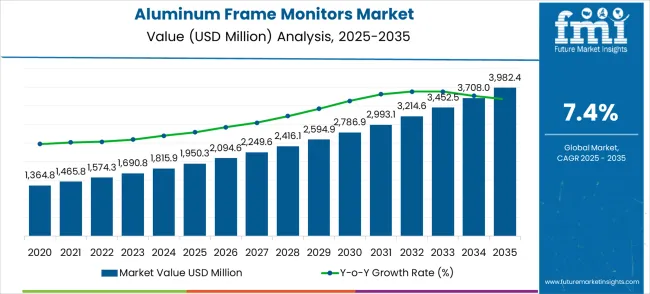

The aluminum frame monitors market is valued at USD 1,950.3 million in 2025 and is forecasted to reach USD 3,982.4 million by 2035, reflecting a robust CAGR of 7.4% over the forecast period. The market trajectory highlights significant growth potential, underpinned by increasing consumer demand for lightweight, durable, and aesthetically appealing monitor solutions, as well as the rising adoption of aluminum frames in commercial and residential displays.

The initial market value, projected value, and CAGR highlight the strategic importance of aluminum frame monitors in enhancing display performance while meeting sustainability and design standards across various applications, including IT equipment and home electronics.The global aluminum frame monitors market is projected to grow from USD 1,950.3 million in 2025 to approximately USD 3,982.4 million by 2035, recording an absolute increase of USD 2,032.1 million over the forecast period.

This translates into a total growth of 104.2%, with the market forecast to expand at a compound annual growth rate (CAGR) of 7.4% between 2025 and 2035. The overall market size is expected to grow by nearly 2.0X during the same period, supported by increasing demand for durable display solutions, growing adoption of industrial automation systems, and rising need for reliable monitoring equipment in harsh operating environments requiring corrosion-resistant and lightweight display technologies.

Year-on-year analysis shows steady growth from USD 1,950.3 million in 2025 to USD 2,249.6 million in 2027, reflecting early adoption trends in key markets. During this phase, growth is driven primarily by the integration of aluminum frames in high-end monitors, premium laptops, and professional display panels. Technological advancements in lightweight aluminum alloys and consumer preference for sleek designs contributed to incremental YoY value increases of approximately USD 144–155 million annually. Minor growth moderation observed in 2026 aligns with temporary supply chain constraints in aluminum procurement, signaling sensitivity of the market to raw material availability.Between 2025 and 2030, the aluminum frame monitors market is projected to expand from USD 1,950.3 million to USD 2,793.6 million, resulting in a value increase of USD 843.3 million, which represents 41.5% of the total forecast growth for the decade. This phase of growth will be shaped by increasing industrial digitalization, growing adoption of Industry 4.0 technologies, and rising demand for corrosion-resistant display solutions in manufacturing environments. Display manufacturers are expanding their aluminum frame monitor portfolios to address the growing demand for durable display systems with enhanced environmental protection and operational reliability characteristics.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 1,950.3 million |

| Forecast Value in (2035F) | USD 3,982.4 million |

| Forecast CAGR (2025 to 2035) | 7.4% |

From 2028 onward, the market experiences accelerated expansion, reaching USD 3,214.6 million by 2032 and USD 3,982.4 million in 2035. This mid-to-late period reflects wider adoption across mainstream monitor segments and the replacement of older plastic-frame models with aluminum alternatives. Inflection points in 2029 and 2032 correspond to regulatory incentives for ecofriendly materials and large-scale corporate adoption of premium display solutions, which amplified YoY growth rates. Consumer trends favoring energy-efficient, premium-built monitors also contributed to stronger market performance during these years.

Market restraints during certain intervals include fluctuations in aluminum prices and potential disruptions in global trade policies, which slightly moderated growth in 2026 and 2031. The market demonstrates resilience through continuous product innovation, expansion in emerging regions, and alignment with sustainability goals.

From 2030 to 2035, the market is forecast to grow from USD 2,793.6 million to USD 3,982.4 million, adding another USD 1,188.8 million, which constitutes 58.5% of the overall ten-year expansion. This period is expected to be characterized by widespread deployment of smart manufacturing systems, integration with IoT and edge computing platforms, and development of next-generation lightweight display technologies. The growing demand for advanced human-machine interfaces and real-time monitoring capabilities will drive the adoption of sophisticated aluminum frame monitors with enhanced connectivity and interactive features.

Between 2020 and 2025, the aluminum frame monitors market experienced significant growth, driven by the increasing adoption of industrial automation systems and the growing recognition of aluminum's superior properties for display frame construction, including its lightweight nature, corrosion resistance, and thermal management capabilities. The market evolved as manufacturers recognized the advantages of aluminum framing over traditional materials, which provide durability while maintaining aesthetic appeal and functional performance.

Market expansion is being supported by the superior material properties of aluminum and the corresponding demand for display solutions that can provide exceptional durability while maintaining lightweight characteristics and thermal efficiency. Modern industrial facilities and commercial applications are increasingly focused on display technologies that can operate reliably in challenging environments while providing enhanced heat dissipation and corrosion resistance. The proven capability of aluminum frame monitors to deliver superior environmental protection, thermal management, and structural integrity makes them essential components of industrial automation and commercial display systems.

The growing emphasis focus on sustainable green manufacturing and environmental responsibility is driving demand for display solutions that incorporate recyclable materials while providing enhanced operational longevity and energy efficiency. Industry preference for display systems that can integrate with existing infrastructure while providing superior durability and maintenance efficiency is creating opportunities for aluminum frame monitor development. The rising influence of aesthetic design requirements and premium product positioning is also contributing to increased adoption of aluminum frame displays across different commercial and industrial applications.

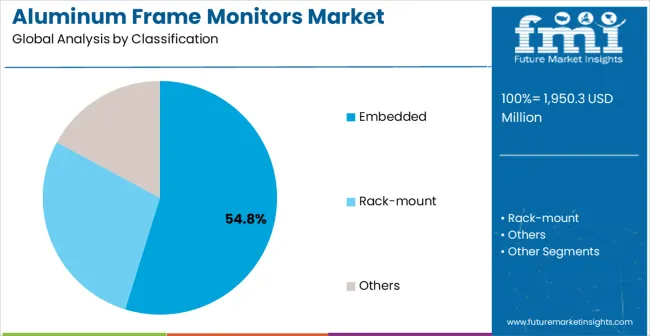

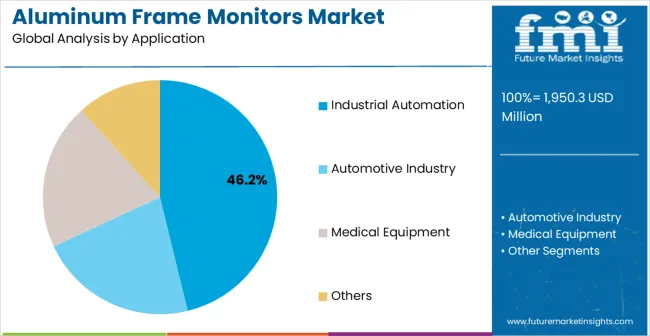

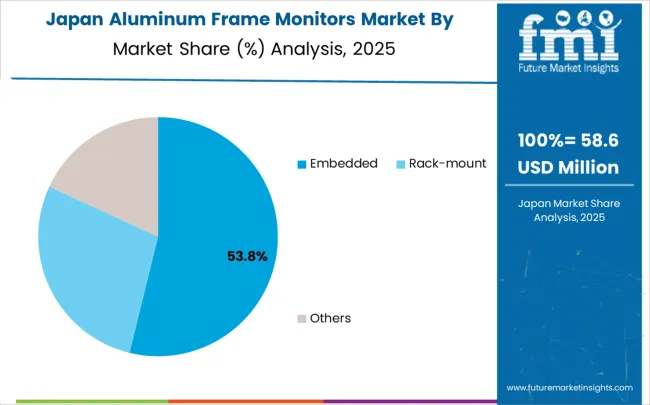

The market is segmented by classification, application, and region. By classification, the market is divided into embedded, rack-mount, and others. Based on application, the market is categorized into industrial automation, automotive industry, medical equipment, and others. Regionally, the market is divided into Asia Pacific, North America, Europe, Latin America, and Middle East & Africa.

The embedded classification is projected to account for 54.8% of the aluminum frame monitors market in 2025, reaffirming its position as the category's dominant installation type. Industrial system integrators increasingly recognize the space-efficient design and seamless integration capabilities provided by embedded aluminum frame monitors for modern automation and control systems. This classification addresses the most demanding integration requirements while providing essential structural strength and environmental protection characteristics.

This classification forms the foundation of most industrial automation and control panel applications, as it represents the most space-efficient and aesthetically integrated approach for display system installation. Technology development and design optimization continue to strengthen confidence in embedded monitor performance for demanding industrial applications. With increasing recognition of the importance of streamlined system integration and space optimization, embedded solutions align with both current installation requirements and future automation objectives. Their comprehensive integration capabilities across multiple mounting configurations ensures sustained market dominance, making them the central growth driver of aluminum frame monitor adoption.

Industrial automation applications are projected to represent 46.2% of aluminum frame monitors demand in 2025, underscoring highlighting their role as the primary application driving market development. Manufacturing companies recognize that industrial automation systems require the most reliable and durable display solutions to ensure consistent operation in demanding production environments with exposure to chemicals, temperature variations, and mechanical stress. Industrial automation applications demand exceptional environmental resistance and operational reliability that aluminum frame monitors are uniquely positioned to deliver.

The segment is supported by the continuous expansion of manufacturing automation requiring comprehensive human-machine interface solutions and the increasing adoption of Industry 4.0 technologies across industrial facilities. Additionally I, industrial automation is increasingly implementing advanced display systems that can support both process monitoring and data visualization requirements while maintaining long-term durability. As understanding of industrial automation display requirements advances, aluminum frame monitor applications will continue to serve as the primary commercial driver, reinforcing their essential position within the industrial display technology market.

The aluminum frame monitors market is advancing rapidly due to increasing industrial automation adoption and growing demand for durable display solutions with superior material properties. However T, the market faces challenges including higher material costs compared to plastic alternatives, manufacturing complexity, and competition from other metal frame solutions. Innovation in aluminum processing technology and display integration continues to influence product development and market expansion patterns.

The growing implementation of smart manufacturing technologies is creating enhanced opportunities for aluminum frame monitor integration with advanced manufacturing execution systems and IoT platforms. Smart manufacturing facilities require reliable display solutions that can interface with sophisticated automation systems while providing long-term operational stability. Advanced manufacturing integration provides opportunities for intelligent display systems that can support both human-machine interaction and automated process monitoring in demanding industrial environments.

Modern display manufacturers are incorporating advanced thermal management solutions, lightweight aluminum alloys, and optimized frame designs to enhance aluminum frame monitor performance and operational efficiency. These technologies improve heat dissipation, reduce overall system weight, and provide enhanced structural integrity throughout extended operation periods. Advanced design integration also enables optimized electromagnetic shielding and improved environmental protection characteristics.

| Country | CAGR (2025-2035) |

|---|---|

| China | 10.0% |

| India | 9.3% |

| Germany | 8.5% |

| Brazil | 7.8% |

| USA | 7.0% |

| UK | 6.3% |

| Japan | 5.6% |

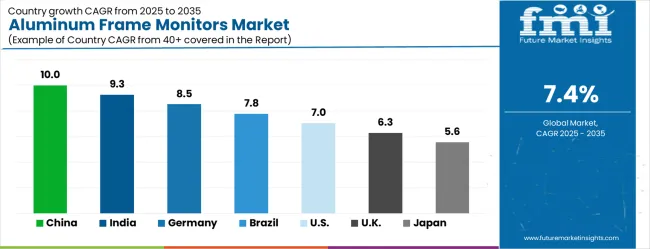

The aluminum frame monitors market is experiencing robust growth globally, with China leading at a 10.0% CAGR through 2035, driven by massive manufacturing sector expansion, government support for industrial automation, and rapidly growing adoption of premium display technologies. India follows at 9.3%, supported by expanding industrial automation initiatives, increasing manufacturing capabilities, and growing investment in modernization programs. Germany shows growth at 8.5%, emphasizing focusing precision manufacturing excellence and comprehensive industrial automation systems. Brazil records 7.8% growth, focusing on expanding industrial modernization and growing adoption of advanced display technologies. The USA shows 7.0% growth, representing steady demand from established industrial operations and technology integration programs.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

China is expected to expand at a CAGR of 10.0% from 2025 to 2035, driven by growing demand across corporate offices, design studios, educational institutions, and gaming setups. Aluminum frame monitors are increasingly preferred due to their premium aesthetics, lightweight construction, and durability suitable for high-intensity daily use. Domestic manufacturers are investing in advanced aluminum alloys and precision production techniques to deliver superior display quality and energy efficiency. Widespread adoption is facilitated through institutional procurement, e-commerce platforms, and specialty electronics retailers. Rising integration of digital signage in retail, hospitality, and corporate environments is creating additional market opportunities. Collaborative projects between technology firms and monitor manufacturers support innovation in interactive and smart monitors. Government incentives for electronics manufacturing, coupled with consumer preference for high-performance devices, further accelerate market growth.

India is projected to grow at a CAGR of 9.3% during 2025–2035, fueled by expanding IT hubs, corporate offices, educational institutions, and home setups requiring high-quality monitors. Aluminum frame monitors are favored for their lightweight design, modern aesthetics, and durability suitable for continuous use in schools and offices. Domestic manufacturers are focusing on cost-effective production without compromising premium features, while collaborations with global technology partners enable the launch of innovative, affordable products. Distribution channels include e-commerce platforms, electronics showrooms, and institutional procurement. Rising adoption of digital signage in banking, retail, and corporate sectors, coupled with growing home office setups in metro cities, supports consistent market growth. Training and awareness programs for IT infrastructure upgrades further encourage adoption.

Germany is expected to grow at a CAGR of 8.5% from 2025 to 2035, driven by adoption of aluminum frame monitors in corporate offices, industrial control rooms, design studios, and creative agencies. These monitors are preferred for durability, lightweight construction, and superior display performance in high-precision work environments. Domestic manufacturers focus on slim profiles, energy-efficient displays, and compliance with European environmental standards. Distribution is managed through electronics retailers, corporate procurement channels, and online B2B platforms. Government-backed smart workplace initiatives and the rise of ergonomic office solutions further encourage market penetration. Collaboration between research institutions and monitor manufacturers promotes product innovation, ensuring high-quality, technologically advanced solutions for commercial and professional applications.

Brazil is projected to grow at a CAGR of 7.8% from 2025 to 2035, led by rising adoption in corporate offices, educational institutions, retail signage networks, and healthcare facilities. Aluminum frame monitors are valued for their robust construction, lightweight design, and premium appearance suitable for high-use environments. Manufacturers are optimizing production techniques to ensure durability under tropical climate conditions. Adoption is increasing across smart classrooms, corporate conference rooms, and large-scale retail digital signage. Strategic collaborations with international suppliers enhance product quality, performance, and availability. Modernization of IT infrastructure, rising interest in ergonomic office equipment, and corporate digitization initiatives are key drivers. The market benefits from a combination of domestic production expansion and imported premium models.

The United States market is projected to expand at a CAGR of 7.0% during 2025–2035, led by adoption in corporate offices, content creation studios, gaming setups, and home offices. Aluminum frame monitors are preferred due to lightweight construction, durability, and premium design suitable for high-performance applications. Manufacturers focus on ultra-thin designs, energy-efficient displays, and ergonomic features. Distribution occurs through specialized electronics retailers, e-commerce platforms, and corporate procurement channels. Demand is also driven by digital signage adoption in retail, airports, and healthcare facilities. Strategic partnerships between domestic and international technology firms are supporting the introduction of advanced monitors with high-resolution panels and interactive features. Rising consumer preference for aesthetically designed and durable monitors strengthens market growth.

The United Kingdom is expected to grow at a CAGR of 6.3% during 2025–2035, supported by rising adoption in corporate offices, home workspaces, and educational institutions. Aluminum frame monitors are preferred for their slim profiles, lightweight construction, and premium aesthetics suitable for high-use environments. Manufacturers focus on anti-glare panels, ergonomic designs, and energy-efficient technology. Distribution is managed through electronics retailers, B2B procurement channels, and online marketplaces. Adoption is reinforced by digital signage deployment in offices, universities, healthcare facilities, and retail spaces. Collaborations between domestic producers and international suppliers expand product offerings and improve manufacturing efficiency. Growth is further accelerated by increasing home office setups and IT modernization programs in both private and public sectors.

Japan is projected to grow at a CAGR of 5.6% from 2025–2035, reflecting steady demand in corporate offices, educational institutions, specialized design studios, and healthcare facilities. Aluminum frame monitors are favored for robust construction, lightweight design, and sleek aesthetics suitable for both professional and residential applications. Manufacturers emphasize energy-efficient displays, ergonomic design, anti-glare panels, and advanced aluminum alloys. Distribution channels include electronics retailers, online platforms, and institutional procurement. Growth is driven by digital signage adoption in retail and corporate settings, upgrades in educational computer labs, and home office setups in urban centers. Collaborative innovation with international suppliers ensures improved product performance and premium quality for high-end applications.

Revenue from aluminum frame monitors in China is projected to exhibit outstanding growth with a CAGR of 10.0% through 2035, driven by unprecedented manufacturing sector modernization and comprehensive government support for industrial automation and premium display technology adoption. The country's massive industrial base and increasing adoption of advanced manufacturing technologies are creating tremendous opportunities for durable display solutions. Major domestic and international display manufacturers are establishing comprehensive production and distribution capabilities to serve the rapidly expanding industrial automation market.

Government initiatives supporting manufacturing transformation and substantial investment in industrial automation infrastructure are driving accelerated adoption of premium display systems throughout major industrial regions.

Manufacturing sector modernization and Industry 4.0 implementation are supporting large-scale deployment of aluminum frame monitors among leading manufacturers, automation companies, and system integrators nationwide.

Revenue from aluminum frame monitors in India is expanding at a CAGR of 9.3%, supported by rapidly growing industrial automation sector, increasing manufacturing capabilities, and expanding investment in modernization programs. The country's substantial manufacturing growth and commitment to technology advancement are driving demand for reliable and durable display solutions. International display manufacturers and domestic companies are establishing partnerships to serve the growing demand for industrial display technologies.

Rising investment in industrial automation and manufacturing modernization are creating significant opportunities for premium display systems across automotive, electronics, and general manufacturing sectors.

Growing government support for digitalization initiatives and smart manufacturing development is supporting increased adoption of aluminum frame monitors among industrial facilities and automation providers.

Revenue from aluminum frame monitors in Germany is projected to grow at a CAGR of 8.5%, supported by the country's leadership in precision manufacturing and comprehensive expertise in industrial automation technologies. German manufacturers and automation companies consistently invest in advanced display technologies and human-machine interface solutions. The market is characterized by engineering excellence, comprehensive quality standards, and established relationships between display suppliers and industrial users.

Industrial automation leadership and manufacturing excellence are supporting continued investment in premium display systems throughout leading manufacturers and automation providers.

Research institution collaboration and engineering excellence are facilitating advancement of industrial display applications while ensuring superior performance and operational reliability.

Revenue from aluminum frame monitors in Brazil is projected to grow at a CAGR of 7.8% through 2035, driven by expanding industrial modernization, increasing adoption of automation technologies, and growing focus on manufacturing efficiency improvement. Brazilian manufacturers are increasingly recognizing the importance of reliable display solutions in achieving operational excellence and competitive positioning.

Industrial modernization programs and manufacturing automation expansion are supporting increased deployment of premium display systems across diverse manufacturing applications and industrial sectors.

Growing collaboration between international display companies and local manufacturers is enhancing technology adoption and supporting development of domestic industrial automation capabilities.

Revenue from aluminum frame monitors in the USA is projected to grow at a CAGR of 7.0%, supported by established industrial automation infrastructure, continued innovation in manufacturing technologies, and comprehensive adoption of advanced display systems. American manufacturers and automation companies maintain consistent advancement of display technologies through established technology integration programs and operational excellence initiatives.

Industrial automation leadership and manufacturing innovation are driving continued investment in premium display systems throughout leading industrial facilities and automation providers.

Technology innovation programs and industry collaboration are supporting continued advancement in aluminum frame monitor performance and industrial application capabilities.

Revenue from aluminum frame monitors in the UK is projected to grow at a CAGR of 6.3% through 2035, supported by industrial technology innovation initiatives and increasing investment in manufacturing automation systems. British manufacturers emphasize advanced display technologies within comprehensive industrial frameworks that prioritize operational efficiency and technology integration.

Industrial technology development programs and manufacturing modernization initiatives are supporting systematic adoption of premium display systems across established industrial sectors and automation applications.

Innovation programs and industrial excellence initiatives are maintaining high standards for display technology performance while supporting continued development of advanced human-machine interface capabilities.

Revenue from aluminum frame monitors in Japan is projected to grow at a CAGR of 5.6% through 2035, supported by the country's leadership in precision manufacturing and comprehensive approach to industrial display technologies. Japanese manufacturers emphasize technology-driven development of sophisticated display systems within established frameworks that prioritize technical excellence and operational reliability.

Advanced manufacturing capabilities and precision engineering expertise are supporting continued leadership in display technology innovation across leading companies and research institutions.

Industry collaboration initiatives and comprehensive technology standards are maintaining excellence in industrial display applications while supporting commercial success and market development.

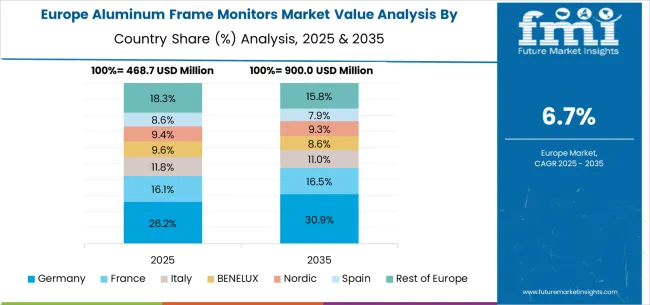

The aluminum frame monitors market in Europe is projected to expand steadily through 2035, supported by established manufacturing industries, comprehensive industrial automation adoption, and ongoing modernization of production facilities. Germany will continue to lead the regional market, accounting for 29.2% in 2025 and rising to 30.0% by 2035, supported by strong manufacturing capabilities, advanced industrial automation infrastructure, and comprehensive display technology expertise. The United Kingdom follows with 18.6% in 2025, increasing to 18.9% by 2035, driven by industrial technology innovation initiatives, government support for manufacturing modernization, and expanding automation adoption.

France holds 16.8% in 2025, edging up to 17.1% by 2035 as manufacturers expand automation capabilities and demand grows for reliable display systems. Italy contributes 12.7% in 2025, remaining stable at 12.9% by 2035, supported by manufacturing sector strength and growing adoption of industrial automation technologies. Spain represents 9.3% in 2025, moving upward to 9.4% by 2035, underpinned by expanding industrial modernization and increasing investment in automation systems.

Nordic countries together account for 8.9% in 2025, maintaining their position at 9.0% by 2035, supported by advanced manufacturing initiatives and early adoption of innovative display technologies. The Rest of Europe represents 4.5% in 2025, declining slightly to 2.7% by 2035, as larger markets capture greater investment focus and established industrial infrastructure advantages.

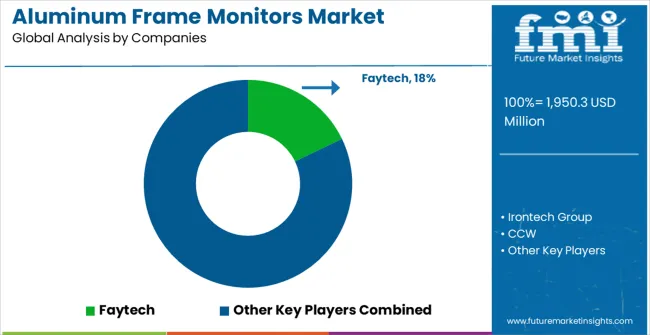

The market is highly competitive, driven by design aesthetics, display performance, and build quality. LG Electronics, Samsung, Dell, and ASUS lead with premium offerings that combine slim aluminum bezels, high-resolution panels, and advanced features such as color accuracy, high refresh rates, and ergonomic design. Their competitive edge stems from global distribution, brand recognition, and extensive R&D capabilities, ensuring consistent product performance for professional, commercial, and consumer applications. Product brochures highlight durability, lightweight construction, and sleek aesthetics, appealing to both corporate buyers and tech-savvy consumers.

BOE, Innolux, TCL CSOT, and Faytech compete by supplying high-quality panels and integrated aluminum frame displays, focusing on reliability, energy efficiency, and cost-effectiveness. BOE and Innolux leverage large-scale panel manufacturing to offer competitive pricing, while TCL CSOT emphasizes high-volume production with design customization for regional markets. Faytech and Irontech Group differentiate by providing industrial-grade monitors designed for rugged environments and continuous operation, targeting niche applications in control rooms, kiosks, and manufacturing.

CCW, AOC, and smaller players strengthen their position by offering mid-range displays with aluminum frames, focusing user-friendly installation, durability, and competitive pricing. Product brochures often highlight anti-glare coatings, VESA compatibility, and flexible orientation options. Competition in this market is defined by material quality, display performance, and brand reliability. Firms invest in thin bezel engineering, energy-efficient panels, and modular designs, while regional players focus on affordability and niche applications. Innovation in aluminum frame construction, combined with visual performance, remains central to maintaining a competitive edge in this market.The aluminum frame monitors market is characterized by competition among specialized industrial display manufacturers, established electronics companies, and innovative display technology providers. Companies are investing in advanced aluminum processing technologies, thermal management enhancement, strategic partnerships, and application development to deliver high-performance, reliable, and cost-effective aluminum frame monitor solutions. Technology development, quality assurance, and customer support strategies are central to strengthening competitive advantages and market presence.

Faytech leads the market with significant expertise in industrial display technologies, offering comprehensive aluminum frame monitor solutions with focus on durability and industrial applications. Irontech Group provides specialized ruggedized display capabilities with emphasis on harsh environment applications and military-grade solutions. CCW focuses on industrial display solutions with comprehensive automation and control applications. Innolux delivers advanced display panel technologies with strong focus on manufacturing excellence and cost optimization.

LG Electronics operates with focus on comprehensive display technologies and advanced manufacturing capabilities. Samsung provides advanced display panel innovations with emphasis on premium performance and reliability. BOE specializes in display manufacturing with comprehensive technology development capabilities. Dell, TCL CSOT, ASUS, and AOC provide diverse technological approaches and market access strategies to enhance overall market development and display technology advancement.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 1,950.3 mMillion |

| Classification | Embedded, Rack-mount, Others |

| Application | Industrial Automation, Automotive Industry, Medical Equipment, Others |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, Middle East & Africa |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan and 40+ countries |

| Key Companies Profiled | Faytech, Irontech Group, CCW, Innolux, LG Electronics, Samsung, BOE, Dell, TCL CSOT, ASUS, AOC |

| Additional Attributes | Dollar sales by monitor type and application, regional adoption trends, competitive landscape, industrial partnerships, integration with automation systems, innovations in aluminum processing and thermal management, durability analysis, and operational reliability optimization strategies |

The global aluminum frame monitors market is estimated to be valued at USD 1,950.3 million in 2025.

The market size for the aluminum frame monitors market is projected to reach USD 3,982.4 million by 2035.

The aluminum frame monitors market is expected to grow at a 7.4% CAGR between 2025 and 2035.

The key product types in aluminum frame monitors market are embedded, rack-mount and others.

In terms of application, industrial automation segment to command 46.2% share in the aluminum frame monitors market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aluminum Alloy Sacrificial Anode Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foam Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Cap & Closure Market Forecast and Outlook 2025 to 2035

Aluminum Casing of the Blade Battery Market Size and Share Forecast Outlook 2025 to 2035

Aluminum ROPP Closure Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Cans Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Packaging Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Pouches Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Peel-Off Ends Maker Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Tape Market Size and Share Forecast Outlook 2025 to 2035

Aluminum-Free Food Pouch Market Size and Share Forecast Outlook 2025 to 2035

Aluminum-Nickel Catalyst Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Composite Materials Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Coated Thermal Protective Clothing Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Flat Products Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Alloys Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Sheets and Coils Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Containers Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Aerosol Cans Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Extrusion Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA