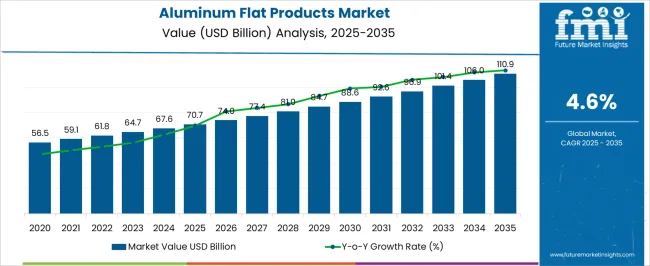

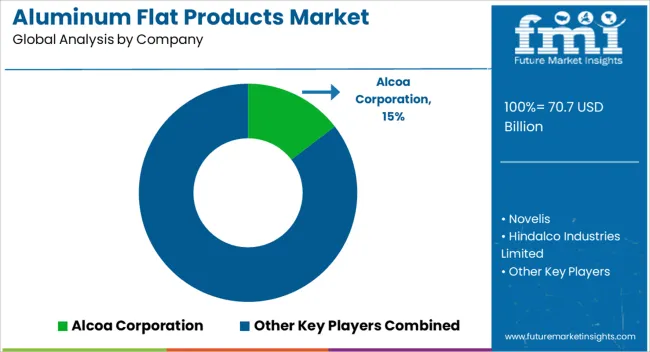

The aluminum flat products market is estimated to be valued at USD 70.7 billion in 2025 and is projected to reach USD 110.9 billion by 2035, registering a compound annual growth rate (CAGR) of 4.6% over the forecast period.

The aluminum flat products market is projected to reach USD 110.9 billion by 2035 from USD 70.7 billion in 2025, advancing at a CAGR of 4.6%. The progression of values from USD 70.7 billion in 2025 to USD 92.6 billion in 2031, and further to USD 110.9 billion in 2035, reflects a steady and dependable upward trajectory. This compound annual growth rate indicates that the material’s usage in diverse industrial settings, from automotive to aerospace and construction, is set to intensify over the decade. The CAGR of 4.6% may appear moderate, yet its consistency highlights resilience against raw material pricing swings and manufacturing pressures. Such a growth curve shows that the aluminum flat products market is positioned to capture rising demand for lightweight, durable, and high-strength materials across multiple applications.

The CAGR trajectory demonstrates that even as alternative materials are being tested, aluminum maintains a stronghold due to its recyclability, adaptability, and cost-effectiveness in scaling production. By 2030, the market is expected to cross USD 88 billion, validating the view that reliance on aluminum for structural and functional applications will not diminish but strengthen further. Industry stakeholders will likely see this market as a safe growth avenue, with consistent CAGR-based returns providing confidence for manufacturers, suppliers, and investors targeting long-term expansion.

| Metric | Value |

|---|---|

| Aluminum Flat Products Market Estimated Value in (2025 E) | USD 70.7 billion |

| Aluminum Flat Products Market Forecast Value in (2035 F) | USD 110.9 billion |

| Forecast CAGR (2025 to 2035) | 4.6% |

The aluminum flat products market is estimated to hold a notable proportion within its parent markets, representing approximately 22-24% of the aluminum market, around 15-16% of the non-ferrous metals market, close to 28-30% of the rolled aluminum products market, about 10-11% of the metal fabrication market, and roughly 8-9% of the construction and automotive materials market. Collectively, the cumulative share across these parent segments is observed in the range of 83-90%, reflecting the dominant role of flat-rolled aluminum in industrial, construction, and automotive supply chains. The market has been influenced by the increasing reliance on lightweight, durable, and versatile materials where performance efficiency, corrosion resistance, and adaptability across applications are highly prioritized.

Adoption has been guided by procurement decisions that emphasize consistent quality, machinability, and cost-effectiveness for downstream processing. Producers have focused on expanding rolling capacity, alloy variations, and process optimization to deliver value-added products meeting sector-specific demands. As a result, the aluminum flat products market has not only captured a commanding share within the rolled aluminum domain but has also significantly impacted non-ferrous metals, fabrication, construction, and automotive materials markets, highlighting its critical role in shaping industrial production, infrastructure development, and mobility solutions on a global scale.

The aluminum flat products market is witnessing accelerated growth as industries prioritize lightweight, corrosion-resistant materials with high recyclability and mechanical strength. Increasing global focus on reducing carbon emissions and improving fuel efficiency is driving demand for flat-rolled aluminum products across automotive, transportation, construction, and packaging sectors. Technological advancements in aluminum alloy design and processing capabilities are enhancing performance while reducing manufacturing costs.

As energy-efficient and sustainable alternatives gain prominence in the industrial landscape, aluminum flat products are being adopted for structural components, body panels, and functional assemblies. The market is further supported by government initiatives promoting sustainable manufacturing practices and the growing emphasis on circular economy models.

In addition, rising investments in electric vehicle production, green buildings, and smart infrastructure are expected to sustain high-volume demand for high-quality aluminum flat products As end-use industries expand and regulatory standards evolve, the market is expected to grow steadily, driven by its alignment with global sustainability goals and its adaptability across multiple high-growth applications.

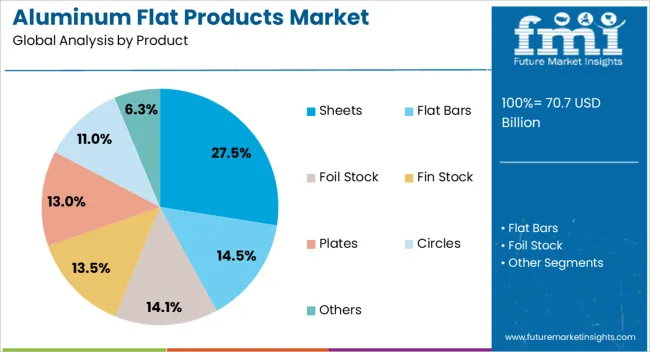

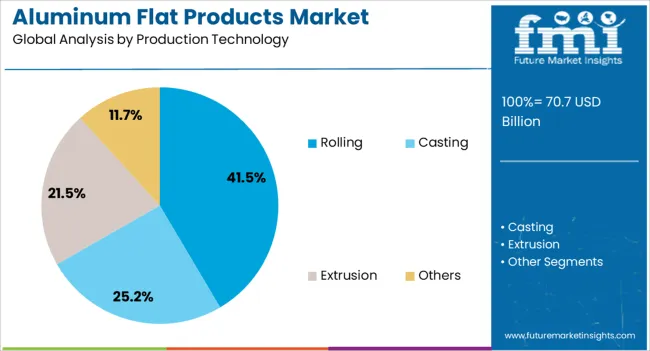

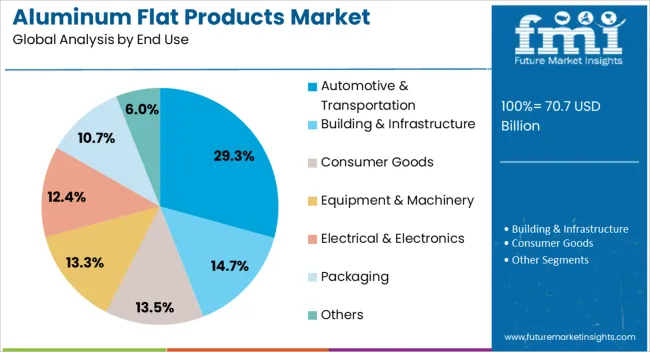

The aluminum flat products market is segmented by product, production technology, end use, and geographic regions. By product, aluminum flat products market is divided into sheets, flat bars, foil stock, fin stock, plates, circles, and others. In terms of production technology, aluminum flat products market is classified into rolling, casting, extrusion, and others. Based on end use, aluminum flat products market is segmented into automotive & transportation, building & infrastructure, consumer goods, equipment & machinery, electrical & electronics, packaging, and others. Regionally, the aluminum flat products industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The sheets segment is projected to hold 27.5% of the aluminum flat products market revenue share in 2025, positioning it as a key contributor within the product category. This growth is being supported by the material’s widespread use across applications requiring excellent formability, lightweight properties, and corrosion resistance. Aluminum sheets are being increasingly utilized in sectors such as transportation, construction, aerospace, and packaging, where durability and performance under stress are essential.

The segment’s expansion is being further driven by improvements in rolling and heat treatment techniques, which enhance mechanical strength and surface quality while maintaining cost-efficiency. Its adaptability to different thicknesses and surface finishes allows manufacturers to serve a broad spectrum of end-use requirements.

With the shift toward environmentally friendly materials, aluminum sheets are gaining preference over traditional steel in lightweight structural applications The recyclability and high strength-to-weight ratio of aluminum sheets are also contributing to their market share, particularly in markets focused on reducing energy consumption and material waste.

The rolling production technology segment is anticipated to capture 41.5% of the aluminum flat products market revenue share in 2025, making it the leading method of manufacturing. Its dominance is being attributed to the process’s high efficiency, scalability, and ability to produce uniform and defect-free flat aluminum products at competitive costs. Rolling is enabling the production of sheets, plates, and strips with precise dimensional accuracy and consistent mechanical properties, supporting applications that require high-performance standards.

Innovations in hot and cold rolling techniques are improving productivity and surface finish quality while reducing energy consumption and scrap generation. The segment is benefiting from rising investments in advanced rolling mills and integrated production facilities, particularly in Asia and North America.

With growing demand for aluminum components in automotive, aerospace, and construction industries, rolling technology is being favored for its capacity to meet bulk production requirements while maintaining quality standards Its compatibility with downstream processing methods further reinforces its role in shaping the supply chain of aluminum flat products.

The automotive and transportation segment is expected to account for 29.3% of the aluminum flat products market revenue share in 2025, making it the leading end-use category. This leadership is being driven by the global transition toward lightweight vehicle design, improved fuel efficiency, and reduced emissions. Aluminum flat products, particularly sheets and plates, are being increasingly utilized in manufacturing vehicle panels, body structures, chassis components, and heat exchangers due to their strength-to-weight advantage over traditional materials.

The segment’s growth is also being fueled by the surge in electric vehicle production, which requires lightweight materials to offset battery weight and extend driving range. In the transportation sector, applications in railways, marine, and aerospace are contributing to sustained demand for corrosion-resistant and high-strength aluminum components.

Regulatory mandates aimed at lowering vehicle emissions and improving crash safety standards are accelerating the adoption of aluminum-based solutions As original equipment manufacturers and suppliers seek to enhance performance and sustainability, aluminum flat products are expected to remain integral to the future of mobility and transportation infrastructure.

The aluminum flat products market is supported by strong demand from automotive, construction, and packaging industries. Opportunities are expanding within the renewable energy and logistics sectors, while trends are shaped by recycling initiatives and product customization. However, challenges arise from raw material price fluctuations, energy-intensive processes, and regional dependence on imports. The overall market outlook reflects a balance between consistent demand drivers and pressing challenges, with growth potential likely to be realized by producers who diversify applications, enhance recycling capabilities, and stabilize supply chains in a highly competitive environment.

The demand for aluminum flat products has been fueled by their increasing adoption in automotive manufacturing and construction activities. Automakers are favoring aluminum sheets and plates for their lightweight properties, corrosion resistance, and ability to enhance fuel efficiency in vehicles. In construction, these products are being widely applied in roofing, cladding, and structural frameworks due to their durability and strength-to-weight ratio. Consumer appliances and packaging industries are also strengthening demand as aluminum flat products deliver high formability and long service life. With industrial sectors emphasizing efficiency and reliability, the market demand for rolled aluminum products is positioned to remain strong across multiple application areas.

The aluminum flat products market is witnessing promising opportunities within the packaging and renewable energy industries. Beverage can manufacturing, foil packaging, and flexible packaging solutions have relied heavily on aluminum sheets for their barrier properties and recyclability. The renewable energy sector has been expanding its use of aluminum plates and sheets in solar panel frames and wind energy components, given their strength and corrosion resistance. Logistics and transportation firms are also exploring new applications for lightweight aluminum sheets to cut fuel costs. With industrial priorities shifting toward performance-driven materials, aluminum flat products are expected to capture further growth in these emerging segments.

Prominent trends in the aluminum flat products market are shaped by the rising focus on recycling processes and product customization. Secondary aluminum production has gained momentum due to its cost efficiency and lower energy consumption compared to primary production. Manufacturers are increasingly offering tailored flat products to meet the specific requirements of end-use industries such as aerospace, shipbuilding, and railways. Higher-grade alloys and specialized surface finishes are being developed to expand application possibilities. The market is clearly tilting toward diversified product portfolios, as industries demand more specialized aluminum flat products for both heavy-duty and lightweight structural applications.

Challenges in the aluminum flat products market are being defined by fluctuating raw material prices and dependence on imports in several regions. Volatile bauxite and alumina costs frequently impact profit margins for producers. In markets where domestic supply is limited, reliance on imported aluminum exposes manufacturers to currency risks and trade restrictions. Energy-intensive production processes also add to the cost burden, with rising electricity tariffs straining operations. Competitive pressure from alternative materials such as steel and composites is another hurdle. These challenges underline the necessity for producers to optimize production efficiency and explore localized supply options to remain competitive.

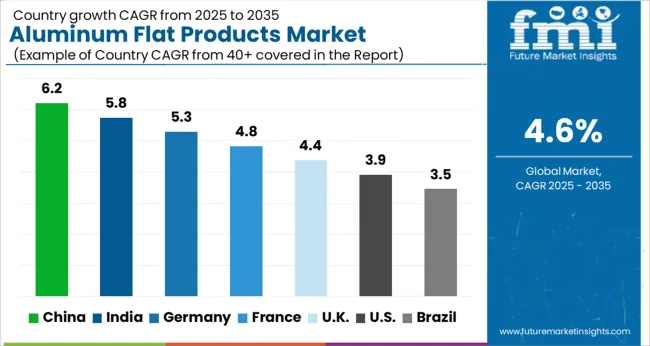

| Country | CAGR |

|---|---|

| China | 6.2% |

| India | 5.8% |

| Germany | 5.3% |

| France | 4.8% |

| UK | 4.4% |

| USA | 3.9% |

| Brazil | 3.5% |

The global aluminum flat products market is projected to grow at a CAGR of 4.6% from 2025 to 2035. China leads with the highest growth at 6.2%, followed by India at 5.8%, while France stands at 4.8%. The United Kingdom records a CAGR of 4.4%, and the United States shows the lowest growth among leading economies at 3.9%. Growth is shaped by expanding demand from automotive, construction, aerospace, and packaging industries. While Asian markets dominate due to large-scale production and consumption, European and USA markets focus on technological improvements, value-added products, and compliance with global trade standards. This report includes insights on 40+ countries; the top markets are shown here for reference.

The aluminum flat products market in China is projected to grow at a CAGR of 6.2%. Growth is driven by rapid industrialization, infrastructure development, and rising demand from construction, automotive, and packaging industries. Chinese manufacturers are scaling up production capacity and investing in advanced rolling mills to meet domestic and export requirements. The aerospace and automotive sectors are increasingly adopting lightweight aluminum flat products to improve efficiency and performance. Export opportunities are expanding as China strengthens its role as a global aluminum supplier. With supportive government policies and competitive pricing, China is expected to maintain a dominant position in the aluminum flat products market.

The aluminum flat products market in India is projected to grow at a CAGR of 5.8%. Rising demand is being fueled by rapid urban development, infrastructure expansion, and growing adoption of aluminum in automobiles and packaging. Indian producers are investing in new rolling capacities and technology upgrades to strengthen domestic supply. Export potential is also expanding, supported by competitive manufacturing costs and government encouragement for domestic production. Aerospace and defense applications are further boosting demand for high-quality aluminum flat products. With an expanding middle-class consumer base and industrial growth, India is poised to be one of the fastest-growing markets for aluminum flat products.

The aluminum flat products market in France is projected to grow at a CAGR of 4.8%. Market expansion is supported by strong demand from automotive, packaging, and aerospace industries. French producers emphasize high-quality, precision-rolled aluminum products tailored for advanced engineering applications. Investments in technology upgrades and compliance with EU trade and environmental standards are strengthening domestic production capabilities. The country’s role as a key aerospace hub drives significant aluminum usage in aircraft components. Partnerships with international suppliers and local automotive manufacturers further support steady demand growth. France is expected to remain a leading European market for aluminum flat products.

The aluminum flat products market in the United Kingdom is projected to grow at a CAGR of 4.4%. Growth is being supported by rising demand in automotive, construction, and aerospace industries. The shift toward lightweight materials in vehicle manufacturing has boosted the adoption of aluminum flat products. UK manufacturers are investing in modernization of rolling facilities and digital monitoring systems to improve efficiency and product quality. Imports play a significant role in meeting domestic demand, while local firms are focusing on niche and high-value applications. Despite moderate growth, the UK is expected to sustain its role as an important European consumer of aluminum flat products.

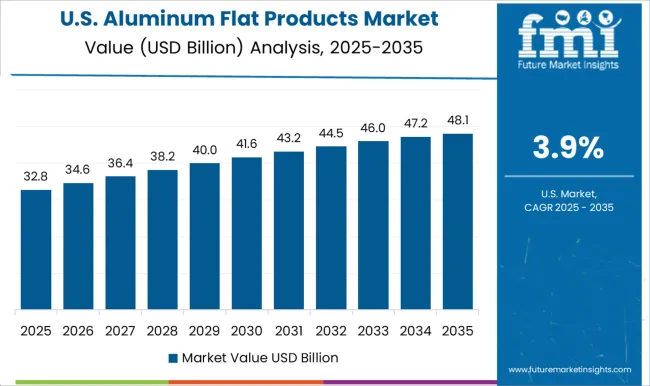

The aluminum flat products market in the United States is projected to grow at a CAGR of 3.9%. Market growth is influenced by demand from aerospace, automotive, construction, and packaging sectors. USA producers are focusing on high-strength, lightweight, and value-added aluminum flat products to meet engineering requirements. Investments in advanced rolling technologies, recycling, and R&D are shaping domestic production trends. The aerospace sector remains a major driver, with aluminum being crucial for aircraft manufacturing. Trade dynamics and imports also influence supply, with manufacturers balancing domestic production and international sourcing. While growth is slower compared to Asia, the USA continues to remain a key market for premium aluminum flat products.

The aluminum flat products market is driven by a strong set of global and regional producers delivering sheet, plate, and foil for applications across automotive, aerospace, packaging, building, and industrial sectors. Alcoa Corporation, Novelis, Hindalco Industries Limited, and Norsk Hydro hold prominent positions, leveraging advanced rolling technologies and large-scale production capabilities. Their portfolios emphasize lightweighting benefits for transportation, corrosion resistance, and recyclability, aligning with the rising demand for efficient materials. Arconic and UACJ Corporation are particularly active in aerospace-grade flat products, with brochures highlighting specialized alloys and precision finishing required for defense and commercial aviation.

Constellium and Aleris Corporation focus on automotive-grade flat rolled products, often promoted as critical to reducing vehicle weight and enhancing fuel efficiency, with integrated R&D showcased as a differentiator. Regional players such as National Aluminum Company Limited (NALCO) and Elvalhalcor Hellenic Copper and Aluminum Industry S.A strengthen supply across Asia and Europe, offering competitive pricing and localized supply chain advantages. JW Aluminum and Maharashtra Metal serve niche markets, focusing on foil and value-added sheet for packaging and industrial uses, often emphasizing flexibility and customer-specific customization in their service literature.

The competitive landscape is shaped by capacity expansions, recycling initiatives, and strategic collaborations aimed at securing long-term contracts with automotive OEMs, packaging leaders, and construction firms. Brochures across the sector consistently highlight durability, recyclability, and formability as key performance attributes, reinforcing aluminum flat products as versatile solutions across multiple industries. With increasing demand for lightweight materials in transport and packaging, market participants continue to position themselves through scale, technology, and customer-focused innovation.

| Item | Value |

|---|---|

| Quantitative Units | USD 70.7 billion |

| Product | Sheets, Flat Bars, Foil Stock, Fin Stock, Plates, Circles, and Others |

| Production Technology | Rolling, Casting, Extrusion, and Others |

| End Use | Automotive & Transportation, Building & Infrastructure, Consumer Goods, Equipment & Machinery, Electrical & Electronics, Packaging, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Alcoa Corporation, Novelis, Hindalco Industries Limited, Norsk Hydro, Arconic, UACJ Corporation, Constellium, Aleris Corporation, National Aluminum Company Limited (NALCO), Elvalhalcor Hellenic Copper and Aluminum Industry S.A, JW Aluminum, and Maharashtra Metal |

| Additional Attributes | Dollar sales by product type (sheets, plates, foils, strips) and application (automotive, aerospace, construction, packaging, machinery) are key metrics. Trends include rising demand for lightweight and durable materials, growth in transportation and infrastructure projects, and increasing adoption in packaging and consumer goods. Regional production, technological advancements, and recycling initiatives are driving market growth. |

The global aluminum flat products market is estimated to be valued at USD 70.7 billion in 2025.

The market size for the aluminum flat products market is projected to reach USD 110.9 billion by 2035.

The aluminum flat products market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in aluminum flat products market are sheets, flat bars, foil stock, fin stock, plates, circles and others.

In terms of production technology, rolling segment to command 41.5% share in the aluminum flat products market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aluminum Foam Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Cap & Closure Market Forecast and Outlook 2025 to 2035

Aluminum Casing of the Blade Battery Market Size and Share Forecast Outlook 2025 to 2035

Aluminum ROPP Closure Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Cans Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Packaging Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Pouches Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Peel-Off Ends Maker Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Tape Market Size and Share Forecast Outlook 2025 to 2035

Aluminum-Free Food Pouch Market Size and Share Forecast Outlook 2025 to 2035

Aluminum-Nickel Catalyst Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Frame Monitors Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Composite Materials Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Coated Thermal Protective Clothing Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Alloys Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Sheets and Coils Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Containers Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Aerosol Cans Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Extrusion Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Hydroxide Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA