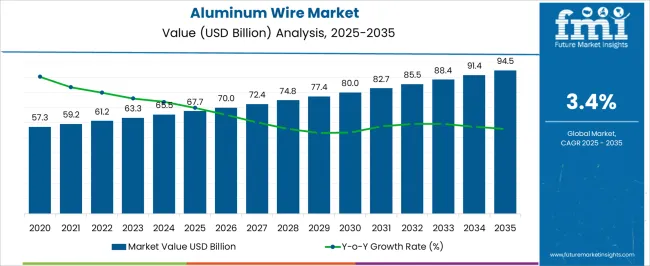

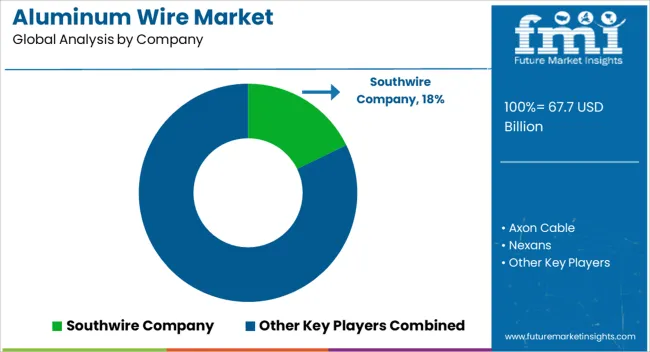

The global aluminum wire market is projected to grow from USD 67.7 billion in 2025 to USD 94.5 billion by 2035, reflecting a moderate CAGR of 3.4%. In the early adoption phase (2020–2024), the market experienced steady but slow growth, moving from USD 57.3 billion to around USD 65.5 billion. During this period, demand was driven primarily by conventional electrical transmission, construction, and automotive applications. Innovation focused on improving wire efficiency, conductivity, and corrosion resistance, while regional adoption varied based on industrial infrastructure and investment in energy and construction sectors. Market awareness increased gradually, but high competition and existing supply chains limited rapid expansion.

From 2025 to 2030, the market enters a scaling phase, with projected growth from USD 67.7 billion to roughly USD 77.4 billion. This period benefits from incremental technological improvements, broader use in renewable energy, and growing electrical infrastructure projects globally. Adoption accelerates in emerging markets, and aluminum’s advantages over copper, such as lower cost and lighter weight, enhance its appeal. Between 2030 and 2035, the market moves into consolidation, reaching USD 94.5 billion by 2035. Competitive pressures encourage mergers and partnerships, while standardization, supply chain optimization, and regulatory compliance define the mature market stage. The lifecycle highlights a transition from steady early adoption to gradual scaling and eventual consolidation in a mature, stable industry.

| Metric | Value |

|---|---|

| Aluminum Wire Market Estimated Value in (2025 E) | USD 67.7 billion |

| Aluminum Wire Market Forecast Value in (2035 F) | USD 94.5 billion |

| Forecast CAGR (2025 to 2035) | 3.4% |

The aluminum wire market is undergoing significant momentum, driven by the growing demand for lightweight, cost-effective, and energy-efficient conductive materials across industrial, electrical, and mobility applications. The rising emphasis on electrification, coupled with increased investments in energy infrastructure and automotive manufacturing, is expanding deployment across both domestic and export-focused manufacturing zones.

Additionally, the rising cost of copper has enhanced the appeal of aluminum as a competitive alternative in many winding and transmission applications. Regulatory shifts toward emission reduction and the scaling up of renewable energy infrastructure are also supporting broader adoption of aluminum wire.

As industries prioritize recyclability and sustainability, aluminum’s low carbon profile and high conductivity-to-weight ratio are reinforcing its long-term relevance in motors, transformers, and transmission systems.

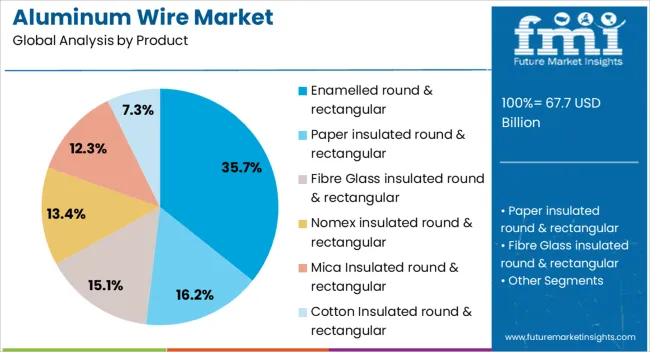

The aluminum wire market is segmented by product, end use, and geographic regions. By product, the market is divided into Enamelled round & rectangular, Paper insulated round & rectangular, Fibre Glass insulated round & rectangular, Nomex insulated round & rectangular, Mica Insulated round & rectangular, and Cotton Insulated round & rectangular. In terms of end use, the market is classified into Motors, rotating machines, Automotive, Circuit breakers, switches & meters, Home electrical appliances, Transformers, Shipping, and Others. Regionally, the aluminum wire industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Enamelled round & rectangular wire is anticipated to account for 35.70% of the total aluminum wire market revenue in 2025, making it the leading product category. This segment’s leadership is being driven by increasing demand from OEMs and electrical component manufacturers for magnet wire solutions that provide insulation, space efficiency, and high thermal endurance.

The widespread application of these wires in windings for motors, generators, and transformers has been supported by improvements in thermal class ratings and resistance to abrasion. Their form factor flexibility enables compact designs and optimized slot-filling in high-performance rotating machines.

Moreover, as production volumes of electric vehicles and industrial motors rise, the use of enamelled wires continues to expand due to their efficiency, manufacturability, and regulatory alignment with energy standards.

Motors and rotating machines are projected to contribute 29.40% of the aluminum wire market revenue in 2025, ranking it as the leading end-use segment. The segment’s dominance is being driven by the increased electrification of industrial systems and consumer appliances, where aluminum winding solutions are being adopted for improved efficiency and reduced weight.

Demand has also been amplified by the rising penetration of electric vehicles, HVAC systems, and industrial automation, all of which rely on efficient and cost-optimized motor components. Technological advancements in insulation coatings and heat dissipation have enhanced the performance of aluminum in high-speed and high-temperature motor applications.

The scalability and availability of aluminum wire have enabled cost control in large-volume motor manufacturing, ensuring long-term growth in both domestic and export-oriented production facilities.

The aluminum wire market is expanding as industries prioritize lightweight, corrosion-resistant, and cost-effective electrical conductors. Aluminum wire finds applications in power transmission, distribution lines, building wiring, automotive components, and renewable energy projects. Its lower density and competitive cost compared to copper make it attractive for large-scale energy networks. Adoption is supported by ongoing infrastructure projects in North America and Asia-Pacific, along with increasing industrial electrification. Manufacturers focus on alloy optimization, improved conductivity, and reliable supply chains to meet rising global demand.

Aluminum’s low density allows for reduced structural support requirements in overhead power lines and building installations. Its lightweight nature minimizes stress on supporting towers and reduces installation labor costs. Utilities increasingly prefer aluminum wire for high-voltage transmission due to easier handling during installation over long distances. Automotive and industrial applications also benefit from weight reduction, improving vehicle efficiency and lowering operational costs. This property, combined with competitive pricing, makes aluminum wire a preferred alternative to heavier copper conductors, especially for large-scale energy distribution networks.

Aluminum wire offers high resistance to environmental degradation, including oxidation, moisture exposure, and temperature fluctuations. This makes it suitable for both indoor and outdoor installations, reducing maintenance and replacement requirements. Coastal regions and industrial sites, where corrosion risk is high, particularly benefit from aluminum conductors. Enhanced durability ensures consistent electrical performance over extended service life. Manufacturers increasingly develop alloyed and coated aluminum wires to further improve resistance to chemical and atmospheric conditions, providing confidence to utilities, construction firms, and industrial clients relying on long-term operational reliability.

Expanding electricity grids, renewable energy installations, and urban construction projects are boosting aluminum wire consumption. Rising industrialization in Asia-Pacific, coupled with government-backed energy distribution projects, supports high demand. Power utilities are transitioning from copper to aluminum for overhead lines due to cost efficiency and scalability. Additionally, the need for robust wiring solutions in smart grids and renewable installations, such as solar and wind farms, further increases market potential. Aluminum wire’s adaptability to various applications makes it a critical component for ongoing global energy expansion and modernization efforts.

Aluminum wire’s affordability compared to copper reduces upfront project costs for utilities, commercial buildings, and industrial facilities. Lower raw material and transportation costs make it ideal for large-scale deployments in transmission lines, substations, and industrial wiring. Bulk production capabilities and widespread availability of aluminum ensure consistent supply, supporting competitive pricing. Cost benefits, combined with adequate performance characteristics, make it a preferred choice for budget-conscious projects seeking reliable electrical conduction without sacrificing efficiency. This advantage encourages wider adoption in both developed and emerging markets worldwide.

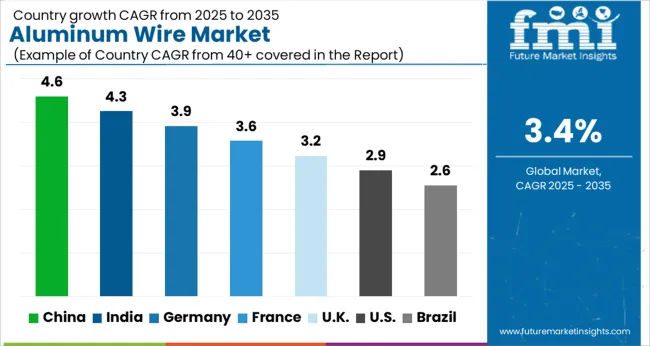

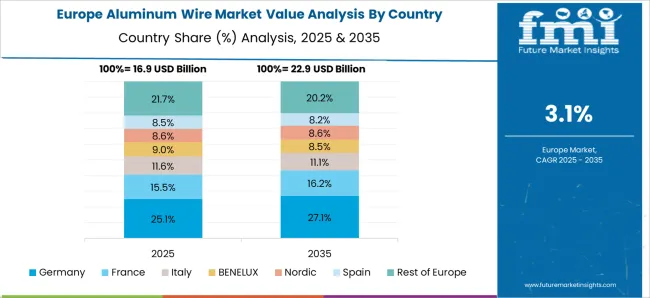

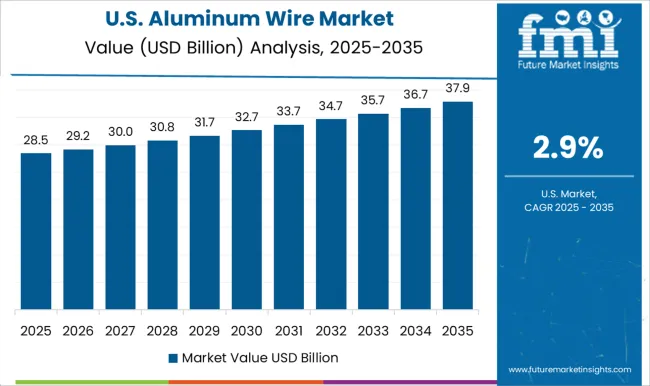

The global aluminum wire market is projected to grow at a CAGR of 3.4%, driven by demand in electrical, construction, and industrial applications. China leads the market with a 4.6% growth rate, supported by large-scale infrastructure and industrial projects. India follows at 4.3%, driven by expansion in urban construction and electrical distribution networks. Germany shows steady growth at 3.9%, leveraging advanced manufacturing and industrial demand. The UK and USA record moderate growth rates of 3.2% and 2.9%, respectively, reflecting stable demand in residential and commercial sectors. This report includes insights on 40+ countries; the top countries are shown here for reference.

China leads the aluminum wire market with a 4.6% growth rate, supported by rapid industrialization and strong construction activities. The country’s extensive power transmission and distribution projects drive significant demand for high-quality aluminum wires. Compared to India, China benefits from advanced manufacturing facilities, greater technological adoption, and stronger domestic supply chains, ensuring consistent product availability. Investments in infrastructure, including smart grids and renewable energy projects, further boost market growth. Rising demand from automotive, electronics, and industrial sectors also supports expansion. Environmental regulations encourage manufacturers to adopt energy-efficient production processes, improving product quality and reliability. With ongoing urbanization and government-backed development initiatives, China is positioned as a major hub for aluminum wire manufacturing and export. Continuous research in lightweight and corrosion-resistant materials strengthens market competitiveness.

Aluminum wire market in Germany grows steadily at 3.9%, driven by industrial automation, renewable energy, and infrastructure modernization. Compared to the UK, Germany emphasizes high-quality, energy-efficient production standards, meeting strict European Union regulations. The country’s focus on sustainability and long-term durability promotes demand for lightweight, corrosion-resistant aluminum wires. Renewable energy projects, including wind and solar power, contribute significantly to consumption. German manufacturers invest heavily in research to enhance wire conductivity and reduce material waste. Industrial applications, including automotive and electronics sectors, maintain steady demand, while exports to neighboring European countries strengthen market resilience. Though growth is moderate compared to China and India, Germany’s combination of high-quality standards, technological expertise, and innovation ensures a reliable and sustainable market. The focus on environmental compliance and long-term efficiency positions Germany as a key player in Europe’s aluminum wire industry.

The UK aluminum wire market grows at 3.2%, supported by industrial infrastructure upgrades, energy projects, and urban development. Compared to the USA, the UK focuses on energy-efficient and high-quality production to comply with stringent environmental and safety regulations. Rising construction and electrical infrastructure projects increase demand for lightweight, corrosion-resistant aluminum wires. Manufacturers invest in technology to improve production efficiency and ensure product reliability. The renewable energy sector, particularly wind and solar projects, contributes to market growth. Export opportunities within Europe and collaborations with industrial partners further support the market. Despite moderate growth compared to China and India, the UK emphasis on quality, sustainability, and technological improvements ensures steady adoption and reliable long-term market prospects.

The USA aluminum wire market grows at 2.9%, driven by power distribution modernization, industrial expansion, and renewable energy adoption. Compared to China, the USA market emphasizes quality, safety, and environmental compliance over rapid expansion. Investments in smart grids, solar, and wind energy projects drive demand for durable and high-performance aluminum wires. Industrial sectors, including automotive and electronics, maintain steady consumption. Manufacturers increasingly adopt lightweight and corrosion-resistant wire technologies to improve efficiency and longevity. Export demand remains moderate but contributes to market stability. Regulatory requirements and sustainability initiatives shape production processes, ensuring compliance with environmental standards. Although growth is slower than Asian markets, continuous investment in technology and infrastructure supports long-term adoption, positioning the USA as a stable and reliable market for aluminum wires.

Specialized positioning is being used in the aluminum wire sector. Overhead conductor lines are being supported by a full range of AAC, ACSR, and ACSS cables. Lightweight all-aluminum conductors are being manufactured in large sizes to improve distribution efficiency and reduce sag under load. Vibration-resistant conductor designs are being produced with twisted-lay configurations to minimize galloping in ice-prone regions.

Sustainability is being integrated into product portfolios. Low-voltage cables with recycled aluminum content are being produced using low-carbon processes, targeted at photovoltaic projects and distribution networks. Medium-voltage cables with aluminum cores and advanced insulation are being positioned for utilities modernizing grids. Large-scale recycling initiatives are being launched, with thousands of tons of cable being reused annually and significant reductions in carbon emissions being reported.

The competitive ecosystem is being shaped by technical specialization and green innovation, aligning aluminum wire with infrastructure expansion and environmental imperatives.

| Item | Value |

|---|---|

| Quantitative Units | USD 67.7 Billion |

| Product | Enamelled round & rectangular, Paper insulated round & rectangular, Fibre Glass insulated round & rectangular, Nomex insulated round & rectangular, Mica Insulated round & rectangular, and Cotton Insulated round & rectangular |

| End use | Motors, rotating machines, Automotive, Circuit breakers, switches & meters, Home electrical appliances, Transformers, Shipping, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Southwire Company, Axon Cable, Nexans, Superior Essex, Sam Dong, Norsk Hydro ASA, Kaiser Aluminum Corporation, General Cable, Rea Magnet Wires, Condumex, Inc., Novametal, Alconex, Classic Wire & Cable, and Priority Wire & Cable |

| Additional Attributes | Dollar sales in the aluminum wire market vary by type including bare, insulated, and stranded wires, application across power transmission, automotive, and construction sectors, and region covering North America, Europe, and Asia-Pacific. Growth is driven by increasing demand for lightweight, cost-effective electrical wiring, expanding power infrastructure, and rising adoption in automotive and industrial applications. |

The global aluminum wire market is estimated to be valued at USD 67.7 billion in 2025.

The market size for the aluminum wire market is projected to reach USD 94.5 billion by 2035.

The aluminum wire market is expected to grow at a 3.4% CAGR between 2025 and 2035.

The key product types in aluminum wire market are enamelled round & rectangular, paper insulated round & rectangular, fibre glass insulated round & rectangular, nomex insulated round & rectangular, mica insulated round & rectangular and cotton insulated round & rectangular.

In terms of end use, motors, rotating machines segment to command 29.4% share in the aluminum wire market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA