The functional seafood market is estimated to be valued at USD 16.4 billion in 2025 and is projected to reach USD 27.2 billion by 2035, registering a compound annual growth rate (CAGR) of 5.2% over the forecast period.

As consumers increasingly seek healthier, protein-rich food options, the demand for functional seafood products such as fortified fish oils, omega-3-enriched fish, and other nutraceuticals is set to rise. This market growth is driven by the growing awareness surrounding the health benefits of seafood and its role in promoting heart health, cognitive function, and overall wellness. The ongoing shift in dietary preferences towards functional foods is expected to fuel sustained interest in seafood-based supplements and fortified products.

Furthermore, the functional seafood market’s expansion is supported by the increasing adoption of seafood in various applications, ranging from functional snacks to specialized dietary products. As seafood products are enriched with added nutrients, the market is witnessing a surge in demand across health-conscious consumer segments. With evolving consumer trends emphasizing wellness and nutrition, the market’s growth is anticipated to continue throughout the decade. Key drivers also include the growing penetration of seafood in emerging markets, where awareness of functional food products is rising, and improved distribution networks that facilitate broader access to these specialized products.

| Metric | Value |

|---|---|

| Functional Seafood Market Estimated Value in (2025 E) | USD 16.4 billion |

| Functional Seafood Market Forecast Value in (2035 F) | USD 27.2 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

The functional seafood market holds a unique position within various parent markets, with a relatively small but significant share. Within the seafood market, functional seafood represents about 4-5%, driven by the growing demand for value-added products that offer additional health benefits, such as omega-3 fatty acids, vitamins, and minerals. In the broader functional foods market, functional seafood accounts for approximately 2-3%, as consumers seek functional ingredients with proven health benefits, especially those related to heart and brain health. In the health and wellness market, the share of functional seafood is around 1-2%, as the trend towards healthier, more nutritious foods continues to gain traction, particularly among health-conscious consumers.

Within the nutraceuticals market, functional seafood holds roughly 3-4%, reflecting its role in supplementing dietary needs with bioactive compounds, such as fish oil and marine collagen. The functional seafood market also contributes around 2-3% to the overall food and beverage market, as it increasingly finds its place in product categories like functional snacks, beverages, and ready-to-eat meals. This growing share across these markets highlights the increasing recognition of seafood as a functional food source, valued for its diverse health benefits, especially in the context of preventive health care and wellness-focused diets.

The market is experiencing strong growth as consumers increasingly seek nutrient-rich food products that contribute to overall health and wellness. Rising awareness of the benefits of functional ingredients, such as Omega-3 fatty acids, antioxidants, and proteins, has influenced purchasing behavior, particularly among health-conscious and aging populations. The demand for seafood products fortified with bioactive compounds is being supported by scientific validation of their role in promoting cardiovascular health, cognitive function, and immune system support.

Supply chain advancements, cold storage infrastructure, and improved processing technologies have enabled manufacturers to maintain product quality while incorporating functional enhancements. Regulatory encouragement for healthier dietary patterns is also creating favorable market conditions.

With global trends shifting toward preventive healthcare and clean-label products, functional seafood is expected to gain wider acceptance across diverse demographics Strategic innovation in product development, packaging, and distribution is further paving the way for sustained market expansion in both mature and emerging economies.

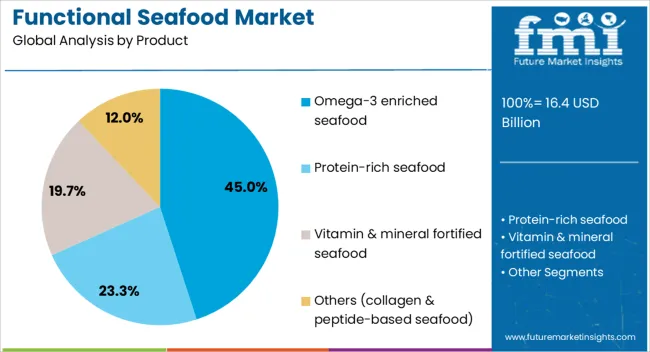

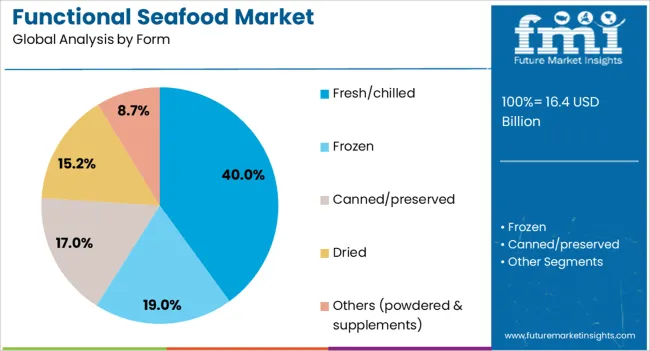

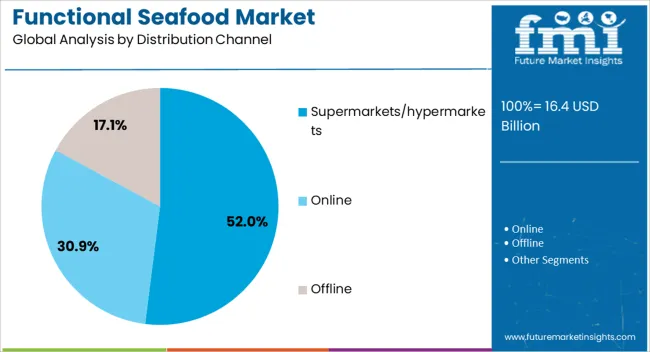

The functional seafood market is segmented by product, form, distribution channel, and geographic regions. By product, functional seafood market is divided into omega-3 enriched seafood, protein-rich seafood, vitamin & mineral fortified seafood, and others (collagen & peptide-based seafood). In terms of form, functional seafood market is classified into fresh/chilled, frozen, canned/preserved, dried, and others (powdered & supplements). Based on distribution channel, functional seafood market is segmented into supermarkets/hypermarkets, online, and offline. Regionally, the functional seafood industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Omega-3 enriched seafood product segment is projected to hold 45% of the market revenue share in 2025, making it the leading product category. Growth in this segment has been driven by increasing consumer awareness of the health benefits associated with Omega-3 fatty acids, particularly in supporting heart, brain, and joint health. Scientific evidence and nutritional recommendations from global health organizations have reinforced demand for these products, making them a preferred choice among consumers focused on long-term wellness.

Advancements in enrichment processes have allowed producers to enhance natural Omega-3 levels without compromising taste or texture, further improving consumer acceptance. Additionally, the segment has benefited from targeted marketing campaigns highlighting the preventive health advantages of Omega-3 consumption.

Rising prevalence of lifestyle-related diseases has prompted consumers to seek nutrient-dense dietary options, positioning Omega-3 enriched seafood as a staple in health-oriented diets This combination of health benefits, quality assurance, and consumer trust continues to support its market leadership.

The fresh or chilled form segment is expected to account for 40% of the market revenue share in 2025, maintaining its position as the leading product form. The dominance of this segment is attributed to consumer preference for seafood that retains natural flavor, texture, and nutritional value. Fresh or chilled seafood is perceived as higher quality compared to frozen or processed alternatives, particularly among premium buyers and health-focused consumers.

Continuous improvements in cold chain logistics have made it possible to deliver fresh functional seafood to wider markets without compromising safety or shelf life. The segment has also benefited from the trend toward minimally processed foods, where freshness and clean-label attributes are highly valued.

Retailers and suppliers have increasingly invested in advanced refrigeration and packaging technologies that extend freshness while maintaining nutrient integrity This emphasis on quality preservation, combined with growing consumer willingness to pay for premium seafood, has reinforced the strong market position of the fresh or chilled segment.

The supermarkets or hypermarkets distribution channel is anticipated to hold 52% of the market revenue share in 2025, securing its place as the primary retail platform. This leadership is supported by the ability of large-format retailers to offer a wide variety of functional seafood products under one roof, catering to diverse consumer preferences. The strong position of supermarkets and hypermarkets is further enhanced by their investment in modern refrigeration systems, dedicated seafood counters, and in-store promotions that attract health-conscious shoppers.

Their extensive reach into both urban and suburban areas allows functional seafood brands to access a broad customer base. Consumers also value the transparency offered by in-store purchases, where product freshness, labeling, and quality can be personally verified.

Strategic partnerships between seafood producers and retail chains have ensured consistent product availability, competitive pricing, and brand visibility As demand for convenient access to premium health-oriented seafood continues to grow, supermarkets and hypermarkets remain the dominant distribution channel.

The functional seafood market is experiencing substantial growth, fueled by rising consumer demand for healthy, nutrient-enriched food options. As opportunities emerge in expanding product offerings, trends such as sustainable sourcing and seafood-based snacks continue to shape the market landscape. However, challenges like high costs and regulatory constraints must be addressed for sustained growth. The market is expected to thrive as consumers seek healthier alternatives, offering considerable potential for manufacturers in the global functional food sector.

The demand for functional seafood is witnessing notable growth, driven by increasing consumer awareness about the health benefits of seafood. Functional seafood, enriched with added nutrients like omega-3 fatty acids, vitamins, and minerals, has gained popularity among health-conscious consumers. Rising awareness regarding the role of nutrition in disease prevention, along with the growing trend of plant-based and organic diets, is pushing consumers toward seafood products as a source of essential nutrients. This demand is also supported by the rising interest in natural and functional food products that offer long-term health benefits.

Opportunities in the functional seafood market are increasing as manufacturers develop innovative products to cater to evolving consumer preferences. The rising focus on enhancing the nutritional profile of seafood products, such as fortified fish oils, collagen, and protein-rich products, is opening new avenues for growth. Additionally, seafood's role in functional ingredients for nutraceuticals and supplements offers significant potential for companies looking to expand their product portfolios. Markets in regions like Asia-Pacific and North America are anticipated to witness robust growth due to the increasing demand for functional food products across various age groups.

One of the key trends in the functional seafood market is the increasing incorporation of sustainable and traceable sourcing methods. Consumers are becoming more discerning about the origin of their food, prompting manufacturers to focus on transparency and sustainable harvesting methods. Another notable trend is the growing popularity of seafood-based snacks, including fish jerky, seafood powders, and ready-to-eat seafood meals, which offer convenience without compromising on nutritional value. These trends are reshaping the market, with manufacturers focusing on catering to the needs of busy, health-conscious consumers.

Despite the market’s promising growth, several challenges hinder widespread adoption. One key challenge is the relatively high cost of functional seafood products, which may limit their accessibility to all consumer segments. Moreover, maintaining the freshness and quality of seafood while enhancing its nutritional content can be difficult, requiring advanced processing techniques. Regulatory hurdles, including varying food safety standards across regions, also add complexity to the market, limiting the scalability of functional seafood products. Overcoming these challenges is essential for market growth in the long term.

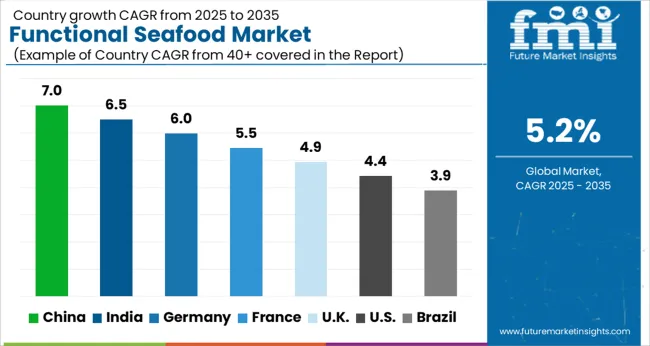

| Country | CAGR |

|---|---|

| China | 7.0% |

| India | 6.5% |

| Germany | 6.0% |

| France | 5.5% |

| UK | 4.9% |

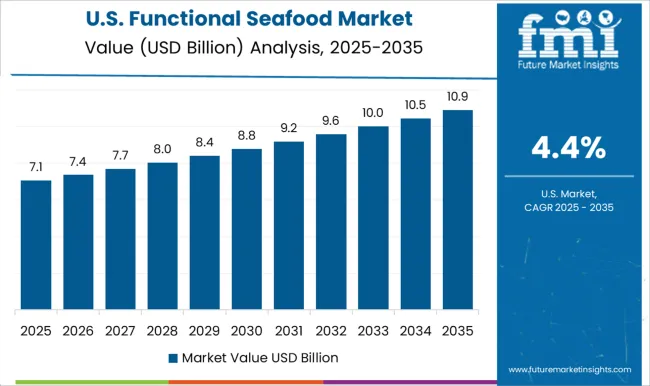

| USA | 4.4% |

| Brazil | 3.9% |

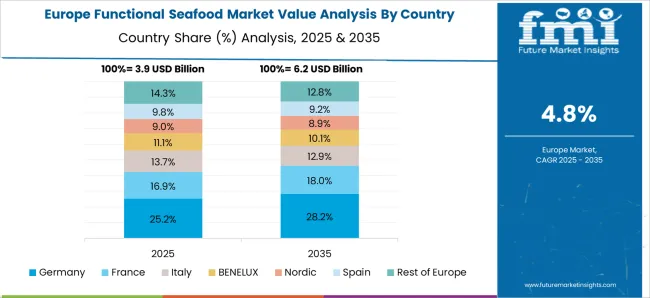

The global functional seafood market is projected to grow at a 5.2% CAGR from 2025 to 2035. China leads with a growth rate of 7%, followed by India at 6.5%, and Germany at 6%. The United Kingdom records a growth rate of 4.9%, while the United States shows the slowest growth at 4.4%. These varying growth rates are driven by increasing consumer demand for nutrient-rich, functional foods, rising awareness of health benefits, and the growing popularity of seafood-based supplements and products. Emerging markets like China and India are seeing higher growth rates due to an expanding middle class and growing health-consciousness, while more mature markets like the USA and the UK see steady growth driven by health trends and sustainability initiatives in the food industry. This report includes insights on 40+ countries; the top markets are shown here for reference.

The functional seafood market in China is projected to grow at a CAGR of 7%. China’s rapidly growing middle class, increasing disposable income, and heightened awareness of the health benefits of seafood are fueling demand for functional seafood products. The country’s expanding retail sector, along with a shift towards healthier and more nutritious food choices, is further supporting market growth. Additionally, China’s focus on sustainable aquaculture practices and the growing popularity of seafood-based functional foods, such as omega-3 supplements, continue to contribute to the market's expansion.

The functional seafood market in India is expected to grow at a CAGR of 6.5%. India’s growing population, rising health consciousness, and increasing disposable income are major factors driving the market. As consumers become more aware of the nutritional benefits of seafood, particularly omega-3 fatty acids and other essential nutrients, demand for functional seafood products is rising. Additionally, the country’s expanding retail network and evolving dietary preferences toward healthier food options continue to support the growth of the functional seafood market.

The functional seafood market in Germany is projected to grow at a CAGR of 6%. Germany’s increasing focus on health and wellness, coupled with a strong demand for functional foods, is contributing to the growth of the functional seafood market. The country’s high consumer awareness of the benefits of seafood, particularly in the form of supplements like omega-3 oils, continues to support market demand. Additionally, the growing preference for sustainable and responsibly sourced seafood products plays a significant role in driving market growth.

The functional seafood market in the United Kingdom is expected to grow at a CAGR of 4.9%. The UK’s growing awareness of the health benefits of functional foods, particularly those derived from seafood, is driving market growth. Increasing interest in natural and organic food products, along with the growing popularity of omega-3 fatty acids and other nutrients found in seafood, is fueling demand. Additionally, sustainability concerns are pushing consumers toward responsibly sourced seafood products, contributing to steady market expansion in the UK.

The functional seafood market in the United States is projected to grow at a CAGR of 4.4%. The USA market is driven by the increasing consumer preference for health-enhancing foods, including those rich in omega-3 fatty acids and other essential nutrients found in seafood. Growing awareness of the health benefits of functional seafood products, along with the rising demand for natural supplements, is supporting market growth. Additionally, the expanding trend of sustainable and eco-friendly sourcing practices is contributing to the continued demand for functional seafood in the USA

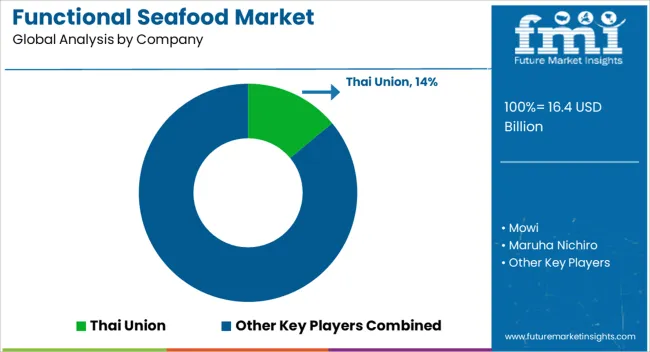

The functional seafood market is characterized by intense competition, with leading players like Thai Union, Mowi, Maruha Nichiro, Nippon Suisan, and Nutreco at the forefront of innovation and market expansion. Thai Union, a global leader in the seafood industry, offers a wide range of functional seafood products, focusing on high nutritional value and added health benefits. The company’s strategic emphasis on sustainable sourcing and innovative product development has positioned it as a key player in the growing demand for functional ingredients. Mowi, known for its premium salmon products, continues to expand its portfolio with functional seafood items, incorporating omega-3 fatty acids and other health-enhancing ingredients that cater to health-conscious consumers.

Maruha Nichiro and Nippon Suisan, both based in Japan, are integral to the functional seafood market, offering a variety of seafood products enriched with functional benefits, such as supporting heart health and improving cognitive function. These companies benefit from their strong presence in Asian markets, where seafood consumption remains high. Nutreco, with its focus on aquaculture nutrition, provides functional seafood solutions that prioritize sustainability and quality, meeting the growing demand for fish-based products in functional foods and supplements. The competitive landscape is shaped by a combination of product innovation, regional market strategies, and the ability of companies to meet consumer demand for healthier, functional seafood alternatives.

| Item | Value |

|---|---|

| Quantitative Units | USD 16.4 Billion |

| Product | Omega-3 enriched seafood, Protein-rich seafood, Vitamin & mineral fortified seafood, and Others (collagen & peptide-based seafood) |

| Form | Fresh/chilled, Frozen, Canned/preserved, Dried, and Others (powdered & supplements) |

| Distribution Channel | Supermarkets/hypermarkets, Online, and Offline |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Thai Union, Mowi, Maruha Nichiro, Nippon Suisan, and Nutreco |

| Additional Attributes | Dollar sales by product type (fresh, frozen, canned, processed), dollar sales by form (fillet, whole, chunks, paste), trends in health-conscious consumer preferences and omega-3 adoption, use in functional foods and supplements, growth in demand for sustainable sourcing, and regional patterns of seafood consumption and formulation in global markets. |

The global functional seafood market is estimated to be valued at USD 16.4 billion in 2025.

The market size for the functional seafood market is projected to reach USD 27.2 billion by 2035.

The functional seafood market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in functional seafood market are omega-3 enriched seafood, protein-rich seafood, vitamin & mineral fortified seafood and others (collagen & peptide-based seafood).

In terms of form, fresh/chilled segment to command 40.0% share in the functional seafood market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Functional Plating Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Functional Flours Market Size and Share Forecast Outlook 2025 to 2035

Functional Flour Market Size and Share Forecast Outlook 2025 to 2035

Functional Endoscopic Sinus Surgery Systems Market Size and Share Forecast Outlook 2025 to 2035

Functional Foods Market Size and Share Forecast Outlook 2025 to 2035

Functional Safety Market Size and Share Forecast Outlook 2025 to 2035

Functional Printing Market Size and Share Forecast Outlook 2025 to 2035

Functional Textile Finishing Agents Market Size and Share Forecast Outlook 2025 to 2035

Functional Water Market Size and Share Forecast Outlook 2025 to 2035

Functional Pet Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Functional Cosmetic Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Functional Food Ingredients Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Functional Flavour Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Functional Extracts Market Analysis – Size, Share, & Forecast Outlook 2025 to 2035

Functional Chewing Gum Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Functional Carbohydrate Market Analysis -Size, Share, & Forecast Outlook 2025 to 2035

Functional Mushroom Market Size, Growth, and Forecast for 2025 to 2035

Functional Protein Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Functional Electrical Stimulation (FES) Market Trends - Growth & Forecast 2025 to 2035

Functional Milk Replacers Market Size, Growth, and Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA