The functional safety market is estimated to be valued at USD 6.4 billion in 2025 and is projected to reach USD 13.1 billion by 2035, registering a compound annual growth rate (CAGR) of 7.5% over the forecast period. The functional safety market is projected to create an absolute dollar opportunity of USD 6.7 billion over the forecast period. This growth is supported by a strong CAGR of 7.5%, driven by the increasing adoption of safety systems across critical industries such as automotive, industrial manufacturing, oil & gas, and utilities.

In the first five-year phase (2025–2030), the market is expected to grow from USD 6.4 billion to USD 9.4 billion, adding USD 3 billion, which accounts for 44.8% of the total incremental growth, driven by stricter regulatory requirements and a growing focus on automation and risk mitigation. The second phase (2030–2035) will contribute USD 3.7 billion, representing 55.2% of the total growth, reflecting stronger momentum as functional safety solutions become integral to next-generation technologies such as AI, IoT, and autonomous systems.

Annual increments rise from USD 0.6 billion in early years to USD 0.9 billion by 2035, reflecting the increasing importance of safety in emerging industries like electric vehicles, robotics, and smart factories. Manufacturers focusing on advanced functional safety systems with enhanced capabilities for fault detection and prevention will capture the largest share of this USD 6.7 billion opportunity.

| Metric | Value |

|---|---|

| Functional Safety Market Estimated Value in (2025 E) | USD 6.4 billion |

| Functional Safety Market Forecast Value in (2035 F) | USD 13.1 billion |

| Forecast CAGR (2025 to 2035) | 7.5% |

The functional safety market is expanding steadily due to increasing automation, rising awareness of industrial hazards, and stricter global safety regulations. As manufacturing systems grow more complex, the need for fail-safe mechanisms and reliable safety protocols has become critical in ensuring human and asset protection.

Governments and regulatory bodies across regions are enforcing compliance standards such as IEC 61508 and ISO 13849, driving widespread adoption of safety technologies. In parallel, advancements in sensor accuracy, system redundancy, and integrated safety logic have strengthened deployment in high-risk industries.

Functional safety has become an operational imperative in sectors such as oil and gas, energy, and chemicals, where even momentary failures can result in catastrophic consequences. The market outlook remains favorable as industries increasingly invest in predictive safety systems and digital transformation to ensure operational continuity and regulatory alignment.

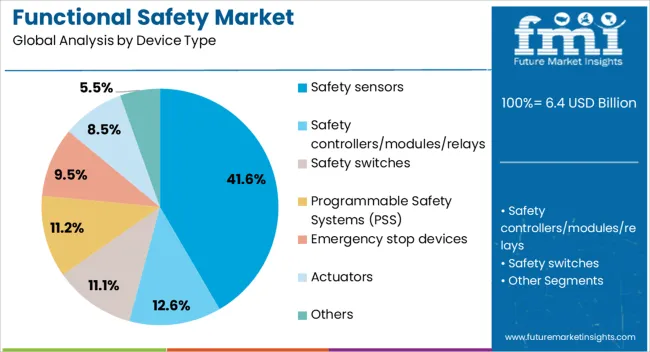

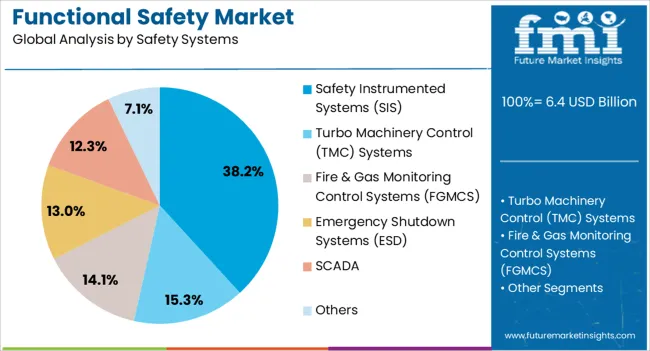

The functional safety market is segmented by device type, safety systems, vertical industry, and geographic regions. By device type, the functional safety market is divided into Safety sensors, Safety controllers/modules/relays, Safety switches, Programmable Safety Systems (PSS), Emergency stop devices, Actuators, and Others. In terms of safety systems, the functional safety market is classified into Safety Instrumented Systems (SIS), Turbo Machinery Control (TMC) Systems, Fire & Gas Monitoring Control Systems (FGMCS), Emergency Shutdown Systems (ESD), SCADA, and Others.

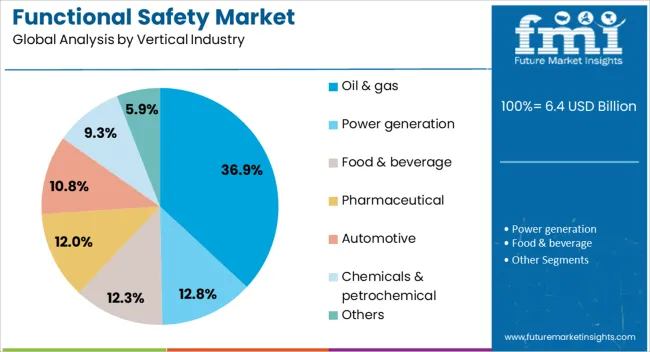

Based on vertical industry, the functional safety market is segmented into Oil & gas, Power generation, Food & beverage, Pharmaceutical, Automotive, Chemicals & petrochemical, and Others. Regionally, the functional safety industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The safety sensors segment is anticipated to hold 41.60% of the total revenue by 2025 within the device type category, making it the largest contributor. The increasing need for real-time monitoring, machine safeguarding, and personnel protection in automated environments is driving this growth.

These sensors are integral to detecting unsafe conditions and triggering corrective actions without interrupting operations. Their compact design, enhanced sensitivity, and compatibility with both legacy and modern systems have made them a preferred choice in assembly lines, robotic workstations, and high-speed production areas.

The ongoing integration of sensors with data analytics and industrial IoT platforms has further expanded their utility, reinforcing their leadership within this segment.

The safety instrumented systems segment is projected to contribute 38.20% of the market revenue by 2025, leading within the product segment category. This dominance is attributed to the growing reliance on logic solvers, sensors, and final control elements to prevent hazardous events and maintain safe operating conditions.

These systems are deployed to ensure critical processes are brought to a safe state in the event of a system fault or failure. Their adoption is especially pronounced in industries with high process safety risk, where functional reliability and fail-safe architecture are required.

The integration of diagnostic capabilities, along with compliance with international safety integrity level standards, has strengthened their role as a foundational component of industrial safety infrastructure.

The oil and gas sector is expected to account for 36.90% of total market revenue by 2025 under the vertical industry category, establishing it as the leading segment. This dominance is fueled by the inherently hazardous nature of upstream and downstream operations, where process failures can result in severe environmental, human, and financial consequences.

Functional safety systems are critical in preventing blowouts, fires, and gas leaks through the implementation of automated shutdowns and real-time alerts. Additionally, aging infrastructure and offshore installations demand continuous safety upgrades, contributing to steady market demand.

Regulatory mandates and the growing need for compliance in high-risk zones further support the adoption of robust safety architectures across drilling, refining, and distribution operations. This ongoing reliance positions oil and gas as the most critical and invested industry vertical in the functional safety landscape.

Opportunities in these expanding sectors, coupled with trends toward automation and safety system integration, are shaping the market’s future. However, high implementation costs and complex regulatory compliance remain key challenges. By 2025, addressing these obstacles through cost-effective solutions and standardized processes will be essential for continued market growth and the widespread adoption of functional safety systems.

The functional safety market is driven by the increasing demand for enhanced safety measures across various industries such as automotive, oil and gas, chemicals, and manufacturing. With more stringent regulations and rising awareness regarding operational risks, businesses are focusing on improving safety standards to minimize accidents and equipment failures. Functional safety systems help ensure that safety functions are automatically performed when required. By 2025, the market is expected to grow significantly, as more companies prioritize safety and regulatory compliance in their operations.

The functional safety market presents significant opportunities in the expanding automotive and industrial sectors. With the automotive industry increasingly adopting autonomous and electric vehicles, there is a greater need for functional safety systems to ensure the safe operation of complex vehicle systems. Similarly, industries like chemicals, manufacturing, and energy are investing in functional safety solutions to mitigate risks associated with equipment malfunctions and hazardous environments. By 2025, the continued growth of these sectors will offer vast opportunities for service providers and manufacturers in the functional safety market.

Emerging trends in the functional safety market include the integration of automation and safety systems in various industrial processes. The increasing reliance on automated systems, driven by Industry 4.0 principles, is pushing for more advanced functional safety solutions to ensure that automated processes function safely. The integration of safety protocols into automated machinery, sensors, and control systems is gaining traction, as companies seek more reliable and efficient operations. By 2025, the demand for automated safety systems will become even more pronounced in manufacturing and other industrial applications.

Despite growth, challenges such as high implementation costs and regulatory compliance remain significant barriers in the functional safety market. The integration of functional safety systems often requires substantial initial investment, particularly in industries with legacy infrastructure. Additionally, businesses must comply with a growing number of complex safety regulations, which can vary across regions, complicating the implementation of standardized safety measures. By 2025, overcoming these challenges will require efficient and cost-effective solutions that streamline implementation and ensure regulatory compliance without compromising safety standards.

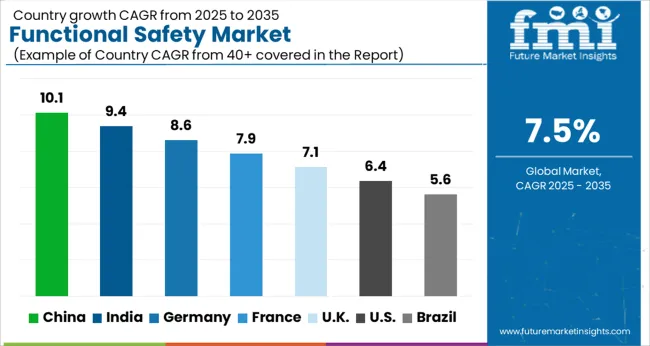

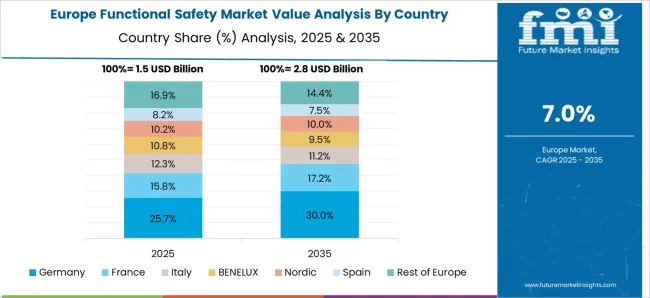

The global functional safety market is projected to grow at a 7.5% CAGR from 2025 to 2035. China leads with a growth rate of 10.1%, followed by India at 9.4%, and Germany at 8.6%. The United Kingdom records a growth rate of 7.1%, while the United States shows the slowest growth at 6.4%. These varying growth rates are driven by the increasing demand for safety systems in critical industries like automotive, manufacturing, and energy, coupled with growing regulatory requirements and safety standards. Emerging markets, such as China and India, are experiencing higher growth rates due to industrialization, rapid urbanization, and the expansion of sectors like automotive and energy. In contrast, mature markets, including the USA and the UK, are experiencing steady growth, driven by innovations in safety technologies, regulatory compliance, and increased investment in automated systems. This report includes insights on 40+ countries; the top markets are shown here for reference.

The functional safety market in China is growing rapidly, with a projected CAGR of 10.1%. China’s rapid industrialization, particularly in the automotive, manufacturing, and energy sectors, is driving the demand for functional safety systems. The country’s focus on improving safety standards, coupled with the increasing adoption of automation and smart technologies, further accelerates market growth. China’s strong regulatory frameworks for safety in industries such as automotive, chemical manufacturing, and power generation also contribute to the increasing adoption of functional safety systems. Additionally, investments in industrial infrastructure and advancements in smart manufacturing technologies continue to drive the demand for safety solutions.

The functional safety market in India is projected to grow at a CAGR of 9.4%. India’s expanding industrial sectors, including automotive, chemicals, and power generation, are significantly contributing to the increasing demand for functional safety systems. The country’s growing focus on safety, quality standards, and automation in industrial processes is driving market expansion. Additionally, India’s regulatory environment, which emphasizes safety in critical industries, further supports the adoption of safety systems. As India continues to invest in infrastructure and industrial modernization, the demand for functional safety systems in sectors like manufacturing, automotive, and energy will continue to grow.

The functional safety market in Germany is projected to grow at a CAGR of 8.6%. Germany’s strong automotive, manufacturing, and energy industries, along with the growing focus on safety and efficiency in industrial operations, are driving steady demand for functional safety systems. The country’s well-established regulatory environment and its emphasis on sustainability and energy efficiency in industrial processes further boost market growth. Additionally, Germany’s leadership in automation and smart manufacturing technologies, along with rising investments in energy transition and industrial safety, continues to fuel the adoption of functional safety systems in various sectors.

The functional safety market in the United Kingdom is projected to grow at a CAGR of 7.1%. The UK is witnessing growing demand for functional safety systems in key sectors such as automotive, energy, and manufacturing, driven by an increasing focus on safety standards and regulatory compliance. The country’s growing adoption of automation and smart technologies in industrial processes, coupled with investments in renewable energy and energy-efficient systems, further accelerates the market’s expansion. Additionally, the UK government’s focus on industrial safety and sustainability continues to drive the demand for functional safety systems in various industries.

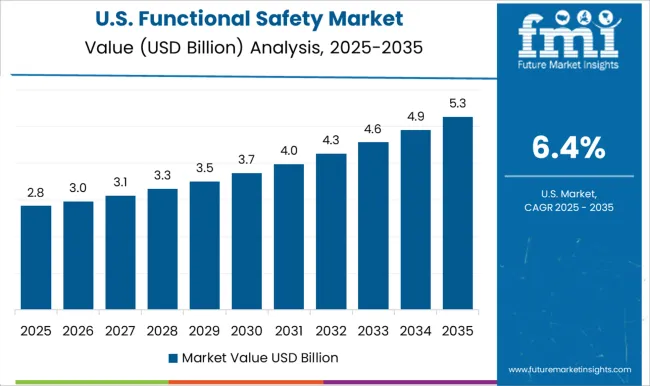

The functional safety market in the United States is expected to grow at a CAGR of 6.4%. The USA market is driven by increasing demand for functional safety systems in sectors such as automotive, power generation, and chemical manufacturing. The country’s regulatory standards for safety in critical industries, coupled with the growing emphasis on automation and smart manufacturing, are contributing to steady market growth. Additionally, the USA government’s initiatives to promote energy efficiency and safety in industrial operations, along with rising investments in infrastructure and automation technologies, further support the adoption of functional safety systems.

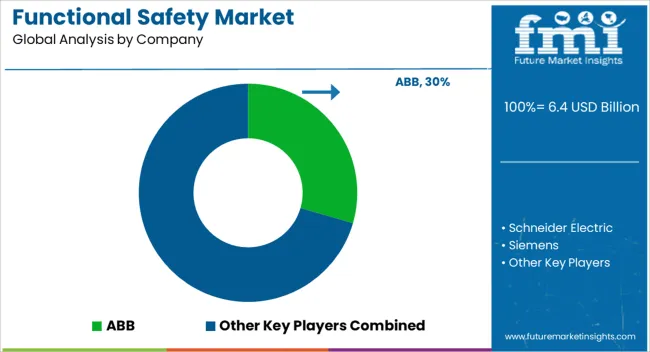

The functional safety market is dominated by ABB, which leads with its advanced safety solutions designed to protect people, equipment, and processes across industries such as oil and gas, chemicals, and manufacturing. ABB’s dominance is supported by its strong global presence, innovative safety technologies, and deep expertise in providing systems that ensure regulatory compliance and operational reliability. Key players such as Schneider Electric, Siemens, and Emerson Electric Co. maintain significant market shares by offering comprehensive functional safety solutions, including safety instrumented systems (SIS), safety sensors, and control systems that help prevent accidents and downtime in industrial processes. These companies focus on enhancing system efficiency, improving risk management, and integrating advanced monitoring and diagnostic capabilities.

Emerging players like Rockwell Automation Inc., Honeywell International Inc., and Yokogawa Electric Corporation are expanding their market presence by offering specialized functional safety solutions for niche applications, such as smart factories, autonomous systems, and critical infrastructure. Their strategies include enhancing real-time monitoring, improving automation, and incorporating artificial intelligence to prevent failures. Market growth is driven by increasing regulatory pressure for safety standards, the rise in automation across industries, and growing concerns about workplace safety. Innovations in AI-driven risk assessment, safety analytics, and system integration are expected to continue shaping competitive dynamics and fuel further growth in the global functional safety market.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.4 Billion |

| Device Type | Safety sensors, Safety controllers/modules/relays, Safety switches, Programmable Safety Systems (PSS), Emergency stop devices, Actuators, and Others |

| Safety Systems | Safety Instrumented Systems (SIS), Turbo Machinery Control (TMC) Systems, Fire & Gas Monitoring Control Systems (FGMCS), Emergency Shutdown Systems (ESD), SCADA, and Others |

| Vertical Industry | Oil & gas, Power generation, Food & beverage, Pharmaceutical, Automotive, Chemicals & petrochemical, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, Schneider Electric, Siemens, Rockwell Automation Inc., Emerson Electric Co., Honeywell International Inc., and Yokogawa Electric Corporation |

| Additional Attributes | Dollar sales by safety system type and application, demand dynamics across automotive, industrial, and healthcare sectors, regional trends in functional safety adoption, innovation in safety integrity levels (SIL) and real-time monitoring technologies, impact of regulatory standards on risk management and compliance, and emerging use cases in autonomous systems and Industry 4.0. |

The global functional safety market is estimated to be valued at USD 6.4 billion in 2025.

The market size for the functional safety market is projected to reach USD 13.1 billion by 2035.

The functional safety market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in functional safety market are safety sensors, safety controllers/modules/relays, safety switches, programmable safety systems (PSS), emergency stop devices, actuators and others.

In terms of safety systems, safety instrumented systems (SIS) segment to command 38.2% share in the functional safety market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Functional Plating Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Functional Flours Market Size and Share Forecast Outlook 2025 to 2035

Functional Flour Market Size and Share Forecast Outlook 2025 to 2035

Functional Endoscopic Sinus Surgery Systems Market Size and Share Forecast Outlook 2025 to 2035

Functional Foods Market Size and Share Forecast Outlook 2025 to 2035

Functional Printing Market Size and Share Forecast Outlook 2025 to 2035

Functional Seafood Market Size and Share Forecast Outlook 2025 to 2035

Functional Textile Finishing Agents Market Size and Share Forecast Outlook 2025 to 2035

Functional Water Market Size and Share Forecast Outlook 2025 to 2035

Functional Pet Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Functional Cosmetic Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Functional Food Ingredients Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Functional Flavour Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Functional Extracts Market Analysis – Size, Share, & Forecast Outlook 2025 to 2035

Functional Chewing Gum Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Functional Carbohydrate Market Analysis -Size, Share, & Forecast Outlook 2025 to 2035

Functional Mushroom Market Size, Growth, and Forecast for 2025 to 2035

Functional Protein Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Functional Electrical Stimulation (FES) Market Trends - Growth & Forecast 2025 to 2035

Functional Milk Replacers Market Size, Growth, and Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA