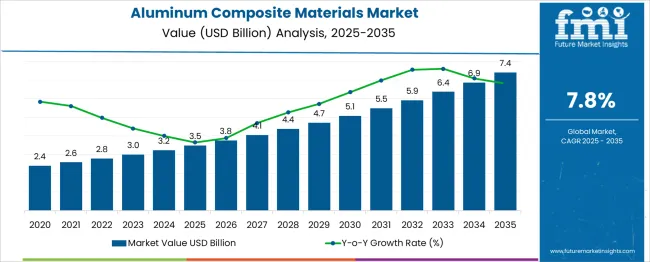

The global aluminum composite materials market is forecasted to grow from USD 3.5 billion in 2025 to approximately USD 7.4 billion by 2035, recording an absolute increase of USD 3.91 billion over the forecast period. This translates into a total growth of 112.0%, with the market forecast to expand at a CAGR of 7.8% between 2025 and 2035. The market size is expected to grow by nearly 2.12X during the same period, supported by increasing construction activities worldwide, growing demand for lightweight building materials, and expanding applications in signage and transportation sectors.

Between 2025 and 2030, the aluminum composite materials market is projected to expand from USD 3.5 billion to USD 5.16 billion, resulting in a value increase of USD 1.67 billion, which represents 42.7% of the total forecast growth for the decade. This phase of growth will be shaped by increasing urbanization and construction activities, expanding commercial building development, and growing adoption of lightweight materials in architectural applications across global markets.

From 2030 to 2035, the market is forecast to grow from USD 5.16 billion to USD 7.4 billion, adding another USD 2.24 billion, which constitutes 57.3% of the ten-year expansion. This period is expected to be characterized by advancement in composite material technologies, expansion into emerging applications including transportation and industrial sectors, and development of renewable aluminum composite solutions that meet evolving environmental and performance requirements.

| Metric | Value |

| Estimated Value in (2025E) | USD 3.5 billion |

| Forecast Value in (2035F) | USD 7.4 billion |

| Forecast CAGR (2025 to 2035) | 7.8% |

Market expansion is being supported by increasing construction activities and urbanization worldwide, driving demand for lightweight, durable, and aesthetically appealing building materials that offer superior performance characteristics compared to traditional construction materials. Growing focus on energy efficiency and renewable building practices is creating opportunities for aluminum composite materials that provide excellent thermal insulation and weather resistance while reducing building weight and structural requirements.

The expanding signage and advertising industry is driving steady demand for aluminum composite materials that offer superior printability, weather resistance, and design flexibility for outdoor and indoor signage applications. Increasing adoption in transportation sectors including recreational vehicles and trailer manufacturing, is creating demand for lightweight composite materials that reduce fuel consumption while maintaining structural integrity and durability.

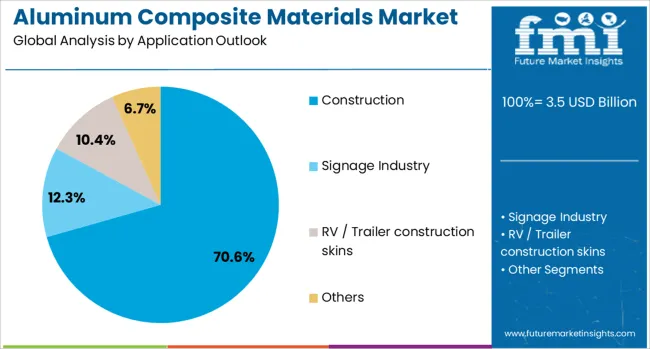

The market is segmented by application and region. By application, the market is divided into construction, signage industry, RV/trailer construction skins, and others. Regionally, the market is divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Construction applications are projected to account for 70.6% of the aluminum composite materials market in 2025. This leading share is supported by widespread adoption in commercial and residential building facades, interior cladding, and architectural applications that require lightweight, durable, and aesthetically versatile materials. Aluminum composite materials provide excellent weather resistance, fire safety properties, and design flexibility that make them ideal for modern architectural applications. The segment benefits from ongoing urbanization, commercial construction growth, and increasing preference for energy-efficient building materials.

The Aluminum Composite Materials market is advancing rapidly due to increasing construction activities and growing demand for lightweight building materials. The market faces challenges including raw material price volatility, competition from alternative materials, and varying regulatory standards across different regions that affect product specifications and market access. Innovation in composite material technology and renewable manufacturing continue to influence market development patterns.

The growing demand for improved performance characteristics is driving development of advanced aluminum composite materials that incorporate high-performance core materials, enhanced surface coatings, and specialized additives for specific applications. Next-generation composites offer superior fire resistance, improved thermal insulation, and enhanced durability while maintaining lightweight properties and design flexibility that support diverse architectural and industrial applications.

Modern aluminum composite manufacturers are implementing comprehensive environmental responsibility programs that encompass recycled content utilization, energy-efficient production processes, and end-of-life material recovery systems that minimize environmental impact. Advanced recycling technologies enable recovery and reuse of aluminum composite materials while maintaining quality standards, supporting circular economy principles and meeting growing environmental responsibility requirements.

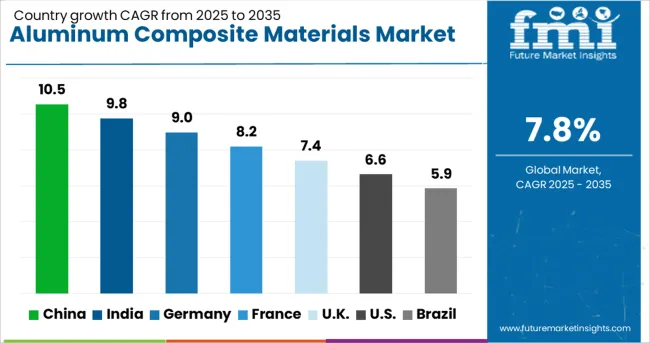

| Country | CAGR (2025-2035) |

| China | 10.5% |

| India | 9.8% |

| Germany | 9.0% |

| France | 8.2% |

| United Kingdom | 7.4% |

| United States | 6.6% |

| Brazil | 5.9% |

The aluminum composite materials market is growing rapidly across global markets, with China leading at a 10.5% CAGR through 2035, driven by massive urbanization programs and extensive commercial construction activities that create substantial demand for lightweight building materials, followed by India at 9.8% supported by rapid urbanization and infrastructure development programs, while Germany records 9.0% emphasizing engineering excellence and renewable solutions, France grows at 8.2% with architectural innovation and modern building design initiatives, the United Kingdom shows 7.4% growth focusing on performance and regulatory compliance, the United States expands at 6.6% with market diversification and technology innovation, and Brazil maintains 5.9% growth supported by construction expansion and increasing awareness of modern building materials that provide superior performance characteristics across diverse construction and architectural applications. The report covers an in-depth analysis of 40+ countries; top-performing countries are highlighted below.

Revenue from aluminum composite materials in China is projected to exhibit the highest growth rate with a CAGR of 10.5% through 2035, driven by massive urbanization programs, extensive commercial construction activities, and growing infrastructure development that creates substantial demand for lightweight building materials. The country's comprehensive construction industry and manufacturing capabilities are generating consistent demand for diverse aluminum composite applications. Major construction projects are driving adoption of advanced composite materials.

Revenue from aluminum composite materials in India is expanding at a CAGR of 9.8%, supported by rapid urbanization, expanding commercial construction sector, and growing infrastructure development programs that drive demand for modern building materials including aluminum composites. The country's construction industry growth and smart city initiatives are creating opportunities for advanced composite material applications. Domestic and international manufacturers are investing in local production capabilities.

Demand for aluminum composite materials in Germany is projected to grow at a CAGR of 9.0%, supported by advanced engineering capabilities, established construction industry, and strong focus on renewable building practices that drive adoption of high-performance composite materials. German construction and manufacturing companies are implementing comprehensive composite material solutions that emphasize quality, durability, and environmental responsibility. The market is characterized by focus on technical innovation and regulatory compliance.

Demand for aluminum composite materials in France is expanding at a CAGR of 8.2%, driven by established architectural tradition, comprehensive construction industry, and growing focus on modern building design that utilizes advanced composite materials for aesthetic and functional applications. French architects and construction companies are implementing innovative composite solutions that combine performance with design excellence. The market benefits from strong construction spending and established procurement practices.

Demand for aluminum composite materials in the UK is growing at a CAGR of 7.4%, supported by established construction industry, comprehensive building regulations, and growing focus on fire safety and performance standards that drive adoption of certified composite materials. British construction companies are prioritizing composite solutions that meet stringent safety and performance requirements while providing cost-effective building solutions. The market is characterized by focus on regulatory compliance and quality assurance.

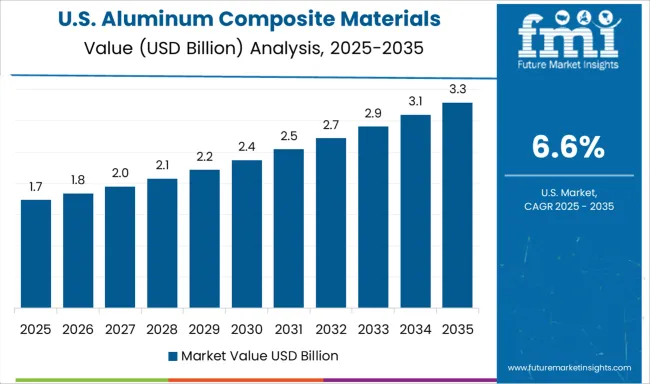

Demand for aluminum composite materials in the USA is expanding at a CAGR of 6.6%, driven by diverse construction markets, established manufacturing capabilities, and growing adoption across multiple applications including construction, signage, and transportation sectors. Large construction and manufacturing companies are implementing comprehensive composite material strategies that emphasize performance, cost-effectiveness, and application versatility. The market benefits from robust construction spending and established supply chains.

Revenue from aluminum composite materials in Brazil is growing at a CAGR of 5.9%, driven by expanding construction industry, growing urbanization, and increasing awareness of modern building materials that provide superior performance and aesthetic appeal. The country's construction sector development and infrastructure projects are creating opportunities for aluminum composite applications. Companies are developing cost-effective solutions tailored to Brazilian market requirements.

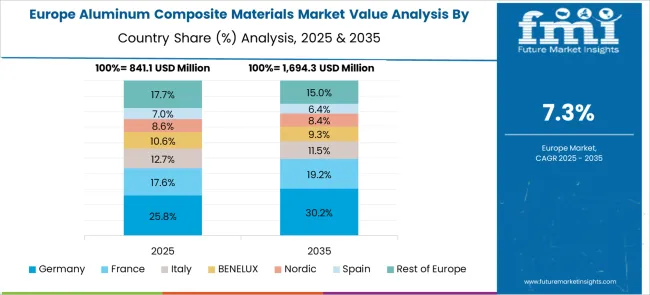

The European aluminum composite materials market is characterized by mature construction industries and comprehensive regulatory frameworks that promote high-quality composite materials across diverse building applications. Countries across the region maintain stringent quality standards and eco- compliance requirements that drive adoption of advanced aluminum composite technologies while supporting architectural innovation and environmental responsibility. The market benefits from established construction practices, comprehensive technical standards, and strong focus on fire safety and performance that creates steady demand for certified composite materials across commercial, residential, and institutional construction projects.

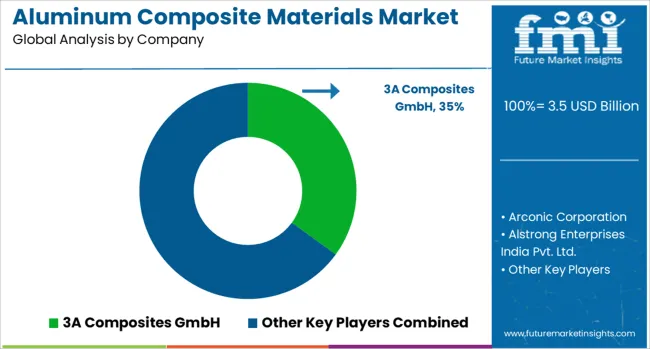

The aluminum composite materials market is defined by competition among specialized composite manufacturers, building materials suppliers, and architectural solution providers offering diverse aluminum composite products for construction and industrial applications. Companies are investing in advanced manufacturing technologies, product innovation, quality assurance systems, and market expansion to deliver high-performance composite materials that meet evolving construction requirements and regulatory standards across global markets. Strategic partnerships, technical support, and geographic expansion are central to strengthening product portfolios and competitive positioning.

Major aluminum composite manufacturers maintain comprehensive production capabilities and extensive technical support services that enable construction and architectural professionals to implement optimal composite solutions for diverse building applications and project requirements. 3A Composites GmbH, Germany-based, offers comprehensive aluminum composite portfolios emphasizing quality, innovation, and application versatility across global construction markets. Arconic Corporation provides advanced composite materials with focus on performance and technical excellence. Alstrong Enterprises India Pvt. Ltd. delivers cost-effective composite solutions tailored to emerging market requirements.

Mitsubishi Chemical Corporation and Alubond USA (a brand of Mulk Holdings International) offer innovative composite technologies with focus on quality and market leadership. Yaret Industrial Group Co. Ltd., Shanghai Huayuan New Composite Materials Co. Ltd., Jyi Shyang Industrial Co. Ltd., and Interplast Co. Ltd. provide specialized composite expertise, advanced manufacturing capabilities, and comprehensive market support across regional and international construction and architectural markets.

| Items | Values |

|---|---|

| Quantitative Units | USD 7.4 billion |

| Application | Construction, Signage Industry, RV/Trailer Construction Skins, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | 3A Composites GmbH; Arconic Corporation; Alstrong Enterprises India Pvt. Ltd.; Mitsubishi Chemical Corporation; Alubond USA (a brand of Mulk Holdings International); Yaret Industrial Group Co., Ltd.; Shanghai Huayuan New Composite Materials Co., Ltd.; Jyi Shyang Industrial Co., Ltd.; Interplast Co. Ltd. |

| Additional Attributes | Dollar sales by application, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established composite manufacturers and building materials suppliers, adoption of advanced manufacturing technologies and quality assurance systems, integration with renewable building practices and environmental responsibility initiatives, innovations in composite material formulations and performance enhancement, and development of specialized solutions for demanding architectural and industrial applications. |

The global aluminum composite materials market is estimated to be valued at USD 3.5 billion in 2025.

The market size for the aluminum composite materials market is projected to reach USD 7.4 billion by 2035.

The aluminum composite materials market is expected to grow at a 7.8% CAGR between 2025 and 2035.

The key product types in aluminum composite materials market are construction, signage industry, rv/trailer construction skins and others.

In terms of application, construction segment to command 70.6% share in the aluminum composite materials market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aluminum Alloy Sacrificial Anode Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foam Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Cap & Closure Market Forecast and Outlook 2025 to 2035

Aluminum Casing of the Blade Battery Market Size and Share Forecast Outlook 2025 to 2035

Aluminum ROPP Closure Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Cans Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Packaging Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Pouches Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Peel-Off Ends Maker Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Tape Market Size and Share Forecast Outlook 2025 to 2035

Aluminum-Free Food Pouch Market Size and Share Forecast Outlook 2025 to 2035

Aluminum-Nickel Catalyst Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Frame Monitors Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Coated Thermal Protective Clothing Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Flat Products Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Alloys Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Sheets and Coils Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Containers Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Aerosol Cans Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Extrusion Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA