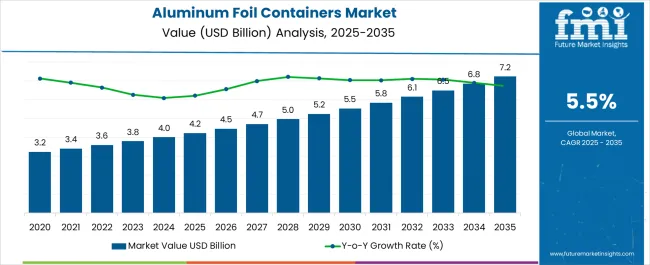

The Aluminum Foil Containers Market is estimated to be valued at USD 4.2 billion in 2025 and is projected to reach USD 7.2 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

Foodservice procurement managers evaluate aluminum container specifications based on gauge thickness optimization, rim strength characteristics, and stackability efficiency when establishing packaging systems for restaurant takeout, institutional catering, and meal delivery services requiring durable food containment solutions. Container selection involves analyzing heat transfer properties, grease resistance performance, and lid sealing compatibility while considering storage space efficiency, cost-per-unit economics, and branding surface availability factors necessary for operational workflow optimization. Purchasing decisions balance container costs against operational convenience benefits, incorporating food quality preservation, preparation time reduction, and waste management simplification advantages that justify premium packaging adoption through measurable service efficiency improvements.

Manufacturing processes require precision stamping operations, annealing treatments, and dimensional tolerance control that achieve foodservice industry standards while maintaining cost competitiveness throughout high-volume production environments serving restaurants, airlines, and institutional catering markets. Production coordination involves managing aluminum coil sourcing, tooling maintenance, and forming operations while addressing food-grade surface treatments, package integrity validation, and dimensional consistency requirements specific to aluminum container manufacturing. Quality assurance encompasses thickness measurement, leak testing, and food contact compliance verification that ensure specification compliance while supporting customer application requirements and regulatory approval throughout varying temperature exposures.

Technology advancement prioritizes forming process optimization, coating system development, and recycling compatibility enhancement that improve aluminum container performance while reducing manufacturing costs and environmental impact throughout foodservice applications. Innovation encompasses non-stick surface treatments, enhanced barrier properties, and lightweight design optimization that optimize food containment while maintaining structural integrity and heat transfer efficiency. Advanced manufacturing includes automated forming systems, integrated quality monitoring, and sustainable production methods that enhance operational efficiency while ensuring consistent container properties and environmental responsibility.

Distribution relationships involve coordination between aluminum container manufacturers, foodservice distributors, and restaurant operators to establish reliable supply networks that address inventory management, delivery scheduling, and quality consistency throughout foodservice packaging supply chains. Partnership agreements include volume pricing, customization services, and technical support provisions that protect foodservice investments while ensuring packaging performance and operational efficiency achievement. Strategic alliances encompass collaboration with recycling organizations, sustainability certifiers, and foodservice equipment manufacturers to deliver integrated packaging solutions supporting comprehensive foodservice sustainability and operational excellence.

Foodservice industry transformation reflects increasing emphasis on delivery optimization, sustainability commitment, and food safety enhancement that drives demand for versatile packaging systems supporting restaurant operation efficiency and environmental responsibility throughout applications requiring reliable food containment and temperature management across foodservice segments seeking operational advantages through advanced packaging technology and sustainable practices commitment

| Metric | Value |

|---|---|

| Aluminum Foil Containers Market Estimated Value in (2025 E) | USD 4.2 billion |

| Aluminum Foil Containers Market Forecast Value in (2035 F) | USD 7.2 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The aluminum foil containers market is witnessing robust expansion driven by rising demand for convenient food packaging solutions, increasing urbanization, and the growth of food delivery services. Lightweight, recyclable, and heat resistant properties have positioned aluminum foil containers as a preferred choice in foodservice, hospitality, and retail sectors.

Regulatory emphasis on sustainable and recyclable packaging is further encouraging adoption, as industries seek alternatives to single use plastics. Advancements in manufacturing technology and improved barrier properties have enabled wider applications, ranging from ready to eat meals to frozen and takeaway food segments.

Growing consumer preference for hygienic, tamper proof, and portable packaging continues to reinforce market prospects. The future outlook remains positive as both developed and emerging economies focus on eco friendly packaging while catering to the rising demand for on the go consumption.

The up to 50 ml capacity segment is expected to hold 42.70% of market revenue by 2025, making it the leading capacity range. This dominance is attributed to its suitability for packaging sauces, dips, condiments, and small serving portions.

The segment benefits from strong demand in catering services, airline meals, and quick service restaurants, where portion control and convenience are highly valued.

Its lightweight structure and compatibility with mass production have reinforced adoption, making it the most widely used capacity category.

The compartmental product type segment is projected to account for 55.30% of market revenue by 2025, positioning it as the leading product type. The preference for compartmental containers is driven by their ability to separate multiple food items in a single pack while maintaining taste, texture, and freshness.

This design has been embraced by institutional catering, airline services, and ready meal providers where meal segregation and presentation are critical.

Operational efficiency in food handling and enhanced consumer convenience have further reinforced the leadership of this product type.

The standard duty foil type segment is anticipated to contribute 63.80% of total revenue by 2025, establishing it as the leading foil type. Its widespread use is supported by cost effectiveness, adequate durability for everyday food service needs, and broad availability across global supply chains.

Standard duty foil is commonly adopted in takeout, home use, and catering due to its balance of strength, flexibility, and affordability.

Continuous production scalability and recyclability have further supported its dominance, making it the most widely preferred foil type within the market.

There has been a dynamic shift in the consumers’ consumption patterns in the food and beverages sector. Consumer inclination towards takeaway or ready-to-eat food is increasing, owing to changing lifestyles and growing disposable incomes, especially in emerging economies across the globe.

Food service operators offer various services such as ‘takeaway and drive-through’ to cater to the growing number of on-the-go consumers. With the growing working population and increasing urbanization, these food formats are expected to gain popularity among millennials. Increasing usage of aluminum foil containers for packaging in the food service industry, in turn, is expected to drive the demand for the aluminum foil containers market during the forecast period.

Short-term (2025 to 2025): Global demand for convenience and hygienic packaging solutions is increasing exponentially, especially in food packaging. Aluminum foil containers are gaining popularity in the food service industry due to their recyclable, lightweight, and cost-effective nature. Aluminum foil containers are also proven to reduce food contamination, thereby making them a hygienic packaging solution. These factors are expected to propel the market in the short-term period.

Mid-term (2025 to 2035): The rising acceptance of aluminum foil containers in food service and other end-uses is due to their easy storage, on-the-go use feature, and lightweight nature. Further, the growing e-commerce industry is making the availability of these containers easy, which is boosting their demand from households. These factors are likely to push the global aluminum foil container market growth during this period.

Long-term (2035 to 2035): A significant amount of food items are spoiled due to exposure to moisture and air, thereby increasing the need for packaging solutions that protect food items from these elements. Aluminum foil containers can withstand extreme temperature changes and hence can be used in microwave ovens and are very easy to clean. Moreover, aluminum foil containers are good when it comes to the storage of food and avoiding exposure to extreme temperatures, and they are also affordable. These factors are expected to fuel the growth of the global aluminum foil containers market during the forecast period.

Volatility in Pricing of Raw Materials to hamper the Market

Maintaining a long-term relationship with raw material suppliers, distributors, and retailers is essential in any business. Thus, manufacturers need to channel their efforts toward it.

The increasing number of domestic players in the aluminum foil containers market and the capacity expansion of existing players lead to a reduction in pricing, which ultimately shrinks the net profit of aluminum foil container manufacturers. These factors are likely to hinder the growth of the global aluminum foil containers market during the forecast period.

The global aluminum foil containers market, by capacity, spans up to 50 ml, 50 ml to 200 ml, 200 ml to 400 ml, and 400 ml & above. By type of product, it’s non-compartmental and compartmental. By type of aluminum foil, it’s heavy-duty foil and standard-duty foil.

By end-use, it’s food services, bakery & confectionery, food packers/processors, retail and supermarkets, and others (electronics, medical, etc.). Out of these, the compartmental product type holds the largest market share. The segment is expected to register a CAGR of 5.5% by the end of the forecast period. By end-use, food services are dominating the market. This scenario is expected to continue even in the forecast period.

There is expected to be a rising demand for aluminum food foil containers as these ensure the safety of food products. The Food industry especially uses aluminum foil containers with lid so that there is no spillage of food items. With the rising e-commerce sector, the food delivery vendors too are increasing in numbers. People prefer ordering food online these days due to health concerns associated with eating out. This is giving rise to the adoption of aluminum foil takeaway containers.

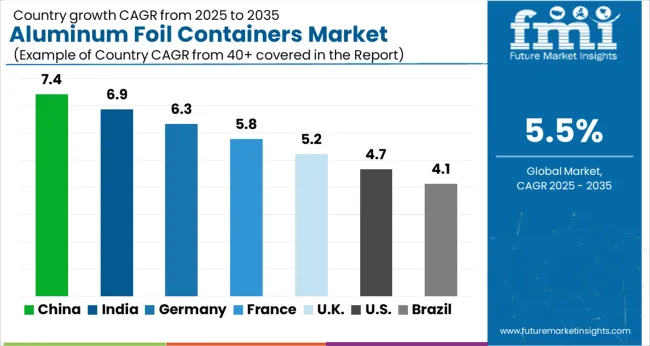

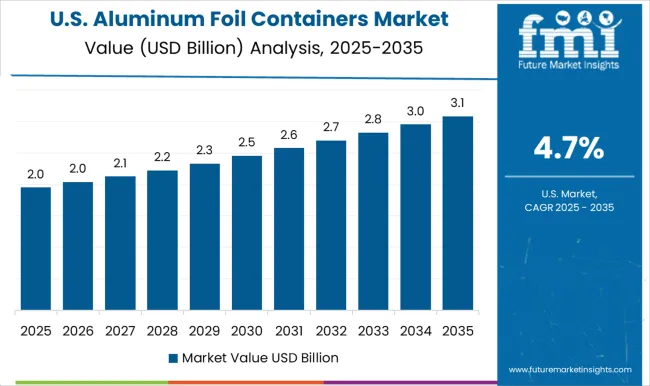

North America holds a significant market share, followed by Europe and the Asia-Pacific. This could be credited to an extensive demand for aluminum foil containers throughout, especially in the post-COVID era. With hygiene being the topmost priority, the foodservice vertical is unimaginable without aluminum foil containers.

The United States is expected to be the dominant region during the forecast period. Increasing use of EV batteries has risen production and is thereby boosting the demand for aluminum foil. Further, the growing acceptance of fast food chains and ordering via e-commerce websites has risen the demand for aluminum foil containers in the United States. The United States market is expected to reach a valuation of USD 1.2 billion and register a CAGR of 5.3% during the forecast period.

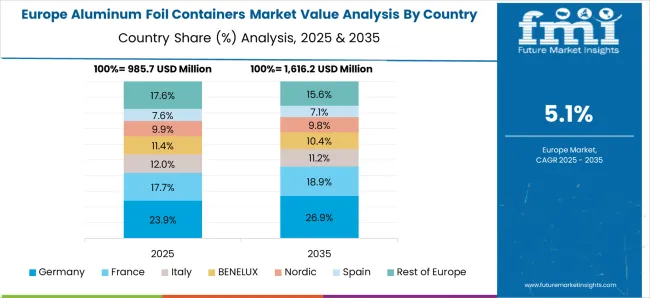

Various factors, like initiatives taken by the government for the promotion of food exports and efforts taken towards decarbonization, are driving the demand for aluminum foil containers. This rising need is correspondingly increasing vendors for making aluminum foil containers in Europe. The United States market is expected to register a CAGR of 3.6% during the forecast period.

The packaging industry in the Asia Pacific is growing exponentially. For example, the board of SRF Ltd., India, gave approval for setting up a manufacturing plant for aluminum foils in Indore in the year 2025 with a huge investment. The plant is expected to address packaging requirements from domestic vendors as well as export needs from the food industry. The Indian market is anticipated to register a CAGR of 7.5% during the forecast period.

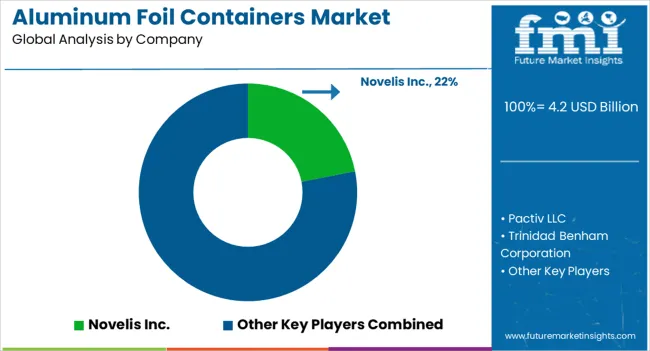

The Aluminum Foil Containers Market is witnessing robust growth, driven by increasing demand for lightweight, durable, and heat-resistant food packaging solutions across the foodservice, bakery, and ready-meal sectors. Leading manufacturers such as Novelis Inc., Pactiv LLC, and Trinidad Benham Corporation are focusing on advanced foil technologies that enhance strength and recyclability while meeting food safety standards. Hulamin Containers Ltd. and D&W Fine Pack LLC are investing in sustainable production methods and expanding product lines tailored to quick-service restaurants and catering industries.

Companies like Penny Plate LLC, Handi-foil of America Inc., and Revere Packaging Inc. are capitalizing on the rising trend of single-use yet recyclable aluminum packaging, catering to convenience-oriented consumers. Nicholl Food Packaging Limited, Contital S.r.l., and Laminazione Sottile S.p.A. are strengthening their market presence in Europe through innovation in tray design and customization for oven and freezer applications. Meanwhile, Asian producers such as Nagreeka Indcon Products Pvt. Ltd., Shanghai Metal Corporation, and Manaksia Ltd. are boosting capacity to meet growing regional consumption in retail and institutional segments.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD million/billion for Value |

| Key Regions Covered | North America; Latin America; Europe; South Asia; East Asia; Oceania; and the Middle East & Africa |

| Key Countries Covered | USA, Canada, Brazil, Mexico, Germany, United Kingdom, France, Italy, Spain, Benelux, Russia, China, Japan, South Korea, India, Thailand, Indonesia, Malaysia, Singapore, China, Japan, South Korea, Australia, New Zealand, Turkiye, Egypt, North Africa, South Africa, and GCC Countries |

| Key Market Segments Covered | Capacity, Product Type, Aluminum Foil Type, End-use, and Region |

| Key Companies Profiled | Novelis Inc., Pactiv LLC, Trinidad Benham Corporation, Hulamin Containers Ltd., D&W Fine Pack LLC, Penny Plate LLC, Handi-foil of America Inc., Revere Packaging Inc., Nicholl Food Packaging Limited, Contital S.r.l., Nagreeka Indcon Products Pvt. Ltd., Laminazione Sottile S.p.A., Eramco, i2r Packaging Solutions Limited, Wyda Packaging (Pty) Ltd., Alufoil Products Pvt. Ltd., Durable Packaging International, Prestige Packing Industry LLC, Shanghai Metal Corporation, Manaksia Ltd. |

| Pricing | Available upon Request |

The global aluminum foil containers market is estimated to be valued at USD 4.2 billion in 2025.

The market size for the aluminum foil containers market is projected to reach USD 7.2 billion by 2035.

The aluminum foil containers market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in aluminum foil containers market are up to 50 ml, 50 ml to 200 ml, 200 ml to 400 ml and 400 ml & above.

In terms of product type, compartmental segment to command 55.3% share in the aluminum foil containers market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aluminum Alloy Sacrificial Anode Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foam Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Cap & Closure Market Forecast and Outlook 2025 to 2035

Aluminum Casing of the Blade Battery Market Size and Share Forecast Outlook 2025 to 2035

Aluminum ROPP Closure Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Cans Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Pouches Market Size and Share Forecast Outlook 2025 to 2035

Aluminum-Free Food Pouch Market Size and Share Forecast Outlook 2025 to 2035

Aluminum-Nickel Catalyst Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Frame Monitors Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Composite Materials Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Coated Thermal Protective Clothing Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Flat Products Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Alloys Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Sheets and Coils Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Aerosol Cans Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Extrusion Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Hydroxide Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Disposable Plates Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Cladding Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA