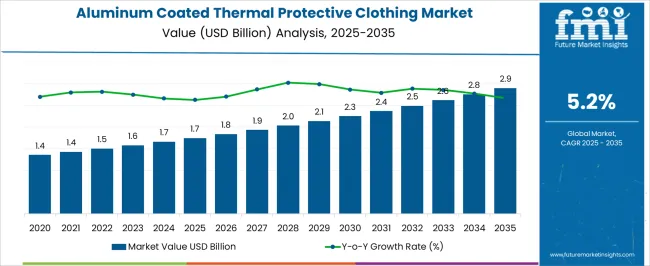

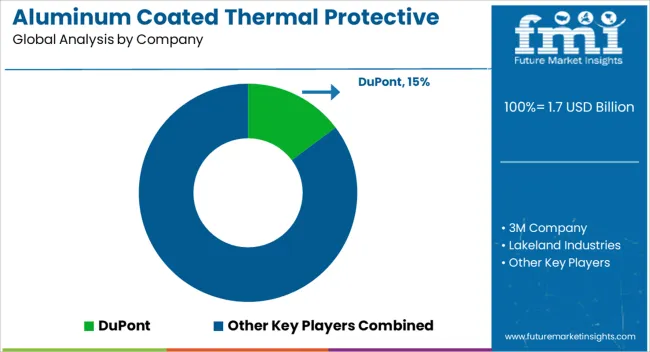

The aluminum coated thermal protective clothing market is estimated to be valued at USD 1.7 billion in 2025 and is projected to reach USD 2.9 billion by 2035, registering a compound annual growth rate (CAGR) of 5.2% over the forecast period.

Raw material procurement, primarily aluminum foils, high-performance fabrics, and heat-resistant fibers, accounts for a substantial portion of the cost base. The gradual annual increase from USD 1.7 billion to USD 2.9 billion implies incremental scaling of material sourcing, reflecting the importance of supply chain reliability and cost optimization in maintaining competitive pricing. Manufacturing and coating processes constitute another critical cost segment, where specialized equipment for aluminum lamination, bonding, and thermal treatment determines both production efficiency and product quality.

Labor and process control contribute to cost allocation, particularly in high-precision operations required for consistent thermal performance and adherence to safety standards. Automation and process standardization gradually improve throughput, minimize waste, and reduce overall manufacturing expenses, thereby influencing margins positively. Distribution and logistics form an essential part of the value chain, as finished garments are delivered to industrial end-users, including petrochemical, metallurgical, and firefighting sectors.

Packaging, handling, and transport costs escalate with geographic expansion, while regulatory compliance and certification processes add further value by assuring product safety and performance reliability. The cost-structure and value-chain analysis indicate a market where raw material sourcing, precision manufacturing, and compliance-driven distribution collectively drive value creation. Incremental efficiency improvements and material innovations support steady growth and sustain the market’s competitive equilibrium, reflecting a mature yet steadily expanding industrial segment.

| Metric | Value |

|---|---|

| Aluminum Coated Thermal Protective Clothing Market Estimated Value in (2025 E) | USD 1.7 billion |

| Aluminum Coated Thermal Protective Clothing Market Forecast Value in (2035 F) | USD 2.9 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

The aluminum coated thermal protective clothing market represents a specialized segment within the global personal protective equipment and industrial safety apparel industry, emphasizing heat resistance, flame protection, and durability. Within the broader protective clothing sector, it accounts for about 3.9%, driven by demand from metal processing, firefighting, foundries, and high-temperature industrial operations. In the thermal protective gear and heat-resistant fabrics segment, its share is approximately 4.5%, reflecting adoption of aluminized coatings, reflective layers, and multi-layered textile constructions.

Across the industrial safety equipment market, it contributes around 3.7%, supporting worker safety, compliance with regulatory standards, and operational efficiency. Within the high-risk occupational apparel category, it represents 3.2%, highlighting integration with ergonomic design, comfort, and mobility considerations. In the overall industrial PPE ecosystem, the market contributes about 2.9%, emphasizing reliability, performance, and protection in hazardous thermal environments. Recent developments in the aluminum coated thermal protective clothing market have focused on material innovation, enhanced comfort, and compliance with international safety standards. Groundbreaking trends include use of advanced aluminized fabrics, lightweight composites, flame-retardant coatings, and multi-layered protective assemblies to improve thermal insulation and reflectivity.

Key players are collaborating with industrial manufacturers, emergency services, and textile innovators to deliver ergonomic and performance-optimized protective solutions. Adoption of moisture-wicking linings, breathable membranes, and flexible designs is gaining traction to enhance wearer comfort during prolonged use. The research on high-performance coatings, durability improvements, and modular protective ensembles is shaping product development. These innovations demonstrate how safety, material technology, and ergonomic design are driving the market.

The aluminum coated thermal protective clothing market is expanding steadily, driven by stringent occupational safety regulations and increasing awareness around thermal hazards in high-risk industries. The need for advanced protective gear that offers both heat reflectivity and durability has positioned aluminum-coated clothing as a preferred solution in firefighting, metalworking, and foundry environments.

As industrial sectors continue to evolve with more complex operational risks, the demand for specialized apparel designed to withstand extreme temperatures has intensified. Innovations in fabric technologies, combined with rising investment in worker safety by public and private organizations, are contributing to sustained market momentum.

Looking ahead, the market is expected to benefit from government-backed safety mandates, a growing focus on worker health, and ongoing advancements in material engineering that enhance comfort, mobility, and long-term protection under hazardous conditions

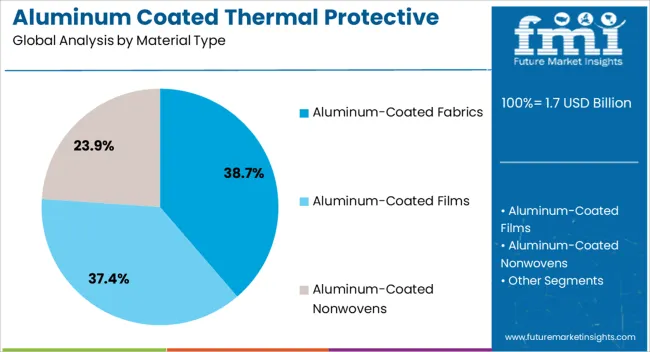

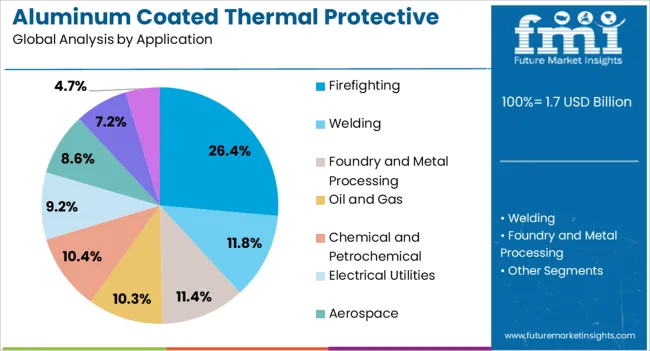

The aluminum coated thermal protective clothing market is segmented by material type, application, and geographic regions. By material type, aluminum coated thermal protective clothing market is divided into aluminum-coated fabrics, aluminum-coated films, and aluminum-coated nonwovens. In terms of application, aluminum coated thermal protective clothing market is classified into firefighting, welding, foundry and metal processing, oil and gas, chemical and petrochemical, electrical utilities, aerospace, manufacturing, and emergency response. Regionally, the aluminum coated thermal protective clothing industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The aluminum-coated fabrics segment dominates the material type category with a 38.7% market share, owing to its superior heat resistance and reflective properties that provide reliable protection in high-temperature environments. These fabrics are engineered to reflect radiant heat and are commonly used in garments designed for firefighters, foundry workers, and others exposed to open flames or molten materials.

The segment's growth is supported by advancements in composite layering techniques that enhance thermal insulation without compromising on flexibility or breathability. Additionally, the longevity and reusability of aluminum-coated fabrics make them a cost-effective choice for industrial buyers.

Rising emphasis on safety compliance and the availability of lightweight variants that reduce wearer fatigue are further strengthening market demand. As industries prioritize thermal safety standards, this segment is expected to maintain a strong trajectory through continuous innovation and expanded application scope

The firefighting segment accounts for 26.4% of the aluminum coated thermal protective clothing market, reflecting its critical need for high-performance gear that can withstand extreme heat and direct flame exposure. Firefighting professionals operate in some of the most hazardous conditions, necessitating apparel that offers thermal insulation, durability, and ergonomic design.

Aluminum-coated clothing is specifically engineered to reflect radiant heat while maintaining structural integrity during intense rescue operations. The segment is bolstered by government funding for firefighter equipment modernization, urbanization-led growth in fire services, and training programs emphasizing safety gear usage.

Manufacturers are increasingly focusing on comfort, fit, and moisture management to improve usability in prolonged firefighting scenarios. With global attention on firefighter safety and evolving regulatory norms, the demand for specialized thermal protective clothing within this segment is expected to remain robust in the coming years

The market has experienced growth due to the rising demand for high-performance protective apparel across industrial, military, firefighting, and aerospace sectors. These garments provide exceptional heat reflection, flame resistance, and thermal insulation, safeguarding workers and personnel against extreme temperatures and radiant heat exposure. Advanced metallized fabrics, composite materials, and multilayer designs are increasingly adopted to enhance protective performance without compromising mobility or comfort. Compliance with safety standards and occupational regulations has further fueled adoption. Growth in high-risk industries, along with technological advancements in textile coatings and reflective laminates, has supported the expansion of aluminum coated thermal protective clothing, ensuring personnel safety in challenging operational environments globally.

Industrial safety has been a major driver of demand for aluminum coated thermal protective clothing. Workers in steel mills, foundries, glass manufacturing, and petrochemical plants are exposed to high radiant heat and molten metal hazards. Aluminum coated fabrics reflect heat efficiently, reducing burn risks and enhancing operational safety. Manufacturers are producing garments with reinforced stitching, ergonomic designs, and moisture-wicking linings to improve comfort during prolonged use. Safety certifications and compliance with occupational standards such as NFPA and ISO further incentivize adoption. The increasing emphasis on workplace safety, employee health, and accident prevention has ensured continuous procurement of thermal protective clothing by industrial enterprises globally, reinforcing the market’s growth trajectory.

The market has benefited from innovations in aluminum coatings, multilayer composites, and advanced textiles that combine thermal protection with wearability. Improvements in metallization techniques, nanocoatings, and reflective layers have enhanced heat resistance while reducing garment weight. Hybrid fabrics incorporating aramid, fiberglass, and aluminized polyester provide durability, flexibility, and resistance to flame, sparks, and molten metal splashes. Advanced manufacturing methods, including automated laminating and bonding, improve consistency and quality of protective clothing. Research is ongoing to develop breathable, lightweight materials that maintain thermal protection and moisture management. Such technological advancements have expanded application scope, enabling adoption in aerospace, firefighting, and emergency response, as well as industrial sectors requiring high-level thermal protection.

Regulatory compliance and occupational safety standards play a crucial role in driving demand for aluminum coated thermal protective clothing. Standards set by organizations such as NFPA, ISO, EN, and ASTM define garment performance in terms of heat reflection, flame resistance, and thermal insulation. Compliance ensures worker safety and mitigates organizational liability. Governments and industrial associations increasingly mandate the use of certified protective apparel in high-risk environments. Labeling, testing, and quality certifications influence procurement decisions and market acceptance. Companies investing in compliance and advanced product testing can expand market reach and trust. Regulatory enforcement ensures adoption across industries where thermal and flame hazards are prevalent, sustaining growth in protective clothing markets globally.

The demand for aluminum coated thermal protective clothing is expanding in defense, firefighting, and emergency response sectors. Military personnel require heat-resistant uniforms for combat, training, and handling high-temperature equipment. Firefighters benefit from aluminized suits that provide radiant heat protection during structural fires, chemical incidents, and industrial accidents. Emergency response teams adopt these garments for disaster management, hazardous material handling, and rescue operations. Enhanced durability, mobility, and ergonomic designs improve operational effectiveness. Strategic investments in personnel safety, technological upgrades, and protective apparel procurement have created opportunities for manufacturers. The adoption across multiple safety-critical sectors ensures continued market expansion, highlighting the versatility and necessity of aluminum coated thermal protective clothing.

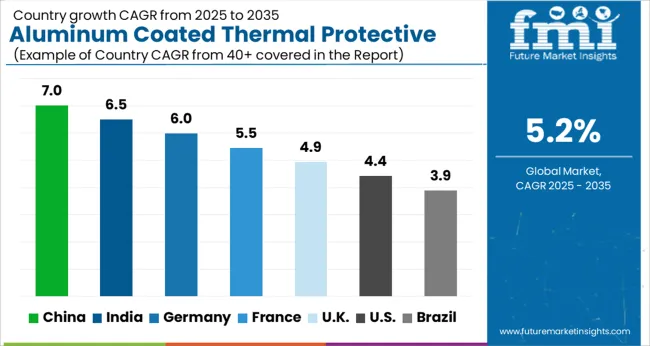

| Country | CAGR |

|---|---|

| China | 7.0% |

| India | 6.5% |

| Germany | 6.0% |

| France | 5.5% |

| UK | 4.9% |

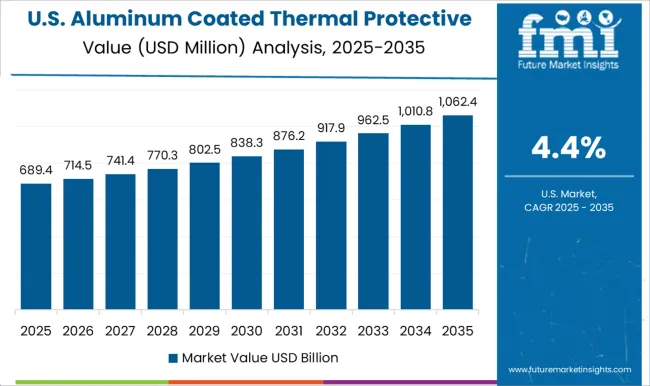

| USA | 4.4% |

| Brazil | 3.9% |

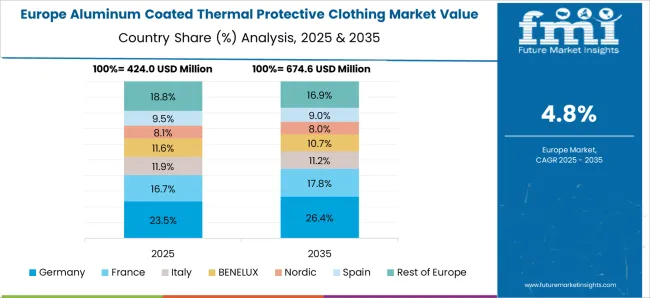

The market is estimated to witness a CAGR of 5.2% from 2025 to 2035, reflecting rising demand for safety apparel in industrial and high-temperature environments. China leads at 7.0, driven by industrial expansion and stringent workplace safety regulations. India follows at 6.5, supported by growth in manufacturing and construction sectors. Germany records 6.0, owing to strong adoption of advanced protective clothing standards. The UK registers 4.9, reflecting increasing investments in worker safety solutions. The USA reaches 4.4, driven by technological innovations in thermal protective fabrics and growing compliance requirements. The market is expected to grow steadily with continuous emphasis on workplace safety and protective equipment innovation. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is witnessing a CAGR of 7.0%, driven by rising industrial and manufacturing activities requiring worker safety in high-temperature environments. Aluminum-coated thermal protective clothing is increasingly adopted in steel, foundry, and glass industries to protect employees from heat and molten metal hazards. Local manufacturers focus on heat-reflective coatings, flame-retardant fabrics, and ergonomic designs for enhanced comfort and safety. Collaboration with international technology providers accelerates adoption of advanced thermal protection materials. The growing number of industrial facilities and stringent workplace safety regulations further support market growth.

India is expanding at a CAGR of 6.5%, supported by growing manufacturing and heavy industry sectors. Thermal protective clothing is adopted in steel mills, chemical plants, and foundries to ensure safety against heat, molten metals, and fire hazards. Indian manufacturers emphasize cost-effective production, durable fabrics, and compliance with national occupational safety standards. Partnerships with global suppliers enhance technical know-how for reflective coatings and flame-retardant performance. Rising awareness of worker safety in industrial setups drives demand for high-quality aluminum-coated garments.

Germany is witnessing a CAGR of 6.0%, driven by industrial, manufacturing, and energy sectors requiring advanced thermal protection. Aluminum-coated protective clothing is widely adopted in foundries, steel plants, and chemical facilities. German manufacturers prioritize compliance with European safety standards, high-quality reflective coatings, and flame-retardant fabrics. Innovation in ergonomic designs and lightweight materials enhances worker comfort while maintaining protection. Adoption of thermal protective garments is complemented by automation and smart monitoring of industrial safety practices.

The United Kingdom is expanding at a CAGR of 4.9%, supported by industrial safety regulations and adoption in heavy manufacturing, steel, and chemical sectors. Aluminum-coated protective clothing is preferred for heat and flame resistance, ergonomic comfort, and durability. UK manufacturers integrate reflective coatings, flame-retardant fabrics, and modern design standards to meet safety compliance requirements. Growing awareness of occupational health and safety in industries encourages procurement of advanced thermal protective garments.

The United States is growing at a CAGR of 4.4%, driven by heavy industry, steel production, and energy sector demand for heat-resistant protective clothing. Thermal garments with aluminum coatings are widely used for molten metal handling, fire protection, and industrial heat exposure. Manufacturers focus on ergonomic designs, flame-retardant materials, and compliance with OSHA and NFPA safety standards. Adoption is further supported by awareness programs and corporate safety initiatives in industrial facilities.

The market is driven by rising demand for high-performance safety apparel across industrial, firefighting, and energy sectors. Key players such as DuPont, 3M Company, Lakeland Industries, and Ansell lead the market by leveraging strong R&D capabilities, advanced material technologies, and extensive global distribution networks. These companies focus on innovations in heat-reflective fabrics, lightweight protective materials, and ergonomic designs to enhance wearer comfort without compromising safety.

Mid-tier and regional competitors, including Honeywell International Inc., Kimberly-Clark Corporation, MSA Safety Incorporated, National Safety Apparel, and Workrite Uniform Company, differentiate themselves by offering specialized solutions for niche applications and region-specific safety standards. Their strengths lie in customization, quick delivery, and strong customer service. Emerging trends such as integration of moisture-wicking layers, flame-resistant coatings, and sustainable materials are shaping market competition.

Strategic collaborations, acquisitions, and partnerships are increasingly pursued to expand technological capabilities and regional market coverage. Companies that can effectively combine innovation, compliance with safety regulations, and cost-efficiency are well-positioned to gain a competitive edge and capture significant market share in the aluminum coated thermal protective clothing industry.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.7 billion |

| Material Type | Aluminum-Coated Fabrics, Aluminum-Coated Films, and Aluminum-Coated Nonwovens |

| Application | Firefighting, Welding, Foundry and Metal Processing, Oil and Gas, Chemical and Petrochemical, Electrical Utilities, Aerospace, Manufacturing, and Emergency Response |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | DuPont, 3M Company, Lakeland Industries, Ansell, Honeywell International Inc., Kimberly-Clark Corporation, MSA Safety Incorporated, National Safety Apparel, Workrite Uniform Company, Polartec, PBI Performance Products, Inc., Lion Protects, Carhartt, Inc., Alpha ProTech, and Stanco Safety Products |

| Additional Attributes | Dollar sales by clothing type and application, demand dynamics across firefighting, industrial, and military sectors, regional trends in personal protective equipment adoption, innovation in heat-reflective materials, comfort, and durability, environmental impact of material production and disposal, and emerging use cases in high-temperature operations, emergency response, and hazardous environment protection. |

The global aluminum coated thermal protective clothing market is estimated to be valued at USD 1.7 billion in 2025.

The market size for the aluminum coated thermal protective clothing market is projected to reach USD 2.9 billion by 2035.

The aluminum coated thermal protective clothing market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in aluminum coated thermal protective clothing market are aluminum-coated fabrics, aluminum-coated films and aluminum-coated nonwovens.

In terms of application, firefighting segment to command 26.4% share in the aluminum coated thermal protective clothing market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aluminum Alloy Sacrificial Anode Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foam Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Cap & Closure Market Forecast and Outlook 2025 to 2035

Aluminum Casing of the Blade Battery Market Size and Share Forecast Outlook 2025 to 2035

Aluminum ROPP Closure Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Cans Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Packaging Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Pouches Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Peel-Off Ends Maker Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Tape Market Size and Share Forecast Outlook 2025 to 2035

Aluminum-Free Food Pouch Market Size and Share Forecast Outlook 2025 to 2035

Aluminum-Nickel Catalyst Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Frame Monitors Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Composite Materials Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Flat Products Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Alloys Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Sheets and Coils Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Containers Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Aerosol Cans Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Extrusion Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA