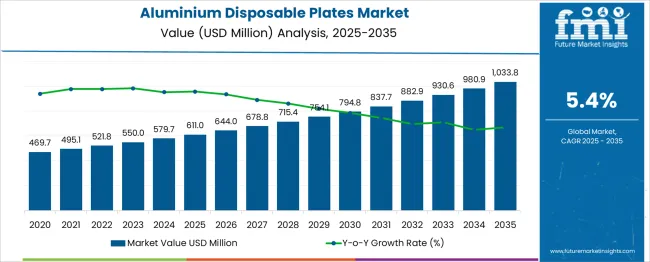

The aluminium disposable plates market is set to grow from USD 611.0 million in 2025 to USD 1,033.8 million by 2035, with a CAGR of 5.4%. The contribution of volume versus price growth shows that volume plays a significant role in early-stage market expansion, while price growth gains momentum in the later years. Between 2025 and 2030, the market grows from USD 611.0 million to USD 794.8 million, contributing USD 183.8 million in growth.

During this period, volume growth is the dominant contributor, driven by increasing demand for aluminium disposable plates in foodservice, packaging, and catering industries. Rising consumer preference for convenient, eco-friendly disposable products boosts overall demand. The volume-driven growth is particularly evident in emerging markets where disposable products are rapidly gaining popularity. From 2030 to 2035, the market continues to expand from USD 794.8 million to USD 1,033.8 million, adding USD 239 million in growth, with an increased contribution from price growth.

As demand for high-quality, premium, and environmentally friendly products rises, manufacturers are able to increase prices, especially with innovations in production processes and more sustainable materials. Price growth is particularly evident in markets where consumer spending power increases, allowing for premium-priced, eco-conscious products. The overall contribution analysis shows that while volume plays a significant role initially, price growth becomes increasingly important as the market matures.

| Metric | Value |

|---|---|

| Aluminum Disposable Plates Market Estimated Value in (2025 E) | USD 611.0 million |

| Aluminum Disposable Plates Market Forecast Value in (2035 F) | USD 1033.8 million |

| Forecast CAGR (2025 to 2035) | 5.4% |

The aluminium disposable plates market is witnessing consistent expansion, driven by the growing demand for lightweight, recyclable, and heat-resistant food packaging solutions. Increasing environmental concerns and restrictions on plastic-based disposables have accelerated the shift toward aluminium alternatives that offer both sustainability and performance benefits.

In the current landscape, foodservice operators, event organizers, and QSRs are prioritizing packaging materials that combine hygiene with strength, and aluminium plates have emerged as a favorable option due to their grease resistance, thermal stability, and ease of stacking. The growing focus on single-serve and ready-to-eat meal consumption, especially in urban areas, is expected to further support market adoption.

Government initiatives promoting circular economy practices and consumer awareness about eco-friendly materials are also playing a crucial role. Over the forecast period, innovations in aluminium rolling technologies, increasing customization in plate design, and the expansion of organized retail food formats are projected to enhance the market’s long-term trajectory.

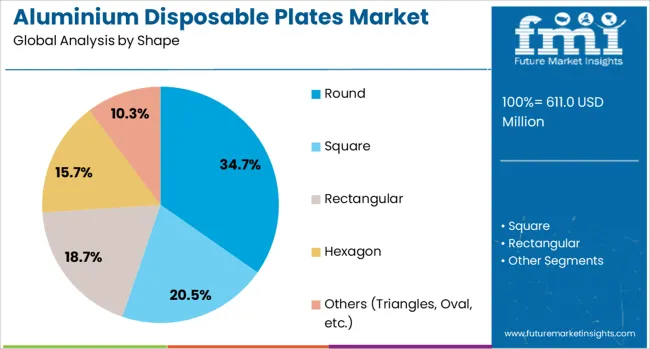

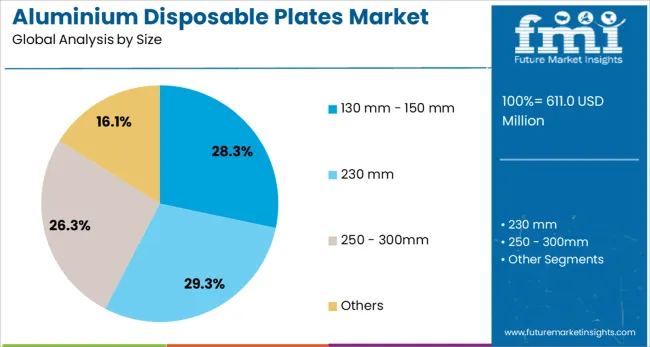

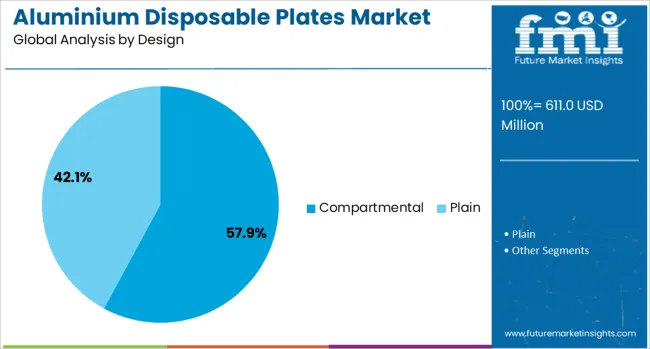

The aluminum disposable plates market is segmented by shape, size, designsales channel, and geographic regions. By shape of the aluminum disposable plates market is divided into Round, Square, Rectangular, HexagonOthers (Triangles, Oval, etc.). In terms of size of the aluminum disposable plates market is classified into 130 mm - 150 mm, 230 mm, 250 - 300mmOthers. Based on design of the aluminum disposable plates market is segmented into Compartmental and Plain. By sales channel of the aluminum disposable plates market is segmented into B2B B2C (Retail). Regionally, the aluminum disposable plates industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The round shape segment is projected to account for 34.7% of the aluminium disposable plates market revenue share in 2025, making it the leading shape category. This prominence is being supported by the universal applicability of round plates across both casual and formal dining setups. Round plates are preferred in foodservice operations due to their ergonomic design, balanced weight distribution, and space-efficient stacking during transport and storage.

Manufacturers have optimized tooling systems to mass-produce round formats with consistent thickness and edge protection, aligning with hygiene and safety standards in institutional catering. Their compatibility with a wide variety of sealing and wrapping materials has also enhanced utility across delivery-based food models.

Furthermore, consumer perception of round plates as a conventional and familiar option contributes to higher purchase frequency. The ability to cater to both hot and cold dishes without structural compromise, coupled with superior recyclability and heat retention, has ensured their dominance in the segment.

The 130 mm - 150 mm size segment is expected to hold 28.3% of the aluminium disposable plates market revenue share in 2025. This segment’s leadership is influenced by its suitability for single-portion servings across catering events, institutional dining, and takeaway services. The size range balances compactness and usability, making it ideal for snacks, appetizers, and side dishes while minimizing material usage and cost per unit.

Increased adoption of this size in airline meals, quick-service restaurants, and packed lunch offerings has strengthened its presence in high-volume consumption settings. The segment has benefited from advances in die-pressing techniques that ensure uniform depth and edge curling, improving product safety and usability.

Its compact dimensions allow efficient nesting, reducing transportation costs and storage space requirements. As operators in the foodservice and hospitality sectors seek portion-controlled and cost-effective disposable packaging, this size range is expected to remain a preferred standard in various operational models.

The compartmental design segment is projected to contribute 57.9% of the aluminium disposable plates market revenue share in 2025, establishing it as the most dominant design format. This growth has been driven by the need for functional food separation, especially in multi-item meal services such as thalis, combo meals, and institutional trays. Compartmental plates address consumer preferences for neatly divided meal components while reducing cross-contamination and preserving food textures.

The design also supports efficient portioning and aesthetic presentation, which are increasingly valued in corporate catering and event dining. Advances in die-moulding and sheet extrusion have allowed the development of multi-compartment formats without compromising structural integrity or heat resistance.

Their ability to accommodate both solid and liquid dishes without spillage enhances convenience in takeaway and delivery models. As hygiene and food presentation standards gain greater importance across the foodservice ecosystem, the demand for compartmental aluminium plates is expected to remain strong and resilient.

The aluminium disposable plates market is expanding due to the increasing demand for convenient, eco-friendly, and lightweight food packaging solutions. Aluminium plates are widely used in the foodservice industry for their durability, heat resistance, and ability to retain food freshness. As consumers seek more convenient, disposable options for both personal and commercial use, the demand for aluminium plates continues to rise. Despite challenges such as cost considerations and competition from alternative materials, opportunities exist in the growing preference for environmentally conscious, recyclable products and the rise of online food delivery services.

The growth of the aluminium disposable plates market is primarily driven by the increasing demand for convenient, disposable food packaging solutions. As consumers’ lifestyles become busier, the demand for ready-to-eat meals and food delivery services has increased. Aluminium plates offer several advantages, including heat resistance, insulation, and strength, making them ideal for holding hot food and preventing leakage. Additionally, the growing preference for eco-friendly, recyclable packaging options is encouraging the shift towards aluminium plates over plastic alternatives. These factors, combined with their ability to provide effective food storage and presentation, contribute to the growing market demand.

A major challenge in the aluminium disposable plates market is the high cost of raw materials and production processes. Aluminium is more expensive compared to other materials like plastic or paper, which can make disposable aluminium plates less affordable, particularly for price-sensitive consumers and foodservice businesses. The higher production costs also impact the price of the final product, limiting its widespread adoption. Competition from alternative materials, such as biodegradable plates, paper, and plastic, poses a challenge, especially in markets where consumers are opting for lower-cost or perceived more sustainable alternatives to aluminium-based products.

The aluminium disposable plates market presents significant opportunities driven by the growth in food delivery services and increasing consumer preference for convenience. As online food delivery services continue to rise, especially in urban areas, the demand for disposable packaging solutions like aluminium plates is increasing. Aluminium’s ability to maintain food temperature and its strength make it a preferred choice for takeout and delivery packaging. Furthermore, the growing emphasis on recyclable packaging and the desire for more durable, high-quality disposable products present opportunities for market expansion. As consumers continue to seek high-performance, convenient packaging, the demand for aluminium plates is likely to increase.

A key trend in the aluminium disposable plates market is the increasing demand for recyclable and lightweight packaging solutions. With growing concerns over plastic waste and environmental impact, consumers and businesses are opting for packaging materials that are easy to recycle and eco-friendly. Aluminium plates, known for their recyclability and ability to withstand high temperatures, are gaining traction in this regard. Manufacturers are focusing on producing lighter aluminium plates that maintain strength and durability, helping reduce transportation costs and improve overall efficiency. This shift toward more sustainable and efficient packaging solutions is expected to continue shaping the market, making aluminium disposable plates a more attractive option for foodservice businesses.

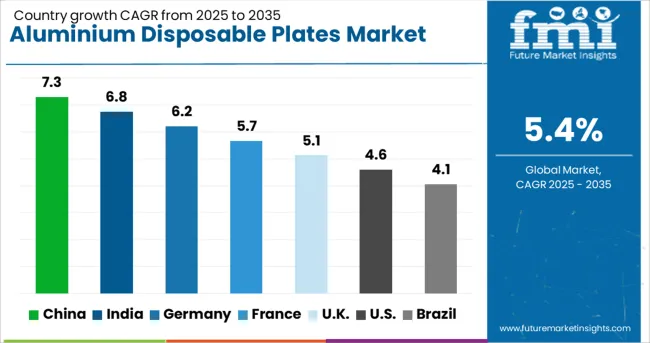

| Country | CAGR |

|---|---|

| China | 7.3% |

| India | 6.8% |

| Germany | 6.2% |

| France | 5.7% |

| UK | 5.1% |

| USA | 4.6% |

| Brazil | 4.1% |

The aluminium disposable plates market is expected to experience steady growth globally, with significant contributions from countries like China, India, and OECD markets such as France, the UK, and the USA China leads the market with a growth rate of 7.3%, followed by India at 6.8%, and Germany at 6.2%. France is projected to grow at 5.7%, while the United Kingdom shows a growth rate of 5.1%, and the USA at 4.6%. The demand for aluminium disposable plates in China and India is driven by growing consumer preference for convenience and sustainability in food packaging. In developed economies like France, the UK, and the USA, increasing regulations on eco-friendly alternatives to traditional plastic products contribute to steady market growth. The analysis spans 40+ countries, with the leading markets shown below.

China is expected to grow at a CAGR of 7.3% through 2035 in the aluminium disposable plates market. The country’s expanding foodservice sector, particularly in urban areas, is driving the demand for convenient and eco-friendly packaging solutions. As consumer preferences shift toward sustainable alternatives to plastic, aluminium disposable plates are gaining popularity. The growing awareness of environmental concerns, combined with increasing disposable incomes and a shift in eating habits, further boosts demand. The expansion of food delivery services and the rise in takeaway culture contribute to the demand for aluminium plates. Manufacturers are focusing on enhancing the quality of disposable plates to cater to the growing foodservice industry. With rapid urbanization and government policies promoting the reduction of plastic waste, China’s demand for aluminium disposable plates is expected to continue its strong growth.

India is projected to grow at a CAGR of 6.8% through 2035, driven by an increasing preference for convenient and eco-friendly packaging. With rapid urbanization, there is a surge in food delivery and takeaway services, increasing demand for disposable plates. The rise in disposable incomes, especially among the middle class, is driving higher consumption of ready-to-eat meals, further boosting the market for aluminium disposable plates. As consumers become more conscious of environmental impact, the shift away from plastic products and toward sustainable alternatives like aluminium is gaining momentum. India’s foodservice industry, supported by increasing fast-food chains and online food delivery platforms, is a major contributor to the market. Government regulations focusing on reducing plastic usage and promoting sustainable packaging solutions are further accelerating growth.

Germany is projected to grow at a CAGR of 6.2% through 2035 in the aluminium disposable plates market. Germany’s increasing commitment to reducing plastic waste, coupled with the growing demand for eco-friendly alternatives, is significantly driving the market. The foodservice industry, particularly fast-food outlets, caterers, and takeaway services, is adopting aluminium disposable plates as part of efforts to reduce plastic use. Growing environmental awareness among German consumers is encouraging the shift to sustainable packaging options. Germany’s strong focus on sustainability and green initiatives, along with stricter regulations on plastic products, further accelerates the market for aluminium plates. As demand for eco-conscious products grows, manufacturers are investing in high-quality aluminium plates that offer durability and environmental benefits. With Germany being a leader in sustainable practices within the European Union, its commitment to eco-friendly packaging drives the adoption of aluminium disposable plates.

The United Kingdom is projected to grow at a CAGR of 5.1% through 2035 in the aluminium disposable plates market, as the demand for sustainable and convenient packaging solutions continues to rise. With a growing focus on reducing plastic waste, the UK has become a key market for aluminium plates, driven by increasing awareness among consumers and businesses about environmental impact. The rise in takeaway and food delivery services, particularly in urban areas, has led to an increased need for high-quality disposable plates. As a result, manufacturers in the UK are innovating to provide aluminium plates that meet both performance and sustainability standards. Moreover, stringent government regulations promoting the reduction of plastic use are driving the adoption of aluminium as a more environmentally friendly alternative for disposable packaging.

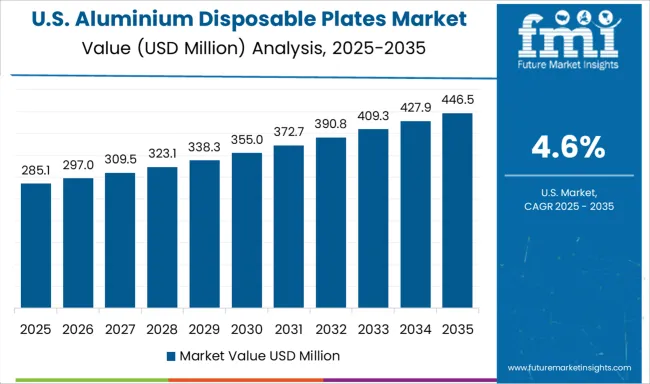

The United States aluminium disposable plates market grows at 4.6%, supported by increasing food delivery and catering services. Compared to China, the US market faces stronger competition from biodegradable alternatives but maintains steady growth through product durability and convenience. Demand is rising among consumers hosting outdoor gatherings and large events. The hospitality industry incorporates aluminium plates for ease of use and cleanup. Manufacturers invest in product improvements like grease resistance and stackability. Government regulations on single-use plastics contribute to gradual market shift toward aluminium plates. Growing awareness of recyclable packaging further supports market expansion.

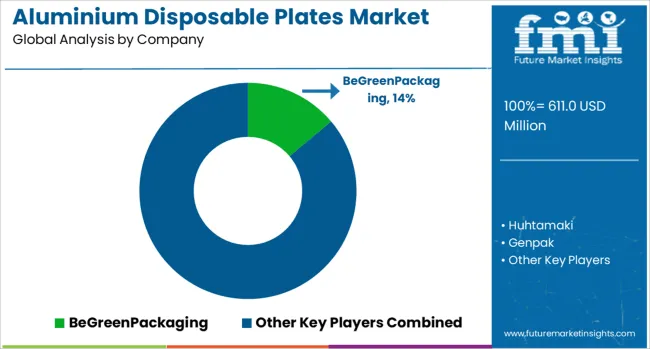

The aluminium disposable plates market is driven by major players specializing in eco-friendly, high-quality disposable tableware used in the foodservice, catering, and hospitality industries. BeGreen Packaging is a market leader, focusing on environmentally sustainable products that offer both convenience and eco-friendliness with their aluminium disposable plates. Huhtamaki offers a wide range of disposable tableware, including aluminium plates, with a strong emphasis on sustainability and innovation in design.

Genpak is another significant player, providing a broad selection of foodservice products, including aluminium plates, with a focus on durability and functionality. Georgia-Pacific and CKF contribute to the market with disposable packaging solutions, including aluminium plates, catering to both commercial and institutional foodservice sectors, emphasizing strength and cost-effectiveness. Contital offers high-quality aluminium plates designed for both food safety and convenience, targeting the hospitality industry and mass catering needs.

Duni is known for providing innovative and aesthetically designed disposable tableware, including aluminium plates, to meet the demands of upscale foodservice businesses. Dopla and FastPlast are key players offering cost-effective aluminium plates, focusing on bulk supply and functional design. HOSTI and NUPIK-FLOUK provide specialised disposable plates for hotels, catering services, and large events, ensuring product reliability and performance. Jinhua Lansin Commodity and Poppies Europe focus on the production of affordable, high-quality disposable aluminium plates for the catering and takeaway industries.

Aluminium

| Item | Value |

|---|---|

| Quantitative Units | USD 611.0 Million |

| Shape | Round, Square, Rectangular, Hexagon, and Others (Triangles, Oval, etc.) |

| Size | 130 mm - 150 mm, 230 mm, 250 - 300mm, and Others |

| Design | Compartmental and Plain |

| Sales Channel | B2B and B2C (Retail) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Be Green Packaging, Huhtamaki, Genpak, Georgia-Pacific, CKF, Contital, Duni, Dopla, FastPlast, HOSTI, NUPIK-FLOUK, Jinhua Lansin Commodity, PoppiesEurope, PolarPlastic, and SeowKhimPolyethylene |

| Additional Attributes | Dollar sales by product type (round aluminium plates, square aluminium plates, divided aluminium plates) and end-use segments (foodservice, catering, hospitality, retail). Demand dynamics are driven by increasing consumer preference for sustainable, single-use tableware, as well as growing use in outdoor events, parties, and quick-service restaurants. Regional trends show strong growth in North America and Europe, with increasing demand for eco-friendly disposable products in response to environmental concerns, while Asia-Pacific is expanding rapidly due to the growing foodservice sector. |

The global aluminum disposable plates market is estimated to be valued at USD 611.0 million in 2025.

The market size for the aluminum disposable plates market is projected to reach USD 1,033.8 million by 2035.

The aluminum disposable plates market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in aluminum disposable plates market are round, square, rectangular, hexagon and others (triangles, oval, etc.).

In terms of size, 130 mm - 150 mm segment to command 28.3% share in the aluminum disposable plates market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Disposable Plates Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Disposable Plates Providers

Aluminum Alloy Sacrificial Anode Market Size and Share Forecast Outlook 2025 to 2035

Disposable Medical Gowns Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foam Market Size and Share Forecast Outlook 2025 to 2035

Disposable Drills Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Cap & Closure Market Forecast and Outlook 2025 to 2035

Aluminum Casing of the Blade Battery Market Size and Share Forecast Outlook 2025 to 2035

Disposable Food Containers Market Size and Share Forecast Outlook 2025 to 2035

Disposable Protective Apparel Market Size and Share Forecast Outlook 2025 to 2035

Aluminum ROPP Closure Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Cans Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Packaging Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Pouches Market Size and Share Forecast Outlook 2025 to 2035

Disposable Hygiene Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Peel-Off Ends Maker Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Tape Market Size and Share Forecast Outlook 2025 to 2035

Aluminum-Free Food Pouch Market Size and Share Forecast Outlook 2025 to 2035

Aluminum-Nickel Catalyst Market Size and Share Forecast Outlook 2025 to 2035

Disposable Umbilical Cord Protection Bag Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA