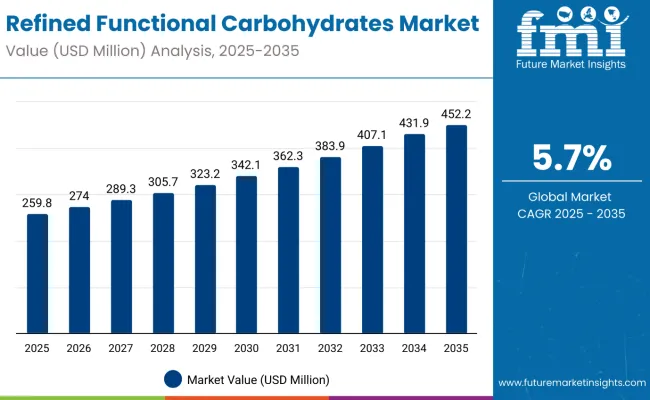

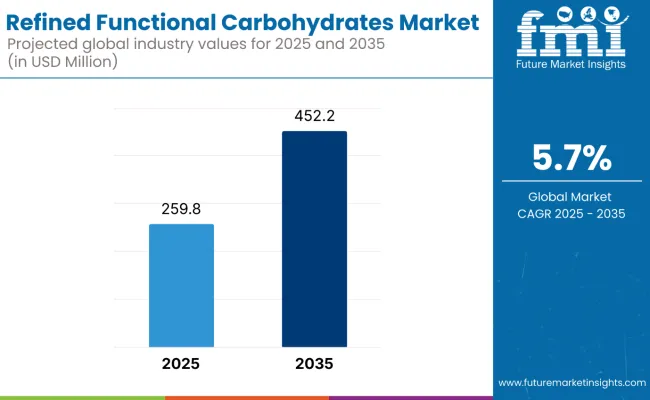

The refined functional carbohydrates market is anticipated to grow from a value of USD 259.8 million in 2025 to USD 452.2 million by 2035, representing a CAGR of 5.7% over the forecast period. This steady growth reflects increasing demand across key application sectors such as cattle, poultry, swine, and aquaculture, driven by the market’s expanding recognition for the functional benefits of refined carbohydrates in animal nutrition and health.

| Metric | Value |

|---|---|

| Estimated Value in 2025 (E) | USD 259.8 million |

| Forecast Value in 2035 (F) | USD 452.2 million |

| Forecast CAGR (2025 to 2035) | 5.7% |

By 2030, the market is anticipated to reach USD 345.2 million, reflecting consistent growth fueled by its expanding use in animal feed applications and the rising awareness of the health benefits associated with functional carbohydrates. This represents an absolute dollar growth of USD 85.4 million from the 2025 market value. Innovations in product development and biotechnology are expected to strengthen the market’s capacity to address diverse nutritional needs across livestock species.

Overall, the market is set to expand moderately but consistently over the next decade, fueled by growing applications in animal feed, increasing awareness of functional ingredient benefits, and sustained investments by leading companies to enhance product offerings. Innovations in product formulations and advancements in biotechnology are expected to open new avenues for market growth.

Companies such as DuPont Danisco and Lallemand are strengthening their competitive positions through investments in advanced processing technologies and scalable production systems. Innovation-driven approaches are enabling expansion into animal nutrition, aquaculture, and specialty feed applications. Market performance will continue to be supported by regulatory compliance, quality standards, and sustainable sourcing practices.

The market plays a crucial role in the animal nutrition sector, contributing significantly to functional ingredient adoption in feed formulations globally. It supports improved animal health and productivity through its specialized carbohydrate products, with growing integration into aquaculture, poultry, and livestock nutrition applications. The market benefits from increasing investments in biotechnology and natural sourcing practices, which align with regulatory standards to ensure safety and efficacy.

The market structure is evolving with key players such as DuPont Danisco and Lallemand driving consolidation and innovation. Advances in extraction technologies and product formulation are accelerating development timelines and expanding application scope. Regulatory frameworks continue to support market growth by balancing product efficacy with safety and environmental considerations.

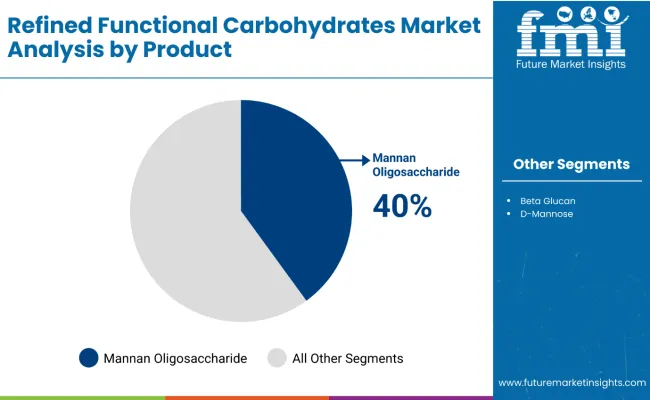

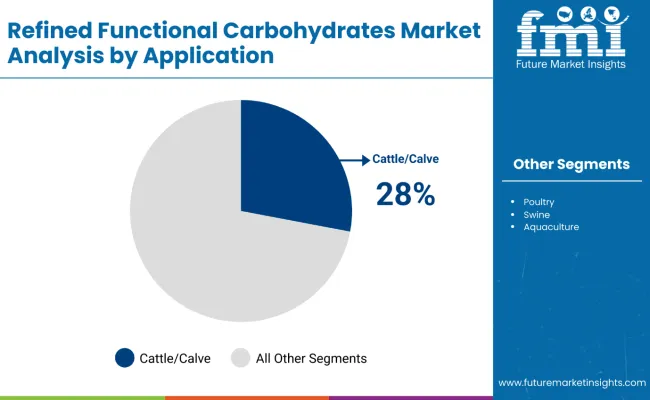

The market is segmented by product, application, and region. By product, the market is divided into mannan oligosaccharides, beta glucan, and d-mannose. Based on application, the market is segmented into cattle/calves, poultry, swine, aquaculture, and others (including equine and companion animal feeds). Regionally, the market is classified into North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa.

Mannan Oligosaccharides (MOS) are the largest segment within the market, holding 40% of the market share. MOS are valued primarily for their prebiotic properties, which promote the growth of beneficial gut bacteria in animals. This helps improve digestion, nutrient absorption, and overall gut health, leading to enhanced immunity and disease resistance.

Widely used in livestock and poultry nutrition, MOS contribute to better feed efficiency and growth performance. The increasing focus on natural and sustainable feed additives has further boosted the demand for MOS. Their ability to reduce pathogens and support a healthier intestinal environment makes them a preferred choice among animal nutritionists and feed manufacturers, driving steady growth within the industry globally.

The cattle/calves segment holds a significant share of 28% in the market, making it one of the largest application segments. This prominence is driven by the growing demand for enhanced animal health and productivity in the cattle industry. Refined functional carbohydrates, such as Mannan Oligosaccharides and Beta Glucan, play a crucial role in improving gut health and boosting the immune system of cattle and calves. These benefits lead to better nutrient absorption, higher feed efficiency, and reduced incidence of diseases, ultimately enhancing growth performance.

Increasing awareness among livestock producers about the advantages of natural feed additives over antibiotics is further propelling demand in this segment. Additionally, the rising focus on sustainable and organic farming practices highlights functional carbohydrates as effective, safe, and environmentally friendly solutions. As a result, the cattle/calves application segment is expected to continue driving substantial growth within the overall market over the coming years.

The market is growing due to the expanding use of functional carbohydrates in enhancing animal health and nutrition, which improves feed efficiency and productivity across livestock and aquaculture sectors. Rising awareness of the benefits of prebiotics and immune-enhancing carbohydrates is driving demand for specialized products like Mannan Oligosaccharides and Beta Glucan. Additionally, the market benefits from increasing investments in biotechnology and sustainable sourcing, supporting the development of climate-resilient and natural feed additives.

Growing global concerns about animal health, food safety, and sustainable agriculture are further propelling market growth. Innovations in extraction and formulation technologies enable higher purity and efficacy, encouraging adoption in diverse animal feed applications. As industries prioritize health-promoting ingredients, the Refined Functional Carbohydrates Market outlook remains positive with steady demand across key regions like the United States, India, and South Korea.

From 2025 to 2035, the market is propelled by growing adoption of advanced feed additive technologies and increasing focus on sustainable animal nutrition. Companies are investing in innovative extraction methods and formulation techniques to improve the functional efficacy of carbohydrates, enhancing animal health, immunity, and productivity in livestock and aquaculture. This evolution positions refined functional carbohydrate suppliers as essential partners in developing next-generation, natural feed solutions that support overall farm sustainability and animal welfare.

Rising Innovation in Animal Nutrition Drives Market Growth

Continuous research and development in functional feed ingredients, alongside growing awareness of antibiotic alternatives, serve as primary growth drivers. In recent years, advancements in biotechnology and extraction technology have enabled the production of higher purity and more effective functional carbohydrates like Mannan Oligosaccharides and Beta Glucan. These developments strengthen the demand for natural, health-promoting feed additives, fueling consistent market growth and deeper industry adoption.

Integration of Advanced Technologies Creates Expansion Opportunities

Functional carbohydrate producers are increasingly integrating biotechnology with precise feed formulation techniques to optimize animal health and feed efficiency. Adoption of immune-supporting and gut-health-enhancing carbohydrates in cattle, poultry, swine, and aquaculture feed highlights the practical benefits of these innovations. Manufacturers offering high-quality, scientifically validated feed additives with proven health benefits and regulatory compliance are well-positioned to capitalize on expanding demand and evolving sustainability standards in global animal agriculture.

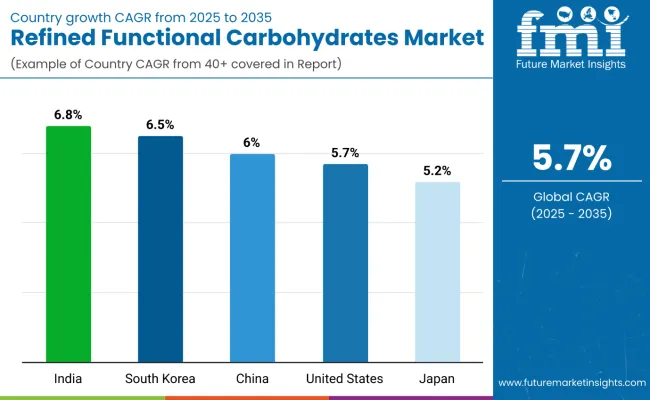

| Country | CAGR (%) |

|---|---|

| India | 6.8 |

| South Korea | 6.5 |

| China | 6.0 |

| United States | 5.7 |

| Japan | 5.2 |

The market shows varied growth across key countries. India leads with a 6.8% CAGR, driven by expanding livestock farming and government support for natural feed additives. South Korea follows at 6.5%, fueled by modernization and biotechnology adoption. China grows at 6.0%, supported by large-scale livestock farming and sustainable practices.

The United States has steady growth of 5.7%, driven by advanced research and precision farming, while Japan records the slowest growth at 5.2%, focusing on niche, high-quality applications. Emerging markets like India and South Korea outpace developed countries due to expanding livestock sectors and rising awareness of natural feed solutions.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

Sales of refined functional carbohydrates in India are slated to flourish at a CAGR of 6.8%, driven by rapid expansion in livestock farming and increasing protein consumption. Rising demand for meat and dairy products fuels the adoption of functional carbohydrates such as MOS, which improve animal health and productivity. Government support and subsidies encourage farmers to use natural feed additives over antibiotics, boosting market penetration. Regional feed manufacturing hubs are growing, with expanding infrastructure and technological adoption. The increasing awareness of sustainable and organic farming practices further solidifies the market’s upward trajectory, making India a critical player in the global landscape.

Demand for refined functional carbohydrates in South Korea is experiencing dynamic growth at a CAGR of 6.5%, fueled by modernization of livestock farming and growing adoption of advanced feed additives. Government initiatives to improve food safety and agricultural productivity encourage widespread use of functional carbohydrates in animal nutrition. The rapid expansion of the aquaculture sector also supports market demand for immune-boosting carbohydrates. Increasing consumer awareness about quality and sustainability drives investment in natural feed solutions. Additionally, South Korea’s commitment to biotechnology innovation and feed formulation advances accelerates the market’s expansion and enhances product availability across livestock segments.

Revenue from refined functional carbohydrates in China is growing at a CAGR of 6.0%, supported by a large and diverse livestock industry and an increasing emphasis on sustainable farming practices. Government policies promoting environmental conservation and animal welfare encourage the use of natural and effective feed additives like refined carbohydrates. Large-scale operations in cattle, swine, and poultry farming form a strong base for market demand. Investments in functional nutrition and precision feeding technologies further enhance application scope. Consumer preference for healthier and safer meat products also drives industry growth. Expanding feed additive production capabilities and technological improvements contribute to China’s rapid market development.

Revenue from refined functional carbohydrates in the USA is growing steadily with a CAGR of 5.7%, driven by advancements in animal nutrition and increased focus on sustainable feed additives. The country’s well-established livestock industry strongly contributes to demand for functional carbohydrates such as Mannan Oligosaccharides and Beta Glucan. High investments in R&D and strict regulatory standards promote innovation and product safety, ensuring steady market expansion. The growing consumer preference for natural and organic animal products further fuels demand. Additionally, precision farming and biotechnology adoption support the increasing integration of refined carbohydrates in feed formulations. The mature supply chain and presence of key market players reinforce the country’s dominant position globally.

Sales of refined functional carbohydrates in Japan maintain moderate growth at a CAGR of 5.2% in the market, driven by its focus on animal health and high-quality feed additives. The mature livestock and aquaculture industries prefer advanced, scientifically backed functional carbohydrates like MOS and Beta Glucan for improved immunity and productivity. Stringent regulations for feed safety and animal welfare shape product formulations and market acceptance. Japan’s investment in research and development supports innovation in feed enhancement, catering to niche markets such as premium aquaculture. Consumer demand for sustainable and safe animal products further supports steady growth in this market.

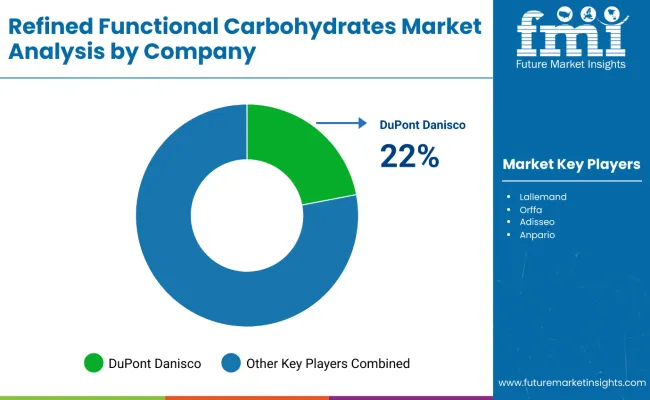

The market is moderately consolidated, dominated by key players with strong expertise in carbohydrate extraction, formulation, and animal nutrition applications. DuPont Danisco and Lallemand lead the market with advanced technologies in producing high-purity Mannan Oligosaccharides and Beta Glucan, offering superior bioactive properties tailored for livestock and aquaculture feed. Their competitive edge lies in robust R&D capabilities and extensive regulatory compliance frameworks.

Orffa and Adisseo differentiate through specialized product lines and regional market focus, addressing diverse livestock nutritional needs across emerging and developed markets. Smaller, specialized companies emphasize customized solutions and sustainable sourcing to meet growing consumer demand for natural and environmentally friendly feed additives.

Additionally, major feed manufacturers and biotechnology firms are investing in innovative production systems and expanding distribution networks to strengthen market presence. This strategic diversification enables players to capture growing demand across multiple animal species and regions while enhancing product efficacy and supply chain stability.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 259.8 Million |

| Type | Mannan Oligosaccharides, Beta Glucan, D-Mannose |

| Application | Cattle/Calves, Poultry, Swine, Aquaculture |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia and 40+ countries |

| Key Companies Profiled | DuPont Danisco, EW Nutrition, VWR Corporation, Orffa, Lallemand Inc., Biofeed Technology Inc., Matrix Nutrition, L.L.C., STR Biotech, Super Beta Glucan, Kerry Group, Kemin Industries, Inc. |

| Additional Attributes | Dollar sales by product and application segments, rising adoption of natural and sustainable feed additives, increasing investments in biotechnology and extraction technologies, growing focus on animal health and productivity, regulatory compliance ensuring product safety, expansion in aquaculture and livestock nutrition applications. |

The global refined functional carbohydrates market is estimated to be valued at USD 259.8 billion in 2025.

The market size for the refined functional carbohydrates market is projected to reach USD 452.3 billion by 2035.

The refined functional carbohydrates market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in refined functional carbohydrates market are mannan oligosaccharides, beta glucan and d-mannose.

In terms of application, cattle/calves segment to command 44.2% share in the refined functional carbohydrates market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Refined Lactose Market Size and Share Forecast Outlook 2025 to 2035

Refined Cane Sugar Market Analysis by Product Type and End Use Through 2035

Europe Rubber Derived Unrefined Pyrolysis Oil Market Size and Share Forecast Outlook 2025 to 2035

Functional Multi-Layer Coextruded Film Market Size and Share Forecast Outlook 2025 to 2035

Functional Plating Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Functional Flours Market Size and Share Forecast Outlook 2025 to 2035

Functional Flour Market Size and Share Forecast Outlook 2025 to 2035

Functional Endoscopic Sinus Surgery Systems Market Size and Share Forecast Outlook 2025 to 2035

Functional Foods Market Size and Share Forecast Outlook 2025 to 2035

Functional Safety Market Size and Share Forecast Outlook 2025 to 2035

Functional Printing Market Size and Share Forecast Outlook 2025 to 2035

Functional Seafood Market Size and Share Forecast Outlook 2025 to 2035

Functional Textile Finishing Agents Market Size and Share Forecast Outlook 2025 to 2035

Functional Water Market Size and Share Forecast Outlook 2025 to 2035

Functional Pet Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Functional Cosmetic Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Functional Food Ingredients Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Functional Flavour Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Functional Extracts Market Analysis – Size, Share, & Forecast Outlook 2025 to 2035

Functional Chewing Gum Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA