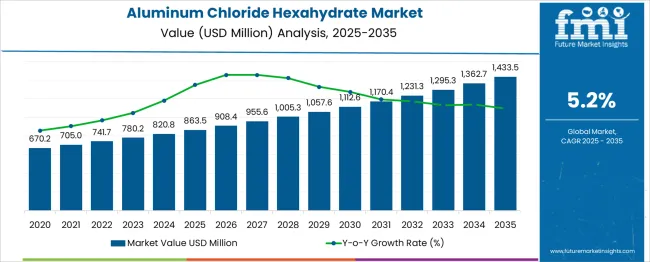

The Aluminum Chloride Hexahydrate Market is estimated to be valued at USD 863.5 million in 2025 and is projected to reach USD 1433.5 million by 2035, registering a compound annual growth rate (CAGR) of 5.2% over the forecast period. The first half of the decade (2025–2030) contributes approximately USD 249 million, as the market advances from USD 863.5 million to USD 1,112.6 million, driven by strong demand from water treatment, pharmaceuticals, and chemical processing industries. This phase focuses on expansion in emerging economies and increased regulatory mandates for clean water, boosting consumption of aluminium-based coagulants. The second half (2030–2035) accounts for an additional USD 320.9 million, with the market reaching USD 1,433.5 million, reflecting higher adoption in advanced applications such as specialty chemicals, petrochemical catalysts, and aluminium-based intermediate compounds. Growth in this period is supported by investments in industrial wastewater recycling, expansion of chlor-alkali processes, and product innovation targeting low-impurity grades for high-value chemical synthesis. Manufacturers optimizing cost structures through energy-efficient production and prioritizing high-purity and eco-compliant formulations will capture significant shares. With the absolute dollar opportunity concentrated in industrial expansions and water infrastructure projects, suppliers focusing on scalability and distribution efficiency are positioned to maximize returns in a steadily growing market.

| Metric | Value |

|---|---|

| Aluminum Chloride Hexahydrate Market Estimated Value in (2025 E) | USD 863.5 million |

| Aluminum Chloride Hexahydrate Market Forecast Value in (2035 F) | USD 1433.5 million |

| Forecast CAGR (2025 to 2035) | 5.2% |

The aluminum chloride hexahydrate segment contributes measurable but highly specialized shares. In the aluminum-based chemical intermediates market, it represents 9–11%, reflecting its status as a key derivative among aluminum‑salt products. In the pharmaceutical synthesis and reagent market, its share is 4–5%, used for complex acylation and catalysis in organic synthesis, though overshadowed by larger reagent categories. For water treatment and flocculant chemical systems, its share remains minimal at 1–2%, as aluminum sulfate and polyaluminum chloride dominate. In the specialty catalysts and fine chemicals market, it captures 12–14%, valued for its specificity in certain polymer and material synthesis processes. Within the laboratory and analytical chemicals market, its contribution is 6–7%, driven by demand in R&D, QC, and specialty analysis. Supply is supported by companies like Kemira Oyj, Honeywell International, GFS Chemical, Sisco Research Laboratories, and several regional players, serving both industrial and academic segments. Product growth is propelled by demand for high-grade, water-soluble aluminum catalysts and catalyst precursors, alongside applications in pharmaceutical R&D, advanced polymer chemistry, and fine chemical synthesis.

Significant consumption is being observed in the pharmaceutical and healthcare sectors, where high-purity grades are required for drug manufacturing and other medicinal processes. As regulatory standards tighten across industries, particularly in drug and food-grade applications, the demand for high-purity forms is rising. Further market momentum is being created by advancements in production technologies that allow for better purity control, cost efficiency, and environmental compliance.

The compound’s versatility in applications ranging from pigment manufacturing to water treatment is fostering broader adoption. As industries shift toward higher quality and performance materials, Aluminum Chloride Hexahydrate is expected to sustain long-term relevance in high-growth segments globally, driven by a combination of regulatory alignment, innovation in chemical processing, and industrial scalability..

The aluminum chloride hexahydrate market is segmented by purity and end use industry and geographic regions. By purity of the aluminum chloride hexahydrate market is divided into 97–99%. In terms of end use industry of the aluminum chloride hexahydrate market is classified into Pharmaceuticals and healthcare. Regionally, the aluminum chloride hexahydrate industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 97–99% purity segment is expected to account for 66% of the Aluminum Chloride Hexahydrate market revenue share in 2025, positioning it as the leading purity category. This dominance is being driven by its essential role in industries that require high chemical stability, low impurity levels, and reliable reactivity. The pharmaceutical and healthcare industries, in particular, have relied on this grade for its suitability in sensitive applications such as active pharmaceutical ingredient synthesis and laboratory formulations.

The growing emphasis on regulatory compliance and product traceability has supported increased demand for this high-purity material. Its adoption has also been encouraged by process manufacturers who prioritize consistent yield and minimal contamination.

The ability of this purity level to meet stringent quality standards has allowed it to be integrated into critical end-use processes without the need for additional refinement. With rising demand for precision chemical ingredients across high-growth sectors, this segment is expected to retain its leadership in the global market..

The pharmaceuticals and healthcare segment is projected to hold 39.20% of the Aluminum Chloride Hexahydrate market revenue share in 2025, making it the largest end-use industry. Growth in this segment has been propelled by the compound’s vital role in the synthesis of medicinal intermediates, drug formulations, and diagnostic reagents. The increase in chronic disease incidence and expansion of generics manufacturing has heightened the need for reliable and scalable raw materials that meet pharmaceutical-grade specifications.

High-purity Aluminum Chloride Hexahydrate has been preferred in sterile environments where precision and contamination control are essential. This segment has also benefited from rising global healthcare investments and modernization of manufacturing practices in both developed and emerging economies.

Additionally, stringent regulatory oversight has encouraged the use of substances with verified safety and performance records. As the pharmaceutical sector evolves to address global health priorities, the demand for high-quality aluminum-based compounds is expected to remain robust within this leading end-use industry..

Aluminum chloride hexahydrate (AlCl₃·6H₂O) is a crystalline compound used across sectors including water purification, personal care, pharmaceuticals, and chemical synthesis. Its role as a highly effective coagulant in municipal and industrial water treatment, and as an active ingredient in antiperspirants and hyperhidrosis treatment, has driven wide adoption. Demand is shaped by growing recognition of its efficacy in removing suspended solids and controlling perspiration. Suppliers that offer pharmaceutical-grade purity, consistent reagent quality, and compliance with industry protocols remain competitive. Products that support easy formulation, traceability, and validated performance continue guiding procurement in utilities, hygiene, and industrial chemistry contexts.

Use of aluminum chloride hexahydrate has been reinforced by its functional versatility in water treatment plants and pharmaceutical or cosmetic formulations. In water systems, it enables effective flocculation and sediment removal, meeting stringent quality requirements. In personal care, high-purity grades address hyperhidrosis and are integrated into antiperspirant formulations. The chemical’s effectiveness in chemical intermediate roles, for example, in organic synthesis or catalyst use, has supported demand in specialty chemical and industrial dye applications. Coordination with regulatory authorities for clinical use and water safety compliance has enhanced confidence. Fluctuating demand across hygiene, environmental cleanup, and industrial processing continues to bolster application diversity and usage stability.

Wider deployment has been restrained by variability in purity grades and inconsistent identification of chemical form across suppliers. Regulatory approval for pharmaceutical or cosmetic use demands detailed safety profiling and traceability, which increases entry complexity. Use in environmental settings requires alignment with water quality regulations that vary by region. Supply chain volatility, for example, in precursor chlorides or aluminum raw materials, affects availability and consistency. Use of low-grade or mislabeled grades in treatment systems can reduce effectiveness. Limited awareness among small-scale formulators regarding correct dosing and handling protocols may reduce adoption in niche sectors such as healthcare or local water utilities.

Opportunities are emerging in expanding use for decentralized water purification solutions in developing regions and rural institutions. Development of pharmaceutical-grade product formulations tailored for dermatologic use in climates with high excessive sweating prevalence presents growth avenues. Linkage with chemical manufacturers for intermediate use in polymer, dye, and aluminum derivative production offers industrial expansion. Partnerships between chemical suppliers and public utilities can offer bundled supply and technical support services. Innovation in treatable formulations, for example, slow-release antiperspirant gels or flocculant tablets, offers differentiation. Export opportunities from regions with robust alum or acid processing capacity enhance access to underserved markets in emerging economies.

Trends are being influenced by growth in certified analytics services offering traceable batch records and purity validation for pharmaceutical- or cosmetic-grade aluminum chloride hexahydrate. Demand for blended coagulant systems combining aluminum chloride hexahydrate with polyaluminum compounds is rising in advanced water treatment facilities. Analytical platforms for residual chloride measurement and floc formation efficiency validation are being integrated into procurement protocols. Use of pre-dosed sachets or dry granules calibrated for field or hospital use is shaping product design. Enhanced focus on environmentally safe handling, minimal residual pH impact, and smooth integration with existing treatment lines continues to define product evolution in industrial and hygiene-focused contexts.

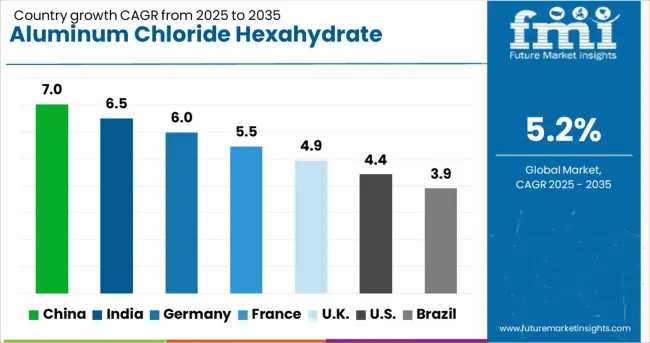

| Country | CAGR |

|---|---|

| China | 7.0% |

| India | 6.5% |

| Germany | 6.0% |

| France | 5.5% |

| UK | 4.9% |

| USA | 4.4% |

| Brazil | 3.9% |

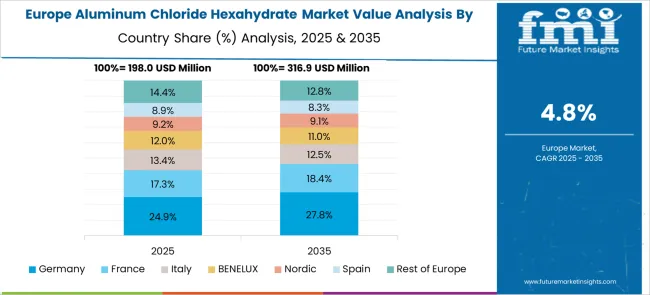

The aluminum chloride hexahydrate market is projected to grow at a CAGR of 5.2% from 2025 to 2035, supported by demand from groups such as water treatment operators, pharmaceutical manufacturers, and cosmetic product formulators. China leads with 7.0%, driven by chemical production expansion and municipal water projects. India follows at 6.5%, supported by industrial wastewater treatment and growing pharma output. Among developed economies, Germany posts 6.0%, the United Kingdom 4.9%, and the United States 4.4%, fueled by the requirement for high-purity grades in healthcare and specialty chemicals. The analysis includes over 40 countries, with the top five detailed below for group-specific trends and applications.

China is expected to grow at a CAGR of 7.0% through 2035, supported by its strong role as a global supplier of aluminum chloride hexahydrate. Expanding applications in water treatment plants and pharmaceutical intermediates continue to drive demand. The cosmetic industry is increasingly adopting this compound for use in antiperspirant formulations, boosting consumption across urban markets. Manufacturers are investing in large-scale production facilities and quality enhancement technologies to meet domestic and export needs. Rising e-commerce penetration in chemical distribution further strengthens supply chain efficiency for small and medium-scale buyers in China.

India is projected to post a CAGR of 6.5% from 2025 to 2035, driven by rapid expansion in wastewater treatment projects and the pharmaceutical sector. The compound’s usage in producing active pharmaceutical ingredients and catalyst systems ensures steady demand. Domestic suppliers are introducing cost-effective, high-purity grades to cater to export markets across Asia and Africa. Demand from deodorant and personal hygiene product manufacturers further strengthens market growth. Strategic collaborations with global chemical distributors are improving access to advanced technologies and expanding India’s role as a regional export hub for aluminum chloride hexahydrate.

Germany is expected to achieve a CAGR of 6.0% through 2035, supported by strong demand for specialty chemicals and advanced catalyst systems. The compound is widely used in wastewater treatment, reflecting the country’s stringent water quality regulations. Manufacturers are focusing on eco-compliant production methods to align with environmental standards in the chemical sector. Growth in the cosmetics industry is boosting adoption for antiperspirant formulations, while industrial sectors continue to integrate aluminum chloride hexahydrate in chemical synthesis. Research initiatives are emphasizing purity enhancement and alternative processing techniques to reduce environmental impact during large-scale production.

The United Kingdom is forecasted to grow at a CAGR of 4.9% from 2025 to 2035, driven by steady adoption in personal care products and specialty chemical formulations. Demand for aluminum chloride hexahydrate in deodorants and antiperspirants remains significant as brands emphasize safety and efficacy in product lines. Industrial usage in water treatment and pharmaceutical catalysts contributes to incremental growth. Manufacturers are prioritizing packaging innovations and small-batch customization to meet varying requirements of cosmetic brands and chemical processors. Digital sales channels, combined with specialist distribution networks, are improving product availability across regional markets.

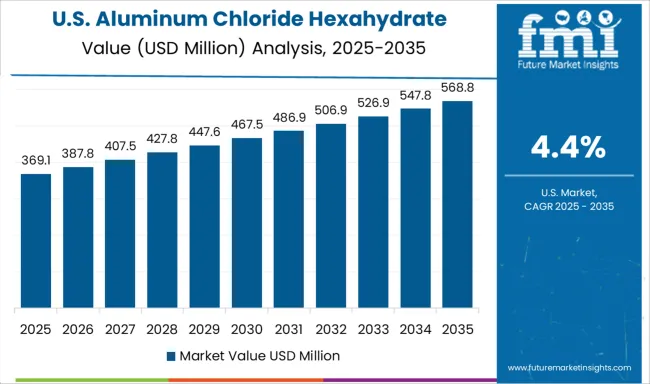

The United States is expected to post a CAGR of 4.4% through 2035, supported by demand for high-performance catalysts, water treatment chemicals, and cosmetic ingredients. Manufacturers are focusing on advanced production technologies to achieve consistent particle size and superior purity levels for pharmaceutical applications. Growth in clinical-grade chemical requirements is increasing the use of aluminum chloride hexahydrate in drug synthesis. The personal care segment remains a major contributor, with brands adopting the compound for premium deodorants and skincare products. Strategic partnerships with logistics providers and e-commerce channels are improving distribution efficiency and accessibility for SMEs.

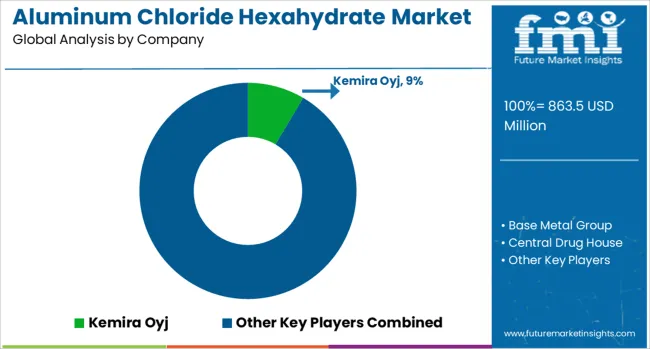

The aluminum chloride hexahydrate market is moderately fragmented, featuring key players such as Kemira Oyj, Base Metal Group, Central Drug House, GFS Chemical, Glentham, Honeywell International, IRO Group, Loba Chemie, Nandkrishna Chemical, Noah Chemicals, and Sisco Research Laboratories. Kemira Oyj leads with large-scale production for water treatment and industrial applications, leveraging global distribution networks and stringent quality controls.

Honeywell International focuses on high-purity grades for pharmaceutical and specialty chemical sectors, offering consistent compliance with international safety standards. GFS Chemical and Glentham supply laboratory and research-grade variants, supporting the demand from analytical and formulation development markets. Loba Chemie, Central Drug House, and Sisco Research Laboratories primarily cater to regional markets in Asia with cost-effective solutions targeting research institutions and small-scale manufacturing units.

Base Metal Group and Nandkrishna Chemical position themselves in niche applications, including catalyst production, petroleum refining, and pigment manufacturing. Competitive strategies include expanding production capacities, adopting advanced crystallization processes for improved purity, and developing customized grades for diverse end-use sectors. Future market competitiveness will hinge on scaling up high-purity manufacturing capabilities, reducing energy consumption during production, and forming strategic alliances for global distribution. Increasing demand from pharmaceuticals, cosmetics, and water treatment industries will push manufacturers to focus on product consistency and packaging innovations to meet end-user requirements.

On July 24, 2025, Kemira announced a €20 million investment to expand its Tarragona (Spain) site with a new Aluminium Chloride Hydrate (ACH) production line. The investment will support water treatment capabilities serving Europe and Africa, with anticipated operation in early 2028. ACH is a high-basicity coagulant offering enhanced treatment efficiency, reduced CO₂ emissions, and sustainability benefits compared to traditional chemicals.

| Item | Value |

|---|---|

| Quantitative Units | USD 863.5 Million |

| Purity | 97–99% |

| End Use Industry | Pharmaceuticals and healthcare |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Kemira Oyj, Base Metal Group, Central Drug House, GFS Chemical, Glentham, Honeywell International, IRO Group, Loba Chemie, Nandkrishna Chemical, Noah Chemicals, and Sisco Research Laboratories |

| Additional Attributes | Dollar sales by grade type (industrial grade, pharmaceutical grade, laboratory grade) and application (water treatment, pharmaceuticals, catalysts, personal care products), with demand driven by growth in specialty chemicals and industrial processing. Regional dynamics highlight Asia-Pacific as the fastest-growing market due to chemical manufacturing hubs, while North America and Europe maintain steady demand in pharmaceutical and petrochemical sectors. Innovation trends include eco-friendly synthesis processes, improved moisture-resistant packaging, and automation in crystallization techniques for uniform particle sizing. |

The global aluminum chloride hexahydrate market is estimated to be valued at USD 863.5 million in 2025.

The market size for the aluminum chloride hexahydrate market is projected to reach USD 1,433.5 million by 2035.

The aluminum chloride hexahydrate market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in aluminum chloride hexahydrate market are 97–99% and _more than 99%.

In terms of end use industry, pharmaceuticals and healthcare segment to command 39.2% share in the aluminum chloride hexahydrate market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aluminum Alloy Sacrificial Anode Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foam Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Cap & Closure Market Forecast and Outlook 2025 to 2035

Aluminum Casing of the Blade Battery Market Size and Share Forecast Outlook 2025 to 2035

Aluminum ROPP Closure Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Cans Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Packaging Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Pouches Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Peel-Off Ends Maker Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Tape Market Size and Share Forecast Outlook 2025 to 2035

Aluminum-Free Food Pouch Market Size and Share Forecast Outlook 2025 to 2035

Aluminum-Nickel Catalyst Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Frame Monitors Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Composite Materials Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Coated Thermal Protective Clothing Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Flat Products Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Alloys Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Sheets and Coils Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Containers Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Aerosol Cans Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA