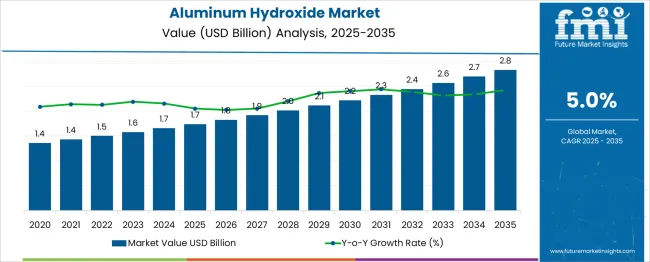

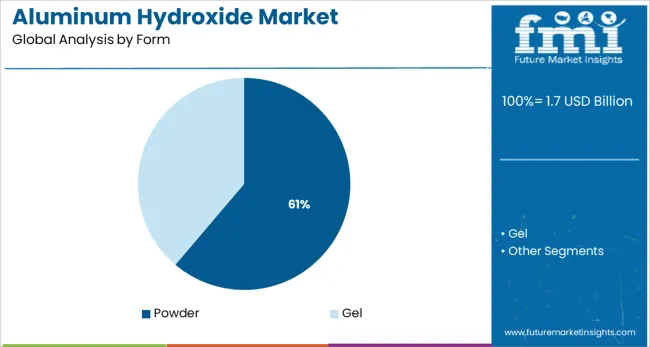

The aluminum hydroxide market is valued at USD 1.7 billion in 2025 and is projected to reach USD 2.8 billion by 2035 at a CAGR of 5.0%. Growth is shaped by rising use of aluminum hydroxide across pharmaceuticals, wastewater treatment, plastics, polymers, chemicals, and cosmetics. The pharmaceutical grade segment accounts for 57.9% of the market in 2025, supported by sustained demand for antacid formulations amid rising global acidity prevalence. The powder form segment holds 61.2% share due to its ease of handling, high compatibility with industrial processes, and widespread usage in plastics, chemicals, and water treatment applications.

Market progression continues as wastewater treatment initiatives expand, cosmetic and personal care products gain traction, and the chemical industry accelerates production of pigments, additives, and specialty materials. Strong industrial growth in Asia Pacific, driven by China’s expanding chemical and pharmaceutical sectors, enhances regional consumption of aluminum hydroxide as a functional raw material. North America and Europe contribute steady demand through growing applications in fire retardants, fillers, and pharmaceutical formulations.

Constraints arise from increasing availability of substitutes such as magnesium hydroxide and health concerns associated with aluminum exposure. However, active R&D investments, capacity expansions, and improvements in product purity and performance by companies like Sumitomo, Albemarle, Huber, Hindalco, Nabaltec, and Showa Denko support long term adoption. As industrial operations scale and wastewater treatment, pharmaceuticals, plastics, and personal care applications grow, aluminum hydroxide remains a critical ingredient across global manufacturing ecosystems.

| Metric | Value |

|---|---|

| Aluminum Hydroxide Market Estimated Value in (2025 E) | USD 1.7 billion |

| Aluminum Hydroxide Market Forecast Value in (2035 F) | USD 2.8 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The pharmaceutical grade segment is expected to hold 57.9% of the aluminum hydroxide market in 2025, making it the dominant grade category. This leadership is driven by high global consumption of antacids used to treat acidity, indigestion, and gastric discomfort. Aluminum hydroxide functions as a key active ingredient due to its strong acid neutralizing capacity and favorable safety profile in regulated formulations. Rising incidence of digestive disorders, linked to changing dietary habits and increasing stress levels, contributes significantly to demand. Pharmaceutical manufacturers also prefer this grade for its stringent purity standards, consistent performance, and compliance with international pharmacopoeia requirements. As OTC antacid demand grows worldwide, pharmaceutical grade aluminum hydroxide continues to anchor market share.

The powder segment is projected to account for 61.2% of the aluminum hydroxide market in 2025, establishing it as the leading form category. Its prominence is supported by extensive use in water treatment, plastics and polymers, chemical formulations, pigments, catalysts, and flame retardant systems. Powdered aluminum hydroxide offers high dispersibility, stable performance in dry blending, and flexible compatibility with industrial manufacturing lines. It is widely adopted in wastewater treatment facilities where it serves as an effective flocculant and adsorbent. The segment also benefits from increasing use in plastic additives, fillers, and coatings where powdered forms provide improved processing efficiency. As industrial applications expand across APAC, the Middle East, and North America, the powder form maintains a strong and consistent market presence.

Rising prevalence of acidity across the globe is increasing the demand for antacids, thereby boosting sales of aluminum hydroxide in the global market. Hence, surging application of aluminum hydroxide in the formulation of antacids due to its functional properties is propelling the growth in the market.

Elevated levels of water pollution and concern over the environment has heightened the focus on wastewater treatment. Aluminum hydroxide is used in various water purification processes. Thus, increasing water pollution will also spur demand for aluminum hydroxide over the coming decade.

Further, rapid growth in textiles, cosmetics, chemicals, and paper and ink industries is another factor facilitating the growth in the aluminum hydroxide market. Due to its functional properties, aluminum hydroxide is used in the manufacturing of various beauty products, textile products, in the production of chemicals, paper and ink.

One of the key factors hampering the demand in the market is high availability of alternative products such as magnesium hydroxide. Low-cost and easy availability of alternatives is anticipated to limit sales of magnesium hydroxide. Additionally, rising health risks, due to exposure to aluminum hydroxide, will also restrict growth to an extent.

Over the past decade, Asia Pacific has seen rapid growth in the chemicals and pharmaceutical industries. Growing consumption of cosmetics and personal care products is one of the key factors aiding the growth in the chemical industry.

Within the Asia Pacific market, China is expected to account for a dominant share.. Due to the presence of one of the world’s largest chemical markets, China wields a powerful impact on regional market.

Further, favorable policies in the pharmaceutical industry is increasing the adoption of aluminum hydroxide in China. This is expected to further bolster the demand in the Asia Pacific market.

Middle East and Africa is set to witness significant growth in aluminum hydroxide market. Growing presence of multiple industries and similar activities in Africa along with rising wastewater treatment activities in Middle East will increase market potential for aluminum hydroxide.

Chemical and pharmaceutical industries are also taking space in Middle East and Africa. Growing use of polymers and plastics, high demand for fire retardants are also expected to drive the growth in the aluminum hydroxide market in Middle East and Africa.

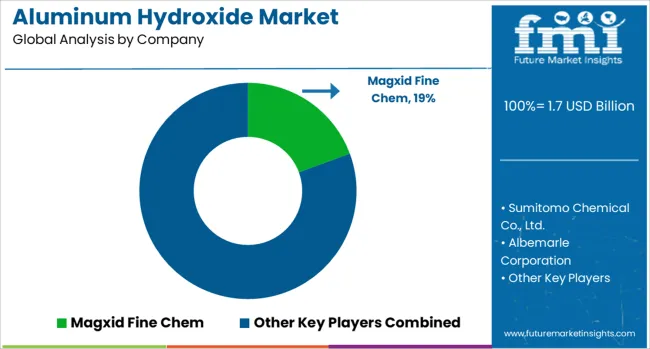

Some of the key players in the global aluminum hydroxide market are Magxid Fine Chem, Sumitomo Chemical Co., Ltd., Albemarle Corporation, Radhaji Pharma Chem, P J Chemicals, Avanschem, Showa Denko, Nabeltec AG, Huber Engineered Materials, Nashtec LLC, MAL Hungarian Aluminum and Hindalco Chemicals among others.

Aluminum hydroxide is a fairly competitive market. Leading companies are investing in research and development activities to build their existing product portfolios, while others are seeking to increase their manufacturing capacities in order to meet the surging demand for aluminum hydroxide.

| Report Attribute | Details |

|---|---|

| Growth Rate | 5% CAGR from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million, and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered |

Grade, Form, Application, End User, Region |

| Countries Covered |

North America (USA, Canada), Latin America (Mexico, Brazil, Argentina, Chile, Peru), Western Europe (Germany, Italy, France, UK, Spain, BENELUX, Nordics), Eastern Europe (Russia, Poland, CIS), Asia-Pacific (China, India, ASEAN, South Korea), Japan, Middle East and Africa (GCC Countries, South Africa, Turkey, Iran, Israel) |

| Key Companies Profiled |

Magxid Fine Chem; Sumitomo Chemical Co., Ltd.; Albemarle Corporation; Radhaji Pharma Chem; P J Chemicals; Avanschem; Showa Denko; Nabeltec AG; Huber Engineered Materials; Nashtec LLC; MAL Hungarian Aluminium; Hindalco Chemicals |

| Customization | Available Upon Request |

The global aluminum hydroxide market is estimated to be valued at USD 1.7 billion in 2025.

The market size for the aluminum hydroxide market is projected to reach USD 2.8 billion by 2035.

The aluminum hydroxide market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in aluminum hydroxide market are pharmaceutical grade and industrial grade.

In terms of form, powder segment to command 61.2% share in the aluminum hydroxide market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aluminum Alloy Sacrificial Anode Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foam Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Cap & Closure Market Forecast and Outlook 2025 to 2035

Aluminum Casing of the Blade Battery Market Size and Share Forecast Outlook 2025 to 2035

Aluminum ROPP Closure Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Cans Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Packaging Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Pouches Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Peel-Off Ends Maker Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Tape Market Size and Share Forecast Outlook 2025 to 2035

Aluminum-Free Food Pouch Market Size and Share Forecast Outlook 2025 to 2035

Aluminum-Nickel Catalyst Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Frame Monitors Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Composite Materials Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Coated Thermal Protective Clothing Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Flat Products Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Alloys Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Sheets and Coils Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Containers Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Aerosol Cans Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA