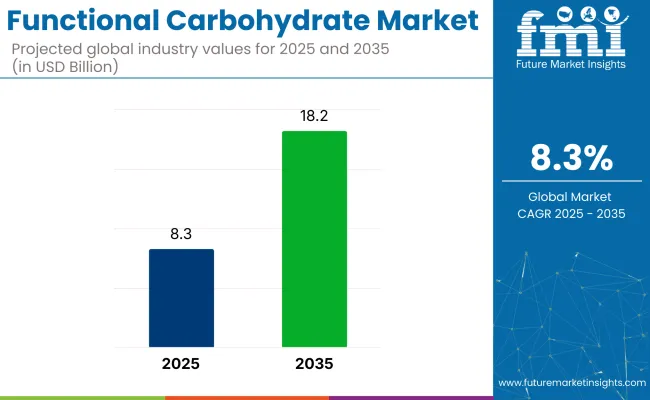

The functional carbohydrate market has been valued at USD 8.3 billion for 2025 and is forecast to reach USD 18.2 billion by 2035, growing at a compound annual rate of 8.3%.

| Attribute | Value |

|---|---|

| Industry Value (2025) | USD 8.3 billion |

| Industry Value (2035) | USD 18.2 billion |

| CAGR (2025 to 2035) | 8.3% |

As food systems continue to grapple with the dual burden of malnutrition and metabolic disease, the role of ingredients has moved toward carbohydrates that do more than provide energy. This has unlocked demand across multiple regions, with strong uptake observed in both high-income markets focused on glycemic response and middle-income economies where demand for gut-health-enhancing foods is rising.

The industry registers an estimated 18.4% share of the broader functional food ingredients market in 2025. Within the nutraceutical ingredients segment, its contribution stood near 10.5%, driven by rising integration in metabolic health formulations.

In the specialty carbohydrates market, functional variants made up roughly 41.7% of the total, underscoring their dominance in advanced carbohydrate applications. Across the food additives domain, they contributed around 6.9%, primarily through clean-label stabilizers and bulking agents.

Their presence in the health and wellness ingredients market reached about 12.2%. These values reflect growing prioritization of glycemic control, digestive function, and sugar substitution strategies across multiple ingredient categories, with the product acting as a convergence point between taste, wellness, and performance.

Production methods are moving from starch breakdown to precise bioconversion, breaking the link between output and grain prices. In 2024, three European plants added 120 kt of annual capacity for enzyme-designed isomalto-oligosaccharides produced from lactose-free whey permeate, reducing feedstock costs by USD 26 per metric ton compared with corn syrup. Carbon-capture loops pipe fermentation CO₂ into nearby greenhouses, covering about 4% of the operating cost for each kilogram of palatinose.

Japan’s pharmacopoeia placed resistant dextrins on a food-for-specified-health-use fast track, trimming approval time to nine months and encouraging beverage companies to sign three-year toll-manufacturing deals. These production and regulatory shifts, rather than sugar taxes, are driving margin differences and enabling faster scale-up.

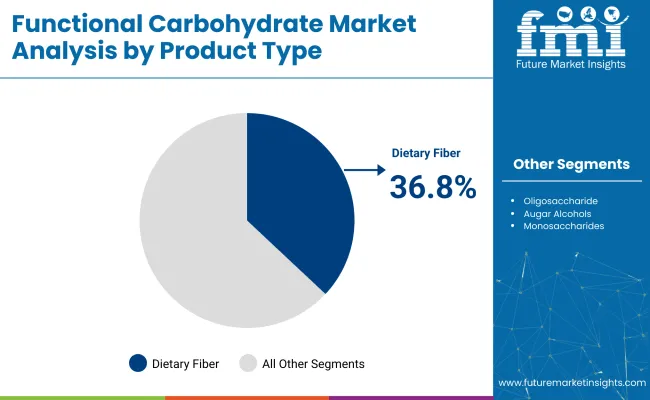

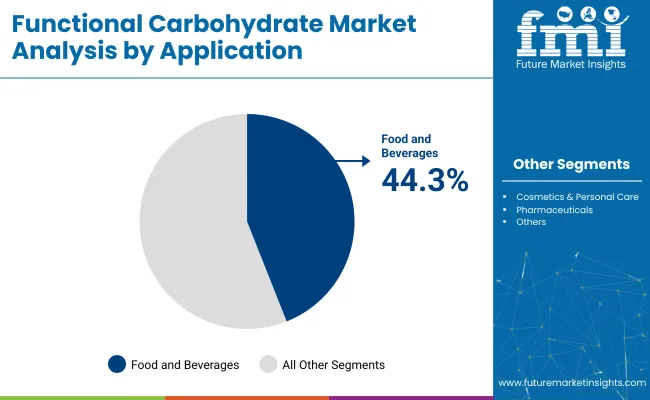

Dietary fiber leads the market with a 36.8% share in 2025, driven by its roles in gut health, metabolic regulation, and versatile formulation. Food and beverages hold 44.3% share, supported by easy consumer adoption, reformulation flexibility, and rapid retail rollout.

Dietary fiber accounts for a 36.8% market share in the functional carbohydrate market as of 2025, making it the leading segment. This dominance stems not only from its long-established links to digestive health but also from its expanding role in metabolic management, satiety regulation, and microbiome modulation.

Food and beverages contribute 44.3% to the functional carbohydrate market in 2025, making it the most dominant application area by value. This position is a result of its foundational role in everyday consumption, where reformulated products, ranging from breakfast staples to dairy and drinkable snacks.

New food labeling rules and growing consumer focus on sugar and fiber are speeding up reformulation using functional carbohydrates. At the same time, interest in gut health is pushing more R&D and boosting fiber supply chains. Ingredient use is increasing as health claims are backed by studies and supported by new fermentation technologies.

Label-Led Reformulation Drives Sugar-Shift Momentum

In regions like the EU, USA, and Asia, food makers now have to show added sugar and fiber on the front of packs. This has led many brands to replace refined sugar with functional alternatives. Shoppers are reading sugar labels more carefully than prices.

Brands are using palatinose, inulin, and resistant dextrins to cut sugar by 14% in new cereal products since 2023, without changing taste or texture. Retailers are helping by giving better shelf space to reformulated items, which speeds up product changes and reduces risk.

Microbiome-Centric R&D Spurs Fiber Supply Expansion

Gut health is now seen as a key part of overall wellness. Suppliers have tripled research budgets since 2022 to study fiber’s role. One study found that resistant starch increased bifidobacteria by 22% in four weeks. These results now appear on product labels.

To keep up with demand, companies are locking in tapioca and chicory supplies and adding new processing lines in Southeast Asia, growing output by 18% in one year. Startups using fermentation are creating new oligosaccharide ingredients for food makers.

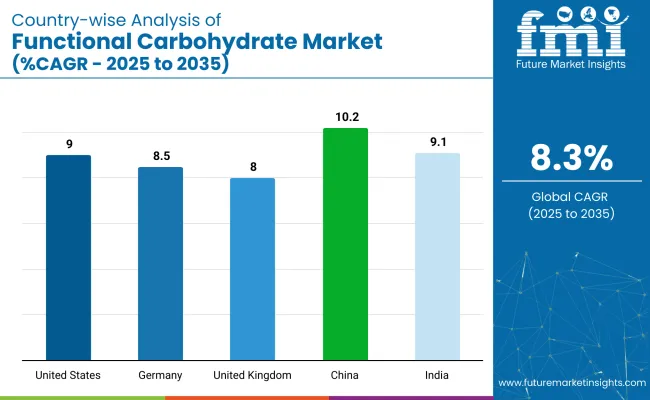

The report covers a detailed analysis of 40+ countries and the top five countries have been shared as a reference.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 9% |

| Germany | 8.5% |

| United Kingdom | 8% |

| China | 10.2% |

| India | 9.1% |

The functional carbohydrate market is set to grow at different rates across key economies, influenced by policy, consumer behavior, and supply chain maturity. The United States, an OECD member, will expand at a 9.0% CAGR, driven by FDA sugar-labeling mandates that are prompting reformulation in cereals, beverages, and dairy using low-GI carbohydrates. Germany, also in the OECD, is projected at 8.5%, with the Nutri-Score system encouraging fiber inclusion through locally sourced oat and barley derivatives.

The United Kingdom, growing at 8.0%, leverages a graduated soft-drink levy and retailer-driven bakery reformulations, also as part of the OECD group. China, a BRICS country, leads at 10.2% due to aggressive sugar-reduction policies, cassava-based fiber production, and strong e-commerce traction in functional snacks. India, also within BRICS, is set for 9.1% growth, as rising diabetes rates and quick-commerce expansion accelerate demand for low-glycemic, starch-derived functional carbohydrates in both urban and tier-2 cities.

The USA functional carbohydrate market is estimated to grow at 9.0% CAGR during the study period. Rising concern over metabolic disorders has steered processors toward low-glycemic sweeteners and prebiotic fibers that enable sugar-reduction without sensory compromise.

Front-of-pack disclosures enforced by the FDA have pushed retailers to prefer products showing total-sugar cuts, so brand reformulation pipelines now place products at the center of baked goods, dairy alternatives, and performance beverages. Sports-nutrition brands have embedded palatinose for sustained energy, while resistant dextrins are used to improve mouthfeel in high-protein bars.

Supply chains have remained resilient because domestic corn and wheat substrates allow on-shore production of polyols and soluble fibers, limiting exposure to import volatility. Clinical collaborations with USA universities have reinforced consumer trust by confirming gut-microbiome benefits, thereby elevating repeat-purchase rates for fiber-fortified items.

Germany’s functional carbohydrate sector is projected to expand at an 8.5% CAGR over 2025-2035. Strong public insurance incentives favor preventive nutrition, so formulators emphasize fibers and slowly absorbed carbohydrates to manage glycemic response in everyday foods.

The country’s “Nutri-Score” labeling system has guided supermarkets toward stocking items with higher fiber ratings, prompting bakeries to integrate inulin and beta-glucans into rye and spelt lines. Local ingredient firms leverage established cereal-processing infrastructure to extract soluble fibers from barley and oats, keeping cost inflation modest.

Scientific institutes in Bonn and Munich have published gut-brain axis findings that position as cognitive-support agents, drawing interest from adult-wellness brands. Export-oriented manufacturers employ clean-label claims to capitalize on demand across neighboring EU markets, further scaling domestic production volumes.

In China, functional carbohydrate revenues are forecast to rise at a 10.2% CAGR through the forecast horizon. National health campaigns encouraging reduced free-sugar intake have dovetailed with a surge in e-commerce snacks touting low-glycemic profiles. Palatinose and isomaltulose are being applied in ready-to-drink teas and coffee to moderate post-meal glucose swings among urban consumers managing prediabetes.

Domestic biotech firms have invested in enzymatic-conversion lines that transform cassava starch into soluble fibers, easing reliance on imports and aligning with self-sufficiency goals. Government subsidies for “special medical purpose foods” permit accelerated market entry for functional carbohydrate-fortified formulas aimed at elderly-care facilities and hospital nutrition. Strong live-stream commerce further accelerates consumer education, turning gut-health narratives into rapid sales uptake.

The functional carbohydrate landscape in the United Kingdom is expected to register an 8.0% CAGR across the assessment window. A graduated soft-drink industry levy has nudged beverage makers toward sugar-substitution strategies featuring resistant starches and sugar alcohol blends to meet levy thresholds without flavor trade-offs. Public Health England’s reformulation targets have spilled over into bakery and cereals, leading retailers to favor fiber-enhanced own-label lines.

University-led trials in London have connected digestive-comfort claims with daily fiber intake, prompting premium yogurt brands to showcase inulin-rich recipes. Brexit-related supply disruptions have encouraged manufacturers to localize chicory-root sourcing in Lincolnshire, helping secure a consistent inulin feedstock.

India’s functional carbohydrate market is poised for roughly 9.1% CAGR growth during the forecast span, outpacing the global average. Rising incidences of type-2 diabetes have spurred food firms to replace traditional sugars with isomalt, palatinose, and resistant dextrins across biscuits, malt-based drinks, and ready-to-eat breakfast mixes.

The Food Safety and Standards Authority of India has tightened labeling norms around added sugars, which has encouraged multinational and regional players to highlight “low-GI” on packaging. Domestic starch processors in Gujarat and Maharashtra have scaled production of soluble fibers derived from tapioca and maize to meet reformulation demand while keeping ingredient costs competitive. Ayurveda-inspired nutraceutical brands incorporate soluble fibers with herbal extracts to tap into holistic-wellness positioning.

The functional carbohydrate market is shaped by a mix of global ingredient leaders and specialized suppliers targeting glycemic management, digestive wellness, and clean-label formulation. Major players such as Beneo GmbH, Roquette Frères, and Cargill, Incorporated drivein prebiotic fibers and low-glycemic sugar alternatives tailored for food and nutraceutical sectors. Wacker Chemie AG and Evonik Industries AG bring biochemical expertise to develop systems with improved stability and bioavailability. Chinese producers like Sanxinyuan Food Industry Corporation Limited, Haihang Industry Co., Ltd., and Zibo Qianhui Biological Technology Co., Ltd. support scalable, starch-based supply chains for isomaltulose and resistant dextrins. FrakenBiochem Co. Ltd. and Foodchem International Corporation cater to regional contract manufacturers, offering competitively priced product ingredients for bakery, beverages, and clinical nutrition products across emerging Asia-Pacific markets.

Recent Functional Carbohydrate Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 8.3 billion |

| Projected Market Size (2035) | USD 18.2 billion |

| CAGR (2025 to 2035) | 8.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and volume in metric tons |

| Product Type Analyzed (Segment 1) | Dietary Fiber, Functional Polysaccharides, Functional Oligosaccharides, Sugar Alcohols, and Other Functional Monosaccharides. |

| Application Analyzed (Segment 2) | Food & Beverages, Cosmetics & Personal Care, Pharmaceuticals, Nutraceuticals, and Others. |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, Japan, South Korea, India, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Beneo GmbH, Wacker Chemie AG, Cargill, Incorporated, Evonik Industries AG, Roquette Frères, Sanxinyuan Food Industry Corporation Limited, Haihang Industry Co., Ltd., Fraken Biochem Co. Ltd., Zibo Qianhui Biological Technology Co., Ltd., Foodchem International Corporation. |

| Additional Attributes | Dollar sales, share by product type, application trends, regional demand shifts, pricing benchmarks, competitive positioning, buyer preferences, regulatory changes, and future growth projections. |

The industry is segmented into dietary fiber, functional polysaccharides, functional oligosaccharides, sugar alcohols, other functional monosaccharides.

The industry finds applications in food & beverages, cosmetics & personal care, pharmaceuticals, nutraceuticals, others.

The industry covers regions including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

The industry is valued at USD 8.3 billion in 2025.

It is forecasted to reach USD 18.2 billion by 2035.

The industry is anticipated to grow at a CAGR of 8.3% during this period.

Food and Beverages are projected to lead the market with a 44.3% share in 2035.

Asia Pacific, particularly China, is expected to be the key growth region with a projected growth rate of 10.2%.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Refined Functional Carbohydrates Market Size and Share Forecast Outlook 2025 to 2035

Functional Multi-Layer Coextruded Film Market Size and Share Forecast Outlook 2025 to 2035

Functional Plating Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Functional Flours Market Size and Share Forecast Outlook 2025 to 2035

Functional Flour Market Size and Share Forecast Outlook 2025 to 2035

Functional Endoscopic Sinus Surgery Systems Market Size and Share Forecast Outlook 2025 to 2035

Functional Foods Market Size and Share Forecast Outlook 2025 to 2035

Functional Safety Market Size and Share Forecast Outlook 2025 to 2035

Functional Printing Market Size and Share Forecast Outlook 2025 to 2035

Functional Seafood Market Size and Share Forecast Outlook 2025 to 2035

Functional Textile Finishing Agents Market Size and Share Forecast Outlook 2025 to 2035

Functional Water Market Size and Share Forecast Outlook 2025 to 2035

Functional Pet Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Functional Cosmetic Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Functional Food Ingredients Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Functional Flavour Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Functional Extracts Market Analysis – Size, Share, & Forecast Outlook 2025 to 2035

Functional Chewing Gum Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Functional Mushroom Market Size, Growth, and Forecast for 2025 to 2035

Carbohydrates Testing Services Market - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA