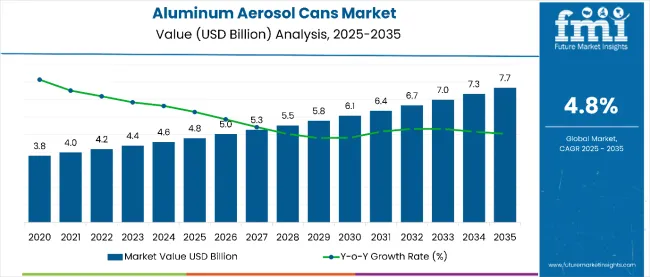

The global aluminum aerosol cans market is expected to rise from USD 4.8 billion in 2025 to USD 7.7 billion by 2035, expanding at a steady CAGR of 4.8% over the forecast period. This growth is underpinned by increasing consumption across personal care, household, and automotive segments, alongside structural demand for recyclable and lightweight packaging formats.

In 2025, the global packaging formats market is estimated at USD 120.4 billion, positioning aluminum aerosol cans at approximately 4% share of the total. The material’s recyclability, pressure tolerance, and barrier properties make it a preferred choice for products requiring controlled dispensing and extended shelf life.

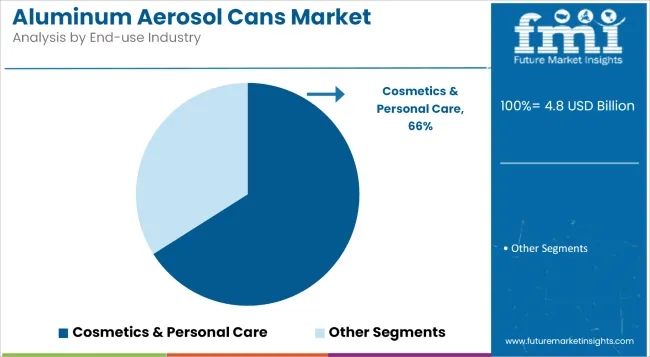

Rising consumption of deodorants, shaving foams, and skincare aerosols across emerging markets is driving demand, with cosmetics & personal care accounting for 66% of total end-use in 2025. Two core levers sustaining this growth include the expansion of e-commerce distribution for premium grooming products and the lightweight, fully recyclable nature of aluminum packaging.

However, volatility in raw aluminum prices, averaging over USD 2,300 per metric ton in 2024, has tightened converter margins, particularly for mid-size fillers. A key trend shaping market dynamics is the transition toward 100% recycled content cans.

As of 2025, a key regulatory shift impacting the aluminum aerosol cans market is the impending enforcement of the EU Packaging and Packaging Waste Regulation (PPWR), slated for phased implementation starting late 2025 and intensifying through 2026.

This legislation mandates minimum recycled content requirements, reuse targets, andrestrictions on non-recyclable formats, directly affecting aerosol packaging formats across cosmetics, household, and industrial categories. Specifically, aluminum packaging sold in the EU will be required to contain at least 50% recycled content by 2030, with interim reporting and compliance frameworks beginning 2025.

In parallel, the USA Environmental Protection Agency (EPA)is finalizing updates under RCRA Subtitle C to clarify the classification of aerosol cans as universal waste nationwide, with roll out expected in early 2026. This will harmonize disposal and recycling protocols across states, reducing compliance costs for manufacturers while tightening tracking of post-consumer material recovery.

Package engineers evaluate aluminum aerosol specifications based on wall thickness requirements, internal coating compatibility, and pressure rating characteristics when developing formulations for hair styling products, automotive spray paints, and pharmaceutical inhalers requiring precise dispensing control and extended shelf stability. Container selection involves analyzing dome strength specifications, valve neck dimensions, and actuator compatibility while considering decoration printing capabilities, regulatory compliance requirements, and supply chain sustainability factors necessary for brand differentiation and market acceptance. Development decisions balance material costs against product protection benefits, incorporating barrier properties, aesthetic appeal, and environmental impact considerations that influence consumer purchasing behavior and regulatory approval processes.

| Attribute | Values |

|---|---|

| Estimated Industry Size (2025E) | USD 4.8 billion |

| Projected Industry Value (2035F) | USD 7.7 billion |

| CAGR (2025 to 2035) | 4.8% |

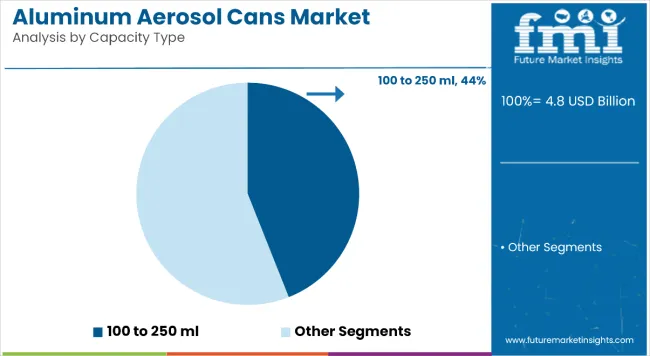

The aluminum aerosol cans market is segmented into distinct categories for precise demand tracking and strategic planning. By Capacity Type, the market includes: Less than 100 ml; 100-250 ml; 251-500 ml; and More than 500 ml.

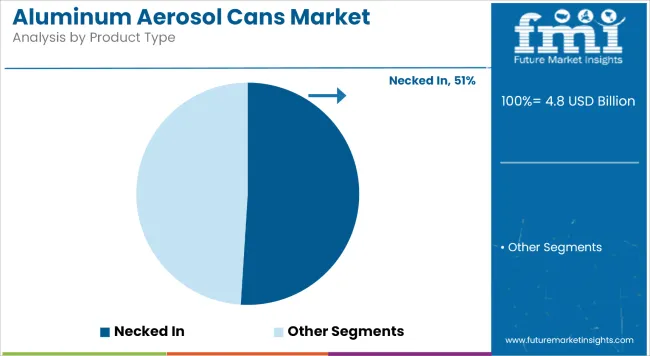

By Product Type, segmentation covers: Necked In; Shaped Wall; and Straight Wall. Based on End-use Industry, the categories comprise: Cosmetic & Personal Care; Household Products; Automotive/Industrial; and Others. Geographically, the market spans: North America; Latin America; Europe; Asia Pacific excluding Japan; Japan; and the Middle East & Africa.

Necked In aluminum aerosol cans will dominate the global market in 2025 with a 51% share, generating an estimated USD 2.45 billion. Their widespread use in deodorants, hair sprays, and automotive sprays is anchored by superior pressure resistance and ease of stacking.

Growth in this segment is driven by two levers

A less visible disruptor is tooling standardization; machinery compatibility across high-speed lines can lower capex by 8-10%, accelerating adoption among regional fillers and private-label suppliers.

The 100 to 250 ml capacity range leads the global aluminum aerosol cans market in 2025, capturing 44% of total revenue, equivalent to USD 2.11 billion. This mid-size format remains the standard across personal grooming and travel-size products due to its portability and compatibility with regulatory volume limits for air travel.

Two principal drivers reinforce its dominance

A key disruptor is miniaturization in cosmetic formulations-new concentrate formats allow brands to reduce can size while retaining dosage efficacy, which could further consolidate demand in the 100-250 ml bracket and reduce unit shipping costs by up to 15%.

Cosmetics & personal care applications will dominate aluminum aerosol can usage in 2025, accounting for 66% of global revenue-equivalent to USD 3.17 billion. This segment spans deodorants, hair sprays, shaving foams, and skincare mists, all of which rely on precision dispensing and long shelf-life.

Growth is reinforced by two major factors

A pivotal disruptor is refillable pressurized can designs gaining traction among EU brands-early pilots in France indicate potential cost reductions of 18-22% over two refill cycles, with regulatory incentives further tilting the market toward hybrid aluminum systems.

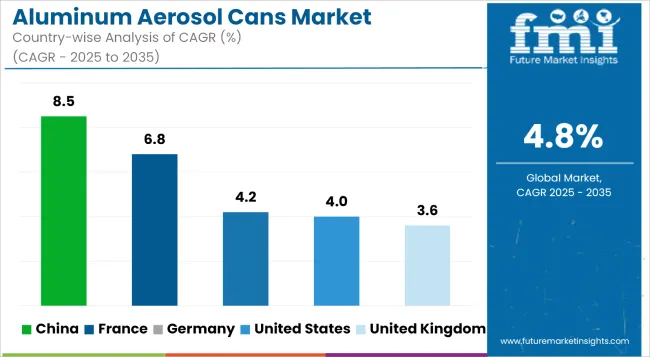

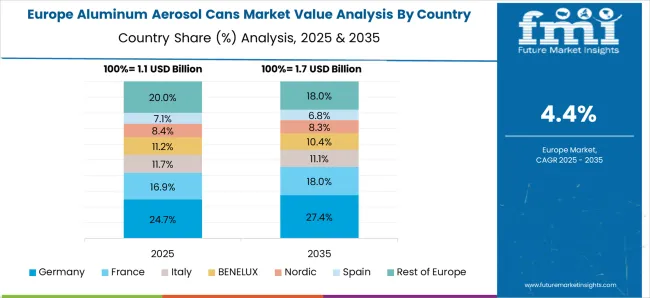

The aluminum aerosol cans market displays varied growth patterns across major economies, shaped by consumer preferences, regulatory landscapes, and industrial demand clusters. While developed markets such as the United States and Germany are seeing stable uptake in personal care and automotive sprays, emerging economies are registering accelerated growth driven by localized manufacturing, retail expansion, and sustainability mandates. Each market’s trajectory reflects a distinct mix of innovation focus, price sensitivity, and recycling infrastructure maturity, which will shape competitive entry points and investment priorities across the next decade.

The United States aluminum aerosol cans market is valued at USD 1.32 billion in 2025 and is projected to reach USD 1.9 billion by 2035, expanding at a CAGR of 4%. Despite maturing consumption patterns, demand is sustained by strong brand activity in premium grooming, air care, and OTC hygiene sprays.

Margin pressures persist due to aluminum input costs and transportation surcharges, both of which have risen by at a steady rate. However, private-label penetration in deodorants and sanitizers has helped retailers preserve unit economics, with store brands accounting for over a substantial share in 2025.

Regulatory clarity is expected to improve with the EPA’s finalization of aerosol waste classification under the universal waste rule by early 2026, streamlining recycling obligations and reducing state-level compliance friction.

According to a 2025 industry surveydone by FMI, over 50% of USA consumers cite “ease of disposal” as a key purchase driver for aerosols.

The United Kingdom aluminum aerosol cans market is forecast to grow at a CAGR of 3.6% between 2025 and 2035. Growth remains moderate, shaped by saturated penetration in personal care but supported by new packaging mandates under the UK Plastic Packaging Tax and Extended Producer Responsibility (EPR) schemes.

Profitability remains mixed as energy and logistics costs have risen 5.2% year-on-year, pressuring small converters, while larger players have absorbed cost shocks through vertical integration and contract manufacturing.

EPR reporting, compulsory from 2025 for all packaging producers over the threshold, is triggering a packaging shift toward recyclable aluminum formats. Online retail dynamics further amplify demand for damage-resistant, lightweight containers across grooming and household sprays.

Consumer insights show that 54% of UK aerosol buyers associate aluminum packaging with “premium product experience,” and 43% prefer brands that disclose recyclability metrics clearly on-pack.

Germany’s aluminum aerosol cans market is forecast to grow at a CAGR of 4.2% from 2025 to 2035. Demand is anchored in both personal care and automotive segments, with industrial sprays benefiting from the country’s strong OEM manufacturing base.

Regulatory pressures around recyclability and compliance with extended producer responsibility laws are prompting mid-sized converters to rethink packaging formats. While cost volatility is a concern, consistent consumer expectations for quality, hygiene, and sustainability continue to support aluminum adoption.

Demand for aluminum aerosol cans in France is projected to expand at a CAGR of 6.8% over the forecast period, led by its global stature in the beauty and personal care industry. Domestic brands are increasingly aligning with circular packaging goals, and aluminum is gaining favor for its design flexibility and alignment with national recycling mandates. While filler capacity remains tight, brand innovation in packaging aesthetics and consumer willingness to switch based on environmental labeling are accelerating the transition toward mono-material formats.

China’s aluminum aerosol cans sales are expected to grow at a CAGR of 8.5% from 2025 to 2035, the fastest among major economies. Growth is powered by scale manufacturing, expanding rural retail networks, and rising middle-class adoption of aerosol-based grooming and hygiene products. Local governments are piloting waste reduction targets and encouraging eco-efficient packaging solutions, positioning aluminum as a strategic fit. Increasing product differentiation and brand investment in decorative formats are further reinforcing this upward trajectory.

The Aluminum Aerosol Cans Market is expanding rapidly, driven by rising demand from the personal care, household, and pharmaceutical industries. Leading players such as Ball Corporation and Crown Holdings Inc. dominate the sector with lightweight, recyclable, and high-barrier packaging solutions that meet consumer expectations for convenience and product preservation. Alucon Public Company Limited and CPMC Holdings Ltd. are strengthening their positions in the Asia-Pacific region through large-scale manufacturing capabilities and cost-efficient production.

Kian Joo Can Factory Bhd. and CCL Industries Inc. are focusing on advanced decoration technologies and customizable designs to cater to premium packaging segments. Nampak Limited and China Aluminum Cans Holdings Ltd. are expanding their export networks to meet increasing global demand for sustainable and durable aerosol containers. BWAY Corporation, operating under Mauser Packaging Solutions, emphasizes integrated packaging systems, while Toyo Seikan Group Holdings Ltd. continues to innovate in forming and coating technologies to enhance product safety and performance.

The market’s growth is further supported by the expanding cosmetics and healthcare industries, along with technological advancements in can shaping and pressurization techniques. Enhanced recycling infrastructure and consumer preference for hygienic, lightweight packaging continue to drive industry transformation worldwide.

| Attribute | Details |

| Forecast Period | 2025 to 2035 |

| Base Year | 2024 |

| Historical Data | 2019 to 2024 |

| Market Units | USD Billion (Value) |

| Key Segments | By Capacity Type, By Product Type, By End-use Industry |

| Capacity Type Covered | Less Than 100 ml; 100-250 ml; 251-500 ml; More Than 500 ml |

| Product Type Covered | Necked In; Shaped Wall; Straight Wall |

| End-use Industry Covered | Cosmetic & Personal Care; Household Products; Automotive/Industrial; Others |

| Key Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, Russia, China, Japan, South Korea, India, ASEAN-6, Australia, New Zealand, GCC Countries, Türkiye, South Africa, Rest of MEA |

| Key Companies Profiled |

Ball Corporation, Crown Holdings Inc., Alucon Public Company Limited, CPMC Holdings Ltd., Kian Joo Can Factory Bhd., CCL Industries Inc., Nampak Limited, China Aluminum Cans Holdings Ltd., BWAY Corporation (part of Mauser Packaging Solutions), Toyo Seikan Group Holdings Ltd. |

| Coverage | Market Size & Forecast, Segment-wise Analysis, Country-level Trends, Regulatory Impact, Competitive Landscape, Investment Outlook |

The global aluminum aerosol cans market is estimated to be valued at USD 4.8 billion in 2025.

The market size for the aluminum aerosol cans market is projected to reach USD 7.7 billion by 2035.

The aluminum aerosol cans market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in aluminum aerosol cans market are less than 100 ml, 100 to 250 ml, 251 to 500 ml and more than 500 ml.

In terms of product type, shaped wall segment to command 42.3% share in the aluminum aerosol cans market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Competitive Overview of the Aluminum Aerosol Cans Market Share

Aluminum Alloy Sacrificial Anode Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foam Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Cap & Closure Market Forecast and Outlook 2025 to 2035

Aluminum Casing of the Blade Battery Market Size and Share Forecast Outlook 2025 to 2035

Aluminum ROPP Closure Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Packaging Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Pouches Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Peel-Off Ends Maker Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Tape Market Size and Share Forecast Outlook 2025 to 2035

Aluminum-Free Food Pouch Market Size and Share Forecast Outlook 2025 to 2035

Aluminum-Nickel Catalyst Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Frame Monitors Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Composite Materials Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Coated Thermal Protective Clothing Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Flat Products Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Alloys Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Sheets and Coils Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Containers Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Extrusion Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA