The Class 3 Truck Market is estimated to be valued at USD 8.1 billion in 2025 and is projected to reach USD 16.7 billion by 2035, registering a compound annual growth rate (CAGR) of 7.5% over the forecast period. This growth pattern indicates that the market is transitioning from early growth to the early majority stage within the adoption lifecycle. Initial adoption was driven by fleet operators seeking medium-duty trucks for regional logistics, delivery services, and municipal operations, with technological enhancements in fuel efficiency, telematics integration, and safety systems acting as key enablers.

The incremental annual growth figures, rising from 8.1 billion in 2025 to 10.0 billion by 2029, reflect steady uptake among early adopters, while the acceleration from 11.6 billion in 2030 to 16.7 billion in 2035 signifies broader acceptance and penetration into mainstream fleet operations. This pattern aligns with the technology adoption lifecycle, where early growth is followed by adoption by the early majority as operational reliability, total cost of ownership benefits, and regulatory compliance become well established. Market maturity is expected to advance significantly during the latter half of the forecast period. Fleet operators increasingly prioritize total cost efficiency, emissions compliance, and connectivity, which drives the adoption of advanced Class 3 trucks.

Manufacturers responding with modular designs, improved telematics, and scalable maintenance networks are positioned to capture the expanding mainstream market. The convergence of operational efficiency and regulatory alignment underpins the accelerated adoption, suggesting that the Class 3 Truck market is entering a phase of sustained growth and consolidation.

| Metric | Value |

|---|---|

| Class 3 Truck Market Estimated Value in (2025 E) | USD 8.1 billion |

| Class 3 Truck Market Forecast Value in (2035 F) | USD 16.7 billion |

| Forecast CAGR (2025 to 2035) | 7.5% |

The class 3 truck market is demonstrating robust growth supported by rising demand for medium duty logistics vehicles across industrial, municipal, and commercial use cases. The balance of payload capacity, maneuverability, and compliance with urban transportation regulations makes class 3 trucks increasingly attractive in last mile delivery, utility services, and vocational applications.

Infrastructure investments and fleet modernization programs are further contributing to segment expansion. Technological advancements in chassis design, emission control systems, and driver comfort features are improving vehicle utility and lifecycle value.

Moreover, regulatory incentives favoring fleet upgrades and sustainability transitions are motivating enterprises to invest in newer vehicle models. The market outlook remains positive as the sector responds to efficiency pressures, fleet electrification goals, and the demand for versatile transportation platforms capable of supporting industrial and service based operations.

The class 3 truck market is segmented by vehicle, fuel, application, drive configuration, and geographic regions. By vehicle, the class 3 truck market is divided into Walk-in, Box truck, City delivery, and Heavy-duty pick-up. In terms of fuel, the class 3 truck market is classified into Gasoline, Diesel, Hybrid, Electric, and Others.

Based on application, the class 3 truck market is segmented into Industrial and Commercial. By drive configuration, the class 3 truck market is segmented into 2WD, 4WD, and AWD. Regionally, the class 3 truck industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The walk in vehicle type is expected to contribute 38.70% of total market revenue by 2025, positioning it as the leading format within the vehicle category. This dominance is driven by the segment’s ability to support high frequency stops, ergonomic access, and efficient cargo handling, making it ideal for parcel delivery, maintenance services, and mobile workshops.

The box shaped design and walk through configuration allow for better space optimization and safer loading and unloading practices. Fleet operators also benefit from the vehicle’s adaptability to customization based on service type and delivery volume.

As e commerce and urban delivery networks expand, the demand for walk in vehicles continues to grow, reinforcing their position as the preferred platform in medium duty transportation.

The gasoline segment is projected to account for 41.20% of total market share in 2025 within the fuel category, maintaining its leadership position due to cost efficiency, infrastructure availability, and favorable performance in short to mid range routes. Gasoline powered class 3 trucks offer reduced upfront costs and widespread fueling access, making them ideal for fleets operating in metropolitan and suburban zones.

The lower maintenance costs and smoother engine operation further enhance their appeal for service based applications. While alternative fuels are gaining traction, gasoline remains dominant due to its logistical flexibility and lower entry barrier for fleet owners looking to modernize without substantial investment.

This combination of economic and operational advantages secures its continued relevance in the class 3 truck fuel landscape.

The industrial segment is anticipated to capture 55.60% of total market revenue by 2025, emerging as the top application area in the class 3 truck market. This leadership is attributed to the vehicle’s versatility in supporting manufacturing operations, equipment transport, field services, and facility maintenance tasks.

Class 3 trucks offer optimal balance between payload capacity and regulatory compliance, making them suitable for a wide range of industrial settings. Industries rely on these vehicles for dependable performance in demanding environments, where durability and cargo flexibility are key.

With ongoing industrial expansion and infrastructure upgrades, class 3 trucks have become integral to material movement and on site operations, establishing industrial use as the most dominant application segment in the market.

The market has been expanding due to increasing demand for medium-duty commercial vehicles with gross vehicle weight ratings (GVWR) between 10,001 and 14,000 pounds. These trucks have been deployed extensively in delivery, utility services, municipal operations, and regional transportation. Market growth has been driven by fleet modernization, urban delivery needs, and the integration of telematics and fuel-efficient technologies. Enhanced payload capacity, maneuverability, and operational reliability have positioned Class 3 trucks as essential solutions for small- to medium-scale logistics, service, and commercial operations globally.

The market has been strongly influenced by urban delivery and last-mile logistics requirements. These vehicles have been utilized to transport goods efficiently in densely populated areas where larger trucks are less effective. Their compact size combined with substantial payload capacity has facilitated the transport of retail goods, groceries, parcels, and commercial materials across urban centers. Telematics and GPS-based fleet management systems have been integrated to optimize routes, track assets in real-time, and schedule predictive maintenance, reducing downtime and operational costs. The growing e-commerce sector has amplified the need for reliable and agile delivery vehicles. The service providers, including municipal agencies and utility companies, have adopted Class 3 trucks for maintenance and equipment transport, further expanding their application across urban and suburban regions.

Technological innovation has significantly contributed to the growth of the market by improving efficiency, safety, and operational performance. Integration of hybrid and electric drivetrains has reduced fuel consumption and emissions, aligning with environmental standards and sustainability goals. Advanced driver assistance systems, including collision avoidance, adaptive cruise control, and lane departure warnings, have improved operator safety and vehicle reliability. Connectivity features, such as telematics, remote diagnostics, and predictive maintenance analytics, have enabled real-time monitoring and reduced unplanned downtime. Lightweight materials, improved aerodynamics, and enhanced powertrain efficiency have optimized payload performance and fuel economy. These technological advancements have reinforced adoption across diverse commercial operations, allowing Class 3 trucks to meet urban and regional transportation demands while providing energy-efficient, safe, and cost-effective fleet solutions.

The market has been shaped by regulatory frameworks and emission standards aimed at improving environmental sustainability and vehicle safety. Emission regulations, including EPA and Euro standards, have prompted manufacturers to incorporate low-emission engines, hybrid drivetrains, and electric powertrains. Safety mandates concerning braking systems, vehicle stability, and crashworthiness have ensured compliance for urban and commercial operations. Incentives for clean energy and zero-emission vehicles have encouraged fleet operators to modernize their vehicles. Industry standards for telematics integration, reporting, and maintenance practices have further driven adoption. Compliance with these regulations has ensured that Class 3 trucks offer reliable, safe, and environmentally responsible solutions, supporting the modernization of fleets while meeting operational and societal expectations in logistics, municipal services, and commercial transportation globally.

The market has been strengthened by fleet modernization programs and customization options tailored to specific applications. Fleet operators have replaced older vehicles with models offering improved fuel efficiency, enhanced payload capacity, and advanced safety and telematics systems. Custom configurations, including refrigerated units, service bodies, flatbeds, and utility compartments, have enabled trucks to meet specific operational needs across delivery, municipal services, and light commercial transport. Leasing, rental, and subscription-based models have facilitated easier fleet expansion for small- and medium-sized enterprises. Aftermarket services, including maintenance support, calibration, and technical upgrades, have ensured continued reliability and operational performance. These strategies have allowed operators to optimize resource utilization, reduce operating costs, and enhance service quality, reinforcing Class 3 trucks as indispensable vehicles in urban, suburban, and regional commercial applications.

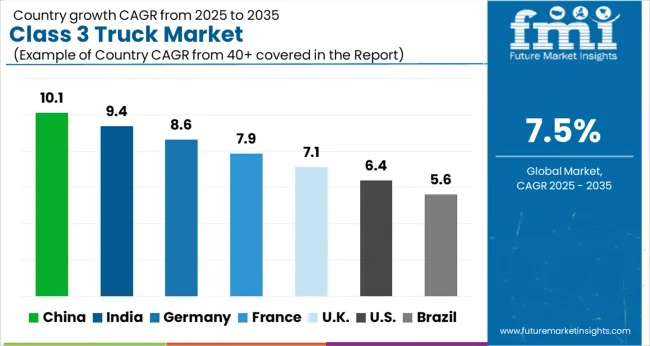

The market is expected to grow at a CAGR of 7.5% from 2025 to 2035, driven by increasing demand for medium-duty commercial vehicles, urban logistics, and fleet modernization. China leads with a 10.1% CAGR, supported by rapid industrial growth and expansion of urban delivery networks. India follows at 9.4%, propelled by government initiatives for commercial vehicle adoption and improvements in transportation infrastructure. Germany, at 8.6%, benefits from established manufacturing capabilities and strong demand in industrial logistics. The UK, with a 7.1% CAGR, focuses on fleet upgrades and emission-compliant solutions, while the USA, at 6.4%, sees steady growth due to regulatory compliance and e-commerce-driven distribution needs. This report covers 40+ countries, with the top markets highlighted here for reference.

China is projected to grow at a CAGR of 10.1%, driven by expanding logistics, urban deliveries, and intra-city freight transport. Rising demand for fuel-efficient, emission-compliant medium-duty trucks is shaping fleet purchasing patterns. Manufacturers are focusing on telematics integration, safety features, and engine efficiency improvements. Strategic partnerships between truck OEMs and logistics operators are enhancing distribution channels. Adoption of electric and hybrid Class 3 trucks is gradually increasing, supported by government policies promoting low-emission commercial vehicles. The market is further supported by investments in infrastructure modernization and smart fleet management technologies.

India’s market is expected to expand at a CAGR of 9.4% due to growing last-mile delivery, e-commerce logistics, and intra-city freight demand. Manufacturers are introducing compact, fuel-efficient, and emission-compliant Class 3 trucks for Indian road conditions. Adoption of telematics, predictive maintenance, and safety technologies is increasing among fleet operators. Government initiatives promoting low-emission and energy-efficient commercial vehicles are encouraging fleet upgrades. Strategic alliances between OEMs, distributors, and logistics companies are enhancing market penetration across tier-1 and tier-2 cities.

Germany is forecasted to grow at a CAGR of 8.6%, fueled by regional distribution, industrial logistics, and municipal transport needs. Focus on low-emission, fuel-efficient, and connected trucks is increasing. Electric and hybrid Class 3 trucks are gradually gaining adoption among fleet operators. OEMs are collaborating with technology providers to integrate telematics, safety, and fleet management solutions. Stringent European Union regulations on emissions and efficiency continue to shape product development. Investment in research and development for durability, safety, and connected solutions supports market expansion.

The United Kingdom market is expected to expand at a CAGR of 7.1%, supported by urban deliveries, regional logistics, and service operations. Manufacturers are introducing fuel-efficient, emission-compliant, and telematics-enabled trucks. Adoption of connected vehicle technologies, advanced safety systems, and hybrid powertrains is gradually rising. Collaborations with logistics providers and leasing companies are enhancing market penetration. Emphasis on reducing operational costs, improving fuel efficiency, and meeting environmental regulations is further driving market demand.

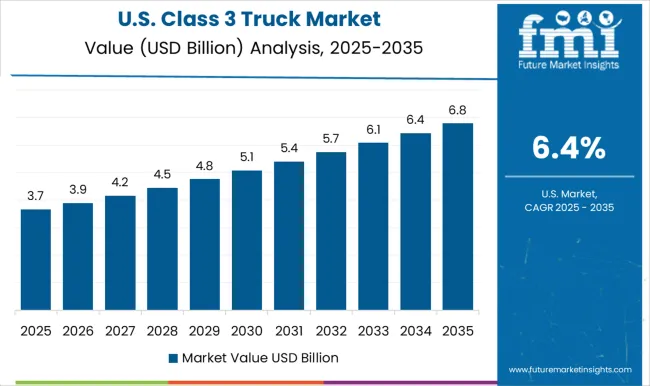

The United States market is forecasted to grow at a CAGR of 6.4% due to demand in urban delivery, regional logistics, and commercial transportation. Adoption of telematics, fuel-efficient engines, and advanced driver assistance systems is increasing among medium-duty fleets. Manufacturers are focusing on emission-compliant engines and operational efficiency. Investments in electric and hybrid Class 3 trucks for municipal and commercial fleets are supporting growth. Partnerships between OEMs, fleet operators, and technology providers are enhancing deployment and market expansion.

The market consists of medium-duty trucks that are widely used for urban deliveries, utility services, and light commercial transport. Daimler AG, Ford Motor, and General Motors dominate the market by offering versatile trucks that combine payload capacity, driver comfort, and advanced safety technologies. These manufacturers provide models designed for durability, efficiency, and compliance with regulatory emission standards. International Trucks and Isuzu Motors Limited focus on robust engineering and reliability, catering to fleet operators who require vehicles capable of intensive daily operations. Nissan Motor, Stellantis, and Toyota Motor emphasize cost-effective solutions and fuel-efficient powertrains for commercial applications, while Volvo Group integrates telematics, driver-assist systems, and customizable configurations to optimize operational efficiency. Collectively, these companies drive innovation in the Class 3 Truck segment, enhancing fleet performance, reducing operating costs, and meeting diverse commercial transportation needs across global markets. The competitive landscape is shaped by a focus on durability, technological integration, and adherence to evolving environmental and safety standards.

| Item | Value |

|---|---|

| Quantitative Units | USD 8.1 Billion |

| Vehicle | Walk-in, Box truck, City delivery, and Heavy-duty pick-up |

| Fuel | Gasoline, Diesel, Hybrid, Electric, and Others |

| Application | Industrial and Commercial |

| Drive Configuration | 2WD, 4WD, and AWD |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Daimler AG, Ford Motor, General Motors, International Trucks, Isuzu Motors Limited, Nissan Motor, Stellantis, Toyota Motor, and Volvo Group |

| Additional Attributes | Dollar sales by truck type and payload capacity, demand dynamics across logistics, construction, and commercial sectors, regional trends in fleet modernization, innovation in fuel efficiency and telematics, environmental impact of emissions, and emerging use cases in regional distribution and specialized transport solutions. |

The global class 3 truck market is estimated to be valued at USD 8.1 billion in 2025.

The market size for the class 3 truck market is projected to reach USD 16.7 billion by 2035.

The class 3 truck market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in class 3 truck market are walk-in, box truck, city delivery and heavy-duty pick-up.

In terms of fuel, gasoline segment to command 41.2% share in the class 3 truck market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Classic Organic Pigments Market Size and Share Forecast Outlook 2025 to 2035

Class D Audio Amplifiers Market is Segmented by Type, End Use and Region through 2025 to 2035

Classified Platform Market Analysis by Type, Application, and Region Through 2035

Class 7 Truck Market Size and Share Forecast Outlook 2025 to 2035

Class 8 Truck Market Size and Share Forecast Outlook 2025 to 2035

Class 5 Trucks Market Size and Share Forecast Outlook 2025 to 2035

Class 1 Truck Market Size and Share Forecast Outlook 2025 to 2035

Class 2 Trucks Market Size and Share Forecast Outlook 2025 to 2035

Class 4 Truck Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Class 6 Trucks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Air Classifying Mill Market Size and Share Forecast Outlook 2025 to 2035

Smart Classroom Market Size and Share Forecast Outlook 2025 to 2035

Virtual Classroom Market Trends – Size, Demand & Forecast 2024-2034

Enterprise-Class Hybrid Storage Market Size and Share Forecast Outlook 2025 to 2035

Fault Detection and Classification Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Defense C Class Parts Market Size and Share Forecast Outlook 2025 to 2035

3-Layer Seam Tapes Market Size and Share Forecast Outlook 2025 to 2035

3D Automatic Optical Inspection Machine Market Size and Share Forecast Outlook 2025 to 2035

3D Ready Organoid Expansion Service Market Size and Share Forecast Outlook 2025 to 2035

3-Hydroxyphenyl Phosphinyl Propanoic Acid Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA