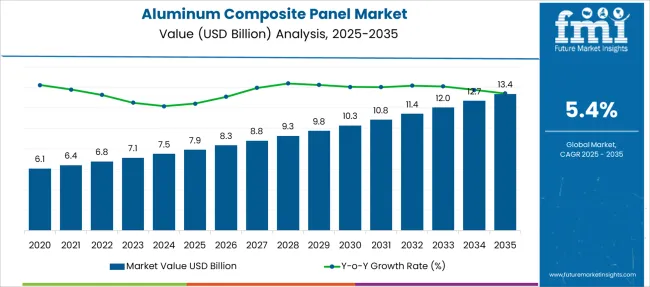

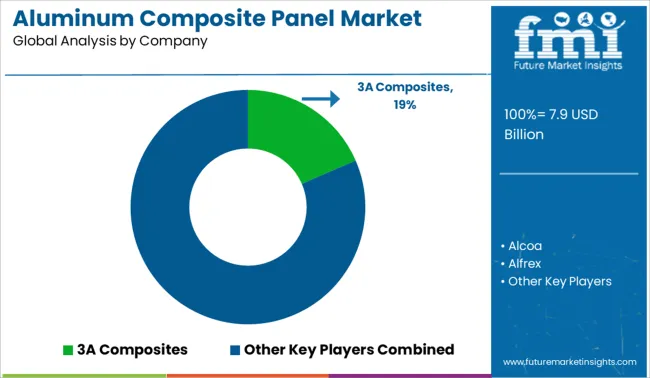

The Aluminum Composite Panel Market is estimated to be valued at USD 7.9 billion in 2025 and is projected to reach USD 13.4 billion by 2035, registering a compound annual growth rate (CAGR) of 5.4% over the forecast period.

| Metric | Value |

|---|---|

| Aluminum Composite Panel Market Estimated Value in (2025 E) | USD 7.9 billion |

| Aluminum Composite Panel Market Forecast Value in (2035 F) | USD 13.4 billion |

| Forecast CAGR (2025 to 2035) | 5.4% |

The aluminum composite panel market is experiencing robust growth driven by increased demand for durable and lightweight building materials. Urbanization and infrastructure development projects worldwide have pushed the adoption of panels that offer enhanced fire safety and aesthetic flexibility. Innovations in coating technologies have improved the performance and lifespan of aluminum composite panels, making them more resistant to environmental factors.

The rise in green building initiatives and stringent fire safety regulations has further accelerated market expansion. Growing investments in commercial and residential construction, particularly in exterior cladding applications, have fueled demand.

The market is expected to continue growing as architects and builders prioritize materials that combine safety, design versatility, and sustainability. Segment growth is anticipated to be led by fire retardant panel types, polyvinylidene difluoride coatings, and exterior applications due to their superior protection and durability.

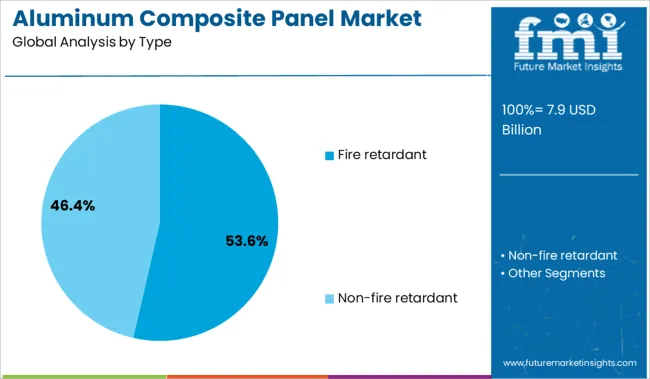

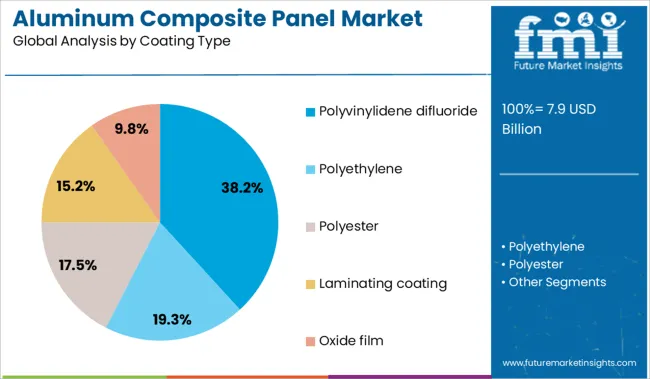

The market is segmented by Type, Coating Type, Application, End Use Industry, and Distribution Channel and region. By Type, the market is divided into Fire retardant and Non-fire retardant. In terms of Coating Type, the market is classified into Polyvinylidene difluoride, Polyethylene, Polyester, Laminating coating, and Oxide film.

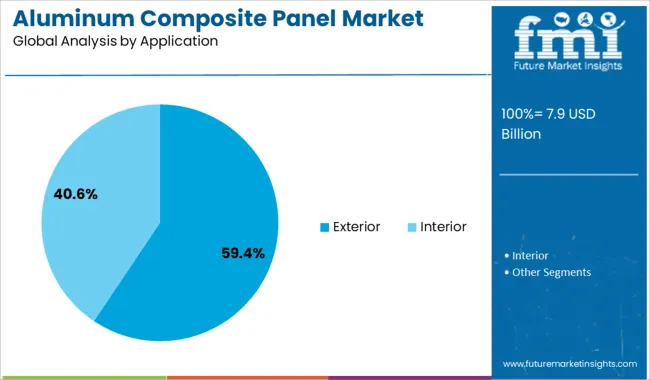

Based on Application, the market is segmented into Exterior and Interior. By End Use Industry, the market is divided into Construction, Transportation, Advertising, and Others. By Distribution Channel, the market is segmented into Direct sales and Indirect sales. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The fire retardant segment is expected to hold 53.6% of the aluminum composite panel market revenue in 2025, making it the leading type category. This segment has grown because of increasing concerns over building safety and the enforcement of stricter fire codes globally. Fire retardant panels provide critical protection by reducing the risk of fire spread, which has become a key requirement for modern construction.

Their ability to meet safety standards without compromising design flexibility has made them the preferred choice for architects and contractors.

As awareness of fire hazards rises and regulations tighten, the demand for fire retardant aluminum composite panels is anticipated to remain strong.

The polyvinylidene difluoride coating segment is projected to contribute 38.2% of the market revenue in 2025, securing its position as the dominant coating type. This coating is favored for its excellent weather resistance, color retention, and durability against UV exposure. These properties make it especially suitable for exterior applications where panels face harsh environmental conditions.

The coating’s low maintenance requirements and aesthetic appeal have encouraged widespread adoption in commercial and residential projects.

Continued improvements in coating formulations are expected to further enhance performance, sustaining the segment’s growth.

The exterior application segment is forecasted to hold 59.4% of the aluminum composite panel market revenue in 2025, establishing it as the largest application area. The demand for panels in exterior cladding has been driven by their ability to provide weather protection, energy efficiency, and architectural aesthetics. Construction of commercial buildings, residential complexes, and public infrastructure has increasingly relied on aluminum composite panels for their lightweight and durable qualities.

The segment benefits from urban development trends and the growing emphasis on sustainable building materials.

As building codes and design preferences evolve, the exterior application is expected to remain the key driver for market growth.

The aluminum composite panel market has gained importance as construction projects demand lightweight, rigid, and aesthetically adaptable cladding materials. Applications have expanded into both exterior and interior architectural domains, as ACPs offer thermal insulation, design versatility, and cost-efficiency over conventional facades. Fire-safety compliance, customization in surface finishes, and corrosion resistance have become key purchasing factors. The inconsistencies in regulatory adoption and cost inflation in aluminum pricing present challenges across procurement cycles.

Stricter building safety codes have compelled developers and contractors to adopt fire-rated ACPs. Modified cores such as mineral-filled or non-combustible variants are now replacing polyethylene-based cores in high-rise applications. Compliance with smoke and flame spread norms has become non-negotiable, leading to the demand for third-party certified systems. ACP manufacturers have responded by investing in advanced production lines, fire-testing labs, and region-specific certifications. Projects that prioritize public safety, including airports, hospitals, and educational buildings, have begun specifying fire-rated ACPs as standard. The result is a narrowing of the market toward compliant products, sidelining generic variants lacking structural safety data.

Demand for design flexibility in modern architecture has created strong interest in ACPs with customized finishes. Panels with wood, stone, or brushed metallic textures are being specified to mimic premium materials while maintaining low structural load. Large-format digital printing capabilities enable unique facade identities, especially for retail chains and institutional buildings. These custom panels also reduce the need for external decorative layers, simplifying construction timelines. Suppliers offering versatile finishing lines, weather-resistant coatings, and extended color durability have become favored partners among architects. Firms integrating design support with material supply are increasingly influencing specification decisions at the early design stage.

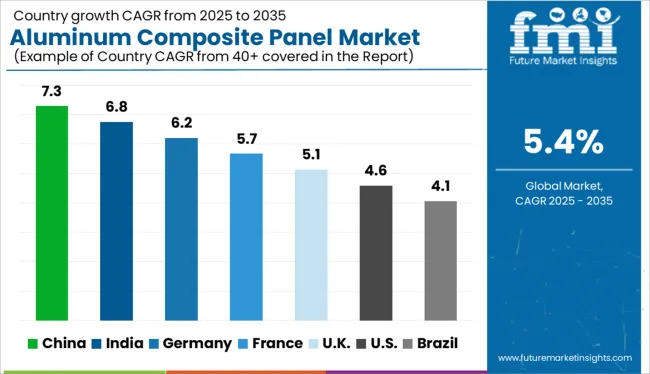

| Country | CAGR |

|---|---|

| India | 6.8% |

| Germany | 6.2% |

| France | 5.7% |

| UK | 5.1% |

| USA | 4.6% |

| Brazil | 4.1% |

Global aluminum composite panel (ACP) demand is rising at a CAGR of 5.4% from 2025 to 2035, with country-level differences reflecting building code reforms, coating technology adoption, and regional construction cycles. China leads at 7.3%, nearly two points above the global average, driven by domestic real estate recovery, infrastructure-led retrofitting, and exports of fire-rated panels to ASEAN and Africa. India follows at 6.8%, backed by metro rail expansions, smart city projects, and private housing developments where PVDF-coated ACPs are increasingly specified. Germany, at 6.2%, outpaces the global benchmark with demand focused on ventilated façade systems and fire-resistant cladding for non-residential segments. Local suppliers are integrating nano-coating capabilities to meet evolving EU fire safety norms. France, tracking at 5.7%, maintains momentum through government retrofit incentives and school infrastructure upgrades. The United Kingdom posts 5.1%, slightly below global pace, where regulatory tightening post-Grenfell has raised compliance costs and extended project timelines. The report covers detailed analysis of 40+ countries and the top five countries have been shared as a reference.

Demand for aluminum composite panel in China is expanding at a 7.3% CAGR through 2035, underscored by its dominance in infrastructure and facade projects. Domestic suppliers have maintained cost leadership in both fire-rated and PE core variants, supporting large-scale adoption in commercial and transit spaces. Rapid metro expansion and real estate consolidation drive consistent demand. Compared to EU nations, China exhibits broader spectrum usage across public utilities, interior décor, and advertising segments.

The aluminum composite panel market in India is growing at 6.8% CAGR, driven by residential mid-rise construction and cost-efficient cladding solutions. Make-in-India policies have enabled indigenous brands to gain prominence in Tier 2–3 city developments. Fire-resistant ACPs have seen rising traction due to updated building norms post safety incidents. Compared to China’s export-oriented model, India’s market is fueled primarily by urban spread and regulatory-driven retrofits.

Germany is projected to grow at a 6.2% CAGR in aluminum composite panel consumption, supported by its precision-oriented construction practices and sustainability directives. EU directives for recyclable facade systems have favored ACPs with PVDF coating and LDPE alternatives. Germany’s renovation-centric market contrasts with India’s new-build demand, focusing on thermal insulation and energy efficiency certifications.

Sales for aluminum composite panels in France are advancing at a 5.7% CAGR, with strong adoption in public buildings and cultural infrastructure. Paris’s historical facade guidelines limit ACP use in certain zones, yet suburban expansion fuels steady demand. Fire-retardant and mineral core panels are increasingly preferred amid compliance with Euroclass standards. Compared to Germany, France exhibits more selective adoption led by safety and design aesthetics.

Demand for aluminum composite panels in the United Kingdom is growing at a 5.1% CAGR, shaped by post-Grenfell regulatory shifts and retrofitting programs. Use of polyethylene-core ACPs has sharply declined, replaced by A2-s1-d0 classified fire-resistant alternatives. The market is dominated by demand from schools, public housing, and healthcare buildings undergoing exterior upgrades. Compared to France, the UK landscape is heavily compliance-driven and centralized in public sector procurement.

The aluminum composite panel industry is shaped by material innovation, brand positioning, and regional manufacturing expansions. 3A Composites and Mitsubishi Chemical Corporation lead with diversified portfolios across architecture, transport, and signage. Alpolic Materials and Alfrex focus on fire-retardant solutions, meeting global façade safety norms. Viva ACP and Alstrong have strengthened presence in South Asia with local production. Yaret and Alucopanel are aggressively expanding across Middle East and Africa. Companies like Alumax and Alumanate compete on cost-effective cladding solutions, while Alcoa leverages upstream aluminum expertise. Stacbond and Vanco target architectural design flexibility and sustainability certifications. Strategic investments in weather-resistant coatings, color durability, and recycling capabilities continue to intensify competition, especially among Asian and European players offering region-specific customization and supply chain resilience.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.9 Billion |

| Type | Fire retardant and Non-fire retardant |

| Coating Type | Polyvinylidene difluoride, Polyethylene, Polyester, Laminating coating, and Oxide film |

| Application | Exterior and Interior |

| End Use Industry | Construction, Transportation, Advertising, and Others |

| Distribution Channel | Direct sales and Indirect sales |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | 3A Composites, Alcoa, Alfrex, Alpolic Materials, Alstrong, Alucopanel, Alumanate, Alumax Industrial, Alumaze, Alutec, Mitsubishi Chemical Corporation, Stacbond, Vanco, Viva ACP, and Yaret |

| Additional Attributes | Dollar sales by panel type and core material, demand growth in fire-retardant and anti-bacterial ACP variants, adoption in commercial façades and transport interiors, expansion of PVDF-coated and nano-treated surfaces, regulatory shifts influencing non-combustible material usage, retrofitting momentum in high-rise and public infrastructure projects across Asia and Europe |

The global aluminum composite panel market is estimated to be valued at USD 7.9 billion in 2025.

The market size for the aluminum composite panel market is projected to reach USD 13.4 billion by 2035.

The aluminum composite panel market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in aluminum composite panel market are fire retardant and non-fire retardant.

In terms of coating type, polyvinylidene difluoride segment to command 38.2% share in the aluminum composite panel market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aluminum Alloy Sacrificial Anode Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foam Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Cap & Closure Market Forecast and Outlook 2025 to 2035

Aluminum Casing of the Blade Battery Market Size and Share Forecast Outlook 2025 to 2035

Aluminum ROPP Closure Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Cans Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Packaging Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Pouches Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Peel-Off Ends Maker Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Tape Market Size and Share Forecast Outlook 2025 to 2035

Aluminum-Free Food Pouch Market Size and Share Forecast Outlook 2025 to 2035

Aluminum-Nickel Catalyst Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Frame Monitors Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Coated Thermal Protective Clothing Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Flat Products Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Alloys Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Sheets and Coils Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Containers Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Aerosol Cans Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Extrusion Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA