The functional foods market is estimated to be valued at USD 246.5 billion in 2025 and is projected to reach USD 419.1 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period. Between 2020 and 2024, the market grew steadily from USD 189.1 billion to 233.8 billion, representing the early adoption stage. This period was shaped by rising awareness of products offering additional benefits beyond basic nutrition. Early adopters, including health-conscious consumers and niche retailers, drove uptake by showcasing product variety and positioning functional foods as part of everyday diets. While growth was moderate, this phase laid the foundation for expansion by establishing consumer trust and familiarity.

From 2025 to 2030, the market enters its scaling phase, increasing from USD 246.5 billion to approximately 321.5 billion. During this time, consumption broadens across mainstream channels, with supermarkets, foodservice, and e-commerce driving access and visibility. Established brands strengthen their product ranges while new entrants compete to capture specific categories such as fortified snacks, beverages, and dairy products.

By 2030, as the market nears USD 321.5 billion, adoption is widespread, signaling a transition toward consolidation. Between 2030 and 2035, growth steadies, with the market reaching USD 419.1 billion, where leading players solidify dominance and functional foods become a consistent, mature part of the global diet.

| Metric | Value |

|---|---|

| Functional Foods Market Estimated Value in (2025 E) | USD 246.5 billion |

| Functional Foods Market Forecast Value in (2035 F) | USD 419.1 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The current market scenario reflects a consumer shift toward preventive healthcare and natural health solutions, as noted in health-focused publications and corporate wellness initiatives. Companies across the food and beverage sector are increasingly investing in functional formulations, supported by scientific validation and rising demand for clean-label ingredients.

The outlook for this market remains optimistic, driven by technological innovation in food processing, enhanced ingredient bioavailability, and evolving dietary preferences across global demographics. Regulatory support for health claims, along with increased R&D in gut health, immunity, and metabolic wellness, is encouraging companies to expand product portfolios.

Industry communications and press statements have emphasized that product personalization, convenience, and transparency are becoming critical differentiators. As functional foods continue to align with consumer health goals, the market is expected to expand steadily, offering long-term opportunities across ingredients, formats, and targeted health applications.

The functional foods market is segmented by ingredient, product, application, and geographic regions. By ingredient, the functional foods market is divided into Prebiotics & Probiotics, Carotenoids, Dietary Fibers, Fatty Acids, Minerals, Vitamins, and Others. In terms of product, the functional foods market is classified into Dairy Products, Bakery & Cereals, Meat, Fish & Eggs, Soy Products, Fats & Oils, and Others.

Based on application, the functional foods market is segmented into Digestive Health, Sports Nutrition, Weight Management, Immunity, Clinical Nutrition, Cardio Health, and Others. Regionally, the functional foods industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The prebiotics and probiotics ingredient segment is anticipated to account for 28.6% of the Functional Foods market revenue share in 2025, positioning it as the leading segment within the ingredient category. This dominance is being attributed to the increased focus on gut health and its established connection to immune function, nutrient absorption, and chronic disease prevention. Corporate announcements and product innovation updates have shown significant investment in microbiome-targeted ingredients, particularly in dairy, beverages, and snacks.

Prebiotics and probiotics are being increasingly incorporated due to their ability to support digestive balance, which has become a top consumer priority. The demand is also being supported by growing clinical research validating the benefits of these components, which has improved consumer trust and widened adoption across age groups.

Their compatibility with a variety of formulations and ability to address lifestyle-related health issues have further enhanced their appeal. These factors have driven the segment’s leadership in 2025.

The dairy products segment is projected to contribute 32.1% of the Functional Foods market revenue share in 2025, marking it as the top-performing product category. This leadership has been supported by the long-standing association of dairy with health and nutrition, as well as its adaptability to fortification and functional ingredient integration.

Corporate press releases and industry trend reports have indicated that yogurts, fermented milk, and dairy-based beverages are being reformulated with added probiotics, vitamins, and minerals to meet rising consumer health demands. The segment has benefited from the ability to deliver both taste and efficacy, making it a preferred choice across all age groups.

The widespread availability of refrigerated supply chains and established consumption patterns in both developed and emerging markets have also contributed to its growth. These elements, combined with the segment’s alignment with clean-label and functional trends, have solidified its leadership in the market in 2025.

The digestive health application segment is expected to hold 26.4% of the Functional Foods market revenue share in 2025, making it the leading segment by application. This growth has been driven by a widespread consumer focus on gut wellness and its link to immunity, energy levels, and mental well-being. Public health campaigns and industry-backed awareness initiatives have played a role in educating consumers on the importance of digestive balance.

Functional food companies have responded by developing formulations that specifically target gut flora and promote gastrointestinal comfort, which has led to greater product acceptance. Press coverage and brand communications have frequently positioned digestive health as a core benefit in functional product marketing.

Additionally, the segment’s compatibility with trending formats such as drinkable yogurts, functional snacks, and plant-based options has expanded its reach across diverse consumer groups. These drivers have reinforced the application’s leadership and sustained its growth momentum in the 2025 market landscape.

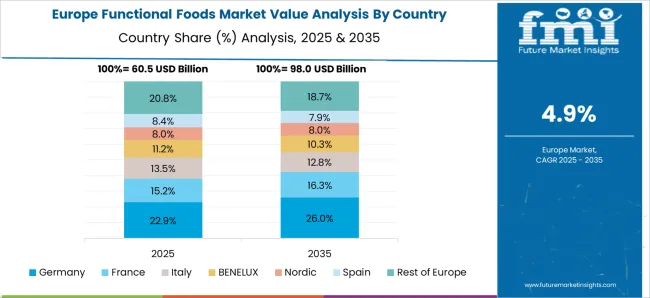

The functional foods market is expanding rapidly as consumers increasingly demand products that deliver both nutritional value and specific health benefits. Functional foods enriched with probiotics, vitamins, omega-3s, fibers, and plant-based bioactives are being integrated into dairy, bakery, beverages, and snacks. Rising health awareness, aging populations, and preventive healthcare trends drive adoption globally. North America and Europe dominate due to established functional food brands and regulatory frameworks, while Asia-Pacific shows strong growth, driven by traditional wellness culture and rising disposable incomes. Market expansion focuses on innovation, scientific validation, and clean-label positioning across multiple food categories.

Maintaining consistent bioactive ingredient quality and navigating complex regulations are major challenges in the functional foods market. Variability in raw material sourcing, ingredient stability, and formulation processes can affect efficacy and shelf life. Regulatory frameworks differ across regions: while some countries allow functional claims under strict clinical validation, others restrict health-related labeling. Failure to comply with these standards can result in product recalls or reputational damage. Companies investing in validated formulations, transparent labeling, and recognized certifications gain trust and market access. Until regulatory harmonization and stricter quality protocols become widespread, compliance complexity will remain a barrier to consistent market growth.

Advances in food technology are reshaping functional foods by improving ingredient stability, bioavailability, and sensory appeal. Techniques such as microencapsulation, nanoemulsions, and fermentation enhance the delivery of probiotics, omega-3s, and plant extracts without altering taste or texture. Functional ingredients are increasingly incorporated into everyday foods like beverages, bakery, and dairy, widening consumer accessibility. Digital tools and AI-driven nutrition research accelerate product development and personalization, aligning with consumer demand for tailored health solutions. Companies collaborating with biotech and research institutions are strengthening innovation pipelines. As technology-driven nutrition delivery gains traction, functional foods are transitioning from niche offerings to mainstream health-enhancing products.

The regulatory environment strongly shapes functional food adoption. In the EU, EFSA strictly controls health claims, requiring strong clinical evidence, while North America allows structure/function claims under defined guidelines. In the Asia-Pacific region, regulatory frameworks vary significantly, with some countries promoting functional foods under traditional wellness categories. Restrictions on marketing unverified claims pose significant challenges for manufacturers, especially small players lacking the resources for clinical validation. Clear labeling, dosage transparency, and substantiated claims are critical for consumer trust. Until international harmonization is achieved, companies must navigate fragmented rules and balance innovation with regulatory compliance in order to expand globally.

The functional foods market is highly competitive, with global food multinationals, nutraceutical companies, and startups all competing for consumer attention. Established players leverage strong R&D, marketing, and distribution networks, while smaller brands focus on niche health categories such as gut health, immunity, or plant-based nutrition. Supply chain complexity, particularly for bioactive ingredients like probiotics, botanical extracts, and omega-3 oils, exposes manufacturers to cost fluctuations and sourcing challenges. Competitive differentiation increasingly depends on sustainability, clean-label claims, and consumer engagement through e-commerce and direct-to-consumer channels. Until ingredient supply stability improves, rivalry and cost pressures will continue to shape growth and brand positioning.

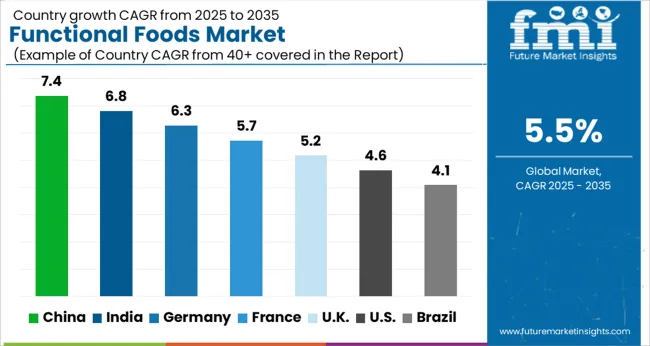

The global functional foods market is projected to grow at a CAGR of 5.5% through 2035, supported by increasing demand across fortified products, dietary supplements, and specialized nutrition. Among BRICS nations, China has been recorded with 7.4% growth, driven by expanding consumption of fortified beverages and health-oriented packaged foods, while India has been observed at 6.8%, supported by growing demand in dairy-based products and enriched snacks. In the OECD region, Germany has been measured at 6.3%, where established food-processing industries and widespread retail penetration have been maintained. The United Kingdom has been noted at 5.2%, reflecting stronger adoption of fortified cereals and nutritional products, while the USA has been recorded at 4.6%, with steady demand noted in protein-enriched foods and functional beverages. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The functional foods market in China is expanding rapidly, recording a CAGR of 7.4%, fueled by rising health consciousness and growing demand for nutrition-focused products. Chinese consumers are increasingly seeking foods that offer added benefits such as improved immunity, digestive health, and energy enhancement. This trend is driven by the aging population, changing lifestyles, and the influence of Western dietary habits. Functional beverages, fortified dairy products, and probiotic-rich foods are particularly popular. Domestic manufacturers are focusing on product innovation and partnerships with international companies to expand their portfolios. E-commerce platforms are also playing a key role in widening product reach across both urban and rural regions. Additionally, supportive government policies encouraging the development of health-focused foods are bolstering growth. With an expanding middle-class population and rising disposable incomes, demand for functional foods in China is expected to continue on a strong upward trajectory.

The functional foods market in India is growing at a CAGR of 6.8%, supported by increasing health awareness and a growing preference for preventive healthcare solutions. Indian consumers are shifting toward foods enriched with vitamins, minerals, probiotics, and natural ingredients to boost immunity and overall wellness. Urbanization and changing dietary habits are also contributing to this demand. Products such as fortified dairy, nutrition bars, and functional beverages are witnessing notable adoption, particularly among young professionals and fitness-conscious consumers. Domestic players are investing in product development while multinational companies are introducing specialized products tailored to local needs. The rapid rise of e-commerce platforms has made functional foods accessible to a wider audience, extending beyond metropolitan regions. With a growing focus on nutrition and preventive health, the functional foods market in India is poised for sustained growth, supported by evolving consumer preferences and increased disposable incomes.

The functional foods market in Germany is expanding at a CAGR of 6.3%, reflecting the nation’s strong focus on health, wellness, and sustainable living. German consumers are highly conscious of nutrition, with rising demand for products that promote digestive health, immunity, and energy balance. Probiotic yogurt, fortified cereals, and functional beverages are among the most popular categories. The country’s well-established food industry and strong regulatory environment support the development and distribution of high-quality functional foods. Organic and clean-label products are gaining traction, aligning with consumer preferences for natural and sustainable options. Additionally, the influence of fitness and sports nutrition trends is encouraging demand for protein-enriched functional foods. With an aging population and increasing focus on preventive health solutions, the functional foods market in Germany is set to grow steadily. Continuous product innovation and sustainability initiatives remain critical drivers shaping the market’s future outlook.

The functional foods market in the United Kingdom is projected to grow at a CAGR of 5.2%, driven by increasing awareness of the role of diet in maintaining health and preventing chronic diseases. Consumers are showing strong interest in fortified foods and beverages that support immunity, digestive health, and mental well-being. Probiotic drinks, fortified juices, and functional snacks are gaining popularity across different consumer groups. The rising adoption of plant-based diets has further boosted demand for functional foods enriched with plant proteins and natural ingredients. Retail and e-commerce channels are expanding access to a wide range of products, making functional foods more mainstream. Health-conscious millennials and Gen Z are leading this demand shift, focusing on convenient yet nutritious food options. With growing interest in personalized nutrition and natural wellness, the functional foods market in the UK is expected to sustain robust growth in the coming years.

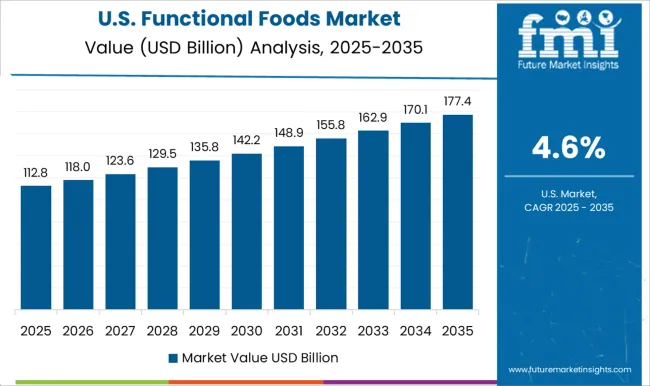

The functional foods market in the United States is growing at a CAGR of 4.6%, reflecting the country’s dynamic health and wellness culture. Consumers are increasingly demanding products with added nutritional value, including fortified dairy, protein bars, omega-3 enriched foods, and probiotics. The trend toward preventive healthcare is encouraging people to adopt functional foods as part of daily diets. Innovation in flavors and formats, including convenient ready-to-eat options, is also expanding market appeal. USA consumers, particularly millennials and health-conscious families, are prioritizing natural, organic, and clean-label functional food options. The growing fitness and sports nutrition sector is fueling demand for protein-enriched products, while plant-based functional foods continue to gain momentum. E-commerce and subscription services are making functional foods more accessible nationwide. With rising healthcare costs and increasing awareness of nutrition, the functional foods market in the USA is poised for long-term growth.

Competition in the functional foods market is shaped by formulation expertise, nutritional efficacy, consumer trust, and distribution network strength. General Mills Inc. leads with a broad portfolio of fortified cereals, dairy products, and snack items, emphasizing nutritional value, large-scale production capabilities, and strong brand recognition. Nutri-Nation competes through specialized functional beverages and supplements that target immunity, gut health, and metabolic support, highlighting product innovation and health-focused branding. BASF differentiates by supplying high-purity bioactive ingredients and nutritional additives, catering to food manufacturers seeking formulation flexibility and regulatory compliance. Amway leverages direct-to-consumer channels and wellness-oriented products, emphasizing personalized nutrition and lifestyle integration.

Arla Foods focuses on protein-enriched dairy and probiotic offerings, highlighting taste and nutritional optimization. GFR Pharma competes with specialty functional ingredients for sports nutrition, weight management, and clinical nutrition markets, emphasizing efficacy and scientific validation. Cargill maintains a strong position through global ingredient supply, research-backed formulations, and integration with food manufacturing processes.

| Item | Value |

|---|---|

| Quantitative Units | USD 246.5 Billion |

| Ingredient | Prebiotics & Probiotics, Carotenoids, Dietary Fibers, Fatty Acids, Minerals, Vitamins, and Others |

| Product | Dairy Products, Bakery & Cereals, Meat, Fish & Eggs, Soy Products, Fats & Oils, and Others |

| Application | Digestive Health, Sports Nutrition, Weight Management, Immunity, Clinical Nutrition, Cardio Health, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | General Mills Inc., Nutri-Nation, BASF, Amway, Arla Foods, GFR Pharma, and Cargill |

| Additional Attributes | Dollar sales by product type including dairy products, bakery and cereals, fats and oils, and dietary supplements, application across immunity, digestive health, and weight management, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising health awareness, demand for fortified foods, and expanding nutraceutical innovations. |

The global functional foods market is estimated to be valued at USD 246.5 billion in 2025.

The market size for the functional foods market is projected to reach USD 419.1 billion by 2035.

The functional foods market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in functional foods market are prebiotics & probiotics, carotenoids, dietary fibers, fatty acids, minerals, vitamins and others.

In terms of product, dairy products segment to command 32.1% share in the functional foods market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Functional Plating Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Functional Flours Market Size and Share Forecast Outlook 2025 to 2035

Functional Flour Market Size and Share Forecast Outlook 2025 to 2035

Functional Endoscopic Sinus Surgery Systems Market Size and Share Forecast Outlook 2025 to 2035

Functional Safety Market Size and Share Forecast Outlook 2025 to 2035

Functional Printing Market Size and Share Forecast Outlook 2025 to 2035

Functional Seafood Market Size and Share Forecast Outlook 2025 to 2035

Functional Textile Finishing Agents Market Size and Share Forecast Outlook 2025 to 2035

Functional Water Market Size and Share Forecast Outlook 2025 to 2035

Functional Pet Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Functional Cosmetic Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Functional Food Ingredients Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Functional Flavour Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Functional Extracts Market Analysis – Size, Share, & Forecast Outlook 2025 to 2035

Functional Chewing Gum Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Functional Carbohydrate Market Analysis -Size, Share, & Forecast Outlook 2025 to 2035

Functional Mushroom Market Size, Growth, and Forecast for 2025 to 2035

Functional Protein Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Functional Electrical Stimulation (FES) Market Trends - Growth & Forecast 2025 to 2035

Functional Milk Replacers Market Size, Growth, and Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA