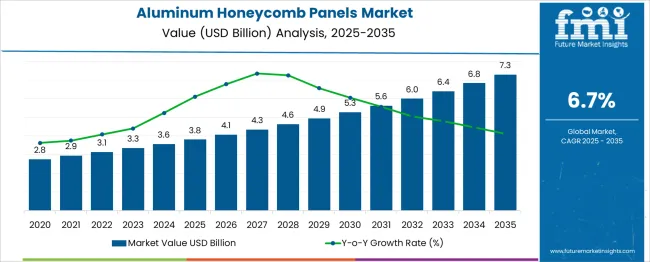

The Aluminum Honeycomb Panels Market is estimated to be valued at USD 3.8 billion in 2025 and is projected to reach USD 7.3 billion by 2035, registering a compound annual growth rate (CAGR) of 6.7% over the forecast period. This reflects a strong CAGR of 6.7% over the forecast period. Year-on-year (YoY) growth analysis reveals steady, predictable gains driven by increased adoption in construction, aerospace, transportation, and marine industries. Between 2025 and 2026, the market is expected to rise from USD 3.8 billion to 4.1 billion, marking a YoY growth of approximately 7.1%.

From 2026 through 2030, growth continues at an average annual rate of 6.5% to 7.0%, reaching USD 4.9 billion. This acceleration is attributed to the rising use of aluminum honeycomb panels in building facades, ceilings, and cleanrooms, where strength-to-weight ratio, thermal insulation, and fire resistance are critical. From 2030 to 2035, the market adds nearly USD 2.4 billion, with annual growth averaging 6.8%, culminating in a value of USD 7.3 billion. The consistent YoY performance reflects increasing demand for sustainable, recyclable construction materials and innovations in panel manufacturing that enhance durability and design flexibility for diverse end-use applications.

| Metric | Value |

|---|---|

| Aluminum Honeycomb Panels Market Estimated Value in (2025 E) | USD 3.8 billion |

| Aluminum Honeycomb Panels Market Forecast Value in (2035 F) | USD 7.3 billion |

| Forecast CAGR (2025 to 2035) | 6.7% |

The Aluminum Honeycomb Panels market is a specialized segment within the broader composite panels and advanced materials market, which itself is part of the global construction and aerospace materials industry. As of 2025, the global composite panels market is valued at over USD 80 billion, with applications across building facades, ceilings, partitions, flooring systems, transportation interiors, and aerospace components. Within this space, metal-based composite panels, including aluminum honeycomb panels, account for approximately 10–12% of the total market due to their superior strength-to-weight ratio, thermal insulation, and fire resistance. Aluminum honeycomb panels are gaining traction in both commercial and industrial construction, particularly in architectural cladding, curtain walls, cleanrooms, and modular structures. Their lightweight nature reduces overall structural load while offering excellent durability, corrosion resistance, and ease of installation. In aerospace and transportation, these panels are used for interior partitions, flooring, and cabinetry where weight reduction directly contributes to fuel efficiency. The market is fueled by growing emphasis on sustainable construction materials and energy-efficient building systems, especially in developed economies. Leading players in the parent market include Arconic, Hexcel Corporation, 3A Composites, Pacific Panels Inc., and Corex Honeycomb, which offer a range of advanced panel solutions catering to both infrastructure and high-performance industrial sectors.

The current landscape is shaped by growing emphasis on fuel efficiency, sustainability, and structural integrity in sectors such as aerospace, transportation, construction, and marine. These panels have gained attention for their excellent strength-to-weight ratio, corrosion resistance, and energy absorption capabilities, making them suitable for both interior and exterior applications.

Technological advancements in bonding techniques, surface coatings, and composite integration are further enhancing the performance and durability of aluminum honeycomb panels. As regulatory bodies push for stricter environmental compliance and reduced carbon emissions, manufacturers are increasingly adopting these panels to replace traditional materials.

The future outlook for the market is promising, supported by the increasing pace of urban infrastructure development, modernization of aircraft fleets, and rising demand for advanced lightweight materials. With ongoing innovation and material optimization, aluminum honeycomb panels are expected to remain a preferred choice in critical structural applications worldwide..

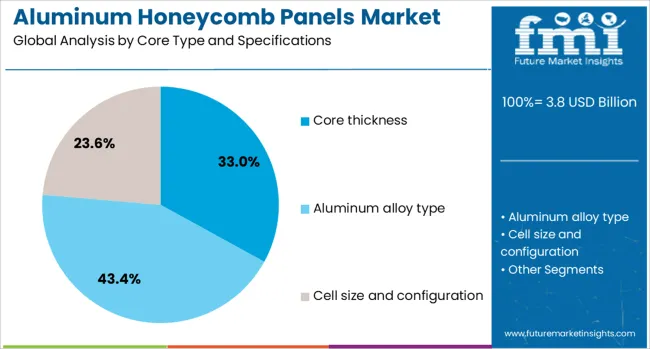

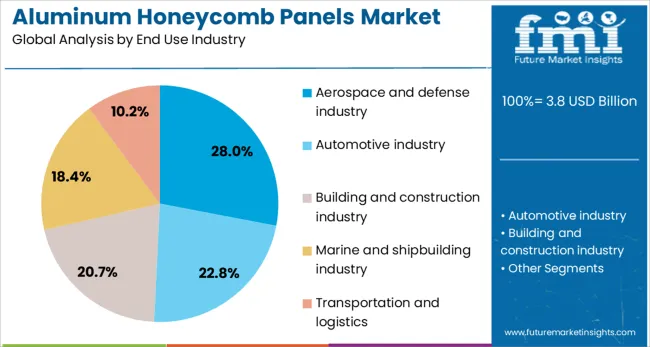

The aluminum honeycomb panels market is segmented by core type, specifications, and end-use industry and geographic regions. The aluminum honeycomb panels market is divided by core type and specifications into Core thickness, Aluminum alloy type, Cell size and configuration, Face sheet material, and Panel size and dimensions. In terms of end-use industry, the aluminum honeycomb panels market is classified into Aerospace and defense industry, Automotive industry, Building and construction industry, Marine and shipbuilding industry, Transportation and logistics, Industrial manufacturing, Others, and Furniture and interior design. Regionally, the aluminum honeycomb panels industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The core thickness subsegment within the core type and specifications segment is anticipated to account for 33% of the Aluminum Honeycomb Panels market revenue share in 2025. This dominance has been supported by its critical role in determining panel strength, stiffness, and weight distribution. It has been observed that varying thickness levels allow for customizable solutions that meet specific mechanical and thermal requirements across applications.

The ability of core thickness to directly influence load-bearing capacity and impact resistance has made it an essential parameter in structural design. Increased adoption in sectors such as construction, rail, and marine has been driven by the need for materials that balance durability with reduced mass.

The growing focus on optimizing payload efficiency and thermal insulation has also contributed to the widespread use of panels with tailored core thickness. As manufacturers continue to prioritize precision engineering and material performance, the flexibility offered by core thickness specifications is expected to remain a key factor supporting this segment’s market leadership..

The aerospace and defense industry subsegment within the end use industry segment is projected to hold 28% of the Aluminum Honeycomb Panels market revenue share in 2025. This leadership position has been achieved due to the stringent weight and performance requirements in both commercial and defense aviation. Aluminum honeycomb panels have been extensively utilized in aircraft interiors, flooring systems, and structural components where strength, fire resistance, and weight savings are essential.

The ability of these panels to meet rigorous safety and durability standards while contributing to overall fuel efficiency has made them a preferred choice in aerospace applications. Additionally, the growing demand for lightweight armor and modular construction in defense systems has reinforced their relevance in military applications.

As the global aerospace sector continues to expand with increasing aircraft production and modernization programs, the reliance on advanced materials like aluminum honeycomb panels is expected to intensify. Continued government investments in defense infrastructure and the pursuit of next-generation aircraft design are further driving sustained growth in this end use segment..

Aluminum honeycomb panels are gaining momentum across architecture, transportation, and industrial sectors due to their lightweight strength, fire resistance, and structural efficiency. Growth is driven by investments in high‑speed rail, green building initiatives, and defense platforms seeking energy‑absorbing, rigid materials. Market maturity varies by region, with strong adoption in North America and Europe and rapid expansion in Asia‑Pacific. Innovation focuses on fire‑rated and acoustic panels, customized bonding techniques, and recyclable material systems. However, fluctuating aluminum prices and complex fabrication processes continue to influence competitive positioning.

Broad adoption of aluminum honeycomb panels across aerospace, rail and defense showcases their ability to deliver high strength‑to‑weight ratios and energy absorption. In aircraft interiors and lightweight train bodies, the panels help reduce fuel burn and comply with strict safety standards. Structural engineering in high‑rise and façade applications harnesses these panels for rigidity combined with architectural freedom. Bonding techniques such as adhesive film lamination and mechanical fastening allow greater design flexibility. Thermal break cores and acoustic layers can be integrated to meet insulation or noise‑control requirements. Manufacturers that collaborate with engineers and fabricators to customize panel performance and compatibility gain a competitive edge in complex installations where both performance and aesthetics matter.

Fire safety compliance shapes product adoption in both architecture and transit. Regulations set by codes such as International Building Code or EN standards require panels to meet fire rating thresholds while minimizing smoke and toxic emissions. Acoustic and fire‑rated panels that combine honeycomb cores with intumescent surfaces or mineral‑reinforced facings are gaining traction. Certification processes, including testing for flame spread and smoke density, add cost and timeline to product development.

Regions with strict fire norms provide premium opportunities for certified panels. Producers that maintain testing infrastructure and meet multiple regional standards can support global rollouts. Without proper certification, products risk rejection on safety grounds, delaying projects and harming brand credibility in high‑risk installations.

Aluminum honeycomb panel production relies on precise aluminum foil sourcing, honeycomb core fabrication, and facings using composites or metal skins. Fluctuations in aluminum commodity pricing, especially linked to global energy costs and trade policy, directly affect manufacturing margins. Additionally, foil suppliers capable of producing consistently thin, high‑strength aluminum sheets are limited, creating dependency risks. Bonding processes—whether adhesive, thermal or mechanical—add complexity, and fabrication tolerances demand specialized equipment and skilled labor.

Producers that control upstream sourcing or invest in integrated foil and core capabilities manage cost variability better. Meanwhile, automation in core expansion and panel bonding increases throughput and consistency. Those who fine‑tune logistics, minimize waste through nesting or scrap recycling, and maintain steady resource access secure pricing stability and a reliable enterprise edge across competitive markets.

Aluminum honeycomb panels offer unmatched design flexibility for sectors requiring strong yet lightweight construction materials. Architects favor these panels for curtain walls, canopies, cladding, and column covers due to their clean finish and strength without excessive bulk. In marine and cleanroom environments, their corrosion resistance and non-particulating surfaces meet hygiene and durability requirements. Interior designers integrate panels in ceilings and partitions for acoustic and aesthetic purposes.

Standard panels can be modified with stone, wood, or custom laminate finishes, expanding their decorative use. Additionally, automotive and defense sectors explore hybrid formats combining aluminum with composite skins for crash energy management or weight savings. This adaptability across function and form gives aluminum honeycomb panels a competitive edge in high-specification markets.

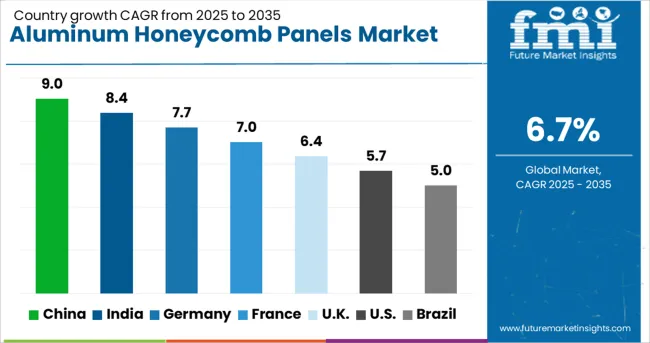

| Country | CAGR |

|---|---|

| China | 9.0% |

| India | 8.4% |

| Germany | 7.7% |

| France | 7.0% |

| UK | 6.4% |

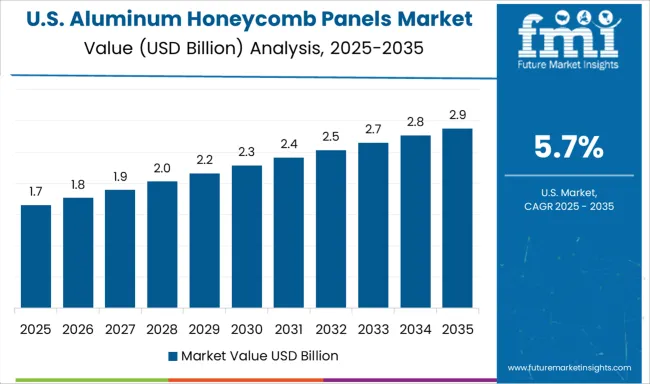

| USA | 5.7% |

| Brazil | 5.0% |

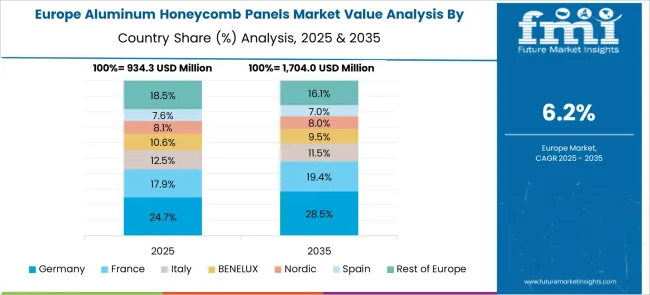

The global aluminum honeycomb panels market is projected to grow at a CAGR of 6.7% through 2035, driven by increased use in aerospace, construction, and transportation industries. Among BRICS nations, China leads with a strong 9.0% growth rate, supported by large-scale infrastructure projects and expanding export demand. India follows at 8.4%, fueled by government-backed construction initiatives and the shift toward lightweight building materials. Within the OECD region, Germany posts a solid 7.7% growth, reflecting its leadership in precision engineering and composite material innovation. The United Kingdom records a steady 6.4% increase, backed by demand in architectural facades and modular structures. The United States, growing at 5.7%, remains a mature but active market emphasizing durability, fire resistance, and quality standards. These countries represent key players advancing the adoption of aluminum honeycomb panels across industries. This report includes insights on 40+ countries; the top five markets are shown here for reference.

China has registered a CAGR of 9.0% in the aluminum honeycomb panels market, driven by its booming construction and transportation industries. These panels are widely adopted in commercial buildings, railway coaches, and aerospace applications due to their high strength-to-weight ratio and resistance to corrosion. Large infrastructure projects such as airports, metros, and stadiums demand lightweight cladding solutions, accelerating market expansion. Domestic manufacturers are scaling production using automation and are also integrating flame-retardant and soundproof coatings to enhance functionality. The push toward prefabricated buildings further supports panel demand, especially in urban areas with high population density. Export activities to Southeast Asia and Africa are rising as Chinese producers offer competitively priced and customizable panels. Local regulations favoring energy-efficient and durable materials contribute to the adoption rate across private and public sectors.

India has achieved a CAGR of 8.4% in the aluminum honeycomb panels market, largely due to rapid urban development and increasing use in interior and exterior architectural elements. Commercial buildings, airports, and corporate campuses are incorporating these panels for aesthetic and practical benefits like fire resistance and thermal insulation. Indian manufacturers are expanding output capabilities and offering composite panel options that combine lightweight structure with durability. Growing preference for green-certified materials in infrastructure is contributing to adoption. The use of aluminum honeycomb panels in modular office partitions and elevators is also expanding. Additionally, developers are leveraging the material's ability to support high design flexibility while reducing dead weight. Public sector construction and smart city projects are creating further opportunities. Several local players have formed partnerships with global technology firms to improve manufacturing efficiency and meet export standards.

Germany has recorded a CAGR of 7.7% in the aluminum honeycomb panels market, shaped by demand in high-end architecture and transportation sectors. German engineering emphasizes material efficiency, making these panels ideal for load-bearing and insulation purposes in automotive, rail, and aerospace designs. Leading panel manufacturers are adopting clean production techniques, including solvent-free bonding and precision cutting systems. There is notable uptake in luxury commercial interiors and exterior curtain walls that prioritize fire safety and thermal control. Domestic demand is complemented by export contracts in Europe and the Middle East. Architects and contractors increasingly specify aluminum honeycomb panels due to their formability and resistance to environmental degradation. Companies are also offering anodized and powder-coated finishes for extended lifecycle. Strong compliance standards in construction materials ensure consistent demand across sectors.

The United States has recorded a CAGR of 5.7% in the aluminum honeycomb panels market, driven by demand from defense, aerospace, and construction industries. The material's lightweight and structural rigidity make it ideal for aircraft interiors, military shelters, and building facades. USA manufacturers are innovating with corrosion-resistant alloys and expanding production capacity to support federal infrastructure and defense projects. Energy efficiency goals in commercial buildings are also pushing adoption of thermally efficient panel systems. Custom solutions tailored for seismic zones and extreme weather conditions are increasingly popular in the western and southern states. Leading construction firms use these panels to speed up installation and reduce structural load. Collaborations with universities and research institutes are helping optimize bonding materials and joining techniques for longer panel lifespan and better insulation.

The United Kingdom has seen a CAGR of 6.4% in the aluminum honeycomb panels market, largely driven by building renovation and energy-efficient cladding solutions. With many older structures undergoing refurbishment, there is increasing adoption of lightweight and fire-rated panel systems. These panels are being used in both new construction and restoration of public buildings, transit hubs, and mixed-use complexes. UK-based suppliers are developing fire-compliant panels that meet updated safety regulations, particularly after heightened scrutiny of cladding systems. In transportation, applications include use in marine interiors and aviation components due to their structural benefits and low weight. The shift toward modular building also supports demand. Design consultants value the material for its ability to deliver clean lines and minimalistic finishes, which align with modern architectural trends.

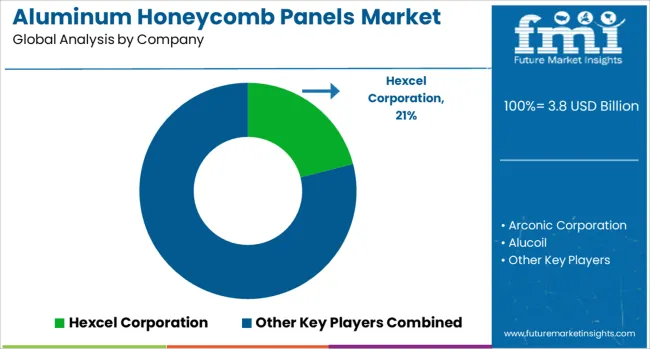

The aluminum honeycomb panels market serves a wide range of sectors, including aerospace, construction, rail transport, marine, and industrial cleanrooms, where strong yet lightweight materials are critical. These panels are valued for their excellent stiffness, compression strength, and impact resistance while offering significant weight savings compared to solid metal sheets. Demand is largely driven by applications that require materials capable of withstanding mechanical stress while reducing structural weight and improving fuel or energy efficiency. Hexcel Corporation is a prominent supplier of advanced composite and aluminum honeycomb solutions, with a strong foothold in aerospace and defense.

Its panels are used in aircraft flooring, doors, partitions, and satellite structures, where tight dimensional tolerances and strength-to-weight performance are essential. Arconic Corporation offers engineered aluminum panels tailored for architectural and transport applications, emphasizing structural consistency, panel flatness, and surface finish for both interior and exterior uses. Alucoil, Pacific Panels Inc., and Corex Honeycomb provide customizable panels for industrial and construction environments, with Corex focusing on high-precision core materials and Alucoil offering both architectural-grade and transport-specific solutions.

BCP (Bespoke Composite Panels) specializes in tailored panel systems for machinery enclosures, cleanroom walls, and display structures, while EconCore NV supports scalable production of thermoplastic and aluminum honeycomb cores through proprietary processing technologies. These companies are meeting growing requirements for durable, formable, and cost-effective panel systems that can be adapted to a broad set of technical specifications.

Hexcel officially launched its Flex‑Core® HRH‑302 mid‑temperature honeycomb core on September 10, 2024, at 11:06 AM, as confirmed via its official press release and social media. The non‑metallic product delivers enhanced thermal resistance and structural efficiency, tailored for aerospace and industrial composites requiring lightweight performance and compatibility with automated production.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.8 Billion |

| Core Type and Specifications | Core thickness, Aluminum alloy type, Cell size and configuration, Face sheet material, and Panel size and dimensions |

| End Use Industry | Aerospace and defense industry, Automotive industry, Building and construction industry, Marine and shipbuilding industry, Transportation and logistics, Industrial manufacturing, Others, and Furniture and interior design |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Hexcel Corporation, Arconic Corporation, Alucoil, Pacific Panels Inc., Corex Honeycomb, BCP (Bespoke Composite Panels), and EconCore NV |

| Additional Attributes | Dollar sales by panel type include standard and structural aluminum honeycomb panels used across aerospace, automotive & transportation, construction, marine, and energy sectors in North America, Europe, and Asia‑Pacific. Demand is driven by lightweight strength, fuel‑efficiency, and sustainability. Innovation targets hybrid materials, advanced coatings, and automated manufacturing. Costs depend on raw aluminum prices, complex fabrication, and energy use. |

The global aluminum honeycomb panels market is estimated to be valued at USD 3.8 billion in 2025.

The market size for the aluminum honeycomb panels market is projected to reach USD 7.3 billion by 2035.

The aluminum honeycomb panels market is expected to grow at a 6.7% CAGR between 2025 and 2035.

The key product types in aluminum honeycomb panels market are core thickness, _ultra-thin (5mm–10mm), _standard (11mm–25mm), _medium (26mm–50mm), _thick (51mm–100mm), _heavy-duty (above 100mm), aluminum alloy type, _3003 alloy (commercial grade), _5052 alloy (aerospace grade), _5056 alloy (high-performance), _other specialized alloys, cell size and configuration, _standard hexagonal cells, _micro-cell configurations, _custom cell geometries, face sheet material, _aluminum face sheets, _composite face sheets, _hybrid configurations, panel size and dimensions, _standard panels, _large format panels and _custom-sized applications.

In terms of end use industry, aerospace and defense industry segment to command 28.0% share in the aluminum honeycomb panels market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aluminum Alloy Sacrificial Anode Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foam Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Cap & Closure Market Forecast and Outlook 2025 to 2035

Aluminum Casing of the Blade Battery Market Size and Share Forecast Outlook 2025 to 2035

Aluminum ROPP Closure Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Cans Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Packaging Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Pouches Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Peel-Off Ends Maker Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Tape Market Size and Share Forecast Outlook 2025 to 2035

Aluminum-Free Food Pouch Market Size and Share Forecast Outlook 2025 to 2035

Aluminum-Nickel Catalyst Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Frame Monitors Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Composite Materials Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Coated Thermal Protective Clothing Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Flat Products Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Alloys Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Sheets and Coils Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Containers Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Aerosol Cans Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA