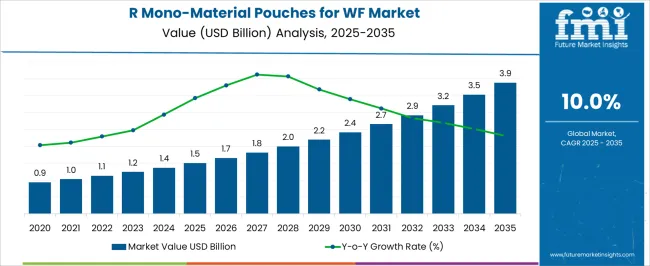

The retortable mono-material pouches for wet foods market is expected to grow from USD 1.5 billion in 2025 to USD 4.0 billion by 2035, resulting in a total increase of USD 2.5 billion over the forecast decade. This represents a 166.7% total expansion, with the market advancing at a compound annual growth rate (CAGR) of 10.0%. Over ten years, the market grows by a 2.67 multiple.

The market is growing as food manufacturers and packaging companies shift toward sustainable solutions that meet both regulatory and consumer demands. Traditional multi-layer pouches are difficult to recycle due to their complex material structure, whereas mono-material pouches offer high recyclability without compromising barrier properties, heat resistance, or shelf-life performance. Growing demand for ready-to-eat meals, pet foods, and convenience packaging is driving adoption, especially in urban markets. In addition, stricter packaging waste regulations in Europe, rising corporate commitments to circular economy goals, and technological advances in high-barrier films are accelerating the transition to retortable mono-material pouch formats globally.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 1.5 billion |

| Forecast Value in (2035F) | USD 4.0 billion |

| Forecast CAGR (2025 to 2035) | 10.0% |

From 2020 to 2024, the market expanded from USD 0.7 billion to USD 1.4 billion, driven by increasing regulatory pressure to adopt recyclable packaging solutions and growing consumer environmental consciousness. Nearly 70% of revenue came from developed markets implementing circular economy initiatives. Leading companies such as Amcor Plc, Mondi Plc, and Huhtamaki Oyj focused on developing advanced barrier properties while maintaining recyclability. Competition centered on processing capabilities, shelf-life extension, and regulatory compliance, while cost optimization remained a key challenge for widespread adoption.

By 2035, the Retortable Mono-Material Pouches for Wet Foods Market will reach USD 4.0 billion, growing at a CAGR of 10.0%, with pet food applications and ready meals representing over 75% of market value. Competition will intensify as packaging companies invest in specialized retort processing equipment and develop customized solutions for specific food categories. Market leaders will focus on integrated approaches combining advanced polymer science with processing expertise, while emerging players gain share through cost-effective solutions targeting price-sensitive segments.

The increasing regulatory pressure to adopt recyclable packaging solutions is driving growth in the retortable mono-material pouches market. Government initiatives to reduce packaging waste and implement circular economy principles are creating mandatory requirements for mono-material solutions. Growing consumer environmental awareness is pushing food brands to proactively adopt sustainable packaging alternatives that maintain product quality and safety standards.

Retortable mono-material pouches offer superior recyclability compared to traditional multi-layer laminates while providing equivalent barrier properties and shelf-life extension. Food manufacturers benefit from reduced packaging weight, lower transportation costs, and enhanced supply chain efficiency. The technology enables customization of barrier properties, processing parameters, and design features specifically tailored to wet food applications, supporting brand differentiation and consumer convenience requirements.

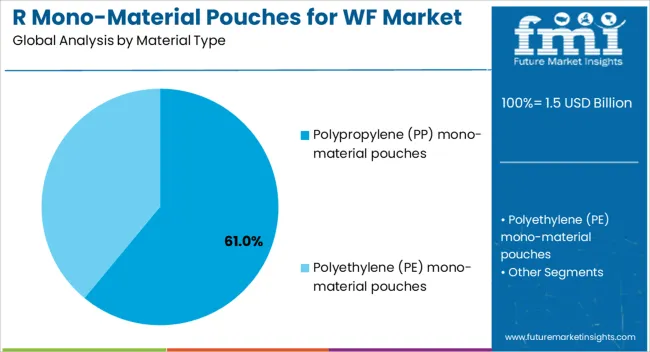

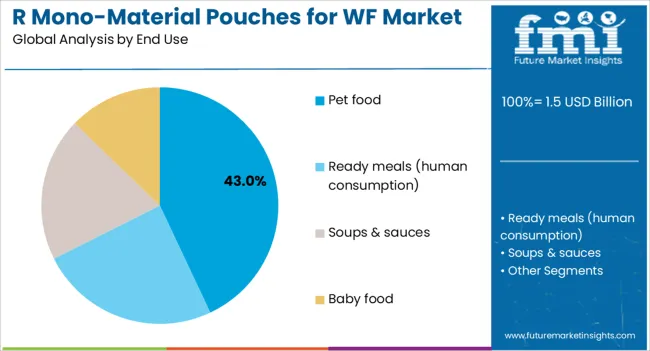

The market is segmented by material type, end use, closure/design, and region. Material type segmentation includes polypropylene (PP) mono-material pouches and polyethylene (PE) mono-material pouches, offering distinct performance characteristics for different applications. End use covers pet food, ready meals (human consumption), soups & sauces, and baby food, each requiring specific barrier and processing requirements. Closure/design segmentation includes tear-open flat pouches, spouted pouches, and zipper resealable pouches, enabling diverse consumer convenience features. Regionally, the market spans North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

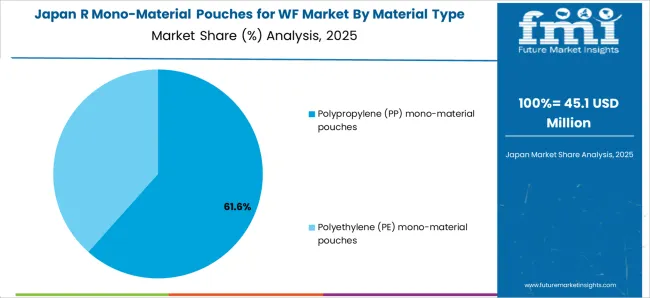

Polypropylene (PP) mono-material pouches are projected to command a dominant 61.0% share of the retortable mono-material pouches market by 2025, establishing their position as the preferred solution for high-temperature processing applications. Their superior heat resistance and chemical stability make them particularly well-suited for retort sterilization processes required in wet food packaging. PP's excellent barrier properties against moisture and oxygen ensure extended shelf life while maintaining food safety standards critical for commercial food processing operations.

The widespread adoption of PP mono-material pouches is driven by their compatibility with existing retort processing equipment and established recycling infrastructure. Advanced PP formulations have been optimized for enhanced puncture resistance and seal integrity, ensuring package reliability during processing and distribution. Compared to PE alternatives, PP offers superior temperature stability and barrier performance, making it the preferred choice for premium wet food applications requiring extended shelf life and robust packaging performance across diverse storage conditions.

Pet food applications are set to account for 43.0% of retortable mono-material pouch applications in 2025, reflecting the rapid growth in premium pet food categories and owner willingness to invest in high-quality nutrition. Wet pet food products require robust packaging solutions that maintain nutritional integrity while providing convenience features for pet owners. The shift from traditional metal cans to retortable pouches offers weight reduction, portion control, and easier storage benefits that align with evolving consumer preferences in pet care.

Ready meals represent 32.0% of applications, driven by increasing demand for convenient, shelf-stable meal solutions that maintain home-cooked taste and nutritional quality. Soups & sauces account for 15.0% of the market, benefiting from portion control capabilities and enhanced product visibility through clear packaging options. Baby food applications represent 10.0% of the market, a category requiring the highest safety and quality standards, where mono-material pouches provide sterile packaging with easy dispensing features critical for infant nutrition products.

Tear-open flat pouches are forecasted to capture 47.0% of closure/design formats in 2025, highlighting their cost-effectiveness and manufacturing efficiency in high-volume food processing operations. These pouches provide reliable seal integrity while minimizing packaging complexity, making them ideal for single-serving applications across pet food and ready meal categories. Their streamlined design enables efficient filling and processing while reducing material usage compared to more complex closure systems.

Spouted pouches account for 29.0% of the market, offering enhanced consumer convenience through controlled dispensing capabilities particularly valued in baby food and sauce applications. Zipper resealable pouches represent 24.0% of the market, providing premium convenience features that enable portion control and product freshness retention after opening. The distribution reflects market segmentation between cost-focused applications favoring simple designs and premium categories where consumer convenience justifies additional packaging complexity and cost.

The retortable mono-material pouches market is expanding as food manufacturers seek sustainable packaging solutions that maintain product quality and safety standards. Environmental regulations, consumer sustainability preferences, and circular economy initiatives drive adoption. However, higher initial costs, processing complexity, and limited recycling infrastructure constrain growth. Technological advances in barrier properties, processing efficiency, and design innovation are reshaping market dynamics.

Government regulations mandating recyclable packaging solutions are creating compliance requirements for food manufacturers across developed markets. Consumer environmental consciousness is pushing brands to adopt mono-material solutions that demonstrate sustainability credentials while maintaining product quality. Circular economy initiatives from major retailers are establishing supplier requirements for recyclable packaging formats. The technology's ability to replace multi-layer laminates with fully recyclable alternatives addresses both regulatory compliance and consumer expectations for environmental responsibility.

Premium pricing compared to traditional packaging formats creates adoption barriers in price-sensitive market segments. Specialized retort processing equipment requirements increase capital investment needs for food manufacturers. Limited recycling infrastructure for specialized polymer films creates challenges for circular economy implementation. Technical complexity in achieving optimal barrier properties while maintaining recyclability requires significant R&D investment and processing expertise that may limit adoption among smaller manufacturers.

Key trends include breakthrough improvements in polymer barrier properties that enable thinner films while maintaining performance standards. Enhanced processing technologies reduce cycle times and improve energy efficiency during retort sterilization. Smart packaging integration enables temperature indicators and freshness monitoring capabilities. Partnerships between packaging suppliers and food manufacturers accelerate customized solution development for specific applications and processing requirements.

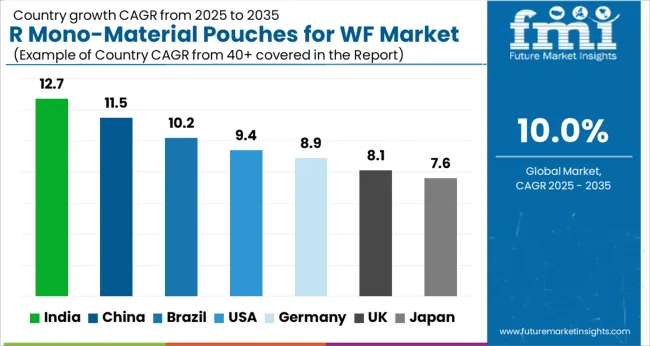

The global retortable mono-material pouches market is expanding rapidly across diverse regions, driven by sustainability regulations, consumer environmental awareness, and technological advances in packaging solutions. Asia-Pacific emerges as the fastest-growing region, with India and China leading adoption due to expanding wet food processing industries and growing environmental consciousness. Developed markets such as the USA, Germany, and UK focus on regulatory compliance, premium positioning, and circular economy implementation.

India's Retortable Mono-Material Pouches for Wet Foods Market is projected to grow at a CAGR of 12.7% from 2025 to 2035, driven by rapid expansion of wet pet food packaging and ready meal processing industries. The country's growing middle class and urbanization trends support increased demand for convenient, shelf-stable food products requiring advanced packaging solutions. Domestic packaging manufacturers are scaling production capabilities while international companies establish local partnerships to serve both domestic and export markets. Government sustainability initiatives are creating regulatory frameworks favoring recyclable packaging solutions across food processing industries.

China's Retortable Mono-Material Pouches for Wet Foods Market is forecast to grow at a CAGR of 11.5%, supported by scaling domestic pouch manufacturing capabilities and increasing demand for recyclable flexible packaging solutions. Local packaging companies are investing in advanced retort processing technologies while developing cost-competitive production processes. The country's large food processing industry and export focus create substantial growth opportunities for mono-material packaging solutions. Rising environmental awareness among urban consumers supports adoption of sustainable packaging alternatives in premium food categories.

Brazil's Retortable Mono-Material Pouches for Wet Foods Market is projected to grow at a CAGR of 10.2%, driven by expanding pet food market and consumer preference for lightweight retort packaging over traditional metal cans. The country's growing pet ownership and premium pet food adoption create opportunities for advanced packaging solutions. Local food processors are implementing sustainable packaging strategies to meet export requirements and domestic consumer expectations. Strong agricultural sector and food processing capabilities support domestic production development for both local and regional markets.

The USA Retortable Mono-Material Pouches for Wet Foods Market is expected to grow at a CAGR of 9.4%, supported by FDA-approved mono-material trials and rising demand in soups and sauces applications. American food processors are implementing sustainable packaging strategies to meet corporate environmental commitments and consumer expectations. The country's advanced food processing industry and innovation capabilities support development of specialized applications for diverse wet food categories. Major retailers are establishing supplier requirements for recyclable packaging formats, accelerating adoption across supply chains.

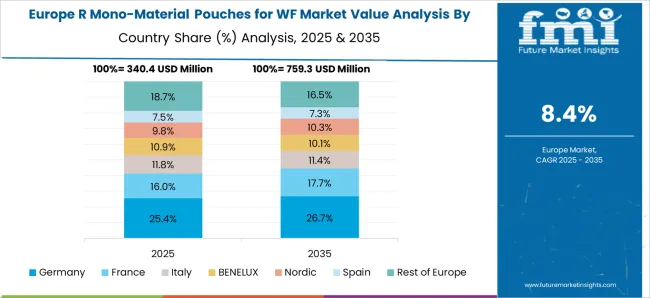

Germany's Retortable Mono-Material Pouches for Wet Foods Market is projected to grow at a CAGR of 8.9%, driven by EU packaging regulations mandating transition away from multi-layer laminates toward recyclable alternatives. German food manufacturers are investing in advanced mono-material solutions to maintain compliance with strict environmental regulations while preserving product quality standards. The country's strong engineering and food processing sectors support domestic production capability development. Consumer environmental consciousness and premium positioning strategies enable successful market penetration across major urban centers.

The UK Retortable Mono-Material Pouches for Wet Foods Market is forecast to grow at a CAGR of 8.1%, driven by major retailer initiatives mandating recyclable packaging adoption across supplier networks. British food manufacturers are implementing comprehensive sustainability strategies to meet retailer requirements and consumer environmental expectations. The country's focus on circular economy principles and waste reduction creates strong incentives for mono-material packaging adoption. Brexit-related supply chain considerations motivate domestic production capability development and reduced import dependencies.

Japan's Retortable Mono-Material Pouches for Wet Foods Market is projected to grow at a CAGR of 7.6%, supported by high consumer trust in retort pouch technology for baby food and ready meal applications. Japanese food manufacturers are implementing advanced packaging solutions for premium product categories requiring precise quality control and safety standards. The country's aging population and convenience food trends support growth in ready meal packaging applications. Advanced food processing technology sector enables development of innovative packaging solutions for traditional and modern food applications.

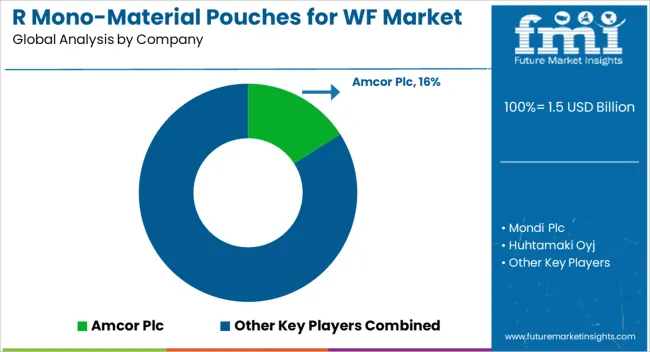

The retortable mono-material pouches market is moderately concentrated, with global packaging companies, specialized flexible packaging providers, and material suppliers competing across product development, processing capabilities, and market access strategies. Market leader Amcor Plc holds a significant 16.0% share through proprietary polymer technologies, strategic food manufacturer partnerships, and comprehensive processing capabilities. Their strategy emphasizes innovation in barrier properties, cost reduction, and regulatory compliance to achieve commercial viability across diverse wet food applications.

Established players including Mondi Plc, Huhtamaki Oyj, and Sealed Air Corporation focus on specialized applications, regional market development, and customized solutions for specific food processing requirements. These companies leverage advanced materials science, sustainable packaging expertise, and direct customer relationships to differentiate their offerings. Their emphasis on processing optimization, quality assurance, and supply chain integration strengthens competitive positioning in the evolving market.

Emerging companies such as Coveris, ProAmpac, Constantia Flexibles, Glenroy Inc., Sonoco Products Company, and Toppan Printing Co. concentrate on innovative processing technologies, cost-competitive manufacturing, and niche market applications. Their strengths include flexible manufacturing capabilities, rapid product development cycles, and specialized expertise that enables customization for diverse wet food applications and regional preferences.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.5 billion |

| By Material Type | Polypropylene (PP) mono-material pouches, Polyethylene (PE) mono-material pouches |

| By End Use | Pet food, Ready meals (human consumption), Soups & sauces, Baby food |

| By Closure/Design | Tear-open flat pouches, Spouted pouches, Zipper resealable pouches |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Germany, India, China, United Kingdom, Japan, Brazil |

| Key Companies Profiled | Amcor Plc, Mondi Plc, Huhtamaki Oyj, Sealed Air Corporation, Coveris, ProAmpac, Constantia Flexibles, Glenroy Inc., Sonoco Products Company, Toppan Printing Co. |

| Additional Attributes | Growing adoption of polypropylene mono-material pouches for superior heat resistance, increasing demand from pet food applications seeking sustainable packaging alternatives, rising preference for tear-open flat pouches optimizing manufacturing efficiency, expanding ready meals segment requiring extended shelf life capabilities, and emerging baby food applications demanding highest safety and quality standards |

The global market is estimated to be valued at USD 1.5 billion in 2025.

The size of the market is projected to reach USD 3.9 billion by 2035.

The market is expected to grow at a 10.0% CAGR between 2025 and 2035.

The key product types in market are polypropylene (pp) mono-material pouches and polyethylene (pe) mono-material pouches.

In terms of end use, pet food segment to command 43.0% share in the market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Foodservice Paper Bag Companies

Europe Foodservice Disposables Market Insights – Growth & Trends 2024-2034

Foodservice Disposable Market Growth & Trends Forecast 2024-2034

Kosher Foods Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Canned Foods Business

Organic Foods Market Analysis by Category, Product Type, Distribution Channel, and Region Through 2035

Coloring Foodstuffs Market Insights – Natural Pigments & Growth 2025 to 2035

Functional Foods Market Size and Share Forecast Outlook 2025 to 2035

Compostable Foodservice Packaging Market Size and Share Forecast Outlook 2025 to 2035

Market Share Insights of Compostable Foodservice Packaging Providers

Vegan Protein Foods Market analysis and forecast by Form, Ingredient Type, Animal Type, and Region through 2035

Low-Calorie Snack Foods Market Insights - Growth & Trends 2025 to 2035

Low-Lactose Dairy Foods Market

Health and Wellness Foods Market – Growth, Demand & Forecast 2025-2035

Low Fat and Low Carb Foods Market Growth -Trends & Forecast 2025 to 2035

Reduced Salt Packaged Foods Market - Health-Conscious Eating Trends 2025 to 2035

Whole Grain & High Fiber Foods Market Growth – Demand, Trends & Forecast 2025–2035

United Kingdom Whole Grain and High Fiber Foods Market Report – Trends & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA