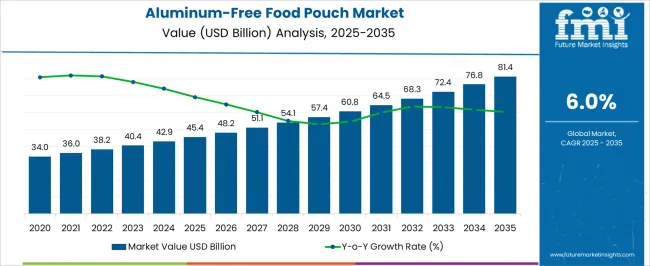

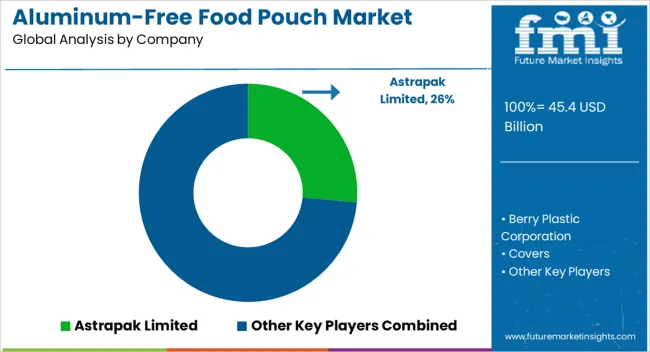

The Aluminum-Free Food Pouch Market is estimated to be valued at USD 45.4 billion in 2025 and is projected to reach USD 81.4 billion by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period.

| Metric | Value |

|---|---|

| Aluminum-Free Food Pouch Market Estimated Value in (2025 E) | USD 45.4 billion |

| Aluminum-Free Food Pouch Market Forecast Value in (2035 F) | USD 81.4 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

The Aluminum-Free Food Pouch market is witnessing robust growth as consumer demand shifts toward sustainable and eco-friendly packaging solutions. Traditional aluminum-based packaging is increasingly being replaced due to environmental concerns, recyclability challenges, and rising demand for lightweight yet durable alternatives. Innovations in bioplastics, paper-based laminates, and multilayer flexible films are creating new opportunities for packaging manufacturers to cater to environmentally conscious consumers and regulatory requirements.

The growing emphasis on reducing carbon footprints, achieving circular economy goals, and promoting plastic waste reduction is reinforcing the adoption of aluminum-free packaging solutions across food categories. Convenience, extended shelf life, and branding opportunities offered by aluminum-free pouches further strengthen their market position. Increasing demand from ready-to-eat foods, snacks, and beverages is driving volume consumption, supported by the expansion of retail and e-commerce channels.

Regulatory mandates in key regions requiring sustainable packaging adoption and industry commitments toward eco-friendly practices are shaping the market landscape As technological advancements continue to improve barrier properties and performance, aluminum-free food pouches are expected to emerge as a mainstream packaging choice in global markets.

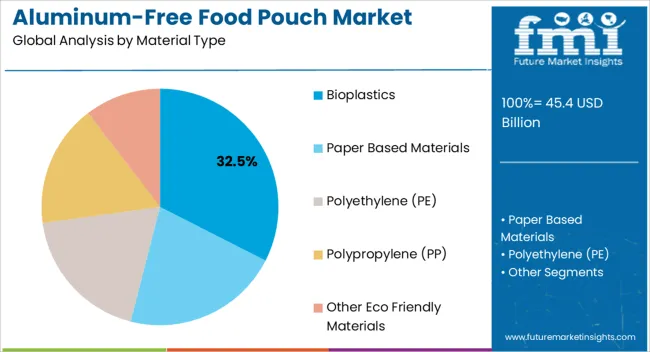

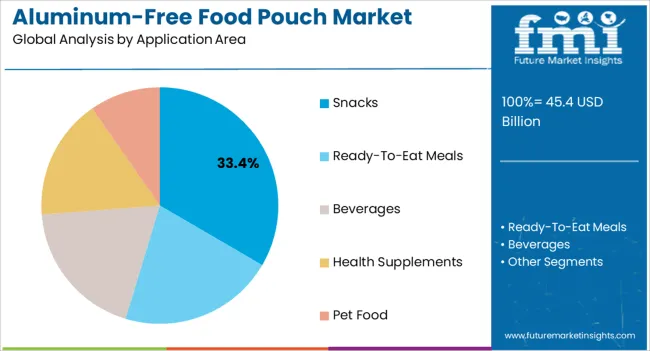

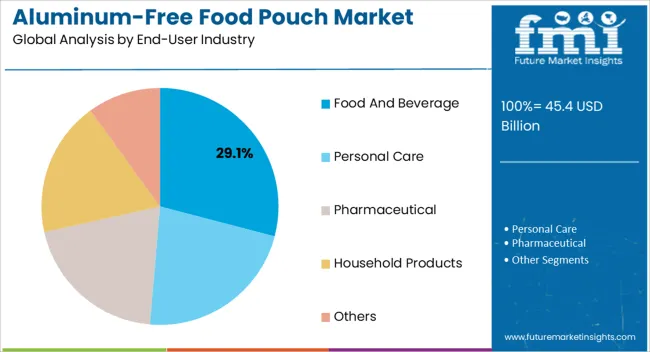

The aluminum-free food pouch market is segmented by material type, application area, end-user industry, thickness, distribution channel, and geographic regions. By material type, aluminum-free food pouch market is divided into Bioplastics, Paper Based Materials, Polyethylene (PE), Polypropylene (PP), and Other Eco Friendly Materials. In terms of application area, aluminum-free food pouch market is classified into Snacks, Ready-To-Eat Meals, Beverages, Health Supplements, and Pet Food. Based on end-user industry, aluminum-free food pouch market is segmented into Food And Beverage, Personal Care, Pharmaceutical, Household Products, and Others. By thickness, aluminum-free food pouch market is segmented into Below 50 Microns, 50 To 100 Microns, 100 To 150 Microns, and Above 150 Microns. By distribution channel, aluminum-free food pouch market is segmented into Online Retail, Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, and Direct Sales. Regionally, the aluminum-free food pouch industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The bioplastics material type segment is expected to account for 32.5% of the Aluminum-Free Food Pouch market revenue in 2025, positioning it as the leading material choice. Growth is being driven by increasing consumer preference for renewable, biodegradable, and compostable packaging alternatives that reduce dependency on fossil-based materials. Bioplastics provide favorable mechanical strength, barrier protection, and compatibility with food products, making them suitable for flexible pouch applications.

Manufacturers are investing in scalable bioplastic production to meet the rising demand from food brands aiming to achieve sustainability targets. Additionally, regulatory encouragement for bio-based solutions and consumer awareness campaigns promoting green packaging are further enhancing adoption. Bioplastics also allow customization of pouch designs, ensuring brand differentiation and functional performance.

Their ability to balance performance with eco-friendliness provides an edge in markets where environmental compliance and consumer perception are equally critical As global food companies continue to adopt sustainable practices, bioplastics are expected to maintain a strong growth trajectory, reinforcing their leadership within the material segment.

The snacks application area segment is projected to hold 33.4% of the Aluminum-Free Food Pouch market revenue in 2025, making it the dominant application. Growth is being supported by the rising consumption of packaged snacks, including chips, dried fruits, energy bars, and bakery items, across both developed and emerging economies. The need for lightweight, portable, and sustainable packaging has made aluminum-free pouches highly attractive for snack manufacturers.

These pouches provide excellent barrier protection against moisture and oxygen, ensuring product freshness and extended shelf life. Branding opportunities through customizable printing and flexible design further drive their adoption in competitive snack markets. Increasing health-conscious consumer behavior and demand for portion-controlled packaging are also influencing pouch innovation in this segment.

Expansion of retail chains, online food delivery platforms, and convenience stores has accelerated demand for snack pouches Regulatory guidelines promoting sustainable packaging adoption further strengthen the segment’s growth prospects As snack consumption continues to rise globally, the snacks application area is set to remain the leading contributor to the market’s revenue.

The food and beverage end-user industry segment is anticipated to account for 29.1% of the Aluminum-Free Food Pouch market revenue in 2025, underscoring its leading position among end users. This dominance is driven by the increasing reliance of food and beverage brands on sustainable packaging solutions to enhance shelf appeal, meet consumer expectations, and comply with regulatory standards. Aluminum-free pouches are being widely adopted for packaging ready meals, sauces, dairy products, and beverages due to their lightweight, flexible, and durable characteristics.

Their ability to preserve taste, aroma, and nutritional value without the drawbacks of aluminum packaging provides strong competitive advantages. Food and beverage manufacturers are leveraging these pouches for eco-friendly branding, ensuring alignment with sustainability commitments and consumer preferences.

Furthermore, advancements in multilayer bioplastic films and recyclable laminates are enhancing the functional performance of pouches in this segment As global food consumption and beverage demand continue to expand, the food and beverage end-user industry is expected to remain the primary driver of aluminum-free pouch adoption, reinforcing its leading revenue share.

The aluminium-free food pouch market is likely to record a CAGR of 6% through 2035. The market is expected to reach valuation of US$ 38.16 Billion in 2025, and is likely to reach a valuation of US$ 68.34 Billion by 2035.

| Attributes | Detail |

|---|---|

| Aluminum-free Food Pouch Market CAGR | 6% |

| Aluminum-free Food Pouch Market (2025) | US$ 38.16 Billion |

| Aluminum-free Food Pouch Market (2035) | US$ 68.34 Billion |

From fresh produce to ready-to-eat meals, effective packaging has become essential as a result of the general use of packaging and the development of modern food safety and commercialization techniques.

Fresh food packaging companies are increasingly using aluminum-free food pouches due to their customization abilities and the possibility of designing customized designs. These pouches are also eco-friendly as they are non-toxic and biodegradable.

There is a high degree of fragmentation and competition in the global aluminum-free food pouch market. Some prominent players across the globe dominate the market. Various factors, such as the rising demand for pouches in the food and beverage sector, have created enormous opportunities for the players. Mergers and acquisitions are among the strategies being adopted by players to capitalize on such opportunities.

Due to their lightweight and easy handling characteristics, aluminum-free food pouches are widely accepted by manufacturers as an eco-friendly alternative to aluminum pouches. Aside from offering flexibility and improved shelf visibility, aluminum-free food pouches are more cost-effective than aluminum pouches.

Additionally, storing food in aluminum-free pouches is much easier because users can view the contents. In contrast, aluminum pouches are difficult to see, and aluminum reacts with acids in acidic foods. Hence, most food pouch manufacturers are opting for aluminum-free pouches.

Manufacturers are creating a positive environmental impact through streamlined operations, engaged partners, and optimized products. There are companies on the market developing packaging to protect all kinds of products, including human food, pet food, medical devices, and industrial and agricultural products.

Due to the rising regulatory pressures and consumer awareness of sustainability, end-use companies are increasingly requesting sustainable packaging solutions.

There is a wide range of pouches available from the key players, and they are designed to cater to diverse applications across the food, beverage, personal care, and healthcare industries. Having a strong global presence, many companies focus on growth strategies, such as acquisitions and product launches, to maintain their leading position. Several companies have launched metal-free packaging options and ultra-high barrier packaging solutions for spouted pouches, pouches, flow packs, sachets, and bags in recent years.

A lot of manufacturers are concentrating on providing their customers with innovative products that are based on customer-centric approaches and designed to meet their needs. As a result, manufacturers are expected to be able to bypass the challenges they face and keep their growth moving forward for the global aluminum-free food pouch market even in the face of these challenges.

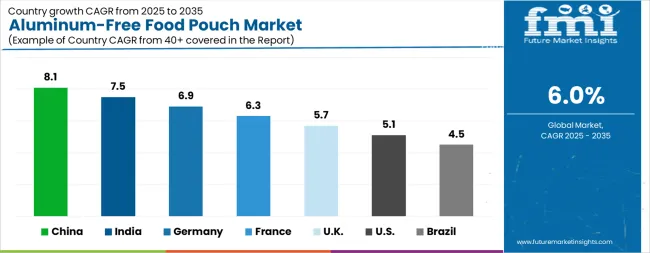

| Country | CAGR |

|---|---|

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

| France | 6.3% |

| UK | 5.7% |

| USA | 5.1% |

| Brazil | 4.5% |

The Aluminum-Free Food Pouch Market is expected to register a CAGR of 6.0% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 8.1%, followed by India at 7.5%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 4.5%, yet still underscores a broadly positive trajectory for the global Aluminum-Free Food Pouch Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 6.9%. The USA Aluminum-Free Food Pouch Market is estimated to be valued at USD 16.3 billion in 2025 and is anticipated to reach a valuation of USD 26.9 billion by 2035. Sales are projected to rise at a CAGR of 5.1% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 2.5 billion and USD 1.3 billion respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 45.4 Billion |

| Material Type | Bioplastics, Paper Based Materials, Polyethylene (PE), Polypropylene (PP), and Other Eco Friendly Materials |

| Application Area | Snacks, Ready-To-Eat Meals, Beverages, Health Supplements, and Pet Food |

| End-User Industry | Food And Beverage, Personal Care, Pharmaceutical, Household Products, and Others |

| Thickness | Below 50 Microns, 50 To 100 Microns, 100 To 150 Microns, and Above 150 Microns |

| Distribution Channel | Online Retail, Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, and Direct Sales |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Astrapak Limited, Berry Plastic Corporation, Covers, Mondi Group, and Sonoco |

The global aluminum-free food pouch market is estimated to be valued at USD 45.4 billion in 2025.

The market size for the aluminum-free food pouch market is projected to reach USD 81.4 billion by 2035.

The aluminum-free food pouch market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in aluminum-free food pouch market are bioplastics, paper based materials, polyethylene (pe), polypropylene (pp) and other eco friendly materials.

In terms of application area, snacks segment to command 33.4% share in the aluminum-free food pouch market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wet Food Pouch Market Size and Share Forecast Outlook 2025 to 2035

Retortable Mono-Material Pouches for Wet Foods Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food & Beverage OEE Software Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Crosslinked Polyvinylpolypyrrolidone (PVPP) Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Cassia Gum Powder Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Dry Film Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food Basket Market Forecast and Outlook 2025 to 2035

Food Grade Tremella Polysaccharide Market Size and Share Forecast Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Film Market Size and Share Forecast Outlook 2025 to 2035

Food Certification Market Size and Share Forecast Outlook 2025 to 2035

Food Tray Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage Industrial Disinfection and Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Food Technology Market Size and Share Forecast Outlook 2025 to 2035

Food Tourism Sector Market Size and Share Forecast Outlook 2025 to 2035

Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA