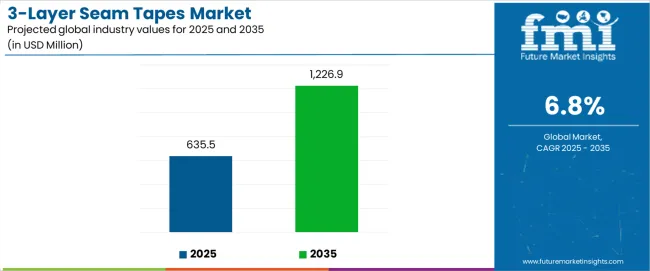

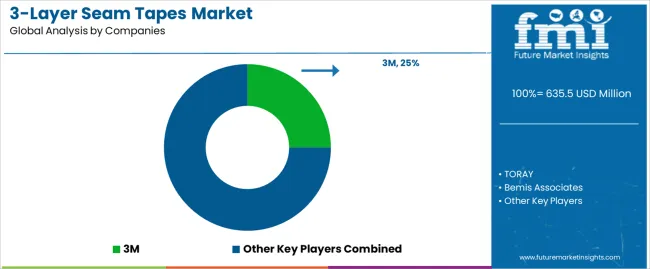

The global 3-layer seam tapes market is projected to rise from USD 635.5 million in 2025 to USD 1,226.9 million by 2035, reflecting an absolute increase of USD 591.4 million, with total growth of 93.1% at a CAGR of 6.8%. The overall market size is expected to expand by nearly 1.9X during this period. While global growth is steady, regional imbalances define the trajectory, shaped by industrial adoption, apparel manufacturing clusters, and regulatory frameworks.

Asia Pacific leads in both production and consumption, emerging as the fastest-growing regional market. High volumes of apparel manufacturing in China, Bangladesh, Vietnam, and India drive consistent demand for seam tapes in waterproof outdoor wear, sports apparel, and protective clothing. Regional suppliers benefit from economies of scale, abundant labor, and proximity to global textile supply chains. Growth is reinforced by rising domestic demand from expanding middle-class populations in China and India, creating a dual market pull. The imbalance stems from Asia Pacific’s ability to dominate manufacturing output while simultaneously capturing increasing end-use consumption, leaving other regions comparatively smaller in market share growth.

Europe demonstrates strong but more stable growth, shaped by stringent quality standards and premium positioning. Outdoor brands in Germany, Italy, and the Nordics rely on advanced 3-layer seam tapes for waterproof breathable fabrics used in high-end sportswear and technical clothing. European automotive manufacturers also contribute to demand through applications in sealing and weatherproofing. Growth rates are lower than Asia Pacific, but Europe’s emphasis on high-value, certified, and eco-compliant seam tapes positions it as a leader in premium and sustainable segments. The imbalance reflects Europe’s reliance on niche value-added growth rather than high-volume expansion.

North America represents a mature but steady market. The United States drives demand through its outdoor apparel sector, medical textiles, and automotive industries. Growth is reinforced by demand for durable performance fabrics in sportswear and military gear. However, reliance on imports for large-scale apparel manufacturing limits North America’s production-based expansion. The imbalance here lies in strong end-user consumption but limited upstream manufacturing share compared with Asia Pacific.

Latin America and Africa remain emerging regions where demand is linked to industrial and healthcare applications rather than high-value outdoor apparel. Brazil and Mexico show moderate adoption in automotive and protective clothing, while African markets are at a nascent stage, limited by weak industrial textile infrastructure. Growth is slower, reflecting structural constraints in manufacturing ecosystems and consumer spending.

Regional growth imbalance highlights Asia Pacific as the primary growth engine due to manufacturing scale, while Europe and North America sustain steady growth through premium applications and consumption. Latin America and Africa contribute incremental demand but remain minor players in the global expansion. At 6.8% CAGR, the 3-layer seam tapes market reflects a structure where global growth is disproportionately concentrated in Asia Pacific, creating both opportunities and competitive pressures for suppliers in other regions.

| Item | Value / Description |

|---|---|

| Market Value (2025) | USD 635.5 million |

| Forecast Value (2035) | USD 1,226.9 million |

| Forecast CAGR (2025-2035) | 6.8% |

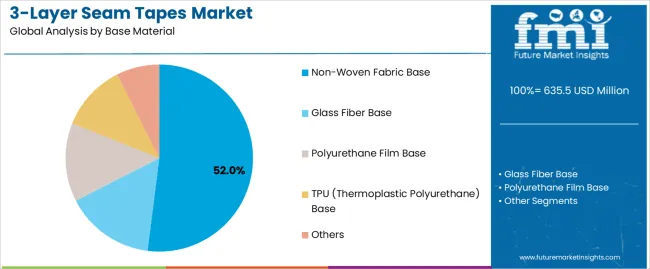

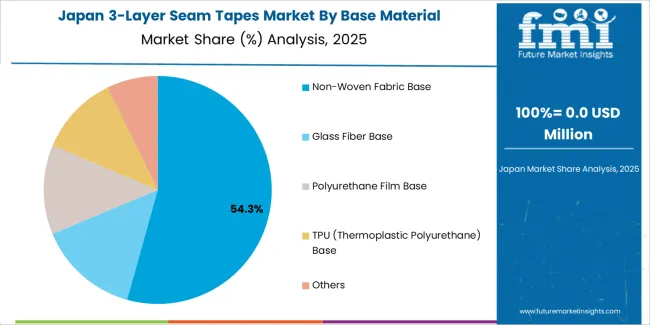

| Leading Base Material (2025) | Non-Woven Fabric Base - 52.0% share |

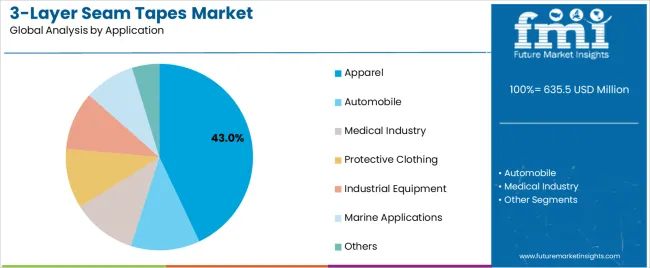

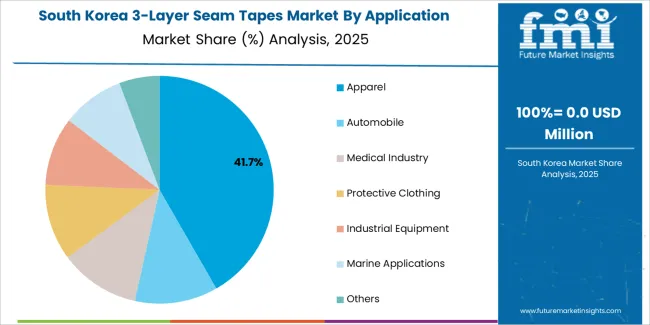

| Leading Application (2025) | Apparel - 43.0% share |

| Leading Distribution Channel (2025) | Direct Sales - 68% share |

| Key Growth Regions | Asia Pacific; North America; Europe |

| Top Companies by Market Share | 3M; TORAY; Bemis Associates |

| Metric | Value |

|---|---|

| Market Value (2025) | USD 635.5 million |

| Market Forecast Value (2035) | USD 1,226.9 million |

| Forecast CAGR (2025-2035) | 6.8% |

| INDUSTRY DEMAND TRENDS | PErfORMANCE REQUIREMENTS | TECHNOLOGY & INNOVATION |

|---|---|---|

| Outdoor Apparel Expansion - Growing participation in outdoor activities and adventure sports driving demand for high-performance waterproof garments requiring advanced seam sealing solutions. | Waterproof Performance Standards - Industry requirements establishing stringent waterproofing benchmarks favoring high-performance 3-layer seam tape technologies for critical applications. | Adhesive Technology Advancement - Development of hot-melt adhesives, thermoplastic films, and multi-layer bonding systems enabling superior sealing performance and durability. |

| Automotive Industry Growth - Increasing vehicle production and quality standards creating demand for reliable sealing solutions in automotive interiors, convertible tops, and component weatherproofing. | Breathability Requirements - Advanced moisture management needs requiring tapes that maintain waterproof integrity while allowing vapor transmission for comfort applications. | Multi-Layer Construction Innovation - Enhanced three-layer designs combining protective films, adhesive layers, and carrier materials optimized for specific application requirements. |

| Medical Textile Applications - Rising healthcare standards and surgical textile requirements driving demand for biocompatible sealing solutions with antimicrobial properties and sterile performance. | Durability and Flexibility - Performance standards requiring tapes that withstand repeated flexing, washing, and environmental exposure while maintaining sealing effectiveness. | Specialized Application Development - Emerging demand for tapes engineered for specific industries including protective clothing, military textiles, and industrial applications. |

| Category | Segments / Values |

|---|---|

| By Base Material | Non-Woven Fabric Base; Glass Fiber Base; Polyurethane Film Base; Tpu (Thermoplastic Polyurethane) Base; Others |

| By Application | Apparel; Automobile; Medical Industry; Protective Clothing; Industrial Equipment; Marine Applications; Others |

| By End-Use Industry | Outdoor Sports; Automotive Manufacturing; Healthcare; Military & Defense; Construction; Textile Manufacturing |

| By Adhesive Type | Hot-Melt Adhesive; Thermoplastic Film; Solvent-Based; Water-Based; Others |

| By Distribution Channel | Direct Sales; Specialized Distributors; Online B2B Platforms; Regional Dealers; Technical Service Providers |

| By Region | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Segment | 2025-2035 Outlook |

|---|---|

| Non-Woven Fabric Base | Leader in 2025 with 52.0% market share; maintaining strong position through 2035. Excellent adhesion properties, cost-effective manufacturing, and broad compatibility with various textile substrates. Momentum: steady growth across apparel and industrial applications. Watchouts: competition from advanced polymer films in premium segments. |

| Glass Fiber Base | Specialized segment with 18.5% share, preferred for high-temperature applications and automotive industry requirements. Superior strength and chemical resistance. Momentum: growing in automotive and industrial applications. Watchouts: limited flexibility and higher costs. |

| Polyurethane Film Base | Premium segment focusing on breathable waterproof applications with superior flexibility and comfort properties. Momentum: rising in high-end outdoor apparel and medical applications. |

| Tpu Base | Advanced technology offering excellent elasticity, transparency, and biocompatibility for specialized applications. Momentum: strong growth in medical and protective clothing segments. |

| Others (PTFE, PE Film, etc.) | Includes specialized materials for extreme conditions and industrial applications. High-performance requirements, niche markets. Momentum: selective growth in chemical resistance and extreme temperature applications. |

| Segment | 2025-2035 Outlook |

|---|---|

| Apparel | Largest application segment in 2025 at 43.0% share, driven by outdoor sports industry growth and performance garment demand. Includes rainwear, ski wear, and technical outdoor clothing. Momentum: strong growth from adventure tourism and athletic wear markets. Watchouts: seasonal demand fluctuations and fashion trend dependencies. |

| Automobile | Critical segment for automotive sealing applications including convertible tops, seat covers, and interior weatherproofing. Requires durability and temperature resistance. Momentum: steady growth through automotive production expansion. Watchouts: electric vehicle transition affecting traditional sealing requirements. |

| Medical Industry | Specialized segment requiring biocompatible materials for surgical drapes, protective gowns, and medical equipment covers. Strict regulatory compliance essential. Momentum: strong growth from healthcare infrastructure expansion and infection control standards. Watchouts: regulatory complexity and certification requirements. |

| Protective Clothing | Industrial safety applications including chemical protective suits, flame-resistant garments, and hazmat equipment. Momentum: growth driven by workplace safety regulations and industrial expansion. Watchouts: specialized performance requirements and limited market size. |

| Industrial Equipment | Covers, enclosures, and protective barriers for industrial machinery and equipment requiring weatherproof sealing. Momentum: moderate growth through industrial automation and equipment modernization. |

| Marine Applications | Boat covers, sail repairs, and marine textile sealing applications requiring saltwater resistance and UV stability. Momentum: selective growth in recreational boating and marine industry segments. |

| Distribution Channel | Status & Outlook (2025-2035) |

|---|---|

| Direct Sales | Dominant channel in 2025 with 68% share for industrial and automotive applications. Provides technical support, custom solutions, and bulk pricing for large-scale users. Momentum: steady growth driven by B2B relationships and technical service requirements. Watchouts: margin pressure from competitive bidding. |

| Specialized Distributors | Key channel serving regional manufacturers and smaller-scale users requiring technical expertise and inventory management. Momentum: stable growth as manufacturers seek distribution efficiency. Watchouts: consolidation pressure and digital transformation requirements. |

| Online B2B Platforms | Emerging channel for standardized products serving mid-size manufacturers seeking competitive pricing and convenient ordering. Momentum: strong growth as businesses adopt digital procurement. Watchouts: limited technical support and product complexity management. |

| Regional Dealers | Traditional channel serving local manufacturers and repair services with immediate availability and regional support. Momentum: declining for commodity products, stable for specialized applications requiring local presence. |

| Technical Service Providers | Specialized channel offering application engineering, custom solutions, and installation support for complex sealing requirements. Momentum: rising as applications become more sophisticated and performance-critical. |

| DRIVERS | RESTRAINTS | KEY TRENDS |

|---|---|---|

| Growing outdoor recreation participation and adventure sports popularity driving demand for high-performance waterproof apparel requiring advanced seam sealing solutions. | Raw material cost volatility affecting adhesive components and specialty films impacting production costs and pricing strategies. | Development of bio-based adhesives and environmentally friendly materials responding to environmental regulations and corporate responsibility initiatives. |

| Automotive Industry Expansion - Increasing vehicle production and premium interior requirements creating demand for reliable sealing solutions and weatherproofing applications. | Technical Application Complexity - Specialized performance requirements and application-specific engineering increasing development costs and market entry barriers. | Smart Textile Integration - Advanced materials incorporating sensors, heating elements, and electronic components requiring specialized sealing technologies. |

| Healthcare Infrastructure Growth - Rising medical facility construction and infection control standards fueling demand for biocompatible sealing solutions in medical textile applications. | Regulatory Compliance Costs - Medical and automotive industry certifications requiring extensive testing and documentation increasing supplier qualification expenses. | Multi-Functional Tape Development - Integration of antimicrobial properties, flame resistance, and enhanced durability features meeting diverse application requirements. |

| Industrial Safety Standards - Enhanced workplace protection regulations driving adoption of chemical-resistant and protective clothing requiring reliable seam sealing capabilities. | Competition from Alternative Technologies - Welding, ultrasonic bonding, and heat sealing methods competing with traditional tape applications in certain segments. | Customization and Application Engineering - Increasing demand for tailored solutions and technical support services creating opportunities for specialized suppliers. |

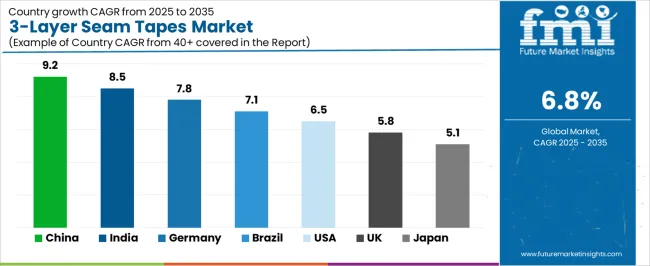

| Country | CAGR (2025-2035) |

|---|---|

| China | 9.2% |

| India | 8.5% |

| Germany | 7.8% |

| Brazil | 7.1% |

| United States | 6.5% |

| United Kingdom | 5.8% |

| Japan | 5.1% |

Revenue from 3-layer seam tapes in China is projected to exhibit robust growth with a market value of USD 285.4 million by 2035, driven by expanding textile manufacturing infrastructure and comprehensive outdoor apparel production innovation creating substantial opportunities for component suppliers across automotive manufacturing, medical textile operations, and specialty industrial sectors. The country's established chemical processing tradition and expanding technical textile capabilities are creating significant demand for both non-woven and glass fiber base tape systems. Major textile companies and automotive manufacturers including BYD and Great Wall Motors are establishing comprehensive local component production facilities to support large-scale manufacturing operations and meet growing demand for efficient sealing solutions.

Revenue from 3-layer seam tapes in India is expanding to reach USD 198.7 million by 2035, supported by extensive textile industry development and comprehensive automotive sector expansion creating demand for reliable sealing solutions across diverse manufacturing categories and industrial protection segments. The country's growing manufacturing base and expanding technical textile sector are driving demand for component solutions that provide consistent waterproof performance while supporting cost-effective production requirements. Component distributors and textile manufacturers are investing in local market development to support growing industrial operations and automotive demand.

Demand for 3-layer seam tapes in Germany is projected to reach USD 156.3 million by 2035, supported by the country's leadership in automotive manufacturing and advanced chemical processing technologies requiring sophisticated adhesive systems for professional and industrial applications. German companies are implementing high-precision manufacturing systems that support advanced bonding capabilities, operational reliability, and comprehensive quality protocols. The 3-layer seam tapes market is characterized by focus on engineering excellence, material innovation, and compliance with stringent automotive and medical device standards.

Revenue from 3-layer seam tapes in Brazil is growing to reach USD 142.6 million by 2035, driven by automotive industry expansion programs and increasing industrial manufacturing creating opportunities for component suppliers serving both consumer goods operations and industrial protection contractors. The country's growing automotive sector and expanding textile manufacturing base are creating demand for sealing components that support diverse industrial requirements while maintaining performance standards. Industrial suppliers and specialty material service providers are developing distribution strategies to support operational efficiency and manufacturing quality.

Demand for 3-layer seam tapes in United States is projected to reach USD 128.9 million by 2035, expanding at a CAGR of 6.5%, driven by outdoor recreation industry excellence and specialized technical textile capabilities supporting advanced performance apparel development and comprehensive industrial applications. The country's established chemical manufacturing tradition and mature automotive market segments are creating demand for high-quality sealing components that support operational performance and regulatory standards. Component manufacturers and industrial suppliers are maintaining comprehensive development capabilities to support diverse application requirements.

Revenue from 3-layer seam tapes in United Kingdom is growing to reach USD 115.8 million by 2035, supported by technical textile innovation and established automotive manufacturing capabilities driving demand for premium sealing solutions across traditional industrial systems and specialized marine applications. The country's marine industry heritage and established chemical processing capabilities create demand for sealing components that support both traditional manufacturing applications and modern high-performance requirements.

Demand for 3-layer seam tapes in Japan is projected to reach USD 102.4 million by 2035, driven by precision manufacturing tradition and established material technology leadership supporting both domestic industrial markets and export-oriented component production. Japanese companies maintain sophisticated adhesive development capabilities, with established manufacturers continuing to lead in high-performance materials and precision application technologies.

European 3-layer seam tape operations are increasingly concentrated between German chemical engineering excellence and Nordic outdoor apparel manufacturing. German facilities dominate automotive-grade sealing solutions and industrial applications, leveraging advanced adhesive technologies and strict automotive quality protocols that command price premiums in global markets. Nordic manufacturers maintain leadership in technical outdoor apparel applications, with companies driving performance specifications that suppliers must meet to access premium outdoor gear contracts.

Eastern European operations in Czech Republic and Poland are capturing volume-oriented production contracts through skilled labor advantages and EU regulatory compliance, particularly in non-woven fabric base tapes for mass-market apparel applications. These facilities increasingly serve as manufacturing capacity for Western European brands while developing their own technical expertise.

The regulatory environment presents both opportunities and constraints. REACH compliance requirements create quality standards that favor established European manufacturers over imports while ensuring consistent material safety specifications. Brexit has created complexity for UK component sourcing from EU suppliers, driving opportunities for direct relationships between manufacturers and international distributors.

Supply chain consolidation accelerates as manufacturers seek economies of scale to absorb rising raw material costs and specialized adhesive expenses. Vertical integration increases, with major outdoor apparel manufacturers acquiring tape production facilities to secure component supplies and quality control. Smaller manufacturers face pressure to specialize in niche applications or risk displacement by larger, more efficient operations serving mainstream industrial equipment requirements.

South Korean 3-layer seam tape operations reflect the country's advanced chemical manufacturing sector and export-oriented business model. Major conglomerates including LG Chem and Kolon Industries drive component procurement strategies for their automotive and textile divisions, establishing direct relationships with specialized tape suppliers to secure consistent quality and pricing for their automotive sealing and technical textile operations targeting both domestic and international markets.

The Korean market demonstrates particular strength in integrating seam sealing technologies into automotive interior applications, with companies developing products that meet both domestic vehicle manufacturing requirements and export specifications. This integration approach creates demand for specific performance characteristics that differ from traditional textile applications, requiring suppliers to adapt adhesive formulations and base material properties.

Regulatory frameworks emphasize chemical safety and automotive performance standards, with Korean Agency for Technology and Standards requirements often exceeding international specifications. This creates barriers for smaller component suppliers but benefits established manufacturers who can demonstrate compliance capabilities. The regulatory environment particularly favors suppliers with KC certification and comprehensive material safety documentation.

Supply chain efficiency remains critical given Korea's technological advancement focus and competitive manufacturing dynamics. Companies increasingly pursue development contracts with suppliers in Japan, Germany, and specialized manufacturers to ensure access to advanced adhesive technologies while managing material costs. Investment in research and development supports performance advancement during extended product qualification cycles.

Profit pools are consolidating upstream in specialized adhesive formulation and downstream in application-specific tape designs for automotive, medical, and high-performance outdoor markets where certification, waterproof performance, and consistent bonding strength command premiums. Value is migrating from basic non-woven tape production to specification-driven, application-ready solutions where material engineering expertise, adhesive technology, and reliable performance create competitive advantages. Several archetypes define market leadership: established chemical companies defending share through adhesive innovation and manufacturing scale; specialized tape manufacturers leveraging application expertise and customer relationships; automotive tier suppliers with sealing system integration and OEM connections; and emerging manufacturers pursuing cost-competitive production while developing technical capabilities. Switching costs - application testing, qualification processes, manufacturing integration - provide stability for established suppliers, while performance requirements and cost pressures create opportunities for innovative manufacturers. Consolidation continues as companies seek manufacturing scale; direct sales channels grow for industrial applications while distribution remains relationship-driven for smaller users. Focus areas: secure automotive and industrial market positions with application-specific performance specifications and technical support; develop adhesive technology and precision manufacturing capabilities; explore specialized applications including medical textiles and protective equipment requirements.

| Stakeholder Type | Primary Advantage | Repeatable Plays |

|---|---|---|

| Chemical Company Integrators | Advanced adhesive formulation; manufacturing scale; material science expertise | R&D investment; production efficiency; quality control systems |

| Specialized Tape Manufacturers | Application expertise; customer relationships; technical support capabilities | Market focus; service-based differentiation; custom solutions |

| Automotive Tier Suppliers | OEM relationships; system integration; automotive quality standards | Certification management; high-volume production; cost optimization |

| Regional Technical Distributors | Local market knowledge; technical service; inventory management | Customer relationships; application support; supply chain efficiency |

| Emerging Cost-Competitive Producers | Manufacturing efficiency; competitive pricing; production scaling | Technology development; market entry strategies; operational excellence |

| Item | Value |

|---|---|

| Quantitative Units | USD 635.5 million |

| Base Materials | Non-Woven Fabric Base; Glass Fiber Base; Polyurethane Film Base; Tpu Base; Others |

| Applications | Apparel; Automobile; Medical Industry; Protective Clothing; Industrial Equipment; Marine Applications |

| Adhesive Type | Hot-Melt Adhesive, Thermoplastic Film, Solvent-Based, Water-Based, Others |

| End-use Industry | Outdoor Sports, Automotive Manufacturing, Healthcare, Military & Defense, Construction, Textile Manufacturing |

| Distribution Channels | Direct Sales; Specialized Distributors; Online B2B Platforms; Regional Dealers; Technical Service Providers |

| Regions Covered | North America; Latin America; Europe; Asia Pacific; Middle East & Africa |

| Key Countries | China; India; Germany; Brazil; United States; United Kingdom; Japan (+35 additional countries) |

| Key Companies Profiled | 3M; TORAY; Bemis Associates; YETOM; LOXY; SEATEX; Sealon; MinMax Seam Tape; GBS Tape; HiMEL KR; Seam Seal International; ESA Reflex (Shanghai); Loctite; Himel Corp; Textiles Coated International; San Chemicals; Adhesive Films Inc. |

| Additional Attributes | Dollar sales by base material and application; Regional demand trends (NA, EU, APAC); Competitive landscape; Direct vs. distributed sales patterns; Manufacturing and adhesive integration; Advanced material innovations driving waterproof performance, durability enhancement, and technical excellence |

The global 3-layer seam tapes market is estimated to be valued at USD 635.5 million in 2025.

The market size for the 3-layer seam tapes market is projected to reach USD 1,226.9 million by 2035.

The 3-layer seam tapes market is expected to grow at a 6.8% CAGR between 2025 and 2035.

The key product types in 3-layer seam tapes market are non-woven fabric base, glass fiber base, polyurethane film base, tpu (thermoplastic polyurethane) base and others.

In terms of application, apparel segment to command 43.0% share in the 3-layer seam tapes market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Seam Welding Machine Market Size and Share Forecast Outlook 2025 to 2035

Seam Tapes Market Insights – Growth & Demand Forecast 2025-2035

De-seamable Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Can Seamers Market Size and Share Forecast Outlook 2025 to 2035

Industry Share & Competitive Positioning in Can Seamer Market

Double Seam Bowl Market

Evaluating Cold Drawn Seamless Steel Pipes Market Share & Provider Insights

Beverage Can Seamers Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Beverage Can Seamers Manufacturers

Hybrid Metal-Paper Seamers Market Size and Share Forecast Outlook 2025 to 2035

Tapes Market Insights – Growth & Demand 2025 to 2035

UV Tapes Market Growth - Trends & Forecast 2025 to 2035

PVC Tapes Market Size and Share Forecast Outlook 2025 to 2035

Leading Providers & Market Share in PVC Tapes Industry

ESD Tapes and Labels Market from 2025 to 2035

USA Tapes Market Analysis – Growth & Forecast 2024-2034

Foil Tapes Market

Nano Tapes Market

Pouch Tapes Market Size and Share Forecast Outlook 2025 to 2035

Washi Tapes Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA