The Aluminum Cladding Market is estimated to be valued at USD 60.3 billion in 2025 and is projected to reach USD 116.5 billion by 2035, registering a compound annual growth rate (CAGR) of 6.8% over the forecast period. A Half-Decade Weighted Growth analysis highlights strong expansion over the forecast period. Between 2025 and 2030, the market grows from USD 60.3 billion to USD 83.8 billion, contributing USD 23.5 billion in growth, with a CAGR of 6.7%. This initial growth is driven by increasing demand for aluminum cladding in the construction and building sectors, supported by its durability, aesthetic appeal, and energy-efficient properties. As urbanization continues to rise, both residential and commercial buildings require efficient materials, and aluminum cladding offers a sustainable, cost-effective solution.

From 2030 to 2035, the market continues to expand from USD 83.8 billion to USD 116.5 billion, adding USD 32.7 billion in growth, with a higher CAGR of 7.2%. This later-phase acceleration is attributed to innovations in aluminum cladding technology, increased adoption in green building projects, and the global push towards energy-efficient buildings. As demand increases for sustainable construction materials, aluminum cladding is favored for its recyclability, strength, and thermal efficiency. The weighted growth analysis suggests a consistent and robust upward trajectory, with a notable acceleration in the latter half of the forecast period due to industry trends toward more energy-efficient and sustainable building solutions.

| Metric | Value |

|---|---|

| Aluminum Cladding Market Estimated Value in (2025 E) | USD 60.3 billion |

| Aluminum Cladding Market Forecast Value in (2035 F) | USD 116.5 billion |

| Forecast CAGR (2025 to 2035) | 6.8% |

The ongoing urbanization across emerging economies, combined with rising investments in smart cities and infrastructure modernization, has reinforced demand for materials that offer both functional and aesthetic value.

Aluminum cladding is being preferred for its corrosion resistance, energy efficiency, recyclability, and ability to support modern design needs across residential, commercial, and industrial buildings. Additionally, the material’s compatibility with fire-rated applications and acoustic insulation standards has positioned it as a preferred choice in safety-conscious architectural planning.

The shift towards sustainable construction, influenced by green building certifications and environmental mandates, is accelerating the use of recyclable cladding products such as aluminum composite panels. Over the forecast period, product innovation focused on weather resistance, easy installation, and thermal insulation is expected to propel market expansion, supported by public and private sector investments in green infrastructure and high-performance construction materials.

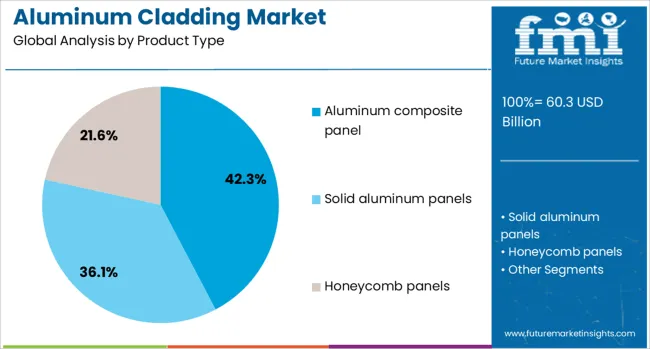

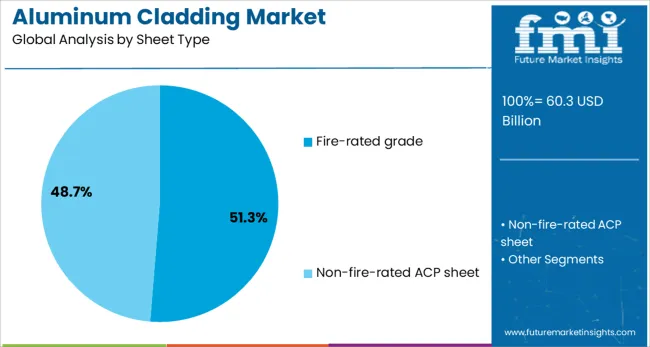

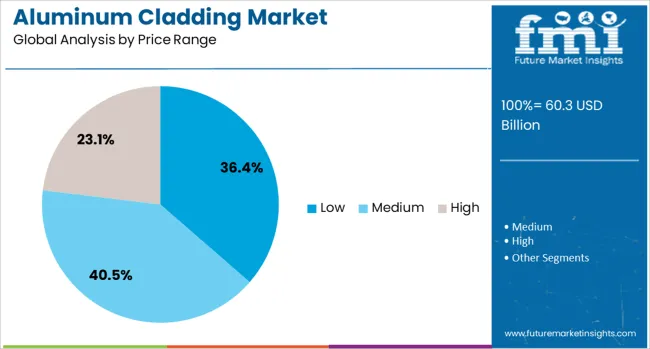

The aluminum cladding market is segmented by product type, sheet type, price range, category, application, end use, and geographic regions. By product type, the aluminum cladding market is divided into Aluminum composite panels, Solid aluminum panels, and honeycomb panels. In terms of sheet type, the aluminum cladding market is classified into Fire-rated grade and Non-fire-rated ACP sheets. Based on the price range, the aluminum cladding market is segmented into Low, Medium, and High. The aluminum cladding market is segmented into New construction and replacement. The aluminum cladding market is segmented into exterior and interior applications. The end use of the aluminum cladding market is segmented into Commercial, Industrial, and Residential. Regionally, the aluminum cladding industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The aluminum composite panel product type is anticipated to capture 42.3% of the aluminum cladding market revenue share in 2025, marking it as the leading product category. This dominance is supported by its excellent strength-to-weight ratio, flexibility in design, and availability in a wide range of finishes that cater to both aesthetic and structural requirements.

The product’s ability to integrate seamlessly into both interior and exterior applications has made it a favored choice for curtain wall facades, signage, and modern architectural finishes. Its layered construction provides superior thermal insulation, noise reduction, and enhanced impact resistance, all while maintaining a sleek appearance.

Furthermore, ease of fabrication and installation has contributed to reduced project timelines and labor costs, strengthening its position in large-scale construction activities. The growing emphasis on sustainable and low-maintenance materials in building projects has further accelerated the adoption of aluminum composite panels, particularly in projects where cost efficiency and durability are critical.

The fire-rated grade sheet type is expected to account for 51.3% of the aluminum cladding market revenue share in 2025, reflecting increasing regulatory pressure for fire safety compliance in construction. Enhanced awareness of building fire hazards and stricter enforcement of fire-resistant material usage have influenced architects and developers to prioritize fire-rated aluminum sheets.

These sheets provide critical flame retardancy without compromising structural integrity or aesthetic flexibility, making them suitable for both low-rise and high-rise applications. Their ability to contain fire spread and emit low smoke density during combustion has become a deciding factor in public buildings, transport hubs, and high-density residential developments.

Technological advancements in mineral core compositions and thermal barrier integration have improved fire performance ratings, allowing manufacturers to meet evolving international standards. As safety-oriented regulations continue to evolve, demand for fire-rated aluminum cladding is projected to remain high, especially in markets focusing on infrastructure safety, building codes compliance, and disaster-resilient urban planning.

The low price range segment is projected to hold 36.4% of the aluminum cladding market revenue share in 2025, driven by increasing construction activity in cost-sensitive regions and the demand for budget-friendly façade solutions. Developers working on mid-scale and affordable housing projects have shown a strong preference for low-priced aluminum cladding due to its ability to deliver essential performance features at reduced costs.

The availability of economically manufactured panels that still maintain acceptable standards of weather resistance, aesthetics, and basic durability has enabled rapid penetration across developing markets. In addition, the low maintenance requirements and long service life of aluminum cladding have contributed to its popularity in infrastructure development, where lifecycle cost is a critical factor.

Manufacturers have increasingly focused on cost optimization and material innovation to cater to this segment, providing value-engineered cladding options that support energy efficiency and modern design without exceeding budgetary constraints. This price tier is expected to play a pivotal role in mass-market applications and expanding urban housing initiatives.

The aluminum cladding market is witnessing growth as construction industries increasingly adopt aluminum as a material for building facades due to its durability, aesthetic appeal, and environmental benefits. Aluminum cladding is favored for its lightweight properties, resistance to corrosion, and low maintenance requirements. It is commonly used in commercial, residential, and industrial applications to enhance building aesthetics and energy efficiency. Despite challenges such as high production costs and competition from other materials, opportunities exist in the growing demand for energy-efficient buildings and the use of aluminum cladding in green building projects.

The aluminum cladding market is primarily driven by the demand for durable and aesthetically pleasing building materials. Aluminum’s lightweight, corrosion-resistant properties make it an ideal choice for facades, offering long-term protection for buildings in varying weather conditions. In addition to its durability, aluminum cladding provides a modern and attractive appearance, making it highly sought after for both residential and commercial buildings. As urbanization and infrastructure development continue to rise globally, particularly in emerging markets, the demand for aluminum cladding in new construction projects is also increasing, driving market growth.

One of the main challenges in the aluminum cladding market is the high production cost associated with aluminum. The cost of raw materials, such as bauxite and energy-intensive production processes, can lead to higher prices for aluminum cladding compared to other materials like vinyl or wood. Additionally, competition from alternative cladding materials, such as composite panels, steel, and stone, which offer similar durability and aesthetic benefits at a lower cost, poses a challenge for the growth of the aluminum cladding market. Overcoming these cost-related challenges while maintaining the quality and performance of aluminum cladding is crucial for market players.

The aluminum cladding market presents significant opportunities driven by the growing trend toward energy-efficient and environmentally conscious construction practices. Aluminum cladding plays a vital role in energy-efficient buildings, as it enhances insulation, reduces heat transfer, and helps regulate indoor temperatures. As governments and organizations introduce stricter energy efficiency standards, the demand for aluminum cladding in green building projects is expected to increase. Additionally, advancements in aluminum production technologies, which are helping reduce environmental impact and costs, offer opportunities for manufacturers to provide more affordable, eco-friendly cladding solutions, further boosting market demand.

A key trend in the aluminum cladding market is the increasing use of aluminum in sustainable and smart building designs. As buildings become more energy-efficient and environmentally friendly, aluminum cladding is gaining popularity due to its ability to provide superior thermal insulation and resistance to environmental factors. The integration of smart technologies in buildings, such as automated climate control and energy management systems, is also driving the demand for aluminum cladding, as it complements modern architectural designs. Furthermore, innovations in aluminum coatings, which offer improved durability, UV resistance, and aesthetic flexibility, are enhancing the appeal of aluminum cladding in the construction industry.

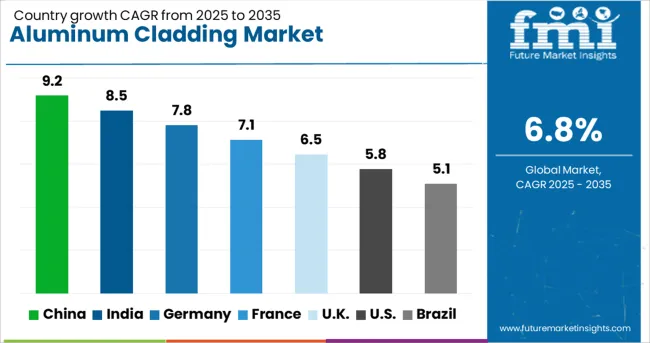

| Country | CAGR |

|---|---|

| China | 9.2% |

| India | 8.5% |

| Germany | 7.8% |

| France | 7.1% |

| UK | 6.5% |

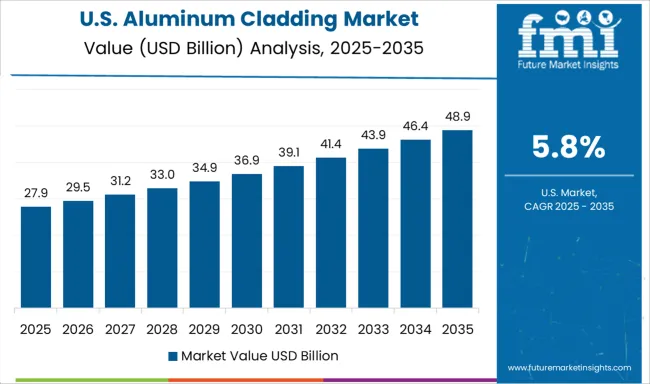

| USA | 5.8% |

| Brazil | 5.1% |

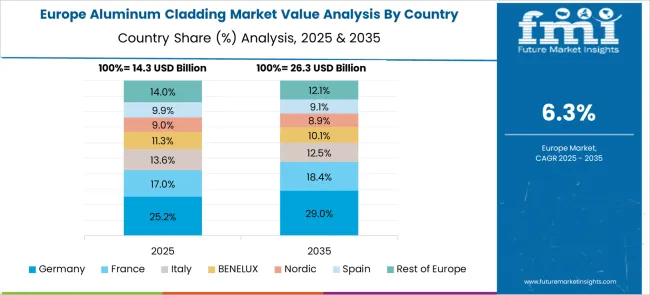

The aluminium cladding market is projected to grow steadily, with significant contributions from China, India, and developed markets like France, the UK, and the USA China leads the market with a growth rate of 9.2%, followed by India at 8.5%, and France at 7.1%. The UK is expected to grow at 6.5%, while the USA shows a growth rate of 5.8%. The demand in China and India is driven by rapid infrastructure development and the need for energy-efficient building solutions, while in mature markets like France, the UK, and the USA, growth is fueled by sustainability regulations and architectural demand for durable, lightweight cladding materials. The analysis spans over 40 countries, with the leading markets shown below.

China is projected to grow at a CAGR of 9.2% through 2035 in the aluminium cladding market, driven by rapid urbanization, booming construction activity, and increasing demand for energy-efficient buildings. The country’s growing demand for modern architectural designs, combined with the expansion of both commercial and residential infrastructure, continues to fuel market growth. Additionally, China's focus on green building standards and the use of sustainable construction materials contributes to the adoption of aluminium cladding, which offers superior durability, energy efficiency, and aesthetic appeal. As China's construction sector continues to expand, particularly in urban areas, the market for aluminium cladding is expected to rise significantly.

India is expected to grow at a CAGR of 8.5% through 2035 in the aluminium cladding market. The increasing focus on urban development, coupled with the demand for modern and energy-efficient buildings, is driving the growth of aluminium cladding. With the rise in construction activity across residential, commercial, and industrial sectors, India is witnessing increased adoption of aluminium cladding due to its versatility, aesthetic appeal, and weather-resistant properties. As India seeks to enhance infrastructure to support its growing population and urban centers, the demand for durable, cost-effective, and environmentally friendly cladding solutions continues to rise.

France is projected to grow at a CAGR of 7.1% through 2035 in the aluminium cladding market. The country’s strong focus on green buildings and energy-efficient construction is a significant driver for the adoption of aluminium cladding. As French regulations become more stringent regarding energy consumption and sustainability in construction, aluminium cladding has emerged as a preferred solution for new buildings and refurbishments. Furthermore, as France’s architectural styles evolve, the demand for lightweight, durable, and aesthetically pleasing cladding materials has been increasing. Aluminium’s versatility and cost-effectiveness make it an ideal choice for both commercial and residential projects in France.

The UK is expected to grow at a CAGR of 6.5% through 2035 in the aluminium cladding market. Driven by the growing demand for sustainable and aesthetically pleasing construction materials, the UK is witnessing a surge in the use of aluminium cladding. The country’s regulatory environment, with increasing focus on energy-efficient building standards and sustainability in construction, supports the adoption of aluminium cladding. The versatility of aluminium cladding, combined with its ability to offer weather protection and visual appeal, makes it an ideal solution for modern buildings. With the rise in both residential and commercial construction projects, the demand for aluminium cladding is expected to grow steadily in the UK

The USA is projected to grow at a CAGR of 5.8% through 2035 in the aluminium cladding market, driven by increasing construction activities, modernization of infrastructure, and a shift towards energy-efficient and sustainable building materials. With the USA leading in technological advancements and building innovations, the demand for aluminium cladding is rising in both new constructions and refurbishments. Aluminium’s lightweight, durable, and aesthetically pleasing properties make it a popular choice for a wide range of applications. As USA regulations on building efficiency become stricter, the adoption of materials like aluminium cladding that contribute to energy savings and sustainability is set to increase.

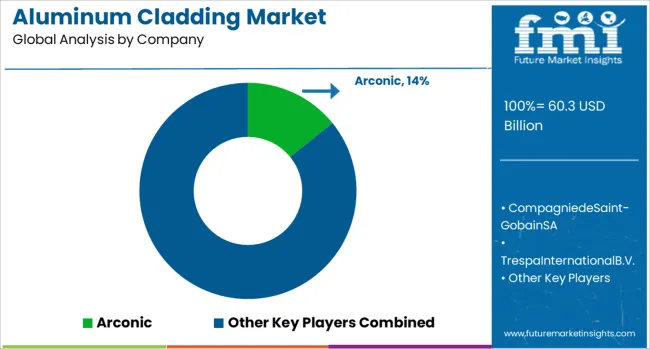

The aluminum cladding space is characterized by a blend of entrenched global leaders, regionally strong innovators, and agile niche players. Alcoa Corporation, Hydro Aluminium, and Novelis dominate through comprehensive alloy portfolios, global supply chains, and partnerships with large-scale construction projects. Constellium and Arconic focus on high-strength panels and customized façades that cater to commercial and industrial infrastructure, using proprietary surface treatments to enhance durability and design appeal. Kingspan Group, Tata BlueScope Steel, and Alubond focus on integrated façade systems, offering pre-finished and coated panels specifically designed for energy-efficient buildings. Emerging players, including Simec Group and Morin, target mid-tier construction, offering cost-optimized panels, modular systems, and retrofit solutions.

Historically, differentiation was anchored on alloy quality, panel strength, and corrosion resistance. In the forecast period, companies are pivoting toward rapid-installation systems, energy-reflective coatings, and smart façade integrations to support green building benchmarks. Expansion strategies involve greenfield production facilities in high-growth regions, localized partnerships with contractors, and vertical integration with suppliers of paints and adhesives. Strategic collaborations with architects and design firms provide an edge in specification-driven projects, while acquisitions of specialized coating or modular panel companies are leveraged to accelerate technological adoption.

| Item | Value |

|---|---|

| Quantitative Units | USD 60.3 Billion |

| Product Type | Aluminum composite panel, Solid aluminum panels, and Honeycomb panels |

| Sheet Type | Fire-rated grade and Non-fire-rated ACP sheet |

| Price Range | Low, Medium, and High |

| Category | New construction and Replacement |

| Application | Exterior and Interior |

| End Use | Commercial, Industrial, and Residential |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Arconic, CompagniedeSaint-GobainSA, TrespaInternationalB.V., DowDuPont, TataSteelLtd, CembritHoldingAS, BoralLimited, EtexGroup, Centria, and CladdingCorp |

| Additional Attributes | Dollar sales by cladding type (aluminum composite panels, aluminum sheets, metal cladding) and end-use segments (residential, commercial, industrial, infrastructure). Demand dynamics are driven by the increasing adoption of energy-efficient construction solutions, rising urbanization, and the growing focus on building aesthetics. Regional trends show strong growth in North America and Europe, driven by increasing demand for modern building designs, while Asia-Pacific is expanding rapidly due to infrastructure development and urban growth. |

The global aluminum cladding market is estimated to be valued at USD 60.3 billion in 2025.

The market size for the aluminum cladding market is projected to reach USD 116.5 billion by 2035.

The aluminum cladding market is expected to grow at a 6.8% CAGR between 2025 and 2035.

The key product types in aluminum cladding market are aluminum composite panel, solid aluminum panels and honeycomb panels.

In terms of sheet type, fire-rated grade segment to command 51.3% share in the aluminum cladding market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aluminum Alloy Sacrificial Anode Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foam Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Cap & Closure Market Forecast and Outlook 2025 to 2035

Aluminum Casing of the Blade Battery Market Size and Share Forecast Outlook 2025 to 2035

Aluminum ROPP Closure Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Cans Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Packaging Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Pouches Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Peel-Off Ends Maker Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Tape Market Size and Share Forecast Outlook 2025 to 2035

Aluminum-Free Food Pouch Market Size and Share Forecast Outlook 2025 to 2035

Aluminum-Nickel Catalyst Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Frame Monitors Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Composite Materials Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Coated Thermal Protective Clothing Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Flat Products Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Alloys Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Sheets and Coils Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Containers Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Aerosol Cans Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA