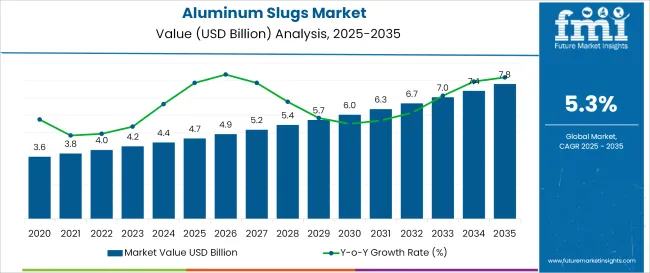

The global aluminum slugs market is valued at USD 4.7 billion in 2025 and is expected to reach USD 7.8 billion by 2035, registering a CAGR of 5.3%. Growth is fueled by increasing demand for lightweight, recyclable packaging solutions across food, cosmetics, and pharmaceutical industries.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 4.7 billion |

| Projected Value (2035F) | USD 7.8 billion |

| CAGR (2025 to 2035) | 5.3% |

Aluminum slugs are favored for their high thermal and electrical conductivity, corrosion resistance, and malleability. The aluminum slugs market accounts for approximately 6.5% of the global aluminum processing industry, driven by the rising demand for lightweight, durable, and recyclable materials across diverse end-use sectors.

In beverage packaging, it contributes around 8.3%, with extensive usage in producing aluminum cans and collapsible tubes for energy drinks, juices, and carbonated beverages. Within the cosmetics and personal care packaging sector, aluminum slugs hold a 5.7% share, owing to their premium appeal, protection against contamination, and compatibility with aerosols and cream dispensers.

Government regulations impacting the market focus on decarbonization, aluminum recycling, and circular manufacturing practices are shaping market trends, especially in developed economies. Policy mandates for lightweight and energy-efficient materials in automotive and consumer packaging are boosting the use of aluminum slugs.

Recent innovations include high-purity aluminum alloys for medical-grade applications, automated multi-die extrusion systems for higher throughput, and low-waste stamping techniques that reduce scrap ratios. Additionally, the growing emphasis on zero-waste packaging and the use of green electricity in aluminum production are positioning slugs as a critical element in sustainable manufacturing.

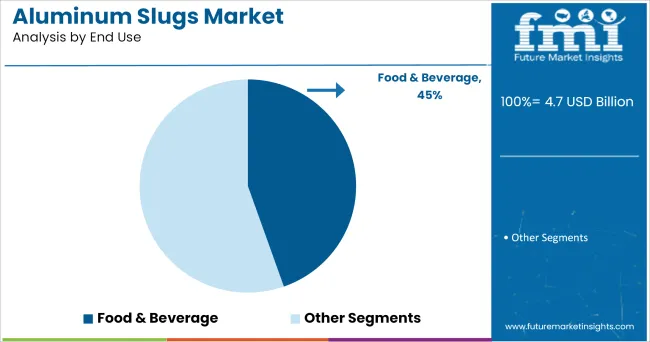

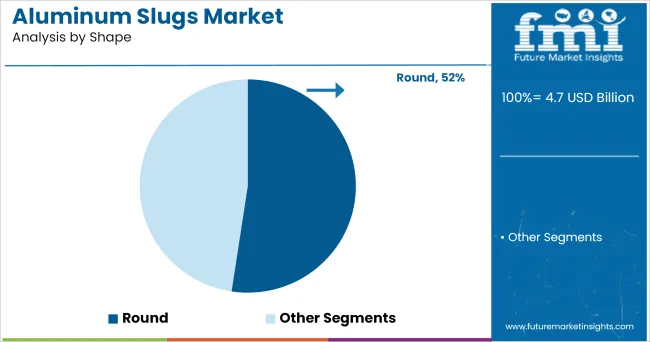

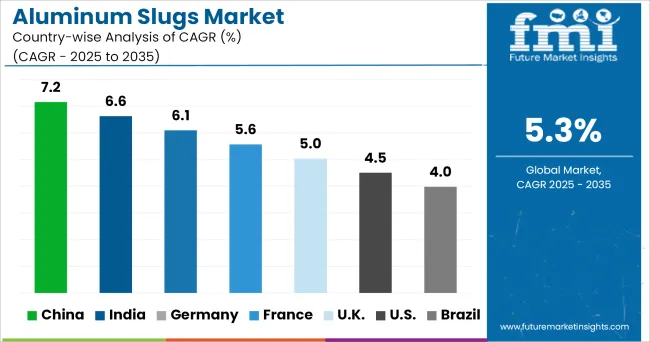

China is projected to be the fastest-growing market, expanding at a CAGR of 7.2% from 2025 to 2035. The aluminum slugs market is witnessing strong growth, with the food & beverages segment leading end-use demand at 45% in 2025. Round-shaped slugs dominate by shape, accounting for 52% of total consumption due to their compatibility with cans and tubes. While, India and Germany markets are also expected to grow at CAGRs of 6.6% and 6.1%, respectively.

The aluminum slugs market is segmented by source, application, end-use, and region. By shape, the market is segmented into round, flat, and rectangle. By application, the market is categorized into cans, bottles, and tubes. Based on end-use, the market includes food & beverages, pharmaceuticals, automotive, cosmetics & personal care, and other consumer goods. Regionally, the market is classified into North America, Latin America, Western Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, Middle East & Africa.

Food & beverage is expected to lead the end-use segment, accounting for 45% of the total market share in 2025. Slugs are widely used in beverage cans, collapsible tubes, and aerosol packaging, providing durability, hygiene, and resistance to corrosion. Aluminum’s recyclability also aligns with sustainability goals in the food industry.

Round aluminum slugs are projected to dominate the shape segment with a 52% share in 2025, primarily due to their use in manufacturing aerosol cans, beverage containers, and tubular packaging.

The global aluminum slugs market is witnessing steady growth, driven by rising demand for lightweight, corrosion-resistant, and recyclable metal components across packaging, automotive, and industrial sectors.

As sustainability and material efficiency become key priorities, manufacturers are increasingly adopting aluminum slugs for applications in beverage cans, aerosol sprays, pharmaceutical tubes, and heat exchangers. Their superior formability, conductivity, and compatibility with high-speed manufacturing lines make them an ideal choice. Additionally, the push toward circular economy practices is accelerating the shift toward eco-friendly, low-waste aluminum slug solutions.

Recent Trends in the Market

Key Challenges in the Market

The USA leads the aluminum slugs market, driven by extensive usage in beverage can manufacturing, pharmaceutical aerosols, and personal care packaging. Early adoption of recycled aluminum and smart packaging technologies enhances its position as a key producer and consumer. Germany and India are significant contributors, with Germany leveraging its advanced automotive and industrial manufacturing, while India benefits from rapid expansion in FMCG and healthcare packaging.

China and Brazil are emerging as global manufacturing hubs for aluminum slugs due to their strong metal processing capabilities, cost-effective production, and rising demand in packaging, automotive, and electronics. The Asia Pacific region is seeing accelerated adoption of aluminum slugs across food & beverage, pharma, and personal care sectors, supported by urbanization, sustainability initiatives, and growing demand for lightweight, recyclable packaging components.

The report covers an in-depth analysis of 40+ countries; with the five top-performing OECD nations highlighted below.

The China aluminum slugs market is projected to grow at a CAGR of 7.2% from 2025 to 2035. Growth is fueled by expanding demand in personal care packaging, household aerosols, and beverage cans. Regional manufacturers are investing in localized production facilities to cater to domestic and Latin American demand.

India’s aluminum slugs market is expected to grow at a CAGR of 6.6% during the forecast period, driven by booming fast-moving consumer goods (FMCG), pharmaceuticals, and automotive industries. Increasing demand for collapsible tubes, ointment containers, and lightweight auto parts supports strong consumption.

Germany’s aluminum slugs market is forecast to grow at a CAGR of 6.1% through 2035, led by consistent demand in automotive thermal systems, EV battery housings, and industrial fittings. The country benefits from a mature manufacturing ecosystem and advanced export network.

The aluminum slugs market in France is expected to grow at a CAGR of 5.6%, with luxury packaging and eco-conscious branding trends boosting adoption. Demand is high in cosmetics, gourmet food tubes, and personalized promotional containers.

The UK market is projected to grow at a CAGR of 5.0% from 2025 to 2035. As one of the largest producers of aluminum beverage cans, the USA leads in slug utilization for high-speed can-making lines. Recycling practices and sustainable sourcing are becoming key market drivers.

The USA 0053 aluminum slugs market is expected to grow at a CAGR of 4.5%. Applications are expanding in pharmaceuticals, dental care tubes, and homecare sprays. The push for metal recyclability and circular economy practices is enhancing aluminum slug demand.

The aluminum slugs market Brazil is projected to grow at a CAGR of 4.0% through 2035. Growth is supported by strong manufacturing activity in electronics, export packaging, and industrial OEM parts. Local producers are scaling up to meet both domestic and international demand.

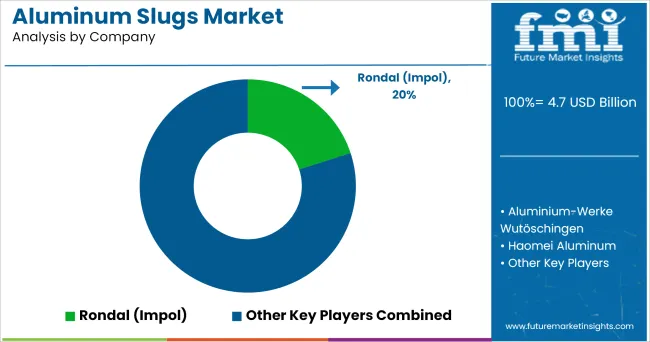

The aluminum slugs market is moderately fragmented, with key players focusing on capacity expansion, alloy innovation, and sustainability initiatives. Companies such as Ball Corporation, Novelis Inc., Alucon, Impol Group, Taisun Aluminum, and NeumanAluminium are investing in automation, eco-efficient production, and supply chain optimization to meet global demand.Leading manufacturers are also prioritizing closed-loop recycling systems, reducing scrap generation, and adopting low-carbon aluminum sourcing to align with global decarbonization goals.

Strategic partnerships with aerosol can and collapsible tube producers are enabling product customization and enhanced market reach. In addition, R&D in high-purity slug formulations is gaining traction to support applications in medical and electronic packaging.

Recent Aluminum Slugs Market News

In March 2025, Novelis announced a USD 1.2 billion investment to expand its aluminum slug production facilities in India and Brazil, aiming to meet rising demand in the automotive and FMCG sectors. The initiative also focuses on closed-loop recycling systems to minimize waste and enhance circularity in packaging.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 4.7 billion |

| Projected Market Size (2035) | USD 7.8 billion |

| CAGR (2025 to 2035) | 5.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billions / Volume in kilo tons |

| By Source | Round, Flat, and Rectangle |

| By Application | Cans, bottles, and Tubes |

| By End-Use | Food & Beverages, Pharmaceuticals, Automotive, Cosmetics & Personal Care, and Other Consumer Goods |

| Regions Covered | North America, Latin America, Western Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | China, India, Germany, France, United States, United Kingdom, Brazil, Japan, South Korea, and 40+ countries |

| Key Players | Ball Corporation, Novelis Inc., Alucon , Haomei Aluminum, Neuman Aluminium , Impol Group, Taisun Aluminum, Aluminium Werke Wutöschingen AG & Co. KG, Perfect Group |

| Additional Attributes | Share by shape, segment-wise dollar sales, regional demand drivers, sustainability focus, competitive benchmarking |

The global aluminum slugs market is estimated to be valued at USD 4.7 billion in 2025.

The market size for the aluminum slugs market is projected to reach USD 7.9 billion by 2035.

The aluminum slugs market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in aluminum slugs market are round, flat and rectangle.

In terms of application, cans segment to command 54.2% share in the aluminum slugs market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Examining Market Share Trends in the Aluminum Slugs Sector

Aluminum Alloy Sacrificial Anode Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foam Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Cap & Closure Market Forecast and Outlook 2025 to 2035

Aluminum Casing of the Blade Battery Market Size and Share Forecast Outlook 2025 to 2035

Aluminum ROPP Closure Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Cans Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Packaging Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Pouches Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Peel-Off Ends Maker Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Tape Market Size and Share Forecast Outlook 2025 to 2035

Aluminum-Free Food Pouch Market Size and Share Forecast Outlook 2025 to 2035

Aluminum-Nickel Catalyst Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Frame Monitors Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Composite Materials Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Coated Thermal Protective Clothing Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Flat Products Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Alloys Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Sheets and Coils Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Containers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA