global demand for packaging automation solutions and the corresponding shift toward advanced manufacturing technologies that can provide superior operational efficiency while meeting industry requirements for high-speed and reliable packaging operations. Modern food and beverage manufacturers are increasingly focused on incorporating automated aluminum foil peel-off ends, which enable them to enhance production capacity while satisfying demands for consistent packaging quality and operational reliability. Aluminum foil peel-off ends makers' proven ability to deliver superior packaging efficiency, process consistency, and operational flexibility makes them essential equipment for modern packaging operations and industrial manufacturing applications.

The growing focus on food safety and pharmaceutical compliance is driving demand for high-quality aluminum foil peel-off ends maker products that can support distinctive operational capabilities and premium equipment positioning across food processing, pharmaceutical manufacturing, and cosmetics packaging categories. Equipment manufacturer preference for machinery that combines packaging excellence with advanced automation capabilities is creating opportunities for innovative aluminum foil peel-off ends maker implementations in both traditional and emerging packaging applications. The rising influence of sustainability requirements and operational efficiency is also contributing to increased adoption of premium aluminum foil peel-off ends maker products that can provide authentic high-performance packaging characteristics.

The aluminum foil peel-off ends maker market represents a mature, specialized packaging equipment opportunity with modest growth prospects, projected to expand from USD 300.3 million in 2025 to USD 453.1 million by 2035 at a conservative 4.2% CAGR—a 50.9% increase reflecting the established nature of this niche industrial machinery segment. This equipment produces the aluminum foil seals used on containers for food, pharmaceuticals, and cosmetics, serving a critical but specialized function in packaging operations.

The market benefits from steady demand in established food processing and pharmaceutical manufacturing sectors, though growth rates reflect the mature technology and limited addressable market size. Fully-automatic systems lead with 34.2% market share due to their efficiency advantages in high-volume production environments, while food and beverage applications dominate demand given the extensive use of foil seals in food packaging. Geographic growth is highest in China (5.7% CAGR) driven by expanding food processing capacity, though overall market expansion remains constrained by the specialized nature of this equipment category.

Pathway A - Fully-Automatic System Leadership. The dominant automation segment offers superior production efficiency and consistency essential for high-volume packaging operations. Companies developing advanced fully-automatic systems with enhanced speed, precision, and reliability will maintain leadership in this established market segment representing the largest share of demand. Expected revenue pool: USD 150-180 million.

Pathway B - Food and Beverage Application Focus. The primary application segment drives demand across food processing facilities requiring reliable foil seal production equipment. Providers developing food-grade systems with enhanced hygiene features, regulatory compliance, and operational efficiency will capture this fundamental market driving overall industry growth. Opportunity: USD 200-280 million.

Pathway C - Industry 4.0 Integration and Smart Manufacturing. Next-generation systems incorporating IoT connectivity, predictive maintenance, and automated quality control enable enhanced operational efficiency. Equipment with comprehensive data analytics, remote monitoring, and integration with broader factory automation systems command premium pricing and create ongoing service revenues. Revenue uplift: USD 60-100 million.

Pathway D - Geographic Expansion in China and Asia. China's food processing industry expansion and manufacturing automation investments create opportunities for packaging equipment suppliers. Local production partnerships, competitive pricing strategies, and technical support capabilities enable market penetration in this highest-growth region. Pool: USD 80-120 million.

Pathway E - Pharmaceutical and Healthcare Applications. Growing pharmaceutical packaging requirements and regulatory compliance standards drive demand for specialized equipment. Developing validated systems with cleanroom compatibility, regulatory documentation, and pharmaceutical-grade materials handling addresses this quality-sensitive, higher-margin market segment. Expected upside: USD 50-80 million.

Pathway F - Semi-Automatic and Flexible Systems. Smaller manufacturers and specialized applications require cost-effective, flexible equipment options. Companies developing semi-automatic systems with modular capabilities and quick changeover features serve mid-market segments and specialized applications beyond high-volume operations. USD 40-70 million.

Pathway G - Service and Support Optimization. Specialized industrial equipment requires comprehensive maintenance services, spare parts, and technical support. Developing integrated service offerings with preventive maintenance programs, training services, and rapid parts availability creates recurring revenue streams and customer relationships beyond equipment sales. Pool: USD 30-50 million.

Pathway H - Sustainability and Energy Efficiency. Environmental regulations and operational cost pressures drive demand for energy-efficient equipment with reduced waste generation. Developing eco-friendly packaging equipment with improved energy consumption, material efficiency, and recyclability features addresses growing environmental requirements in packaging operations. Expected revenue: USD 25-40 million.

The market is segmented by automation level, application, and region. By automation level, the market is divided into fully-automatic and semi-automatic systems. Based on application, the market is categorized into food and beverages, pharmaceuticals, cosmetics, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

The fully-automatic segment is projected to account for 34.2% of the aluminum foil peel-off ends maker market in 2025, reaffirming its position as the leading automation level category. Packaging manufacturers and industrial producers increasingly utilize fully-automatic aluminum foil peel-off ends making systems for their superior production efficiency, consistent operational performance, and ease of integration in large-scale manufacturing processes across diverse packaging applications. Fully-automatic technology's standardized control systems and advanced automation capabilities directly address the industrial requirements for high-speed production and efficient processing in commercial packaging manufacturing operations.

This automation segment forms the foundation of modern packaging applications, as it represents the technology with the greatest productivity potential and established manufacturing compatibility across multiple packaging production systems. Manufacturer investments in automation optimization and quality standardization continue to strengthen adoption among commercial packaging producers. With packaging companies prioritizing operational efficiency and consistent production output, fully-automatic aluminum foil peel-off ends making systems align with both productivity objectives and quality assurance requirements, making them the central component of comprehensive packaging automation strategies.

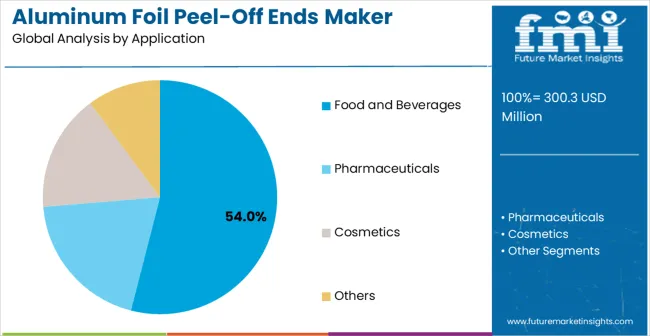

Food and beverages applications are projected to account 54.0% share of aluminum foil peel-off ends maker demand in 2025, highlighting their critical role as the primary application for automated packaging equipment in food processing and beverage manufacturing operations. Equipment manufacturers prefer aluminum foil peel-off ends makers for their exceptional hygiene standards, production efficiency, and ability to maintain consistent packaging quality while supporting strict food safety requirements during processing operations. Positioned as essential equipment for high-performance food packaging operations, aluminum foil peel-off ends makers offer both regulatory compliance and operational efficiency advantages.

The segment is supported by continuous growth in food processing activities and the growing availability of specialized equipment configurations that enable enhanced packaging efficiency and product quality optimization at the manufacturing level. Food and beverage manufacturers are investing in advanced packaging technologies to support premium product positioning and operational consistency. As food processing continues to expand and manufacturers seek superior packaging automation solutions, food and beverage applications will continue to dominate the application landscape while supporting technology advancement and manufacturing efficiency strategies.

The market is advancing steadily due to increasing packaging automation investments and growing demand for efficient manufacturing solutions that emphasize superior operational performance across food processing and pharmaceutical packaging applications. The market faces challenges, including high equipment costs compared to manual packaging alternatives, technical complexity in system integration and maintenance, and competition from alternative packaging technologies. Innovation in automation control systems and application-specific equipment development continues to influence market development and expansion patterns.

The growing adoption of aluminum foil peel-off ends makers in smart manufacturing and Industry 4.0 applications is enabling equipment manufacturers to develop systems that provide distinctive operational capabilities while commanding premium positioning and enhanced performance characteristics. Advanced applications provide superior packaging efficiency while allowing more sophisticated production development across various manufacturing categories and technology segments. Manufacturers are increasingly recognizing the competitive advantages of smart packaging positioning for premium equipment development and advanced manufacturing market penetration.

Modern aluminum foil peel-off ends maker suppliers are incorporating energy-efficient operation systems, eco-friendly material compatibility, and waste reduction technologies to enhance environmental responsibility, improve manufacturing efficiency, and meet industry demands for greener packaging solutions. These programs improve equipment performance while enabling new applications, including eco-friendly packaging and environmentally conscious manufacturing processes. Advanced green integration also allows suppliers to support premium market positioning and environmental leadership beyond traditional commodity packaging equipment.

| Country | CAGR (2025-2035) |

|---|---|

| China | 5.7% |

| India | 5.3% |

| Germany | 4.8% |

| Brazil | 4.4% |

| U.S. | 4.0% |

| U.K. | 3.6% |

| Japan | 3.2% |

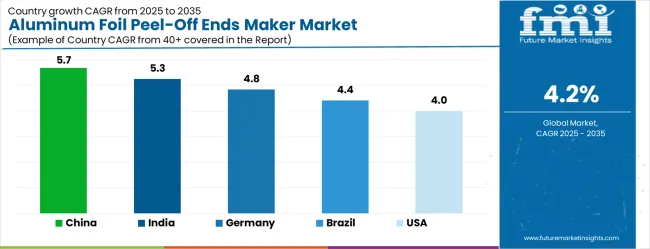

The market is experiencing robust growth globally, with China leading at a 5.7% CAGR through 2035, driven by the rapidly expanding packaging manufacturing sector, massive investments in food processing automation, and increasing adoption of advanced packaging technologies. India follows at 5.3%, supported by a growing food processing industry, rising manufacturing investments, and expanding pharmaceutical packaging capabilities. Germany shows growth at 4.8%, prioritizing advanced engineering technology and premium packaging equipment manufacturing. Brazil records 4.4%, focusing on emerging food processing applications and packaging automation development. The U.S. demonstrates 4.0% growth, prioritizing advanced manufacturing automation and packaging innovation. The U.K. exhibits 3.6% growth, supported by specialized packaging technology development and advanced manufacturing capabilities. Japan shows 3.2% growth, focusing precision manufacturing excellence and high-quality packaging equipment production.

The report covers an in-depth analysis of 40+ countries; top-performing countries are highlighted below.

China is projected to exhibit exceptional growth with a CAGR of 5.7% through 2035, driven by the rapidly expanding packaging manufacturing sector and massive government investments in food processing automation capabilities across major industrial hubs. The country's growing packaging industry capacity and increasing adoption of advanced automation technologies are creating substantial demand for high-performance packaging equipment in both established and emerging manufacturing applications. Major packaging equipment manufacturers and automation companies are establishing comprehensive production and assembly capabilities to serve both domestic consumption and export markets.

India is expanding at a CAGR of 5.3%, supported by the growing food processing industry, increasing manufacturing investments, and expanding pharmaceutical packaging applications. The country's developing packaging ecosystem and expanding automation capabilities are driving demand for reliable packaging equipment across both food processing and pharmaceutical manufacturing applications. International packaging equipment companies and domestic machinery manufacturers are establishing comprehensive distribution and assembly capabilities to address growing market demand for advanced packaging automation solutions.

Germany is projected to grow at a CAGR of 4.8% through 2035, driven by the country's advanced engineering technology sector, premium packaging equipment manufacturing capabilities, and leadership in precision automation solutions. Germany's sophisticated manufacturing culture and willingness to invest in high-performance packaging equipment are creating substantial demand for both standard and specialized aluminum foil peel-off end makers. Leading technology companies and packaging equipment manufacturers are establishing comprehensive innovation strategies to serve both European markets and growing international demand.

Brazil is projected to grow at a CAGR of 4.4% through 2035, supported by the country's expanding food processing sector, growing packaging applications, and increasing adoption of automation technologies requiring efficient packaging equipment solutions. Brazilian manufacturers and international companies consistently seek reliable packaging equipment that enhances operational efficiency for both domestic applications and regional markets. The country's position as a regional manufacturing hub continues to drive innovation in packaging automation applications and equipment standards.

The United States is projected to grow at a CAGR of 4.0% through 2035, supported by the country's advanced manufacturing sector, packaging technology innovation capabilities, and established leadership in automation solutions. American manufacturing companies and equipment manufacturers prioritize performance, reliability, and regulatory compliance, making aluminum foil peel-off ends makers essential equipment for both domestic production and technology-oriented manufacturing. The country's comprehensive research capabilities and technical expertise support continued market development.

The United Kingdom is projected to grow at a CAGR of 3.6% through 2035, supported by the country's specialized packaging technology sector, advanced manufacturing capabilities, and established expertise in automated packaging solutions. British manufacturers' focus on innovation, quality, and technical excellence creates steady demand for premium aluminum foil peel-off ends maker equipment. The country's attention to equipment performance and application optimization drives consistent adoption across both traditional packaging and emerging automation applications.

Japan is projected to grow at a CAGR of 3.2% through 2035, supported by the country's precision manufacturing excellence, advanced packaging technology expertise, and established reputation for producing superior packaging equipment while working to enhance automation efficiency capabilities and develop next-generation packaging technologies. Japan's packaging equipment industry continues to benefit from its reputation for delivering high-quality manufacturing machinery while focusing on innovation and precision engineering.

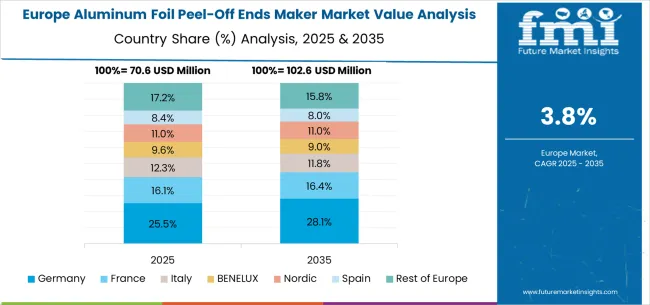

The aluminum foil peel-off ends market in Europe is projected to grow from USD 78.1 million in 2025 to USD 113.2 million by 2035, registering a CAGR of 3.8% over the forecast period. Germany is expected to maintain its leadership position with a 32.8% market share in 2025, remaining stable at 32.6% by 2035, supported by its advanced engineering technology sector, precision packaging equipment manufacturing industry, and comprehensive innovation capabilities serving European and international markets.

The United Kingdom follows with a 19.7% share in 2025, projected to reach 19.9% by 2035, driven by specialized packaging technology development programs, advanced manufacturing capabilities, and a growing focus on automated packaging solutions for premium applications. France holds a 17.4% share in 2025, expected to maintain 17.2% by 2035, supported by food processing industry demand and advanced packaging applications, but facing challenges from market competition and economic considerations. Italy commands a 14.1% share in 2025, projected to reach 14.3% by 2035, while Spain accounts for 8.6% in 2025, expected to reach 8.8% by 2035. The Netherlands maintains a 4.2% share in 2025, growing to 4.3% by 2035. The Rest of Europe region, including Nordic countries, Eastern Europe, Belgium, Switzerland, and Austria, is anticipated to hold 18.4% in 2025, declining slightly to 18.1% by 2035, attributed to mixed growth patterns with moderate expansion in some advanced packaging markets balanced by slower growth in smaller countries implementing packaging automation development programs.

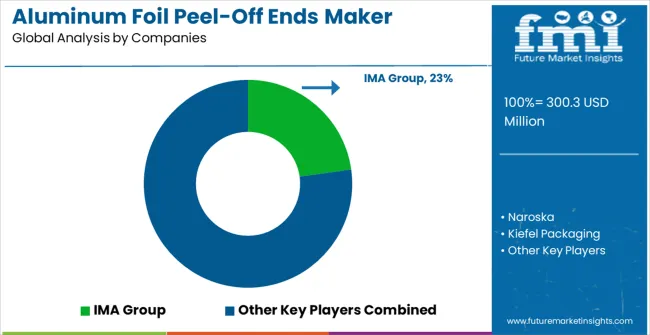

The market is characterized by competition among established packaging equipment companies, specialized automation manufacturers, and integrated machinery suppliers. Companies are investing in advanced automation technologies, operational efficiency systems, application-specific equipment development, and comprehensive technical support capabilities to deliver consistent, high-performance, and reliable aluminum foil peel-off ends maker products. Innovation in control system optimization, operational speed enhancement, and customized equipment configurations is central to strengthening market position and customer satisfaction.

IMA Group leads the market with a strong focus on packaging automation innovation and comprehensive manufacturing solutions, offering sophisticated aluminum foil peel-off ends maker products with focus on operational performance and technical excellence. Naroska provides specialized packaging equipment capabilities with a focus on pharmaceutical applications and precision manufacturing networks. Kiefel Packaging delivers advanced packaging technology, focusing on innovation and premium equipment development. Soudronic AG specializes in metal packaging solutions with focus on technical expertise and automation optimization. Sacmi focuses on packaging and processing equipment with advanced automation technologies. Canrace emphasizes packaging machinery expertise, focusing on operational efficiency and manufacturing reliability.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 300.3 million |

| Automation Level | Fully-automatic, Semi-automatic |

| Application | Food and Beverages, Pharmaceuticals, Cosmetics, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | IMA Group, Naroska, Kiefel Packaging, Soudronic AG, Sacmi, Canrace, Panji Intelligent Device, and Sunking Machinery Manufacturing |

| Additional Attributes | Dollar sales by automation level and application, regional demand trends, competitive landscape, technological advancements in packaging automation, operational efficiency development initiatives, quality optimization programs, and manufacturing integration strategies |

The global blue ceramic abrasive market is estimated to be valued at USD 498.5 million in 2025.

The market size for the blue ceramic abrasive market is projected to reach USD 1,086.2 million by 2035.

The blue ceramic abrasive market is expected to grow at a 8.1% CAGR between 2025 and 2035.

The key product types in blue ceramic abrasive market are coarse grain size (f12-f80), medium grain size (f100-f220) and fine grain size (f230-f800).

In terms of application, aerospace segment to command 38.0% share in the blue ceramic abrasive market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aluminum Alloy Sacrificial Anode Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foam Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Cap & Closure Market Forecast and Outlook 2025 to 2035

Aluminum Casing of the Blade Battery Market Size and Share Forecast Outlook 2025 to 2035

Aluminum ROPP Closure Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Cans Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Pouches Market Size and Share Forecast Outlook 2025 to 2035

Aluminum-Free Food Pouch Market Size and Share Forecast Outlook 2025 to 2035

Aluminum-Nickel Catalyst Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Frame Monitors Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Composite Materials Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Coated Thermal Protective Clothing Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Flat Products Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Alloys Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Sheets and Coils Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Aerosol Cans Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Extrusion Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Hydroxide Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Disposable Plates Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Cladding Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA