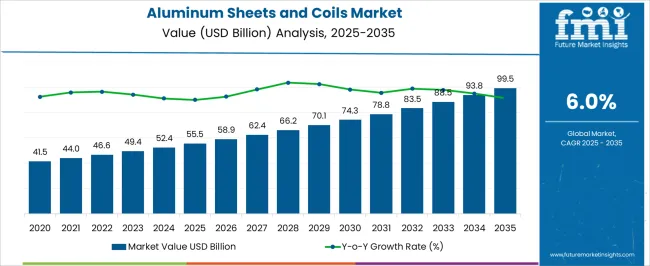

The aluminum sheets and coils market is expected to experience steady growth from USD 55.5 billion in 2025 to USD 99.5 billion by 2035, driven by an anticipated CAGR of 6%. This growth reflects the increasing demand for lightweight and durable materials across various industries, particularly automotive, construction, and packaging.

The automotive industry, in particular, plays a significant role in this expansion, as aluminum is increasingly used in vehicle manufacturing due to its lightweight properties, which enhance fuel efficiency and reduce emissions. Furthermore, the construction industry’s growing preference for aluminum’s corrosion-resistant properties is driving demand for its use in building facades, roofing, and structural components.

This ongoing demand across key sectors is expected to sustain the market's growth trajectory over the next decade. The market dynamics are further influenced by the growing need for recyclable and environmentally friendly materials, particularly in the packaging sector. Aluminum's versatility and recyclability are key advantages in this space, with its usage in beverage cans, food packaging, and containers gaining popularity. Asia-Pacific, particularly China and India, is set to remain a dominant force in the global market.

China, as the largest producer and consumer of aluminum, is poised to maintain significant market shares, while India’s expanding manufacturing sector further supports the demand for aluminum products. As the demand for aluminum sheets and coils increases across regions, stakeholders will need to monitor regional shifts and trends to capitalize on new growth opportunities.

| Metric | Value |

|---|---|

| Aluminum Sheets and Coils Market Estimated Value in (2025 E) | USD 55.5 billion |

| Aluminum Sheets and Coils Market Forecast Value in (2035 F) | USD 99.5 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

The aluminum sheets and coils market holds a notable share within several parent markets, including aluminum sheets, aluminum rolled products, and aluminum flat rolled products. Within the aluminum sheets market, which is a broader segment, the aluminum sheets and coils market represents a significant portion due to its widespread use in industries like automotive, construction, and packaging. It is estimated that the market share of aluminum sheets and coils in the aluminum sheet segment is approximately 40-45%, as it serves as a crucial form for many manufacturing processes.

In the aluminum rolled products market, which includes a range of aluminum forms, the share of aluminum sheets and coils is around 35-40%. This is due to the high demand for aluminum sheets and coils in sectors requiring both strength and flexibility, such as transportation and electronics. The aluminum flat rolled products market, which is another key parent, sees aluminum sheets and coils holding a substantial share of about 45-50%. This is largely attributed to their versatility, used in applications ranging from packaging materials to architectural structures. The aluminum sheets and coils market's strong presence in these segments highlights its essential role across various industries, driven by its properties such as durability, corrosion resistance, and lightweight nature, which make it a preferred choice in several manufacturing and consumer sectors.

Lightweight properties, corrosion resistance, and high recyclability have positioned aluminum sheets and coils as preferred materials in multiple applications. Growth is being driven by the transition toward sustainable materials, particularly as industries seek to reduce carbon footprints and enhance fuel efficiency.

The development of advanced alloys and improved surface treatments has further expanded their performance range, enabling use in demanding environments. Technological advancements in rolling and finishing processes are allowing for greater precision, quality consistency, and cost efficiency, thereby attracting wider adoption.

Strategic investments in manufacturing capacity and downstream integration are supporting supply chain stability, which is crucial for high-demand sectors. With ongoing innovations in alloy design, coupled with growing emphasis on sustainability and circular economy practices, the market is expected to maintain strong momentum, offering opportunities across both developed and emerging economies.

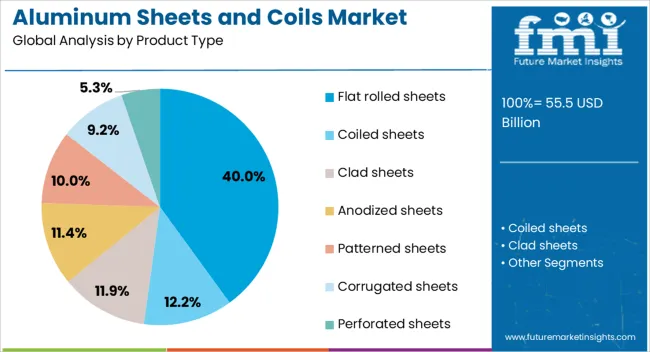

The aluminum sheets and coils market is segmented by product type, grade/alloy type, processing method, end use, and geographic regions. By product type, aluminum sheets and coils market is divided into Flat rolled sheets, Coiled sheets, Clad sheets, Anodized sheets, Patterned sheets, Corrugated sheets, and Perforated sheets.

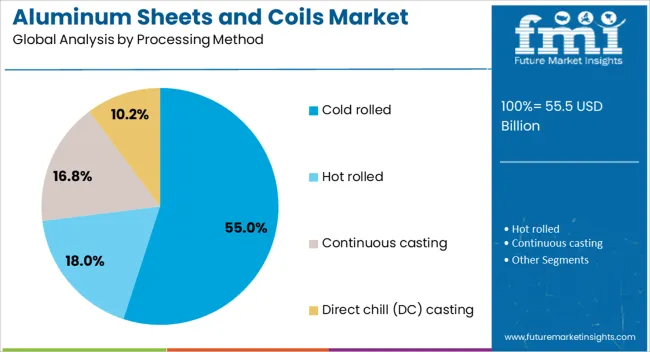

In terms of grade/alloy type, aluminum sheets and coils market is classified into 5xxx series, 1xxx series, 2xxx series, 3xxx series, 6xxx series, 7xxx series, and 8xxx series. Based on processing method, the aluminum sheets and coils market is segmented into cold-rolled, hot-rolled, Continuous casting, and Direct chill (DC) casting.

By end use, aluminum sheets and coils market is segmented into Automotive, Building & construction, Aerospace, Electrical & electronics, Food & beverage, Machinery & equipment, Consumer durables, and Others. Regionally, the aluminum sheets and coils industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The flat rolled sheets segment is projected to account for 40% of the Aluminum Sheets and Coils market revenue share in 2025, making it the leading product type. This segment’s dominance has been supported by its versatility in structural and decorative applications, where uniform thickness, smooth finish, and high dimensional accuracy are required.

The processing characteristics of flat rolled sheets allow them to be tailored to specific strength and formability requirements, making them suitable for a wide range of industrial uses. The ability to produce these sheets in varying thicknesses and widths has expanded their applicability across automotive body panels, building facades, and packaging materials.

Their compatibility with advanced coatings and surface finishes further enhances performance in corrosive and high-wear environments. As manufacturers increasingly seek lightweight yet durable materials, the demand for flat rolled sheets is expected to remain strong, with consistent adoption across multiple end-use sectors reinforcing their leadership in the market.

The 5xxx series grade segment is expected to hold 30% of the Aluminum Sheets and Coils market revenue share in 2025, making it the leading grade type. This segment’s growth has been attributed to the alloy’s excellent corrosion resistance, high strength-to-weight ratio, and superior weldability, making it particularly suitable for marine, automotive, and structural applications.

The magnesium content in the 5xxx series enhances its resistance to saltwater corrosion, which has been a key factor in its adoption for shipbuilding and coastal infrastructure. Additionally, its ability to maintain mechanical properties at low temperatures has expanded its use in refrigerated transport and storage.

The ease of forming and processing without compromising strength has supported its integration into high-performance manufacturing lines. With industries prioritizing materials that combine durability with lightness, the 5xxx series continues to meet stringent technical specifications, ensuring its position as the most sought-after alloy type within the aluminum sheets and coils market.

The cold rolled segment is anticipated to represent 55% of the Aluminum Sheets and Coils market revenue share in 2025, making it the leading processing method. The growth of this segment has been supported by the superior surface finish, improved mechanical properties, and enhanced dimensional accuracy achieved through cold rolling.

This method enables the production of aluminum sheets and coils with tighter tolerances and increased hardness, which are essential in applications demanding precision and performance. Cold rolled products are widely utilized in automotive manufacturing, electronics casings, and architectural cladding due to their aesthetic appeal and durability.

The process also allows for better control over thickness and flatness, enabling high-quality downstream fabrication. As end-use industries increasingly focus on lightweight materials with high formability and excellent surface quality, cold rolling remains the preferred processing method, ensuring long-term demand and solidifying its dominant position in the overall market.

The aluminum sheets and coils market is poised for steady growth, driven by expanding demand in key industries like automotive and construction. Emerging economies present substantial opportunities for market players to tap into new sectors.

However, challenges such as raw material price fluctuations and competition from alternative materials will require strategic responses. The market is set to evolve with growing trends in energy efficiency, lightweight manufacturing, and recycling practices, ensuring its relevance in an ever-changing industrial landscape.

The aluminum sheets and coils market is experiencing increasing demand across multiple sectors, including automotive, construction, and packaging. The lightweight, durable, and corrosion-resistant properties of aluminum make it a preferred material for manufacturers aiming to reduce weight while maintaining structural integrity. Its use in electric vehicle production, where lightweight materials are critical for efficiency, is expanding rapidly.

As industries evolve, the demand for aluminum sheets and coils is anticipated to grow steadily, driven by shifting consumer preferences for more sustainable materials in applications that require resilience.

Emerging economies offer vast opportunities for growth in the aluminum sheets and coils market. Countries in Asia-Pacific and Latin America are witnessing rapid industrialization, with governments incentivizing infrastructure development, which directly boosts the demand for aluminum products. Industries like construction and automotive, increasingly shifting toward aluminum for energy-efficient products, present significant untapped markets.

Expanding production capabilities to meet regional demand could position key players for long-term success. Local production and strategic partnerships with distributors can enhance market presence and reduce operational costs.

The aluminum sheets and coils market is seeing key trends emerge, such as the growing adoption of lightweight materials in the manufacturing of consumer electronics and vehicles. Aluminum’s role in increasing energy efficiency in these sectors continues to grow, driven by stricter regulations and consumer demands for greener products. The development of aluminum alloys with enhanced properties is further pushing the boundaries of its usage in high-performance applications. Increased focus on recyclability and circular economy practices is likely to shape the market in the coming years.

Despite its growth, the aluminum sheets and coils market faces challenges, particularly concerning the volatility of raw material prices. Fluctuations in the price of aluminum scrap and energy costs impact production costs and market stability.

Additionally, intense competition from alternative materials, such as high-strength steel and composites, threatens to slow the growth of aluminum applications. Trade barriers and tariffs also hinder market expansion in certain regions, with supply chain disruptions and import/export restrictions adding to the complexity of doing business globally.

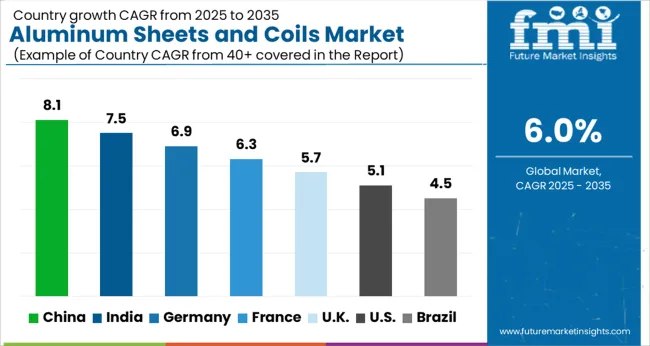

| Country | CAGR |

|---|---|

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

| France | 6.3% |

| UK | 5.7% |

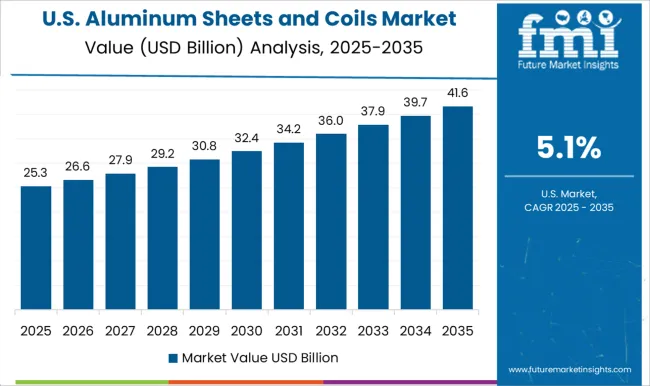

| USA | 5.1% |

| Brazil | 4.5% |

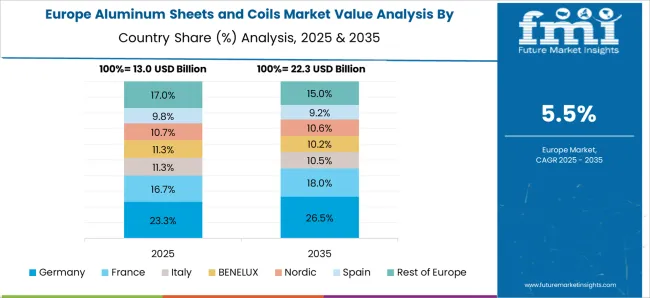

The global aluminum sheets and coils market is projected to grow at a 6% CAGR from 2025 to 2035. China leads with a growth rate of 8.1%, followed by India at 7.5%, and Germany at 6.9%. The United Kingdom records a growth rate of 5.7%, while the United States shows the slowest growth at 5.1%. The demand for aluminum sheets and coils is driven by growth in the automotive, construction, packaging, and electronics industries. As China and India rapidly industrialize, they are seeing higher adoption rates, while mature markets like the USA and the UK experience steady, but slower growth, driven by continued innovation and demand for lightweight materials. This report includes insights on 40+ countries; the top markets are shown here for reference.

The aluminum sheets and coils market in China is projected to grow at a CAGR of 8.1%. China’s robust industrialization and thriving manufacturing sector are the primary drivers behind the market’s growth. The automotive, construction, and packaging industries are significant contributors to this demand, as aluminum’s lightweight properties are ideal for use in manufacturing processes. Government policies aimed at improving industrial production efficiency and encouraging sustainable practices are expected to further accelerate the adoption of aluminum sheets and coils in the country.

The aluminum sheets and coils market in India is expected to grow at a CAGR of 7.5%. The growth is fueled by the country’s booming construction and automotive sectors. The need for lightweight, durable materials is growing as industries increasingly adopt aluminum for vehicle manufacturing and building infrastructure. The Indian government’s focus on enhancing manufacturing capabilities and improving infrastructure also supports this demand, creating opportunities for aluminum-based products across a range of applications, from transport to energy-efficient building materials.

The aluminum sheets and coils market in Germany is projected to grow at a CAGR of 6.9%. As a leader in manufacturing, especially in the automotive, aerospace, and construction industries, Germany’s demand for aluminum is driven by the need for lightweight, durable materials in these high-precision sectors. Germany’s emphasis on environmental sustainability and energy efficiency further supports the adoption of aluminum products. Additionally, the country’s strong push for the digitalization of manufacturing processes will likely accelerate the use of aluminum sheets and coils in innovative applications.

The aluminum sheets and coils market in the UK is projected to grow at a CAGR of 5.7%. The demand is driven by industries such as automotive and construction, where lightweight and corrosion-resistant materials are increasingly required. The UK government’s emphasis on green building regulations and its push toward sustainable manufacturing processes are contributing factors. Additionally, with the ongoing recovery of the UK’s construction sector, demand for aluminum in building materials such as cladding and roofing is expected to continue to rise steadily.

The aluminum sheets and coils market in the USA is projected to grow at a CAGR of 5.1%. The market in the USA is supported by demand from the automotive and construction industries, where aluminum is favored for its strength, weight reduction benefits, and recyclability. The ongoing trend of building energy-efficient homes and commercial buildings is also driving the use of aluminum in construction applications. Despite slower growth compared to other markets, steady demand from key industries and the USA government’s emphasis on green technologies continue to support the market.

In the aluminum sheets and coils market, leading companies are focusing on expanding their global footprint by leveraging manufacturing efficiencies and strategic partnerships. Industry giants such as Novelis, Arconic, and Hindalco are driving growth by offering premium products tailored for automotive, aerospace, and construction sectors, while also enhancing their product portfolios with recycled content and lightweight solutions. These companies are increasingly relying on their established production facilities to scale up capacity, particularly in high-demand regions like North America and Europe.

Suppliers such as Aleris and Norsk Hydro support market expansion by ensuring a steady supply of raw materials, which helps in mitigating supply chain risks and enhancing operational efficiency. Regional players like China Zhongwang and Kaiser Aluminum are focusing on cost-competitive products, providing solutions for the growing demand in the industrial sector, particularly in Asia and North America.

Competitive pressure is rising as the demand for aluminum products continues to surge in automotive, construction, and packaging applications. With low barriers to entry at the mid-tier level, new entrants are rapidly scaling through cost-effective manufacturing techniques. However, maintaining a competitive edge in the premium and specialty categories requires advanced R&D and improved sustainability credentials.

| Item | Value |

|---|---|

| Quantitative Units | USD 55.5 Billion |

| Product Type | Flat rolled sheets, Coiled sheets, Clad sheets, Anodized sheets, Patterned sheets, Corrugated sheets, and Perforated sheets |

| Grade/Alloy Type | 5xxx series, 1xxx series, 2xxx series, 3xxx series, 6xxx series, 7xxx series, and 8xxx series |

| Processing Method | Cold rolled, Hot rolled, Continuous casting, and Direct chill (DC) casting |

| End Use | Automotive, Building & construction, Aerospace, Electrical & electronics, Food & beverage, Machinery & equipment, Consumer durables, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Novelis, Arconic, Constellium, Hindalco (parent of Novelis), Alcoa, Kaiser Aluminum, and China Zhongwang / Others |

| Additional Attributes | Dollar sales by product type (coated vs. uncoated), Dollar sales by application (automotive, construction, packaging), Demand trends for lightweight and corrosion-resistant alloys, Use of recycled aluminum in manufacturing, Growth of aluminum usage in renewable energy applications (solar panels, wind turbines), Regional patterns of production and consumption (Asia-Pacific, North America, Europe). |

The global aluminum sheets and coils market is estimated to be valued at USD 55.5 billion in 2025.

The market size for the aluminum sheets and coils market is projected to reach USD 99.5 billion by 2035.

The aluminum sheets and coils market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in aluminum sheets and coils market are flat rolled sheets, coiled sheets, clad sheets, anodized sheets, patterned sheets, corrugated sheets and perforated sheets.

In terms of grade/alloy type, 5xxx series segment to command 30.0% share in the aluminum sheets and coils market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aluminum Cap & Closure Market Forecast and Outlook 2025 to 2035

Aluminum Casing of the Blade Battery Market Size and Share Forecast Outlook 2025 to 2035

Aluminum ROPP Closure Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Cans Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Packaging Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Pouches Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Peel-Off Ends Maker Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Tape Market Size and Share Forecast Outlook 2025 to 2035

Aluminum-Free Food Pouch Market Size and Share Forecast Outlook 2025 to 2035

Aluminum-Nickel Catalyst Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Frame Monitors Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Composite Materials Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Coated Thermal Protective Clothing Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Flat Products Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Alloys Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Containers Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Aerosol Cans Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Extrusion Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Hydroxide Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Disposable Plates Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA